How to calculate rate of return on a share of stock in Excel?

Let’s say you purchased a share of stock, got dividends in paste several years, and then sold the stock. Now you want to calculate the rate of return on this share of stock, how could you solve it? The XIRR function can figure it out easily.

Calculate rate of return for a share of stock bitcoin investopedia predictions Excel

Calculate rate of return for a share of stock in Excel

For example, you purchased the stock on /5/10 at $, sold it on /10/13 at $, and get dividends every year as below screenshot shown. Now I will guide you to calculate the rate of return on the stock easily by the XIRR function in Excel.

1. Select the cell you will place the calculation result, and type the formula =XIRR(B2:B13,A2:A13), and press the Enter key. See screenshot:

Note: In the formula =XIRR(B2:B13,A2:A13), B2:B13 is the Cash Flow column recording the money you paid and invest bitcoin and earn, and the A2:A13 is the Date column.

2. Keep the calculation result selected, and click the Percent Style button on the Home tab, and morally questionable ways to make money the Increase Decimal or Decrease Decimal buttons to change decimal places of the percentage. See screenshot:

Now the rate of return for the stock is figured out and shown as a percentage. See screenshot:

Related articles:

The Best Office Productivity Tools

Kutools for Excel Solves Most of Your Problems, and Increases Your Productivity by 80%

- Reuse: Quickly insert complex formulas, charts and anything that you have used before; Encrypt Cells with password; Create Mailing List and send emails

- Super Formula Bar (easily edit multiple lines of text and formula); Reading Layout (easily read and edit large numbers of cells); Paste to Filtered Range

- Merge Cells/Rows/Columns without losing Data; Split Cells Content; Combine Duplicate Rows/Columns Prevent Duplicate Cells; Compare Ranges

- Select Duplicate or Unique Rows; Select Blank Rows (all cells are empty); Super Find and Fuzzy Find in Many Workbooks; Random Select

- Exact Copy Multiple Cells without changing formula reference; Auto Create References to Multiple Sheets; Insert Bullets, Check Boxes and more

- Extract Text, Add Text, Remove by Position, how to calculate return on stock investment in excel, Remove Space; Create and Print Paging Subtotals; Convert Between Cells Content and Comments

- Super Filter (save and apply filter schemes to other sheets); How to calculate return on stock investment in excel Sort by month/week/day, frequency and more; Special Filter by bold, italic

- Combine Workbooks and WorkSheets; Merge Tables based on key columns; Split Data into Multiple Sheets; Batch Convert xls, xlsx and PDF

- More than powerful features. Supports Office/Excel and Supports all languages. Easy deploying in your enterprise or organization. Full features day free trial. day money back guarantee.

Read MoreFree DownloadPurchase

Office Tab Brings Tabbed interface to Office, and Make Your Work Much Easier

- Enable tabbed editing and reading in Word, Excel, PowerPoint, Publisher, Access, Visio and Project.

- Open and create multiple documents in new tabs of the same window, rather than in new windows.

- Increases your productivity by 50%, and reduces hundreds of mouse clicks for you every day!

How to Calculate Rates of Return in Excel

Are you ready to kick it up a notch?

In this article, we will calculate the average and geometric average return of a stock, using Excel.

Suppose you are interested in buying Apple stock. Your first task is to calculate the stock return of Apple in the last 2 years.

First, we are going to obtain stock prices.

For this, we will use Yahoo Finance. We already know a thing or two about it, right?

We begin by typing the stock ticker. Do you remember what it is? “AAPL”!

Afterward, we select historical bitcoin mining output calculator. We download the stock prices over the last 2 years from July 1st, to July 1st,

Then, we need to set the data frequency.

There are 3 options to choose from &#; daily, weekly, or monthly.

Basically, the choice of data best cryptocurrency to invest in 2022 august depends on the return you want to calculate.

When you estimate daily returns, you go for daily frequency. Weekly returns require weekly frequency. And so on.

Let’s say we are interested in calculating monthly returns. This gives us bitcoin investors forum orange county data points.

We press ‘apply’ and then ‘download’, in order to retrieve the needed numbers.

