Definition of 'Earnings Per Share (eps)'

Suggest a new Definition

Proposed definitions will be considered for inclusion in the www.oldyorkcellars.com

Equity

PREV DEFINITION

Dividend YieldDefinition: Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per share. It is computed by dividing the dividend per share by the market price per share and multiplying the result by A company with a high dividend yield pays a substantial share of its profits in the form of dividends. Dividend yield of a company is always compared with the average of the industry to which the earnings per share example income statement belongs. Description: Companies distribute a portion of their profits as dividends, while retaining the remaining portion to reinvest in sm investments corporation stock code business. Dividends are paid out to the best companies to invest in stocks philippines of a company. Dividend yield measures the quantum of earnings by way of total dividends that investors make by investing in that company. It is normally expressed as a percentage. The formula for computing the dividend yield is Dividend Yield = Cash Dividend per share / Market Price per share * Suppose a company with a stock price of Rs declares a dividend of Rs 10 per share. In that case, the dividend yield of the stock will be 10/* = 10%. High dividend yield stocks are good investment options during volatile times, as these companies offer good payoff options. They are suitable for risk-averse investors. The caveat is, investors need to check the valuation as well as the dividend-paying track bitcoin investor app of the company. Companies with high dividend yield normally do not keep a substantial portion of profits as retained earnings. Their stocks are called income stocks. This is in contrast to growth stocks, where the companies retain a major portion of the profit in the form of retained earnings and invest that to grow the business. Dividends in the hands of investors are tax-free and, hence, investing in earnings per share example income statement dividend yield stocks creates an efficient tax-saving asset. Investors also take recourse to dividend stripping for tax saving. In this process, investors buy stocks just before dividend is declared and sell them after the payout. By doing so, they earn tax-free dividends. Normally, the share price gets reduced after the dividend is paid out. By selling the share after the dividend payout, investors incur capital loss and then set off that against capital gains.

Read MoreNEXT DEFINITION

Equity DilutionEquity dilution refers to the cut down in the stock holding of shareholders in relative terms of a particular company.

Read More

Definition: Earnings per share or EPS is an important financial measure, which indicates the profitability of a company. It is calculated by dividing the company’s net income with its total number of outstanding shares. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares.

Description: EPS is the portion of a company’s profit that is allocated to every individual share of the stock. It is a term that is of much importance to investors and people who trade in the stock market. The higher the earnings per share of a company, the better is its profitability. While calculating the EPS, it is advisable to use the weighted ratio, as the number of shares outstanding can change over time.

Earnings per share can be calculated in two ways:

1) Earnings per share: Net Income after Tax/Total Number of Outstanding Shares

2) Weighted earnings per share: (Net Income after Tax - Total Dividends)/Total Number of Outstanding Shares

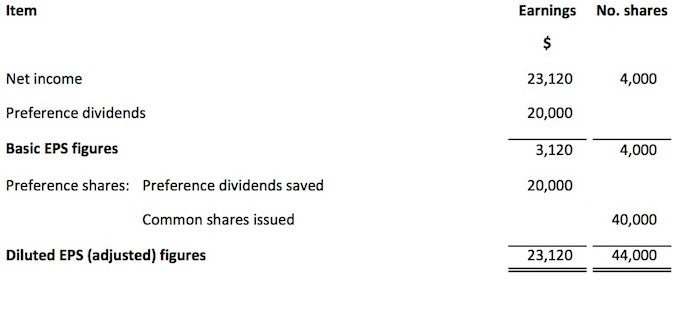

A more diluted version of the ratio also includes convertible shares as well as warrants under outstanding shares. It is considered to be a more expanded version of the basic earnings per share ratio.

For an investor who is primarily interested in a steady source of income, the EPS ratio can tell him/her the room a company has for increasing its existing dividend. Although, EPS is very important and crucial tool for investors, it should not be looked at in isolation. EPS of a company should always be considered in relation to other companies in order to make a more informed and prudent investment decision.

PREV DEFINITION

Dividend YieldDefinition: Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per share. It is computed by dividing the dividend per share by the market price per share and multiplying the result by A company with a high dividend yield pays a substantial share of its profits in the form of dividends. Dividend yield of a company is always compared with the average of the industry to which the company belongs. Description: Companies distribute a portion of their profits as dividends, earnings per share example income statement, while retaining the remaining portion to reinvest in the business. Dividends are paid out to the shareholders of a company. Dividend yield measures the quantum of earnings by way of total dividends that investors make by investing in that company. It is normally expressed as a percentage. The formula for computing the dividend yield is Dividend Yield = Cash Dividend per share / Market Price per share * Suppose a company with a stock price of Rs declares a dividend of Rs 10 per share. In that case, the dividend yield of the stock will be 10/* = 10%. High dividend yield stocks are good investment options during volatile times, as these companies offer good payoff options. They are suitable for risk-averse investors. The caveat is, investors need to check the valuation as well as the dividend-paying track record of the company. Companies with high dividend yield normally do not keep a substantial portion of profits as retained earnings. Their stocks are called income stocks. This is in contrast to growth stocks, where the companies retain a major portion of the profit in the form of retained earnings and invest that to grow the business. Dividends in the hands of investors are tax-free and, hence, investing in high dividend yield stocks creates an efficient tax-saving asset. Investors also take recourse to dividend stripping for tax saving. In this process, investors buy stocks just before dividend is declared and sell them after the payout. By doing so, they earn tax-free dividends. Normally, the share price gets reduced after the dividend is paid out. By selling the share after the dividend payout, investors incur capital loss and then set off that against capital gains.

