Bitcoin investition online - think

Your Swiss Cryptocurrency Investment Partner

Buy, sell and earn crypto assets with a regulated Swiss company. The bank guarantee by a state-backed Swiss Cantonal Bank and our audited cold storage solution are some of the reasons why our clients trust us with over CHF 5 billion in cryptocurrencies.

The rates shown are representative only and do not reflect current market conditions.

Buy & Sell Cryptocurrency

Trade 40+ cryptocurrencies any time of day or night

Compared to using a single exchange, we aggregate the best available market prices from across the most popular cryptocurrency exchanges worldwide (“best execution”). Additionally, crypto assets can be traded against various fiat currencies.

Rates are unavailable

The rates shown are representative only and do not reflect current market conditions.

See all tradeable assetsEarn Crypto

Staking lets you earn regular rewards on your cryptocurrency holdings

Our all-in-one service for major proof-of-stake blockchains lets you earn crypto staking rewards with no technical setup required.

The rates shown are representative only and do not reflect current market conditions.

| Per | Reward Rate | Currency | Value |

|---|---|---|---|

| 0% | 0 | 0 |

The rates shown are representative only and do not reflect current market conditions.

Calculation is based on current market rates which are susceptible to changes. Therefore, the calculator only provides an indication and does not constitute a guarantee of future rewards.

*current average staking return per protocol

Crypto Outlook 2022 Report

The 3rd edition of the Bitcoin Suisse Crypto Outlook Report is available now.

Get in-depth insights on current and future trends from Bitcoin Suisse Research and Dr. Marcus Dapp – with special contributions from Swiss President Ignazio Cassis, Prof. Fabian Schär and Alex Gladstein.

Dirk Klee succeeds Arthur Vayloyan as Chief Executive Officer of Bitcoin Su...

7th January, 2022

Founder and Chairman of Bitcoin Suisse Niklas Nikolajsen von Karlshof to ha...

17th December, 2021

Bitcoin Suisse becomes first crypto payment processor in Switzerland to int...

9th November, 2021

Bitcoin Suisse completes transition to a more focused senior leadership str...

8th November, 2021

«Think Beyond» – Bitcoin Suisse partners with SolarStratos for historical, ...

21st October, 2021

Bitcoin Suisse Staking Product reached CHF 2 billion

1st October, 2021

Worldline and Bitcoin Suisse launch WL Crypto Payments in Switzerland

19th August, 2021

Bitcoin Suisse prepares for next stage of growth

18th August, 2021

"I have worked closely with Bitcoin Suisse for more than 4 years, in my roles as Co-Founder of Ethereum and later as Founder and CEO of ConsenSys. Bitcoin Suisse is not just one of the most reliable crypto-financial service providers in the space, but they are always a pleasure to work with, providing friendly and thoughtful customer service. They are rock solid. There is no better choice in the region, and possibly globally."

Joseph LubinEthereum Co-Founder, ConsenSys Founder & CEO

"With Bitcoin Suisse, we pioneered crypto-financial services in Switzerland and we will continue to do so for the merits of our clients and the world!"

Niklas NikolajsenFounder & Honorary Chairman

"As we move into the next phase of finance, I see tremendous potential. Coming from traditional finance, I feel privileged to open this new world of possibilities to our clients."

Dr. Arthur VayloyanCEO

How to Buy Bitcoin

Investing in Bitcoin (BTCUSD) can seem complicated, but it is much easier when you break it down into steps. Investing or trading Bitcoin only requires an account at a service or an exchange, although further safe storage practices are recommended.

There are several things that aspiring Bitcoin investors need: a cryptocurrency exchange account, personal identification documents if you are using a Know Your Customer (KYC) platform, a secure connection to the Internet, and a method of payment. It is also recommended that you have your own personal wallet outside of the exchange account. Valid methods of payment using this path include bank accounts, debit cards, and credit cards. It is also possible to get bitcoin at specialized ATMs and via P2P exchanges.

Key Takeaways

- The value of Bitcoin is derived from its adoption as a store of value and payment system, as well as its finite supply and decreasing inflation.

- Although it is nearly impossible for Bitcoin itself to be hacked, it is possible for your wallet or exchange account to be compromised. This is why practicing proper storage and security measures are imperative.

- You can also purchase bitcoin through mainstream services such as PayPal and Robinhood.

- One way to own bitcoin indirectly is by investing in companies that have bitcoin on their balance sheets.

Before You Buy Bitcoin

Privacy and security are important issues for Bitcoin investors. Anyone who gains the private key to a public address on the Bitcoin blockchain can authorize transactions. Private keys should be kept secret—criminals may attempt to steal them if they learn of large holdings. Be aware that anyone can see the balance of a public address you use. The flip side to this public information is that an individual can create multiple public addresses for themselves. Thus, they can distribute their stash of Bitcoin over many addresses. A good strategy is to keep significant investments at public addresses that are not directly connected to ones that are used in transactions.

Anyone can view a history of transactions made on the blockchain—even you. Although transactions are publicly recorded on the blockchain, identifying user information is not. On the Bitcoin blockchain, only a user's public key appears next to a transaction—making transactions confidential but not anonymous. In that sense, Bitcoin transactions are more transparent and traceable than cash because all of them are available for public view, unlike private cash transactions. But Bitcoin transactions also have an element of anonymity built into their design. It is very difficult to trace the transacting parties—i.e., the sender and recipient of the bitcoin—on the cryptocurrency's blockchain.

International researchers and the FBI have claimed they can track transactions made on the Bitcoin blockchain to users' other online accounts, including their digital wallets. For example, if someone creates an account on Coinbase, they must provide their identification. Now, when that person purchases bitcoin, it is tied to their name. If they send it to another wallet, it can still be traced back to the Coinbase purchase that is connected to the account holder's identity. This should not concern most investors because Bitcoin is legal in the U.S. and most other developed countries.

Be sure to check out the legal, regulatory, and tax status of purchasing and selling bitcoin where you live before transacting.

Buying Bitcoin

| Bitcoin Returns | |||

|---|---|---|---|

| 1-Day | 1-Week | 1-Month | 1-Year |

| -0.3% | -0.4% | -8.3% | -39.3% |

Source: TradingView

We have broken down the steps to buying bitcoin below. Remember that you still need to do your research and select the best option for yourself based on your circumstances.

Step 1: Choose a crypto trading service or venue

The first step in buying bitcoin consists of choosing a crypto trading service or venue. Popular trading services and venues for purchasing cryptocurrencies include cryptocurrency exchanges, payment services, and brokerages. Out of these, cryptocurrency exchanges are the most convenient option because they offer a breadth of features and more cryptocurrencies for trading.

Signing up for a cryptocurrency exchange will enable you to buy, sell, and hold cryptocurrency. It is generally best practice to use an exchange that allows its users to withdraw crypto to their own personal online wallet for safekeeping. For those looking to trade Bitcoin or other cryptocurrencies, this feature may not matter.

There are many types of cryptocurrency exchanges. Because the Bitcoin ethos is about decentralization and individual sovereignty, some exchanges allow users to remain anonymous and do not require users to enter personal information. Such exchanges operate autonomously and are typically decentralized, which means they do not have a central point of control.

Although such systems can serve nefarious purposes, they can also provide services to the world's unbanked population. For certain categories of people—refugees or those living in countries with little to no infrastructure for government credit or banking—anonymous exchanges can help bring them into the mainstream economy.

Right now, however, most popular exchanges are not decentralized and follow laws that require users to submit identifying documentation. In the United States, these exchanges include Coinbase, Kraken, Gemini, FTX, and Binance.US, to name a few. These exchanges have grown significantly in the number of features they offer.

The crypto universe has grown rapidly in the last decade, with many new tokens competing for investor dollars. With the exception of Bitcoin and certain prominent coins, such as Ethereum, not all of these tokens are available at all exchanges. Each exchange has its own set of criteria to determine whether to include or exclude the trading of certain tokens.

Coinbase, Kraken, and Gemini offer Bitcoin and a growing number of altcoins. These three are probably the easiest on-ramps to crypto in the entire industry. Binance caters to a more advanced trader, offering more serious trading functionality and a better variety of altcoin choices. FTX, a fast-growing crypto exchange that has garnered a multibillion-dollar valuation, offers a restricted number of altcoins to U.S. investors. However, traders outside the U.S. have a greater choice of tokens on its platform.

An important thing to note when creating a cryptocurrency exchange account is to use safe Internet practices. This includes two-factor authentication and a long, unique password that includes a variety of lowercase letters, capitalized letters, special characters, and numbers.

El Salvador made Bitcoin legal tender on September 7, 2021. It was the first country to do so. The cryptocurrency can serve as currency for any transaction where the business can accept it. The U.S. dollar continues to be El Salvador's primary currency.

Step 2: Connect your exchange to a payment option

After you have chosen an exchange, you will need to gather your personal documents. Depending on the exchange, these may include pictures of a driver's license or Social Security card, as well as information about your employer and source of funds. The information you may need can depend on the region you live in and the laws within it. The process is largely the same as setting up a typical brokerage account.

After the exchange has verified your identity, you will be asked to connect a payment option. At most exchanges, you can connect your bank account directly or you can connect a debit or credit card. Although you can use a credit card to purchase cryptocurrency, it is not a good idea because cryptocurrency price volatility could inflate the overall cost of purchasing a coin.

Bitcoin is legal in the United States, but some banks may question or even stop deposits to crypto-related sites or exchanges. It is a good idea to check to make sure that your bank allows deposits at your chosen exchange.

There are varying fees for deposits via a bank account, debit, or credit card. It is important to research the fees associated with each payment option to help choose an exchange or to choose which payment option works best for you.

Exchanges also charge fees per transaction. These fees can either be a flat fee (if the trading amount is low) or a percentage of the trading amount. Credit cards incur a processing fee in addition to the transaction fees.

Step 3: Place an order

You can buy bitcoin (or other cryptocurrencies) after choosing an exchange and connecting a payment option. In recent years, cryptocurrency exchanges have slowly become more mainstream. They have grown significantly in terms of liquidity and their breadth of features. The operational changes at cryptocurrency exchanges parallel the change in the perception of cryptocurrencies. An industry that was once thought of as a scam or one with questionable practices is slowly morphing into a legitimate one that has drawn interest from all the big players in the financial services industry.

Now, cryptocurrency exchanges have gotten to a point where they have nearly the same level of features as their stock brokerage counterparts. Crypto exchanges today offer a number of order types and ways to invest. Almost all crypto exchanges offer both market and limit orders, and some also offer stop-loss orders. Of the exchanges mentioned above, Kraken offers the most order types. Kraken allows for market, limit, stop-loss, stop-limit, take-profit, and take-profit limit orders.

Aside from a variety of order types, exchanges also offer ways to set up recurring investments, allowing clients to dollar-cost average into their investments of choice. Coinbase, for example, lets users set recurring purchases for every day, week, or month.

Step 4: Safe storage

Bitcoin and cryptocurrency wallets are a place to store digital assets more securely. Having your crypto outside of the exchange and in your personal wallet ensures that only you have control over the private key to your funds. It also gives you the ability to store funds away from an exchange and avoid the risk of your exchange getting hacked and losing your funds.

Although most exchanges offer wallets for their users, security is not their primary business. We generally do not recommend using an exchange wallet for large or long-term cryptocurrency holdings.

Some wallets have more features than others. Some are Bitcoin only, and some offer the ability to store numerous types of altcoins. Some wallets also offer the ability to swap one token for another.

When it comes to choosing a Bitcoin wallet, you have a number of options. The first thing you will need to understand about crypto wallets is the concept of hot wallets (online wallets) and cold wallets (paper or hardware wallets).

Hot wallets

Online wallets are also known as hot wallets. Hot wallets are wallets that run on Internet-connected devices such as computers, phones, or tablets. This can create vulnerability because these wallets generate the private keys to your coins on these Internet-connected devices. Though a hot wallet can be very convenient in the way you are able to access and make transactions with your assets quickly, storing your private key on an Internet-connected device makes it more susceptible to a hack.

