Are absolutely: All forks of bitcoin

| What should i invest in to make money |

| All forks of bitcoin |

| Exchange american express serve card fot bitcoin |

All forks of bitcoin - commit

The ultimate guide to Bitcoin Forks

What are Bitcoin Forks?

A ‘fork’ is a change to the software of a digital currency that creates two separate versions of the blockchain with a shared history. When this happens, a new digital currency – the forked version – is created. What’s important – private keys, that held balances of coins before the fork, provides ownership of forked coins as well.

A fork can occur in any crypto-technology platform, e.g. Ethereum, Litecoin or Monero, but currently the most popular cryptocurrency here is of course Bitcoin. Basic principles governing Bitcoin had their pros and cons, but essentially Bitcoin became a victim of its success and along with its popularity new issues arose – relatively high fees, high energy consumption, slow transaction times, etc.

A solution, that would scale as more users bought and sold the product, was needed. That’s where the forks stepped in.

So in August 2017 a Bitcoin fork brought a new – and the most relevant for now – fork coin into existence: Bitcoin Cash (BCH). Bitcoin Cash initially changed from 1 MB to 8 MB (then to 32MB in 2018) so more transactions could be processed with each block and whole verification process could be sped up.

Despite these improvements the community split – some supported this change and switched to Bitcoin Cash, and there were those who decided to stay with the original rules and keep using the original Bitcoin.

Depending on scope of modifications we distinguish “backward-compatible” soft forks, where transactions are recognized by both old nodes and new nodes and don’t create new coins, and hard forks, which don’t allow this and result in the creation of a totally different coin.

So both forks create a split, however a hard fork creates two blockchains and a soft fork is meant to result in one.

This will be covered in more detail in the next chapter.

What is a Hard Fork?

The main difference between a soft fork and a hard fork is an extent to which an update is respected by miners. If all miners agree with the new rule and then proceed to only validate blocks that respect it, then there is no need for a new chain to split off.

However, if there is no agreement around the rule change, then some miners will continue to validate blocks according to the old rules, while others will validate according to the new rules. As a result blocks mined by each group will be incompatible with the other. This results in a hard fork, e.g. Bitcoin Cash which was mentioned above.

So digging deeper – a hard fork occurs when nodes of the newest version of a blockchain no longer accept the older version of the blockchain. This creates a permanent discrepancy from the previous version of the blockchain. Adding a new rule to the code basically creates a fork in the blockchain. As a result one path follows the new, upgraded blockchain, and the other one continues along the old path. After some time part of users of old chain will realize that their version of the blockchain is outdated and quickly upgrade to the latest version. However nodes that are not upgraded reject the new rules and thus create a hard fork.

This “spin-off” nature of forks also results in confusing names, usually very similar to it’s originator, e.g. Bitcoin: bitcoin cash, bitcoin gold, bitcoin satoshi vision etc. Reasons behind implementation of hard forks vary: to address security issues with the older version, add new functionalities or sometimes to reverse transactions, which occurred as a result of far-reaching scams (and to help victims of such scams reclaim their stolen funds).

What is a Soft Fork?

On contrary to a hard fork, a soft fork is a change to the software protocol where only previously valid transactions are made invalid. Since old nodes will recognize the new blocks as valid, a soft fork is backward-compatible. As opposed to a hard fork that requires all nodes to upgrade and agree on the new version, a soft fork requires only a majority of the miners upgrading to carry out the new rules. So if at least 51% of the mining power switches to the new version, the system corrects itself. However, if less than 51% of miners shifts, the blockchain-fork will not change automatically as the chain created under the old rules has more hashing power and is incompatible with the new rules.

Despite these possible complications, soft forks’ “backward-compatibility” feature has been used many times on the Bitcoin and Ethereum blockchains to implement new components that are backward compatible.

SegWit (which stands for Segregated Witness) is a good example of Bitcoin’s soft fork. The SegWit protocol upgrade intends to reduce transaction size by not including transaction signatures in the block. As signatures constitute a large percentage of the size of a transaction, their removal means that more transactions can be processed per block. The result is lower transaction fees and shorter confirmation times.

Would you like to know more about SegWit soft fork? Read this article.

The new rules allow a subset of the previous valid blocks, therefore all blocks considered valid by the newer version are also valid in the old version.

Blocks created by old versions, that are invalid under the new paradigm, might commence a short-term “old-only blockchain-fork”, but eventually, they would be overtaken by the chain fork created under the new paradigm, as the hashing power working on the old paradigm would be smaller (“only old versions”) than on the new paradigm (“accepted by all versions”).