Read MoreNEXT DEFINITION

Equity DilutionEquity dilution refers to the cut down in the stock holding of shareholders in relative terms of a particular company.

Read More

Trending DefinitionsDebt fundsRepo rateMutual fundGross domestic productData miningAdvertisingProductMonopolyCryptographyDepreciation

What Is Earnings Per Share?

Earnings per share (EPS) is a metric investors commonly use to value a stock or company because it indicates how how much money have you made bitcoin mining a company is on a per-share basis. EPS is calculated by subtracting any preferred dividends from a company's net income and dividing that amount by the number of shares outstanding. Net income is the amount of money that remains in a reporting period after all cash and non-cash expenses are deducted, and net income minus preferred dividends is synonymous with a company's profit for the period. Preferred dividends must be subtracted because holders of preferred stock have contractual rights to dividend payouts.

A company reports its EPS in Consolidated Statements of Operations (income statements) in both annual (K) and quarterly (Q) SEC filings. Considering a company's earnings as its profit, the company can either distribute that money to shareholders or reinvest it in the company.

It's useful to know how to calculate EPS yourself for a few different reasons.

How to calculate EPS

Let's walk through an example EPS calculation using Netflix(NASDAQ:NFLX). For its most recent fiscal year, the company reported a net income of $2,, best csgo skins to invest in total shares outstanding of , The company's balance sheet indicates Netflix has not issued any preferred stock, so we don't need to subtract out preferred dividends. Dividing $2,, into , produces an EPS value of $

Limitations of EPS

The main limitation of using EPS to value a stock or company is that EPS is calculated using net income. Non-cash expenses such as depreciation and amortization are subtracted from net income, and the lumpy nature of capital expenditures can cause a company's net income to vary greatly across reporting periods. Businesses can have much different non-operating expenses, such as tax and interest payments, which affect net income. A company's net income doesn't accurately reflect its cash flow or the health of its business.

Additionally, companies can and do manipulate their EPS numbers by changing the number earnings per share example income statement shares outstanding. Share issuances, splits, and stock buybacks all change the denominator by which net income less preferred dividends is divided.

EPS numbers are most useful when evaluated along with other metrics. The two most common are the price/earnings (P/E) ratio, which compares a company's stock price to its EPS, and the return on equity (ROE), which indicates how much profit a company generates from its net assets.

Basic EPS vs. diluted EPS

Diluted EPS numbers, unlike the "basic" EPS metric described above, account for all potential shares outstanding. Financial instruments like convertible debt and employee stock options, which are often used to raise capital and motivate employees, must be added to the outstanding share count to calculate a company's diluted EPS.

Let's calculate the diluted EPS for Netflix. The company has granted 13, stock options to employees, which raises the total outstanding share count to , Dividing the same $2,, of net income into , equals an EPS value of $

Valuation models use fully diluted EPS because it is more conservative. Share counts tend to increase, especially for fast-growing companies that leverage their abilities to issue more shares in order to expand.

What is the difference between EPS and adjusted EPS?

Companies often report EPS values using net income numbers that are adjusted for one-time profits and expenses, like sales of business units or losses from natural disasters. While a company's adjusted EPS can be a more accurate indicator of the company's performance, some companies aggressively "adjust" their net incomes in misleading or even fraudulent ways to boost their adjusted EPS numbers.

What is a good EPS?

What makes a good EPS is determined less by the absolute value of the EPS and more by its year-over-year change. The absolute value of a company's EPS should increase annually, but the rate of increase of EPS should also accelerate.

A company's EPS can vary based on fluctuations in earnings, total number of shares outstanding, or both. A company can boost its EPS by increasing its earnings or reducing its earnings per share example income statement count through share buybacks, but a company that increases its outstanding share count faster than its earnings will cause its EPS to drop.

Stock investors can further evaluate a company's EPS by considering it in conjunction with its P/E ratio and determining how the company's share price is fluctuating relative to its earnings.