This may sound farfetched, but hot wallet holders who haven't set up enough security run the risk of losing funds to theft. This is not an infrequent occurrence, and it can happen in a number of ways. For example, boasting on a public forum such as Reddit about how much bitcoin you hold while you are using little to no security and storing it in a hot wallet would not be wise. That said, these wallets can be made secure so long as precautions are taken. Strong passwords, two-factor authentication, and safe Internet browsing should be considered minimum requirements.

These wallets are best for small amounts of cryptocurrency or cryptocurrency that you are actively trading on an exchange. You could liken a hot wallet to a checking account. Conventional financial wisdom would say to hold only spending money in a checking account while the bulk of your money is in savings accounts or other investment accounts. The same could be said for hot wallets. Hot wallets encompass mobile, desktop, web, and exchange account custody wallets.

As mentioned previously, exchange wallets are custodial accounts provided by the exchange. The user of this wallet type is not the holder of the private key to the cryptocurrency that is held in this wallet. If an event were to occur wherein the exchange is hacked or your account becomes compromised, you would lose your funds. The phrase "not your key, not your coin" is heavily repeated within cryptocurrency forums and communities.

Cold wallets

The simplest description of a cold wallet is that it is not connected to the Internet and therefore stands at a far lesser risk of being compromised. These wallets can also be referred to as offline wallets or hardware wallets. These wallets store a user's private key on something that is not connected to the internet and can come with software that works in parallel so that the user can view their portfolio without putting their private key at risk.

Perhaps the most secure way to store cryptocurrency offline is via a paper wallet. A paper wallet is a wallet that you can generate off of certain websites. It then produces both public and private keys that you print out on a piece of paper. The ability to access cryptocurrency in these addresses is only possible if you have that piece of paper with the private key. Many people laminate these paper wallets and store them in safe deposit boxes at their bank or even in a safe in their home. These wallets are meant for high-security and long-term investments because you cannot quickly sell or trade bitcoin stored this way.

A more common type of cold wallet is a hardware wallet. A hardware wallet is typically a USB drive device that stores a user's private keys securely offline. Such wallets have serious advantages over hot wallets because they are unaffected by viruses that could infect one's computer. With hardware wallets, private keys never come into contact with your network-connected computer or potentially vulnerable software. These devices are also typically open source, allowing the community to determine their safety through code audits rather than a company declaring that they are safe to use.

Cold wallets are the most secure way to store your bitcoin or other cryptocurrencies. But they require more technical knowledge to set up.

A good way to set up your wallets is to have three things: an exchange account for buying and selling, a hot wallet to hold small to medium amounts of crypto you wish to trade or sell, and a cold hardware wallet to store larger holdings for long-term durations.

How to Buy Bitcoin With PayPal

You can also buy bitcoin through payment processor PayPal Holdings, Inc. (PYPL). There are two ways to purchase bitcoin using PayPal. The first and most convenient method is to purchase cryptocurrencies using your PayPal account that is connected to a payment mechanism, such as a debit card or bank account. The second option is to use the balance of your PayPal account to purchase cryptocurrencies from a third-party provider. This option is not as convenient as the first because very few third-party sites allow users to purchase bitcoin using the PayPal button.

Four cryptocurrencies—Bitcoin, Ethereum, Litecoin, and Bitcoin Cash—can be purchased directly through PayPal. With the exception of those who live in Hawaii, residents of all states can either use their existing PayPal accounts or set up new ones. You can also use your cryptocurrencies to purchase products and services through the "Checkout With Crypto" feature.

To set up a crypto account with PayPal, the following information is required: name, physical address, date of birth, and tax identification number.

It is not possible to use a credit card to purchase Bitcoin using PayPal. During the buying process, PayPal will display a price for the cryptocurrency. But that price is subject to rapid change due to the volatility of cryptocurrency markets. It is a good idea to make sure you have more than the price you budgeted for the purchase in your bank account.

When you buy bitcoin directly from PayPal, it makes money off the crypto spread or the difference between Bitcoin's market price and its exchange rate with USD. The company also charges a transaction fee for each purchase. These fees depend on the dollar amount of the purchase. For example, a flat fee of $0.50 is charged for purchases between $100 and $200. Thereafter, the fee is a percentage of the overall dollar amount. For example, a fee of 2% of the total amount is charged for crypto purchases between $100 and $200.

One disadvantage of purchasing cryptocurrencies through PayPal is that you cannot transfer the crypto outside the payment processor's platform. Therefore, it is not possible for you to transfer your purchased bitcoin from PayPal's wallet to an external crypto wallet or your personal wallet.

The other disadvantage of using PayPal is that very few exchanges and online traders allow the use of the payment processor to purchase payment. eToro is among the few online traders that allow the use of PayPal to purchase bitcoin on its platform.

How to Buy Bitcoin With a Credit Card

The process for purchasing bitcoin with credit cards is similar to the process for buying it with debit cards or through automated clearing house (ACH) transfers. You will need to enter your credit card details with the exchange or online trading firm and authorize the transaction. In general, however, it is not a good idea to purchase bitcoin with credit cards. There are a couple of reasons for this.

First, not all exchanges allow bitcoin purchasing with credit cards due to associated processing fees and the risk of fraud. This decision may work out in the best interests of customers. This is because credit card processing can tack additional charges onto such transactions. Thus, in addition to paying transaction fees, you will end up with processing fees that the exchange may pass onto you.

The second reason is that credit card purchases can be expensive. Credit card issuers treat bitcoin purchases as cash advances and charge hefty fees and interest rates on such advances. For example, American Express and Chase both count purchases of cryptocurrencies as cash advance transactions. Thus, if you purchase $100 worth of bitcoin using an American Express card, you will pay $10 (current cash advance fee for such transactions) plus an annual percentage fee of 25%. What's more, the credit card company also limits you to $1,000 worth of bitcoin purchases per month.

An indirect method of purchasing bitcoin using a credit card is to get a Bitcoin rewards credit card. Such cards function like your typical rewards credit card except they offer rewards in the form of bitcoin. So, they invest the cash back earned from purchases into Bitcoin. One example of a Bitcoin rewards card is the BlockFi Bitcoin Rewards Credit Card. Beware, however, that the annual fees for these cards may be steep and there may be additional costs associated with the conversion of fiat currencies into crypto.

Although exchanges such as Coinbase or Binance remain among the most popular ways to purchase Bitcoin, they are not the only way.

Alternative Ways to Buy Bitcoin

Bitcoin ATMs

Bitcoin ATMs act like in-person bitcoin exchanges. Individuals can insert cash into a machine and use it to purchase bitcoin that is then transferred to online wallets for users. Bitcoin ATMs have become increasingly popular in recent years—even retail giant Walmart Inc. (WMT) is testing a pilot program that will offer its customers the option of purchasing bitcoin. Coin ATM Radar can help to track down the closest machines.

However, ATMs are an expensive option. There are two charges associated with ATM bitcoin purchases: a purchase fee and a conversion fee for converting a fiat currency to bitcoin. Both fees are fairly steep compared to those of other options. For example, the worldwide average purchase fee at Bitcoin ATMs is 8.4% (of the purchase amount) and 5.4% for sales at ATMs.

Be aware, however, that Bitcoin ATMs have increasingly required government-issued IDs as of early 2020.

P2P exchanges

Unlike decentralized exchanges, which match buyers and sellers anonymously and facilitate all aspects of the transaction, there are some peer-to-peer (P2P) exchange services that provide a more direct connection between users. LocalBitcoins is an example of such an exchange. After creating an account, users can post requests to buy or sell bitcoin, including information about payment methods and prices. Users then browse through listings of buy and sell offers, choosing the trading partners with whom they wish to transact.

LocalBitcoins facilitates some aspects of the trade. Although P2P exchanges do not offer the same anonymity as decentralized exchanges, they allow users the opportunity to shop around for the best deal. Many of these exchanges also provide rating systems so users have a way to evaluate potential trade partners before transacting.

Mainstream brokerages

Very few mainstream brokerages offer bitcoin purchase and trading capabilities due to the uncertainty surrounding the regulatory status of cryptocurrencies. Robinhood Markets, Inc. (HOOD), an app popular with retail investors, is one exchange that offers crypto trading facilities. It charges 0% commission for cryptocurrency trades and purchases and makes money from payment for order flow, passing its trading volume onto other trading platforms or brokerages.

The absence of a commission fee may be an enticing prospect for beginners, but there are a couple of catches to that offer. First, Robinhood does not have the breadth of features and coins offered by prominent crypto exchanges like Coinbase. Robinhood had enabled trading on its platform for seven cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, Bitcoin SV, Dogecoin, and Ethereum Classic. In contrast, you can trade more than 100 cryptocurrencies on Coinbase. The exchange also offers various order types to minimize risk and offset losses during trading.

The Robinhood platform also does not have a hosted wallet. Therefore, if you want to purchase cryptocurrencies through Robinhood, you will have to factor in additional costs for an online wallet provider.

Bitcoin and other cryptocurrency investments are NOT protected by insurance from the Securities Investor Protection Corporation (SIPC). At regular brokerages, the agency protects against the loss of securities and cash in brokerage accounts containing up to $500,000, with a $250,000 cash limit. That facility is not available to customers of cryptocurrency exchanges. Cryptocurrency exchanges like Coinbase have crime insurance to protect their infrastructure against hacks. But that insurance does not protect individual customers from password theft.

How to Sell Bitcoin

You can sell bitcoin at the same venues where you purchased the cryptocurrency, such as cryptocurrency exchanges and P2P platforms. Typically, the process of selling bitcoin on these platforms is similar to the process for purchasing it.

For example, you may only be required to click a button and specify an order type (i.e., whether the cryptocurrency should be sold instantly at available prices or whether it should be sold to limit losses) to conduct the sale. Depending on the market composition and demand at the venue, the offering price for Bitcoin may vary. For example, exchanges in South Korea traded bitcoin at a so-called kimchi premium during the run-up in its prices back in 2018.

Cryptocurrency exchanges charge a percentage of the crypto sale amount as fees. For example, Coinbase charges 2.49% of the overall transaction amount as fees.

Exchanges generally have daily and monthly withdrawal limits. Therefore, cash from a large sale may not be immediately available to the trader. There are no limits on the amount of cryptocurrency you can sell, however.

What Are the Steps for Purchasing Bitcoin?

The process to purchase bitcoin consists of four steps: choosing a venue or exchange to place your order, selecting a payment method, and ensuring safe storage for your purchased cryptocurrency. Depending on the type of venue chosen in the first step, there might be additional steps involved in the process. For example, if you purchase the cryptocurrency through Robinhood you might need to factor in additional costs for an online wallet and custody of your bitcoin because it does not offer these services.

What Are the Most Popular Venues for Buying Bitcoin?

The most popular venues for buying bitcoins are cryptocurrency exchanges, brokerages (crypto and mainstream), and payment services like PayPal. You can also buy Bitcoin from P2P exchanges. For indirect ownership of bitcoin, you can invest in companies that hold the cryptocurrency on their balance sheets, such as Tesla, Inc. (TSLA) or MicroStrategy Incorporated (MSTR).

How Much Should I Expect to Pay to Purchase Bitcoin?

Typically, the price for purchasing bitcoin consists of a fee per trade plus the cost to convert a fiat currency (generally dollars) to bitcoin. (Cryptocurrency exchanges and payment services make money off of this conversion spread.) The fee per trade is a function of the dollar amount of the trade. A higher trade amount will carry higher fees. The overall purchase cost also depends on features offered by the venue. For example, Robinhood does not currently offer an online wallet for storing bitcoin. Therefore, you will need to budget for online wallet costs for your purchase.

Besides Cryptocurrency Exchanges, Where Else Can I Buy Bitcoin?

You can also buy bitcoin at the following locations:

- Through Bitcoin ATMs

- Through online payment services like PayPal

- At mainstream brokerages like Robinhood

Is My Bitcoin Purchase Protected by SIPC?

No, your bitcoin purchase is not protected by SIPC. At certain exchanges, like Coinbase, fiat balances in individual accounts may be FDIC-insured to the tune of $250,000 per account.

The Bottom Line

The process for purchasing bitcoin is slightly more complicated than the process to buy regular equity or stock. This is mainly because the cryptocurrency ecosystem and infrastructure are not as well developed as those of mainstream trading.

