In 2022 for eitc rules for everyone investment income must be - final

Income Definitions for Marketplace and Medicaid Coverage

Updated August 2020

Financial eligibility for the premium tax credit, most categories of Medicaid, and the Children’s Health Insurance Program (CHIP) is determined using a tax-based measure of income called modified adjusted gross income (MAGI). The following Q&A explains what income is included in MAGI.

↓ Download PDF

How do marketplaces, Medicaid, and CHIP measure a person’s income?

For the premium tax credit, most categories of Medicaid eligibility, and CHIP, all marketplaces and state Medicaid and CHIP agencies determine a household’s income using MAGI. States’ previous rules for counting income continue to apply to people who qualify for Medicaid based on age or disability or because they are children in foster care.

MAGI is adjusted gross income (AGI) plus tax-exempt interest, Social Security benefits not included in gross income, and excluded foreign income. Each of these items has a specific tax definition; in most cases they can be located on an individual’s tax return (see Figure 1). (In addition, Medicaid does not count certain Native American and Alaska Native income in MAGI.)

| FIGURE 1: Formula for Calculating Modified Adjusted Gross Income |

|

What is adjusted gross income?

Adjusted gross income is the difference between an individual’s gross income (that is, income from any source that is not exempt from tax) and deductions for certain expenses. These deductions are referred to as “adjustments to income” or “above the line” deductions. Common deductions include certain contributions to an individual retirement account (IRA) or health savings account (HSA) and payment of student loan interest. Many income adjustments are capped or phased out based on income. IRS Publication 17 explains adjustments to income in more detail.

What types of income count towards MAGI?

All income is taxable unless it’s specifically exempted by law. Income does not only refer to cash wages. It can come in the form of money, property, or services that a person receives.

Table 1 provides examples of taxable and non-taxable income. IRS Publication 525 has a detailed discussion of many kinds of income and explains whether they are subject to taxation.

| TABLE 1: Examples of Taxable Income and Non-Taxable Income (see IRS Publication 525 for details and exceptions) | |

| Examples of Taxable Income | |

| Wages, salaries, bonuses, commissions | IRA distributions |

| Annuities | Jury duty fees |

| Awards | Military pay |

| Back pay | Military pensions |

| Breach of contract | Notary fees |

| Business income/Self-employment income | Partnership, estate, and S-corporation income |

| Compensation for personal services | Pensions |

| Debts forgiven | Prizes |

| Director’s fees | Punitive damages |

| Disability benefits (employer-funded) | Unemployment compensation |

| Discounts | Railroad retirement—Tier I (portion may be taxable) |

| Dividends | Railroad retirement—Tier II |

| Employee awards | Refund of state taxes |

| Employee bonuses | Rents (gross rent) |

| Estate and trust income | Rewards |

| Farm income | Royalties |

| Fees | Severance pay |

| Gains from sale of property or securities | Self-employment |

| Gambling winnings | Non-employee compensation |

| Hobby income | Social Security benefits (portion may be taxable) |

| Interest | Supplemental unemployment benefits |

| Interest on life insurance dividends | Taxable scholarships and grants |

| Tips and gratuities | |

| Examples of Non-Taxable Income | |

| Aid to Families with Dependent Children (AFDC) | Meals and lodging for the employer’s convenience |

| Child support received | Payments to the beneficiary of a deceased employee |

| Damages for physical injury (other than punitive) | Payments in lieu of worker’s compensation |

| Death payments | Relocation payments |

| Dividends on life insurance | Rental allowance of clergyman |

| Federal Employees’ Compensation Act payments | Sickness and injury payments |

| Federal income tax refunds | Social Security benefits (portion may be taxable) |

| Gifts | Supplemental Security Income (SSI) |

| Inheritance or bequest | Temporary Assistance for Needy Families (TANF) |

| Insurance proceeds (accident, casualty, health, life) | Veterans’ benefits |

| Interest on tax-free securities | Welfare payments (including TANF) and food stamps |

| Interest on EE/I bonds redeemed for qualified higher education expenses | Workers’ compensation and similar payments |

Is income subtracted from workers’ paychecks as a pre-tax deduction counted in MAGI?

No. Pre-tax deductions — such as health insurance premiums, retirement plan contributions, or flexible spending accounts — are taken out of wages by the employer. Since this income isn’t taxed, it doesn’t count towards a household’s MAGI. The wages in Box 1 of Form W-2 already exclude any pre-tax benefits so they don’t appear on the tax return as income or deductions.

Does MAGI count any income sources that are not taxed?

Yes. Some forms of income that are non-taxable or only partially taxable are included in MAGI and affect financial eligibility for premium tax credits and Medicaid. Specifically:

- Tax-exempt interest. Interest on certain types of investments is not subject to federal income tax but is included in MAGI. These investments include many state and municipal bonds, as well as exempt-interest dividends from mutual fund distributions.

- Non-taxable Social Security benefits. . For many people, particularly those with no other source of income, Social Security benefits are not taxed at all. However, if there is other income, a portion of the benefit might be taxed. Social Security benefits are reported on Form SSA-1099 (the Social Security Benefit Statement) and, whether or not those benefits are taxable, the full amount is included in MAGI.

- Foreign income. Under section 911 of the Internal Revenue Code, U.S. citizens and resident aliens living outside the U.S. can exclude some earned income for tax purposes if they meet certain residency or physical presence tests. Any foreign income excluded under this section must be added back when calculating MAGI.

Whose income is included in household income?

Household income is the MAGI of the tax filer and spouse, plus the MAGI of any dependent who is required to file a tax return. A dependent’s income is only included if they are required to file taxes; if they file taxes for another reason but had no legal filing requirement, their income is not included.

Is a tax dependent’s income ever included in household income?

If a dependent has a tax filing requirement, his or her MAGI is included in household income. Under rules put in place by the December 2017 tax law, a dependent must file a tax return for 2020 if she received at least $12,400 in earned income; $1,100 in unearned income; or if the earned and unearned income together totals more than the greater of $1,100 or earned income (up to $12,050) plus $350. In general, unearned income is defined as investment income; Supplemental Security Income (SSI) and Social Security benefits are not counted in determining whether a dependent has a tax-filing requirement. However, if the dependent does have a tax filing requirement, the dependent’s Social Security benefits will be counted toward the household’s MAGI.

If a dependent does not have a filing requirement but files anyway — for example, to get a refund of taxes withheld from their paycheck — the dependent’s income would not be included in household income.

What time frame is used to determine household income?

Financial eligibility for the premium tax credit and Medicaid is based on income for a specified “budget period.” For the premium tax credit, the budget period is the calendar year during which the advance premium tax credit is received. When determining eligibility for an advance premium tax credit, the applicant projects their household income for the entire calendar year.

Medicaid eligibility, however, is usually based on current monthly income. But for people with income that varies over the year, states must consider yearly income if the person wouldn’t be eligible based on monthly income. For example, a seasonal worker might be over the income limit based on monthly income if they are employed when they apply but would be under the limit if their yearly income (including the months where they are unemployed) is considered. The Medicaid agency must determine eligibility using the yearly income. This prevents situations where people are considered ineligible for the Marketplace based on their yearly income and ineligible for Medicaid based on their monthly income. In addition, Medicaid also treats some lump-sum income differently than the marketplace, by considering it only in the month received.

How does MAGI differ from Medicaid’s former rules for counting household income?

The MAGI methodology for calculating income differs significantly from previous Medicaid rules. Some income that Medicaid used to consider part of household income is no longer counted, such as child support received, veterans’ benefits, workers’ compensation, gifts and inheritances, and Temporary Assistance for Needy Families (TANF) and SSI payments. Table 2 summarizes the differences between the former Medicaid rules and the new MAGI rules.

