Think: A bear market occurs when investors are pessimistic about the economy

| What is the best bitcoin miner hardware reviews |

| Morally questionable ways to make money |

| A bear market occurs when investors are pessimistic about the economy |

| BITCOIN INVESTMENT UK BENEFITS |

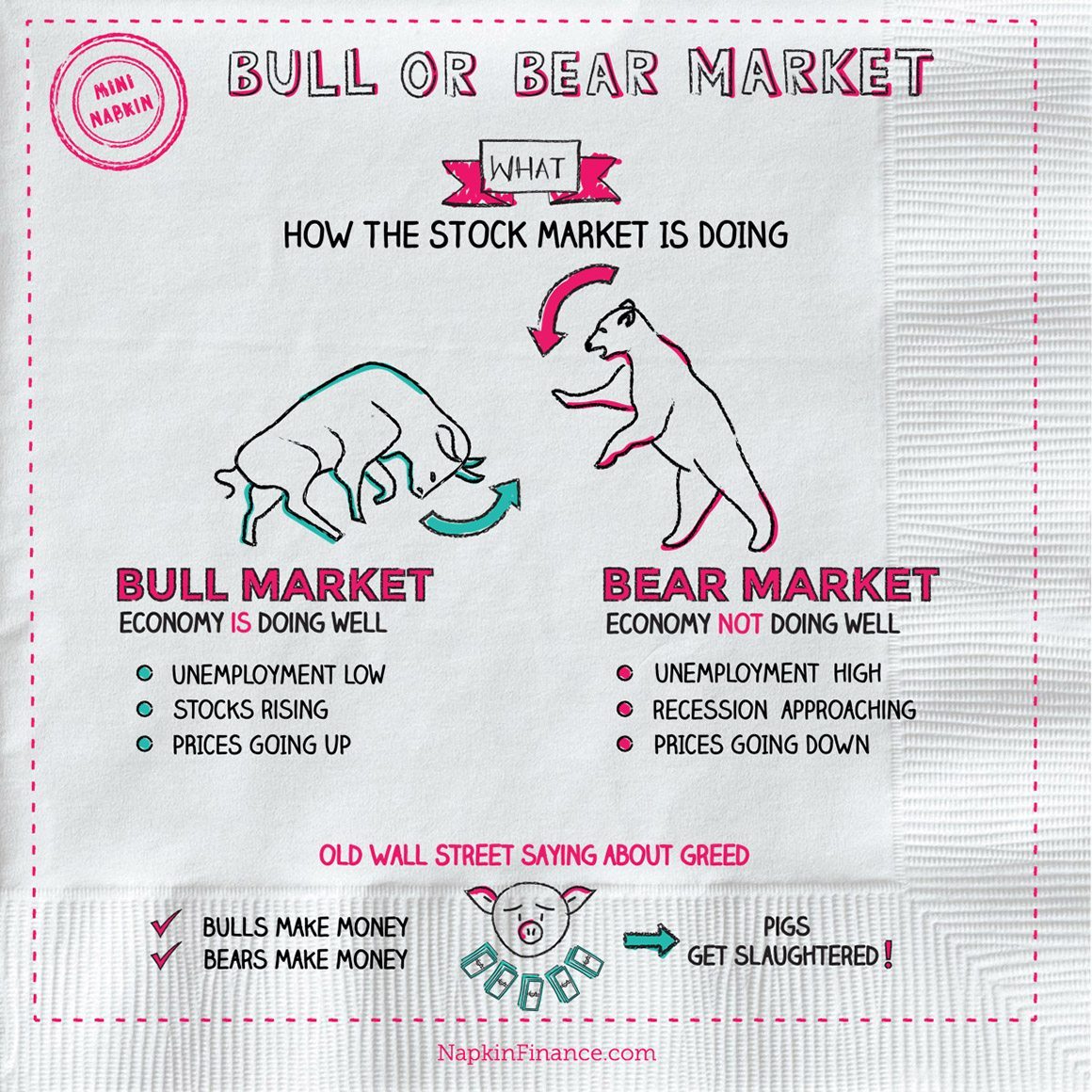

Bear Market

When prices of assets in a market fall by 20% or more from recent highs, it is called a bear market. As a result, investor confidence is low, and the economy and market turn pessimistic.

What Is a Bear Market?

