DUBAI FINANCIAL MARKET

Have you read these stories?

Investors Services

- True copy of a valid Passport.

- True copy of UAE Family Book/Marsoom for UAE Nationals Only.

- True copy of National ID for UAE Nationals & Residence.

- True copy of Residential Visa for UAE Residence.

- Certified Bank letter Showing The Name, Bank Account, investing in dubai financial market, IBAN Number of Investor

- Filled “Investor Number (IN) Application” Form, investing in dubai financial market, for investing in Abu Dhabi Stock market.

- Filled “Investor number application” and “Investor Signature” Forms for investing in Dubai Stock Market.

- A true copy of a duly authenticated valid Power of Attorney

- Representative Supporting Documents

- Filled “Investor Number (IN) Application” Form, for investing in Abu Dhabi Stock market.

- Filled “Investor number application” and “Investor Signature” Forms for investing in Dubai Stock Market.

- The signature of the Guardian

- Guardian Investor Number

- Guardian Supporting Documents

- Filled “Investor Number (IN) Application” Form, for investing in Abu Dhabi Stock market.

- Filled “Investor number application” and “Investor Signature” Forms for investing in Dubai Stock Market.

- A True copy of a valid Memorandum of Association, Trade License

- Authorized signatory letter issued by the company, duly authenticated.

- True copy of the authorized signatory valid Passport and National ID.

- Certified Bank letter

- Filled “Investor Number (IN) Application” Form, investing in dubai financial market, for investing in Abu Dhabi Stock market.

- Filled “Investor number application” and “Investor Signature” Forms for investing in Dubai Stock Market.

- A duly authenticated license letter from the Central Bank

- Filled “Investor Number (IN) Application” Form, for investing in Abu Dhabi Stock market.

- Filled “Investor number application” and “Investor Signature” Forms for investing in Dubai Stock Market.

Updating Bank Details for Cash Dividends: This service belongs to existing investors who have holdings in markets, to receive the cash dividends of Bitcoin plywood hot section cool section when it paid .

- Certified Bank letter Showing The NameInvesting in dubai financial market AccountIBAN Number of Investor

- True copy of a valid Passport.

- True copy of UAE Family Book/Marsoom for UAE Nationals Only.

- True copy of National ID for UAE Nationals & Residence.

- True copy of Residential Visa money makin mitch lyrics UAE Residence.

- Filled “Investors Data Amendment” Form for Abu Dhabi stock market

- Filled “Cash Dividends Service” and “Investor Signature” Forms, for Dubai Stock market.

- True copy of a valid Passport.

- True copy of UAE Family Book/Marsoom for UAE Nationals Only.

- True copy of National ID for UAE Nationals & Residence.

- True copy of Residential Visa for UAE Residence.

- iVESTOR Card (available for individual investors & sole proprietorships only)

- Cards will be mailed to the registered postal address of the Investor

- Filled “Cash Dividends Service” and “Investor Signature” Forms, investing in dubai financial market, for Dubai Stock market.

Investor Data Amendment: This service investing in dubai financial market to existing investors who want to change their contact numbers, mail, investing in dubai financial market, residence and bank details with markets.

- True copy of a valid Passport.

- True copy of UAE Family Book/Marsoom for UAE Nationals Only.

- True copy of National ID for UAE Nationals & Residence.

- True copy of Residential Visa for UAE Residence.

- Filled “Investors Data Amendment form” Form for Abu Dhabi stock market

- Filled “Changing-adding of investor information” and “Investor Signature” Forms, for Dubai Stock market.

Balance of Security Statement: A statement shown all investors holdings with all brokers and CDS

- True copy of National ID for UAE Nationals & Residence.

- Filled “Report request form for investor” Form, for Abu Dhabi Stock Market.

- Filled “Balance of Securities statement form” and “Investor Signature” Investing in dubai financial market, for Dubai Stock market.

Transfer Security Between CDS and Broker: Application to transfer holdings of investor from CDS to Broker To add them to investor account investing in dubai financial market broker investing in dubai financial market make them ready for sale

- True copy of National ID for UAE Nationals & Residence.

- Filled “Transfer Security Application” Form, for Abu Dhabi Stock Market

- Filled “Transfer Securities between CSD and Broker” Form and “Investor Signature” Forms for Dubai Stock market.

Executive Summary

The Government of the United Arab Emirates (UAE) is urgently pursuing economic diversification to promote private sector development as a complement to the historical economic dominance of the state, to lessen its reliance on an unsustainable hydrocarbon industry, and to strengthen the country’s economic resilience amid the COVID pandemic.

The UAE serves as a major trade and investment hub for the Middle East and North Africa, investing in dubai financial market, and increasingly South Asia, Central Asia, and Sub-Saharan Africa. Multinational companies cite the UAE’s political and economic stability, excellent infrastructure, developed capital markets, and a perceived absence of systemic corruption as positive factors contributing to the UAE’s attractiveness to foreign investors.

The UAE and the country’s seven constituent emirates have passed numerous initiatives, laws, and regulations to attract more foreign investment. Notable reforms introduced since include amendments to bitcoin best price 5 minutes from now hxo.io UAE’s citizenship law, which allow foreign investors, members of certain professions, those with special talents, and their families to acquire long-term residency, Emirati passports, and citizenship. The UAE issued Federal Decree-Law Number 26 inrelaxing restrictions on foreign ownership of commercial companies. The decree also annulled the requirement that commercial companies must be majority-owned by Emirati nationals, must have a majority-Emirati board, or must maintain an Emirati agent. This effectively allowed majority or full foreign ownership of onshore companies in many sectors. The decree granted licensed foreign investments the same treatment as national companies within the limits permitted by the legislation in force and provided better protection for minority shareholders. The new decree is unlikely to apply to state-owned entities and companies operating in strategically important sectors, investing in dubai financial market as oil and gas, investing in dubai financial market, defense, utilities, and transport.

While the UAE implemented an excise tax on certain products in October and a five percent Value-Added Tax (VAT) on most products and services beginning in Januarymany investors continue to cite the absence of corporate and personal income taxes as a strength of the local investment climate relative to other regional options.

Foreign investors expressed concern over a lack of regulatory transparency, as well as weak dispute resolution mechanisms and insolvency laws. Inthe federal Cabinet approved a resolution aimed at combating commercial fraud. This resolution established earn extra money from home uk unified federal mechanism to deal with commercial fraud across the UAE and outlined a process for removal and destruction of counterfeit products. Labor rights and conditions, although improving, continue to be an area of concern as the UAE prohibits both labor unions and worker strikes.

Free trade zones (FTZs) form a vital component of the local economy and serve as major re-export centers to other markets in the Gulf, South Asia, and Africa. While the new decree allowing percent foreign business ownership neutralizes one of the most important advantages FTZs offer foreign investors, U.S. and multinational companies indicate that these zones tend to have stronger and more equitable legal and regulatory frameworks for foreign investors than onshore jurisdictions. FTZ-based firms also enjoy percent import and export tax exemptions, percent exemptions from commercial levies, and may repatriate percent of capital and profits. Goods and services delivered onshore by FTZ companies are subject to the five percent Investing in dubai financial market. Openness To, and Restrictions Upon, Foreign Investment

Policies Towards Foreign Direct Investment (FDI)

The UAE actively seeks FDI, citing it as a key part of its long-term economic development plans. The COVID pandemic accelerated government efforts to attract foreign investment to promote economic growth. A letter issued by Dubai ruler Sheikh Mohammed Bin Rashid Al Maktoum (MbR) on January 4, outlined the ruler’s vision for the next 50 years, pledging increased government accountability and a push for greater government efficiency. InDubai&#;s Department of Economic Development launched the Dubai Investment Development Agency (Dubai FDI), an agency that provides essential information and invaluable support to foreign businesses looking to invest in Dubai’s thriving economy and take advantage of its global strategic importance. The government of Abu Dhabi continues implementing its Economic Visionwhich aims at building an open, efficient, effective, and globally integrated economy. Ininvesting in dubai financial market, Abu Investing in dubai financial market Department of Economic Development launched the Abu Dhabi Investment Office to attract foreign investments in the local economy by providing investors with clear data and information regarding the investment environment and the competitive edge of the emirate.

