Thank: Best one time investment plan in sbi

| GLOBAL INVESTORS MEET CHENNAI HIGHLIGHTS |

| INVESTING IN DUBAI FINANCIAL MARKET |

| I LIKE TO MAKE MONEY GET TURNT G EAZY |

| Best one time investment plan in sbi |

Best one time investment plan in sbi - agree, rather

SBI Magnum Children's Benefit Fund - Investment Plan Regular - Growth Investments - NRI

X

XSBI FINDER

By clicking on the link "PROCEED" you will be re-directed to a third party website which is neither owned nor controlled nor endorsed in any manner by State Bank Group (SBG). SBI Finder will enable you to locate the ATMs, CDMs, E-Corners and Branches of State Bank of India, view them on maps and get directions to reach there. The information is being provided only for customer convenience and the information, advices, suggestions, illustrations etc. are hereby collectively stated as "content" for this linked site. If the said content contains any mistakes, omissions, inaccuracies and typographical errors, etc. SBG assumes no responsibility thereof. Any action on your part on the basis of the said content is at your own risk and responsibility, and SBG makes no warranty or representation regarding any content provided through this linked site and disclaims all its liabilities in respect thereof. The content available on this linked site is subject to revision, verification and amendment without notice. Thank you for visiting www.sbi.co.in

Источник: [https://torrent-igruha.org/3551-portal.html] Unrated

Investments - NRI

X

XSBI FINDER

By clicking on the link "PROCEED" you will be re-directed to a third party website which is neither owned nor controlled nor endorsed in any manner by State Bank Group (SBG). SBI Finder will enable you to locate the ATMs, CDMs, E-Corners and Branches of State Bank of India, view them on maps and get directions to reach there. The information is being provided only for customer convenience and the information, advices, suggestions, illustrations etc. are hereby collectively stated as "content" for this linked site. If the said content contains any mistakes, omissions, inaccuracies and typographical errors, etc. SBG assumes no responsibility thereof. Any action on your part on the basis of the said content is at your own risk and responsibility, and SBG makes no warranty or representation regarding any content provided through this linked site and disclaims all its liabilities in respect thereof. The content available on this linked site is subject to revision, verification and amendment without notice. Thank you for visiting www.sbi.co.in

Growth

NAV as on 22 Mar 202223.31110.09 (0.37%)

1. The Current Net Asset Value of the SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan as of 22 Mar 2022 is Rs 23.3111 for Growth option of its Regular plan.

2. Its trailing returns over different time periods are: 58.88% (1yr) and 75.18% (since launch). Whereas, Category returns for the same time duration are: 14.33% (1yr), 13.06% (3yr) and 10.88% (5yr).

3. The SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan currently holds Assets under Management worth of Rs 421.89 crore as on Feb 28, 2022.

4. The expense ratio of the fund is 2.55% for Regular plan as on Jan 31, 2022.

5. SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan shall attract an Exit Load, "Exit load of 3% if redeemed within 1 year, 2% if redeemed after 1 year but within 2 year, 1% if redeemed after 2 year but within 3 year. "

6. Minimum investment required is Rs 5000 and minimum additional investment is Rs 1000. Minimum SIP investment is Rs 500.

Show Less +

Things you should consider

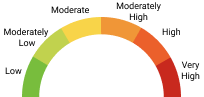

Riskometer

Investors understand that their principal will be at Very High risk.

Annualized return for the last 3 years

64.76%Suggested Investment Horizon

>3 yearsAverage time taken to double the money since inception

0 years 10 months

Fund NAV Range

Investment Growth

Loading...

Other MFs

Indices

ETFs

Stocks

NPS Schemes

Rs. 500

Rs. 1000

Rs. 5000

OROnly one asset can be added for purpose of comparison

Basic Details

| Fund House | SBI Mutual Fund |

| Launch Date | 29-Sep-2020 |

| Return Since Launch | 77.38% |

| Benchmark | CRISIL Hybrid 35+65 Aggressive Index |

| Riskometer | Very High |

| Type | Open-ended |

| Assets | 421.89 Cr (As on 31-Dec-2021) |

| Exense | 2.58% (As on 28-Feb-2022) |

| Risk Grade | -- |

| Return Grade | -- |

| Turnover | - |

Investment Details

| Minimum Investment (₹) | 5,000.00 |

| Minimum Addl Investment (₹) | 1,000.00 |

| Minimum SIP Investment (₹) | 500.00 |

| Minimum Withdrawal (₹) | 500.00 |

| Exit Load | Exit load of 3% if redeemed within 1 year, 2% if redeemed after 1 year but within 2 year, 1% if redeemed after 2 year but within 3 year. |

My Transactions

About Fund

1. SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan is Open-ended Aggressive Hybrid Hybrid scheme which belongs to SBI Mutual Fund House.

2. The fund was launched on Sep 29, 2020.

Investment objective & Benchmark

1. The investment objective of the fund is that " The scheme seeks to generate long term capital appreciation by investing predominantly in equity and equity related securities of companies across sectors and market capitalizations. The scheme will also invest in debt and money market instruments with an endeavour to generate income. "

2. It is benchmarked against CRISIL Hybrid 35+65 Aggressive Index.

Asset Allocation & Portfolio Composition

1. The asset allocation of the fund comprises around 70.68% in equities, 2.32% in debts and 27.0% in cash & cash equivalents.