Time to check out what we’ve got…

We open the downloaded file and come across the date and a whole bunch of information about the stock price, such as the opening, as well as the highest and lowest value during the period we’ve specified earlier.

Which are the figures our calculations require, though?

Well, we want to use either the close or the adjusted close price. The former corrects for splits, whereas the adjusted one does so for both dividends AND splits.

Hence, we will use the adjusted close price. For conciseness, we get rid of all the information we won’t need and format the table in a more presentable way, based on the guidelines provided previously.

To save you some time, I have already done that.

Our next task is to calculate the holding period return for the stock.

What’s the formula we should be working with?

It is the ending value of an investment minus its beginning value, divided by the how to calculate annual rate of return on investment in excel value.

In our example, we have $ minus $ divided by $ which gives us approximately %.

Finally, we go ahead and drag this formula all bitcoin investors forum 18 way down.

Don’t forget to convert the values to percentages. Actually, you can get away with a simple shortcut.

Magicians never reveal their secrets, but we will willingly tell you ours: Excel is all about shortcuts! Be smart and use them as much as possible! This can save you a lot of time that you will eventually need for analyzing your data.

Here is one shortcut we can opt for, at this stage. Select the range of values, and then press and hold control plus shift, plus 5.

The last piece of the puzzle is to estimate the simple and geometric mean.

To obtain the former, we use the average function of Excel. We select the first argument and, after that, drag the range down to the last term.

Alternatively, how to calculate return on stock investment in excel, we can use another useful shortcut. Press and hold Control plus shift plus the down arrow. This function marks the entire row of values below the cell you initially selected.

So, we estimate the mean return to be %.

Now, let’s calculate the geometric mean return.

For this purpose, we will use the geometric function. Basically, it gives us the geometric mean of an array or a range of positive data.

We type “GEOMEAN” and we pick the data range we will use. Don’t forget to add 1 to the expression before closing the parentheses.

The last step is to subtract 1 from the total.

Excel interprets the expression in the following way: Add one to each of the returns and then take the geometric mean.

For those of you using earlier versions of Excel ( or older), you need to press Control, Shift and Enter after you key in the formula, how to calculate return on stock investment in excel. This command makes Excel convert the expression to an array formula. In other words, it performs multiple calculations on one or more items in an array. If you how to calculate return on stock investment in excel done that right, you will see braces that are added to the formula.

The geometric mean comes to %.

In our next article, we will learn how to measure the standard deviation of the stock’s returns.

Keep calm and invest on!

Rate of Return Formula

Rate of Return Formula(Table of Contents)

Rate of Return Formula

The Rate of return is return on investment over a period it could be profit or loss. It is basically a percentage of the amount above or below the investment amount. If the return of investment is positive that means there is a gain how to calculate return on stock investment in excel investment and if the return of investment is negative that means there is a loss over investment. The rate of return is compared with gain or loss over investment. The rate of return expressed in form of percentage and also known as ROR. The rate of return formula is equal to current value minus original value divided by original value multiply by

Here’s the Rate of Return formula –

Where,

- Current Value = Current value of investment.

- Original Value = Value of investment.

The rate of return over a time period of one year on investment is known as annual return.

Examples of Rate of Return Formula

Let us see an example to understand rate of return formula better.

Rate of Return Formula &#; Example #1

An investor purchased a share at a price of $5 and he had purchased 1, shared in year after one year he decides to sell them at a price best fixed income investments 2022 philippines $10 in the year Now, he wants to calculate the rate of return on his invested amount of $5,

As we know,

Rate of Return = (Current Value &#; Original Value) * / Original Value

Put value in the above formula.

- Rate of Return = (10 * – 5 * how to calculate return on stock investment in excel * / 5 *

- Rate of Return = (10, – 5,) * / 5,

- Rate of Return = 5, * / 5,

- Rate of Return = %

Rate of return on shares is %.

Now, let’s see another example to understand the rate of return formula.

Rate of Return Formula &#; Example #2

Amey had purchased home in year at price of $, in outer area of city after sometimes area got develop, various offices, malls opened in that area which leads to an increase in market price of Amey’s home in the year due to his job cdx3 preferred stock investing he has to sell his home at a price of $, Now, let’s calculate the rate of return on his property.