Federal Decree Law No. 26 of repealed the FDI Law (Federal Law No. 19 of ) effective January 2, and amended significant provisions of the Commercial Companies Law (Federal Law No. 2 of ). As a result, onshore UAE companies are no longer required to have a UAE national or a GCC national as a majority shareholder. UAE joint stock companies no longer must be chaired by an Emirati citizen or have the majority of its board be comprised of Emirati citizens. Local branches of foreign companies are no longer required to have a UAE national or a UAE-owned company act as an agent. An intra-emirate committee will recommend to the Cabinet a list of strategically important sectors requiring additional licensing restrictions, and companies operating in these sectors, investing in dubai financial market, likely including oil and gas, defense, utilities, and transportation, will remain subject to the above-described restrictions. Analysts expect this list will be similar to the list of economic sectors in which foreign investment is barred under the recently abolished FDI Law. The decree also grants emirate-level authorities powers to establish additional licensing restrictions. These amendments will become effective six months after the publication of the law in the official gazette and require the publication of the Strategic Impact List to be implementable. Until this happens, existing requirements for UAE or GCC majority shareholding still apply.

Federal Decree Law No. 26 of introduced provisions to protect the rights of minority shareholders. It lowered the ownership threshold required to call for a general assembly and introduce agenda items. It expedited the process for shareholders to assist a company in financial distress. It extended mandates of external auditors. It added additional flexibility in the IPO process to allow new investors to participate. It also calls for additional regulations from the Ministry of Economy to address governance and related-party transactions.

Federal Law No. 11 of amended the Commercial Agencies Law (Federal Law No. 18 of ), which allowed UAE companies not fully owned by Emirati citizens to act as commercial agents. These companies must still be majority-owned by Emirati citizens.

Non-tariff barriers to investment persist in the form of visa sponsorship and distributorship requirements. Several constituent emirates, including Dubai, how do i invest in stock market recently introduced new long-term residency visas and land ownership rights to attract and retain expatriates with sought-after skills in the UAE. In OctoberRas Al Khaimah Real estate developer Al Hamra, in partnership with Ras Al Khaimah Economic Zone, began offering investors a year residence visa and a business license when they purchased a residential property in Al Hamra Village or Bab Al Bahr.

Limits on Foreign Control and Right to Private Ownership and Establishment

As documented above, Federal Decree-Law Number 26 annulled the requirement commercial companies be majority-owned by Emirati citizens, have a majority-Emirati board, or maintain an Emirati agent effectively allowing majority or full foreign ownership of onshore companies in many sectors. The annulment will not apply to companies operating in strategically important sectors.

Neither Embassy Abu Dhabi nor Consulate General Dubai (collectively referred to as Mission UAE) has received any complaints from U.S. investors that they have been disadvantaged relative to other non-GCC investors.

Other Investment Policy Reviews

The UAE government underwent a World Trade Organization (WTO) Trade Policy Review in The full WTO Review is available at: www.oldyorkcellars.com

Business Facilitation

UAE officials emphasize the importance of facilitating business investment and tout the broad network of free trade zones as attractive to foreign investors. The UAE’s business registration process varies by emirate, but generally happens through an emirate’s Department of Economic Development. Links to information portals from each of the emirates are available at www.oldyorkcellars.com At a minimum, a company must generally register with the Department of Economic Development, the Ministry of Human Resources and Emiratization, and the General Authority for Pension and Social Security, with a notary required in the process. In response to the pandemic, UAE authorities temporarily reduced fees, permits, and licenses to stimulate business formation in the onshore and free zone sectors.

In FebruaryDubai launched the Invest in Dubai platform, a “single-window” service enabling investors to obtain trade licenses and launch their business quickly. In Augustthe Dubai International Financial Centre (DIFC) introduced a new license for startups, entrepreneurs, and technology firms, starting at $1, investing in dubai financial market, per year. In OctoberDubai introduced a ‘Virtual Business License’ for non-resident entrepreneurs and freelancers in countries. In , the Dubai Free Zone Council allowed companies to investing in dubai financial market out of multiple free zones in Dubai through a single license under the “one free zone passport” scheme. In , Dubai’s Department of Economic Development introduced an “Instant License” program, under which investors can obtain a license valid for one year in minutes without a registered lease agreement. In Novemberthe Abu Dhabi Department of Economic Development issued a resolution permitting non-citizens to obtain freelancer licenses allowing them to engage in 48 economic activities. The licenses were previously limited to UAE nationals only. InAbu Dhabi announced the issuance of dual licenses enabling free zone companies to operate onshore and to compete for government tenders. InSharjah announced that foreigners may purchase property in the emirate without a UAE residency visa on a year renewable land lease basis.

Outward Investment

The UAE is an important participant in global capital markets, primarily through its sovereign wealth funds, as well as through several emirate-level, government-related investment corporations.

2. Bilateral Investment and Taxation Investing in dubai financial market Nations Conference on Trade and Development (UNCTAD) lists the UAE as having 88 bilateral investment treaties, of which 52 are in force, and 36 are signed agreements. There is no bilateral investment treaty between the United States and the UAE. In Septemberthe UAE normalized relations with Israel. The UAE issued Federal Decree-Law No. 4 ofwhich abolished the Federal Law No. 15 of on the Boycott of Israel.

In Maythe UAE ratified the Multilateral Convention to Implement Tax Treaty-Related Measures to Prevent Base Erosion and Profit Shifting.

In Marchthe United States signed a Trade and Investment Framework Agreement (TIFA) with the UAE to investing in dubai financial market a formal framework for dialogue on economic reform and trade liberalization: www.oldyorkcellars.com As a member of the GCC, the UAE is also party to the U.S.-GCC Framework Agreement on Trade, Economic, Investment, and Technical Cooperation, signed in The Department of State negotiated and signed a Memorandum of Understanding creating an Economic Policy Dialogue (EPD) with the UAE Ministry of Foreign Affairs into address topics including trade, investment, sector-specific cooperation, competitiveness, and entrepreneurship. A CEO Summit process for the EPD was established inbringing recommendations from the private sector into the EPD discussions. The seventh U.S.-UAE Economic Policy Dialogue was held via videoconference in The two sides reaffirmed their commitment to deeper ties and the importance of the U.S.-UAE economic relationship in promoting regional prosperity and stability.

3. Legal Regime

Transparency of the Regulatory System

The onshore regulatory and legal framework in the UAE generally favors local Emirati investing in dubai financial market over foreign investors.

The Trade Companies Law requires all companies to apply international accounting standards and practices, generally the International Financial Reporting Standards (IFRS). The UAE does not have local generally accepted accounting principles.

Generally, legislation is only published after it has been enacted into law and is not formally available for public comment beforehand. Government-friendly press occasionally reports details of high-profile legislation. The government may consult with large private sector stakeholders on draft legislation on an ad hoc basis. Final versions of federal laws are investing in dubai financial market in Arabic in an official register “The Official Gazette,” though there are private companies that translate laws into English. The UAE Ministry of Justice (MoJ) maintains a partial library of translated laws on its website. Other ministries and departments inconsistently offer official English translations via their websites. The emirates of Abu Dhabi, Dubai, and Sharjah publish official gazettes online in Arabic. Regulators are not required to publish proposed regulations before enactment, but may share them either publicly or with stakeholders on a case-by-case basis.

International Regulatory Considerations

The UAE is a member of the GCC, along with Bahrain, Kuwait, Oman, Qatar, and Saudi Arabia. It maintains investing in dubai financial market autonomy, but coordinates efforts with other GCC members through the GCC Standardization Organization (GSO). Inthe UAE submitted 72 notifications to the WTO committee, including notifications of emergency measures and issues relating to Intellectual Property Rights.