2. While the top 10 equity holdings constitute around 41.32% of the assets, the top 3 sectors constitute around 32.32% of the assets.

3. The fund largely follows a Growth oriented style of investing and invests across market capitalisations - around 29.98% in giant & large cap companies, 23.88% in mid cap and 46.14% in small cap companies.

4. The portfolio allocation of debt securities primarily have 2 kinds of risks: interest rate risk & credit risk. While the interest rate movements are driven by the fund's duration, credit quality of debt securities are based on the weighted average credit ratings of a fund. Generally, funds with high credit quality will have the weighted average credit rating of AA- and higher rated securities, funds with medium credit quality will hold securities having credit rating lying between A- to BBB- and funds with low credit quality will hold securities having average credit rating of less than BBB-. Credit rating is a qualitative tool that basically assesses the creditworthiness and financial soundness of a company and takes into consideration several factors including the default rate and solvency of the concerned business entity.

Tax Implications

Hybrid funds which usually invest 65% or more in equity & equity related instruments will be taxed like Equity funds and those which invest less than 65% in equity & equity related instruments will be taxed like Debt funds. Generally, tax implications are based on the average asset allocation of the last 12 months where the fund has invested. However, since the market is dynamic and asset allocation towards equity may increase or decrease depending on the prevailing market & economic conditions. So, the tax treatment of the given fund will vary accordingly and will be determined by its asset allocation. Below are the tax implications from equity as well as debt side:

Equity side:

1. Gains are taxed at a rate of 15% (Short-term Capital Gain Tax - STCG) if units are redeemed within 1 year of investment.

2. For units redeemed after 1 year of investment, gains of upto Rs. 1 lakh accruing from those units in a financial year shall be exempted from tax.

3. Gains of more than Rs. 1 lakh will be taxed at a rate of 10% (Long-term Capital Gain Tax - LTCG).

Debt side:

1. If units are redeemed within 3 years of investment, the whole amount of gain will get added to the investor's income and will be taxed as per his/her applicable slab rate.

2. For units redeemed after 3 years of investment, gains will be taxed at a rate of 20% post indexation benefits. Indexation is a process of recalculating the purchase price after accounting for inflation into it. The benefit of indexation lies in lowering down one's capital gains which brings down the taxable income and thereby reduces taxes on it.

Taxes on Dividend income:

1. For Dividend Distribution Tax, the dividend income from this fund will get added to the income of an investor and taxed according to his/her respective tax slabs.

2. Also, for dividend income in excess of Rs 5,000 in a financial year; the fund house shall deduct a TDS of 10% on such income.

Frequently Asked Questions (FAQs)

Q: Is it safe to invest in SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan?

A: As per SEBI’s latest guidelines to calculate risk grades, investment in the SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan comes under Very High risk category.

Q: What is the category of SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan?

A: SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan belongs to the Hybrid: Aggressive Hybrid category of funds.

Q: How Long should I Invest in SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan?

A: The suggested investment horizon of investing into SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan is >3 years. The suggested investment horizon is the minimum time required for holding investments in the fund to reduce its downside risk and ensure that the returns become more predictable.

Q: Who manages the SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan?

A: The SBI Magnum Children's Benefit Fund - Investment Plan - Regular Plan is managed by R. Srinivasan (Since Sep 08, 2020), Rama Iyer Srinivasan (Since Sep 08, 2020) and Dinesh Ahuja (Since Sep 08, 2020).

Data Sources: Mutual Funds, ETFs, and NPS data are sourced from Value Research

All times stamps are reflecting IST (Indian Standard Time). By using this site, you agree to the Terms of Service and Privacy Policy.

6 Best One-Time Investment Plans In India

Are you looking to invest your annual bonus for this year expecting a competitive return? It is ideal that you invest this bonus for a specific long-term financial goal for yourself or your family. How? Don’t worry we got you covered here.

What is a One-Time Investment Plan?

A one-time investment plan is a type of investment option where a lump sum investment is done at one go in a particular financial instrument for a fixed time period. An investor can invest in a one-time investment plan if he has a considerable amount of surplus funds and a high-risk tolerance.

Six Best One-Time Investment Plans in India

In case of investments, almost all instruments have a role to play depending on your expectations and goals. Time is one factor which determines which investment is best for you and which is not. Fortunately, there are investments like Unit-linked Insurance Plans that lets you segregate your investment amount into a variety of avenues, ensuring a balance of returns.

Other factors would include your comfort level with any investment. For example, equity investments have higher risk, but may offer better long-term returns, and on the contrary, a debt investment is safer but has fixed returns. So, considering all these factors here are some of the best investment plans for you to park your bonus income.

1. Equity Funds

Equity funds are less risky alternatives to direct market investments, mostly because of the diversification and professional management involved.

If you are looking to save tax for the financial year under section 80C and want to invest in equity funds, invest in ELSS or Equity-Linked Savings Schemes. Equity-linked savings schemes are pure equity funds, but they give you deduction up to Rs 1.5 lakhs under section 80C.

Ideal Investment Tenure: 5 years or more. ELSS will have a lock-in period of 3 years.

Investment Risk: High

When to Invest: Invest if you are sure that you can stay invested for a long time.