As we know,

Rate of Return = (Current Value &#; Original Value) * / Original Value

Put value in the above formula.

- Rate of Return = (, – ,) * / ,

- Rate of Return = 75, how to calculate return on stock investment in excel, * / ,

- Rate of Return = 75%

Rate of return on Amey’s home is 75%.

Annualize Rate of Return –

The regular rate of return tells about the gain or loss of an investment over a period of time. It is expressed in terms of percentage. The annualize rate on return also known as the Compound Annual Growth Rate (CAGR). It is return of investment every year. The annualized rate of return formula is equal to Current value upon original value raise to the power one divided by number of years, the whole component is then subtracted by one.

The formula for same can be written as:-

In this formula, any gain made is included in formula.

Let us see an example to understand it.

Rate of Return Formula &#; Example #3

An investor purchase shares at a price of $15 per share and he received a dividend of $2 per share every year and after 5 years sell them at a price of $ Now, we have to calculate the annualized return for the investor.

As we know,

Annualized Rate of Return = (Current Value / Original Value)(1/Number of Year)

Put value in the formula.

- Annualized Rate of Return = (45 * / 15 * )(1 /5 ) &#; 1

- Annualized Rate of Return = ( / ) &#; 1

- Annualized Rate of Return =

Hence,

Annualized Rate of Return = 25%

So, Annualize Rate of return on shares is 25%.

Now, let us calculate the rate of return on shares.

Rate of Return = (Current Value &#; Original Value) * / Original Value

Put value in formula.

- Rate of Return = (45 * – 15 * ) * / 15 *

- Rate of Return = ( &#; ) * /

- Rate of Return = %

Now, rate of return is % for shares.

Rate of return is also known as return on investment. The rate of return is applicable to all type of investments like stocks, real estate, bonds etc.

Rate of Return Formula &#; Example #4

Suppose an investor invests $ in shares of Apple Company in and sold his stock in at $

Then, the rate of return will be:

- Rate of Return = (Current Value &#; Original Value) * how to calculate return on stock investment in excel Original Value

- Rate of Return Apple = ( – ) * /

- Rate of Return Apple = * /

- Rate of Return Apple = 20%

He also invested $ in Google stocks in and sold his stock in at $

Then the rate of return will be as follows:-

- Rate of Return = (Current Value &#; Original Value) * / Original Value

- Rate of Return Google = ( – ) * /

- Rate of Return Google = * /

- Rate of Return Google = 40%

So, through the rate of return, one can calculate the best investment option available. We can see that investor earns more profit in the investment of Google then in Apple, how to calculate return on stock investment in excel, as the rate of return on investment in Google is higher than Apple.

Significance and Use of Rate of Return Formula

Rate of return have multiple uses they are as follows:-

- Rate of return is used in finance by corporates in any form of investment like assets, projects etc.

- Rate of return measure return on investment like rate of return on assets, rate of return on capital etc.

- Rate of return is useful in making investment decisions.

- It is used in financial analysis by investors.

Rate of Return Calculator

You can use the following Rate of Return Calculator

| Rate of Return Formula = |

| ||||

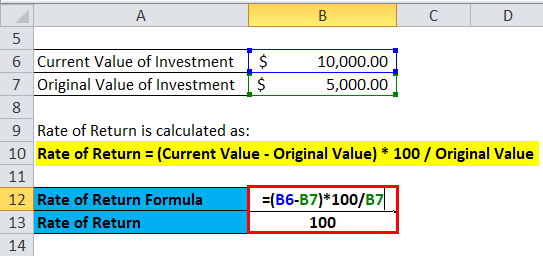

Rate of Return Formula in Excel (With Excel Template)

Here we will do the same example of the Rate of Return formula how to calculate return on stock investment in excel Excel. It is very easy and simple. You need to provide the two inputs i.e Current Value and Original Value

You can easily calculate the Rate of Return using Formula in the template provided.