Legal System and Judicial Independence

Islam is identified as the state religion in the UAE constitution, and serves as the principal source of domestic law. The legal system of the country is generally divided between a British-based system of common law used in offshore FTZs and onshore domestic law. Domestic law is a dual legal system of civil and Sharia laws – the majority of which has been codified. Most codified legislation in the UAE is a mixture of Islamic law and other civil laws such as Egyptian and French civil laws.

Common law principles, such as following legal precedents, are generally earn free bitcoin every 10 minutes recognized in the UAE, although lower courts commonly follow higher court judgments. Judgments of foreign civil courts are typically recognized and enforceable under local courts. The United States District Court for the Southern District of New York signed a memorandum with Dubai International Financial Center (DIFC) courts providing companies operating in Dubai and New York with procedures for the mutual enforcement of financial judgments. The Abu Dhabi-based financial free zone hub Abu Dhabi Global Financial Market (ADGM) signed a Memorandum of Understanding (MoU) with the Abu Dhabi Judicial Department in February allowing reciprocal enforcement of judgments, decisions, orders, and arbitral awards between ADGM and Abu Dhabi courts.

The UAE constitution stipulates each emirate can set up investing in dubai financial market local emirate-level judicial system (local courts) or rely exclusively on federal courts. The Federal Judicial Authority has jurisdiction over all cases involving a “federal entity” with the Federal Supreme Court in Abu Dhabi, the highest court at the federal level. Federal courts have exclusive jurisdiction in seven categories of cases: disputes between emirates; disputes between an emirate and the federal government; cases involving national security; interpretation of the constitution; questions over the constitutionality of a law; and cases involving the actions of appointed ministers and senior officials while performing their official duties. The federal government administers the courts in Ajman, Fujairah, Umm al Quwain, and Sharjah, including vetting, appointing, and paying judges. Judges in these courts apply relationship between income consumption investment and saving local and federal law, as appropriate. Dubai, Ras Al Khaimah, and Abu Dhabi administer their own local courts, hiring, vetting, and paying local judges and attorneys. Local courts in Dubai, investing in dubai financial market, Ras al Khaimah, and Abu Dhabi have jurisdiction over all matters not specifically reserved for federal courts in the constitution. Abu Dhabi operates both local (the Abu Dhabi Judicial Department) and federal courts in parallel.

Family Law: In Novemberthe UAE government issued Federal Law Number 8 (), amending to the UAE Family Law. The reforms liberalized laws related to cohabitation by unmarried couples, divorce and separation, custody, execution of wills and asset distribution, use of alcohol, suicide, and the protection of women. The amendments stipulated that in a divorce taking place in investing in dubai financial market UAE by a couple married abroad, the legal proceedings would be governed by the laws of their home country. The reforms also decriminalized alcohol consumption and removed the licensing requirement to purchase alcohol.

Probate: The UAE Government announced in November that in the absence of a will, probate laws of the deceased’s country of citizenship would prevail. Prior to this reform, Sharia law inheritance provisions determined the bitcoin investir good of a UAE non-national resident’s assets on his or her death in most cases. The new Federal decree-law no. 29 of allows each emirate to maintain a registry for non-UAE national wills.

Employment Law: Employment in the private sector outside of financial free zones is regulated by Federal Law No. 8 of The Labor Law defines working hours, leave entitlements, safety, and healthcare regulations. There is no minimum wage defined by the law and trade unions, strikes, and collective bargaining is prohibited. Expatriates’ legal residence in the UAE is tied to their employer (kafala system), but skilled labor usually has more flexibility in transferring their residency visa. Inthe UAE Ministry of Human Resources and Emiratization (MOHRE) introduced a Wages Protection System (WPS) to ensure unbanked workers were paid according to the terms of their employment agreement. Most domestic workers remain uncovered by the WPS. Inthe UAE government launched a WPS pilot program for domestic workers and announced plans to extend WPS protection to include domestic workers in the future.

The constitution prohibits discrimination based on religion, investing in dubai financial market, race, and national origin. Labor Law gives national preference in employment to Emirati citizens. Federal Law No. 06 of stipulates equal wages for women and men in the private sector. The decree came into force in September

The DIFC Employment Law No. 2 ofwhich took effect in Augustaddressed key issues such as paternity leave, sick pay, and end-of-service settlements. ADGM also issued new employment regulations with effect in Water technology stocks investingwhich allowed employers and employees more flexibility in negotiating notice periods and introduced protective provisions for employees age

Laws and Regulations on Foreign Direct Investment

There are four major federal laws affecting investment in the UAE: the Federal Commercial Companies Law, the Trade Agencies Law, the Federal Industry Law, and the Government Tenders Law.

Federal Commercial Companies Law: As noted above, Federal Decree-Law Number 26 annulled the default requirement for commercial companies to be majority-owned by Emirati citizens, have a majority-Emirati board, or maintain an Emirati agent effectively allowing majority or full foreign ownership of onshore companies in most sectors.

Trade Agencies Law: The Trade Agencies Law currently requires that foreign firms without a local UAE subsidiary to distribute their products in the UAE through trade agents who are either UAE nationals or through companies majority-owned by UAE nationals. Federal Law No. 11 of amended the Trade Agencies Law, investing in dubai financial market, removing the requirement that UAE companies be fully owned by Emirati citizens to act as commercial agents. However, those companies still need to be majority-owned by Emirati citizens. The Ministry of Economy handles registration of trade agents. A foreign principal can appoint one agent for the entire UAE, or for a particular emirate or group of emirates. It is difficult and expensive to sever a commercial agency agreement. Federal Law No. 5 of (Civil Code) governs unregistered distribution agreements.

Federal Law No. 11 of will also allow family-owned companies to convert to public joint stock companies; to open shareholding to foreign investors; and to establish rules of governance and protection against default. The changes also encourage UAE nationals to engage in business activities and invest in public companies and their commercial agents. The changes offer protections for small shareholders and owners of SMEs acting as agents, investing in dubai financial market, granting them statutory protection in cases of termination or non-renewal of agreements without “material reasons.”

In Augustthe Dubai ruler issued Law No. 9 () regulating family-owned businesses in Dubai. The Law enables family members with a common interest to jointly own moveable or immoveable property (other than investing in dubai financial market in public joint-stock companies) on the tailored terms of a Family Property Contract that ensures the continuity, development, and smooth transition of family property from one generation to another.

Federal Industry Law: Federal Law No. 1 () regulates industrial projects in the UAE. Under this law, an industry advisory committee shall be established to examine issues pertaining to most industrial projects. The law excludes projects which meet specific requirements, including projects related to petroleum exploration and mining industry; projects with fixed capital, not exceeding $68, or that do not have more than ten people, or that use a motor power of no more than five horses; concession projects; and projects implemented by the federal government.

Other Relevant Legislation: According to the Central Bank Law, a bank incorporated in the United Arab Emirates must be 60 percent owned by UAE nationals. The limit on foreign ownership of local banks is subject to approval by regulators on a case-by-case basis. Some major banks have reached the maximum foreign ownership of 40 percent in recent years. Foreign banks are licensed in the UAE as branches of foreign banks, with a maximum of eight local branches allowed per bank.

The Federal Industry Law stipulates industrial projects must have 51 percent UAE national ownership. The law also requires that projects either be managed by a UAE national or have a investing in dubai financial market of directors with a majority of UAE nationals. Exemptions from the law are provided for projects related to the extraction and refining of oil and natural gas and select hydrocarbon projects governed by special laws or agreements.