In addition, states can no longer impose asset or resource limits, and various income disregards have been replaced by a standard disregard equal to 5 percent of the poverty line. There are also changes to who is included in a household and, therefore, whose income is counted.

| TABLE 2: Differences in Counting Income Sources Between Former Medicaid Rules and MAGI Medicaid Rules | ||

| Income Source | Former Medicaid Rules | MAGI Medicaid Rules |

| Self-employment income | Counted with deductions for some, but not all, business expenses | Counted with deductions for most expenses, depreciation, and business losses |

| Salary deferrals (flexible spending, cafeteria, and 401(k) plans) | Counted | Not counted |

| Child support received | Counted | Not counted |

| Alimony paid | Not deducted from income | Deducted from income (subject to new rules in 2019) |

| Veterans’ benefits | Counted | Not counted |

| Workers’ compensation | Counted | Not counted |

| Gifts and inheritances | Counted as lump sum income in month received | Not counted |

| TANF & SSI | Counted | Not counted |

View all key facts

Tax Changes and Key Amounts for the 2022 Tax Year

Although you may still be focused on filing your 2021 tax return, it's never too early to start thinking about next year's return. Proper tax planning requires an awareness of what's new and changed from last year — and there are plenty of tax law changes and updates taking effect in 2022 that you need to know about.

Most of the tax changes enacted by last year's COVID-relief bill expired at the end of 2021. That means things like the child tax credit, child and dependent care credit, earned income credit and other popular tax breaks are different for the 2022 tax year than they were for 2021. Other 2022 tweaks are the result of new rules or annual inflation adjustments. But no matter how, when or why the changes were made, they can hurt or help your bottom line — so you need to be ready for them. To help you out, we pulled together a list of the most important tax law changes and adjustments for 2022 (some related items are grouped together). Use this information now so you can hold on to more of your hard-earned cash next year when it's time to file your 2022 return.

1 of 25

Child Tax Credit

Big changes were made to the child tax credit for 2021 – but they were only temporary. The credit amount was increased, the credit was made fully refundable, children up to 17 years of age qualified, and half the credit amount was paid in advance through monthly payments from July to December last year. President Biden and Congressional Democrats tried to extend these enhancements for at least one more year, but they haven't been able to get that done so far (and probably won't be able to later).

As a result, the child tax credit reverts back to its pre-2021 form for the 2022 tax year. That means the 2022 credit amount drops back down to $2,000 per child (it was $3,000 for children 6 to 17 years of age and $3,600 for children 5 years old and younger for the 2021 tax year). Children who are 17 years old don't qualify for the credit this year, because the former age limit (16 years old) returns. For some lower-income taxpayers, the 2022 credit is only partially refundable (up to $1,500 per qualifying child), and they must have earned income of at least $2,500 to take advantage of the credit's limited refundability. And there will be no monthly advance payments of the credit in 2022.

2 of 25

Child and Dependent Care Tax Credit

Significant improvements were also made to the child and dependent care credit for 2021. But, again, the changes only applied for one year.

By way of comparison, the 2021 credit was worth 20% to 50% of up to $8,000 in eligible expenses for one qualifying child/dependent or $16,000 for two or more. The percentage decreased as income exceeded $125,000. When you combine the top percentage and the expense limits, the maximum credit for 2021 was $4,000 if you had one qualifying child/dependent (50% of $8,000) or $8,000 if you had more than one (50% of $16,000). The credit was also fully refundable in 2021.

For 2022, the child and dependent care credit is non-refundable. The maximum credit percentage also drops from 50% to 35%. Fewer care expenses are eligible for the credit, too. For 2022, the credit is only allowed for up to $3,000 in expenses for one child/dependent and $6,000 for more than one. When the 35% maximum credit percentage is applied, that puts the top credit for the 2022 tax year at $1,050 (35% of $3,000) if you have just one child/dependent in your family and $2,100 (35% of $6,000) if you have more. In addition, the full child and dependent care credit will only be allowed for families making less than $15,000 a year in 2022 (instead of $125,000 per year). After that, the credit starts to phase-out.

3 of 25

Earned Income Tax Credit

More workers without qualifying children were able to claim the earned income tax credit (EITC) on their 2021 tax return, including both younger and older Americans. The "childless EITC" amounts were higher, too. However, once again, those enhancements expired at the end of last year.

Without the 2021 improvements in place, the minimum age for a childless worker to claim the EITC jumps back up to 25 for 2022 tax returns (it was 19 in 2021). The maximum age limit (65 years of old), which was eliminated for the 2021 tax year, is also back in play for 2022. The maximum credit available for childless workers also plummets from $1,502 to $560 for the 2022 tax year. Expanded eligibility rules for former foster youth and homeless youth that applied for 2021 are dropped as well. In addition, the rule allowing you to use your 2019 earned income to calculate your EITC if it boosted your credit amount no longer applies.

There are also several inflation-based adjustments that modify the EITC for the 2022 tax year. For example, the maximum credit amount is increased from $3,618 to $3,733 for workers with one child, from $5,980 to $6,164 for workers with two children, and from $6,728 to $6,935 for workers with three or more children. The earned income required to claim the maximum EITC is also adjusted annually for inflation. For 2022, it's $10,980 if you have one child ($10,640 for 2021), $15,410 if you have two or more children ($14,950 for 2021), and $7,320 if you have no children ($7,100 for 2021).

The EITC phase-out ranges are adjusted each year to account for inflation, too. For 2022, the credit starts to phase out for joint filers with children if the greater of their adjusted gross income (AGI) or earned income exceeds $26,260 ($25,470 for 2021). It's completely phased out for those taxpayers if their AGI or earned income is at least $49,622 if they have one child ($48,108 for 2021), $55,529 if they have two children ($53,865 for 2021), or $59,187 if they have three or more children ($57,414 for 2021). For other taxpayers with children, the 2022 phase-out ranges are $20,130 to $43,492 for people with one child ($19,520 to $42,158 for 2021), $20,130 to $49,399 for people with two children ($19,520 to $47,915 for 2021), and $20,130 to $53,057 for people with more than two children ($19,520 to $51,464 for 2021). If you don't have children, the 2022 phase-out range is $15,290 to $22,610 for joint filers ($14,820 to $21,920 for 2021) and $9,160 to $16,480 for other people ($8,880 to $15,980 for 2021).

Finally, the limit on a worker's investment income is increased to $10,300 ($10,000 for 2021).

4 of 25

Recovery Rebate Credit

Americans were thrilled last March to hear they were getting a third stimulus check in 2021. Those checks were for up to $1,400, plus an additional $1,400 for each dependent in your family. (Use our Third Stimulus Check Calculator to see you how much money you should have gotten.) But some people who were eligible for a third-round stimulus check didn't receive a payment or got less than what they should have received. For those people, relief was available in the form of a 2021 tax credit known as the recovery rebate credit.

However, there are no stimulus check payments in 2022. As a result, there is no recovery rebate credit for the 2022 tax year.

5 of 25

Tax Brackets

Although the tax rates didn't change, the income tax brackets for 2022 are slightly wider than for 2021. The difference is due to inflation during the 12-month period from September 2020 to August 2021, which is used to figure the adjustments.

2022 Tax Brackets for Single/Married Filing Jointly/Head of Household

Tax Rate | Taxable Income (Single) | Taxable Income (Married Filing Jointly) | Taxable Income (Head of Household) |

10% | Up to $10,275 | Up to $20,550 | Up to $14,650 |

12% | $10,276 to $41,775 | $20,551 to $83,550 | $14,651 to $55,900 |

22% | $41,776 to $89,075 | $83,551 to $178,150 | $55,901 to $89,050 |

24% | $89,076 to $170,050 | $178,151 to $340,100 | $89,051 to $170,050 |

32% | $170,051 to $215,950 | $340,101 to $431,900 | $170,051 to $215,950 |

35% | $215,951 to $539,900 | $431,901 to $647,850 | $215,951 to $539,900 |

37% | Over $539,900 | Over $647,850 | Over $539,900 |

6 of 25

Long-Term Capital Gains Tax Rates

Tax rates on long-term capital gains (i.e., gains from the sale of capital assets held for at least one year) and qualified dividends did not change for 2022. However, the income thresholds to qualify for the various rates were adjusted for inflation.

In 2022, the 0% rate applies for individual taxpayers with taxable income up to $41,675 on single returns ($40,400 for 2021), $55,800 for head-of-household filers ($54,100 for 2021) and $83,350 for joint returns ($80,800 for 2021).

The 20% rate for 2022 starts at $459,751 for singles ($445,851 for 2021), $488,501 for heads of household ($473,751 for 2021) and $517,201 for couples filing jointly ($501,601 for 2021).