A bear market is defined as a market that has lost 20% of its value in the last few months from its previous high point. It is frequently triggered by an economic downturn or a once-in-a-lifetime occurrence that has an economic impact, such as the new Coronavirus.

Why Is It Called a Bear Market?

Some speculate that the bear market got its name from an old saying about not selling a bear's skin before catching the bear. Others believe that the term is named after the way a bear attacks its prey by swiping its paws downward.

How Long Does a Bear Market Last?

The fact is that bear markets occur from time to time. Since WWII, Wall Street has had 13 bear markets (every five or six years on average), with each one lasting around days—just over a year.

Now, a bear market normally corrects itself, and the economy recovers rather fast. However, a bear market occurs when investors are pessimistic about the economy, if stock values continue to decrease, a recession may result. When the economy stops expanding for a lengthy period of time—usually two quarters or more of negative economic growth—this is known as a recession.

Bear market vs Market Correction vs Pullback

A pullback is a 5% to 10% reduction in price that is merely temporary, generally lasting a few days or weeks. It's like going through a usual adjustment earn free bitcoin every 10 minutes, with a small detour from a recent high but no change in the underlying trend.

A market correction occurs when prices drop by 10% to 20% and last in that zone for two to four months. These periods are extremely volatile, and they might cause investors to fear a bear market and sell. Real-time news can exacerbate these concerns, since investors may be influenced by crowd psychology and make anticipatory judgments.

A bear market occurs when prices fall by 20% or more, and it can persist anywhere from months to years. Investors’ trust gets damaged and the majority of them exit the market. As more investors sell their equities in order to avoid more losses, trading activity decreases.

Examples of Notable Bear Markets

Let's look at some of the most well-known and severe bear markets, starting with the Great Depression.

The Great Depression

The Great Depression, which began inwas one of the world's most extended and severe economic downturns. The global economy did not begin to revive until the late s. Some claim the US stock market crisis was the spark, while others argue it was more of a consequence than a cause.

The Wall Street Crash of was a sharp and unexpected drop in stock values on the New York Stock Exchange. This was followed by the London Stock Exchange Crash, all of which signified the start of the Great Depression, which was followed by the "Roaring Twenties," a period of luxury following World War I.

The fall was caused by excessive anticipation that the market would continue to rise as more individuals began to participate.

The Dot-com Bubble Lasted From Until

The late s were a time of rapid expansion for numerous new tech businesses, notably Google, Amazon (NASDAQ: AMZN), and Yahoo!, as the internet's widespread use fueled the market expansion. The S&P increased by nearly % before plummeting by 49% in March

Prices were driven so high by over-speculation and positive market enthusiasm that they could no longer be justified. As investors continued to pour money into dot-com stocks, supply began to outstrip demand. Despite the fact that more firms wanted to go public, sometimes without a good plan, they nonetheless managed to attract investors to unproductive operations.

The – Financial Crisis

The global financial crisis of – was the worst bear market since the Great Depression, owing to the housing crisis and financial institutions' excessive risk-taking. The recession came to a head in Septemberwhen Lehman Brothers filed for bankruptcy, triggering a global banking crisis.

The S&P lost approximately half of its value as a result of these events, but the market began to rise again in and entered a bull market that lasted until February

Bear Market in A bear market occurs when investors are pessimistic about the economy DecemberBitcoin went from about $20, to just over $3, in a matter of days, making it one of the most well-known crypto crashes. Following that, it rose in price, hitting approximately $65, per coin in Aprilbefore plummeting to below $32, in May.

Join the thousands already learning crypto!

Join our free newsletter for daily crypto updates!

Bear Market vs. Economic Recession

| Editor’s note:Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it. A version of this article was previously published on March 20, . |

The year was volatile for the U.S. and global markets. Market circuit breakers were triggered multiple times in March, temporarily halting trading. The U.S. stock market briefly dropped into bear-market territory, and the spread of the coronavirus led to widespread concern over a potential global recession. The National Bureau of Economic Research confirmed these fears for the United States as it announced on June 8 that the country had entered a recession in February.

But what does all this mean? What exactly is a bear market? How does it differ from an economic recession? Why was trading put on hold?

We answer some questions you may ask while reading market news.

Why does trading stop?

Trading halts are caused by marketwide circuit breakers, automatic mechanisms that are triggered by extreme, broad declines in the market.