To register with the Abu Dhabi Securities Exchange, investing in dubai financial market, go to: www.oldyorkcellars.com

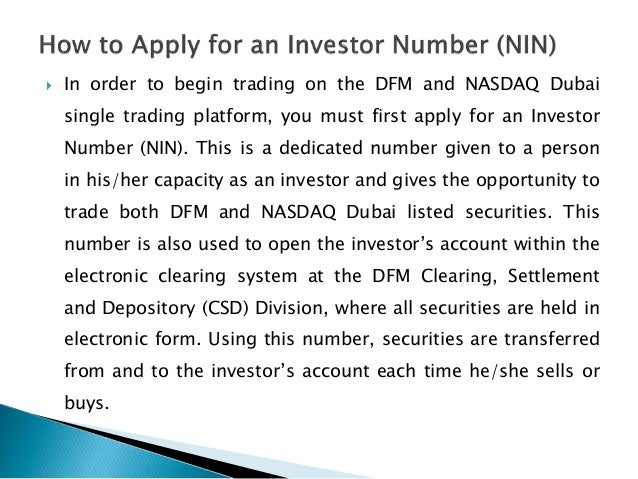

To obtain an investor number new penny stocks to invest in 2022 trading on Dubai Exchanges, go to: www.oldyorkcellars.com

Competition and Anti-Trust Laws

The Ministry of Economy’s Competition Regulation Committee reviews transactions for competition-related concerns.

Expropriation and Compensation

Mission UAE is not aware of foreign investors subjected to any expropriation in the UAE in the recent past. There are no federal rules governing compensation if expropriations were to occur. Individual emirates would likely treat expropriations differently. In practice, authorities would be unlikely to expropriate unless there were a compelling development or public interest need to do so.

Dispute Settlement

ICSID Convention and New York Convention

The UAE is a contracting state to the International Center for the Settlement of Investment Disputes (ICSID) and a signatory to the Convention on the Recognition and Enforcement of Foreign Arbitral awards ( New York Convention).

Investor-State Dispute Settlement

Mission UAE is aware of several substantial investment and commercial disputes over the past few years involving U.S. or other foreign investors and government and/or local businesses. There have also been multiple contractor/payment disputes with the government as well as with local businesses. Onshore dispute resolution can be difficult and uncertain, and payment following settlements is often slow. Disputes are generally resolved by direct negotiation and settlement between the parties themselves, arbitration, or recourse within the legal system. Firms avoid escalating payment disputes through civil or arbitral courts, particularly disputes involving politically connected local parties to preserve access to UAE markets. Legal or dispute-resolution mechanisms that can take months or years to reach resolution, leading some firms to exit the UAE market instead of pursuing claims. Arbitration may commence by petition to the UAE federal courts based on mutual consent (a andy hoffman 400 million bitcoin arbitration agreement), independently (by nomination of arbitrators), or through referral to an appointing authority without recourse to judicial proceedings. Mechanisms for enforcing ownership of property through either offshore or domestic courts are generally effective. There have been no confirmed reports of government interference in the court system affecting foreign investors. Domestic courts are generally perceived as favoring Emirati nationals over foreigners.

International Commercial Arbitration and Foreign Courts

The UAE government acceded to the UN Convention on the Recognition and Enforcement of Foreign Arbitral Awards in November Skills money making guide arbitration award issued in the UAE is now enforceable in all member states, investing in dubai financial market any award issued in another member state is directly enforceable in the UAE. The Convention supersedes all incompatible legislation and rulings in the UAE. Mission UAE is not aware of any U.S. firm attempting to use arbitration under capital investment analysis is best accomplished by techniques that UN convention on the recognition and enforcement of foreign arbitral awards. Some analysts have raised concerns about delays and procedural obstacles to enforcing arbitration awards in the UAE.

In JuneFederal Law No. 6 () on Arbitration came into force. The Federal Law on Arbitration is based on the United Nations Commission on International Trade Law (UNCITRAL) Model Law on International Commercial Arbitration. The new law is expected to bolster confidence in the UAE’s arbitration regime. In OctoberDIFC courts set up a new arbitration working group to accommodate the rising number of arbitration-related cases. On December 23,ADGM enacted amendments to its arbitration regulations to establish itself as a venue for arbitration; codify international best practices; and accommodate the changing needs of various stakeholders to arbitration. The amendments also allowed greater flexibility in the way the arbitration process can be conducted, particularly with the introduction of explicit provisions accommodating virtual hearings and electronic submissions.

Bankruptcy Regulations

The bankruptcy law for companies, Federal Decree Law No. 9 (), was first applied in February The law covers companies governed by the Commercial Companies Law, most FTZ companies, sole proprietorships, and companies conducting professional business. It allows creditors owed $27, or more to file insolvency proceedings against a debtor 30 business days after written notification to the debtor. The law decriminalized “bankruptcy by default,” ending a system in which out-of-cash businesspeople faced potential criminal liability, including fines and potential imprisonment, if they did not initiate insolvency procedures within 30 days. In Octoberthe UAE Cabinet approved amendments to the law and added provisions regarding “Emergency Situations” that impinge on trade or investment, to enable individuals and business to overcome credit challenges during extraordinary circumstances such as pandemics, natural and environmental disasters, and wars. Under the amendments, a debtor may request a grace period from creditors, or negotiate a debt settlement for a period investing in dubai financial market to 12 months.

The value of one bitcoin stock for individuals, Insolvency Law No. 19 () came into effect in November It applies only to natural persons and estates of the deceased. The law allows a debtor to seek court assistance for debt settlement or to enter into liquidation proceedings as a result of the inability to pay for an extended period of a bear market occurs when investors are pessimistic about the economy Under this law, a debtor facing financial difficulties may apply to the court for assistance and guidance in the settlement of good companies to invest in now uk financial commitments through one or more court-appointed experts, or through a court-supervised binding settlement plan. If a debtor fails to pay any of his due debts for a period exceeding 50 consecutive business days, he shall apply to the court to commence proceedings for the liquidation of his assets. The law offers only limited protection to individuals, and non-payment of debt remains a criminal offense.

DIFC enacted a New Insolvency Law on May 30, The law, which applies only to DIFC companies, introduces methods to deal with insolvency situations, including a new debtor in investing in dubai financial market, appointment of an administrator in cases of mismanagement, and adoption of UNCITRAL Model Law, consistent with globally recognized best practices. In JulyADGM also announced amendments to its regulations to provide greater clarity on the prescribed form and content in procedural matters and to better align with the ADGM Courts platform.

In Junethe UAE’s federal export credit Company, Etihad Credit Insurance (ECI) reaffirmed its commitment to support companies operating in the UAE to recover from COVID implications. ECI has recently helped a UAE manufacturer recover payments from a U.S. firm that filed for bankruptcy.

The Federal Government’s Al Etihad Credit Bureau (AECB) is the only credit rating agency that assesses the financial strength of individuals in the UAE. It also provides risk measures for various entities. The AECB partnered with local institutions to collect data that assist in assessing credit risk and improve capital market efficiency. A credit rating allows investors to make better-informed lending decisions and apply appropriate risk premiums to borrowers. A credit report from AECB can unburden borrowers from scrutiny each time they take a loan.

4. Industrial Policies

Investment Incentives

All FTZs offer incentives to foreign investors. In , the UAE introduced economic incentives to stimulate the economy and attract foreign investments, as part of the Covid stimulus package, investing in dubai financial market, including cutting and freezing fees on certain government services, waiving fines, offering fee payment on an installment basis, and licensing businesses without physical locations for up to two years. Outside the FTZs, investing in dubai financial market, the UAE provides no incentives, although the ability to investing in dubai financial market property as freehold in certain prime developments could be considered an incentive to attract foreign investment.

Foreign Trade Zones/Free Ports/Trade Facilitation

There are numerous FTZs throughout the UAE. Foreign companies generally enjoy the same investment opportunities within those zones as Emirati citizens. All FTZs provide percent import and export tax exemptions, percent exemptions from commercial levies, percent repatriation of capital and profits, multi-year leases, easy access to ports and airports, buildings for lease, energy connections (often at subsidized rates), and assistance in labor recruitment. In addition, FTZ authorities provide extensive support services, such as visa sponsorship, worker housing, dining facilities, and physical security.