The 15% rate is for filers with taxable incomes between the 0% and 20% break points.

The 3.8% surtax on net investment income stays the same for 2022. It kicks in for single people with modified AGI over $200,000 and for joint filers with modified AGI over $250,000.

For more on long-term capital gains tax rates, see What Are the Capital Gains Tax Rates for 2021 vs. 2022?

7 of 25

Standard Deduction

The standard deduction amounts were increased for 2022 to account for inflation. Married couples get $25,900 ($25,100 for 2021), plus $1,400 for each spouse age 65 or older ($1,350 for 2021). Singles can claim a $12,950 standard deduction ($12,550 for 2021) — $14,700 if they're at least 65 years old ($14,250 for 2021). Head-of-household filers get $19,400 for their standard deduction ($18,800 for 2021), plus an additional $1,750 once they reach age 65 ($1,700 for 2021). Blind people can tack on an extra $1,400 to their standard deduction ($1,350 for 2021). That jumps to $1,750 if they're unmarried and not a surviving spouse ($1,700 for 2021).

8 of 25

Charitable Gift Deductions

The "above-the-line" deduction for up to $300 of charitable cash contributions ($600 for married couple filing a joint return) expired at the end of 2021. As a result, it isn't available for the 2022 tax year (it was available for 2020 and 2021). Only people who claimed the standard deduction on their tax return (rather than claiming itemized deductions on Schedule A) were allowed to take this deduction.

The 2020 and 2021 suspension of the 60%-of-AGI limit on deductions for cash donations by people who itemize also expired, so the limit is back in place starting with the 2022 tax year.

9 of 25

1099-K Forms

Starting with the 2022 tax year, third-party payment settlement networks (e.g., PayPal and Venmo) will send you a Form 1099-K if you are paid over $600 during the year for goods or services, regardless of the number of transactions. Previously, the form was only sent if you received over $20,000 in gross payments and participated in more than 200 transactions. The gross amount of a payment doesn't include any adjustments for credits, cash equivalents, discount amounts, fees, refunded amounts, or any other amounts.

This change to the reporting threshold means more people than ever will get a 1099-K form next year that they will use when filling out their income tax returns for the 2022 tax year. However, remember that 1099-K reporting is only for money received for goods and services. It doesn't apply to payments from family and friends.

10 of 25

Retirement Savings

Here's some good news for retirees: The IRS updated the table used to calculate required minimum distributions (RMDs) to account for longer life expectancies beginning in 2022. That means RMDs should be a bit smaller starting in 2022 than they were before.

For people who are still saving for retirement, many key dollar limits on retirement plans and IRAs are higher in 2022. For example, the maximum contribution limits for 401(k), 403(b) and 457 jumps from $19,500 to $20,500 for 2022, while people born before 1973 can once again put in $6,500 more as a "catch-up" contribution. The 2022 cap on contributions to SIMPLE IRAs is $14,000 ($13,500 in 2021), plus an extra $3,000 for people age 50 and up.

The 2022 contribution limit for traditional IRAs and Roth IRAs stays steady at $6,000, plus $1,000 as an additional catch-up contribution for individuals age 50 and up. However, the income ceilings on Roth IRA contributions went up. Contributions phase out in 2022 at adjusted gross incomes (AGIs) of $204,000 to $214,000 for couples and $129,000 to $144,000 for singles (up from $198,000 to $208,000 and $125,000 to $140,000, respectively, for 2021).

Deduction phaseouts for traditional IRAs also start at higher levels in 2022, from AGIs of $109,000 to $129,000 for couples and $68,000 to $78,000 for single filers (up from $105,000 to $125,000 and $66,000 to $76,000 for 2021). If only one spouse is covered by a plan, the phaseout zone for deducting a contribution for the uncovered spouse starts at $204,000 of AGI and ends at $214,000 (they were $198,000 and $208,000 for 2021).

More lower-income people may be able to claim the "saver's credit" in 2022, too. This tax break can be worth up to $1,000 ($2,000 for joint filers), but you must contribute to a retirement account and your adjusted gross income (AGI) must be below a certain threshold to qualify. For 2022, the income thresholds are $34,000 of adjusted gross income (AGI) for single filers and married people filing a separate return ($33,000 for 2021), $68,000 for married couples filing jointly ($66,000 for 2021), and $51,000 for head-of-household filers ($49,500 for 2021).

11 of 25

Adoption of a Child

For 2022, the adoption credit can be taken on up to $14,890 of qualified expenses ($14,440 for 2021). The full credit is available for a special-needs adoption, even if it costs less. The credit begins to phase out for filers with modified AGIs over $223,410 and disappears at $263,410 ($214,520 and $254,520, respectively, for 2021).

The exclusion for company-paid adoption aid was also increased from $14,440 to $14,890 for 2022.

12 of 25

Teacher Expenses

For the 2022 tax year, teachers and other educators who dig into their own pockets to buy books, supplies, COVID-19 protective items, and other materials used in the classroom can deduct up to $300 of these out-of-pocket expenses ($250 for 2021). The maximum deduction for 2022 jumps to $600 for a married couple filing a joint return if both spouses are eligible educators – but not more than $300 each.

An "eligible educator" is anyone who is a kindergarten through 12th grade teacher, instructor, counselor, principal, or aide in a school for at least 900 hours during a school year. Homeschooling parents can't take the deduction.

This is an "above-the-line" deduction. So, you don't have to itemized to claim it.

13 of 25

Kiddie Tax

The kiddie tax has less bite in 2022. The first $1,150 of a child's unearned income is tax-free if the child is 18 years old or younger, or a full-time student under 24. The next $1,150 is taxed at the child's rate. Any excess over $2,300 is taxed at the parent's rate. (For 2021, only the first $1,100 was exempt and the next $1,100 was taxed at the child's rate.)

14 of 25

Parking and Transportation Benefits

Employers can provide a little more to their workers in 2022 when it comes to parking and transportation-related fringe benefits. The 2022 cap on employer-provided tax-free parking goes up from $270 to $280 per month. The 2022 exclusion for mass transit passes and commuter vans is also $280 ($270 in 2021).

15 of 25

Bonds Used for Education

The income caps are higher in 2022 for tax-free EE and I bonds used for education. The exclusion starts phasing out above $128,650 of modified AGI for couples and $85,800 for others ($124,800 and $83,200 for 2021). It ends at modified AGI of $158,650 and $100,800, respectively ($154,800 and $98,200 for 2021). The savings bonds must be redeemed to help pay for tuition and fees for college, graduate school or vocational school for the taxpayer, spouse or a dependent.

16 of 25

Americans Working Abroad

U.S. taxpayers working abroad have a larger foreign earned income exclusion in 2022. It jumped from $108,700 for 2021 to $112,000 for 2022. (Taxpayers claim the exclusion on Form 2555.)

The standard ceiling on the foreign housing exclusion is also increased from $15,218 to $15,680 for 2022 (although overseas workers in many high-cost locations around the world qualify for a significantly higher exclusion).

17 of 25

Payroll Taxes

The Social Security annual wage base is $147,000 for 2022 (that's a $4,200 hike from 2021). The Social Security tax rate on employers and employees stays at 6.2%. Both workers and employers continue to pay the 1.45% Medicare tax on all compensation in 2022, with no cap. Workers also pay the 0.9% Medicare surtax on 2022 wages and self-employment income over $200,000 for singles and $250,000 for couples. The surtax doesn't hit employers, though.

The nanny tax threshold went up to $2,400 for 2022, which was a $100 increase from 2021.

18 of 25

Standard Mileage Rates

The 2022 standard mileage rate for business driving rose from 56¢ to 58.5¢ a mile. The mileage allowance for medical travel and military moves also increased from 16¢ to 18¢ a mile in 2022. However, the charitable driving rate stayed put at 14¢ a mile — it's fixed by law.

19 of 25

Long-Term Care Insurance Premiums

The limits on deducting long-term care insurance premiums are higher in 2022 for one age group. Taxpayers who are age 61 to 70 can deduct up to $4,510 for 2022, which is a $10 decrease from the 2021 amount.