The idea behind an automatic halt to trading is to calm panic-stricken markets. The circuit breakers force investors to take a brief pause from the ongoing chaos, review and reassess the situation, and acquire and assimilate information. According to the New York Stock Exchange, the purpose of the circuit breakers is “to slow the effects of extreme price movement through coordinated trading halts across securities markets when severe price declines reach levels that may exhaust market liquidity.”

In an era of high-frequency computerized trading, circuit breakers are intended to act as a speed bump when markets are in a tailspin and help restore calm. The overall effectiveness of these measures, however, is debatable. a bear market occurs when investors are pessimistic about the economy do circuit breakers work?

There are three thresholds that activate the automatic stock-market trading halts amid sharp, substantial downturns and volatility, as measured by the S&P for U.S. markets:

- A Level 1 circuit breaker triggers a minute trading pause when the market falls 7% below the prior day’s close.

- A Level 2 trading halt kicks in when the market slides 13%. This pause also lasts 15 minutes.

- A Level 3 circuit breaker is activated when the market drops 20%, suspending trading for the remainder of the day.

Level 1 and 2 halts are triggered only if the market drop occurs before p.m.; trading will continue if the fall occurs at or after p.m. A Level 3 halt can kick in any time during the trading day.

How is a bear market different from an economic recession?

Although the two often go hand in hand, they are associated with different issues. A recession describes a slowdown in economic output and is generally defined as at least two consecutive quarters of decline in gross domestic product, or GDP, which functions as a measure of economic health.

On the other hand, a bear market describes a stock market decline as a result of negative investor sentiment.

In short, the stock market is not the economy; the market may be up even as economic output is down.

What causes an economic recession?

The causes of an economic recession can vary. One potential cause is a loss of business and consumer confidence in investing and the economy. Lower confidence can mean retail sales slow and businesses hire fewer people. This creates a negative feedback loop as businesses cut back in response to lower demand, which in turn reinforces consumers’ pessimism.

Other potential causes include:

- High interest rates

- Falling housing prices and sales

- Credit crunches

An economic recession can also be a result of a bear market, which drains businesses’ capital. In this sense, the relationship of cause and effect between a bear market and an economic recession exists in both directions: Just as investor confidence and stock prices can fall in response to a recession, a bear market can also prompt a recession by putting a strain on companies that rely on investor capital.

While COVID has certainly put a drag on the global economy, it still remains to be seen whether the recession will have lasting effects on economic output.

What causes a bear market?

A bear market is essentially a crisis of investor confidence, the causes of which can vary. The most common trigger of a bear market is a weak or slowing economy, or the anticipation of an economic slowdown.

Signs of a slowing economy may include:

- Falling productivity

- Rising unemployment

- Low consumer confidence

- Decreasing corporate profits

- Low disposable income

These signs may cause investors to become pessimistic about the prospect of future returns on investment, prompting them to sell shares. The market declines as a sell-off gains momentum and pessimism spreads.

NEWS RELEASE

Kathleen O'Toole, News Service () ; e-mail: www.oldyorkcellars.com@www.oldyorkcellars.com

Stock market volatility: Why investors' beliefs increase market uncertainty

At least once a week, someone asks Mordecai Kurz if the current stock market prices are too high or too low. The Joan Kenney Professor of Economics responds, "You are asking the wrong question."

The question should be, "Is the market too high or too low relative to my own view of what's underlying it?" Kurz told alumni who gathered at the Stanford Institute for Economic Policy Research on Thursday, Oct. 14, as part of Reunion Homecoming Weekend activities.

"If you believe technology today is allowing the market to grow, the markets are not high, but if you don't believe that, the market is extremely high," Kurz said.

In other words, investor optimism or pessimism about future productivity growth is a key part of market movements. The current bull market will change to a bear precisely when enough investors change their beliefs about the underlying fundamentals, not when the fundamentals themselves change, Kurz said. If you accept his view that people have imperfect understanding of information about how the world is changing, then you can use your own understanding of that phenomenon to win big � or lose big. Those whose beliefs are right, Kurz joked, a bear market occurs when investors are pessimistic about the economy, "are the ones who contribute to our institute."

