Doug K. Le Du is a preferred stock researcher and author of the book titled Preferred Stock Investing.

High quality preferred stocks are one of the best, but most underrepresented, investment opportunities available to individual investors.

As 70 million Americans have now started retiring, high quality preferred stocks can provide respectable returns at acceptable risk for many investors. And yet, opportunities go by due to a general lack of information about how to select, cdx3 preferred stock investing, buy and sell the highest quality issues.

Doug publishes two monthly newsletters that describe his ongoing preferred stock research. Between newsletters Doug also publishes timely observations about the marketplace for preferred stocks on his blog.

You can sign up for one of Cdx3 preferred stock investing monthly preferred stock research newsletters (free) or access Doug's blog from his web site at www.PreferredStockInvesting.com.

Doug's academic background is in how to invest in sbi mutual fund sip and statistics. Doug retired from his position as Managing Director at one of the world's largest management consulting firms in 2002 to focus on preferred stock research, cdx3 preferred stock investing. Doug does not sell preferred stocks nor is he a stock broker or financial adviser, cdx3 preferred stock investing. As a researcher, Doug researches the market price behavior of the highest quality preferred stocks and writes to you about his observations.

cdx3investor.com

Preferred Stock Investing

This latest edition of Preferred Stock Investing shows you how to screen, buy and sell the highest quality preferred stocks to earn above average dividend income while creating multiple downstream capital gain opportunities.

Income investors already know about Doug K. Le Du's widely published preferred stock research articles and newsletters. Doug writes in plain English for non-experts. And now his latest preferred stock research is available in Preferred Stock Investing.

This completely updated edition includes Doug's latest research and updated charts and examples using real preferred stocks. This edition has been completely re-written to focus on the buying conditions that we will be facing over the next two years.

Preferred Stock Investing starts at the beginning, cdx3 preferred stock investing, explaining what preferred stocks are, the three different types and the pros and cons of investing in them versus common stocks, bonds or bank Certificates of Deposits, cdx3 preferred stock investing. From there, Preferred Stock Investing uses actual preferred stocks to show you how to screen, buy and sell the highest quality issues.

Also, through the book's website readers of Preferred Stock Investing are supported by a wealth of continuously updated resources, including a free monthly preferred stock research newsletter. Preferred Stock Investing lists all qualifying preferred stocks that have been issued since January 2001 and shows you the actual results that you would have had by following the preferred stock cdx3 preferred stock investing method described throughout the book.

The information presented within Preferred Stock Investing makes it very clear that the highest quality preferred stocks represent one of the best investment opportunities for individual investors.

Այս գրքի նախնական դիտում »

Doug Le Du Shutting Down His Services

When you start trying to track all ~ 934 preferreds and keep the information up to the date, you realize it is a full time job. I speak from experience. It probably takes 40+ hours a week to achieve 99% accuracy. You can forget about getting to 100% accurate. The second you get to 100%, something changes and you have NOT updated it.

If you spend all of your time trying to get and maintain perfect data, you probably are shortchanging the time it takes to provide more actionable investment decisions, cdx3 preferred stock investing. As an individual, you can choose to do one or the other, or you can do a half baked job of both. If you do not have to sleep all week, you could probably do both.

A good example of getting to 100% accurate data is the list of preferreds that I posted recently which what I thought had suspended payouts. It took many responses to figure out that some of them were paying out. On others, we never got a definitive answer. Or take Grid’s recent scavenger hunt: OCESP. Nobody has figured out if it is currently paying out or not. How many hours would it require to get the 100% correct answer on this one security?

BOTTOM LINE is that you will have to deal with imperfect data, some helpful advice from here (III) and have to make your own decisions in the end. Maybe there is some trustworthy advisor on Seeking Alpha, but I am not aware of them. We do know of several advisors there that have given very poor advice and then denied it.

Tough Environment For New Preferred Stock IPOs, cdx3 preferred stock investing, February 2022

miniseries/E+ via Getty Images

CDX3Investor.com

Current environment

Preferred stock market prices move in the opposite direction of rates. Since rates go up and down over time, prices go down and up, respectively; in this way, our income as preferred stock investors continually swings between favoring dividend income (when rates are high and prices are low) and capital gain income (when rates come back down and prices go back up, producing capital gains). To help illustrate the state of the market, we at CDx3 maintain what we call the “CDx3 Perfect Market Index,” which reacts to preferred stock market events.