Soft forks allow only a certain number of blocks to be a sub-category of what was valid before the fork happened, therefore it can’t be reverted without a hard fork. If after an upgrade for some reason the majority of miners will start using the old version again, post-soft fork client users would negate any future blocks from the past. So the general rule is – the more miners that accept the new rules, the more secure the network is post-fork.

Full list of Bitcoin Forks

We present you the most up-to-date list of active forks (inactive forks and airdrops have been excluded):

How to claim Bitcoin Forks?

Currently more than $300 Million in crypto forks remain unclaimed. There are multiple ways to claim your Bitcoin forks, however the majority of them are time-consuming and – what’s more important – not entirely safe, e.g. downloading each fork’s wallet and using your private key is a very risky method as it may contain malware. That’s why Coinfirm launched a dedicated service to support everyone, who looks for a safe and easy way of reclaiming their forks.

More details can be found here.

Summary

Thousands of new forks emerged since Bitcoin started to gain popularity, some of them imitating its originator to gain legitimacy, others to improve the Bitcoin protocol. It became a well known and widely accepted element of crypto space. Thanks to forks when any disagreements occur, the whole community – including developers, miners and investors – have their fair share of voice.

As history shows, not all forks will last, but definitely we’ll see more launches in upcoming months and years, some of them resulting in brand new cryptocurrencies.

About Coinfirm

Coinfirm is a global leader in AML and regulatory technology for blockchain and cryptocurrencies. It offers the industry’s largest blockchain coverage, supporting over 1,500 cryptocurrencies and protocols including Bitcoin, Ethereum, Hyperledger, and many more. Coinfirm’s solutions are used by market leaders globally, ranging from crypto exchanges such as Binance, and protocols like XRP, to major financial institutions like PKO BP. The company’s services also include Reclaim Crypto, as well as Trudatum, a standalone regtech platform that allows any file to be registered, signed, and verified with 100% accuracy.

An Empirical Analysis of Blockchain Forks in Bitcoin

This page provides the dataset used in our paper: Short Paper: An Empirical Analysis of Blockchain Forks in Bitcoin

