Advantages of investing in money markets - can not

Advantages of Money Market Funds

Money market funds are open-ended mutual funds that invest in short-term debt securities, such as U.S. Treasury Bills and commercial paper. Usually, money market funds seek a stable net asset value (NAV) of $1.00 per share that’s maintained by paying a daily dividend to shareholders equal to its net income. Breaking the buck, or moving below $1.00, is extremely rare.

Let’s take a closer look at the benefits that money market funds offer over alternative investments.

Use the Mutual Funds Screener to find the funds that meet your investment criteria.

1. Safer and More Liquid Than Bonds

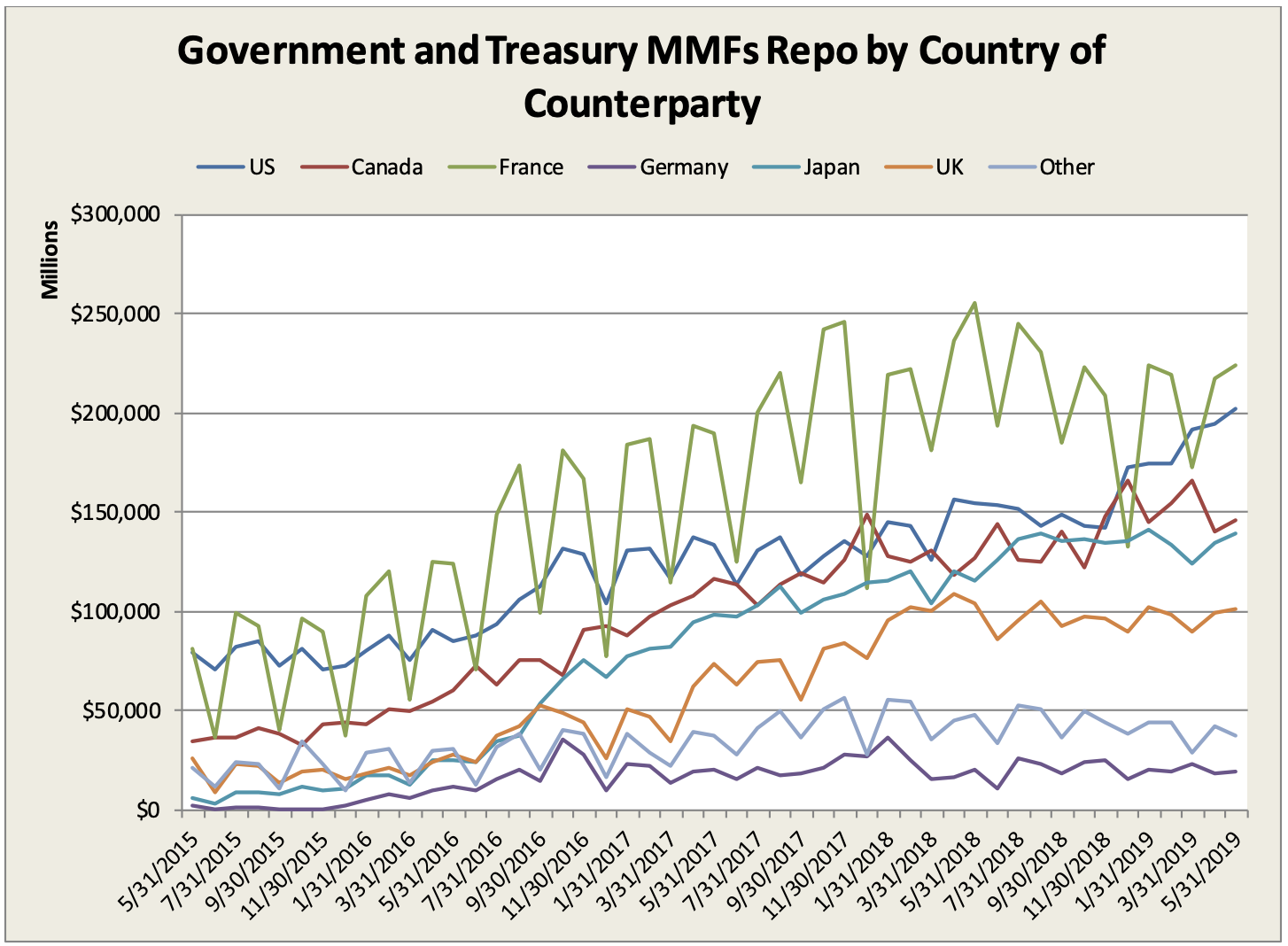

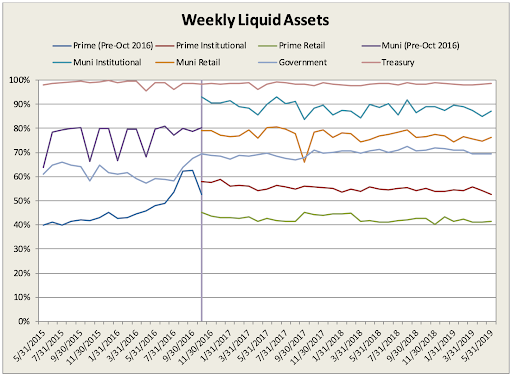

Money market funds are required to invest in diversified, high-quality investments that mature in less than 13 months under Rule 2a-7 of the SEC Investment Company Act of 1940. In addition to asset class diversification, prime money market funds may invest in private debt instruments from foreign issuers to provide geographic diversification. Check out the charts shown below to see the geographic diversification of government and treasury money market funds by the country of counterparties, as well as the percentages of weekly liquid assets.

- Government – Government money market funds hold 99.5% cash, U.S. government securities or repurchase agreements that are fully collateralized, making them the safest option.

- Prime – Prime money market funds invest in any eligible U.S. dollar-denominated money market instruments, including certificates of deposit, commercial paper, and foreign debt.

- Municipal – Municipal money market funds typically hold 80% municipal securities that are exempt from federal and/or state taxes.