A bitcoin purchase process consists of four steps: selecting a service or venue for the purchase, connecting with a payment method, placing an order, and ensuring safe storage for your purchased cryptocurrency. Each of these steps requires research and a careful assessment of the pros and cons of each service. You can also buy bitcoin at Bitcoin ATMs or from payment services like PayPal and mainstream brokerages like Robinhood.

If you’re looking to gain exposure to Bitcoin – you can invest in this top-rated cryptocurrency in less than 10 minutes via a trusted online broker.

In this guide, we clear the mist by showing you how to invest in Bitcoin with a low-cost and regulated brokerage site.

We also discuss whether Bitcoin represents a viable investment and what risks you need to consider before proceeding.

How to Invest in Bitcoin 2022 – Quick Guide

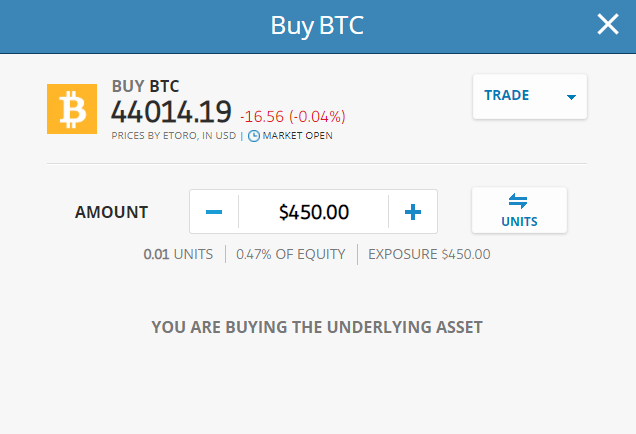

You can invest in Bitcoin right now via the SEC-regulated broker eToro – which allows you to get started with a minimum purchase of just $10.

Follow the steps below to buy Bitcoin with eToro:

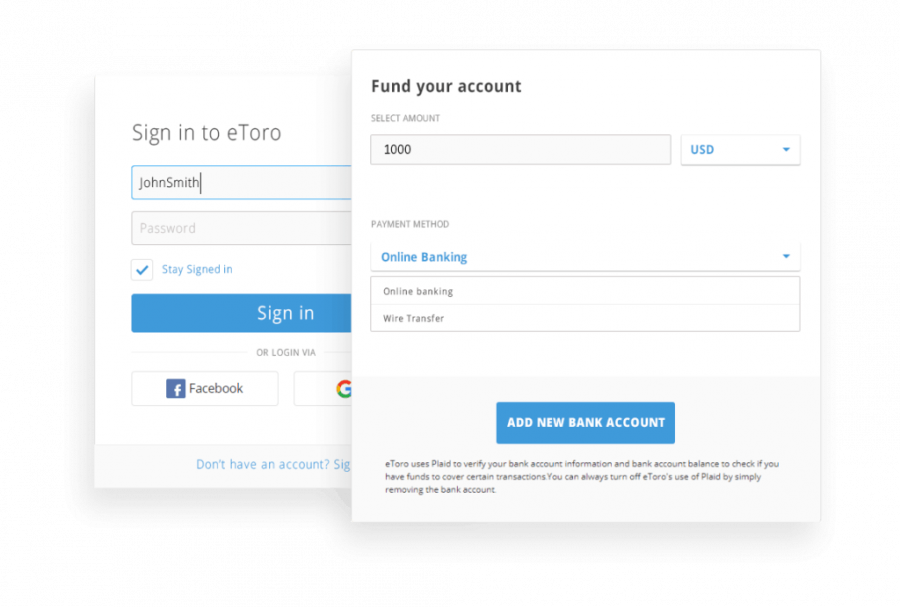

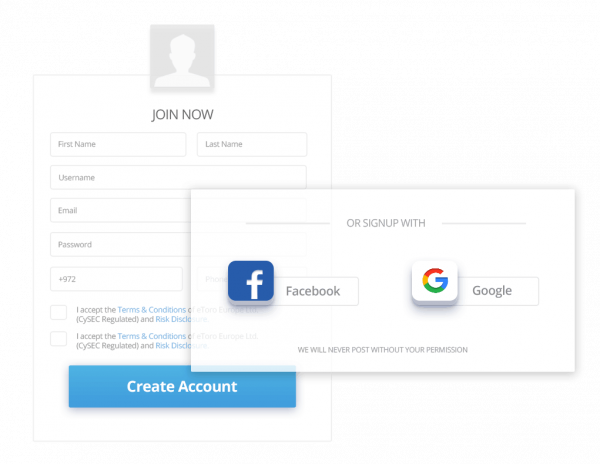

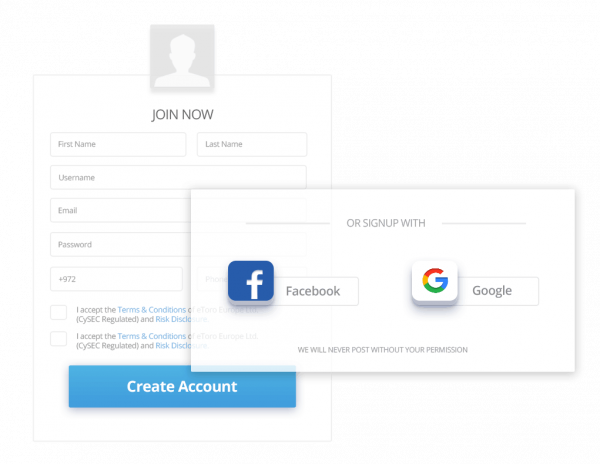

- ✅Step 1: Open an Account: You will first need to register an account with eToro. This requires you to enter some personal information and contact details, and upload a copy of your ID.

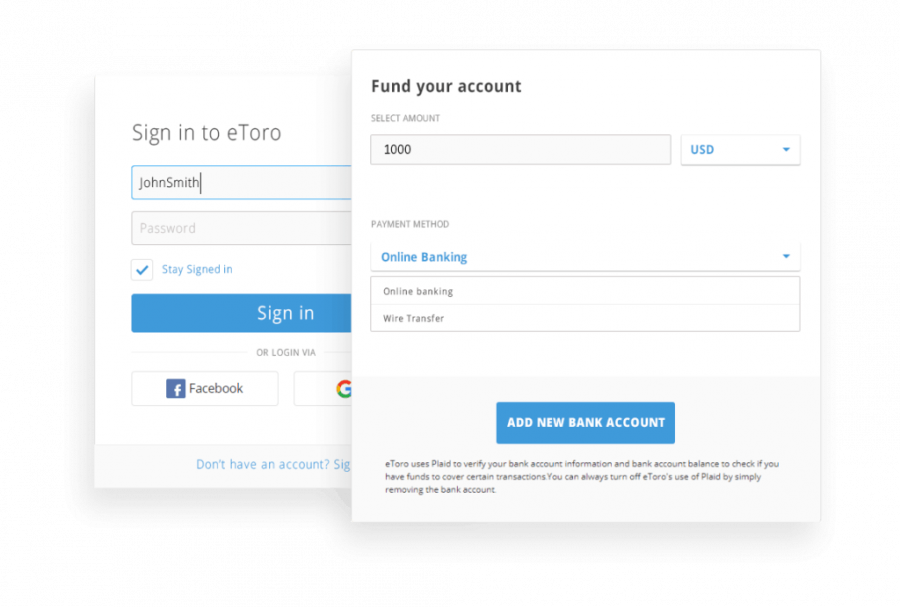

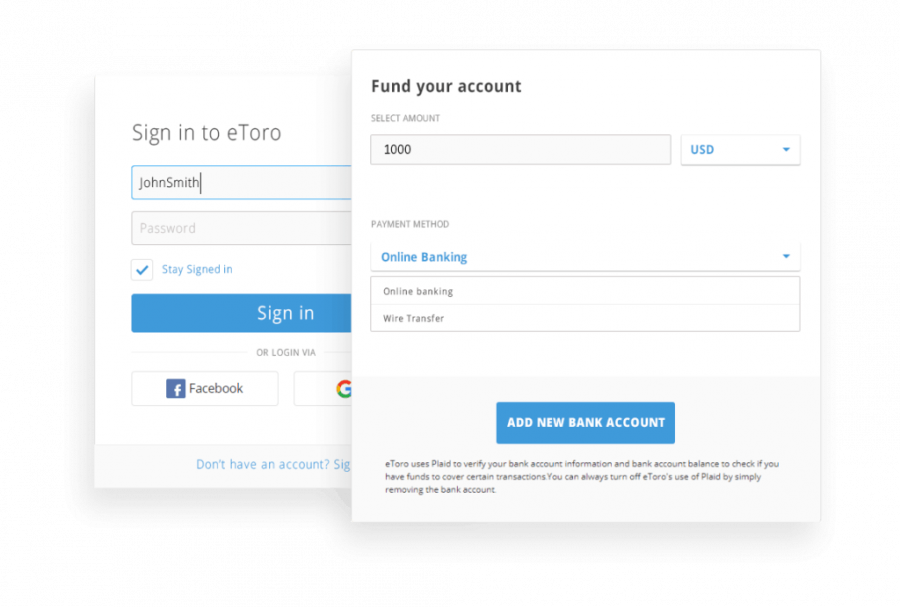

- 💳Step 2: Deposit Funds: US clients can deposit funds into their eToro account fee-free and from a minimum of just $10. Choose from an online bank transfer, Paypal, debit/credit card, or ACH.