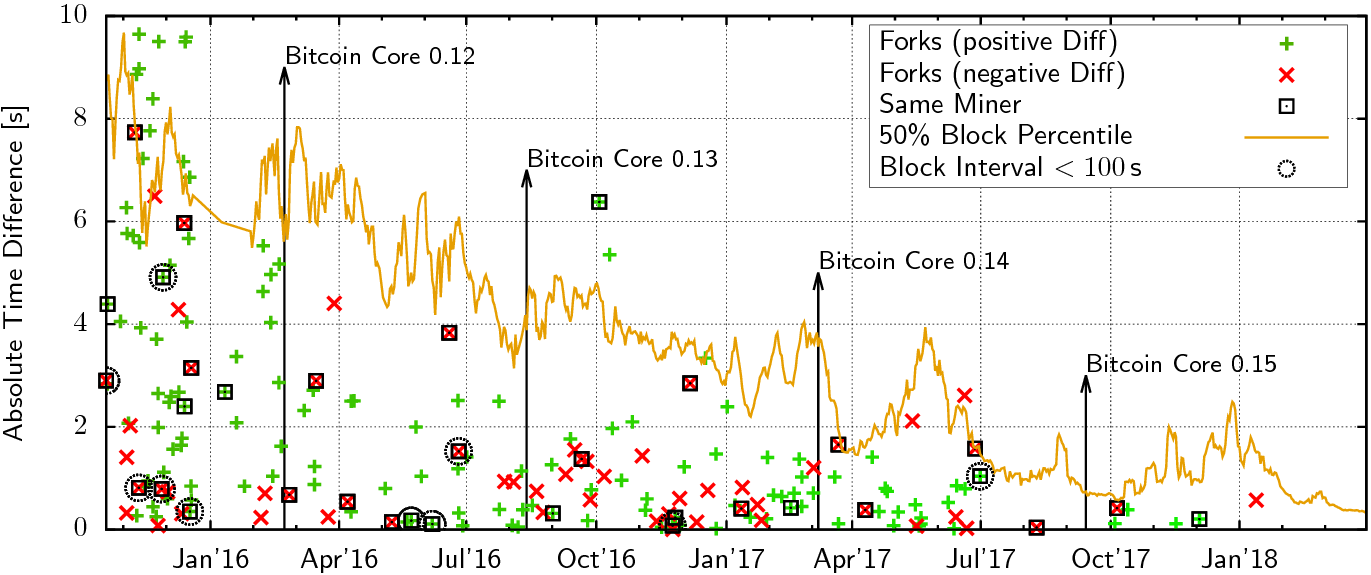

Above figure (Fig. 1 from the paper) shows the time differences between the first announcement of forking blocks. A green cross (positive Diff) indicates that the block that was announced first became part of the main chain, a red cross (negative Diff) indicates that the later announced block became part of the main chain. Boxes around blocks indicate that the subsequent block has been mined by the same miner; additional circles around blocks indicate that the subsequent block has been mined by the same miner within less than 100 seconds. Finally, the average 50% block propagation percentile is shown.

The data shown in the figure is contained in these files: forks and block proagation

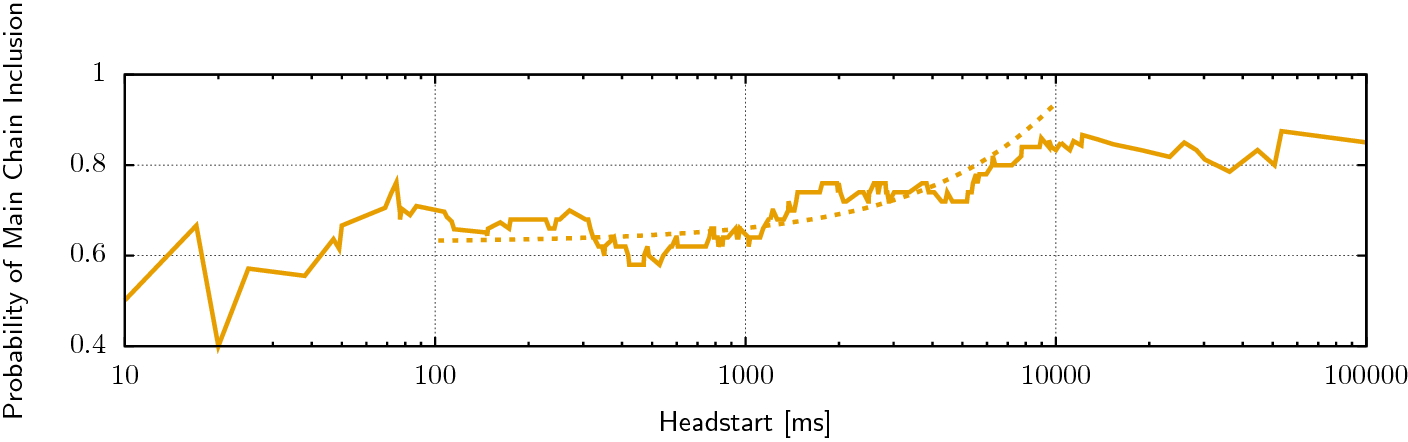

Above figure (Fig. 2 from the paper) shows the probability (moving average, binsize = 50ms) of a forking block becoming part of the main chain depending on the headstart over the competing block.

The data shown in the figure is contained in this file (and can be extracted from above forks file): delay2probsingle