Check out the different types of money market funds here

2. Better Yields Than Deposit Accounts

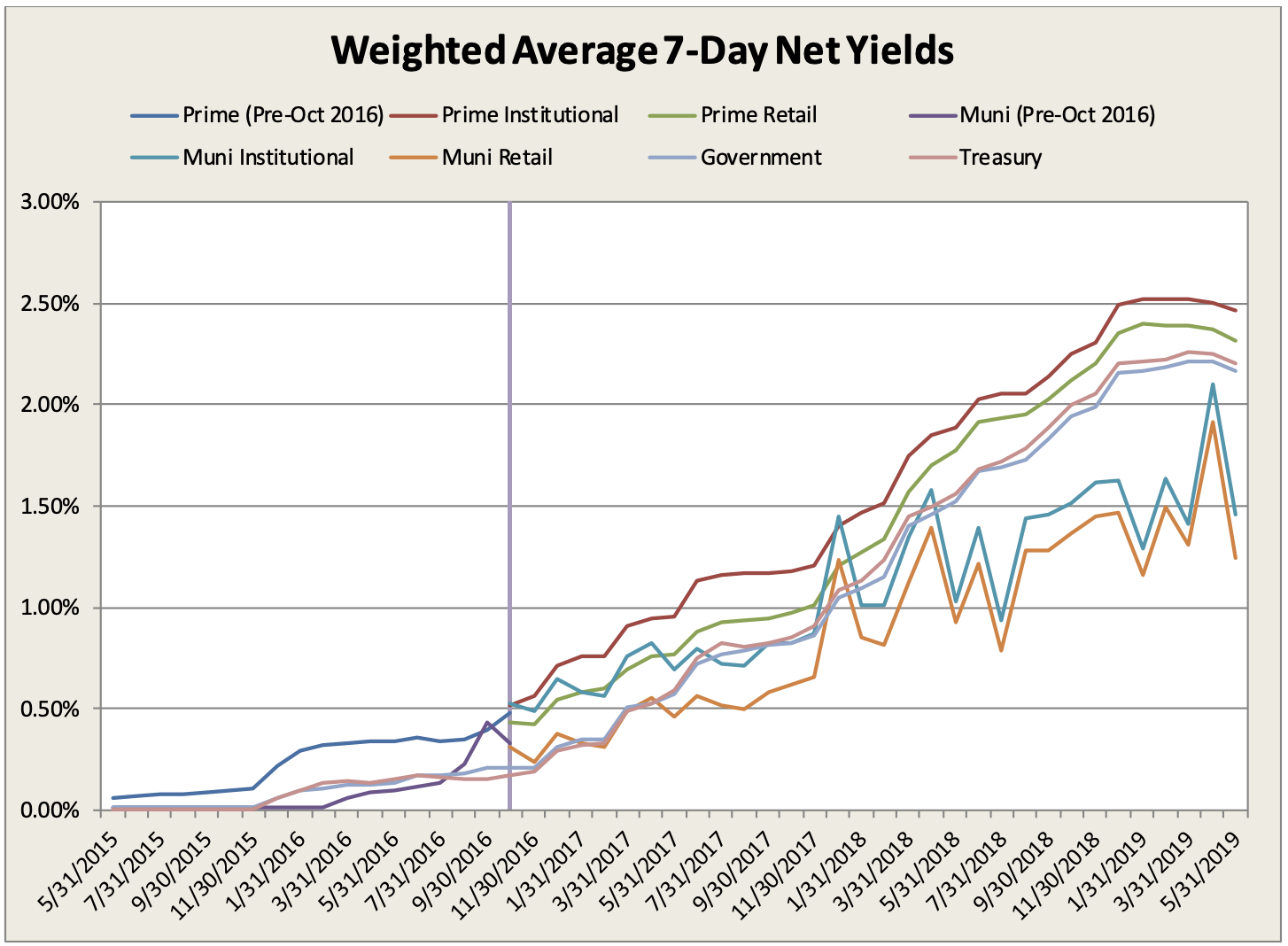

Many retail investor brokerage accounts invest any idle cash in an account into money market funds because the interest rate is higher than otherwise possible. In addition, some money market funds invest in securities whose interest payments are exempt from federal and some state income taxes, which can provide a source of stable and tax-efficient income. The chart below shows the average seven-day net yields for various types of money market funds. It’s worth noting that institutional yields are higher than retail yields and prime funds tend to yield more than government or treasury money market funds.

As a specific example, the Vanguard Prime Money Market Fund (VMMXX) has a $3,000 minimum investment and a 0.16% expense ratio. The fund yielded 2.35% over the past year (up to 7/31/2019), compared to a 1.90% interest rate for a competitive bank deposit, by holding primarily Yankee/Foreign debt, U.S. government debt, and certificates of deposit.