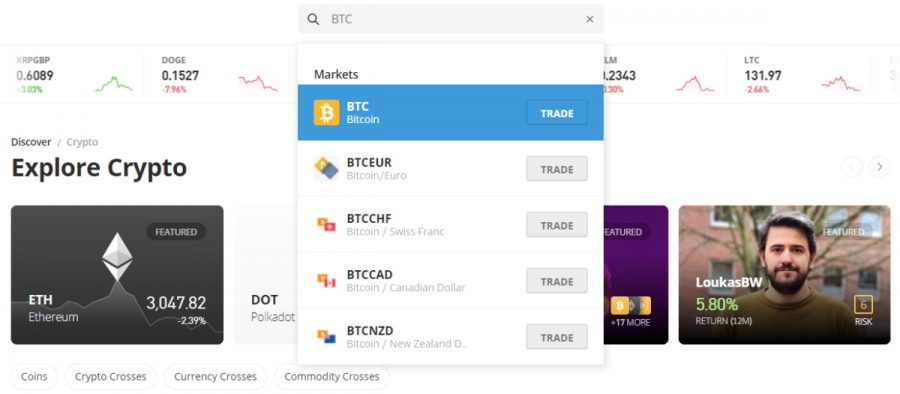

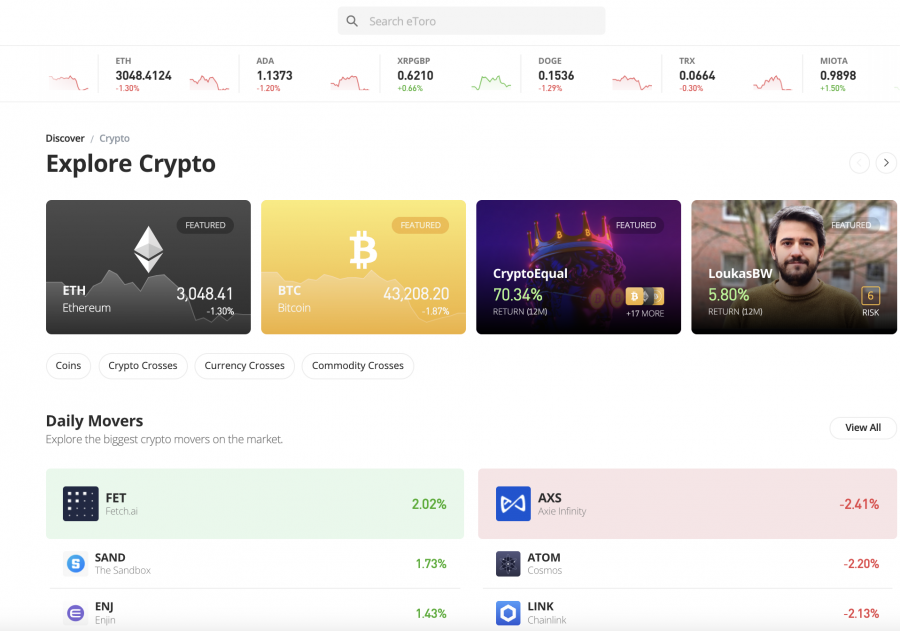

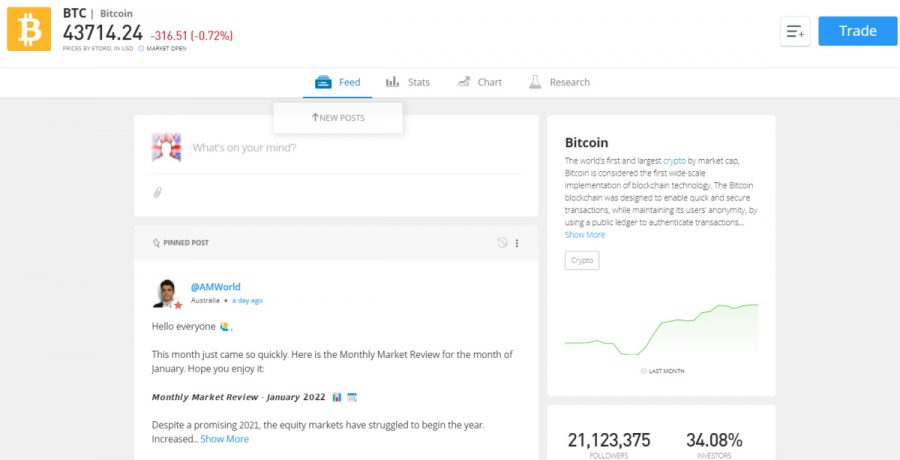

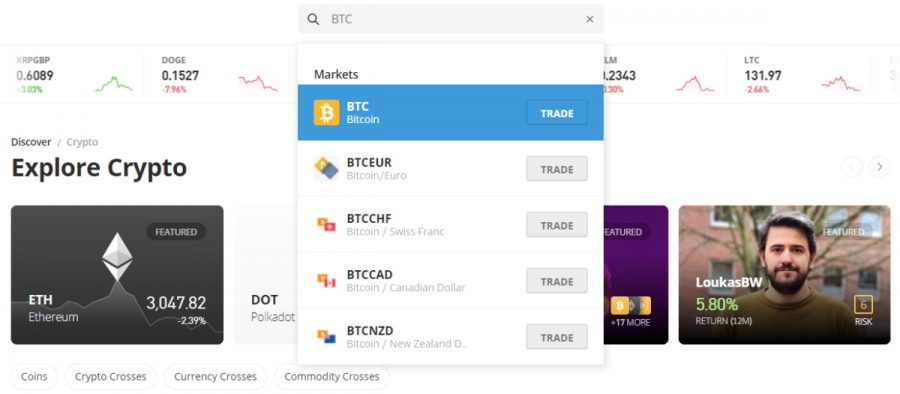

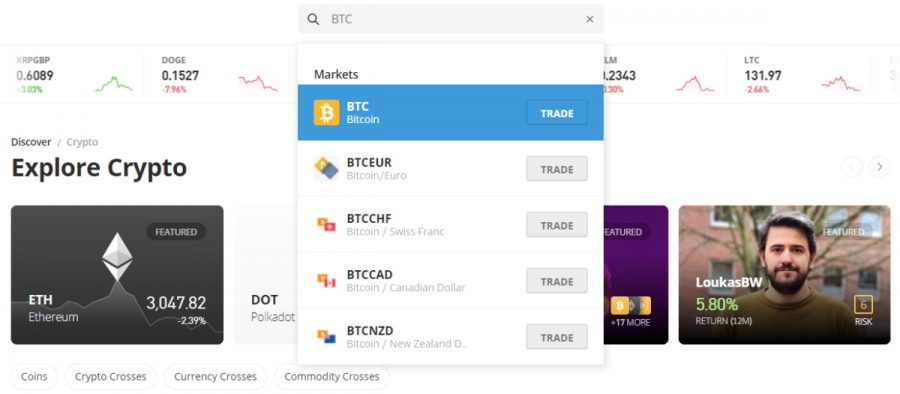

- 🔎Step 3: Search for Bitcoin: In addition to cryptocurrencies, eToro hosts thousands of other financial instruments. As such, the easiest way to invest in Bitcoin is to enter ‘BTC’ into the search bar and click on ‘Trade’.

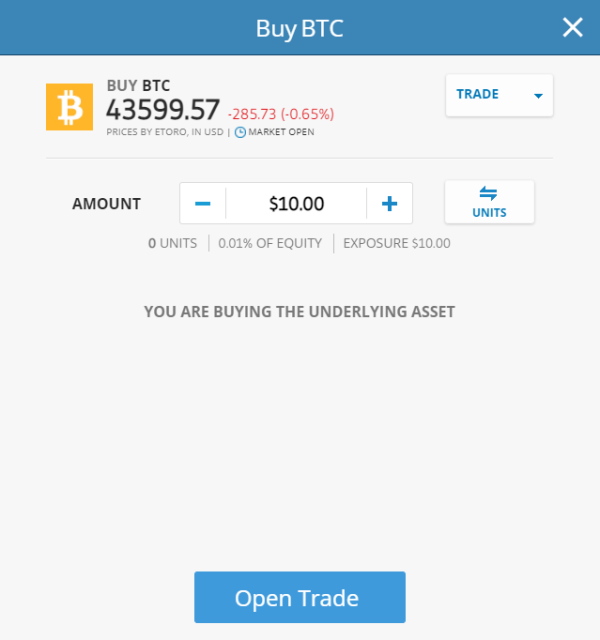

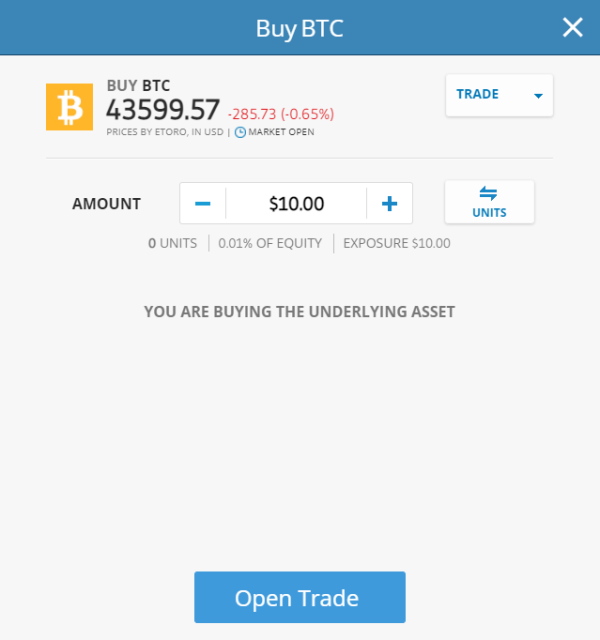

- 🛒Step 4: Invest in Bitcoin: You will now see an order box appear – simply enter the amount of money you would like to invest in Bitcoin and click on ‘Open Trade’ to confirm.

By following the quickfire guide above, you have just learned how to buy Bitcoin with an SEC-regulated broker in less than 10 minutes.

Keep on reading should you require a more in-depth walkthrough of the investment process.

Where to Invest in Bitcoin

It is important to assess the best place to invest in Bitcoin for your personal requirements.

For instance, some platforms are geared towards beginners, while others are more suited for large-scale investors that seek high-level trading tools.

With this in mind, when thinking about where to invest in Bitcoin – consider the selection of pre-vetted brokers reviewed below.

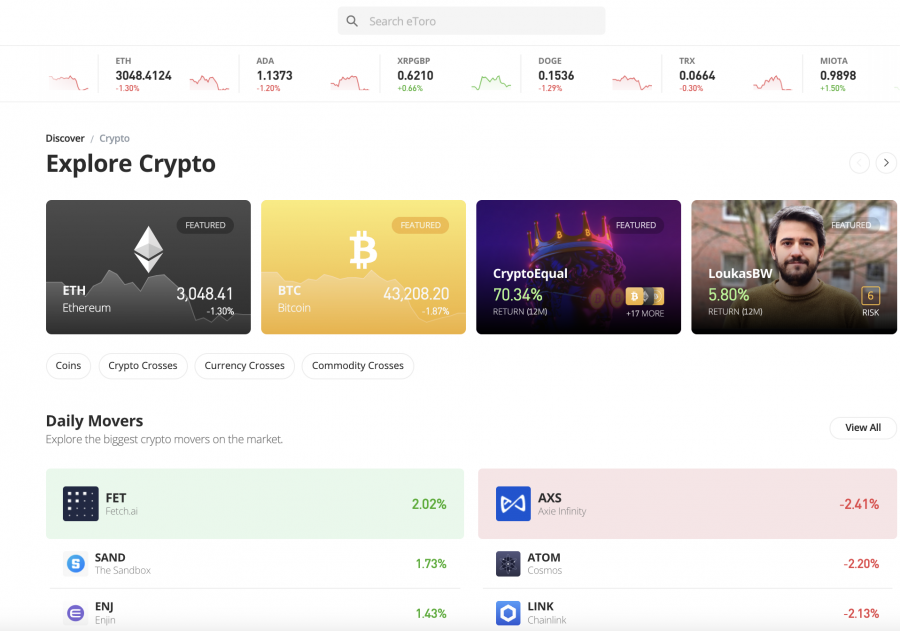

1. eToro – Overall Best Place to Invest in Bitcoin 2022

We used eToro as our example broker in the quickfire guide above, not least because this is the overall best place to invest in Bitcoin and buy cryptocurrency. Put simply, you can open a verified account in minutes at eToro and you only need to risk $10 to invest in Bitcoin in a safe and secure manner.

We used eToro as our example broker in the quickfire guide above, not least because this is the overall best place to invest in Bitcoin and buy cryptocurrency. Put simply, you can open a verified account in minutes at eToro and you only need to risk $10 to invest in Bitcoin in a safe and secure manner.

Payment types accepted at eToro include debit/credit cards issued by Visa and MasterCard, e-wallets like Paypal and Neteller, and traditional bank transfers. So whether you want to buy Bitcoin with PayPal, bank transfer, or any other method, the choice is yours.

Moreover, if you’re from the US, you won’t pay any deposit or withdrawal fees – regardless of which payment method you opt for. Once your account is funded in US dollars, eToro then allows you to invest in Bitcoin on a spread-only basis (from 0.75%).

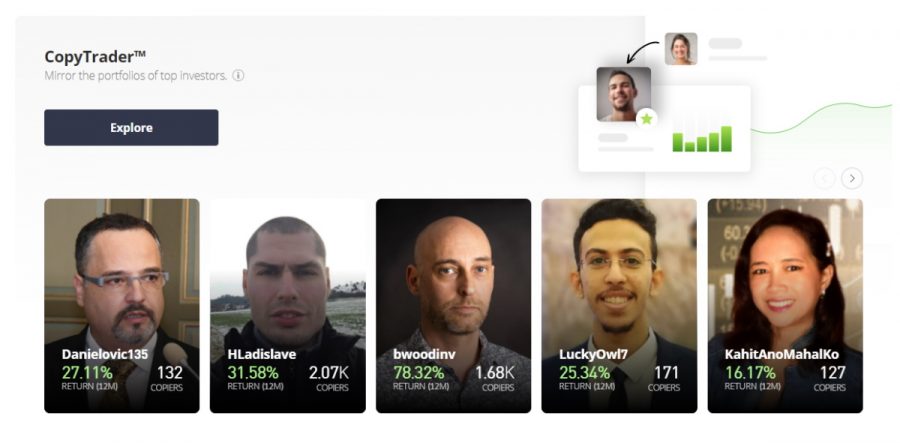

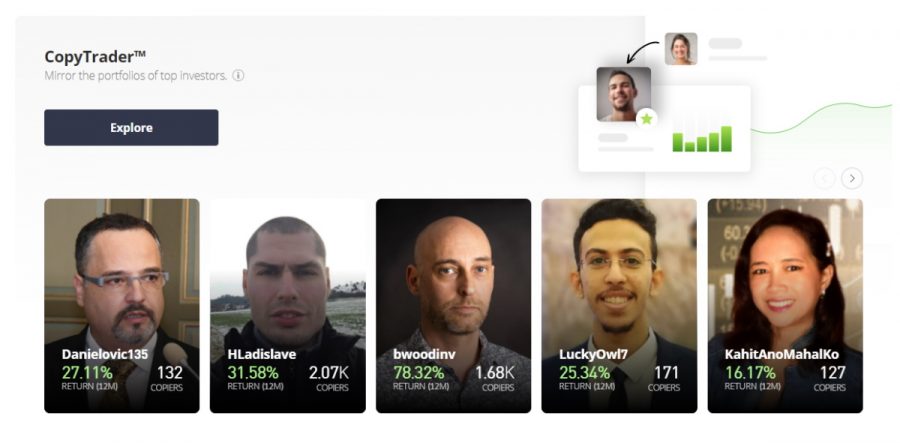

This means that instead of paying a variable commission, you simply need to cover the gap between the buy and sell price. eToro is also useful if you are looking to invest in alternative cryptocurrencies – with the broker supporting over 45+ digital tokens. Hence, you can buy Solana, Dogecoin, Ethereum, Polkadot, the Graph, and more with the click of a button. You can also invest in stocks, ETFs, commodities, indices, and forex. If you’re strapped for time or have little to no experience in the investment space – you might also consider the eToro Copy Trading tool.