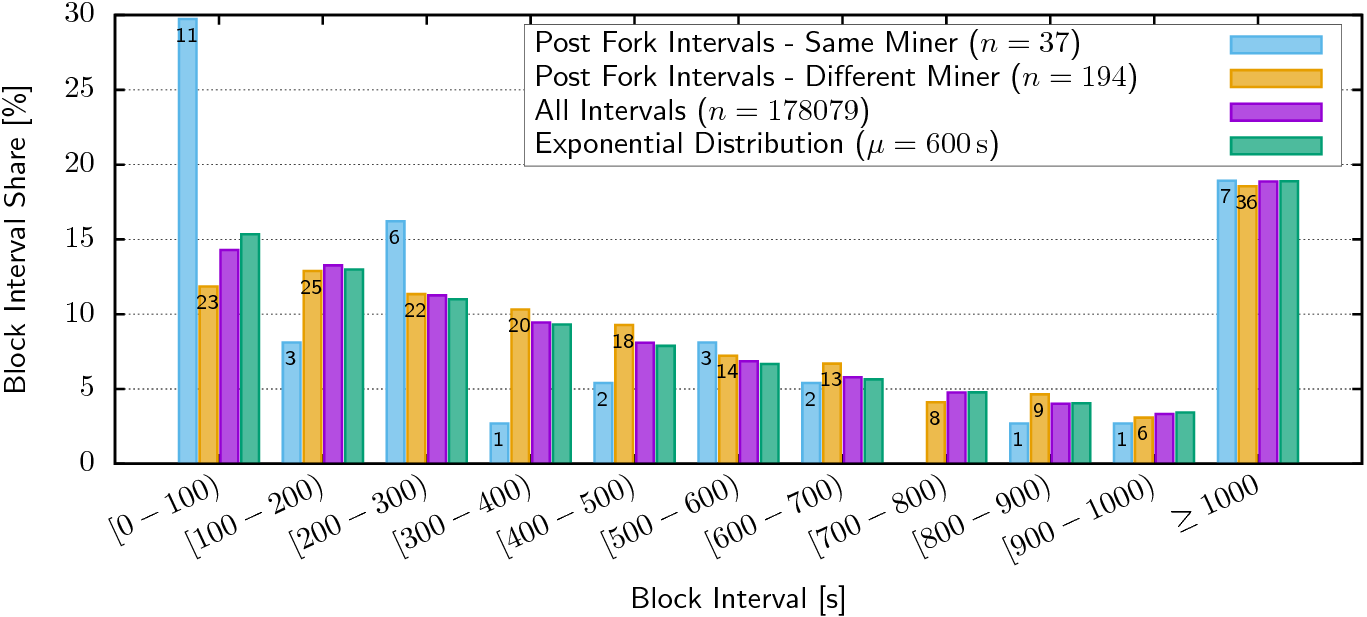

Histogram of the interval to the next block after the fork. Post Fork Intervals - Same miner: only intervals where the subsequent block has been mined by the same miner as the previous block. Post Fork Intervals - Different block: only intervals where the subsequent block has been mined by a different miner as the previous block. All Intervals: All block intervals since block 350,000. Exponential Distribution: Idealized block interval.

The data shown in the figure is contained in these files: Post Fork Intervals and All Intervals