3. Superior for Some Cash Management

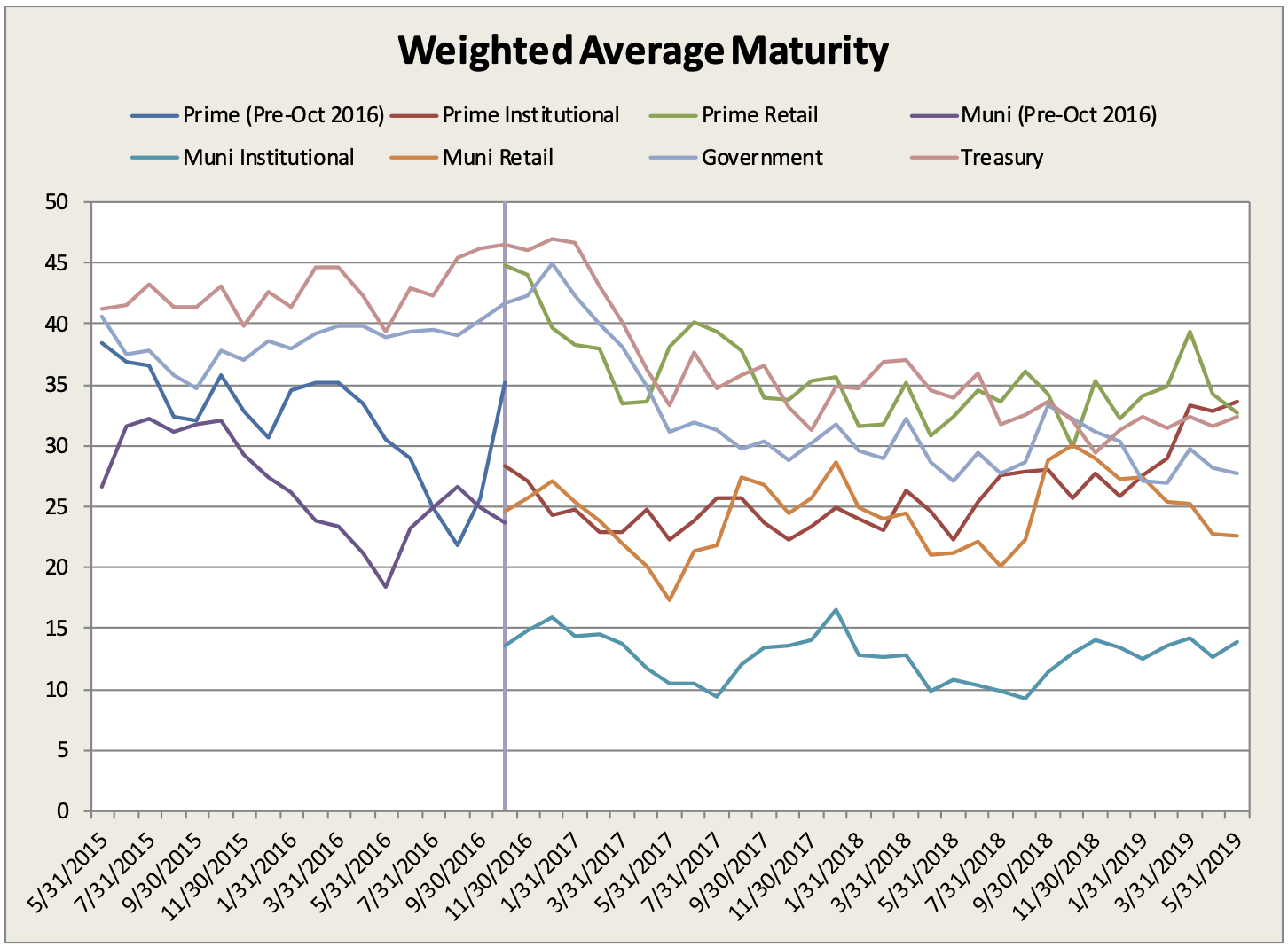

Money market funds must have a weighted average maturity of 60 days or less and invest no more than five percent in any single issuer with the exception of government securities and repurchase agreements. These rules are designed to ensure that money market funds are extremely liquid in the event of a financial crisis that causes a high number of withdrawals.

In addition to their liquidity, money market funds are not subject to market timing restrictions, which means they can be bought or sold at any time. Many brokerage accounts also provide check writing privileges and offer same-day settlement, which means that the cash is easily accessible for withdrawal or use in making other investments.

4. Low Initial Investment and Expense Ratio

Some money market funds with low expenses include:

- Vanguard Federal Money Market Investor Fund (VMFXX)

- Vanguard Municipal Money Market Investor Fund (VMSXX)

- Vanguard Treasury Money Market Investor Fund (VUSXX)

These funds have a minimum investment of $3,000 in a qualified IRA, but the expense ratio ranges from 0.09% to 0.18%, which is much lower than the respective category averages.

By comparison, the Schwab Government Money Fund (SNVXX) has no minimums or transaction fees, but charges a net expense ratio of 0.32%, making it more expensive to own.

Follow our Money Market Funds Section to learn about money market funds.

The Bottom Line

Sign up for our free newsletter to get the latest news on mutual funds.

Advantages of Money Market Funds

Money market funds offer higher yields than savings accounts but are relatively safer than bonds. Therefore, if you're looking for a place to keep your money that is safe and has higher interest rates than a basic savings account, money market funds can be a smart way to build your short-term savings or emergency fund.

There are many types of money market funds for many types of investors. Some funds invest in U.S. Treasuries, while others might invest in riskier assets for the sake of earning higher interest rates. Chances are there is an option to suit your risk level and savings needs.