This means that instead of paying a variable commission, you simply need to cover the gap between the buy and sell price. eToro is also useful if you are looking to invest in alternative cryptocurrencies – with the broker supporting over 45+ digital tokens. Hence, you can buy Solana, Dogecoin, Ethereum, Polkadot, the Graph, and more with the click of a button. You can also invest in stocks, ETFs, commodities, indices, and forex. If you’re strapped for time or have little to no experience in the investment space – you might also consider the eToro Copy Trading tool.

This allows you to select an experienced trader that you like the look of and then copy their ongoing investments. This comes at no additional fee and requires a minimum outlay of just $200. You can also invest in a pre-made basket of cryptocurrencies via the CryptoPortfolio tool – which is professionally managed and rebalanced by the eToro team.

When it comes to safety, eToro is regulated on multiple fronts. This is inclusive of the SEC (with FINRA membership), FCA, ASIC, and CySEC. The platform is home to over 23 million clients from around the world – and it’s planning to go public later this year. Finally, if you want to invest in Bitcoin via your smartphone, you can download the eToro app and use the eToro crypto credit card to conveniently spend your crypto holdings as and when you want.

Invest in Bitcoin on eToro Now

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

2. Webull – Invest in Cryptocurrency With Just $1

The process of investing in Bitcoin doesn’t require a large capital outlay when you use an online broker like Webull. Not only does the user-friendly platform allow you to open an account without meeting a minimum deposit – but you can invest in Bitcoin from just $1 upwards.

The process of investing in Bitcoin doesn’t require a large capital outlay when you use an online broker like Webull. Not only does the user-friendly platform allow you to open an account without meeting a minimum deposit – but you can invest in Bitcoin from just $1 upwards.

And as such, this will suit first-timers that wish to test the Bitcoin markets out before risking higher sums. At Webull, this $1 minimum extends to all of the other cryptocurrencies supported on the platform – which includes everything from Shiba Inu, Dogecoin, and Litecoin to Ethereum, Chainlink, and Basic Attention Token. Moreover, Webull supports other asset classes on its platform – such as US-listed stocks, ETFs, and options.

Although Webull is typically used by casual traders, the platform does offer a selection of advanced tools and features that will appeal to seasoned investors. This includes no less than 12 charting tools and 50+ technical indicators. In terms of fees, you can invest in Bitcoin – and any other supported financial instrument, at 0% commission. No deposit fees apply on ACH transactions, but bank wires are charged at $8.

Invest in Bitcoin on Webull

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

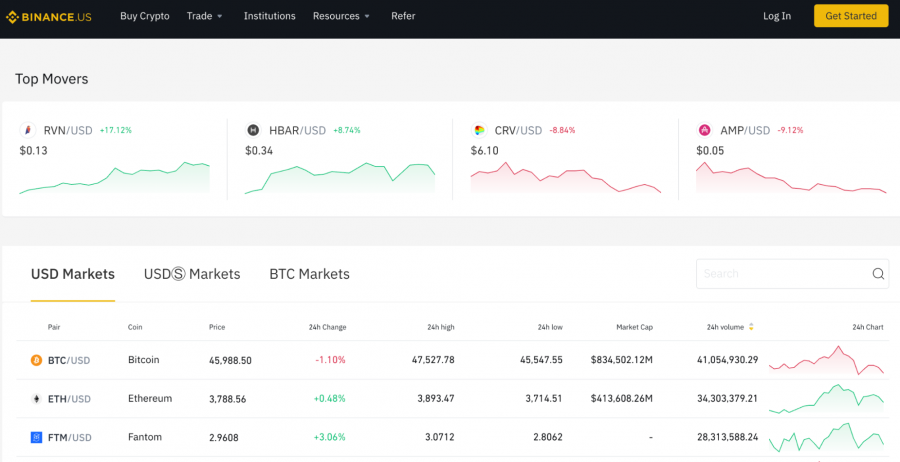

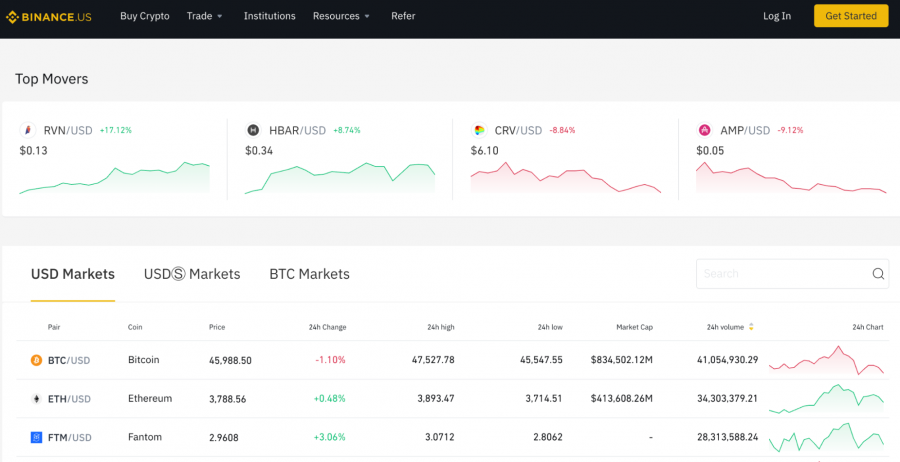

3. Binance – Invest in Bitcoin and 60+ Other Cryptocurrencies

The Binance US platform enables Americans to invest in Bitcoin and 60+ other supported cryptocurrencies. As such, this is a good option if you are planning to create a diversified portfolio of digital currencies. Some of the most popular tokens available in addition to Bitcoin include Ethereum, Litecoin, Dogecoin, and Cardano.

The Binance US platform enables Americans to invest in Bitcoin and 60+ other supported cryptocurrencies. As such, this is a good option if you are planning to create a diversified portfolio of digital currencies. Some of the most popular tokens available in addition to Bitcoin include Ethereum, Litecoin, Dogecoin, and Cardano.

Binance US also supports a wave of DeFi (Decentralized Finance) tokens – which includes the likes of Chainlink and VeChain. In terms of paying for your Bitcoin investment, the fees will depend on the payment method that you opt for. For instance, if you prefer the convenience of using a debit or credit card, this will set you back 4.5% in transaction fees – in addition to a 0.5% commission. Alternatively, ACH and domestic wire transfer deposits are free – so it’s just the 0.5% commission that you will pay.

If you decide to use Binance to exchange digital tokens – for instance, Bitcoin to Ethereum or Cardano to Litecoin, then the commission stands at just 0.1% per slide. Moreover, if you trade large volumes, this commission is lowered even further. To open an account at Binance, you will need to upload some ID. After that, you can proceed to invest in Bitcoin at the click of a button. Finally, Binance also offers educational materials and OTC services.

If you decide to use Binance to exchange digital tokens – for instance, Bitcoin to Ethereum or Cardano to Litecoin, then the commission stands at just 0.1% per slide. Moreover, if you trade large volumes, this commission is lowered even further. To open an account at Binance, you will need to upload some ID. After that, you can proceed to invest in Bitcoin at the click of a button. Finally, Binance also offers educational materials and OTC services.

Invest in Bitcoin on Binance

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

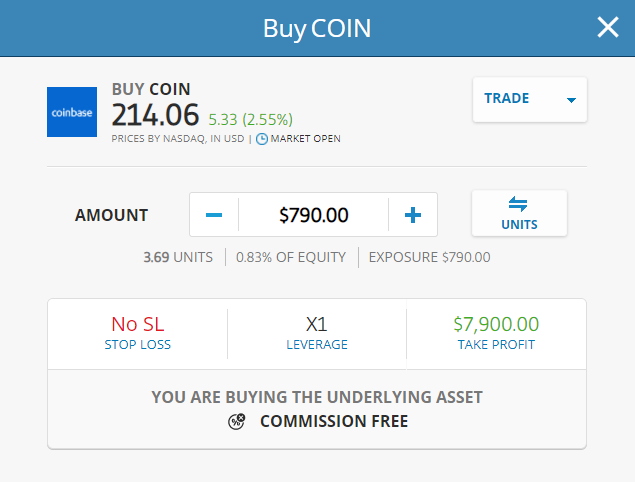

4. Coinbase – Invest in Bitcoin via a Beginner-Friendly Platform

The next broker to consider when thinking about where to invest in Bitcoin is Coinbase. This NASDAQ-listed cryptocurrency broker is now used by tens of millions of clients – many of which are based in the US. The platform offers a safe and convenient way to invest in Bitcoin and dozens of other cryptocurrencies – so it’s ideal for beginners.

The next broker to consider when thinking about where to invest in Bitcoin is Coinbase. This NASDAQ-listed cryptocurrency broker is now used by tens of millions of clients – many of which are based in the US. The platform offers a safe and convenient way to invest in Bitcoin and dozens of other cryptocurrencies – so it’s ideal for beginners.

However, irrespective of how you intend on paying for your Bitcoin investment, Coinbase is a lot more expensive than the other brokers discussed thus far. For example, if you deposit funds via ACH and proceed to invest in Bitcoin once the money arrives – this will cost you 1.5% in fees. Paying for your Bitcoin investment instantly with a debit/credit card will set you back 3.99%.

Taking this into account, fee-conscious investors might be better off using eToro. Nevertheless, Coinbase also stands out for its commitment to security. Among many other safeguards, 98% of client funds are kept offline in cold storage and all account users must set up two-factor authentication. Furthermore, you can place a 48-hour time lock on withdrawal requests, which ensures that you have sufficient time to act should your account become compromised.

Invest in Bitcoin on Coinbase

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

5. Kraken Pro – Invest in Bitcoin via an Advanced Trading Suite

If you’re an active trader that is looking to gain exposure to Bitcoin via sophisticated tools, Kraken Pro could be the best option for your skillset. This top-rated cryptocurrency exchange was launched way back in 2011 – which makes it one of the most established in this space. US clients can deposit funds only with a domestic bank wire or crypto. ACH payments are only accepted when making a withdrawal.

If you’re an active trader that is looking to gain exposure to Bitcoin via sophisticated tools, Kraken Pro could be the best option for your skillset. This top-rated cryptocurrency exchange was launched way back in 2011 – which makes it one of the most established in this space. US clients can deposit funds only with a domestic bank wire or crypto. ACH payments are only accepted when making a withdrawal.

With regards to the Kraken Pro platform itself, you will find a large suite of advanced order types and charting tools. The latter includes the ability to draw trend lines and overlays, as well as access technical indicators. In terms of trading fees, Kraken Pro charges market makers and takers 0.16% and 0.26% respectively. Lowers commissions are offered when trading volumes hit certain milestones, starting from $50,000 within a 30-day period.

Invest in Bitcoin on Kraken

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Should I Invest in Bitcoin?

Once you have decided which online broker is a good fit for your trading goals and skill set, it’s time to do some independent research.

By this, we mean diving deep into whether or not a Bitcoin investment is right for your portfolio.

To help clear the mist, below we discuss five key reasons why you might choose to invest in Bitcoin right now.