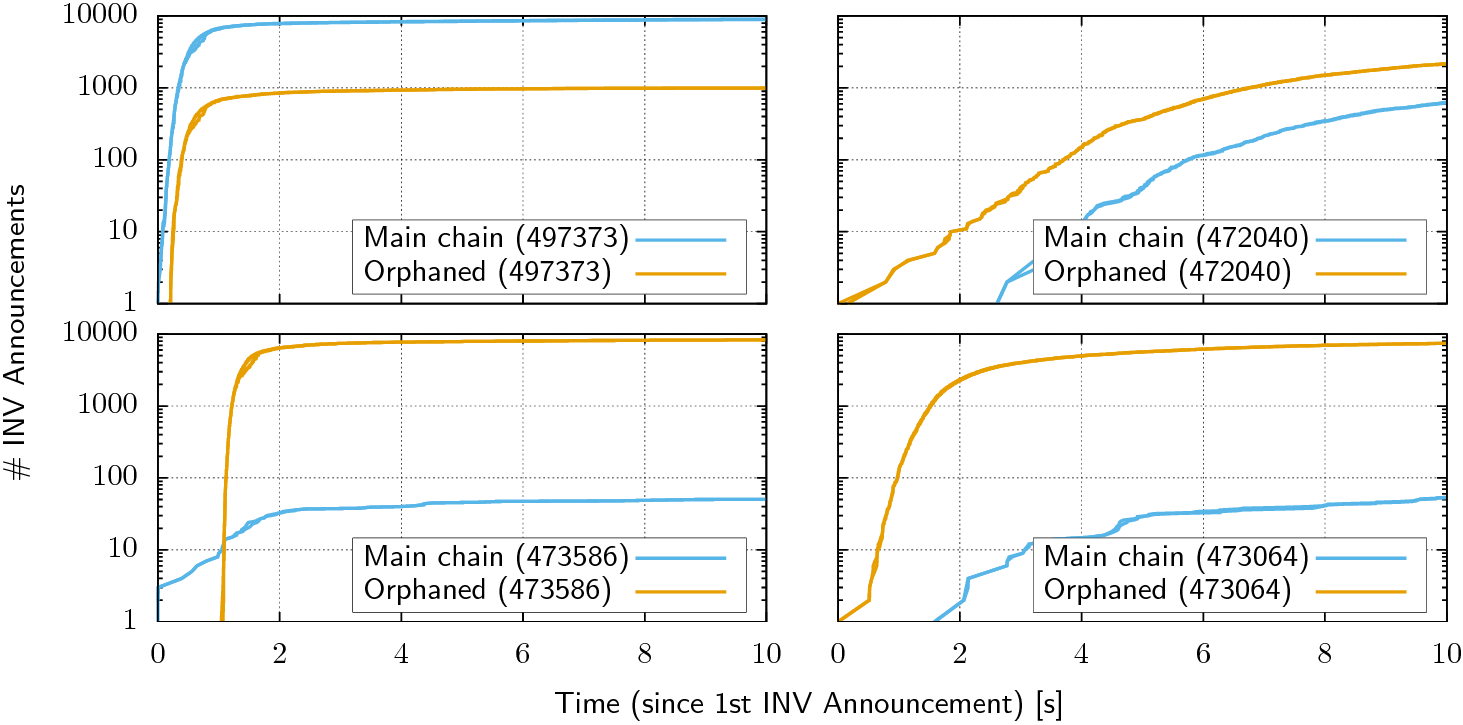

Block propagation for both blocks (Main chain, Orphaned) for selected forks (Fig. 4 from the paper).

The raw data of all forks is listed here. For each block height with a fork, several files are listed: (1) A png that shows a comparison similar to the plots in the paper. (2) A .gp file that generates the plot using gnuplot. (3) A set of .gpd files that contain the same data as the corresponding.gp file but which is a little bit easier to process (the letter m/o after the block height indicates main chain vs orphaned, the digit indicates the id of our monitor node (0 or 1)).

@inproceedings{neudecker-fc19, title={Short Paper: An Empirical Analysis of Blockchain Forks in Bitcoin}, author={Neudecker, Till and Hartenstein, Hannes}, year = {2019} }If you have any questions feel free to contact us!

License

This data is licensed under a Creative Commons Attribution 4.0 International License.

List of bitcoin forks

Main article: Fork (blockchain)

Bitcoin forks are defined variantly as changes in the protocol of the bitcoin network or as the situations that occur "when two or more blocks have the same block height".[1] A fork influences the validity of the rules. Forks are typically conducted in order to add new features to a blockchain, to reverse the effects of hacking or catastrophic bugs. Forks require consensus to be resolved or else a permanent split emerges.

Forks of the client software

The following are forks of the software client for the bitcoin network:

- Bitcoin XT

- A fork initiated by Mike Hearn. The current reference implementation for bitcoin contains a computational bottleneck.[2] The actual fork was preceded by Mike Hearn publishing a Bitcoin Improvement Proposal (BIP 64) on June 10, 2014, calling for the addition of "a small P2P protocol extension that performs UTXO lookups given a set of outpoints."[src 1] On December 27, 2014 Hearn released version 0.10 of the forked client XT, with the BIP 64 changes.[src 2] It achieved significant attention within the bitcoin community in mid-2015 amid a contentious debate among core developers over increasing the block size cap.[3]

- On June 22, 2015, Gavin Andresen published BIP 101 calling for an increase in the maximum block size. The changes would activate a fork allowing eight MB blocks (doubling in size every two years) once 75% of a stretch of 1,000 mined blocks is achieved after the beginning of 2016.[src 3] The new maximum transaction rate under XT would have been 24 transactions per second.[4]

- On August 6, 2015 Andresen's BIP101 proposal was merged into the XT codebase.[src 4][src 5] Bip 101 was reverted[src 6] and the 2-MB block size bump of Bitcoin Classic was applied instead.[citation needed]

- The August 2015 release of XT received widespread media coverage. The Guardian wrote that "bitcoin is facing civil war".[3]

- Wired wrote that "Bitcoin XT exposes the extremely social—extremely democratic—underpinnings of the open source idea, an approach that makes open source so much more powerful than technology controlled by any one person or organization."[5] Developer Adam Back was critical of the 75% activation threshold being too low and that some of the changes were insecure.[6]

- On August 25, 2017, Bitcoin XT published Release G, which was a Bitcoin Cash client by default.[src 7] Subsequently, Release H was published, which supported the November 2017 Bitcoin Cash protocol upgrade, followed by Release I, which supported the May 2018 Bitcoin Cash protocol upgrade.[citation needed]

- Bitcoin Classic

- In its first 8 months, Bitcoin Classic promoted a single increase of the maximum block size from one megabyte to two megabytes.[7] In November 2016 this changed and the project moved to a solution that moved the limit out of the software rules into the hands of the miners and nodes.[8]

- Bitcoin Unlimited

All three software clients attempt to increase transaction capacity of the network. None achieved a majority of the hash power.[9]

Intended hard forks splitting the cryptocurrency

Hard forks splitting bitcoin (aka "split coins") are created via changes of the blockchain rules and sharing a transaction history with bitcoin up to a certain time and date. The first hard fork splitting bitcoin happened on 1 August 2017, resulting in the creation of Bitcoin Cash.