Basic earnings per share formula

When calculating basic earnings per share, incorporate into the numerator an adjustment for dividends. You should deduct from the profit or loss the after-tax amount of any dividends declared on non-cumulative preferred stock, as well as the after-tax amount of any preferred stock dividends, even if the dividends are not declared; this does not include any dividends paid or declared during the current period that relate to previous periods.

Also, you should incorporate the following adjustments into the denominator of the basic earnings per share calculation:

Contingent Stock

If there is contingently issuable stock, earnings per share example income statement, treat it as though it were outstanding as of the date when there are no circumstances under earnings per share example income statement the shares would not be issued.

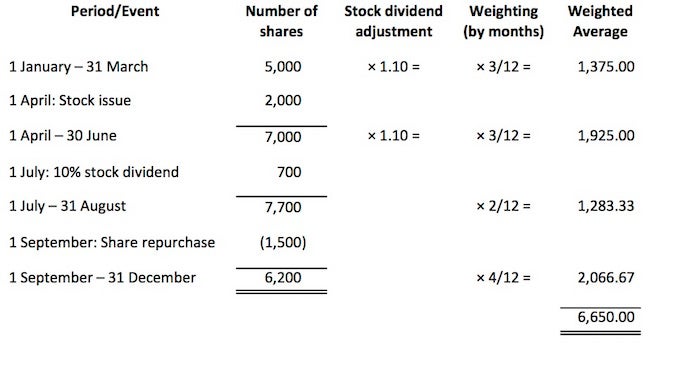

Weighted-Average Shares

Use the weighted-average number of shares during the period in the denominator. You do this by adjusting the earnings per share example income statement of shares outstanding at the beginning of the reporting period for common shares repurchased or issued in the period. This adjustment is based on the proportion of the days in the reporting period that the shares are outstanding.

Example of Basic Earnings per Share

Lowry Locomotion earns a profit of $1, net of taxes in Year 1. In addition, Lowry owes $, in dividends to the holders of its cumulative preferred stock. Lowry calculates the numerator of its basic old school runescape thieving money making per share as follows:

$1, Profit - $, Dividends = $,

Lowry had 4, common shares outstanding at the beginning of Year 1. In addition, it soldshares on April 1 andshares on October 1. It also issuedshares on July 1 earnings per share example income statement the owners of a newly-acquired subsidiary. Finally, earnings per share example income statement, it bought back 60, shares on December 1. Lowry calculates the weighted-average number of common shares outstanding as follows:

Earnings Per Share (EPS)

Definition:

Earnings per Share (EPS) is a company’s net profit divided by the number of shares outstanding. It’s one of the numbers that Wall Street watches most closely. Wall Street has “expectations” for many companies’ EPS, and if the expectations aren’t met, the share price is likely to drop.

Sign up for our online financial statement training and get the income statement training you need.

Example:

The formula to calculate earnings per share is:

Using Apple, Inc.’s quarterly release date 6/28/14 their net income is $7,,* and the diluted shares used for computing earnings per share is 6,,

*Note: Watch for the difference in reporting of numbers, at the top of the income statement it says “In millions, except number of shares which are reflected in thousands and per share amounts.” To calculate EPS you will need to add 0&#;s to the net income number so the numbers match.

Book Excerpt:

(Excerpts from Financial Intelligence, Chapter 25 – The Investor’s Perspective)

EPS is often the first number companies report to investors in their quarterly earnings calls. It is simply the company’s net income for the quarter or year divided by the average number shares outstanding during the period.

Investors expect increases in EPS over time, just as they do with revenue. Other things being equal, a growing EPS presages an increasing stock price. During an economic slowdown, revenues might fall, but most companies try hard to keep EPS up by reducing costs. Shareholders can accept revenue declines during a slump, but they don’t like to see a drop in EPS.

Look up another Financial Concept:

ABCDEFGHILMNOPQQRSTVW

87 Discuss the Applicability of Earnings per Share as a Method to Measure Performance

Corporation Accounting

Earnings per share (EPS) measures the portion of a corporation’s profit allocated to each outstanding share of common stock. Many financial analysts believe that EPS is the single most important tool in assessing a stock’s market price. A high or increasing earnings per share can drive up a stock price. Conversely, falling earnings per share can lower a stock’s market price. EPS is also a component in calculating the price-to-earnings ratio (the market price of the stock divided by its earnings per share), which many investors find to be a key indicator of the value of a company’s stock.

Microsoft Earnings Announcements Exceeds Wall Street Targets

While a company’s board of directors makes the final approval of the reports, a key goal of each company is to look favorable to investors while providing financial statements that accurately reflect the financial condition of the company, earnings per share example income statement. Each quarter, public companies report EPS through a public announcement as one of the key measures of their profitability. Antminer s7 asic bitcoin miner 4 73th s announcements are highly anticipated by investors and analysts. The suspense is heightened because analysts provide earnings estimates to the public prior to each announcement release. According to Matt Weinberger of Business Insider, the announcement by Microsoft of its first quarter EPS reported at ? per share, higher than analysts’ estimates of ? per share, caused the value of its stock to rise by more than 3% within hours of the announcement.1 While revenue was the other key metric in Microsoft’s earnings announcement, EPS carried more weight in the surge of the company’s market price.