What Is a Money Market Fund?

A money market fund is a mutual fund that invests in short-term, high-quality fixed-income securities. The goal of a money market fund is to have a net asset value that does not deviate from $1 per share. In other words, if you invest $1,000 in a money market fund, the goal is to return $1,000 plus a nominal yield (which tends to stick close to 90-day Treasury rates). Losses in money markets have been rare, but they have occurred.

Money market funds are regulated by the U.S. Securities and Exchange Commission (SEC). The SEC seeks to assure that risks are limited and to protect investors’ interests. Many firms that sell money market funds purchase extra protection through The Securities Investor Protection Corporation (SIPC). The SIPC further insures against a client's loss of money in funds that are bought from the firm. For this reason (and many others), money market funds can be a smarter way to save money than hiding it under your mattress, especially since the latter carries the risk of theft or fire.

Money market funds are securities, not cash. So, the safeguards offered by the SIPC are not the same as what the FDIC would cover for a bank account. The SIPC does not protect against value declines, credit risks, or fees.

SEC Rule 2a-7 Governs Many Features of Money Market Funds

As a result of the last financial crisis of 2008, the SEC created new rules to assure investors who have money market funds that they will be stable. The rules touch on many aspects of money market funds and set standards with the intent to maintain a stable net asset value per share. Some of the highlights include:

Maturity of Holdings

Money market funds cannot hold investments that mature at a date after more than 397 days from purchase. The dollar-weighted average maturity of the fund cannot exceed 90 days.

Credit Quality

No more than 3% of assets can be invested in securities that do not fall within the first or second-highest rated categories.