The following is a list of notable hard forks splitting bitcoin by date and/or block:

- Bitcoin Cash: Forked at block 478558, 1 August 2017, for each bitcoin (BTC), an owner got 1 Bitcoin Cash (BCH)

- Bitcoin SV: Forked at block 556766, 15 November 2018, for each Bitcoin Cash (BCH), an owner got 1 Bitcoin SV (BSV).

- eCash: Forked at block 661648, 15 November 2020, for each Bitcoin Cash (BCH), an owner got 1,000,000 eCash (XEC).

- Bitcoin Gold: Forked at block 491407, 24 October 2017, for each bitcoin (BTC), an owner got 1 Bitcoin Gold (BTG)

Intended soft forks splitting from a not-most-work block

- The fork fixing the value overflow incident was controversial because it was announced after the exploit was mined. It was assigned CVE-2010-5139.

Intended soft forks splitting from the most-work block

Segwit

Main article: Segwit

Taproot

Taproot is an agreed soft fork in the transaction format. The fork adds support for Schnorr signatures, and improves functionality of smart contracts and the Lightning Network. The fork was installed in November 2021.[10] The upgrade adds privacy features.[11][12] Taproot includes Bitcoin Improvement Proposal numbers BIP340, BIP341, BIP342.[13]

Advantages:

- Complex transactions, such as those requiring multiple signatures or those with delayed release, are indistinguishable from simple transactions in terms of on-chain data.[citation needed]

- Reduced transaction costs: The data size of complex Bitcoin transactions is reduced, which leads to lower transaction fees.[citation needed]

- Support for more complicated conditions for a transaction via Schnorr signatures.[citation needed]

- Benefits for the Lightning Network: More flexibility, privacy enhancement, lower costs.[citation needed]

Unintended hard forks

Two hard forks were created by "protocol change" definition:

- March 2013 Chain Fork (migration from BerkeleyDB to LevelDB caused a chain split)[14]

- CVE-2018-17144 (Bitcoin 0.15 allowed double spending certain inputs in the same block. Not exploited)

References

Source code

Other references

- ^Antonopoulos, Andreas (2017). Mastering Bitcoin: Programming the Open Blockchain (2 ed.). USA: O' Reilly media, inc. p. Glossary. ISBN .

- ^Maria Bustillos (25 August 2015). "Inside the Fight Over Bitcoin's Future". The New Yorker. Conde Naste. Retrieved 7 January 2017.

- ^ abAlex Hern (17 August 2015). "Bitcoin's forked: chief scientist launches alternative proposal for the currency". the Guardian. Retrieved 20 August 2015.

- ^Tim Hornyak (21 August 2015). "Bitcoin XT debate overshadowing growth opportunities". PC World. IDG. Retrieved 7 January 2017.

- ^Cade Metz (19 August 2015). "The Bitcoin Schism Shows the Genius of Open Source". WIRED.

- ^Everett Rosenfeld (20 August 2015). "Bitcoin splits: Will it break, or be better than ever?". CNBC. Retrieved 5 January 2017.

- ^Paul Vigna (17 January 2016). "Is Bitcoin Breaking Up?". Wall Street Journal.

- ^"Classic is Back". Archived from the original on 2017-02-02. Retrieved April 28, 2017.

- ^Ammous, Saifedean (2018). The Bitcoin Standard: The Decentralized Alternative to Central Banking. John Wiley & Sons. pp. 227, 228. ISBN . Retrieved 23 April 2018.

- ^Sigalos, MacKenzie (2021-06-09). "Bitcoin just got its first makeover in four years". CNBC. Retrieved 2021-06-15.

- ^Kharif, Olga (2021-06-15). "Bitcoin to get more privacy features in Taproot update, making it harder to trace payments". Bloomberg. Retrieved 2021-06-23.

- ^Locke, Taylor (2021-06-14). "7 key things that happened in crypto over the past week". CNBC. Retrieved 2021-06-23.

- ^"All Bitcoin Improvement Proposals, including BIP340". 2021-06-01 – via GitHub.

- ^March 2013 Chain Fork

Understanding forks and Bitcoin variants

NEW DELHI: Bitcoin enjoys incomparable popularity, with a market capital of $1.24 trillion on October 21 after the all-time high value of $66,000, according to CoinMarketCap.