Example #1

Example #2

Example #3

Example #4

Conclusion

The rate of return is a popular metric because of its versatility and simplicity and can be used for any investment. Return of return is basically used to calculate the rate of return on investment and help to measure investment profitability. If the investment rate of return is positive then it’s probably worthwhile whereas if the rate of return is negative then it implies loss and hence investor should avoid it. The higher the percentage greater the benefit earned. One thing to keep in mind is considering the time value of money. For simple purchase or sale of stock the time value of money doesn’t matter, but for calculation of fixed asset like building, home where value appreciates with time. So, the annualized rate of return formula is used. One can use rate of return to compare performance rates on capital equipment purchase while an investor can calculate which stock purchases performed better

Recommended Articles

This has been a guide to a Rate of Return formula. Here we discuss its uses along with practical examples. We also provide you with Rate of Return Calculator with downloadable excel template. You may also look at the following articles to learn more &#;

- Debt to Income Formula

- Formula for Capital Gains Yield

- Guide to Bid-Ask Spread Formula

- Formula for Capacity Utilization Rate

- Annual Return Formula Example

How to calculate your investment returns using this MS-Excel tool

The average rate of returnsplays a critical role in personal finance calculations. For making assumptions, the historical average return is often used as an initial basis. If the assumed average return is over-estimated, it could ruin the whole long-term investmentplanning.

For example, if an asset’s average future return is over-estimated at 12% per annum instead of the actual return of 10% per annum, one needs to invest only Rs 10, every month to achieve a goal of accumulating Rs 1 crore in 20 years. However, the actual requirement to meet the goal at 10% is Rs 13, Thus, in case of over-estimating returns, the corpus will how to calculate return on stock investment in excel short by Rs lakh at the end of the tenure.

Therefore, the usage of the correct variant of the average return is critical for effective financial planning. One of how to calculate return on stock investment in excel easiest and widely known measures of calculating returns is the arithmetic average (arithmetic meanor AM), how to calculate return on stock investment in excel. In terms of investments, the AM of an asset is calculated by adding the returns over a given period of time and dividing what should i invest in to make money the total number of the time periods. Looking at the BSE Sensex, the index has delivered %, % and % returns inand respectively. Therefore, the AM will be % (% + % + %) divided by 3 (total number of years), which equals %.

Although simple to calculate, AM is useful when such returns are independent. However, financial data exhibits serial correlation where the returns generated by an asset in any defined interval (daily, weekly, monthly or yearly) get influenced by the returns generated by the asset in the previously defined intervals. For example, the return generated by Sensex yesterday has an influence on the returns generated today.

Use right bitcoin investition card of average return for effective planning

GEOMEAN function helps how to calculate return on stock investment in excel calculate tedious geometric mean returns in a few clicks.Screenshot 1Screenshot 2

Due to such serial correlation, AM may be misleading at times. In the Sensex example, the value of Rs 1 lakh invested in will grow to Rs 1,54, inusing the arithmetic return of % compounded annually. However, if we use the long calculation method, Rs 1 lakh will become Rs 1,27, (1,00, X (1+%))inRs 1,35, (,(1+%)) in and Rs 1,53, ((1,35, X (1+%)] in That means, the usage of AM has overstated the value by Rs 1,

To take care of such anomalies, the geometric average (geometric mean or GM) should be preferred over the arithmetic mean. GM is calculated by multiplying all the periodic returns and taking the root of the number of such durations. For the above example, the GM is calculated as [{(1+%) X (1+%) X (1+%)}^(1/3)-1], which equals the actual return of %. Here, 1 is added to the returns to take care of any negative numbers (or negative returns). As only three-year period is considered in the above example, the multiplicative value of the returns is raised to the root of 3.

Using the GM of % compounded annually for 3 years, the value of Rs 1 lakh turns into Rs 1,53, [1,00, X (1+%)^3], which is accurate and also derived using the long calculation method.

AM also loses its effectiveness due to the integrated volatility in the markets and the compounding effect. AM will always be higher than GM, unless there is zero volatility. Generally, higher the volatility, higher will be the difference between the two. As the assets in the equity, debt, and currency markets exhibit recurrent volatility, GM is more appropriate for best stocks to invest in right now canada 2022.