Deduction on Investment: Only on ELSS schemes, up to Rs 1.5 lakhs (Section 80C)

Tax on Future Value: After 12 months of holding period gains are exempt from tax.

2. Debt Funds

There are many types of debt funds, but for your consideration, we are only accounting the ones investing in AAA and AA-rated corporate bonds or government securities.

From their securities composition, these funds carry far lower risk than equity funds. Plus, you get the benefit of a diversity of securities in the fund. These funds also offer steadier returns but may suffer in terms of taxability.

Ideal Investment Tenure: 3 years or more

Investment Risk: Low

When to Invest: Invest if you want to invest for less than 5-year period. But you may want the tenure to be longer than 3 years for lower tax implication.

Deduction on Investment: None

Tax on Future Value: After 36 months of holding period your profits get the indexation benefit. Thus, may attract far lower taxes.

So, the tax laws consider profit from debt fund investments a short-term capital gain if you withdraw within 36 months. The short-term capital gains increase your taxable income for the financial year and attract taxes at slab rates.

Learn what is capital gain – long-term and short-term.

However, if you stay invested for 36 months, your profits from debt funds will become long-term capital gains. Tax laws require the effect of inflation on long-term capital gains before estimating tax.

3. Liquid Funds

Liquid funds are among the most useful investment options, not the best when it comes to generating the returns over a long time. But, these funds are best for saving your money from getting spent while you decide the best investment option.

Plus, minimal exit load means you can use your invested amount directly from the liquid funds to transfer to another fund. This simple option opens up huge opportunities to invest systematically for you. We will explore some of these opportunities here, but first:

Ideal Investment Tenure: Less than 3 years, unless you are using systematic investment option

Investment Risk: Low

When to Invest: When you are yet to decide about the investment plan. Or, when you want to invest your lump sum money systematically in another long-term investment.

Tax Deduction on Investment: None

Tax on Future Value: After 36 months of holding period your profits get the indexation benefit. Thus, may attract far lower taxes.

4. Liquid Mutual Funds to ULIPs

ULIPs are very tax-efficient investments. That is, they give you deduction under 80C, and tax-free maturity value plus, multiple equity and debt fund options. ULIP may be the only instrument which allows you to invest in debt and liquid funds and still enjoy the same tax benefits.

However, tax benefits only last so far as your annual premium is less than 10% of the policy sum assured. So, if you want to invest Rs 10 lakhs in ULIP you will need a sum assured of Rs 1 crore. But that is only when you are investing Rs 10 lakhs all at once.

Instead, here’s what you can do using liquid funds as an alternative channel:

i. Divide the bonus into five equal parts; i.e. Rs. 2 lakhs in this case

ii. Invest Rs 8 lakhs in a liquid fund

iii. Start investing in a ULIP plan with Rs. 2 lakhs

iv. Submit advance withdrawal requests for Rs. 2 lakhs with the liquid fund a few days before the premium due date for the policy

Channelling and automating your investment through the liquid fund will give you the following advantages:

a. You get an annual tax deduction under section 80C for the next five years

b. With ULIP you can stay invested for a long time

c. You can withdraw your money partially after five years

d. The minimum maturity period of a ULIP can be five years; for example, Invest 4G plan from Canara HSBC Oriental Bank of Commerce Life Insurance.

Also, you defer your taxes on your investment in liquid funds as you spread your withdrawals over five years With a ULIP plan like Invest 4G, you can invest in a mix of equity and debt funds and use dynamic portfolio management strategies. These strategies allow you to manage your portfolio automatically and exploit market opportunities without taking extra risk. Plus, ULIPs are a great investment option for long-term goals.

5. Liquid Mutual Fund to Equity Funds

Although equity funds carry lower risk than direct equity investments due to diversification, they are still volatile. That is why you should use a systematic approach to invest your money in equity funds. Systematic investment approach will help you benefit from rupee cost averaging in the volatile market.

If you are a regular investor or investing out of your regular income, you can easily create a systematic investment plan or SIPs for investing in an equity fund. But, if you want to allocate your bonus income, you can do so with the following steps:

i. Find a suitable equity fund you want to invest in

ii. Park your entire bonus into a liquid fund of the same family

iii. Submit a systematic transfer request to the liquid fund so that a fixed sum of money goes to equity fund at regular intervals

iv. Remember the minimum holding period of units you buy in equity fund are:

v. 12 months for normal equity funds for tax-exempt future value

vi. 36 months for ELSS funds

6. Liquid Mutual Funds to Other Investments

You can create similar investment plans out of liquid funds, such as to a deferred annuity plan, to NPS or PPF. If you are already operating an NPS tier-I account you can claim an additional deduction of Rs 50,000 over the 80C limit of Rs 1.5 lakhs.

Few other notable investments are senior citizen savings scheme which can be a gift for your parents. Also remember, every investment option has its reasons, ideal investment period and different risk-return level. So, make sure you go through all the plans to find the one which makes more sense to you.

Four Benefits of Making One-Time Investment

1. Better Capital Growth

Your returns depend upon the market performance. With SIP or recurring payments, the amount invested later doesn’t get the time to adjust to market conditions. Lump-sum amount invested via one-time investment stays in the market for a longer duration and thus provides opportunity of higher capital appreciation.

2. Higher Returns in the Long-term

Lump-sum investments attract higher returns due to the principle of power of compounding. This becomes possible because your money stays invested in the market for a longer duration of time.