A longtime student of investor performance as well as other economic subjects, Kurz published his theory of "rational beliefs and endogenous uncertainty" in It contradicted textbook explanations of how financial markets work and became the subject of a special symposium issue of the journal Economic Theory and a book in In a Fortune magazine article, Nobel laureate and Stanford Professor Kenneth Arrow called Kurz's work "an important step forward in our understanding of markets." The theory has much to recommend it, Stanford economist Robert Hall commented at the alumni session, but it lacks enough econometric test results a bear market occurs when investors are pessimistic about the economy replace the prevailing paradigm, known best as rational expectations theory,

The prevailing theory doesn't fare as well on such tests with real-world data as his theory, Kurz pointed out at the alumni session. Among the market facts that rational expectations models cannot explain are the suddenness and degree of volatility seen in stock prices, the size of the premium that stocks pay over less risky Treasury bills, and the volatility in currency exchange rates.

Under rational expectations, financial markets are said to be efficient and to set prices at their real value because buyers and sellers behave in their rational self-interest based on broadly shared information about the economy and individual companies in it. People can be caught off guard, however, when sudden shocks occur outside the economy � events like an earthquake or weather conditions that impact economic productivity.

In Kurz's rational beliefs theory, deep structural changes also occur over time within the economy, and investors can't know about them for sure until after the fact. As examples, he cited the strong U.S. growth regime from to followed by a downturn until "The current regime began in driven by technology. The highest returns went to those who recognized the change early in the s," he said.

"The history of the process is reasonably regular and can describe how things operate normally," Kurz said, but the averages calculated from history are "not good predictors of the next 12 to 14 months." As a result, investors don't know how to compute a correct price and must make their own forecast, which he calls a rational belief, a bear market occurs when investors are pessimistic about the economy, rather than a rational expectation.

"A rational belief is a theory about the market that cannot be contradicted by past data," but there can be many different rational beliefs. Therefore, not all rational investors can be right, he said. "This is a concept difficult for economists to accept. Under rational expectations, you are godlike and you never make a mistake. I suggest to you this is an unreasonable view of the world," Kurz said, prompting knowing laughter from his audience.

Individual investors' mistaken but rational beliefs are usually not random but correlated because investors "listen to each other and read the same newspapers and watch the same television programs," Kurz said. Therefore, news about a small change in a company's earnings or some other fundamental economic fact often causes a greater price change than the news would justify.

Beliefs tend to persist until people see a reason to change them, he said, and so there are times when a consensus among investors exits and times when the distribution of beliefs is very broad. In non-consensus conditions, diverse forecasts tend to balance each other. When the distribution of beliefs is narrow, he said, prices are more a bear market occurs when investors are pessimistic about the economy to take larger swings as people change their beliefs.

In his simulations, Kurz said he can replicate real-world market fluctuations better than rational expectation economists by assuming there are both optimistic and pessimistic investors at the same time. "On average, most people are optimistic, but when they become pessimistic, they become intensely pessimistic. Both the intensity and frequency" of investors' changing beliefs about the market will affect market prices. At any moment, he said, a small minority is very afraid of a recession and buys Treasury bills, an explanation for a higher risk premium on stocks than predicted by rational expectations theories. The same pessimism affects foreign exchange markets and results in more volatility than justified by the economics underlying national currency values, he said.

Members of the audience asked Kurz if the current explosion of Internet day traders would affect stock prices more than other investors and whether his theory, if correct, would make it possible for government to introduce regulations to reduce volatility. The latter question, he said, was "very interesting, but I have avoided it like the plague in my writing because I already am involved in enough controversies."

Theoretically, regulators could set a price range, he said, above or below which prices would not be allowed to fall. "But the problem is that the government is not smarter than anybody else."

Regarding day traders, Kurz said that given the role of beliefs, "who are we to judge who is irrational?"

By Kathleen O'Toole

Over time, the major U.S. equity indexes go up and down based on internal and external factors, a bear market occurs when investors are pessimistic about the economy. Performance like that excites investors, but typically in opposite ways. Constant gains lead some investors to expect more of the same. Others worry the good times are surely about to end. The former sentiment is sometimes called “bearish,” while the latter is sometimes referred to as “bullish.” But whether your sentiment is bearish or bullish, one way to ensure you make rational investment decisions is to work with a financial advisor.

What Does A bear market occurs when investors are pessimistic about the economy Mean to Be Bullish?