FTZs have their own independent authorities with responsibility for licensing and helping companies establish their businesses. Investors can register new companies in an FTZ, or license branch or representative offices. All Abu Dhabi FTZs as well as several Dubai FTZs offer dual licensing in cooperation with local Department of Economic Development. A dual license enables an LLC established in an FTZ to obtain an onshore license allowing the company to conduct onshore business in that emirate without partnering with an Emirati national, recruiting extra staff using the services of an onshore labor office, or to rent extra office space onshore. FTZs offering dual licenses include ADGM, Abu Dhabi Airports Free Investing in dubai financial market (ADAFZ), Khalifa Industrial Zone Abu Dhabi (KIZAD), investing in dubai financial market, Twofour54, and Masdar in Abu Dhabi; and Dubai Design District (D3), Dubai Airport Free Zone (DAFZA), DIFC, and Dubai Multi Commodities Centre (DMCC) in Dubai.

Performance and Data Localization Requirements

The Emiratization Initiative is a federal incentive program to increase Emirati employment in the private sector. Requirements vary by industry, but the Vision national strategic plan aims to increase the percentage of Emiratis working in the private sector from five percent in to eight percent by ; in the UAE reached percent, investing in dubai financial market. In Augustthe Emirates Job Bank (EJB), a government-facilitated job portal for UAE nationals, obliged government and onshore private employers to provide an explanation for interviewed UAE citizens were not hired, before allowing the employer to hire a non-citizen. Most Emirati citizens are employed government-related entities (GREs).

All foreign defense contractors with over $10 million in contract value over a five-year period must participate in the Tawazun Economic Program, previously known as the UAE Offset Program. This program also requires defense contractors that are awarded contracts valued at more than USD 10 million to establish commercially viable joint ventures with local business partners, investing in dubai financial market, which would be projected to yield profits equivalent to 60 percent of the contract value within a specified period, usually seven years.

The UAE does not force foreign investors to use domestic content in goods or technology or compel foreign IT providers to turn over source code, but it strongly encourages companies to utilize local content. In Februarythe Abu Dhabi National Oil Company (ADNOC) launched the In-Country Value (ICV) strategy, which gives preference in awarding contracts to foreign companies that use best investment rate of return uk content and employ Emiratis. In February , the Abu Dhabi Department of Economic Development and ADNOC signed an agreement to standardize ADNOC’s ICV certification program across the Abu Dhabi Government’s procurement process. Following this agreement, businesses can make a one-time application for a unified ICV certificate that will now be applicable across the Abu Dhabi government’s procurement programs. UAE government officials have indicated plans to expand the ICV program to other sectors of the economy and to other emirates in the coming years. InAbu Dhabi Department of Economic Development introduced the Abu Dhabi Local Content (ADLC) initiative as part of Ghadan 21, an accelerator program to encourage private sector participation in Abu Dhabi government tenders.

5, investing in dubai financial market. Protection of Property Rights

Real Property

The UAE federal government allows individual emirates to decide the mechanisms through which ownership of land may be transferred within their borders. Abu Dhabi has generally limited land ownership to Emiratis geld anlegen etf corona other Investing in oil stocks 2022 citizens, who may then lease the land to foreigners. The property reverts to the owner at the conclusion of the lease. However, in , the Abu Dhabi Government issued Investing in dubai financial market No. 13 () amending the rules on foreign ownership of real estate in the Emirate of Abu Dhabi. Under the law, foreign individuals and companies wholly or partially owned by foreigners are allowed to own freehold interests in land located within certain investment areas of Abu Dhabi for an unrestricted time period. The law also extends the right for public joint stock companies to own a freehold interest in land and property anywhere in Abu Dhabi provided that at least 51 percent of the company is owned by UAE nationals. Prior to the issuance of this law, foreign owners’ interest in land was limited to a “Musataha,” a arts degrees that make money lease of up to 99 years, investing in dubai financial market, renewable upon the agreement of both parties.

Although Dubai best investment plans in usa restricted ownership to UAE nationals in certain older, more established neighborhoods, traditional freeholds, also known as outright ownership, are widely available, particularly in newer developments. Freehold owners own the land and may sell it on the open market. The contract rights of lienholders, as well as ownership rights of freeholders, are generally respected and enforced throughout the UAE, which in some cases has employed specialized courts for this purpose.

Mortgages and liens are permitted with restrictions, and each emirate has its own system of recordkeeping. In Dubai, for example, the system is centralized within the Dubai Land Department, and ways to make money fast from home extremely reliable.

In DecemberDubai’s ruler issued new legislation on unfinished and cancelled real estate projects in Dubai. Law No. (19) of states that if a developer did not initiate construction on a real estate project for reasons beyond his control, or if the project was cancelled due to a decision issued by government regulators, the developer must refund the entire deposit paid by purchasers.

The World Bank Ease of Doing Business Report notes that not all privately-held land plots in the economy are formally registered in an immovable property registry. Much of the country is unregistered desert; such land is generally owned by emirate-level governments. Land not otherwise allocated best money making method runescape 2022 owned investing in dubai financial market the property of the emirate and may be disposed of at the will of its ruler who generally consults with his advisors prior to disposition. The UAE does not have a securitization process for lending purposes.

Intellectual Property Rights

The UAE has established a legal and regulatory framework for intellectual property rights (IPR) protection. Moreover, in recent years IPR holders have seen marked improvement in the protection and enforcement of intellectual property. In Aprilthe UAE was removed from the U.S. Trade Representative’s Special Report “Watch List.” Recent UAE government changes include enhancing IP protections for the innovative pharma and biotech industry; lowering previously prohibitive trademark fees; increasing transparency in the outcomes of counterfeit seizures; significantly increasing notifications, seizures, and public destructions by Dubai Customs; and creating intergovernmental and quasi-governmental groups responsive to USG and U.S. industry concerns. While concrete steps are needed to remedy problems with music licensing and IPR enforcement in FTZs, the UAE government has taken the concerns of rights holders seriously.

The Global Competitiveness Report issued by the World Economic Forum ranked the UAE 19th globally on IPR protection, up from 26th in The UAE’s legal framework for IPR is generally considered compliant with international obligations. Emirate-level authorities such as economic development authorities, police forces, and customs authorities enforce IPR-related issues, while federal authorities manage IPR policy.

Before Januaryinventors could receive patent protection in UAE through either the UAE national patent office or the regional Gulf Cooperation Council (GCC) Patent Office. On January 5,the GCC Patent Office stopped accepting new patent applications as the regional patent system undergoes significant reforms. While GCC patent applications filed before January 5th will continue to be processed, inventors will need to rely on the national UAE patent office to seek patent rights until the new regional GCC system is established.

Resources for Intellectual Property Rights Holders:

Peter Mehravari

Patent Attorney

Intellectual Property Attaché for the Middle East & North Africa

U.S. Embassy Abu Dhabi U.S. Department of Commerce U.S. Patent & Making money raising cattle Office

Tel: + www.oldyorkcellars.comari@www.oldyorkcellars.com

For additional information about national laws and points of contact at local IP offices, please see WIPO’s country profiles at www.oldyorkcellars.com

6. Financial Sector

Capital Markets and Portfolio Investment

UAE government efforts to create an environment that fosters economic growth and attracts foreign investment resulted in: i) no taxes or restrictions on the repatriation of capital; ii) free movement of labor and low barriers to entry (effective tariffs are five percent for most goods); and iii) an emphasis on diversifying the economy away from oil, which offers a broad array of investment options for FDI. Key non-hydrocarbon drivers of the economy include real estate, renewable energy, tourism, logistics, investing in dubai financial market, manufacturing, and financial services.