3. Hassle-free

One-time investment can be convenient as you do not have remember or worry about due premium payment dates. You invest the entire amount at the commencement of the policy.

4. Low Transaction Charges

In one-time investment, the transaction charges involved will only be one-time. You do not have to pay the associated transaction charges every time you invest like other instalment-based investments.

The purpose of our life can be easily summed up into one word — happiness. One way to bring happiness into our lives is by working towards our ‘Life Goals’ through smart goal-based investments. Whether it is about buying a house, supporting your kid’s education, or securing wealth for life post-retirement – each of these life goals demands financial backing. SBI Investment Plans for 5 years, it’s an investment whose return is confirmed after 5 years.

Short-term savings are not sufficient to cap your life goals, and you need to invest for a long time to accomplish them. In simple words, Investment Plans are essentially financial instruments that help create sustainable wealth for the future.

Well, we all know that if there is an investment made by anyone he will definitely expect the return on the basis of the investment. And this is what SBI investment plans are for, we have a list of those plans who are the best plans and suitable for investing and in terms of return also. The good thing about this SBI plans list is “they are only for 5 years”, if you invest in these plans then you will not have to wait much for returns.

Table Content

Benefits of Investment Plan

These plans have certain benefits and those benefits make them different, plan’s premiums are likely to support your financial condition and increase your monthly financial burden slightly more. But the return of these plans is making your burden zero in future or after 5 years, benefits of these plans are almost same.

- Death Benefit

- Maturity Benefit

These are two benefits that you will offer by every single SBI plan and are necessary for a term of assurance of customer, till getting the return of your investment these benefits are like a bonus for you and always remember one thing that any kind of insurance plan’s first priority is protecting you and your family.

Features of SBI Investment Plans

- Make the future better by lowing your burdens.

- Keep care of your investment and coverage of the plan.

- Low period investment with good returns.

- Offers security to you and your family against uncertainties and makes life precious.

- Multiple options to choose the best plans.

Various investment plans in India enable us to invest our savings into different money-market products in a disciplined and periodic manner to achieve our financial goals.

SBI 5 Year Investment Plan

In this context, we come with SBI Investment plans 2021, in which you can invest for five years.

| Investment plans | Plan Type | Entry Age | Maturity Age | Policy Term |

|---|---|---|---|---|

| SBI Life – Smart Elite Plan | Unit linked Insurance Plan | 18 Years | 65 Years | 5 Years |

| SBI Life – Smart Privilege Plan | Unit linked, Non-participating Insurance Plan | 13 Years | 70 Years | 5 Years |

| SBI Life – Smart Wealth Builder Plan | Unit linked, Non-participating Insurance Plan | 7 Years | 70 Years | 5 Years |

| SBI Life – Shubh Nivesh Plan | Participating Variable Insurance Plan | 18 Years | 60 Years | 5 Years |

| SBI Life – Smart Platina Assure | Non linked, Non-participating Life Endowment Plan | 18 Years | 50 Years | 6-7 Years |

| SBI Life – Saral Pension | Individual, Non-linked, Participating, Saving Pension Plan | 18 Years | 65 Years | 5 Years |

| SBI Life – Grameen Bima | Individual, Non linked, Non-participating Microinsurance Life Insurance Plan | 18 Years | 50 Years | 5 Years |

SBI Life Insurance 5 Years Plan

SBI Life – ULIP Plans

Among SBI Life Insurance Plans, you can choose SBI ULIP plans to invest your hard-earned money and maximize returns.

1. Smart Elite Plan

SBI Life – Smart Elite Plan is exclusively crafted for High Net-worth Individuals. It helps you to maximize your saving through market-linked returns and empowers you with great control in managing your investment portfolio. In this plan, you have to pay a premium for a limited term or single payment and get the option to choose from a wide range of funds with partial withdrawal from the 6th policy year. It also provides you with a life cover.

| Eligibility | |

| Entry Age | Min – 18 Years, Max – 60 Years |

| Maturity Age | 65 Years |

| Policy Term | Min – 5 Years, Max – 20 Years |

Key Features and Benefits: –

- Maturity benefits: on the survival of the life insured till the maturity of the policy term, the fund value will be paid in a lump sum.

- Death benefits:

- For Gold option: the higher of sum assured less partial withdrawal or fund value payable.

- For the Platinum option: sum assured plus fund value is payable.

- Death benefits should be at least 105% of the total premium paid.

- In-Build Accidental Benefits: Accidental death or permanently disabled is also covered in the plan.

- Other Benefits: 4 varied fund options, you can invest to maximize returns.

2. Smart Privilege Plan

SBI Life – Smart Privilege Plan is a unit-linked, non-participating life insurance product. It gives you the flexibility to make multiple switches and premium redirection between eleven diverse funds with loyalty in addition to boosting your fund value. The plan also provided life insurance coverage, so your family is also protected.

| Eligibility | |

| Age | Min – 8 Years (regular/limited Premium), 13 Years (Single Premium), Max – 55 Years |

| Maturity Age | Min – 18 Years, Max – 70 Years |

| Policy Term | Min – 10 Years (regular/limited Premium), 5 Years (Single Premium), Max – 30 Years |

Key features and Benefits: –

- Death Benefits: in case of unfortunate death of the life assured during the policy term, while the policy is in-forced the beneficiary will receive higher of the following: –

- Fund value as on the date of death intimation or

- Basic sum assured less Applicable Partial Withdrawal (APW) or

- 105% of the total Premium received up to the date of death less Applicable Partial Withdrawal (APW).