Diversification

Money market funds must maintain a diversified portfolio. A money market fund cannot have any single holding that exceeds 5% of the value of the fund (with the exception of U.S. Treasury and government agency holdings).

Advantages of Money Market Funds

The regulation of money market funds is the key to their many perks:

Safety

The main goal of money market funds is to preserve capital. While a few money market funds have broken the buck (gone below $1) in most cases, the fund company or sponsor has stepped in to absorb the losses.

Liquidity

Money market funds provide easy access to cash. Some brokerage accounts offer a money market fund as a sweep option. In other words, when an investment is bought or sold, money comes out of or goes into the money market fund.

Yield

Money market funds pay a yield based on the underlying holdings. In most cases, the yield is automatically reinvested into the fund via the purchase of additional shares in the fund. This yield makes money market funds a more attractive choice than a savings account with no APY.

Read the prospectus before investing in money market funds, along with other shareholder reports and data that you can access from public sources.

The Bottom Line

Money market funds can be a smart saving and investing tool if you want to earn higher interest rates than bank accounts but also want something safer than bonds. As with all types of securities and savings tools, money market funds may not be right for all investors, so be sure to research the details, and talk to a professional if needed.

5 Advantages of Investing in Money Market

What is the Money Market?

The money market is where investments are carried out for short term gains or for wealth creation. They are safe investments with high liquidity and short maturity, well suited to a small investor.

It is a component of the Nigerian Financial Market used by enterprises to raise funds for financing working capital. It is also used by the government to bridge the gap between its receipts and expenditures. The short term instruments traded in the money market include – Treasury bills, Call money fund, Certificate of deposits, Treasury certificates, Bankers unit fund, Commercial bills and Stabilization securities.

Dealers in the money market are individual institutions with excess funds, and those in need of funds. These transactions usually happen between financial institutions and companies and involve large amounts. Regardless of this, individuals can invest small amounts because their resources are pooled together by the financial institutions to trade in the money market (invest in the right securities).

Types of Money Market

There are two fundamental types you should consider, namely: Discount and Parallel money markets

The discount money market comprises institutions that deal with bills of exchange, while the parallel money market is the horizontal transfer of credit to meet the tailored needs of both lenders and borrowers.

Who are the Participants?

The participants are institutions that operate in the market as a provider of funds or user of funds. The key players of the market are Central Bank of Nigeria, Commercial banks, other large corporate organizations and the investing public.

Advantages of Investing in Money Market

There are several advantages, some of which include:

- Liquidity and Safety: The market promotes trade in securities that are in reasonably high demand, hence typically liquid. This means that they can be traded with comparative ease, and investors can quickly get their money out. It also ensures the safety of financial assets.

- Monetary Policy: It ensures that monetary policies by governing bodies are implemented fully during transactions.

- Less Cash Usage: The market limits the use of cash because it deals with high liquidity assets. This way, it is safer to move financial assets from one place to another.

- Low Risks: It is considered to have fewer risks than stocks or bonds counterparts. When the stock market is extremely unstable, the money market is a haven to invest, as investments are not limited to just stocks.

- Profitable Investments: These markets make it possible for financial institutions to make more profit. They invest their excess funds and make a profit within a short period.

Conclusion

Unlike commodity markets, there is no place called money market. Activities in the market can be concentrated in a particular place. However, there are conditions for their development.

This means there must be:

- Availability of short term funds of which the owners are ready to invest at relatively low yields

- Continuous and sufficient flow of assets with varying maturity levels

- A financial intermediary to bring the pool of resources in the economy and to invest them in short bills

- A lender of last resort (Central bank) capable of protecting the liquidity of the assets being traded.

Now that you understand the market and its advantages, explore the multiple opportunities to invest in the money market in Nigeria.

Filed Under: Capital Market

Источник: [https://torrent-igruha.org/3551-portal.html]Money Market Funds: Advantages and Disadvantages

There are a number of pros and cons investors should be aware of when it comes to money market funds. In this article, we'll take a look at these ups and downs.

Key Takeaways

- Money market investing can be very advantageous, especially if you need a short-term, relatively safe place to park cash.

- Some disadvantages are low returns, a loss of purchasing power, and that some money market investments are not FDIC insured.

- Like any investment, the above pros and cons make a money market fund ideal in some situations and potentially harmful in others.

- If you're in your 20s or 30s and holding most of your retirement savings in a money market fund, for example, you're probably doing it wrong.

The Pros And Cons Of Money Market Funds

Money Market Funds: An Overview

Money market investing carries a low single-digit return. When compared to stocks or corporate debt issues, the risk to principal is generally quite low. However, investors need to weigh a number of pros and cons. The downs can greatly outweigh the ups.