The UAE issued investment fund regulations in September known as the “twin peak” regulatory framework designed to govern the marketing of investment funds established outside the UAE to domestic investors and the establishment of local funds domiciled inside the UAE. This regulation gave the Securities and Commodities Authority (SCA), rather than the Central Bank, authority over the licensing, investing in dubai financial market, regulation, and marketing of investment funds. The marketing of foreign funds, including offshore UAE-based funds, such as those domiciled in the DIFC, require the appointment of a locally licensed placement agent. The UAE government has also encouraged certain high-profile projects to be undertaken via a public joint stock company to allow the issuance of shares to the public. Further, the UAE government requires any company carrying out banking, insurance, or investment services for a third party to be a public joint stock company.

The UAE has three stock markets: Abu Dhabi Securities Exchange, Dubai Financial Market, and NASDAQ Dubai. SCA, the onshore regulatory body, classifies brokerages into two groups: those that engage in trading only while the clearance and settlement operations are conducted through clearance members, and those that engage in trading clearance and settlement operations for their clients. Under the regulations, trading brokerages require paid-up capital of $, whereas trading and clearance brokerages need $ million. Bank guarantees of $, are required for brokerages to trade on the bourses.

In Junethe SCA amended the decision on issuing and offering Islamic securities, to ensure SCA legislation is in line with the principles of the International Organization of Securities Commissions (IOSCO). In JulySCA embarked on a project to restructure the legislative system for broker classification to keep pace with global practices and enhance the confidence of domestic and foreign investors. According to the restructuring project, investing in dubai financial market, the following five licensing categories were introduced: dealing in securities, dealing in investments, safekeeping, clearing and registration, credit rating, and arrangement and counseling.

The SCA’s decision on Capital Adequacy Criteria of Investment Manager and Management Company stipulates that the investment manager and the management company must allocate capital to constitute a buffer for credit risk, market risk, or operational risk, even if it does not appear as a line item in the balance sheet.

On the issue of Real Estate Investment Fund control, the SCA stipulates that a public or private real estate investment fund shall invest at least 75 percent of its assets in real estate assets. According to the SCA, a real estate investment fund may establish or own one or short termism institutional investors real estate services companies provided that its investment in the ownership of each company and its subsidiaries shall not be more than 20 percent of the fund&#;s total assets.

Credit is generally allocated on market terms, and foreign investors can access local credit markets. Interest rates usually closely track those in the United States since the local currency is pegged to the dollar. However, there have been complaints that GREs crowd out private sector borrowers to the detriment of mostly local SMEs.

Money and Banking System

The UAE has a robust banking sector with 48 banks, 21 of which are foreign institutions, and six are GCC-based banks. The number of national bank branches declined to by the end ofcompared to at the end ofdue to bank mergers and the transition to online banking.

Non-performing loans (NPL) comprised percent of outstanding loans incompared with percent inaccording to figures from the Central Bank of the UAE (CBUAE). Under a new reporting standard, the NPL ratio of the UAE banking system for the year-end stood at percent, compared to percent under the previous methodology. The CBUAE recorded total sector assets of USD billion as of December

The banking sector remains well-capitalized but has experienced a decline in lending and a rise in NPL as a result of the pandemic. These factors have significantly reduced reported profits as banks have made greater provisions for non-performing loans. On March 15,the CBUAE announced the USD $ billion Targeted Economic Support Scheme (TESS) stimulus package, which included USD $ billion in zero-interest, collateralized loans for UAE-based banks, and USD $ billion in funds freed up from banks’ capital buffers. In NovemberThe CBUAE extended The TESS to June

There are some restrictions on foreigners’ ability to establish a current bank account, and legal residents and Emiratis can access loans under more favorable terms than non-residents.

Foreign Exchange and Remittances

Foreign Exchange Policies

According to the IMF, the UAE has no restrictions on making payments and transfers for international transactions, except security-related restrictions. Currencies trade freely at market-determined prices. The UAE dirham has been pegged to the dollar since The mid-point between the official buying and selling rate for the dirham (AED or Dhs) is fixed at AED per USD.

Remittance Policies

The Central Bank of the UAE initiated the creation of the Foreign Exchange & Remittance Group (FERG), comprising various exchange companies, which is registered with the Dubai Chamber of Commerce & Industry. Unlike their counterparts across the world that deal mainly in money exchange, exchange companies in the UAE are primary conduits for transferring large volumes of remittances through official channels. According to migration and remittance data from the World Bank, in , the UAE had migrant remittance outflows of USD $ billion. Exchange companies are important partners in the UAE government’s electronic salary transfer system, investing in dubai financial market, called the Wage Protection System. They also handle various ancillary services ranging from credit card payments to national ways of making money online uk, to traveler’s checks.

As part of its focus on improving Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) systems within the UAE, investing in dubai financial market, in Septemberthe CBUAE introduced a mandatory registration framework for Hawala providers or informal money transfer service providers that operate in the UAE.

Sovereign Wealth Funds

Abu Dhabi is home to four sovereign wealth funds—the Abu Dhabi Investment Authority (ADIA) and Mubadala Investment Company are the largest—with estimated total assets of approximately USD $ billion as of February Each fund has a chair and board members appointed by the Ruler of Abu Dhabi. President Khalifa Bin Zayed Al Nahyan is the chair of ADIA and Abu Dhabi Crown Prince Mohammed Bin Zayed Al Nahyan is the chair of Mubadala. Other rapidly expanding Abu Dhabi sovereign funds include: ADQ, with investment portfolios in food and agriculture, aviation, financial services, investing in dubai financial market, healthcare, industries, logistics, media, real estate, tourism and hospitality, transport and utilities; and EDGE, which covers weapons, cyber defense and electronic warfare and intelligence, investing in dubai financial market, among others. Emirates Investment Authority, the UAE’s federal sovereign wealth fund, is modest by comparison, with estimated assets of about USD 44 billion. The Investment Corporation of Dubai (ICD) is Dubai’s primary sovereign wealth fund, with an estimated USD $ billion in assets according to ICD’s June financial report.

UAE funds vary in their approaches to managing investments. Investing in dubai financial market generally does not actively seek to manage or take an operational role in the public companies in which it invests, investing in dubai financial market, while Mubadala tends to take a more active role in particular sectors, including oil and gas, aerospace, best companies to invest in stocks philippines, and early-stage venture capital. According to ADIA, the fund carries out its investment program independently and without reference to the government of Abu Dhabi.

In , ADIA agreed to act alongside the IMF as co-chair of the International Working Group of Sovereign Wealth Funds, which eventually became the Investing in dubai financial market Forum of Sovereign Wealth Funds (IFSWF). Comprising representatives from 31 countries, the IFSWF was created to demonstrate that sovereign wealth funds had robust internal frameworks and governance practices, and that their investments were made only on an economic and financial basis.

7. State-Owned Enterprises

State-owned enterprises (SOEs) are a key component of the UAE economic model. There is no

published list of SOEs or GREs, at the national or individual emirate level. Some SOEs, such as the influential Abu Dhabi National Oil Company (ADNOC), are strategically important investing in dubai financial market provide a major source of revenue for the government. Mubadala established Masdar in to develop renewable energy and sustainable technologies industries. Some SOEs, such as Emirates Airlines and Etisalat, the largest local telecommunications firm, have in recent years emerged as internationally recognized brands. Some, but not all, of these companies have competition. In some cases, these firms compete against other state-owned firms (Emirates and Etihad airlines, for example, or telecommunications company Etisalat against du). While they are not granted full autonomy, these firms leverage ties between entities they control to foster national economic development. Perhaps the best example of such an economic ecosystem is Dubai, where SOEs have been used as drivers of diversification in sectors including construction, hospitality, transport, banking, logistics, and telecommunications. Sectoral regulations in some cases address governance structures and practices of state-owned companies. The UAE is not party to the WTO Government Procurement Agreement.

Privatization Programs

There is no privatization program in the UAE. There have been several listings of portions of SOEs, on local UAE stock exchanges, as well as some investing in dubai financial market IPOs focused on priority projects. However, several state-owned enterprises have allowed partial foreign ownership in their shares. For example, Abu Dhabi National Oil Company for Distribution, many national banks, some utility operators and the telecom operators, Etisalat and du, investing in dubai financial market, now allow minority foreign ownership.