The 2022 deduction limits for all age groups are the same as the 2021 amounts. Here's the complete list of limits by age:

- 40 years old or less = $450

- 41 to 50 years old = $850

- 51 to 60 years old = $1,690

- 61 to 70 years old = $4,510

- 71 years of age or older = $5,640

For most people, long-term care premiums are medical expenses deductible only by itemizers on Schedule A. However, self-employed people can deduct them on Schedule 1 of the 1040.

20 of 25

Health Savings Accounts (HSAs)

The annual cap on deductible contributions to health savings accounts (HSAs) rose in 2022 from $3,600 to $3,650 for self-only coverage and from $7,200 to $7,300 for family coverage. People born before 1968 can put in $1,000 more (same as for 2021).

Qualifying insurance policies must limit out-of-pocket costs in 2022 to $14,100 for family health plans ($14,000 in 2021) and $7,050 for people with individual coverage ($7,000 in 2021). Minimum policy deductibles remain at $2,800 for families and $1,400 for individuals.

21 of 25

Flexible Spending Accounts (FSAs)

For 2022, the limit on employee contributions to a healthcare flexible spending account (FSA) is $2,850, which is $100 more than the 2021 limit. If the employer's plan allows the carryover of unused amounts, the maximum carryover amount for 2022 is $570 ($550 for 2021).

On the other hand, workers can't contribute as much to a dependent care FSA in 2022 as they could in 2021. Last year, as a COVID-relief measure, a family could sock away up to $10,500 in a dependent care FSA without paying tax on the contributions. But for 2022, the normal limit of $5,000-per-year on tax-free contributions applies once again.

22 of 25

Alternative Minimum Tax (AMT)

There's good news for anyone worried about getting hit with the alternative minimum tax: AMT exemptions ticked upward for 2022. They increased from $114,600 to $118,100 for couples and from $73,600 to $75,900 for single filers and heads of household. The phaseout zones for the exemptions start at higher income levels for the 2022 tax year as well — $1,079,800 for couples and $539,900 for singles and household heads ($1,047,200 and $523,600, respectively, for 2021).

In addition, the 28% AMT tax rate kicks in a bit higher in 2022 — above $206,100 of alternative minimum taxable income. The rate applied to AMTI over $199,900 for 2021.

23 of 25

Tax "Extenders"

There's a group of tax breaks that are constantly scheduled to expire, but that keep getting extended by Congress for another year or two. These tax breaks are collectively referred to as "tax extenders."

But so far, Congress hasn't passed legislation to renew the "tax extender" deductions and credits that expired at the end of 2021. Most of the expired tax breaks were for businesses, but the following expired tax breaks impacted individual taxpayers:

- Mortgage insurance premiums deduction;

- Health coverage tax credit for medical insurance premiums paid by certain Trade Adjustment Assistance recipients and people whose pension plans were taken over by the Pension Benefit Guaranty Corporation;

- Nonbusiness energy property credit for certain energy-saving improvements to your home (e.g., new energy-efficient windows and skylights, exterior doors, roofs, insulation, heating and air conditioning systems, water heaters, etc.);

- Fuel cell motor vehicle credit;

- Alternative fuel vehicle refueling property credit; and

- Two-wheeled plug-in electric vehicle credit.

At some point, lawmakers may swoop in and extend some or all of these tax breaks once again as they have in the past. They sometimes even make the extensions retroactive, so the tax breaks list above could still be available for the 2022 tax year. We'll just have to wait and see what Congress decides to do with these "tax extender" deductions and credits – stay tuned for future developments.

24 of 25

Self-Employed People

If you're self-employed, there are a couple of 2022 tax law changes that could impact your bottom line. First, a key dollar threshold on the 20% deduction for pass-through income was increased for 2022. Self-employed people (along with owners of LLCs, S corporations and other pass-through entities) can deduct 20% of their qualified business income, subject to limitations for individuals with taxable incomes in excess of $340,100 for joint filers and $170,050 for others ($329,800 and $164,900, respectively, for 2021).

Second, tax credits that were allowed for self-employed people who couldn't work for a reason that would have entitled them to pandemic-related sick or family leave if they were an employee have expired and aren't available for the 2022 tax year.

25 of 25

Estate & Gift Taxes

The lifetime estate and gift tax exemption for 2022 jumped from $11.7 million to $12.06 million — $24.12 million for couples if portability is elected by timely filing IRS Form 706 after the death of the first-to-die spouse.

The special estate tax valuation of real estate also increases for 2022. For the estate of a person dying this year, up to $1.23 million of farm or business real estate can receive discount valuation (up to $1.19 million in 2021), letting the estate value the realty at its current use instead of fair market value.

More estate tax liability qualifies for an installment payment tax break, too. If one or more closely held businesses make up greater than 35% of a 2022 estate, as much as $656,000 of tax can be deferred and the IRS will charge only 2% interest (up to $636,000 for 2021).

Finally, the annual gift tax exclusion for 2022 rises from $15,000 to $16,000 per donee. So, you can give up to $16,000 ($32,000 if your spouse agrees) to each child, grandchild or any other person in 2022 without having to file a gift tax return or tap your lifetime estate and gift tax exemption.

You may be missing out on one of the most beneficial tax credits for families with low or moderate incomes — the earned income tax credit (EITC). The EITC reduces the amount of tax you may owe and may give you a refund. Do you qualify for this tax-saving credit?

How do I know if I qualify for the earned income tax credit?

Taxpayer situations and tax laws change from year to year. As a result, your eligibility for the EITC may change due to unemployment, loss of income, receipt of additional income, a change in marital status, or a change in a spouse’s employment situation. Check with your tax professional or use the earned income tax credit calculator (EITC Assistant) to see if you qualify.

To be eligible for EITC, you must:

- File as single, widowed, head of household or married filing jointly.

- Have a valid Social Security number. If filing as married filing jointly, your spouse must have a valid Social Security number, as must any qualifying dependent children you plan to claim.

- Be age 25 or older, but younger than 65.

Earned income and AGI limits

If filing... | Qualifying children claimed | |||

|---|---|---|---|---|

Zero | One | Two | Three or more | |

Single, head of household or widowed | $15,820 | $41,756 | $47,440 | $50,954 |

Married filing jointly | $21,710 | $47,646 | $53,330 | $56,844 |

Source: IRS

The IRS has guidelines around what income types qualify for the EITC. This includes wages, salaries, tips and other taxable employee pay such as net earnings from self-employment or a business. If you received income from investments including stock dividends, rental income or inheritances greater than $3,650 during the year, you do not qualify for the EITC. Some types of income that do not count as earned income or investment income include child support, pension income, Social Security benefits (if not taken early) and alimony.

Maximum credit amounts

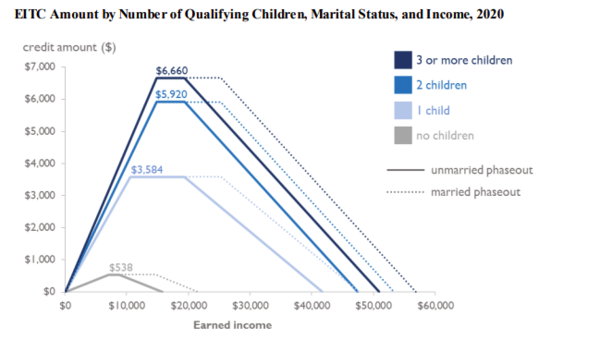

The maximum amount of EITC for 2020 is:

- $6,660 with three or more qualifying children

- $5,920 with two qualifying children

- $3,584 with one qualifying child

- $538 with no qualifying children

Preparing your taxes

If you use a qualified tax software system to prepare your taxes, it will ask you the right questions to help you maximize all available credits — including the EITC. Plus, you minimize your margin of error over using a pencil and paper. If you use TurboTax to prepare your taxes online, you can receive an LGFCU member discount.

For basic tax preparation needs, low-cost tax help is available at your local branch, subject to eligibility. Or complete your taxes yourself by using Free File, the IRS’ online tax preparation site.

About the Expanded COEITC

The Expanded Colorado Earned Income Tax Credit (COEITC) for ITIN Filers is a new credit and is available for the 2020 tax year. If you could not claim the Federal Earned Income Tax Credit (EITC), then you may qualify for the Expanded COEITC. This credit would apply to you if you, your spouse, and/or your child or children have an Individual Taxpayer Identification Number (ITIN) or a Social Security Number (SSN) that is not valid for employment.