But there are also cryptocurrencies such as Bitcoin Cash and Bitcoin SV, which belong to the same Bitcoin family, with some fundamental similarities and differences.

What led to the emergence of these newer versions? How are they different from each other? We start by first trying to understand Bitcoin forks that are responsible for the creation of Bitcoin variants.

Forks and their types:

A blockchain fork is simply an upgrade in the network initiated either by developers or the crypto community.

* A soft fork has a minor upgrade and needs only a majority of nodes to upgrade to the latest version.

- It is ‘backwards-compatible’, which means that the upgraded chain can successfully share and use data from earlier versions of the network.

- Soft forks bring small changes and do not separate from their parent chain.

* Hard forks bring major changes and require all the nodes to upgrade to the new rules.

* Mostly they lead to permanent separation from the old chain, making newer versions incompatible to the older version like in Bitcoin Cash.

A Bitcoin fork was created through a hard fork, as a result of disagreement within the Bitcoin community over speed, transaction fees and block size or to add more features to the existing Bitcoin. So far, there have been 100 BTC forks, out of which 74 versions have survived and are still functional.

Bitcoin variants: Bitcoin Cash and Bitcoin SV:

Bitcoin Cash (BCH)

Origin:

* It emerged as a result of a hard fork in August 2017.

* The upgrade Segwit2x was proposed by a fraction of the Bitcoin community to scale up the blockchain by increasing the block size and lowering transaction fees.

* However, Segwit2x would also burden the miners and full-node operators to store excessive data.

* The proposal led to the creation of a hard fork, Bitcoin Cash (BCH).

* BCH is the second largest fork of the network and considered electronic cash.

* Its block size is 32 MB while BTC has a block size of just 1 MB.

* The transaction cost is substantially lower and a faster transaction rate of 200 TPS than 5-7 TPS of BTC.

* Bitcoin Cash further forked and bifurcated into Bitcoin Cash ABC and Bitcoin Cash Node (BCN).

Bitcoin Satoshi Vision (BSV)

Origin:

* In November 2018, BSV was created by the efforts of the Australian Computer scientist Craig Wright who persuaded the community to increase the block size of BCH to 128 MB.

* Bitcoin SV expanded its block size to 1 TB, obviously much larger than Bitcoin.

* BSV's transaction cost is the lowest among the three variants of Bitcoin, and is at a high transaction speed of 9000 TPS due to its large block size.

* BSV uses the scaling platform Bitcoin Scaling Test Network (STN) to achieve the desired scalability.

* Educational platforms such as Bitcoin SV Academy and banking application Gravity give the biggest use cases for the adoption of BSV.

* BSV's supporters hail it as the genuine peer-to-peer financial infrastructure, true to the vision of Satoshi Nakamoto (the famed pseudonymous person who created Bitcoin).

* It is priced at $170.80 on October 27, according to CoinmarketCap.

Other leading Bitcoin hard forks include Bitcoin Gold, Bitcoin Cloud, Bitcoin Classic and Bitcoin Private.

Key similarities in BTC, BCH and BSV

* All three Bitcoin variants have the same stock supply of 21 million coins, and the total supply of the three coins is expected to be exhausted by 2140.

* Both BCH and BTC work on the PoW (Proof-of-Work) model.

* Just like Bitcoin, the BCH blockchain ensures transparency, is publicly accessible and cannot be modified by a single entity.

(For the latest crypto news and investment tips, follow our Cryptocurrency page and for live cryptocurrency price updates, click here.)

FacebookTwitterInstagram

end of article

Источник: [https://torrent-igruha.org/3551-portal.html]Looking to get cryptocurrency exposure in your portfolio? You can buy Bitcoin and Bitcoin Cash on Webull!

Have you ever wondered what the heck someone is talking about when they mention Bitcoin forks? To many, just the thought of Bitcoin or digital currencies is enough to bewilder. Throw in the terms blockchain technology or Bitcoin forks, and you might as well be speaking a foreign language.

Continue reading if you have no idea what a Bitcoin fork is or if you have some idea but want to learn more. Benzinga provides enough information in this article to clear up confusion. You’ll stop feeling perplexed and be able to talk about forks with confidence.

What Is Forking in Cryptocurrency?

When learning about cryptocurrency forks, the first thing to understand is that they come in 2 types: soft fork and hard fork. When someone mentions crypto forks, they are talking about when a blockchain splits into 2 separate blockchains.