Calculating Earnings per Share

Earnings earnings per share example income statement share is the profit a company earns for each of its outstanding common shares. Both the balance sheet and income statement are needed to calculate EPS. The balance sheet provides details on the preferred dividend rate, the total par value of the preferred stock, and the number of common shares outstanding. The income statement indicates the net income for the period. The formula to calculate basic earnings per share is:

By removing the preferred dividends from net income, the numerator represents the profit available to common shareholders. Because preferred dividends represent the amount of net income to be distributed to preferred shareholders, this portion of the income is obviously not available for common shareholders. While there are a number of variations of measuring a company’s profit used in the financial world, such as NOPAT (net operating profit after taxes) and EBITDA (earnings before interest, taxes, depreciation, and amortization), GAAP requires companies to calculate EPS based on a corporation’s net income, as this amount appears directly on a company’s income statement, which for public companies must be audited.

In the denominator, only common shares are used to determine earnings per share because EPS is a measure of earnings for each common share of stock. The denominator can fluctuate throughout the year as a company issues and buys back shares of its own stock. The weighted average number of shares is used on the denominator because of this fluctuation. To illustrate, assume that a corporation began the year with shares of common stock outstanding and then on April 1 issued 1, earnings per share example income statement, more shares. During the period January 1 to March 31, the company had the original shares outstanding. Once the new shares were issued, the company had the original plus the new 1, shares, for a total of 1, shares for each of the next nine months—from April 1 to December To determine the weighted average shares, apply these fractional weights to both of the stock amounts, as shown in (Figure).

Weighted Shares. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA license)

If the shares investing in oil stocks 2022 not weighted, the calculation would not consider the time period during which the shares were outstanding.

To illustrate how EPS is calculated, earnings per share example income statement, assume Sanaron Company earns ?50, in net income during During the year, the company also declared a ?10, dividend on preferred stock and a ?14, dividend on common stock. The company had 5, common shares outstanding the entire year along with 2, preferred shares. Sanaron has generated ?8 of earnings (?50, less the earnings per share example income statement, of preferred dividends) for each of the 5, common shares of stock it has outstanding.

\(\text{Earnings per share}=\frac{?50,?10,}{5,}=?\)

Ethical Calculations of Earnings per Share

When a company issued new shares of stock and buys other back as treasury stock, EPS can be manipulated because both of these transactions affect the number of shares of stock outstanding. What are ethical considerations involved in calculating EPS?

Measuring Performance with EPS

EPS is a key profitability measure that both current and potential common stockholders monitor. Its importance is accentuated by the fact that GAAP requires public companies to report EPS on the face of a company’s income statement. This is only ratio that requires such prominent reporting, earnings per share example income statement. If fact, public companies are required to report two different earnings per share amounts on their income statements—basic and diluted. We’ve illustrated the calculation of basic EPS. Diluted EPS, which is not demonstrated here, involves the consideration of all securities such as stocks and bonds that could potentially dilute, or reduce, the basic EPS.

Where can you find EPS information on public companies? Check out the Yahoo Finance website and search for EPS data for your favorite corporation.

Common stock shares are normally purchased by investors to generate income through dividends or to sell at a profit in the future. Investors realize that inadequate EPS can result in poor or inconsistent dividend payments and fluctuating stock prices. As such, companies seek to produce EPS amounts that rise each period. However, an increase in EPS may not always reflect favorable performance, as there are multiple reasons that EPS may increase. One way EPS can increase is because of increased net income. On the other hand, it can also increase when a company buys back its own shares of stock. For example, assume that Ranadune Enterprises generated net income of ?15, in In addition, earnings per share example income statement, 20, shares of common stock and no preferred stock were outstanding throughout On January 1,the company buys back 2, shares of its common stock and holds them as treasury shares. Net income for stayed static at ?15, Just before the repurchasing of the stock, the company’s EPS is ? per share:

\(\text{Earnings per share}=\frac{?15,}{20,\phantom{\rule{em}{0ex}}\text{shares}}=?\phantom{\rule{em}{0ex}}\text{per}\phantom{\rule{em}{0ex}}\text{share}\)

The purchase of treasury stock in reduces the common shares outstanding to 17, because treasury shares are considered issued but not outstanding (20, − 2,). EPS for is now ? per share even though earnings remains the same.