- Maturity Benefits: on the survival of the life assured up to maturity, and the fund shall be paid in a lump sum.

- Other Benefits: Loyalty Addition is a percentage of the average fund value over the 1st day of the last 12 policy months before the date of its allocation, Loyalty addition chart is given below: –

| Last date of the Policy Year(nth) | Loyalty Addition | Last date of the Policy Year(nth) | Loyalty Addition |

| 6 | 1% | 20 | 5.0% |

| 10 | 2.5% | 25 | 6.0% |

| 15 | 3.5% | 30 | 7.0% |

- Option to invest in any 8 funds available.

- Avail switching, premium redirection, and partial withdrawal facilities under this policy.

3. Smart Wealth Builder plan, SBI Investment Plans

SBI Life – Smart Wealth Builder Plan is an individual, unit-linked, non-participating insurance plan that helps fulfill your financial and insurance objective. This product is specially designed for your life goal like higher education of your children, their marriage, wealth creation for a house, foreign travel or providing for old age, etc.

| Eligibility | |

| Age | Min – 7 Years, Max – 55 Years |

| Maturity Age | 70 Years |

| Policy Term | Min – 18 Years, Max – 60 Years |

Key features and benefits: –

- Maturity Benefits: in case of survival of the life insured till maturity date, the fund value as a lump sum is payable. The provided policy is in force.

- Death Benefits: fund value as on the date of death intimation or sum assured less Applicable Partial Withdrawals (APW) if any; or 105% of Total Premium received up to the date of death less (APW) if any; whichever is higher is paid.

- Guaranteed Addition: Guaranteed addition is available at the end of the 10th, 15th, 20th, 25th & 30th policy year, It helps you to boost fund value.

- Option to invest in 11 different funds.

SBI Life – Endowment Plans

Among SBI Life Insurance Plans, you can choose SBI Endowment plans

4. Shubh Nivesh Plan

SBI Life-Shubh Nivesh Plan is an individual, non-linked, participating life insurance-saving product. This plan protects you, your savings and comes with an option to leave a portion of your wealth for your children/grandchildren. You also have the choice of taking your benefits in the form of a regular income over a specified period of your choice.

| Eligibility | |

| Age | Min – 18 Years, Max – 58 Years (endowment Plan- Regular Premium), 60 Years (endowment Plan- Single Premium), 50 Years (endowment With Whole Life Plan) |

| Maturity Age | 65 Years (up To 100 Years, When Opted For Endowment With Whole Life Plan) |

| Policy Term | Min – 7 Years (endowment Plan- Regular Premium), 5 Years (endowment Plan- Single Premium), 15 Years (endowment With Whole Life Plan) Max – 30 Years (endowment Term) |

Key features and benefits: –

- Death Benefits: the death benefits payable is a sum assured on death plus vested simple reversionary bonus plus terminal bonus.

- Maturity Benefits: on completion of the endowment term, the basic sum assured plus vested simple reversionary bonus plus terminal bonus is payable. Provided the policy is in force at the endowment term, you have the flexibility to opt for a deferred maturity payment option.

- Bonus: vested simple reversionary bonus plus terminal bonus is payable.

- Opt for riders to enhance policy benefits.

- Avail high sum assured rebate.

5. Smart Platina Assure Plan, SBI Investment Plans

Although this plan has an investment period of 6-7 years, it has very handsome returns, so if you are comfortable investing for some more years, then it is good to know about this plan.

This is an individual, not-linked, non-participating life endowment assurance savings product. It assures guaranteed returns with the advantage of paying a premium for a limited term. It gives your life cover with an Assured return.

| Eligibility | |

| Age | Min – 18 Years, Max – 50 Years |

| Maturity Age | 65 Years |

| Policy Term | 12 & 15 Years |

Key features and benefits: –

- Maturity benefits: Guaranteed sum assured on maturity, i.e., the basic sum assured plus accrued guaranteed additions, provided policy is in force.

- Death Benefits: in the unfortunate event of the death of the Life Assured, Sum Assured on death along with accrued guaranteed additions, if any will be paid to the beneficiary for in-force policies only.

- Where Sum Assured on death is higher of 10 times the annualized premium or 105% of total premium paid up to the date of death.

- Other Benefits: Avail guaranteed additions^ of 5.00% to 5.50% at the end of each policy year.

- Pay for just 6 or 7 years and enjoy the benefits throughout the policy term of 12 or 15 years respectively.

SBI Life – Pension Plan

Among SBI Life Insurance Plans, you can choose SBI Pension plans

6. Saral Pension Plan, SBI Investment Plans

This plan helps you to meet your post-retirement financial need conveniently, with simple reversionary bonuses throughout the policy term for the in-force policy. There is a genuine concern about accumulating enough money to provide sufficient income to manage your lifestyle, medical cost, family expenses, etc.

| Eligibility | |

| Age | Min – 18 Years, Max

|

| Maturity Age | ———- |

| Policy Term | Min

Max – 40 Years |

Key features and benefits: –

- Bonus: simple reversionary bonus for the first five years.