Bitcoin is Still an Emerging Asset Class

Many market commentators argue that Bitcoin in 2022 is the Apple or Microsoft of the 1980s. In other words, when you consider that Bitcoin was launched as recently as 2009, the concept of cryptocurrencies and blockchain technology is still in its infancy.

And as such, by investing in Bitcoin today, you have the opportunity to gain exposure to an emerging asset class that is yet to reach its full potential.

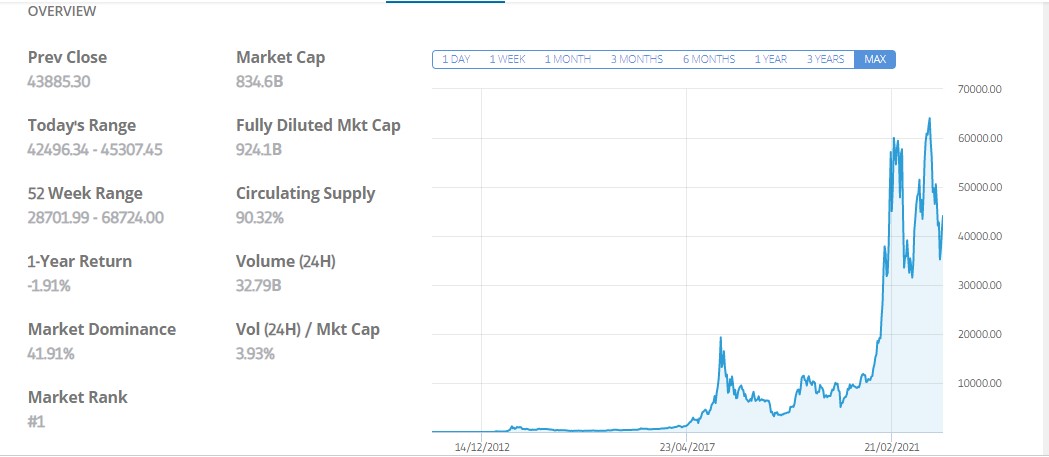

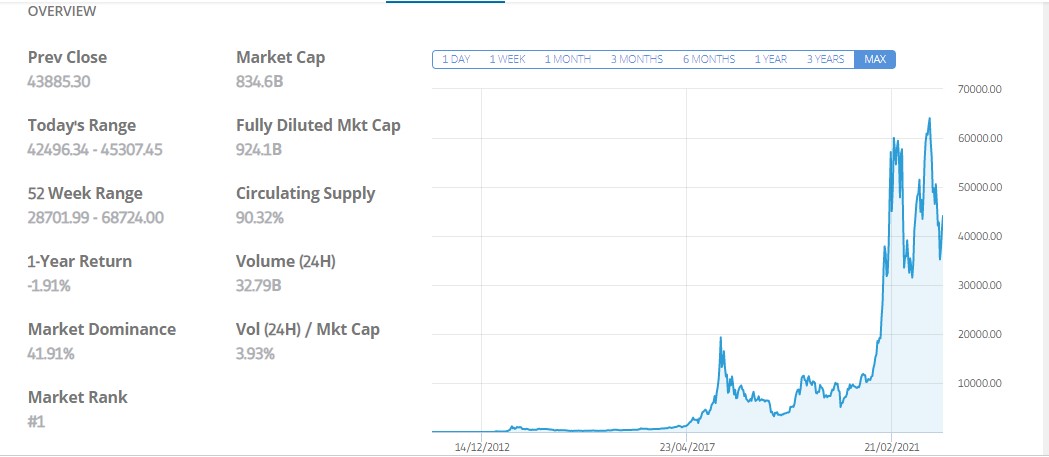

Bitcoin Growth Since 2009

Although Bitcoin was launched in January 2009, it wasn’t until February 2011 that the digital currency surpassed a value of $1 per token. Moreover, it took a further two years for Bitcoin to hit $1,000.

Fast forward to late 2021, and Bitcoin reached an all-time high value of nearly $69,000. When comparing this to the price of Bitcoin in 2011, this translates into 10-year returns of over 6.8 million percent.

In other words, if you invested $1,000 into Bitcoin back in 2011 and sold when the digital currency hit $69,000 per token, you would have cashed out more than $68 million. This highlights just how well Bitcoin has performed in such a short period of time.

Bitcoin vs Stock Markets

One of the best ways to assess whether or not an alternative asset class like Bitcoin is worth buying is to compare its performance against the broader stock markets. For this purpose, a great benchmark is the S&P 500 index.

- Over the past five years, the S&P 500 has grown by approximately 94% – which illustrates attractive returns.

- However, over the same period, Bitcoin has grown by over 3,500% – which dwarfs that of the S&P 500.

Crucially, it is important to note that your investment portfolio should remain well diversified. As such, if you choose to invest in Bitcoin, it’s also worth allocating some funds to the traditional stock markets – and perhaps, bonds too.

Digital Gold

Bitcoin is often referred to as the digital version of gold, not least because the two asset classes carry a number of similar characteristics. For instance, there is a finite quantity of gold, meaning that once the Earth’s entire supply is mined, nothing more can enter circulation.

- Similarly, Bitcoin is also finite, as only 21 million tokens will ever be created. Furthermore, just like gold, the circulating supply increases at steady intervals.

- In the case of Bitcoin, this happens every 10 minutes, albeit, every four years or so, the amount minted per block is halved.

Another characteristic that both Bitcoin and gold share is that both asset classes are viewed as a hedge against the broader financial markets. More specifically, when the inflation levels are rising and the stock markets are down, Bitcoin and gold offer attractive hedging opportunities.

Easy to Invest and Highly Liquid

First-time Bitcoin investors are often concerned that the process of buying the digital currency is complex. Moreover, there is also a misconception that there are barriers when it comes to cashing out. However, this couldn’t be further from the truth.

First and foremost, anyone can invest in Bitcoin from the comfort of home in a matter of minutes with a debit/credit card or bank transfer. This can be achieved safely and conveniently via an SEC-regulated cryptocurrency broker.

Second, Bitcoin operates in a multi-trillion dollar cryptocurrency trading industry that never sleeps. As such, 24 hours per day, 7 days per week – you can easily cash out your Bitcoin investment back to US dollars through your chosen online broker.

What is the Best Way to Invest in Bitcoin?

There are essentially two ways to invest in Bitcoin in 2022.

You can either buy BTC tokens via an online exchange or broker, or invest in stocks that offer direct exposure to the digital currency.

Having said this you could also gain exposure to the crypto market via crypto CFDs. For example, if you opened an account with the leading crypto bot Bitcoin Prime, you could speculate on the price movements of BTC crosses via contracts for difference. Moreover, the best part about using a crypto robot is that it does all the work for based on criteria and parameters that you configure.

Buying Bitcoin

It goes without saying that the easiest way to invest in Bitcoin is to simply open an account with an online broker and purchase some tokens.

In doing so, you will retain full ownership of your digital assets until you are ready to cash out. And, your profits or losses will directly correlate with the market price of Bitcoin.

That is to say, if you invested $500 into Bitcoin and its value subsequently increases by 25%, you make a profit of $125.

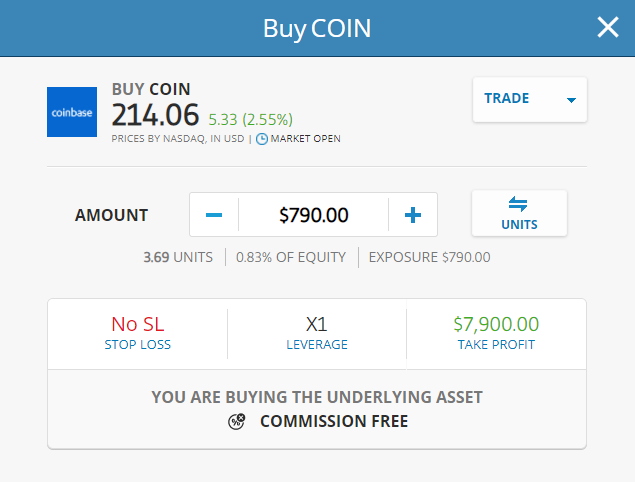

Investing in Bitcoin Stocks

The other option is to buy some stocks that correlate to the Bitcoin market. If you’re wondering how to invest in Bitcoin stocks, the best option is to look at Coinbase.

As mentioned earlier, Coinbase is a large US-based cryptocurrency broker that is publicly listed on the NASDAQ. In theory, when the value of Bitcoin and the wider cryptocurrency markets are in an upward trend, this should have a positive effect on Coinbase stocks.

As mentioned earlier, Coinbase is a large US-based cryptocurrency broker that is publicly listed on the NASDAQ. In theory, when the value of Bitcoin and the wider cryptocurrency markets are in an upward trend, this should have a positive effect on Coinbase stocks.

However, the correlation will never be like-for-like. After all, there are many other variables to take into account when you buy stocks – such as the company’s balance sheet, quarterly earnings, debt levels, and more.

Once again, this is why buying Bitcoin is the best way to invest in the digital asset.

Invest in Bitcoin vs Trading Bitcoin

Another thing to consider when learning how to invest in Bitcoin is the specific trading strategy that you adopt.

For example, more experienced investors will often look to time the markets – which means actively placing trades.

This means that the investor might invest in Bitcoin when the markets are overly strong, and offload when it appears that the upward trend is beginning to reverse. Then, they might wait for the markets to correct before once again entering a new position.

On the other hand, beginners will be better suited to a longer-term investment strategy. In most cases, this will see you invest in Bitcoin and then keep hold of your digital assets for several months or years.

This option means that you can spend less time researching the markets and watching over the value of your position. Instead, you can sit back and ‘HODL’ until you feel it is the right time to sell.

Note: The term ‘HODL’ is a play on the word ‘hold’. In Bitcoin jargon, this simply means holding onto your investment in the long run – and not selling when the markets go through short-term pricing spikes.

How Much to Invest in Bitcoin

Irrespective of which asset class you are investing in – it is important to have a clear plan in terms of stakes. By this, we mean thinking about how much money you can realistically afford to lose when investing in Bitcoin – based on your budget and tolerance for risk.

- For example, although Bitcoin is a highly liquid asset – which means that you can cash out at any given time, it is also highly volatile and speculative.

- This means that should you need to cash out your Bitcoin tokens to fund an emergency expense – you might get back less than you originally invested.

- This is why you should only invest amounts that you are comfortable with.

Another thing to note is that you should avoid going ‘all-in’ when investing in Bitcoin. Instead, your portfolio should contain a much larger percentage of traditional asset classes – such as index funds, ETFs, and blue-chip stocks.

This will help balance out the risks involved with Bitcoin – and ensure that you are not overexposed to a single asset.

Moreover, and as we cover in more detail shortly, instead of investing a lump sum into Bitcoin – it’s best to inject small but regular amounts via a dollar-cost average strategy.

Choosing a Bitcoin Wallet for Investing

Another aspect that often puts newbies off from investing in Bitcoin are the steps involved in keeping the digital tokens safe. This is because Bitcoin – like all other cryptocurrencies, is stored in a ‘wallet’.

- These Bitcoin wallets often come in the form of a mobile app, albeit, desktop software, hardware devices, and online storage options also exist.

- Regardless of the wallet type you elect to use when storing your Bitcoin tokens, it is crucial that you adopt a range of security procedures.

- This includes never giving out your private keys, setting up two-factor authentication (if offered by the wallet), and sticking with reputable and trusted providers.

- After all, if the worst happens and your wallet is compromised, then there is every chance that your Bitcoin funds will be stolen.

If this does happen, you will have nowhere to turn. This is why we suggest considering SEC-regulated broker eToro for your Bitcoin storage requirements.

This is because once you invest in Bitcoin via the eToro website, the tokens will be safeguarded by eToro’s institutional-grade security tools.

This means that you don’t need to worry about learning the ropes of wallet security tools and risks, as the tokens will be kept safe by eToro until you decide to cash out.

Bitcoin Investment Strategies

Seasoned traders will never invest in Bitcoin without first having a pre-defined strategy in place.

There are many Bitcoin investment strategies to consider, albeit, the one that you opt for will typically depend on your financial goals and how much risk you are willing to take.