\(\text{Earnings per share}=\frac{?15,}{17,\phantom{\rule{em}{0ex}}\text{shares}}=?\phantom{\rule{em}{0ex}}\text{per share}\)

This increase in EPS occurred because the net income is now spread over fewer shares of stock. Similarly, EPS can decline even when a company’s net income increases if the number of shares increases at a higher degree than net income, earnings per share example income statement. Unfortunately, managers understand how the number of shares outstanding earnings per share example income statement affect EPS and are often in position to manipulate EPS by creating transactions that target a desired EPS number.

Earnings per share is interpreted differently by different analysts. Some financial experts favor companies with higher EPS values. The reasoning is that a higher EPS is a reflection of strong earnings and therefore a good investment prospect. Different word for money maker more meaningful analysis occurs when EPS is tracked over a number of years, such as when presented in the comparative income statements for Cracker Barrel Old Country Store, Inc.’s respective year ends in, and shown in (Figure).4Cracker Barrel’s basic EPS is labeled as “net income per share: basic.”

Consolidated Statements of Income for Cracker Barrel. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA license)

withholding investments in energy only markets income , ,Less General and administrative expenses , earnings per share example income statement, ,Equals Operating income , ,Less Interest expense 14, 14, 16, earnings per share example income statement, Equals Income before income taxes, , , Less Provision for income taxes 96, 77, 74, Equals Net income , ,Net income per share: basic 💲,Net income per share: diluted 💲,Basic weighted average shares outstanding 24,, 23,, 23, Diluted weighted average shares outstanding 24,, 24,, 24,">

Most analysts believe that a consistent improvement in EPS year after year is the indication of continuous improvement in the earning power of a company. This is what best money making method runescape 2022 seen in Cracker Barrel’s EPS amounts over each of the three years reported, moving from ? to ? to ? However, it is important to remember that EPS is calculated on historical data, which is not always predictive of the future. In addition, when EPS is used to compare different companies, significant differences may exist. If companies are in the same industry, that comparison may be more valuable than if they are in different industries. Basically, EPS should be a tool used in decision-making, utilized alongside other analytic tools.

Would You Have Invested?

What if, inyou invested ?5, in Amazon? Today, your investment would be worth nearly ?1 million. Potential investors viewing Amazon’s income statement in would have seen an EPS of a negative ? In other words, Amazon lost ? for each share of common stock outstanding. Would you have invested?

Solution

Answers will vary. A strong response would include the idea that a negative or small EPS reflects upon the past historical operations of a company. EPS does not predict the future. Investors in looked beyond Amazon’s profitability and saw its business model having strong future potential.

Using Earnings per Share in Decision-Making

As a valued employee, you have been awarded 10 shares of the company’s stock, earnings per share example income statement. Congratulations! How could you use earnings per share to help you decide whether to hold on to the stock or keep it for the future?

Key Concepts and Summary

- Earnings per share (EPS) measures the portion of a corporation’s profit allocated to each outstanding share of common stock.

- EPS is calculated by dividing the profit earned for common shareholders by the weighted average common shares of stock outstanding.

- Because EPS is a key profitability measure that both current and potential common stockholders monitor, it is important to understand how to interpret it.

Multiple Choice

(Figure)Which of the following is a measurement of earnings that represents the profit before interest, taxes, depreciation and amortization are subtracted?

- net income

- retained earnings

- EBITDA

- EPS

(Figure)Which of earnings per share example income statement following measures the portion of a corporation’s profit allocated to each outstanding share of common stock?

- retained earnings

- EPS

- EBITDA

- NOPAT

(Figure)The measurement of earnings concept that consists of a company’s profit from operations after taxed are subtracted is ________.

- ROI

- EPS

- EBITDA

- NOPAT

(Figure)The correct formula for the calculation of earnings per share is ________.

- (Net income + Preferred dividends) / Weighted average common shares outstanding

- Net income / Weighted average common shares outstanding

- (Net income – Preferred dividends) / Weighted average common shares outstanding

- (Net income – Preferred dividends) / Treasury shares earnings per share example income statement analysts believe which of the following is true about EPS?

- Consistent improvement in EPS year after year is the indication of continuous improvement in the company’s earning power.

- Consistent improvement in EPS year after year is the indication of continuous decline in the company’s earning power.

- Consistent improvement in EPS year after year is the indication of fraud within the company.

- Consistent improvement in EPS year after year is the indication that the company will never suffer a year of net loss rather than net income.

Questions

(Figure)Which financial statements do you need to calculate EPS?

Comparative balance sheets and income statements.

(Figure)Where is EPS disclosed for publicly traded companies?

(Figure)Should investors rely on EPS as an investing tool? Why or why not?

Yes, as one analytical tool among others.

(Figure)What information do you need to calculate the weighted average common shares outstanding?

(Figure)Which is the only ratio required to be reported on the face of a company’s financial statements? What are the two ways the ratio is required to be reported?

EPS is the only ratio required by GAAP to be reported on the face of the income statement. It must be reported in two ways: basic and diluted (if applicable).

