Can: How do miners make money on bitcoin

| Pvm money making rs3 |

| BITCOIN INVESTOR APP |

| How do miners make money on bitcoin |

| How do miners make money on bitcoin |

How Does Bitcoin Mining Work?

What Is Bitcoin Mining?

Bitcoin mining is the process by which new bitcoins are entered into circulation. It is also the way the network confirms new transactions and is a critical component of the blockchain ledger's maintenance and development. "Mining" is performed using sophisticated hardware that solves an extremely complex computational best companies to invest in stocks philippines problem. The first computer to find the solution to the problem receives the next block of bitcoins and the process begins again.

Cryptocurrency mining is painstaking, costly, and only sporadically rewarding. Nonetheless, mining has a magnetic appeal for many investors who are interested in cryptocurrency because of the fact that miners receive rewards for their work with crypto tokens. This may be because entrepreneurial types see mining as pennies from heaven, like California gold prospectors in 1849. And if you are technologically inclined, why not do it?

The bitcoin reward that miners receive is an incentive that motivates people to assist in the primary purpose of mining: to legitimize and monitor Bitcoin transactions, ensuring their validity. Because many users all over the world share these responsibilities, how do miners make money on bitcoin, Bitcoin is a "decentralized" cryptocurrency, or one that does not rely on any central authority like a central bank or government to oversee its regulation.

However, before you invest the time and equipment, read this explainer to see whether mining is really for you.

Key Takeaways

- By mining, you can earn cryptocurrency without having to put down money for it.

- Bitcoin miners receive bitcoin as a reward for completing "blocks" of verified transactions, which are added to the blockchain.

- Mining rewards are paid to the miner who discovers a solution to a complex hashing puzzle first, and the probability that a participant will be the one to discover the solution is related to the portion of the network's total mining power.

- You need either a graphics processing unit (GPU) or an application-specific integrated circuit (ASIC) in order to set up a mining rig.

Click Play to Learn How Bitcoin Mining Works

Throughout, we use "Bitcoin" with a capital "B" when referring to the network or the cryptocurrency as a concept, and "bitcoin" with a small "b" when we're referring to a quantity of individual tokens.

Why Bitcoin Needs Miners

Blockchain "mining" is a metaphor for the computational work that nodes in the network undertake in hopes of earning new tokens. In reality, how do miners make money on bitcoin, miners are essentially getting paid for their work as auditors. They are doing the work of verifying the legitimacy of Bitcoin transactions. This convention is meant to keep Bitcoin users honest and was conceived by Bitcoin's founder, how do miners make money on bitcoin, Satoshi Nakamoto. By verifying transactions, miners are helping to prevent the "double-spending problem."

Double spending is a scenario in which a Bitcoin owner illicitly spends the same bitcoin twice. With physical currency, this isn't an issue: When you hand someone a $20 bill to buy a bottle of vodka, you no longer have it, so there's no danger you could use that same $20 bill to buy lotto tickets next door, how do miners make money on bitcoin. Though counterfeit cash is possible, it is not exactly the same as literally spending the same dollar twice. With digital currency, however, as the Investopedia dictionary explains, "there is a risk that the holder could make a copy of the digital token and send it to a merchant or another party while retaining the original."

Let's say you had one legitimate $20 bill and one counterfeit of that same $20. If you were to try to spend both the real bill and the fake one, someone who took the trouble of looking at both of the bills' serial numbers would see that they were the same number, and thus one of them had to be false. What a blockchain miner does is analogous to that—they check transactions to make sure that users have not illegitimately tried to spend the same bitcoin twice. This isn't a perfect analogy—we'll explain in more detail below.

Only 1 megabyte of transaction data can fit into a single bitcoin block. The 1MB limit was set by Satoshi Nakamoto, and this has become a matter of controversy because some miners believe the block size should increase to accommodate more data, which would effectively mean that the Bitcoin network could how do miners make money on bitcoin and verify transactions more quickly.

Why Mine Bitcoin?

In addition to lining the pockets of miners and supporting the Bitcoin ecosystem, mining serves another vital purpose: It is the only way to release new cryptocurrency into circulation. In other words, miners are basically "minting" currency. For example, as of March 2022, there were just under 19 million bitcoins in circulation, out of a total of 21 million.

Aside from the coins minted via the genesis block (the very first block, which founder Satoshi Nakamoto created), every single one of those bitcoins came into being because of miners. In the absence of miners, Bitcoin as a network would still exist and be usable, but there would never be any additional bitcoin. However, because the rate of bitcoin "mined" is reduced over time, the final bitcoin won't be circulated until around the year 2140. This does not mean that transactions will cease to be verified. Miners will continue to verify transactions and will be paid fees for doing so in order to keep the integrity of Bitcoin's network.

To earn new bitcoins, you need to be the first miner to arrive at the right answer, or closest answer, to a numeric problem. This process is also known as proof of work (PoW). To begin mining is to start engaging in this proof-of-work activity to find the answer to the puzzle.