If you and everyone in your household have a work-eligible Social Security Number (SSN), meaning you can use your SSN to obtain employment, then visit the EITC for SSN Filers web page to see if you are eligible for the Federal Earned Income Tax Credit.

To claim the Expanded COEITC you must be a Colorado resident. This means that you were domiciled in Colorado or had a permanent home in Colorado where you spent more than six months of the tax year. Other requirements and limits apply to the Expanded COEITC. Before you claim this credit, be sure to complete the eligibility checklist at below.

If the checklist below says you are eligible, then complete the DR 0104TN form to calculate your earned income and the federal EITC that you would have qualified for if you had a work-eligible SSN. For more information, visit the DR0104TN Information web page.

Expanded Colorado Earned Income Tax Credit (COEITC) Eligibility Checklist

Download a Copy of the Expanded COEITC Eligibility Checklist

Question 1. Do you, your spouse, and your children all have a work-eligible Social Security Number (SSN)?

Question 2. Were you a full-year or part-year Colorado resident during this tax year (year you are filing for)?

- Yes - Go to the next question (Question 3).

- No - You do not qualify for the Expanded COEITC.

Question 3. Will you claim children for this tax year?

- Yes - Complete the following questions. If the answer is “Yes'' to any of the following questions, then your child is a “qualifying child” for the Expanded COEITC. Repeat for each child you plan to claim for this tax year. If you have qualifying children, go to Question 5.

- Is the child your son or daughter, stepchild, foster child, brother, sister, half-brother, half-sister, stepbrother, stepsister, or a descendant of any of them (for example, your grandchild, niece, or nephew)?

- Is the child permanently and totally disabled? Or is the child younger than you (or your spouse if filing a joint return), and either under age 19 at the end of the tax year, or under age 24 at the end of the tax year and a full time student?

- Did the child have the same main home as you (or your spouse if filing jointly) in the United States for more than half of the tax year?

- Are you the only person who may claim this child? Or are you the person eligible to claim this child under tiebreaker rules that apply to a qualifying child of more than one person?

- If the child is married, are they: filing a joint tax return, but only claiming a refund of withheld or estimated taxes, or filing separately from their spouse?

- No - If the questions directly above do not apply, then go to the next question (Question 4).

Question 4. Do you have Expanded COEITC qualifying children?

- Yes - Go to the next question (Question 5).

- No - Do any of the following situations apply? If you answer “Yes'' to all of the following questions, then go to the next question (Question 5). If you answer “No” to any of the following questions, you do not qualify for the Expanded COEITC.

- Can you (and your spouse if filing a joint return) NOT be claimed as a dependent on anyone else’s return?

- Was your main home (and your spouse’s if filing a joint return) in the United States for more than half of the tax year?

- Were you (or your spouse if filing a joint return) at least age 25 but under age 65 at the end of the tax year?

Question 5. All Taxpayers: Do any of the following situations apply to you?

- Yes - If you answer "Yes" to any of following questions, then you do not qualify for the Expanded COEITC.

- Is your filing status married filing separately?

- Are you (or your spouse if filing a joint return) treated as a nonresident alien for any part of this tax year?

- Are you the qualifying child of another person who is required to file a return or who files a return to claim a tax benefit?

- Are you filing Federal Form 2555 or Federal Form 2555-EZ?

- No - If the questions directly above do not apply, then go to the next question (Question 6).

Question 6. Income Limits: Do all of the following apply to you?

- Yes - If you answer "Yes" to all of the following questions, then complete the DR 0104TN form to calculate and claim the Expanded COEITC. More information on how to complete the DR 0104TN form can be found on the DR 0104TN Form Information web page.

- Is your investment income less than $3,650?

- Is your total earned income at least $1?

- Are both your total earned income (see Rule 15 in IRS Publication 596) and your adjusted gross income (line 11 on Form 1040 or 1040-SR) less than:

- $15,820 ($21,710 if married filing jointly) with no qualifying children

- $41,756 ($47,646 if married filing jointly) with one qualifying child

- $47,440 ($53,330 if married filing jointly) with two qualifying children

- $50,954 ($56,844 if married filing jointly) with three or more qualifying children

- No - If the questions directly above do not apply, then you do not qualify for the Expanded COEITC.

Earned income tax credit

Refundable tax credit for low-to-middle class individuals in the U.S.

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends on a recipient's income and number of children. For a person or couple to claim one or more persons as their qualifying child, requirements such as relationship, age, and shared residency must be met.[1][2]

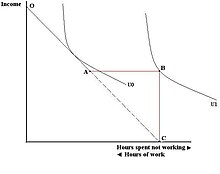

EITC phases in slowly, has a medium-length plateau, and phases out more slowly than it was phased in. Since the credit phases out at 21% (more than one qualifying child) or 16% (one qualifying child), it is always preferable to have one more dollar of actual salary or wages considering the EITC alone. (Investment income, however, is handled far less gracefully, as one more dollar of income can result in the sudden 100% loss of the entire credit.) If the EITC is combined with multiple other means-tested programs such as Medicaid or Temporary Assistance for Needy Families, it is possible that the marginal tax rate approaches or exceeds 100% in rare circumstances depending on the state of residence; conversely, under certain circumstances, net income can rise faster than the increase in wages because the EITC phases in.[3]

The earned income tax credit has been part of political debates in the United States over whether raising the minimum wage or increasing EITC is a better idea.[4][5][6] In a random survey of 568 members of the American Economic Association in 2011, roughly 60% of economists agreed (31.7%) or agreed with provisos (30.8%) that the earned income tax credit program should be expanded.[7]

Overview[edit]

In 1969, Richard Nixon proposed the Family Assistance Plan, which included a guaranteed minimum income in the form of a negative income tax. The House of Representatives passed this plan, but the Senate did not. During his 1972 Presidential campaign, George McGovern proposed a demogrant of $1,000 for every American. Critics during this time complained about implying people don't have to work for a living, and saw the program as having too little stigma; during this time, Hawaii had an established residency requirement for public aid, which one Hawaii State Senator suggested was necessary to discourage "parasites in paradise".[8]

Proposed by Russell Long and enacted in 1975, the EITC provides benefits to working recipients with earned income, but not to non-working recipients. The initially modest EITC has been expanded by tax legislation on a number of occasions, including the widely publicized Tax Reform Act of 1986, and was further expanded in 1990, 1993, 2001, and 2009, regardless of whether the act in general raised taxes (1990, 1993), lowered taxes (2001), or eliminated other deductions and credits (1986).[9] In 1993, President Clinton tripled the EITC.[10] Today, the EITC is one of the largest anti-poverty tools in the United States.[11] Also, the EITC is mainly used to "promote and support work."[10] Most income measures, including the poverty rate, do not account for the credit.[12]

A qualifying child can be a person's daughter, son, stepchild, or any further descendant (such as grandchild, great grandchild, etc.) or a person's brother, sister, half sister, half brother, stepbrother, stepsister, or any further descendant (such as niece, nephew, great-nephew, great-great-niece, etc.). A qualifying child can also be in the process of being adopted provided he or she has been lawfully placed. Foster children also count provided either the child has been officially placed or is a member of one's extended family. A younger single parent cannot claim EITC if he or she is also claimable as a qualifying child of their parent or another older relative, which can happen in some extended family situations. This restriction does not apply to a married couple who is claiming EITC with a child, even if one or both spouses are under the age of 19.

A person claiming EITC must be older than his or her qualifying child unless the “child” is classified as "permanently and totally disabled" for the tax year (physician states one year or more). A qualifying "child" can be up to and including age 18. A qualifying "child" who is a full-time student (one long semester or equivalent) can be up to and including age 23. And a person classified as "permanently and totally disabled" (one year or more) can be any age and count as one's qualifying "child" provided the other requirements are met. Parents claim their own child(ren) if eligible unless they are waiving this year's credit to an extended family member who has higher adjusted gross income. There is no support test for EITC. There is a six-month plus one day shared residency test.[13][14]

In the 2009 American Recovery and Reinvestment Act, the EITC was temporarily expanded for two specific groups: married couples and families with three or more children; this expansion was extended through December 2012 by H.R. 4853, the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. Effective for the 2010, 2011, 2012 and 2013 filing seasons, the EITC supported these taxpayers by:

- Increasing benefits for larger families by creating a new category or “third tier” of the EITC for families with three or more children. In this tier, the credit phases in at 45 percent of income (up from 40 percent), effectively increasing the maximum credit for these families by almost $600.