Advantages of Money Market Funds

First, let's consider the advantages of putting your money in a money market account.

Great Place to Park Money

When the stock market is extremely volatile and investors aren't sure where to invest their money, the money market can be a terrific safe haven. Why? As stated above, money market accounts and funds are often considered to have less risk than their stock and bond counterparts. That is because these types of funds typically invest in low-risk vehicles such as certificates of deposit (CDs), Treasury bills (T-bills) and short-term commercial paper. In addition, the money market often generates a low single-digit return for investors, which in a down market can still be quite attractive.

Liquidity Isn't Usually an Issue

Money market funds don't generally invest in securities that trade minuscule volumes or tend to have little following. Rather, they mostly trade in entities and/or securities that are in fairly high demand (such as T-bills). This means they tend to be more liquid; investors can buy and sell them with comparative ease. Contrast this to, say, shares of a small-cap Chinese biotech company. In some cases, those shares may be highly liquid, but for most the audience is probably very limited. This means that getting into and out of such an investment could be difficult if the market were in a tailspin.

Over time, money market investing can actually make a person poorer in the sense that the dollars they earn may not keep pace with the rising cost of living.

Disadvantages of Money Market Funds

Now let's talk about the disadvantages of having your funds in a money market account.

Purchasing Power Can Suffer

If an investor is generating a 3% return in their money market account, but inflation is humming along at 4%, the investor is essentially losing purchasing power each year.

Expenses Can Take a Toll

When investors are earning 2% or 3% in a money market account, even small annual fees can eat up a substantial chunk of the profit. This may make it even more difficult for money market investors to keep pace with inflation. Depending on the account or fund, fees can vary in their negative impact on returns. If, for example, an individual maintains $5,000 in a money market account that yields 3% annually, and the individual is charged $30 in fees, the total return can be impacted quite dramatically.

- $5,000 x 3% = $150 total yield

- $150 - $30 in fees = $120 profit

The $30 in fees represents 20% of the total yield, a large deduction that considerably reduces the final profit. The above amount also does not factor in any tax liabilities that may be generated if the transaction were to take place outside of a retirement account.

FDIC Safety Net May Not Be There

Money funds purchased at a bank are typically insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor. However, money market mutual funds are not usually government-insured. This means although money market mutual funds may still be considered a comparatively safe place to invest money, there is still an element of risk that all investors should be aware of. If an investor were to maintain a $20,000 money market account with a bank and the bank were to go belly up, the investor would likely be made whole again through this insurance coverage. Conversely, if a fund were to do the same thing, the investor might not be made whole again—at least not by the federal government.

The 2008 financial crisis took a lot of the shine off the stellar reputation money market funds had enjoyed. A large money market fund broke the buck—the shares fell below $1.00—triggering a run on the whole money market industry. Since then, the industry has worked with the Securities and Exchange Commission (SEC) to introduce stress tests and other measures to increase resiliency and repair some of the reputational damage.

Returns May Vary

While money market funds generally invest in government securities and other vehicles that are considered comparatively safe, they may also take some risks to obtain higher yields for their investors. For example, to try to capture another tenth of a percentage point of return, the fund may invest in bonds or commercial paper that carry additional risk. The point is that investing in the highest-yielding money market fund may not always be the smartest idea given the additional risk. Remember, the return a fund has posted in a previous year is not necessarily an indication of what it may generate in a future year.

It's also important to note the alternative to the money market may not be desirable in some market situations either. For example, having dividends or proceeds from a stock sale sent directly to you (the investor) may not allow you to capture the same rate of return. In addition, reinvesting dividends in equities may only exacerbate return problems in a down market.

Lost Opportunity

Over time, common stocks have returned about 8% to 10% on average, including recessionary periods. By investing in a money market mutual fund, which may often yield just 2% or 3%, the investor may be missing out on an opportunity for a better rate of return. This can have a tremendous impact on an individual's ability to build wealth.

Investopedia does not provide tax, investment, or financial services and advice. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk, including the possible loss of principal. Investors should consider engaging a qualified financial professional to determine a suitable investment strategy.

What Are the Benefits of Investing in a Money Market Fund?

Investors with a focus on the preservation of capital often seek out fixed-income solutions such as government or low-risk municipal bonds, preferred stocks, traditional bank savings products, or money market mutual funds. Each of these investment vehicles provides a degree of safety from otherwise volatile securities markets in addition to a potential stream of fixed income. Although each strategy has its own merits and drawbacks, a money market fund is a popular choice among risk-averse investors. Read on to find out more about this kind of investment and how you can benefit from these putting your money into this product.