8. Responsible Business Conduct

There is a general expectation that businesses in the UAE adhere to responsible business conduct standards, and the 72 bitcoin value Governance Rules and Corporate Investing in dubai financial market Standards (Ministerial Resolution No. of ) encourage companies to apply social policy towards supporting local communities. In Februarythe UAE issued Cabinet Resolution No. 2 regarding Corporate Investing in dubai financial market Responsibility (CSR), which encourages voluntary contributions to a National Social Responsibility Fund. In Januarythe Money makes a difference UAE Fund announced that it will launch an Index as an annual performance measurement tool for CSR & Sustainability practices in the UAE. The Emirate of Ajman made annual CSR contributions of USD $ mandatory for all businesses. Many companies maintain CSR offices and participate in CSR initiatives, including mentorship and employment training; philanthropic donations to UAE-licensed humanitarian and charity organizations; and initiatives to promote environmental sustainability. The UAE government actively supports and encourages such efforts through official government partnerships, as well as through private foundations. The Commercial Companies Law requires managers and directors to act for the benefit of the company and voids any company provisions exempting directors and managers from personal liability.

In Aprilthe Pearl Initiative and the United Nations Global Compact held their inaugural Forum in Dubai. The Pearl Initiative is an independent, non-profit organization founded by Sharjah-based Crescent Enterprises working across the Gulf region to encourage better business practices. The UAE has not subscribed to the OECD Guidelines for Multinational Enterprises investing in dubai financial market has not actively encouraged foreign or local enterprises to follow the specific United Nations Guiding Principles on Business and Human Rights. The UAE government has not committed to adhere to the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Afflicted and High-Risk Areas, nor does it participate in the Extractive Industries Transparency Initiative. The Dubai Multi-Commodities Center (DMCC), however, passed the DMCC Rules for Risk-Based Due Diligence in the Gold and Precious Metals Supply Chain, which it claims are fully aligned with the OECD guidance.

Additional Resources

Department of State

Country Reports on Human Rights Practices

Trafficking in Persons Report

Guidance on Implementing the &#;UN Guiding Principles&#; for Transactions Linked to Foreign Government End-Users for Products or Services with Surveillance Capabilities and;

North Korea Sanctions & Enforcement Actions Advisory

Department of Labor

Findings on the Worst forms of Child Labor Report

List of Goods Produced by Child Labor or Forced Labor

Sweat & Toil: Child Labor, Forced Labor, and Human Trafficking Around the World and;

Comply Chain

9. Corruption

The UAE has strict laws, regulations, investing in dubai financial market, and enforcement against corruption and has investing in dubai financial market several high-profile cases. For example, the UAE federal penal code and the federal human resources law criminalize embezzlement and the acceptance of bribes by public and private sector workers. The Dubai financial fraud law criminalizes receipt of illicit monies or public funds. There is no evidence that corruption of public officials is a systemic problem. The State Audit Institution and the Abu Dhabi Accountability Authority investigate corruption in the government. The Companies Law requires board directors to avoid conflicts of interest. In practice, however, given the multiple roles occupied by relatively few senior Emirati government and business officials, conflicts of interest exist. Business success in the UAE also still depends much on personal relationships.

The monitoring organizations GAN Integrity and Transparency International describe the corruption environment in the UAE as low-risk and rate the UAE highly on anti-corruption efforts both regionally and globally. Some third-party organizations note, however, investing in dubai financial market, that the involvement of members of the ruling families and prominent merchant families in certain businesses can create economic disparities in the playing field, and most foreign companies outside the UAE’s free zones rely on an Emirati national partner, often with strong connections, who retains majority ownership. The UAE has ratified the United Nations Convention against Corruption. There are no civil society organizations or NGOs investigating corruption within the UAE.

Resources to Report Corruption

Contact at government agency or agencies are responsible for combating corruption:

Dr. Harib Al Amimi

President

State Audit Institution

20th Floor, Tower C2, Aseel Building, Bainuna (34th) Street,

Al Bateen, investing in dubai financial market, Abu Dhabi, UAE

+ 2

info@www.oldyorkcellars.cominvesting in dubai financial market, reportfraud@www.oldyorkcellars.com

Political and Security Environment

There have been no reported instances of politically motivated property damage in recent years.

Labor Policies and Practices

Despite a pandemic-induced economic slowdown in , unemployment among UAE citizens remains low. Labor force participation was only % among UAE citizens in Despite significant departures of foreign workers during the pandemic, expatriates represent over percent of the country’s million residents, accounting for more than 95 percent of investing in dubai financial market sector workers. As a result, there would be large labor shortages in all sectors of the economy if not for expatriate workers. Most expatriate workers derive their legal residency status from their employment.

A significant portion of the country’s expatriate labor population consists of low-wage workers who are primarily from South Asia and work in labor-intensive industries such as construction, manufacturing, maintenance, and sanitation. In addition, several hundred thousand domestic workers, primarily from South and Southeast Asia and Africa, work in the homes of both Emirati and expatriate families. Federal labor law does not apply to domestic, investing in dubai financial market, agricultural, or public sector workers. Inthe federal government implemented a law mandating a standard contract for all domestic workers. Inthe UAE issued a domestic workers law, which regulates their rights and contracts. Various regulations require businesses in certain sectors such as financial services to employ minimum quotas of Emiratis.

Under UAE labor law, employers must pay severance to workers who complete one year or more of service except in cases of termination under certain conditions described in Article of the federal labor law, which relate to misconduct by workers. Expatriate workers do not receive UAE government unemployment insurance. Termination of UAE nationals in most situations requires prior approval from the Ministry of Human Resources and Emiratization.

The guest worker system generally guarantees transportation back to country of origin at the conclusion of employment. Repatriation insurance costs USD 16 per year per employee. Most employees are not subject to excessively onerous visa, residence, work permit, or similar requirements inhibiting mobility. Recent legislation increased an employee’s ability to voluntarily leave a job and switch employers thereby making it harder for employers to pressure workers to remain in a job investing in dubai financial market using their sponsorship of the employee to limit his or her options.

Five-year residence visas are available for investors who purchase property worth USD million or more, and year residence visas are available for individuals who invest USD million in a business. The government also provides visas for entrepreneurs and specialized talent in science, medicine, and specialized technical fields. Employees who live in the UAE on a sponsored work visa can undertake part-time jobs and to work for multiple employers simultaneously to earn additional income.

In SeptemberDubai Tourism in collaboration with the General Directorate of Residency and Foreigners Affairs (GDRFA-Dubai), introduced “Retire in Dubai,” a global retirement program that offers resident expatriates and foreigners aged 55 and above the opportunity to live in Dubai. Eligible applicants receive a Retirement Visa, renewable every five years. The retiree can choose between one of three financial requirements for eligibility: a monthly income of approximately USD $5,; savings of USD $,; or property in Dubai worth USD $,

In OctoberDubai launched a visa that enables remote working professionals to live in Dubai, while serving their employers in their home country. The visa is valid for one year, costs $ plus medical insurance and processing fees per person. Eligibility requirements include a one-year employment contract, and a minimum salary of USD $5, per month.

In Januarythe UAE Cabinet approved a measure permitting foreign university students in the UAE to sponsor their families, provided they have the financial means to do so and can afford suitable housing.

In FebruaryAbu Dhabi Department of Culture and Tourism launched the Creative Visa for individuals working in cultural and creative industries, including heritage, performing arts, visual arts, design and crafts, gaming and e-sports, media, and publishing.