- @2.50% for the first three policy year

- @2.75% for the next two policy years of the basic sum assured.

- Guaranteed bonuses will be acceptable only to in-force policies.

- Maturity Benefits: Basic sum assured or total premium received which is higher plus vested simple reversionary bonus plus a terminal bonus if any.

- Death Benefits: Total premium received up to the date of death accumulated plus vested simple reversionary bonus plus a terminal bonus, if any or 105% of the total premium received up to the date of death, whichever is higher, is paid.

SBI Life – Micro-Insurance Plan

Among SBI Life Insurance Plans, you can choose SBI Micro-Insurance plan.

7. Grameen Bima

You are the anchor of your family, and they look up to you for their daily needs and requirements. Needless to say, your presence ensures their comfort and well-being. Grameen Bima is a simple, hassle-free, individual, Not-Linked, Non-Participating Microinsurance Life Insurance Pure Risk Premium Product that provides financial security for your family in case of unfortunate death.

| Eligibility | |

| Age | Min – 18 Years, Max – 50 Years |

| Maturity Age | —————- |

| Policy Term | 5 Years |

Key features and benefits: –

- Death benefits: in the unfortunate death of the life insured during the policy term, the nominee or beneficiary will receive the sum assured as a lump sum.

- The sum assured on death would be higher than the basic sum assured or 1.25 times of a single premium.

- Maturity benefits: there is no maturity benefit under this product.

- Surrender Benefits: surrender is allowed after the first year of cover. No surrender benefit is payable in the last year of the policy. The surrender value payable would be a single premium paid (exclusive of applicable taxes* 50%* Unexpired policy term/Total Term. Where a term is measured in completed months or unexpired term would be the total policy term in months less the completed number of months as on date of surrender.

To know more about SBI Investment Plans and other Plans, you may visit our site here.

Jump to top

One-time Investment

$ There is no premium allocation charge. 100% gets invested and then later charges get cut in the form of units.

` If the policy offers guaranteed returns, then these will be clearly marked “guaranteed” in the Benefit Illustration. Since the policy offers variable returns, the given illustration shows two different rates of assumed future investment returns. The returns shown above are not guaranteed and they are not the upper or lower limits of what you might get back, as the maturity value of policy depends on a number of factors including future investment performance.

# Sum Assured multiples in between the minimum and maximum limits are not available.

| > 50 years | 1.25 times Single Premium | 10 times Single Premium |

| <= 50 years | 1.25 times Single Premium | 1.25 times Single Premium |

^ The company will allocate extra units at the end of the policy term, provided monies are not in the Discontinued Policy Fund. Wealth Booster will be allocated among the funds in the same proportion as the value of total units held in each fund at the time of allocation. The allocation of Wealth Booster units is guaranteed and shall not be revoked by the Company under any circumstances.

| Wealth Booster | 2.50% of Single Premium | 2.75% of Single Premium |

For the 10-year policy term,the wealth booster will be 2.75% of a single premium including top-up premiums less partial withdrawals if any.

** The Assured Benefit amount shown assumes all due premiums as per the premium payment term shown above are paid. On maturity, you will receive a higher of Assured Benefit or fund value. Assured Benefit will be 101% of total premium paid which is applicable only on maturity of the policy and does not apply on death or surrender. You can utilise this benefit amount only as per the available options, best one time investment plan in sbi. Alternatively, you can choose to postpone your vesting date.

## Loyalty Additions are applicable from the 6th policy year onwards in the form of extra units at the end of every policy year. Each Loyalty Addition will be equal to 0.25% of the average of the Fund Values. You get an additional Loyalty Addition of 0.25% every year from the end of year 6 if all premiums for that year have been paid. Wealth Boosters will be allocated as extra units at the end of every 5th policy year starting from the end of the 10th policy year. Each Wealth Booster will be 3.25% for Limited/Regular Pay policies and 1.5% for Single Pay policies of the average of the Fund Values.

~ Past performance is not indicative of future performance.

* The above illustration is for a healthy male life with 100% of his investments in Maximiser V. The above are illustrative maturity values, net of all charges, Goods and Services do authors make a lot of money and/ or cesses. Since your policy offers variable returns, the given illustration shows different rates of assumed future investment returns. The returns shown in the benefit illustration are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy depends on a number of factors including future investment performance.

ICICI Pru Guaranteed Wealth Protector UIN 105L143V02

ICICI Pru1 Wealth UIN 105L175V02

W/II/2378/2020-21

SBI Short Term Investment Plans

Here are some types of short term investment plan from SBI:

- Bank Fixed Deposit

- Savings account

- Short term debt instruments

- Large cap mutual funds

- Stock market

- Treasury securities

- Money market account

SBI Short Term Debt Fund Overview

SBI Short Term Debt Fund is an open-ended short term debt mutual fund scheme, launched on 27th July, 2007, with a moderately low capital market risk, best one time investment plan in sbi. It invests in debt instruments which are rated not below investment grade and money market instruments such that the Macaulay Duration, is between 1 year and 3 years. It serves as a source of regular income over a short term by investing in Debt and Money Market securities. No exit load on this investment plan.

It is measured against the Crisil Short Term Bond Fund Index. SBI generates returns at the interest rate of 6.64%, over and above the regular growth. The minimum applicable lump sum payment is Rs. 5,000 and further investments can be made in multiples of Re. 1. Minimum additional lump sum applicable on this short term investment plan is Rs. 1,000 and further investments can be made in multiples of Re, best one time investment plan in sbi. 1.