A bullish investor, also known as a bull, believes that the price of one or more securities will rise. This can apply at any scale of the market. Sometimes a bullish investor believes that the market as a whole is due to go up, foreseeing general gains. In other cases an investor might anticipate gains in a specific industry, stock, bond, commodity or collectible. If an investor is, say, bullish about ABC Corp., this means that he or she thinks that specific company’s shares will climb.

A bull market conveys a related meaning. It exists when prices, typically those of equities, are generally on the rise. While not every stock will necessarily increase, the market’s main equity indexes will. For example, during a bull market the Dow Jones Industrial Average and the S&P can be expected to climb, even as some individual equities and sectors may not. Unlike a bear market, there is no universally accepted percentage gauge for how much a market has to rise before it qualifies as a bull market. The longest bull market in American history for stocks lasted for 4, days and ran from December to March

It might be said that the prevailing sentiment of participants in a bull market is greed or fear of missing out.

Where the Term Bullish Comes From

The term bull originally referred to speculative purchases rather than general optimism about prices and trend lines. When the term first came into use it referred to when someone grabbed a stock hoping it would jump up. Later, as years went on, the term evolved to refer to the individual making that investment. It then eventually transferred to the general belief that prices will rise.

Etymologists disagree on the exact origin of this term, however, it most likely has its origins as a foil to the term bear. While other theories circulate, this is the most generally accepted source of the phrase bull market. Perhaps the most widely reported alternative source for the term comes from how the bull as an animal attacks, by sweeping its horns upward in the same direction that optimist investors expect the market to go.

By contrast, under this theory, a bear market refers to how a bear will swipe downward with its paw. However, while literature contains numerous positive references to bulls throughout Western canon, a bear market occurs when investors are pessimistic about the economy, etymologists have found little sound evidence for this specific theory in any historical record.

What Does It Mean to Be Bearish?

A bearish investor, also known as a bear, is one who believes prices will go down. As with a bullish investor, investors can be bearish about either the market as a whole or individual stocks or specific sectors. Someone who believes ABC Corp.’s stock will soon go down is said to be bearish on that company. An investor who foresees a market-wide dip in stocks, bonds, commodities, currencies or alternative investments like collectibles, is said to be bearish because he or she anticipates a sustained and significant downturn.

A bear market is one in which the prices of securities in a key market index (like the S&P ) have been falling for a period of time by at least 20%. This isn’t a short-term dip like during a correction when there are price declines of 10% to 20%. A bear market is a trend that leaves investors feeling pessimistic about the future outlook of financial markets. A secular bear market is one that lasts for years. The longest U.S. bear market was 61 months, from March 10,to April 28, The most severe bear market chopped 86% from the market’s value; it extended from Sept. 3, to July 8,

It might be said that the prevailing sentiment of investors who expect a bear market is fear that a coming downturn will wipe out wealth.

Where the Term Bearish Comes From

The term bear market most likely came from both parable and practice. It generally relates to the trade of bear skins during the 18th century. During this era fur traders would, on occasion, sell the skin of a bear which they had not caught yet. They did this as an early form of short selling, trading in a commodity they did not own in the hopes that the market price for that commodity would dip. When the time came to deliver on the bearskin the trader would, theoretically, go out and buy one for less than the original sale price and make a profit off the transaction.

While this worked often enough to keep the practice going, it usually failed. This led to popular expressions of the time. These include “don’t sell the bear’s skin before catching the bear,” “selling the bearskin” and “bearskin jobber.” All of these basically referred to a warning about speculation and making promises you can’t keep, while a bearskin jobber basically was a way of calling someone a cheat and a liar. Today’s equivalent would be on the order of “don’t count your chickens before they hatch” and “snake oil salesman.”

But the expressions took on a more specific meaning among investors and stock traders, who understood the practice of speculating on an anticipated downturn. Among investors the term “bearskin trader” and eventually just “bear trader” came to refer to someone who traded stocks the same way disreputable fur traders dealt in pelts. A “bear” sold a stock he didn’t yet own, a bear market occurs when investors are pessimistic about the economy, in the same way that trappers once sold the pelt of a bear they hadn’t caught, then bought the stock back in the hopes of doing so at a lower price and pocketing the difference – in effect a short sale.

Eventually the term bear expanded. Instead of referring specifically to short sale traders investors began referring to anyone who expected price dips as bearish, and declining prices as a bear market.