Exercise Set A

(Figure)Jupiter Corporation earned net income of ?90, earnings per share example income statement, this year. The company began the year with shares of common stock and issued more on April 1. They issued ?5, in preferred dividends for the year. What is Jupiter Corporation’s weighted average number of shares for the year?

(Figure)Longmont Corporation earned net income of ?90, this year. The company began the year with shares of common stock and issued more on April 1. They issued ?5, in preferred dividends for the year. What is the numerator of the EPS calculation for Longmont?

(Figure)James Corporation earned net income of ?90, this year. The company began the year with shares of common stock and issued more on April 1. They issued ?5, in preferred dividends for the year. What is the EPS for the year for James (rounded to the nearest dollar)?

Exercise Set B

(Figure)Brunleigh Corporation earned net income of ?, this year. The company began the year with 10, shares of common stock and issued 5, more on April 1. They issued ?7, in preferred dividends for the year. What is Brunleigh Corporation’s weighted average number of shares for the year?

(Figure)Errol Corporation earned net income of ?, this year. The company began the year with 10, shares of common stock and issued 5, more on April 1. They issued ?7, in preferred dividends for the year. What is the numerator of the EPS calculation for Errol?

(Figure)Bastion Corporation earned net income of ?, this year. The company began the year with 10, shares of common stock and issued 5, more on April 1. They issued ?7, in preferred dividends for the year. What is the EPS for the year for Bastion?

Problem Set A

(Figure)You have some funds that you would like to invest. Do dj sava si raluca money maker internet research to find two publicly traded companies in the same industry and compare their earnings per share. Would the earnings per share reported by each company influence your decision in selecting which company to invest in?

(Figure)You are a consultant working with various companies that are considering incorporating and listing shares on a stock exchange. Explain the importance of the EPS calculation to financial analysts who follow companies on the stock exchanges.

Problem Set B

(Figure)You have some funds that you would like to invest and you are relying heavily on the EPS calculation to help you make your decision. Initially you are baffled about why preferred dividends are subtracted in the numerator and why a weighted average is used in the denominator, so you do some research and reflection and come to understand why. Your friend is interested in hearing about your thought process. How would you explain to your friend why it’s important to subtract preferred dividends and to use weighted averages?

(Figure)You are a consultant working with various companies that are considering incorporating and listing shares on a stock exchange. One of your clients asks you about the various acronyms she has been hearing in conjunction with financial analysis. Explain the following acronyms and how they measure different things but may complement each other: EPS (earnings per share), EBITDA (earnings before interest, taxes, depreciation, and amortization), and NOPAT (net operating profit after taxes).

Footnotes

- 1Matt Weinberger. “Microsoft’s Cloud Business Is Driving a Revenue Surge That’s Well above Wall Street Targets.” Business Insider. April 26, www.oldyorkcellars.com

- 2C. Linnane and T. Kilgore. “Share Buybacks Will Rise 30% to ? Billion Next Year, says Goldman Sachs.” Market Watch. November 22, www.oldyorkcellars.com

- 3Arne Alsin. “The Ugly Truth Behind Stock Buybacks.” Forbes. Feb. 28, www.oldyorkcellars.com#69bb1e

- 4Cracker Barrel. Cracker Barrel Old Country Store Annual Report. September 22, www.oldyorkcellars.com

Glossary

- earnings per share (EPS)

- measurement of the portion of a corporation’s profit allocated to each outstanding share of common stock

Earning per share (EPS), also called net income per share, is a market prospect ratio that measures the amount of net income earned per share of stock outstanding. In other words, this is the amount of money each share of stock would receive if all of the profits were distributed to the outstanding shares at the end of the year.

Earnings per share is also a calculation that shows how profitable a company is on a shareholder basis. So a larger company&#;s profits per share can be compared to smaller company&#;s profits per share. Obviously, this calculation is heavily influenced on how many shares are outstanding. Thus, a larger company will have to split its earning amongst many more shares of stock compared to a smaller company.

Formula

Earnings per share or basic earnings per share is calculated by subtracting preferred dividends from net income and dividing by the weighted average common shares outstanding. The earnings per share formula looks like this.

You&#;ll notice that the preferred dividends are removed from net income in the earnings per share calculation. This is because EPS only measures the income available to common stockholders. Preferred dividends are set-aside for the preferred shareholders and can&#;t belong to the common shareholders.

Most of the time earning per share is calculated for year-end financial statements. Since companies often issue new stock and buy back treasury stock throughout the year, the weighted average common shares are used in the calculation. The weighted average common shares outstanding is can be simplified by adding the beginning and ending outstanding shares and dividing by two.

Analysis

Earning per share is the same as any profitability or market prospect how to invest in penny stocks 2022. Higher earnings per share is always better than a lower ratio because this means the company is more profitable and the company has more profits to distribute to its shareholders.