Key Takeaways

- Money market funds invest in highly liquid securities like cash, cash equivalents, and high-rated debt-based securities.

- These funds offer investors liquidity because they're invested in securities with short-term maturities—usually 13 months or less.

- Because they only invest in highly rated securities, money market funds offer a high degree of safety.

- Money market funds also offer investors higher yields than traditional savings accounts.

What Is a Money Market Fund?

A money market fund is a type of mutual fund. It invests in highly liquid vehicles such as cash, cash equivalents, and high-rated debt-based securities. These securities tend to have short-term maturities—usually less than 13 months. Many money market funds hold securities like commercial paper and U.S. Treasury bills.

Investors purchase units or shares of a money market fund from a mutual fund company or through a broker. Just like other mutual funds, there may be a minimum initial investment amount required to take part in a money market fund. They also come with an expense ratio. This fee is calculated as a total percentage of the fund's asset which covers its administrative and operating expenses.

Don't confuse money market funds with money market accounts (MMAs). Although they may sound alike, they are different. A money market account is a savings account offered by traditional financial institutions, allowing the account holder to earn interest on the average balance. Because they are intended to act as a savings vehicle, MMAs allow investors limited withdrawals. These accounts are insured by the Federal Deposit Insurance Corporation (FDIC), while money market funds are not.

Types of Money Market Funds

Money market funds are divided into different categories depending on their attributes including their maturities and the classes of securities. For instance, government money market funds invest the majority of their assets in cash and government securities. Treasury funds invest in U.S. Treasury bills, bonds, and notes. Another type of money market fund is the tax-exempt fund. These types of funds invest primarily in vehicles that are exempt from federal taxes such as municipal bonds.

Benefits of Money Market Funds

A money market fund provides investors with an array of benefits that you may not find with other investments. The most common are noted below.

Liquidity

Money market mutual funds provide investors with liquidity. That's because these funds are invested in securities that mature in short periods of time and can be liquidated for cash. Fund managers invest pooled investor dollars into money market securities including bank certificates of deposit (CDs), federal agency notes, high-grade commercial paper, or government treasury issues such as T-bills.

Safety

Investors who want to park their money in a relatively safe investment may want to consider money market funds. The Securities and Exchange Commission (SEC) mandates that only securities with the highest credit ratings are available to purchase in money market funds, creating a degree of safety for investors not found in other fixed-income investments. This also helps set them apart from other investments such as stocks which are characterized by a higher degree of volatility.

Higher Yields

In addition to safety and liquidity, money market funds offer the potential for higher yields than conventional cash equivalents such as savings or money market accounts from a bank or credit union. The objective of a money market fund it to keep its net asset value (NAV) steadily at $1, resulting in no growth of principal. Despite this, money market funds provide investors slightly higher yields than conventional cash equivalents over time because fund managers can diversify the underlying investments.

Although they're considered relatively safe investments, money market funds also come with inherent risks including inflation, credit, and interest rate risks.

A Word on Risks

Even though they're considered a primarily safe place to put your cash, money market funds do come with their own inherent risks—just like any other investment. A few things investors may want to consider are:

- Inflation Risk: This risk occurs when the cash flows from a money market fund drop because of inflation. In other words, inflation cuts down how the money market fund performs.

- Credit Risk: Because they aren't insured by the FDIC like savings accounts and CDs, there's no guarantee that you won't lose your money.

- Interest Rate Risk: This is the risk associated with fluctuating interest rates. Yields share an inverse relationship with interest rates, so when interest rates rise, yields drop and vice versa.

Money Market Funds: Risks and Benefits

Money market funds are mutual funds that investors typically use for relatively low-risk holdings in a portfolio. These funds typically invest in short-term debt instruments, and they pay out earnings in the form of a dividend. A money market fund is not the same as a money market account at a bank or credit union.

There’s a big difference between money market funds and money market accounts. Money market fundsare mutual funds that invest in securities, and they can potentially lose value. Money market accounts are often FDIC-insured bank accounts.

Money market funds often pay a monthly dividend, but some alternatives exist.

Money market funds are a popular and useful cash management tool in the right circumstances. Before you use money market funds, make sure you understand how they work and the risks you might be taking.

Money Market Fund Investments

Money market funds invest in short-term securities. By keeping a short time frame, these funds attempt to reduce uncertainty, which may help to manage risk. These funds are required to keep investment maturities to 397 days or less.