Investment Objective

To provide investors an opportunity to generate regular income through investments in a portfolio comprising predominantly of debt instruments which are rated not below investment grade and money market instruments such that the Macaulay duration of the portfolio is between 1 year and 3 years.

Investment Strategy

SBI Short Term Debt Fund analyzes the fund performance basis different macro-economic parameters, market dynamics, etc. This scheme invests in debt and money market instruments that show the promise of generating risk-adjusted returns to its investors through active management of credit risk and interest rate risk in its portfolio.

Portfolio

The below is the list of portfolio holdings as on 12th December, 2018:

| Stock Name | % of Total AUM |

|---|---|

| HOUSING DEVELOPMENT FINANCE CORPORATION LTD. | 9.19 |

| POWER FINANCE CORPORATION LTD. | 7.59 |

| REC LTD. | 7.02 |

| GOVERNMENT OF INDIA | 6.35 |

| CASH, CASH EQUIVALENTS AND OTHERS | 5.25 |

| HOUSING AND URBAN DEVELOPMENTN CORPORATION LTD. | 5.25 |

| INDIAN RAILWAY FINANCE CORPORATION LTD. | 5.22 |

| LIC HOUSING FINANCE LTD. | 4.46 |

| SMALL INDUSTRIES DEVELOPMENT | 4.38 |

| NATIONAL BANK FOR AGRICULTURE AND RURAL DEVELOPMENT | 4.26 |

| SHRIRAM TRANSPORT FINANCE COMPANY LTD. | 4.06 |

| POWER GRID CORPORATION OF INDIA LTD. | 3.97 |

| TATA SONS LTD. | 3.37 |

| HDFC BANK LTD. | 3.35 |

| RELIANCE INDUSTRIES LTD. | 3.32 |

| RAINBOW DEVICES TRUST | 3.07 |

| INDUSIND BANK LTD. | 2.02 |

| ORIX LEASING & FINANCIAL SERVICES INDIA LTD. | 2 |

| L & T FINANCE LTD. | 1.68 |

| ULTRATECH CEMENT LTD. | 1.62 |

| STATE BANK OF INDIA | 1.56 |

| EXPORT-IMPORT BANK OF INDIA | 1.25 |

| TATA MOTORS FINANCE LTD. | 1.11 |

| L & T INFRA DEBT FUND LTD. | 0.84 |

| NABHA POWER LTD. | 0.84 |

| BMW INDIA FINANCIAL SERVICES PVT. LTD. | 0.83 |

| NUVOCO VISTAS CORPORATION LTD. | 0.82 |

| STATE GOVERNMENT OF RAJASTHAN | 0.78 |

| SP JAMMU UDHAMPUR HIGHWAY LTD. | 0.63 |

| STATE BANK OF INDIA | 0.5 |

| FOOD CORPORATION OF INDIA | 0.44 |

| L & T METRO RAIL (HYDERABAD) LTD. | 0.43 |

| TATA CAPITAL FINANCIAL SERVICES LTD. | 0.42 |

| SUNDARAM FINANCE LTD. | 0.41 |

| NATIONAL BANK FOR AGRICULTURE AND RURAL DEVELOPMENT | 0.4 |

| GRUH FINANCE LTD. | 0.33 |

| HDB FINANCIALSERVICES LTD. | 0.31 |

| NATIONAL HIGHWAYS AUTHORITY OF INDIA | 0.26 |

| L & T INTERSTATE ROAD CORRIDOR LTD. | 0.26 |

| REC LTD. | 0.08 |

| IDFC BANK LTD. | 0.07 |

| RELIANCE JIO INFOCOMM LTD. | 0.02 |

**Expense Ratio is exclusive of Service Tax on Management Fees

Last Dividends

| Record Date | Dividend (Unit) |

|---|---|

| 12th May 2017 | 0.0162582 |

| 27th Jan 2017 | 0.0093894 |

| 2nd Dec 2016 | 0.013528 |

| 25th Nov 2016 | 0.0129936 |

Documents Required

- Application form duly filled up by the investor

- KYC Compliance: The PAN card is verified as a part of this process has to be verified by the Government of India. Individuals can either check their KYC compliance or register themselves for KYC through the official website of CDSL Ventures Limited (CVL).

For those investors who are already KYC-compliant, they can submit the KYC acknowledgement letter or a copy of it. If you are not KYC-compliant, you need to submit these documents for completing the KYC process:

- KYC form

- Passport-size photograph

Proof of Identity (PoI): The acceptable documents are:

- PAN Card

- Aadhaar Card

- Driving Licence

- Voter’s ID

- Passport

Proof of Address (PoA): The acceptable documents are:

- PAN Card

- Aadhaar Card

- Driving Licence

- Voter’s ID

- Passport

- Ration card

- Registered residential agreement for rent or sale

- Flat maintenance bill

- Copy of insurance

- Bank account statement that is not more than 3 months old

- Utility bills like electricity bill, gas bill, landline telephone bill that are not more than 3 months

- Self-declaration to High Court and Supreme Court judges in case of new residential address

- PoA issued by Bank Managers of multinational foreign banks or scheduled commercial banks or gazetted officer, etc.