© Image credit: Coinbase

For anyone not familiar with this technology, a blockchain is open-source software. It is what powers cryptocurrencies like Bitcoin or Ethereum. A blockchain is a digital ledger made up of a string of data blocks, in which each new block that forms only becomes valid after the previous block has been confirmed. A blockchain is transparent and permanent, allowing anyone to view transactions back to the genesis block.

Soft Forks

A soft fork is when new features or functions are added to a blockchain, but the rules the blockchain must follow are not changed, thus maintaining a single chain. As long as all users adopt the changes, they become the blockchain’s new set of standards.

Soft forks are seen as safer than hard forks and are also backward compatible, meaning that nodes or computers that do not upgrade to the new version will still see the blockchain as valid. Think of a soft fork like a software update for your PC or mobile phone’s operating system. In contrast, a hard fork would be like changing to an entirely new piece of hardware.

Hard Forks

A hard fork is when there is a complete divergence from the previous blockchain. This change leads to a separation of the blockchain with 2 different versions of the blockchain running separately. An example of this would be Ethereum and Ethereum Classic, with Ethereum Classic being the original blockchain. In this case, the new blockchain, Ethereum, was more widely adopted and thus became the more dominant chain.

Hard forks happen for various reasons, such as to fix critical security issues, to add new functionality or to reverse previous transactions in the event of a hack. Once again, Ethereum and Ethereum Classic are good examples of this transformation. Ethereum created a hard fork to reverse transactions from a Decentralized Autonomous Organization (DAO) hack.

Hard forks also result from a disagreement in a blockchain community about the future of the blockchain. A good example of this situation is Bitcoin and Bitcoin Cash. Bitcoin Cash was forked off of the Bitcoin blockchain because of a concern about the scalability of Bitcoin. Some Bitcoin developers and miners wanted to increase the block size, allowing for more data to be processed at once, which would speed up the transaction verification process. When developers and miners could not agree, the Bitcoin blockchain was hard forked creating Bitcoin Cash.

When Was the 1st Bitcoin Fork?

Now that you have a better idea of what a cryptocurrency fork is, let’s look at the first Bitcoin fork. Bitcoin XT is considered the first major fork of the Bitcoin blockchain. The fork occurred in late 2014 as a way to add several new features. One of these features was to increase the block size from 1 megabyte to 8 megabytes. The reason for increasing the block size was to increase the number of transactions per second from 7 to 24. Bitcoin XT initially saw some success with more than 1,000 nodes running in the summer of 2015, but users lost interest over the next several months, and Bitcoin XT faded away.

The most successful Bitcoin fork to date is Bitcoin Cash. When Bitcoin developers could not agree on how to solve Bitcoin scalability issues, the blockchain was hard forked, creating Bitcoin Cash. The hard fork was also a result of a disagreement between developers over Segregated Witness (SegWit). SegWit changes Bitcoin transactions by separating signatures and scripts from the input and output data. This change allowed more transactions to fit into each block, thus increasing the throughput. Bitcoin Cash currently has a market capitalization of over $11 billion, making it the 21st most valuable cryptocurrency on the market.

History of Bitcoin Forks

Of the 105 Bitcoin forks, 74 are active projects and 31 are historical and no longer relevant. Below is a chronological list of the most notable Bitcoin forks.

Bitcoin XT: Created in late 2014, increased the block size from 1 megabyte to 8 megabytes. The goal was to increase the transaction rate.

Bitcoin Classic: Came into existence in early 2016, similar to Bitcoin XT but only increased the block size to 2 megabytes.

Bitcoin Cash: Split off of the Bitcoin blockchain in August of 2017 partially in response to Segregated Witness and from a disagreement between developers about block size.

Bitcoin Gold: Created in October of 2017, the goal of this hard fork was to restore mining with basic GPU miners.

Here’s a list of other Bitcoin forks:

- Bitcoin Diamond: November 2017

- Super Bitcoin: December 2017

- Bitcoin Atom: January 2018

- Bitcore: November 2017

- Bitcoin God: December 2017

- Bitcoin Private: January 2018

- Bitcoin Zeo: September 2018

- Bitcoin Post-Quantum: December 2018

Bitcoin Cash, Bitcoin Gold & Bitcoin SV

This section examines 3 cryptocurrencies that came into existence by way of hard forks, including why and when the hard fork occurred and how they differ from each other.

Источник: [https://torrent-igruha.org/3551-portal.html]

0 comments