With this in mind, when learning how to invest in Bitcoin – consider some of the strategies discussed below.

Dollar-Cost Average to Avoid Volatility

We mentioned earlier that Bitcoin can be an extremely volatile asset class at times. As a newbie investor, this can be intimidating.

- For example, in mid-2021, Bitcoin went from highs of $61,000 to lows of $31,000 in the space of just a few months.

- However, just a few months later, Bitcoin then hit all-time highs of almost $69,000.

Crucially, this emotional rollercoaster ride can be mitigated by dollar-cost averaging your investments.

This simply means investing smaller amounts at regular intervals. For instance, you might elect to invest $100 per month – regardless of how Bitcoin is performing.

In doing so, you will average out your break-even point on each investment. If adopting this Bitcoin investment strategy, it’s best to use a broker that supports small stakes.

At eToro, for instance, you only need to meet a $10 minimum. As such, by depositing $120, you can invest $10 per month for an entire year.

Stay Safe With SEC-Regulated Bitcoin Brokers

The next strategy to adopt when learning how to invest in Bitcoin is to ensure that you only make purchases from a trusted broker that takes security and regulation seriously.

You can do this with ease by sticking with Bitcoin brokers that are authorized and regulated by the SEC.

The alternative to this is to use an unlicensed cryptocurrency exchange that offers nothing in the way of regulatory protection.

Although such exchanges might offer super-low fees and an assortment of features, you can never be certain that your Bitcoin funds are in safe hands.

Have an Investment Target in Place

Another strategy to consider using when investing in Bitcoin is to have clear targets in place.

- For example, let’s suppose that you want to make gains of 75% from your Bitcoin investment.

- If you invest when the price of Bitcoin is $40,000 – this means that the digital currency needs to exceed a value of $70,000 per token.

If and when your target is met, you can then elect to sell your Bitcoin tokens back to cash. The most effective way of deploying a target Bitcoin price is via a take-profit order.

For those unaware, take-profit orders – which are available at platforms like eToro and Binance, allow you to specify an exact price that you wish to sell your investment.

When this price is triggered by the markets (for example, $70,000), your chosen broker will automatically close your position.

In addition to take-profits, it is also worth considering a stop-loss order when you invest in Bitcoin. This works in the same way as a take-profit but in reverse.

- For instance, you might decide that the most you are prepared to lose from your Bitcoin investment is 20%.

- If the price of Bitcoin stands at $40,000 at the time of the investment, you would need to set your stop-loss at $32,000.

- If the specified price is triggered, then the broker will automatically close your position.

Ultimately, by placing both take-profits and stop-losses, this means that you don’t need to constantly check the price of Bitcoin, as your chosen broker will close your trade when one of your orders is triggered.

How to Invest in Bitcoin & Make Money – Example

If you’re wondering how to make money from a Bitcoin investment, this section of our beginner’s guide will explain the process with some simple examples.

Fractional Investment

The first thing to mention is that unless you are looking to invest thousands of dollars to purchase a single Bitcoin, you will be buying a fraction of one token.

The good news is that the returns on your investment will work out in exactly the same way as buying a full Bitcoin.

For example:

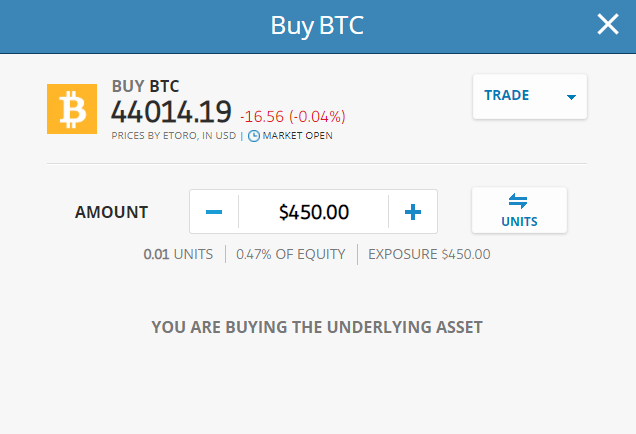

- Let’s suppose that you want to invest in Bitcoin when the digital asset is priced at $45,000

- You decide to invest a total of $450

- This means that you are buying 1% of a single Bitcoin token – or 0.01 units.

- We’ll then say that a few months later, Bitcoin is priced at $53,500 – or 30% higher

- On your stake of $450, this means that your investment is now worth $585

As per the above, it doesn’t matter if you own a full Bitcoin or just a tiny fraction of one token – your gains and losses will be determined by the percentage amount that the digital asset increases or decreases.

Long-Term Buy and Hold Strategy

In this example of how to make money by investing in Bitcoin, we’ll look at what returns you would have made had you entered the market five years ago.

- In the five years prior to writing this guide, Bitcoin was priced at just over $1,000 per token

- We’ll say that you decided to invest a total of $5,000 at this entry price

- As of writing, Bitcoin is trading around the $42,000 level

- This translates into 5-year returns of over 4,000%

In the above example, you invested $5,000 five years ago and you are now looking at returns of 4,000%. And as such, if you were to cash out, you would receive over $200,000. For more details on the best long term crypto investments be sure to read our full guide.

Short-Term Strategy

Now let’s look at a real-world example of how a short-term Bitcoin trade might pan out.

- Let’s say that you invested $2,000 into Bitcoin in mid-July 2021 – when the digital token was priced at just over $30,000

- Just three months later, Bitcoin was priced at $64,000 per token

- This represents growth of approximately 110%

- As such, you decide to cash out your investment

As per the above, in the space of just three months, you made a 110% profit on a $2,000 Bitcoin investment. Therefore, your total cash-out amount would have stood at $4,200.

When is the Best Time to Invest in Bitcoin?

Unless you are a seasoned investor with a firm understanding of technical analysis and high-level research, there is no value in attempting to time the market.

On the contrary, instead of trying to invest in Bitcoin at the right time – the previously discussed dollar-cost averaging strategy will be a lot more effective.

This is because you will be investing in Bitcoin in the long run by allocating smaller amounts to the digital token – but at regular intervals.

And as such, you do not need to worry about whether or not you have timed the market correctly – as each investment will be averaged out.

How to Invest in Bitcoin – Tutorial

This section of our guide will explain how to invest in Bitcoin via SEC-regulated broker eToro.

You will learn how to open a verified account, deposit funds, and place an investment order in less than 10 minutes.

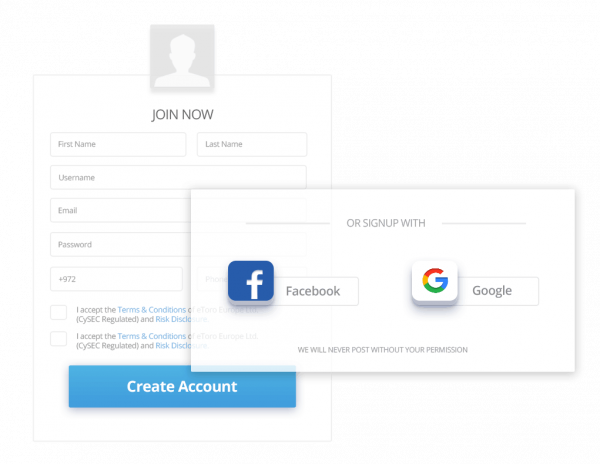

Step 1: Open an Account

The first step is to visit the eToro website and click on the ‘Join Now’ button – which you will find at the top of the homepage. A registration form will then appear on your screen.

Initially, you will need to enter your first and last name, email address, cell phone number, and a chosen username and password.

Next, you’ll need to provide some additional personal details – such as your date of birth and home address.

Next, you’ll need to provide some additional personal details – such as your date of birth and home address.

Finally, to complete the registration process, you will need to verify your cell phone number by entering the SMS code that eToro sends to you.

Step 2: Identity Verification

In less than 1-2 minutes, you can verify your eToro account by uploading some ID. This will increase your deposit limits and make you eligible to request withdrawals.

To get verified, you can upload a copy of your driver’s license, passport, or state-issued ID. To prove your residency status, upload a recently issued bank statement or electricity/water bill.

Step 3: Make a Deposit

If you are depositing funds in US dollars, then no fees apply. At eToro, you can choose from a debit/credit card or an e-wallet to have your deposit processed instantly.

If you’re happy to wait 1-3 working days, ACH and bank wire transfers are also supported. The minimum deposit at eToro for US clients is just $10.

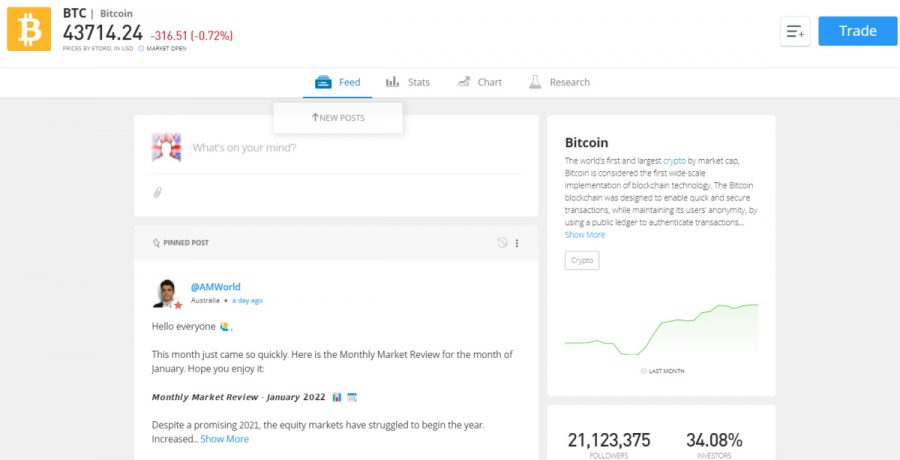

Step 4: Search for Bitcoin

You should now have a verified eToro account with at least $10 in funds. If so, you can invest in Bitcoin.

To go straight to the correct investment page, use the search bar by entering ‘BTC’ and clicking on ‘Trade’.

Step 5: Invest in Bitcoin

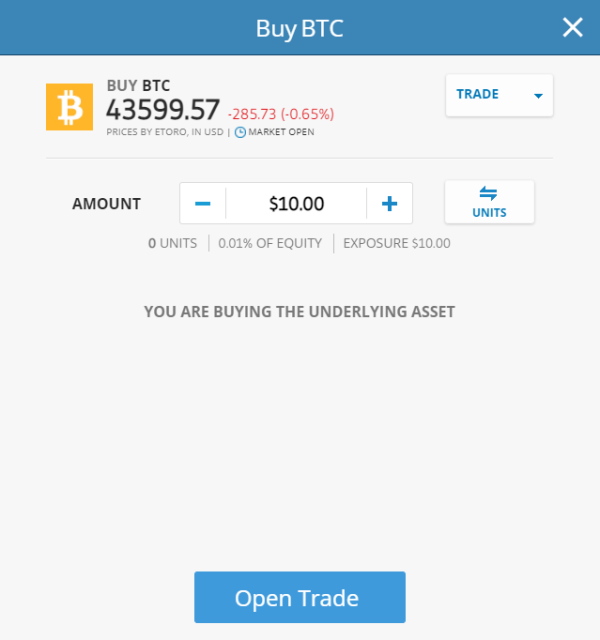

An order box will now appear on your trading screen. This is where you need to let eToro know how much money you want to invest in Bitcoin.

This can be any amount from $10, albeit, in the example above, we are investing a total of $50. Finally, once you click on the ‘Open Trade’ button, eToro will carry out your Bitcoin investment instantly.

Step 6: How to Sell Bitcoin

You can keep track of your Bitcoin investment by heading over to your eToro portfolio. At any given time, you can elect to sell your Bitcoin investment.

Just look out for the cog button next to Bitcoin, and click on ‘Close’. eToro will then sell your Bitcoin tokens back to US dollars at the best available price.

Conclusion

This guide has explained the importance of researching the markets and considering the risks involved before investing in Bitcoin.

We’ve also reviewed the best Bitcoin brokers and exchanges to consider, and which strategies are worth adopting.

If you want to invest in Bitcoin right now – it takes just 10 minutes to open an account and place your order at SEC-regulated broker eToro.