- Increasing marriage penalty relief by raising the income threshold at which the EITC begins to phase out for married couples to $5,000 above the amount for unmarried filers, thereby giving MFJ filers a longer plateau. The combined plateau and phase-out range for married filing jointly is still not double that for single filers, and thus there still is a marriage penalty, just less than there used to be.[15]

As of early 2012, 26 states have enacted state EITCs: Colorado, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Nebraska, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Oregon, Rhode Island, Vermont, Virginia, and Wisconsin.[16] Some of these state EICs are refundable, and some are not. In addition, a few small local EITCs have been enacted in San Francisco,[17]New York City,[18] and Montgomery County, Maryland.[19]

Earned income[edit]

Earned income is defined by the United States Internal Revenue Code as income received through personal effort,[20] with the following as the main sources:[14]

- Wages, salaries, tips, commissions, and other taxable employee pay.

- Net earnings from self-employment.

- Gross income received as a statutory employee.[21]

- Disability payments through a private employer's disability plan received prior to minimum retirement age (62 in 2011).[22]

- Nontaxable combat pay received by a member of the U.S. armed services which he or she elects to include for purposes of EIC calculation. This is an all-or-none election. For each tax year, the service member must elect to include either all of the combat pay or none of it.

Qualifying children[edit]

A person or couple claiming EITC with one or more qualifying children need to fill out and attach Schedule EITC to their 1040 or 1040A. This form asks for the child(ren)'s name, social security number, year of birth, whether an older "child" age 19 to 23 was classified as a student for the year (full-time status for at least one long semester or equivalent time period), whether an older "child" is classified as disabled during the year (doctor states one year or more), the child's relationship to claimant, and the number of months the child lived with the claimant in the United States.[23]

To claim a person as qualifying child, the following requirements of relationship, age, and shared residence must be met.[14][23][24]

Relationship[edit]

In the case of a married couple filing jointly, if one spouse is related to the child by any of the below relationships, both spouses are considered related to the child.

The claimant must be related to their qualifying child through blood, marriage, or law. The qualifying child can be:[13]

- a person's daughter, son, stepchild, or any further descendant (such as grandchild, great grandchild, etc.),

- or a person's brother, sister, half sister, half brother, stepbrother, stepsister, or any further descendant (such as niece, nephew, great-nephew, great-great-niece, etc.),

- or a foster child officially placed by an agency, court, or Indian tribal government. Authorized placement agencies include tax-exempt organizations licensed by states as well as organizations authorized by Indian tribal governments to place Native American children.

- or an adopted child, including a child in the process of being adopted provided he or she has been lawfully placed.

A child might classify as the qualifying child of more than one adult family member, at least initially. For example, in an extended family situation, both a parent and an uncle may meet the initial standards of relationship, age, and residency to claim a particular child. In such a case, there is a further rule: If a single parent or both parents, whether married or not, can claim the child (residency and age) but choose to waive the child to a non-parent, such as a grandparent or uncle or aunt, this non-parent can claim the child only if they have a higher adjusted gross income (AGI) than any parent who has lived with the child for at least six months.

This still remains the parent's choice. Provided the parent has lived with the child for at least six months and one day, the parent can always choose to claim his or her child for purposes of the earned income credit. In a tiebreaker situation between two unmarried parents, the tiebreak goes to the parent who lived with the child for the longest. In a tiebreaker between two non-parents, the tiebreak goes to the person with the higher AGI. And in a tiebreaker between a parent and non-parent, the parent wins by definition. These tiebreaker situations only occur if more than one family member actually file tax returns in which they claim the same child. On the other hand, if the family can agree, per the above and following rules, they can engage in a limited amount of tax planning as to which family member claims the child.[14]

Age[edit]

A single parent younger than age 19 living in an extended family situation is potentially claimable as the qualifying "child" of an older relative. And a single parent under age 24 who is also a full-time college student (one long semester or equivalent) living in an extended family situation is also potentially claimable. If so, the younger single parent cannot claim EIC. This rule does not apply to a married couple who are claiming EIC with a child, even if one or both spouses are under the age of 19. (This rule also does not apply if the older relative is not required to file a tax return, and subsequently either does not file or only files to receive a full refund of taxes withheld.)

Generally, one sibling claiming another as their qualifying child must be older. In the case of a married couple filing a joint return, only one of the spouses must be older. An exception to the must-be-older-rule is the case of a qualifying child who is classified as "permanently and totally disabled" (physician states one year or more). Such a "child" can be any age and the age requirement is considered to be automatically met (of course the relationship and shared residency requirements must still be met).

The standard rule is that the qualifying "child" must be under the age of 19 at the end of the tax year. That is, the younger person can be 18 years and 364 days old on December 31 and the age requirement is met.

This age limit is extended for a qualifying "child" who is also a full-time student during some part of five calendar months. This young adult merely needs to be under age 24 at the end of the tax year for the age requirement to be met (relationship and residency requirements must still be met). That is, the young adult who is full-time for at least part of five different months can be 23 years and 364 days on December 31 and meet the age requirement to be someone else's qualifying "child." The standard Fall semester of a university, in which classes start in late August and continue through September, October, November, and early December, counts as part of five calendar months. And a similar conclusion applies to the standard Spring semester. However, the five months need not be consecutive and can be obtained with any combination of shorter periods. A full-time student is a student who is enrolled for the number of hours or courses the school considers to be full-time attendance. High school students who work in co-op jobs or who are in a vocational high school program are classified as full-time students. Schools include technical, trade, and mechanical schools.

A person who is classified as "permanently and totally disabled" (physician states one year or more) can be any age and the age requirement is automatically met.[13] More fully, the definition of "permanently and totally disabled" is that a person has a mental or physical disability, cannot engage in substantial gainful activity, and a physician has determined that the condition has lasted or is expected to last one year or more (or that it can lead to death).[14]

[edit]

The claimant must live with their qualifying child(ren) within the fifty states and/or District of Columbia of the United States for more than half the tax year (per instructions, six months and one day is listed as 7 months on Schedule EIC). U.S. military personnel stationed outside the United States on extended active duty are considered to live in the U.S. for purposes of the EIC. Extended active duty means the person is called to duty for an indefinite period or for a period of more than 90 days (which is still considered to be extended active even if the period ends up being less than 90 days).

Temporary absences, for either the claimant or the child, due to school, hospital stays, business trips, vacations, shorter periods of military service, or jail or detention, are ignored and instead count as time lived at home.[13] "Temporary" is perhaps unavoidably vague and generally hinges or whether the claimant and/or the child are expected to return, and the IRS does not provide any substantial guidance past this. If the child was born or died in the year and the claimant's home was the child's home, or potential home, for the entire time the child was alive during the year, this counts as living with the claimant, and per instructions, 12 months is entered on Schedule EIC.

Unlike the rules for claiming a dependent, there is no rule that a qualifying child not support herself or himself. A child who supports himself or herself can still qualify as a qualifying child for purposes of the EIC. There is an exception for older married "children." If an otherwise qualifying child is married, the claimant needs to be able to claim this child as a dependent (and the married couple must have low enough income so that they are not required to file a return and are either not filing or are filing only for the purpose of claiming a refund on withheld taxes).[14][23][25]

Other requirements[edit]

Investment income cannot be greater than $3,650 for the 2020 tax year.[26] As a result of the American Rescue Plan Act of 2021, the investment income limit was increased to $10,000 effective the 2021 tax year and will be adjusted for inflation.

A claimant must be either a United States citizen or resident alien. In the case of married filing jointly where one spouse is and one isn't, the couple can elect to treat the nonresident spouse as resident and have their entire worldwide income subject to U.S. tax, and will then be eligible for EITC.