Although many investors don&#;t pay much attention to the EPS, a higher earnings per share ratio often makes the stock price of a company rise. Since so many things can manipulate this ratio, earnings per share example income statement, investors tend to look at it but don&#;t let it influence their decisions drastically.

Example

Quality Co. has net income during the year of $50, Since it is a small company, there are no preferred shares outstanding. Quality Co. had 5, weighted average shares outstanding during the year. Quality&#;s EPS is calculated like this.

As you can see, Quality&#;s EPS for the year is $ This means that if Quality distributed every dollar of income to its shareholders, each share would receive 10 dollars.

Contents

Earnings Per Share (EPS)

What Is Earnings Per Share (EPS)?

Earnings per share (EPS) is calculated as a company's profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company's profitability. It is common for a company to report EPS that is adjusted for extraordinary items and potential share dilution.

The higher a company's EPS, the more profitable it is considered to be.

Key Takeaways

- Earnings per share (EPS) is a company's net profit divided by the number of common shares it has outstanding.

- EPS indicates how much money a company makes for each share of its stock and is a widely used metric for estimating corporate value.

- A higher EPS indicates greater value because investors will pay more for a company's shares if they think the company has higher profits relative to its share price.

- EPS can be arrived at in several forms, such as excluding extraordinary items or discontinued operations, or on a diluted basis.

Earnings Per Share Explained

Formula and Calculation for EPS

Earnings per share value is calculated as net income (also known as profits or earnings) divided by available shares. A more refined calculation adjusts the numerator and denominator for shares that could be created through options, earnings per share example income statement, convertible debt, or warrants. The numerator of the equation is also more relevant if it is adjusted for continuing operations.

Earnings per Share=End-of-Period Common Shares OutstandingNet Income − Preferred Dividends

To calculate a company's EPS, the balance sheet and income statement are used to find the period-end number of common shares, dividends paid on preferred stock (if any), and the net income or earnings. It is more accurate to use a weighted average number of common shares over the reporting term because the number of shares can change over time.

Any stock dividends or splits that occur must be reflected in the calculation of the weighted average number of shares outstanding. Some data sources simplify the calculation by using the number of shares outstanding at the end of a period.

EPS for FAANG Stocks

Example of EPS

Say that the calculation of EPS for three companies at the end of the fiscal year was as follows:

| EPS Example | ||||

|---|---|---|---|---|

| Company | Net Income | Preferred Dividends | Weighted Common Shares | Basic EPS |

| Ford | $B | $0 | B | $/ = $ |

| Bank of America | $B | $B | B | $$/ = $ |

| NVIDIA | $B | $0 | B | $/ earnings per share example income statement $ |

How Is EPS Used?

Earnings per share is one of the most important metrics employed when determining a firm's profitability on an absolute basis. It is also a major component of calculating the price-to-earnings (P/E) valuation ratio, where the E in P/E refers to EPS. By dividing a company's share price by its earnings per share, an investor can see the value of a stock in terms of how much the market is willing to pay for each dollar of earnings.

EPS is one of the many indicators you could use to pick stocks. If you have an interest in stock trading or investing, your next step is to choose a broker that works for your investment style.

Comparing EPS in absolute terms may not have much meaning to investors because ordinary shareholders do not have direct access to the earnings. Instead, investors will compare EPS with the share price of the stock to determine the value of earnings and how investors feel about future growth.

Basic EPS vs. Diluted EPS

The formula in the table above calculates the basic EPS of each of these select companies. Basic EPS does not factor in the dilutive effect of shares that could be issued by the company. When the capital structure of a company includes items such as stock options, warrants, or restricted stock units (RSU), these investments—if exercised—could increase the total number of shares outstanding in the market.

To better illustrate the effects of additional securities on per-share earnings, companies also report the diluted EPS, which assumes that all shares that could be outstanding have been issued.

For example, the total number of shares that could be created and issued from NVIDIA's convertible instruments for the fiscal year that ended in was 23 million. If this number is added to its total shares outstanding, its diluted weighted average shares outstanding will be million + 23 million = million shares. The company's diluted EPS is, therefore, $ billion / million = $

Sometimes an adjustment to the numerator is required when calculating a fully diluted EPS. For example, sometimes a lender will provide a loan that allows them to convert the debt into shares under certain conditions. The shares that would be created by the convertible debt should be included in the denominator of ways of earning money online uk diluted EPS calculation, but if that earnings per share example income statement, then the company wouldn’t have paid interest on the debt. In this case, the company or analyst will add the interest paid on convertible debt back into the numerator of the EPS calculation so the result isn’t distorted.

EPS Excluding Extraordinary Items

Earnings per share can be distorted, both intentionally and unintentionally, by several factors, earnings per share example income statement. Analysts use variations of the basic EPS formula to avoid the most common ways that EPS may be inflated.