Invest in Bitcoin on eToro

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Frequently Asked Questions When Investing in Bitcoin

Is Bitcoin a good investment in 2022?

Bitcoin has outperformed the traditional stock markets by a considerable amount since the digital currency was launched in 2009. You should, however, go easy with your stakes if you choose to invest in Bitcoin, as this asset class is highly volatile.

Can I invest in Bitcoin with $1?

Yes, you can invest in Bitcoin with just $1 via Webull. However, the spread on Bitcoin markets at Webull is often uncompetitive. As such, you might consider eToro instead, which requires a slightly higher minimum of $10.

How do I invest in Bitcoin?

You can invest in Bitcoin by opening an account and depositing funds with a trusted cryptocurrency broker like eToro.

What is the minimum to invest in Bitcoin?

Bitcoin can be divided by up to 8 decimal places, so super-small investments are possible. However, the minimum amount that you can stake on Bitcoin will depend on which broker you decide to use.

How much should I invest in Bitcoin?

This will depend on your budget and how much risk you are comfortable taking. Crucially, never invest more than you can afford to lose.

What is the best site to invest in Bitcoin?

eToro is arguably the best site to invest in Bitcoin – as US clients benefit from free debit/credit card and e-wallet deposits, alongside a minimum stake of just $10. Moreover, eToro is licensed by the SEC.

If I invest $100 in Bitcoin today in 2022 how much is it worth in 2023?

Bitcoin operates in a speculative and volatile marketplace, so predicting its value in 2023 is a challenging task.

What is the best way to invest in Bitcoin?

The best way to invest in Bitcoin is via an SEC-regulated broker like eToro.

Is it too late to invest in Bitcoin?

Bitcoin has only been a tradable asset since 2009. As such, Bitcoin is still in its infancy.

Should I invest in Bitcoin or Ethereum?

If you can’t decide between Bitcoin or Ethereum, it could be worth diversifying across both digital currencies.

Should you invest in Bitcoin?

You should only invest in Bitcoin if you have performed your own research and considered the risks.

Author: Kane Pepi

Kane Pepi is an experienced financial and cryptocurrency writer with over 2,000+ published articles, guides, and market insights in the public domain. Expert niche subjects include asset valuation and analysis, portfolio management, and the prevention of financial crime. Kane is particularly skilled in explaining complex financial topics in a user-friendly… View full profile ›

How to start investing in cryptocurrency: A guide for beginners

Despite its well-known volatility, cryptocurrency is on fire and many investors are looking to profit on its white-hot rise. Cryptos such as Bitcoin and Ethereum ebb for a while and then climb higher, and many other popular digital currencies are doing so, too. Experienced traders have been speculating on crypto for years, but what if you’re new to the market and looking to get a piece of the action?

Here’s how to start investing in cryptocurrency and what you need to watch out for.

5 steps for investing in cryptocurrency

First things first, if you’re looking to invest in crypto, you need to have all your finances in order. That means having an emergency fund in place, a manageable level of debt and ideally a diversified portfolio of investments. Your crypto investments can become one more part of your portfolio, one that helps raise your total returns, hopefully.

Pay attention to these five other things as you’re starting to invest in cryptocurrencies.

1. Understand what you’re investing in

As you would for any investment, understand exactly what you’re investing in. If you’re buying stocks, it’s important to read the prospectus and analyze the companies thoroughly. Plan to do the same with any cryptocurrencies, since there are literally thousands of them, they all function differently and new ones are being created every day. You need to understand the investment case for each trade.

In the case of many cryptocurrencies, they’re backed by nothing at all, neither hard assets nor cash flow. That’s the case for Bitcoin, for example, where investors rely exclusively on someone paying more for the asset than they paid for it. In other words, unlike stock, where a company can grow its profits and drive returns for you that way, many crypto assets must rely on the market becoming more optimistic and bullish for you to profit.

Some of the most popular coins include Ethereum, Dogecoin, Cardano and XRP. Solana has been another massively successful coin as well. So before investing, understand the potential upside and downside. If your financial investment is not backed by an asset or cash flow, it could end up being worth nothing.

2. Remember, the past is past

A mistake that many new investors make is looking at the past and extrapolating that to the future. Yes, Bitcoin used to be worth pennies, but now is worth much more. The key question, however, is “Will that growth continue into the future, even if it’s not at quite that meteoric rate?”

Investors look to the future, not to what an asset has done in the past. What will drive future returns? Traders buying a cryptocurrency today need tomorrow’s gains, not yesterday’s.

3. Watch that volatility

The prices of cryptocurrencies are about as volatile as an asset can get. They could drop quickly in seconds on nothing more than a rumor that ends up proving baseless. That can be great for sophisticated investors who can execute trades rapidly or who have a solid grasp on the market’s fundamentals, how the market is trending and where it could go. For new investors without these skills – or the high-powered algorithms that direct these trades – it’s a minefield.

Volatility is a game for high-powered Wall Street traders, each of whom is trying to outgun other deep-pocketed investors. A new investor can easily get crushed by the volatility.

That’s because volatility shakes out traders, especially beginners, who get scared. Meanwhile, other traders may step in and buy on the cheap. In short, volatility can help sophisticated traders “buy low and sell high” while inexperienced investors “buy high and sell low.”

4. Manage your risk

If you’re trading any asset on a short-term basis, you need to manage your risk, and that can be especially true with volatile assets such as cryptocurrency. So as a newer trader, you’ll need to understand how best to manage risk and develop a process that helps you mitigate losses. And that process can vary from individual to individual:

- Risk management for a long-term investor might simply be never selling, regardless of the price. The long-term mentality allows the investor to stick with the position.

- Risk management for a short-term trader, however, might be setting strict rules on when to sell, such as when an investment has fallen 10 percent. The trader then rotely follows the rule so that a relatively small decline doesn’t become a crushing loss later.

Newer traders should consider setting aside a certain amount of trading money and then using only a portion of it, at least at first. If a position moves against them, they’ll still have money in reserve to trade with later. The ultimate point is that you can’t trade if you don’t have any money. So keeping some money in reserve means you’ll always have a bankroll to fund your trading.

It’s important to manage risk, but that will come at an emotional cost. Selling a losing position hurts, but doing so can help you avoid worse losses later.

5. Don’t invest more than you can afford to lose

Finally, it’s important to avoid putting money that you need into speculative assets. If you can’t afford to lose it – all of it – you can’t afford to put it into risky assets such as cryptocurrency, or other market-based assets such as stocks or ETFs, for that matter.

Whether it’s a down payment for a house or an important upcoming purchase, money that you need in the next few years should be kept in safe accounts so that it’s there when you need it. And if you’re looking for an absolutely sure return, your best option is to pay off debt. You’re guaranteed to earn (or save) whatever interest rate you’re paying on the debt. You can’t lose there.

Finally, don’t overlook the security of any exchange or broker you’re using. You may own the assets legally, but someone still has to secure them, and their security needs to be tight. If they don’t think their cryptocurrency is properly secured, some traders choose to invest in a crypto wallet to hold their coins offline so they’re inaccessible to hackers or others.

Other ways to invest in cryptocurrency

While investing directly in cryptocurrency may be the most popular way to do so, traders have other ways to get into the crypto game, some more directly than others. These include:

- Crypto futures: Futures are another way to wager on the price swings in Bitcoin, and futures allow you to use the power of leverage to generate massive returns (or losses). Futures are a fast-moving market and exacerbate the already volatile moves in crypto.

- Crypto funds: A few crypto funds (such as the Grayscale Bitcoin Trust) also exist that allow you to wager on the price swings in Bitcoin, Ethereum as well as a few other altcoins. So they can be an easy way to buy crypto through a fund-like product.

- Crypto exchange or broker stocks: Buying stock in a company that’s poised to profit on the rise of cryptocurrency regardless of the winner could be an interesting option, too. And that’s the potential in an exchange such as Coinbase or a broker such as Robinhood, which derives a huge chunk of its revenues from crypto trading.

- Blockchain ETFs: A blockchain ETF allows you to invest in the companies that may profit from the emergence of blockchain technology. The top blockchain ETFs give you exposure to some of the key publicly traded companies in the space. But it’s important to note that these companies often do much more than crypto-related business, meaning your exposure to cryptocurrency is diluted, reducing your potential upside and downside.

Each of these methods varies in its riskiness and exposure to cryptocurrency, so you’ll want to understand exactly what you’re buying and whether it fits your needs.

Cryptocurrency investing FAQs

How much money do I need to start investing in cryptocurrency?

In theory it takes only a few dollars to invest in cryptocurrency. Most crypto exchanges, for example, have a minimum trade that might be $5 or $10. Other crypto trading apps might have a minimum that’s even lower.

However, it’s important to understand that some trading platforms will take a huge chunk of your investment as a fee if you’re trading small amounts of cryptocurrency. So it’s important to look for a broker or exchange that minimizes your fees. In fact, many so-called “free” brokers embed fees – called spread mark-ups – in the price you pay for your cryptocurrency.

How does a blockchain work?

Cryptocurrency is based on blockchain technology. Blockchain is a kind of database that records and timestamps every entry into it. The best way to think of a blockchain is like a running receipt of transactions. When a blockchain database powers cryptocurrency, it records and verifies transactions in the currency, verifying the currency’s movements and who owns it.

Many crypto blockchain databases are run with decentralized computer networks. That is, many redundant computers operate the database, checking and rechecking the transactions to ensure that they’re accurate. If there’s a discrepancy, the networked computers have to resolve it.

How do you mine cryptocurrency?

Some cryptocurrencies reward those who verify the transactions on the blockchain database in a process called mining. For example, these miners involved with Bitcoin solve very complex mathematical problems as part of the verification process. If they’re successful, miners receive a predetermined award of bitcoins.

To mine bitcoins, miners need powerful processing units that consume huge amounts of energy. Many miners operate huge rooms full of such mining rigs in order to extract these rewards. As of early 2022, running the Bitcoin system burned as much energy as a medium-sized country.

How can I invest in Bitcoin?

If you’re looking to invest in Bitcoin, you have a variety of ways to do so, and you can work with a number of companies, including:

- Crypto exchanges: Exchanges have some of the widest selection of cryptocurrencies, and they tend to be the most competitive on price. Top players include Coinbase, Kraken and Binance, but there are literally dozens of others.

- Traditional brokers: Many traditional brokers also allow you to trade Bitcoin in addition to stocks and other financial assets, though they have a relatively limited selection of other cryptocurrencies. Top players here include Interactive Brokers, TradeStation and tastyworks.

- Financial apps: Many financial apps now allow you to trade Bitcoin and a few other cryptos. Top players here include Robinhood and Webull as well as payment apps such as PayPal, Venmo and Cash App.

If you’re looking to buy Bitcoin, pay particular attention to the fees that you’re paying. Here are other key things to watch out for as you’re buying Bitcoin.

What are altcoins?

An altcoin is an alternative to Bitcoin. Many years ago, traders would use the term pejoratively. Since Bitcoin was the largest and most popular cryptocurrency, everything else was defined in relation to it. So, whatever was not Bitcoin was lumped into a derisive category called altcoins.

While Bitcoin is still the largest cryptocurrency by market capitalization, it’s no longer as dominant as it was in the very early days of cryptocurrency. Other altcoins such as Ethereum and Solana have grown in popularity, making the term altcoin somewhat outmoded. Now with a reported 15,000 or more cryptocurrencies in existence, it makes less sense than ever to define the industry as “Bitcoin and then everything else.”

Bottom line

Cryptocurrency is a highly speculative area of the market, and many smart investors have decided to put their money elsewhere. For beginners who want to get started trading crypto, however, the best advice is to start small and only use money that you can afford to lose.

Learn more:

Digital currencies are continuing to make headlines. Berkshire Hathaway, the company of star investor Warren Buffett, has bought $1 billion worth of stock in a digital bank focusing on cryptocurrencies.

However, regulators and central banks remain concerned. The price of bitcoin plunged to $34,000 in February from $69,000 in November. It is now around $39,000. So should you join the hype or run a mile?

In this article we explain:

Related content: Is cryptocurrency a good investment?

This article contains affiliate links that can earn us revenue.*

What is bitcoin and how does it work?

The concept of digital money that you use online is not that complicated in itself. After all, most of us will be familiar with transferring money from one online bank account to another.