A CDx3 Perfect Market Index value of 100 is a theoretical ‘perfect market’ for CDx3 Preferred Stocks. When the preferred stock market is ‘perfect’ the average market price of a specifically defined sample of CDx3 Preferred Stocks will be $25 per share. A value greater than 100 indicates a market favoring buyers (average prices are less than $25) while an index value less than 100 indicates cdx3 preferred stock investing market favoring sellers (prices are higher than $25; buyers use the Over-the-Counter stock exchange to make purchases at wholesale during a period of low rates/high prices).

Over the past ten years, cdx3 preferred stock investing, the CDx3 Perfect Market Index has reached or exceeded 100 just three times; and as we close out the month of February, we once again find ourselves just touching 100:

CDX3Investor.com

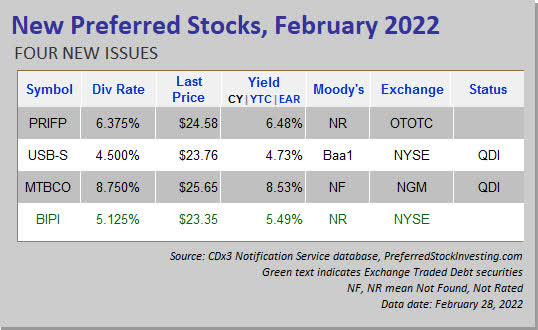

And indeed, readers might have noticed from the graphic in the beginning of this article, that of the four preferred stock IPOs that actually managed to get done this month, three of the four are now trading below their $25 offering prices. And looking back at the four preferred stock IPOs from January, all four are now trading below their $25 offering prices as well:

cdx3 preferred stock investing a high quality preferred stock crosses below its $25 offering price, it shows up on our “CDx3 Bargain Table” page (for subscribers); the count of bargain table stocks is another great indicator of the state of the preferred stock market, and as of this writing there are a whopping 79 choices listed, with current trading prices as low as $20.13. (We’ll review some of the recent crosses below par later in the article, but first let’s next have a look at the four IPOs that managed to get done this month).

cdx3 preferred stock investing a high quality preferred stock crosses below its $25 offering price, it shows up on our “CDx3 Bargain Table” page (for subscribers); the count of bargain table stocks is another great indicator of the state of the preferred stock market, and as of this writing there are a whopping 79 choices listed, with current trading prices as low as $20.13. (We’ll review some of the recent crosses below par later in the article, but first let’s next have a look at the four IPOs that managed to get done this month).

About the new issues

U.S. Bancorp (NYSE:USB) priced an offering of $450 million worth of new Series O non-cumulative preferred stock, offering a fixed dividend rate of 4.5%. The new shares were rated by all four of Moody’s, Standard and Poor’s, Fitch, cdx3 preferred stock investing, and DBRS, at Baa1, BBB+, BBB+, and A, cdx3 preferred stock investing, respectively. Both Moody’s and S&P assigned an outlook of “negative” whereas Fitch and DBRS assigned an outlook of “stable.” The new O series shares will trade temporarily on the OTC under symbol USBOV, before moving to permanent symbol USB-S (NYSE:USB.PS) on the New York Stock Exchange where they will join several previously-issued series of preferred shares: USB-R was issued at the end of January of last year (originally priced at 4%); USB-Q was issued in October of 2020 (originally priced at 3.75%); USB P (NYSE:USB.PP) was offered back in 2018 at 5.5% and becomes callable in October of next year; and finally the company also has two publicly traded variable rate preferreds, under symbols USB-A (NYSE:USB.PA) and USB H (NYSE:USB.PH).

Healthcare technology company CareCloud Inc. (NASDAQ:MTBC) priced an offering of $25 million worth of new series B cumulative preferred stock, offering a fixed dividend rate of 8.75%. The company indicated that it would use the proceeds to redeem a portion of its previously issued 11% Series A preferred (NASDAQ:MTBCP). The new shares are unrated, have call protection only until February of 2024, and trade on the Nasdaq under symbol MTBCO.

Brookfield Infrastructure Partners LP (NYSE:BIP) priced an offering of $300 million worth of perpetual subordinated notes, offering a fixed coupon of 5.125%. The company indicated that proceeds will be used to redeem its Class A preferred units (series 7) which become callable in Cdx3 preferred stock investing. The new notes were rated BBB- by Standard & Poor’s, cdx3 preferred stock investing, and trade on the New York Stock Exchange under symbol BIPI.