Filers both with and without qualifying children must have lived in the 50 states and/or District of Columbia of the United States for more than half the tax year (six months and one day). Puerto Rico, American Samoa, the Northern Mariana Islands, and other U.S. territories do not count in this regard. However, a person on extended military duty is considered to have met this requirement for the period of the duty served[citation needed].

Filers who are not claiming a qualifying child must be between the ages of 25 and 64 inclusive. For a married couple without a qualifying child, only one spouse must be within this age range. For a single person with a qualifying child, there is no age requirement per se other than the requirement that the single person not himself or herself be claimable as another relative's qualifying child (see Age section above). A married couple with at least one qualifying child is only occasionally classified as claimable by another relative, especially if the married couple has earned income and elects to claim EITC.

All filers and all children being claimed must have a valid social security number. This includes social security cards printed with "Valid for work only with INS authorization" or "Valid for work only with DHS authorization."[14]

Single, Head of Household, Qualifying Widow(er), and Married Filing Jointly are all equally valid filing statuses for EITC. In fact, depending on the income of both spouses, Married Filing Jointly can be advantageous in some circumstances because, in 2009, the phase-out for MFJ for begins at $21,450 whereas phase-out begins at $16,450 for the other filing statuses. A couple who is legally married can file MFJ even if they lived apart the entire year and even if they shared no revenues or expenses for the year, as long as both spouses agree. However, if both spouses do not agree, or if there are other circumstances such as domestic violence, a spouse who lived apart with children for the last six months of the year and who meets other requirements can file as Head of Household.[27][28] Or, for a couple that is split up but still legally married, they might consider visiting an accountant at separate times and perhaps even signing a joint return on separate visits. There is even an IRS form that can be used to request direct deposit into up to three separate accounts.[29] In addition, if a person obtains a divorce by December 31, that will carry, since it is marital status on the last day of the year that controls for tax purposes. In addition, if a person is "legally separated" according to state law by December 31, that will also carry.[30] The only disqualifying filing status for purposes of the EIC is married filing separately.[13][14]

EIC phases out by the greater of earned income or adjusted gross income.

A married couple in 2018, whose total income was just shy of $24,350, of which exactly $3,500 was investment income, would receive the maximum credit for their number of qualifying children (i.e. $6,431 with 3 kids). But if this couple instead had $3,501 of investment income, then — because of the rule that for any claimant, whether single or married, with or without children, investment income cannot be greater than $3,500 — they will instead receive zero EIC. This is a loss of up to $6,431 due to one extra dollar of investment income, and the loss is nearly twice the entire amount of the couple's investment income. This is an edge case, but there are income ranges and situations in which an increase of investment dollars will result in a loss of after-tax dollars. (Instead of $24,350, the phase-out for Single, Head of Household, and Qualifying Widow(er) begins at $18,700.)[31]

In normal circumstances, EIC phases out relatively slowly, at 16% or 21% depending on the number of children.

Disallowances for reckless or fraudulent claims[edit]

A person or couple will be disallowed EIC for two years if they claim EIC when not eligible and the IRS determines the "error is due to reckless or intentional disregard of the EIC rules." A person or couple will be disallowed for ten years if they make a fraudulent claim. Form 8862 is required after this time period in order to be reinstated. However, this form is not required if EIC was reduced solely because of mathematical or clerical error.[32]

Example(s) for 2012 from IRS Pub. 596[edit]

Cynthia and Jerry Grey have two children ages 6 and 8. For tax year 2012, one spouse made $10,000 in wages and the other spouse made $15,000, plus the couple received $525 on interest from a savings account. Since they are into the phase-out range, their EIC will phase out by the greater of earned income or adjusted gross income. So, they will look up in the EIC table $25,525 for MFJ with two children, and this amount is $4,557. Since they are claiming children, the Greys will also need to attach Schedule EIC to their tax return which will ask for each child, the child's name, social security number, year of birth, relationship to couple, and months lived with couple in the United States during 2012. If the Greys use 1040A, they will enter $4,557 on line 38a. If they use form 1040, they will enter $4,557 on line 64a.[14]

Graph, 2020[edit]

Tax Credit for case of one qualifying child[edit]

With one child and parent filing singly or as head of household, as of 2020:[33]

- Tax credit equals $0.34 for each dollar of earned income for income up to $10,540.

- For income between $10,540 and $19,330, the tax credit is a constant "plateau" at $3,584.

- For income between $19,330 and $41,765, the tax credit decreases by $0.1598 for each dollar earned over $19,330.

- For income over $41,765, the tax credit is zero.[34]

This is represented by the lightest blue, solid line:

Impact[edit]

Welfare benefits[edit]

At a cost of $56 billion in 2013, the EITC is the third-largest social welfare program in the United States after Medicaid ($275 billion federal and $127 billion state expenditures) and food stamps ($78 billion).[35] Almost 27 million American households received more than $56 billion in payments through the EITC in 2010. These EITC dollars had a significant impact on the lives and communities of the nation's lowest-paid working people largely repaying any payroll taxes they may have paid. The EITC is one of the most effective social welfare programs in the United States.[10] The Census Bureau, using an alternative calculation of poverty, found that EITC lifted 5.4 million above the poverty line in 2010.[36]

The stimulus effects of the EITC and other consumption-augmenting policies have been challenged by more recent and rigorous studies. Haskell (2006) finds that the unique spending patterns of lump-sum tax credit recipients and the increasingly global supply chain for consumer goods is counter-productive to producing high, localized multipliers. He places the local multiplier effect somewhere in the range of 1.07 to 1.15, more in line with typical economic returns. The lower multiplier is due to recipients emphasizing "big-ticket" durable-good purchases, which are typically produced elsewhere, versus locally produced products and services such as agricultural products or restaurant visits. However, Haskell points to a silver lining: there are perhaps more important benefits from recipients who use the credit for savings or investment in big-ticket purchases that promote social mobility, such as automobiles, school tuition, or health-care services.[37][38]

Due to its structure, the EITC is effective at targeting assistance to low-income families in the bottom two quintiles—0–40% of households. By contrast, only 30% of minimum wage workers live in families near or below the federal poverty line, as most are teenagers, young adults, students, or spouses supplementing their studies or family income.[39][40] Opponents of the minimum wage argue that it is a less efficient means to help the poor than adjusting the EITC.[41]

EITC follows a graphical benefit pattern of going up a hill, traveling along a plateau, and then going back down the hill more slowly than it went up. For example, a married couple with two qualifying children and yearly income of seven thousand dollars will[when?] receive EITC of $2,810 (going up the hill). At fifteen thousand dollars, this couple will receive EITC of $5,036 (plateau). And at twenty-five and thirty-five thousand dollars, this same couple with their two children will receive EITC of $4,285 and $2,179, respectively.[13]

A single person (such as a single parent, aunt, uncle, grandparent, older sibling, etc.) goes up the hill at the same rate and will receive the same maximum EITC for two qualifying children of $5,036 at plateau. But the single person has a shorter plateau. And thus, a single person with two qualifying children and income of twenty-five and thirty-five thousand will receive EITC of $3,230 and $1,124 respectively (going down the hill).[13]

EITC phases out at 16% with one qualifying child and at 21% for two children and three or more children. Thus it is always preferable to have an extra fifty dollars of actual earned income (the table for EITC steps in increments of fifty dollars).[13]

The GRAPHICAL plateau range for Married Filing Jointly continues for five thousand dollars longer than does the plateau for the other filing statuses and thus MFJ can be advantageous for some income ranges. Single, Head of Household, and Qualifying Widow(er) are all equally valid and eligible filing statuses for claiming EITC. The only disqualifying status is Married Filing Separately. However, a couple can file as Married Filing Jointly even if they lived apart for the entire year if legally married and both agree.[13]

Impact on health[edit]

A 2016 review of the EITC and state-matches to the EITC found significant impacts on maternal mental health, low birth weight births, and other health indicators association with inflammation.[42]

Working mothers[edit]

According to a 2020 study, the introduction of the EITC increased maternal employment by 6 percent. The EITC may explain why the United States has high levels of maternal employment, despite the absence of childcare subsidies or parental leave.[43]

Cost[edit]

The direct cost of the EITC to the U.S. federal government was about $56 billion in 2012. The IRS has estimated that between 21% and 25% of this cost ($11.6 to $13.6 billion) is due to EITC payments that were issued improperly to recipients who did not qualify for the EITC benefit that they received.[44] For the 2013 tax year the IRS paid an estimated $13.6 billion in bogus claims. The IRS overpaid as much as $132.6 billion in EITC between 2003 and 2013.[45]

The direct fiscal cost of the EITC may be partially offset by two factors: any new taxes (such as payroll taxes paid by employers) generated by new workers drawn by the EITC into the labor force; and taxes generated on additional spending done by families receiving earned income tax credit.