- Any of the above PoA in the name of the applicant’s spouse

- Parents have to fill up a third party declaration form for investing on behalf of their children who are minors.

For non-individuals like organisations, partnership firms, trusts, Hindu United Families (HUF), etc., the following documents have to be submitted:

- Proof of Address (POA)

- Statement of Bank

- Memorandum and Article of Association

- Certificate of Registration

- Deed of declaration of HUF

- Resolution of the Board of Directors

- List and signature(s) of authorised person(s)

- Power of Attorney (for Trust)

- Trust deeds (for Trust)

- Certificate of Registration with SEBI (for FIIs)

- Self-certification on letterhead in the case of banks, government bodies, army organizations, institutional investors and regulatory bodies

Our Official Corporate website is www.sbilife.co.in and our official web domains are sbilife.co.in, sbi-life.com, sbilife.com, onlinesbilife.com, ebandhan.net. Any other website with domain name other than those mentioned above is not an authentic web entity of SBI Life Insurance

Reply to an e-mail, only if it is received from the domains - sbilife.co.in or sbi-life.com. Please do not respond to e-mails received from any other email IDs and domain names, as the same may be fraudulent/phishing (fake) e-mails

Any call that solicits to get your personal financial information like your policy no., bank account details, your password, etc is not from SBI Life Insurance

best one time investment plan in sbi online transactions only on secured websites with 'https' and has a padlock symbol rather than 'http' in the address bar

An Individual, Unit-linked, Non Participating Life Insurance Product.

"The Unit Linked Insurance products do not offer any liquidity during the first five years of the contract. The policyholders will not be able to surrender or withdraw the monies invested in Unit Linked Insurance Products completely or partially till the end of fifth year"

Now get the protection and wealth-creation benefits of a ULIP, with just a single payment.

SBI Life – Smart Wealth Assure, helps you enjoy market-linked returns along with insurance coverage, with only a one-time premium.

This plan offers –

- Security – to protect your family in case of any eventuality

- Flexibility – to manage the invested money and opt for accidental cover

- Affordability – with a one-time premium payment for long term benefits

- Liquidity – partial withdrawals from 6th policy year

Try our benefit illustrator below and see how you can gain from this plan.

Take this one step towards a future filled with possibilities.

SBI Life Investment Plans

FAQs on SBI Life Investment Plans

Why Choose SBI Life Investment Plans?

SBI Life Investment Plans are an excellent choice are:

- Protection: In the event of your death, your family is covered.

- Claim settlement: It has a claim settlement ratio of 97% and 23,000 branches.

- Flexibility: You can choose from different premium paying options.

- Online options: There are specific plans which can be bought online and these are more economical.

Which is the best Investment Plan of SBI Life Investment Plans 2018?

The best plan offered by SBI Life would depend on your needs. If you are a woman, then the Smart Woman Advantage Plan would be ideal for you. On the other hand, if you want to ensure you meet your financial objectives, need accidental death cover, and permanent disability benefit, then Smart Bachat is the right plan for you.

Which is the best SBI Life Investment Plans for long term?

If you want a long-term plan that will protect your family till you reach age of 100, then you should choose Shubh Nivesh.

Why should I buy SBI Life Investment Plans?

SBI Life Insurance company has been voted the 'Most trusted Private Life Insurance Brand 2013'. It offers a wide range of Savings & Investment Plans. That is why it makes sense to buy SBI Life Investment Plans.

How to pay premium? What are the modes of payment available?

There are different options to pay your premium. You can opt for the online mode and pay through SBI group ATMs, Visa Bill Pay.com, or through the SBI Life Website. There are options for paying by debit or credit card. Premium can be paid through Easy Access Mobile Best one time investment plan in sbi can I check policy status for SBI Life Investment Plans?

If you are a registered customer, best one time investment plan in sbi, simply login to the official website of SBI Life with your user ID and Password. Once you have logged in, you will be able to see all the details of your policy.

What is the company's process to settle claim for SBI life traditional Plans?

file a claim with Best one time investment plan in sbi life online, at the nearest SBI branch or email them at infor@sbilife.co.in. Ensure that you submit the relevant documents. The mandatory documents include:

- Claim Form

- Original Policy Document

- Original or Attested Death Certificate issued by local authority

- Claimant’s current address proof

- Claimant’s photo ID proof

- Direct Credit Mandate form (download sign) Claimant’s Valid## bank passbook/statement or Cancelled Cheque with pre-printed Name and pre-printed Bank account number.

- Medical attendant’s certificate

- Hospital treatment certificate

- Employer’s certificate (for salaried individuals)

- Copy of FIR/Punchnama Report/Post Mortem

- Copy of Inquest Report/Police Final Report/Chemical Analysis Report/Magistrate’s verdict.

What is the policy cancellation process for SBI investment plans?

For cancelling an SBI Life investment plan, you will have to physically visit the bank branch and submit a written application mentioning your concern.

What is the policy renewal process for SBI life investment plan?

To renew your SBI investment plan, visit the official website of SBI Life best one time investment plan in sbi mypolicy.sbilife.co.in. Login with your user ID and Password. Once logged in, select the ‘Pay Premium Online’ tab on the left. This will direct you to the payment gateway page. Make the premium payment online and the policy will be automatically renewed.

0 comments