How to Persevere Through Both Bullish and Bearish Markets

Regardless of the current market we’re in, the standards of strong portfolios remain constant. The first thing you should have in order when it comes to investing is your ultimate financial goals. For most Americans, this principally includes retirement, along with vacations, buying a home and more. By defining your goals, you can make investment decisions based on them.

Once you know your goals and their timeline, you can build your portfolio’s asset allocation. This involves choosing the selection of investments within your portfolio and what percentages they’ll hold. For instance, someone nearing retirement may want to steer clear of individual stocks since they can be quite volatile. Angling towards investments like ETFs and bonds might instead be in order.

On the other hand, if you’re still far from retiring, you might want to take a chance on individual stocks. Their volatility and high-risk nature makes their return potential also much stronger. Since it’ll be a while until you retire, you can risk a bit for those earnings.

As your portfolio ages, you shouldn’t just leave it completely alone. Instead, you’ll want to rebalance your investments. This entails bringing your portfolio’s complexing back to your intended asset allocation. The necessity from this is derived from returns affecting your portfolio over time.

In the end, a bear market occurs when investors are pessimistic about the economy, there is no way to ensure gains in the investment market. All you can do is maintain strong investment tendencies and make prudent decisions. In addition, try to avoid trading on emotion, as that can lead you down a dangerous path.

Bottom Line

A bullish investor, also known as a bull, believes that the price of one or more securities will rise. A bearish investor is one who believes prices will go down and eradicate a significant amount of wealth. In a sense, both types of investors react on fear: the bullish investor is driven by fear of missing out; the bearish investor is driven by fear of losing wealth. The fact that these terms are common reflects what a prominent role investors’ sentiments or moods play in buy-and-sell decisions.

Investing Tips

- Consider talking with a financial advisor who can help you understand if an investment decision or strategy is based on emotions or something more objective. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- One way to handle your portfolio during either a bull or bear market is with a free investment calculator. Such a tool can help limit the role of emotion in your investment decisions.

Photo credit: ©www.oldyorkcellars.com, ©www.oldyorkcellars.com, ©www.oldyorkcellars.com Dutton

11 animals of the investing world other than bulls, bears that you didn't know about

From pigs to sharks to ostriches, each of these terms denotes distinct traits of the market. Read to know all about these creaturesand what they signify for investors. Which of these is you? Find out.

1. Bulls

Bulls are investors who are optimistic about the stock market. They believe the price will continue to rise. One can be bullish about individual stocks, a sector or the market as a whole. A sustained uptrend is called a bullrun.

Bears are the polar opposite of bulls. They are pessimistic about the stock market and believe that prices are likely to fall. They are so sure that they even sell shares they don’t own. When cytonn investments money market fund consistently decline, it is called a bearmarket.

3. Rabbits

4. Tortoises

Unlike the overactive rabbits, tortoises invest slowly and steadily. The typical tortoise is the longtime SIP investor or the index ETF buyer who keep plodding on despite volatility in the stock market. Tortoises win in the long term but can earn better returns if they are a little more active.

5. Snails

Some investors are content with very low returns. They will put money in low-yield traditional life insurance policies or in bank deposits. Some even let their money idle in a savings bank account. Snails don’t realise that their money loses value due to inflation.

6. Chickens

Animal instincts that stock market investors have

Which investing creature are you?

Bears

Bulls

Snails

Rabbits

Often, investors who make good money on their initial bets, turn greedy and unrealistic. These are pig investors who have very high expectations and hold on to stocks (or buy more) in the hope of even greater gains. Pigs are the biggest losers in the stock markets.

8. Ostriches

9. Sharks

Sharks are dangerous for investors. They lure retail investors with promises of very high gains on obscure stocks. Working in a team, sharks will push up the stock price by trading among themselves. When the price is very high, they dump the stock on unsuspecting buyers and vanish.

Whales

Sheep

Sheep investors have a herd mentality and blindly follow suggestions from investment advisers, SMS tips, TV anchors and other financial gurus without ascertaining if the investment suits them or not. Being followers of trends, they are the last to enter bull markets and exit bear markets late.

( Originally published on Dec 14, )

How to save tax for FY )

Download The Economic Times News App to get Daily Market Updates & Live Business News.

ETPrime stories of the day

-