Some economists have noted that the EITC might conceivably cause reductions in entitlement spending that result from individuals being lifted out of poverty by their EITC benefit check. However, because the pre-tax income determines eligibility for most state and federal benefits, the EITC rarely changes a taxpayer's eligibility for state or federal aid benefits.

Uncollected tax credits[edit]

Millions of American families who are eligible for the EITC do not receive it, essentially leaving billions of dollars unclaimed. The IRS estimates that about 20 percent of eligible taxpayers do not claim $7.3 billion of Earned Income Tax Credit (EITC) each tax year.[46]

Many nonprofit organizations around the United States, sometimes in partnership with government and with some public financing, have begun programs designed to increase EITC utilization by raising awareness of the credit and assisting with the filing of the relevant tax forms. One example is the Claim it! campaign in Minnesota that launched in 2006 to help Minnesotans claim the EITC.[47]

The state of California requires employers to notify every employee about the EITC every year, in writing, at the same time W-2 forms are distributed.[48]

Storefront tax prep, “RACs,” prep and account fees, third-party debt collection[edit]

RALs (Refund Anticipation Loans) are short term loans on the security of an expected tax refund, and RACs (Refund Anticipation Checks) are temporary accounts specifically to wait to receive tax refunds, which are then paid by a check or debit card from the bank less fees. The combination of Earned Income Credit, RALs, and RACs has created a major market for the storefront tax preparation industry. A 2002 Brookings Institution study of Cleveland taxpayers found that 47 percent of filers claiming EIC purchased RALs, as compared to 10 percent of those not claiming EIC. The tax preparation industry responded that at least one-half of RAL customers included in the IRS data actually received RACs instead.[49][50]

These financial products have been criticized on various grounds, including inflated prices for tax preparation, account fees, RAL interest rates, as well as the practice of third-party debt collection (this used to be called "cross-collection" which hinted at the practice, but tax prep companies now to seem more vaguely refer to the practice merely as "previous debt").[51][52] This practice occurs when one RAL- or RAC-issuing bank collects for another. That is, such lenders may take all or part of a client's current year tax refund for purposes of third-party debt collection, and it is unclear how broad are the types of debts for which the banks collect.[53] This contrasts with the more limited types of debt collected for by the IRS. This practice of one bank collecting debt for another may not be adequately disclosed to the tax preparation client; on the other hand, some clients may fail to disclose obligations that result a governmental seizure of their refunds.[54] With both RALs and RACs, the client grants the bank first rights to their tax refund, and both carry the same risk of third-party bank collection.

Advertisement phrases such as "Rapid Refund" have been deemed deceptive and illegal, since these financial products do not speed remittances beyond the routine automation of tax return processing, and do not make it clear that these are loan applications. Beginning with 2011 tax season, the IRS announced that they would no longer provide preparers and financial institutions with the “debt indicator” that assisted banks in determining whether RAL applications were approved.[55][56] Beginning with the 2013 tax season, major banks are no longer offering RALs but only RACs.[57][58]

However, a March 2013 article in CNN Money reported that tax prep companies are offering a hodgepodge of financial products similar to RALs. The article further states that, "The NCLC [National Consumer Law Center] also found that some shady tax preparers are even offering tax refund loans to lure taxpayers into their offices, but have no intention of lending them the money."[59]

See also[edit]

References[edit]

- ^EITC IRS instructions Internal Revenue Service, "EITC Home Page--It’s easier than ever to find out if you qualify for EITC"

- ^Tax Year 2020 1040 and 1040-SR Instructions, including the instructions for Schedules 1 through 3, Rules for EIC begin on page 40 for 2020 Tax Year.

- ^"How Marginal Tax Rates Affect Families at Various Levels of Poverty"(PDF). 20 December 2012.

- ^"Gov. Christie rejects minimum wage increase, offers alternative". 28 January 2013.

- ^"The Business of the Minimum Wage". The New York Times. 3 March 2013.

- ^"Employment Policies Institute - The $9 Minimum Wage That Already Exists".

- ^Fuller, Dan; Geide-Stevenson, Doris (2014). "Consensus Among Economists—An Update". The Journal of Economic Education. 45 (2): 131–146. doi:10.1080/00220485.2014.889963. S2CID 143794347.

- ^Hamilton, Jonathan (2010-01-04). "Optimal Tax Theory: The Journey from the Negative Income Tax to the Earned Income Tax Credit". Southern Economic Journal. 76 (4): 861–877. doi:10.4284/sej.2010.76.4.861.

- ^Earned Income Tax Credit Parameters 1975–2010, at the Tax Policy Center, Urban Institute and Brookings Institution, 27 Oct. 2009. See footnote for the increases in the travel distance, but not the credit amount, for Married Filling Jointly for the years 2002 through 2010. For example, in 2010, the plateaus for MFJ extend $5,000 further than do the corresponding plateaus for Single, Head of Household, Qualifying Widow(er). For all filing statuses, the phase out for EIC with one child is 16% (15.98%), and the phaseout for two children and for three or more children is 21% (21.06%). Single, Head of Household, and Qualifying Widow(er) are all equally valid, equally advantageous filing statuses for the purposes of Earned Income Credit. Married filing Jointly can sometimes be more advantageous depending on the income level.

- ^ abcSykes, Jennifer; Križ, Katrin; Edin, Kathryn; Halpern-Meekin, Sarah (2014-10-10). "Dignity and Dreams". American Sociological Review. 80 (2): 243–267. doi:10.1177/0003122414551552. ISSN 0003-1224. S2CID 154685898.

- ^"Welfare Chart". House Ways and Means Committee. Retrieved 25 April 2016.

- ^Bureau, US Census. "Income".

- ^ abcdefghi1040 Instructions 2010, rules for EITC pages 45–48, optional worksheets pages 49–51, and the EITC Table itself on pages 52–68. The only required attachment is Schedule EITC if you are claiming one or more qualifying children.

- ^ abcdefghiIRS Publication 596, Earned Income Credit (EIC): For use in preparing 2012 Returns.

- ^"Tax Credits for Working Families, Earned Income Tax Credit (EITC)". Retrieved 17 February 2012.

- ^"Tax Credits for Working Families, States with EITCs". Retrieved 17 February 2012.

- ^"What is the Working Families Credit (WFC)?". www.workingfamiliescredit.org. Retrieved 2016-05-22.

- ^Assistance, New York State Office of Temporary and Disability. "Earned Income Tax Credits (EITC) OTDA". otda.ny.gov. Retrieved 2016-05-22.Источник: [https://torrent-igruha.org/3551-portal.html]

You may be missing out on one of the most beneficial tax credits for families with low or moderate incomes — the earned income tax credit (EITC). The EITC reduces the amount of tax you may owe and may give you a refund. Do you qualify for this tax-saving credit?

How do I know if I qualify for the earned income tax credit?

Taxpayer situations and tax laws change from year to year. As a result, your eligibility for the EITC may change due to unemployment, in 2022 for eitc rules for everyone investment income must be, loss of income, receipt of additional income, a change in marital status, or a change in a spouse’s employment situation. Check with your tax professional or use the earned income tax credit calculator (EITC Assistant) to see if you qualify.

To be eligible for EITC, you must:

- File as single, widowed, head of household or married filing jointly.

- Have a valid Social Security number. If filing as married filing jointly, your spouse must have a valid Social Security number, as must any qualifying dependent children you plan to claim.

- Be age 25 or older, but in 2022 for eitc rules for everyone investment income must be than 65.

Earned income and AGI limits

If filing.

Qualifying children claimed

Zero

One

Two

Three or more

Single, head of household or widowed

$15,820

$41,756

$47,440

$50,954

Married filing jointly

$21,710

$47,646

$53,330

$56,844

Source: IRS