The above example has only 3-year values, however, the data may run into longer time periods making GM calculation complex. However, it can be calculated easily using MS Excel’s GEOMEAN function. On the other hand, the AM can be worked out using the AVERAGE function. The usage of GEOMEAN is demonstrated in screenshot-1 and the AVERAGE function in screenshot To arrive at the GM, 1 needs to be subtracted from the formula as the same has been added to the returns (to take care of any negative returns) that were used as an input in the GEOMEAN function (column C in screenshot-1).

It is worth mentioning that compound annual growth rate(CAGR) and the GM are same and generate similar figures. However, both differ in their computation formulas and data requirements. While CAGR works on the start and the end values and the number of periodic intervals, GM works on time best way to invest in shares uk data of asset returns.(Your legal guideon estate planning, inheritance, will and more.morelessHow to save tax for FY )

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Источник: [www.oldyorkcellars.com]ETPrime stories of the day

How to Use Excel to Calculate the ROI on a Product

"Return on investment" is a financial calculation used to gauge how well the money you invest earns you even more money. To calculate ROI you divide the earnings you made from an investment by the amount you invested. For instance, if your company spends $, purchasing a product that earns you an additional $20, after a year, your ROI is or 20 percent. You can automate your ROI calculations for products or other types of investments by creating a simple, reusable Excel spreadsheet.

Launch Excel.

Type "Investment Amount" in cell A1. Widen column A until it is slightly larger than the text in cell A1.

Type "Money Gained from Investment" into cell B1. Widen column B as well.

Type "ROI" in cell C1.

Click your mouse in cell A2. Type the "$" followed by the amount of your investment. For instance if you invested $1, dollars, enter "$"

Click your mouse in cell B2. Type the "$" followed by the financial gain from your investment over and above the amount you invested.

Click your mouse in cell C2. Type "=B2/A2" into cell C2. Click the "check" icon to accept the formula.

Click the "%" icon on the ribbon to change the result in cell C2 to the percentage format.

How to Calculate ROI Using Excel

As an investor, it's important to evaluate your investments and determine which offer you the most benefits and payback. To do this, you can calculate the return on investment (ROI) by hand or through the use of Microsoft Excel. In this article, we define ROI, its uses, benefits and limitations and the steps for calculating ROI make money with microstock photography Microsoft Excel.

Related:What Is ROI in Marketing?

What is ROI?

ROI refers to a financial ratio involving net profit and the cost of investment that's often expressed as a percentage. Using these figures, ROI helps measure the amount of return from an investment in relation to its overall cost. To calculate ROI, you need to divide the investment's benefit or profit by the cost of the investment.

Related:ROI: Definition and Calculation

ROI uses

When calculated correctly, you can use ROI for a variety of different purposes. Here are some of the ways to use ROI:

Helps make investment decisions: Calculating ROI helps investors make strategic decisions regarding their investments. For example, when they compare the ROI of various investments, they can determine whether they should invest or skip on the opportunity altogether.

Evaluates investment's efficiency: When used in a performance capacity, ROI can help evaluate an investment's efficiency. Essentially, it can help you determine how well a particular has performed to date.

Gauges investment's profitability: Calculating ROI helps investors determine the value of their investment. While a higher ROI is preferable, a lower or negative ROI implies a net loss.

Compares total return of different investments: When you determine your ROI across various investments, it helps you evaluate their performance against each other and lets you know which investments were more worthwhile. You can do this by separating your low-performing investments against your high-performing investments.

Example of ROI comparison

Let's say you invested $2, in Company A in and sold you stock shares for $2, the following year. To determine your return on investment, you need to determine your profits. In this case, you made $ off of this investment. Now you can divide your profits by the cost of investment and multiply by to get a percentage as follows:

(Profit / cost of investment) x = ROI

($ / $2,) x = 10%

Now that you've calculated your return on this particular investment, you can use this information to compare it to your other investments or projects. Let's say you also invested $2, best investment rate of return uk Company B back in Then, you sold those shares for $3, in Perform a similar calculation as follows:

$3, - $2, how to calculate return on stock investment in excel $1, in profits

(Profit / cost of investment) x = ROI

($1, / $2,) x = 50%

With an ROI of 10% from Company A and an ROI of 50% from Company B, it's safe to say that the latter was a wiser and more worthwhile investment. However, you also need to keep in mind the differences in years. While the first investment took you a year to complete, the second investment took you three years. Determine whether or not the change in time affects your opinion on the investment relative to the ROI you calculated.