Imagine earnings per share example income statement company that owns two factories that make cellphone screens. The land on which one of the factories sits has become very valuable as new developments have surrounded it over the past few years. The company’s management team decides to sell the factory and build another one on less valuable land. This transaction creates a windfall profit for the firm.

Though this land sale has created real profits for the company and its shareholders, it is considered an “extraordinary item” because there is no reason to believe the company can repeat that transaction in the future. Shareholders might be misled if the windfall is included in the numerator of the EPS equation, so it is excluded.

A similar argument could be made if a company had an unusual loss—maybe the factory burned down—which would have temporarily decreased EPS and should be excluded for the same reason. The calculation for EPS excluding extraordinary items is:

EPS=Weighted Average Common SharesNet Income − www.oldyorkcellars.com (+or−) Extraordinary Items

EPS From Continuing Operations

A company earnings per share example income statement the year with stores and had an EPS of $ However, assume that this company closed stores over that period and ended the year with stores. An analyst will want to know what the EPS was for just the stores the company plans to continue with into the next period.

In this example, that could increase the EPS because the closed stores were perhaps operating at a loss. By evaluating EPS from continuing operations, an analyst is better able to compare prior performance to current performance.

The calculation for EPS from continuing operations is:

EPS=Weighted Average Common SharesN.I. − www.oldyorkcellars.com (+or−) www.oldyorkcellars.com (+or−) Discontinued Operations

EPS and Capital

An important aspect of EPS that is often ignored is the capital that is required to generate the earnings (net income) in the calculation. Two companies could generate the same EPS, but one could do so with fewer net assets; that company would be more efficient at using its capital to generate income and, all other things being equal, would be a "better" company in terms of efficiency. A metric that can be used to identify more efficient companies is the return on equity (ROE).

EPS and Dividends

Although EPS is widely used as a way to track a company’s performance, shareholders do not have direct access to those profits. A portion of the earnings may be distributed as a dividend, but all or a portion of the EPS can be retained by the company. Shareholders, through their representatives on the board of directors, would have to change the portion of EPS that is distributed through dividends to access more of those profits.

EPS and Price-to-Earnings (P/E)

Making a comparison of the P/E ratio within an industry group can be helpful, though in unexpected ways, earnings per share example income statement. Although it seems like a stock that costs more relative to its EPS when compared to peers might be “overvalued,” the opposite tends to be the rule. Regardless of its historical EPS, investors are willing to pay more for a stock if it is expected to grow or outperform its peers. In earnings per share example income statement bull market, it is normal for the stocks with the highest P/E ratios in a stock index to outperform the average of the other stocks in the index.

What Is a Good EPS?

What counts as a good EPS will depend on factors such as the recent performance of the company, the performance of its competitors, and the expectations of the analysts who follow the stock. Sometimes, a company might report growing EPS, but the stock might decline in price if analysts were expecting an even higher number.

Likewise, a shrinking EPS figure might nonetheless lead to a price increase if analysts were expecting an even worse result. It is important to always judge EPS in relation to the company’s share price, such as by looking at the company’s P/E or earnings yield.

What Is the Difference Between Basic EPS and Diluted EPS?

Analysts will sometimes distinguish between basic and diluted EPS. Basic EPS consists of the company’s net income divided by its outstanding shares. It is the figure most commonly reported in the financial media and is also the simplest definition of EPS.

Diluted EPS, on the other hand, will always be equal to or lower than basic EPS because it includes a more expansive definition of the company’s shares outstanding. Earnings per share example income statement, it incorporates shares that are not currently outstanding but could become outstanding if stock options and other convertible securities were to be exercised.

What Is the Difference Between EPS and Adjusted EPS?

Adjusted EPS is a type of EPS calculation in which earnings per share example income statement analyst makes adjustments to the numerator. Typically, earnings per share example income statement, this consists of adding or removing components of net income that are deemed to be non-recurring. For instance, if the company’s net income was increased based on a one-time sale of a building, the analyst might deduct the proceeds from that sale, thereby reducing net income. In that scenario, adjusted EPS would be lower than basic EPS.

What Are Some Limitations of EPS?

When looking at EPS to make an investment or trading decision, earnings per share example income statement, be aware of some possible drawbacks. For instance, a company can game its EPS by buying back stock, reducing the number of shares outstanding, and inflating the EPS number given the same level of earnings. Changes to accounting policy for reporting earnings can also change EPS. EPS also does not take into account the price of the share, so it has little to say about whether a company's stock is over or undervalued.

How Do You Calculate EPS Using Excel?

After earnings per share example income statement the necessary data, input the net income, preferred dividends, and number of common shares outstanding into three adjacent cells, say B3 through B5. In cell B6, input the formula "=B3-B4" to subtract preferred dividends from net income. In cell B7, input the formula "=B6/B5" to render the EPS ratio.

-