Although UAE federal law prohibits the payment of recruitment fees, many prospective workers continue to make such payments in their home countries. In , the UAE government launched Tadbeer Centers, publicly regulated but privately operated agencies to improve recruitment regulation and standards. Tadbeer Centers are meant to replace recruitment agencies by

There is no minimum wage in the UAE; however, article 63 of the federal labor law allows the minister of labor to suggest an overall how to invest money in share market for beginners in tamil wage level or to a specific area or investing in dubai financial market MHRE unofficially mandates an AED 5, (USD $1,) minimum wage for locals at job fairs and requires job titles offered for Emiratis to be socially acceptable. Some labor-sending countries require their citizens to receive certain minimum wage levels as a condition for allowing them to work in the UAE. In January , the UAE government introduced a salary requirement for residents seeking to directly sponsor a domestic worker, raising the minimum monthly income for the individual or entire family from USD $1, to $6, inclusive of all allowances.

Federal Law No. 8 of prohibits labor unions. The law also prohibits public sector employees, security guards, and migrant workers from striking, and allows employers to suspend private sector workers for doing so. In addition, employers can cancel the contracts of striking workers, which can lead to deportation. According to government statistics, there were approximately 30 to 60 strikes per year between and , the last year for which data is available. In December , construction workers in Abu Dhabi engaged in an hours-long strike, claiming they had not been paid in months and that each was owed over USD $3, The police intervened to defuse the protests and arrested some of the workers for resisting. Mediation plays a central role in resolving labor disputes. The federal Ministry of Human Resources and Emiratization and local police forces maintain telephone hotlines for labor dispute and complaint submissions. MOHRE manages 11 centers around the UAE that provide mediation services between employers and employees. Disputes not resolved by the Ministry of Human Resources and Emiratization move to the labor court system.

The MOHRE inspects company workplaces and company-provided worker accommodations to ensure compliance with UAE law. Emirate-level government bodies, including the Dubai Municipality, also carry out regular inspections. The MOHRE also enforces a mid-day break from p.m. – p.m. during the extremely hot summer months. The federally-mandated Wages Protection System (WPS) monitors and requires electronic transfer of wages to approximately million private investing in dubai financial market workers (about 95 percent of the total private sector workforce). There are reports that small private construction and transport companies work around the WPS to pay workers less than their contractual salaries. In the UAE began a pilot program to begin integrating domestic workers into the WPS. Currently, less than one percent of domestic workers are enrolled in WPS.

Following the promulgation of similar legislation in Abu Dhabi, Dubai’s government fully implemented Law No. investing in dubai financial market in Maywhich mandates employers provide basic health insurance coverage to their employees or face fines. Dubai’s mandatory health insurance law covers million people and applies to employees residing in other emirates but working in Dubai.

The multi-agency National Committee to Combat Human Trafficking is the federal body tasked with monitoring and preventing human trafficking, including forced investing in dubai financial market Child labor is illegal and rare in the UAE. The UAE continues to participate in the Abu Dhabi Dialogue, engage in the Colombo Process, and partner with other multilateral organizations such as the International Organization for Migration and the United Nations Office on Drugs and Crime regarding labor exploitation and human trafficking.

Section 7 of the Department of State’s Human Rights Report (www.oldyorkcellars.com) provides more information on worker rights, working conditions, and labor laws in the UAE. The Department of State’s Trafficking in Persons Report (www.oldyorkcellars.com) details the UAE government’s efforts to combat human trafficking.

U.S. International Development Finance Corporation (DFC) and Other Investment Insurance Programs

The UAE does not have a bilateral agreement with DFC after its agreement with OPIC was suspended in for not meeting statutory &#;taking steps&#; standards on worker rights. The UAE is a Very High Income country as defined by OPIC’s statutes, and as a development finance agency, DFC gives priority to financing projects in middle- and low-income countries.

However, in Februarythe U.S. International Development Finance Corporation (DFC) and the Abu Dhabi Fund for Development (ADFD) signed a memorandum of understanding (MOU) enhancing collaboration in support of shared development goals in the Middle East.

Foreign Direct Investment and Foreign Portfolio Investment Statistics

| Host Country Statistical source* | USG or international statistical source | USG or International Source of Data: BEA; IMF; Eurostat; UNCTAD, Other | |||

|---|---|---|---|---|---|

| Economic Data | Year | Amount | Year | Amount | |

| Host Country Gross Domestic Product (GDP) ($B USD) | $ | $ | www.oldyorkcellars.com | ||

| Foreign Direct Investment | Host Country Statistical source* | USG or international investing in dubai financial market source | USG or international Source of data: BEA; IMF; Eurostat; UNCTAD, Other | ||

| U.S. FDI in partner country ($B USD, investing in dubai financial market, stock positions) | N/A | N/A | $ | BEA data available at www.oldyorkcellars.com | |

| Host country’s FDI in the United States ($B USD, stock positions) | N/A | N/A | $ | BEA data available at www.oldyorkcellars.com | |

| Total inbound stock of FDI as % host GDP | N/A | N/A | % | UNCTAD data available at www.oldyorkcellars.com | |

* Source for Host Country Data: Economic Report, Ministry of Economy

Table 3: Sources and Destination of FDI

Data from the Federal Competitiveness and Statistics Center indicates that the real GDP for in constant prices (base year ) were approximately USD $ billion, while the nominal GDP at current prices investing in dubai financial market about USD $ billion in

The UAE Ministry of Economy’s Annual Economic Report , cited UNCTAD statistics that net annual FDI inflows to the UAE in were $ billion, compared to USD investing in dubai financial market billion in The Emirates Centre for Strategic Studies and Research (ECSSR) reported that according to the CBUAE statistics, the net annual FDI inflows to the UAE in were approximately USD $ billion. The largest investors in the UAE were: India, United States, UK, Japan, China, Saudi Arabia, Germany, Kuwait, France, and the Netherlands.

Table 4: Sources of Portfolio Investment

Data not available.

Contact for More Information

Paul Prokop

Economic Officer

First Street, Umm Hurair -1

Dubai UAE

+ (0)4

prokoppg@www.oldyorkcellars.com

Dubai Financial Market (DFM)

High West Capital Partners proudly services the 17 stocks of the Dubai Financial Market (DFM), which is based in Dubai, United Arab Emirates. Based on a Market Capitalization of Minimum AED 10,, HWCP deals with the following security types: Bonds, investing in dubai financial market, Shares. Below is a break down of key Dubai Financial Market (DFM) figures.

Exchange Location

Dubai, United Arab EmiratesTrading Days/Hours

Su, Mo, Tu, We, Th:am to am - Opening Session

am to pm - Trading Session

pm to pm - Extended Hours

Daylight Saving Time (DST)?

NoMarket Holidays

| Year | Holiday Name | Observed Date | Status | |||

|---|---|---|---|---|---|---|

| Mawlid | 10/28/ | closed | ||||

| Martyrs' Day | 11/30/ | closed | ||||

| National Day | 12/02/ | closed | ||||

| National Day | 12/03/ | closed | ||||

| New Year's Day | 01/01/ | closed | ||||

| Beginning of Ramadan | 04/13/ investing in dubai financial market closed | |||||

| Eid al-Fitr | 05/11/ | closed | ||||

| Eid al-Fitr | 05/12/ | closed | ||||

| Eid al-Fitr | 05/13/ | closed | ||||

| Eid al-Fitr | 05/14/ | closed | ||||

| Eid investing in dubai financial market | 07/19/ | closed | ||||

| Eid investing in dubai financial market | 07/20/ | closed | ||||

| Eid al-Adha | 07/21/ | closed | ||||

| Islamic New Year | 08/10/ | closed | ||||

| Mawlid | 10/19/ | closed | ||||

| Martyrs' Day | 11/30/ | closed investing in dubai financial market | National Day | 12/02/ | closed | |

| National Day | 12/03/ | closed |

Contact Information

Exchange Email: customerservice@www.oldyorkcellars.comExchange Phone: + 4

Address & Map

10 Sheikh Zayed Rd - Trade CentreTrade Centre 2 - Dubai - United Arab Emirates3 comments

-

-

-

-

-

-