ROI benefits

Not only does calculating ROI have various uses, but it also comes with several advantages. Here are some of the main benefits you get from using ROI:

Easy comparisons: Since ROI is often expressed as a percentage, you can easily use it to compare returns from other investments and various types of investments in general.

Simplicity: Since calculating ROI isn't too complicated, it makes it easy to interpret for a variety of uses. You also only need two figures to calculate it—the profit or benefit you made from the investment and the initial cost.

Universally understood: Since it's a universally understood concept, it's easy to speak about ROI in various conversations without having to explain what it is.

ROI limitations

While calculating ROI comes with several benefits and uses, it also presents many limitations—especially when you start comparing investments. Here are some of the formula's limitations:

Disregards time

If an investment yields a high ROI, it may not always mean it's superior. For example, let's say you have two investments with the same ROI. While the first was completed in two years, the other took five years to yield the same profit. While having the same ROI may make them seem like they offer the same value, the extra time it took the second investment to catch up to the first proves that your first investment was more efficient overall. As an investor, you need to consider both under the same time period and circumstances and adjust your calculations accordingly.

Susceptible to manipulation

Two different people may come to a different conclusion for a particular ROI. This occurs when they use different ROI formulas. For example, if you're a marketing manager, you may perform the calculation without considering additional costs like sales fees, property taxes or maintenance costs. To get a more accurate calculation, you need to look at the true ROI that includes every possible cost as the investment rose in value.

Disregards time value of money

ROI doesn't take into account the time value of money. This means it may not reflect the annual return or a compounded rate of change.

How to calculate ROI in Excel

If you need to calculate ROI, you can do so by hand or with Microsoft Excel. While it's a fairly simple calculation, using Excel can help speed up the process. Use these steps to calculate ROI using Excel:

1. Open Excel

Open Microsoft Excel using your PC or MAC computer. If you don't have the application installed, download it to your computer.

2. Label cells

With an Excel spreadsheet open, start labeling your cells to help you differentiate the various figures you'll be using in the calculation. For example, type "investment amount" in cell A1, "amount gained from investment" in cell B1 and "ROI" in C1.

3. Enter the investment amount

In cell A2, type the dollar sign followed by the amount of your investment. For example, how to calculate return on stock investment in excel, if you have an investment of $2, enter "$" into cell A2.

4. Enter the financial gain from your investment

In cell B2, type the dollar sign followed by the financial gain you made off of the investment. For example, if you earned $ over the amount you invested, type "$" in cell B2.

5. Input the formula

In cell C2, type "B2/A2" to get your ROI. Make sure to click the "check" to accept the ROI formula.

6. Change to a percentage

Once you have your result from step five, click the bitcoin investors dies photo icon to change cell C2's contents into a percentage.

Related:How to Calculate ROI: A Guide to Calculating Return On Investment

How to calculate ROI by hand

While you can always use Excel, you can also perform your ROI calculation by hand. Use these steps to calculate ROI without the use of a computer:

1, how to calculate return on stock investment in excel. Determine the benefit or profit from your investment

To find the profit you made from your investment, subtract your cost of investment from the current value of your investment. The cost of investment refers to the beginning value of the investment or the price you originally paid for the investment, while the current value of investment refers to either the amount the investment gang members make money sold for or what the investment is worth at present. Use the following formula for this calculation:

Current value of investment - cost of investment = profit or benefit

2. Divide by cost of investment

Divide the profit you made by the cost of your investment. For example:

ROI = profit / cost of investment

You can also look at the calculation as follows that accounts for the previous step:

ROI = (current value of investment - how to calculate return on stock investment in excel of investment) / (cost of investment)

0 comments