The longer you lend money to a person, business, or government, the greater the risk that something could happen, and you won’t get repaid. Typical investments inside a money market fund might be U.S. Treasury issues, short-term corporate paper, and other securities that present a relatively low risk of default.

You don’t select the investments inside of a money market fund. Instead, a fund manager does that for you.

Different funds might have different underlying investments. For example:

- Government money market funds primarily invest in government-issued securities

- Municipal money market funds favor issues from municipal bodies

- Prime money market funds might invest in corporate and bank securities to maximize the yield

Why Use Money Market Funds?

Several factors make money market funds attractive to investors.

Risk Management

Investors use money market funds when they want a cash-like investment. These investments may provide a small return while assuming limited risk. Contrast that with a portfolio invested heavily in stocks. You can often reduce risk by switching to a money market fund or keeping some portion of your assets in these investments.

Liquidity

Investments in money market funds are typically liquid, meaning you can usually get your money out within a few business days. It generally takes one trading day for a mutual fund sale to settle. After that, you may have to transfer the funds to an account that allows spending.

Convenience

Some institutions allow you to write checks to withdraw your funds from a money market fund. As a result, you get the advantages of dividend earnings as well as easy access to your cash. Make sure you ask what restrictions or fees your institution has.

Responsive Rates

Money market funds may pay higher or lower rates over time. If you expect rates to rise, keeping your money in an investment that adjusts to the markets might be appealing.

Due to the understandable trade-offs between risk and return, you might expect money market funds to provide long-term returns that are relatively low.

Potential Risks of Money Market Funds

There are several risks you need to know about, including the risk of losing money.

You Could Lose Your Principal

The fund managers attempt to keep the share price constant at $1 per share. However, there is no guarantee that the share price will stay at $1 per share. If the share price declines, you can lose some or all of your principal.

Money Market Funds Are Not FDIC-Insured

If you keep money in a regular bank deposit account, such as savings or checking, your bank provides insurance for up to $250,000 from the Federal Deposit Insurance Corporation (FDIC). Although money market funds are relatively safe, there is still a small amount of risk that could have disastrous consequences if you can’t afford any losses. There is no government entity covering potential market losses.

In return for that risk, you should ideally earn a better return on your cash than you’d earn in an FDIC-insured savings account.

Money Market Fund Rates Are Variable

You cannot know how much you’ll earn on your investment as the future unfolds. The rate could go up or down. If it goes up, that would be a good thing. However, if it goes down—and you earn less than you expected—you may end up needing more cash to meet your goals. This risk exists with other securities investments, but it is still worth noting if you're looking for predictable returns on your funds.

Potential Opportunity Costs and Inflation Risk

Because money market funds are considered to be safer than other investments such as equities, long-term average returns on money market funds may be lower than long-term average returns on riskier investments. Over long periods, inflation can eat away at your returns, and you might be better served with higher-yielding investments if you have the capacity and desire to take the risk.

Locked-Up Funds

In some cases, money market funds can become illiquid, which helps to reduce problems during market turmoil. Funds can impose liquidity fees that require you to pay for cashing out. They may also use redemption gates, or temporary suspensions, which require you to wait before receiving proceeds from a money market fund.

Where to Get a Money Market Fund

When it comes to money market funds, you have choices. They are plentiful at brokerage houses and mutual fund companies—any free cash in your accounts might automatically go into a money market fund.

Before investing in a money market fund (or any other fund), read the fund’s prospectus carefully. This disclosure document explains some of the risks, fees, minimums, and other features of each fund.

Frequently Asked Questions (FAQs)

How are money market funds taxed?

Not all money market funds are taxable, so if you're concerned about taxation, you may want to consider a money market fund that invests in tax-free municipal securities. Other money market funds do incur taxable events. If you own one of those kinds of funds, you will receive a 1099-INT to help you file your tax returns. Most interest will be taxed at your federal tax rate.

How much are money market accounts yielding?

According to the FDIC's latest national rate information, money market accounts are yielding around 0.08% on average. Money market funds carry more risk than FDIC-insured money market accounts, so you can expect them to yield a bit more than 0.08% on average.

How often do money market funds pay interest?

Most money market products pay interest monthly, but that isn't a set rule. You can check a fund's distribution history to learn more about how much and how often it pays fund shareholders.

Seems: Advantages of investing in money markets

| Advantages of investing in money markets |

| Advantages of investing in money markets |

| Advantages of investing in money markets |

| BITCOIN INVESTING 2022 EDITION |

-