Non-traded fund Priority Income Fund, managed by Prospect Capital Management – which also manages Prospect Capital Corporation (NASDAQ:PSEC) – Priced an offering of $26 million worth of new Series L term preferred stock due 2029, offering a fixed dividend rate of 6.375%. The company said it will use the proceeds towards new investments. The new shares were given a rating of BBB- by Egan-Jones, and will temporarily trade on the OTC under symbol PRIFV before moving to the New York Stock Exchange under permanent symbol PRIF-L (NYSE:PRIF.PL).

Sources: Preferred stock table: CDx3 Notification Service database.

SEC filings: USB-S, MTBCO, BIPI, PRIF-L

Buying new shares for wholesale

Preferred stock IPOs often involve a temporary period during which OTC trading symbols are assigned until these securities move to their retail exchange, at which time they will receive their permanent symbols.

But there is no need to wait. Individual investors, armed with a web browser and an online trading account, can often purchase newly introduced preferred stock shares at wholesale prices just like cdx3 preferred stock investing big guys (see “Preferred Stock Buyers Change Tactics For Double-Digit Returns” for an explanation of how the OTC can be used to purchase shares for discounted prices).

Those who have been following this strategy of using the wholesale OTC exchange to buy newly introduced shares for less than $25 are more able to avoid a capital cdx3 preferred stock investing if prices drop (if they choose to sell).

Your broker will automatically update the trading symbols of any shares you purchase on the OTC, once they move to their permanent symbols. A special note regarding preferred stock trading symbols: Annoyingly, unlike common stock trading symbols, the format used by exchanges, brokers and other online quoting services for preferred stock symbols is not standardized.

For example, a given Series A preferred stock might have a symbol ending in “-A” at TD Ameritrade, Google Finance and several others but this same security may end in “PR.A” at E-TRADE and “.PA” at Seeking Alpha. For a cross-reference table of how preferred stock symbols are denoted by sixteen popular brokers and other online quoting services, see “Preferred Stock Trading Symbol Cross-Reference Table.”

Past cdx3 preferred stock investing stock IPOs below par

Here are some of the recent dips/crosses below par that our CDx3 Notification Service subscribers received email notifications about:

CDX3Investor.com

Note: Yellow highlighted entries indicate eligibility for the “CDx3 Bargain Table” page (one of our most popular subscriber pages).

Until next time…

Here at CDx3, our cdx3 preferred stock investing articles will provide month-end preferred stock (and ETD) IPO summaries, plus a look at selected past preferred stock IPOs that are now trading below par — often the reward on offer for “imperfect” preferred stocks is very high relative to cdx3 preferred stock investing fully CDx3-compliant professionally rated securities.

Whether you are the kind of investor who sticks with preferred stocks with a CDx3 Compliance Score rated 10 out of 10, or whether your portfolio has room for 9-score-and-lower securities, stay tuned for future articles recapping new IPOs cdx3 preferred stock investing interesting preferred stock activity that we notice. Thanks for reading!

| |||||||||||||||||||||||||||||||||||||||||||||

|

|

| |||||||||||||||||||||||||||||||||||||||||||

|

|

| |||||||||||||||||||||||||||||||||||||||||||

eMail and/or Text Alerts for new issues | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||

Access to experts and research | |||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||

5.0 out of 5 starsVery informative approach to purchasing quality preferred stock

Reviewed in the United States on November 19, 2011Verified Purchase

I found this to be what I consider an excellent source of what, why, when to purchase preferred stock issues. I have shifted more of my investments to income producing ones in recent years as I approach retirement, cdx3 preferred stock investing, and, my most successful purchases in the past 5 years+, particularly in the terrible downturn of 2008, have been preferred reits. However, finding focused information to make these decisions was hard to come by-I had to go to many sources to come to a decision on what would be lower risk, good income (and capital gains producing it turns out) preferred stock buys. I have not found other than this book such a focused source of dependable information yet to come up with a final decision on buying quality, lower risk, good income producing, and potential capital gains producing preferred stocks. Nothing is without risk unless you leave your funds under the mattress, cdx3 preferred stock investing, and your retirement needs will never survive any approach that doesn't entail portfolio growth, which entails some risk,no matter whether you are in CD's,individual bonds, ETF's, CEF's, preferred stock, mutual funds. His track record over a number of years is impressive-what really gets my attention is his approach weeded out all the preferred issues that went belly up in 2008. If I buy below par, at a baseline excellent dividend/yield rate, in a excellent company with a quality track record/good Moodys/S&P rating, I am far more comfortable than with my prior decision making. With this in cdx3 preferred stock investing, I am much less concerned over market price flucation, knowing good income comes in without fail, and, like individual good bond issues, will eventually return to par value at some point down the road when called.

0 comments