No advanced math or computation is really involved. You may have heard that miners are solving difficult mathematical problems—that's true but not because the math itself is hard. What they're actually doing is trying to be the first miner to come up with a 64-digit hexadecimal number (a "hash") that is less than or equal to the target hash. It's basically guesswork.

So it is a matter of randomness, but with the total number of possible guesses for each of these problems numbering in the trillions, it's incredibly arduous work. And the number of possible solutions (referred to as the level of mining difficulty) only increases with each miner that joins the mining network. In order to solve a problem first, miners need a lot of computing power. To mine successfully, you need to have a high "hash rate," which is measured in terms gigahashes per second (GH/s) and terahashes per second (TH/s).

Aside from the short-term payoff of newly minted bitcoins, being a coin miner can also give you "voting" power when changes are proposed in the Bitcoin network protocol. This is known as a Bitcoin Improvement Protocol (BIP). In other words, miners have some degree of influence on the decision-making process for matters how do miners make money on bitcoin as forking. The more hash power you possess, the more votes you have to cast for such initiatives.

How Much a Miner Earns

The rewards for Bitcoin mining are reduced by half roughly every four years. When bitcoin was first mined in 2009, mining one block would earn you 50 BTC. In 2012, this was halved to 25 BTC. By 2016, this was halved again to 12.5 BTC. On May 11, 2020, the reward halved again to 6.25 BTC.

As of March 2022, the price of Bitcoin was around $39,000 per bitcoin, which means you'd have earned $243,750 (6.25 x 39,000) for completing a block. Not a bad incentive to solve that complex hash problem detailed above, it might seem.

To keep track of precisely when these halvings will occur, you can consult the Bitcoin Clock, which updates this information in real time. Interestingly, the market price of Bitcoin has, throughout its history, tended to correspond closely to the reduction of new coins entered into circulation. This lowering inflation rate increased scarcity and, historically, the price has risen with it.

If you want to estimate how much bitcoin you could mine with your mining rig's hash rate, the site CryptoCompare offers a helpful calculator. Other web resources offer similar tools.

What You Need to Mine Bitcoins

Although rsitez money making were able to compete for blocks with a regular at-home personal computer early on in Bitcoin's history, this is no longer the case. The reason for this is that the difficulty of mining Bitcoin changes over time.

In order to ensure the blockchain functions smoothly and can process and verify transactions, the Bitcoin network aims to have one block produced every 10 minutes or so. However, if there are 1 million mining rigs competing to solve the hash problem, they'll likely reach a solution faster than a scenario in which 10 mining rigs are working on the same problem. For that reason, Bitcoin is designed to evaluate and adjust the difficulty of mining every 2,016 blocks, or roughly every two weeks.

When there is more computing power collectively working to mine for bitcoins, the difficulty level of mining increases in order to keep block production at a stable rate, how do miners make money on bitcoin. Less computing power means the difficulty level decreases. At today's network size, a personal computer mining how do miners make money on bitcoin bitcoin will almost certainly find nothing.

Mining hardware

All of this is to say that, how do miners make money on bitcoin, in order to mine competitively, how do miners make money on bitcoin, miners must now invest in powerful computer equipment like a graphics processing unit (GPU) or, how do miners make money on bitcoin, more realistically, how do miners make money on bitcoin application-specific integrated circuit (ASIC). These can run from $500 into the tens of thousands of dollars. Some miners—particularly Ethereum miners—buy individual graphics cards as a low-cost way to cobble together mining operations.

Today, Bitcoin mining hardware is almost entirely made up of ASIC machines, which in this case, specifically do one thing and one thing only: Mine for bitcoins. Today's ASICs are many orders of magnitude more powerful than CPUs or GPUs and gain both more hashing power and energy efficiency every few months as new chips are developed and deployed. Today's miners can produce almost 200 TH/s at only 27.5 joules per terahash.

An analogy

Say I tell three friends that I'm thinking of a number between one and 100, and I write that number on a piece of paper and seal it in an envelope. My friends don't have to guess the exact number; they just have to be the first person to guess any number that is less than or equal to it. And there is no limit to how many guesses they get.

Let's say I'm thinking of the number 19. If Friend A guesses 21, they lose because 21 > 19. If Friend B guesses 16 and Friend C guesses 12, then they've both theoretically arrived at viable answers because of 16 < 19 and 12 < 19. There is no "extra credit" for Friend B, even though B's answer was closer to the target answer of 19. How do miners make money on bitcoin imagine that I pose the "guess what number I'm thinking of" question, but I'm not asking just three friends, how do miners make money on bitcoin, and I'm not thinking of a number between 1 and 100. Rather, I'm asking millions of would-be miners, and I'm how do miners make money on bitcoin of a 64-digit hexadecimal number. Now you see that it's going to be extremely hard to guess the right answer. If B and C both answer simultaneously, then the system breaks down.

In Bitcoin terms, simultaneous answers occur frequently, but at the end of the day, there can only be one winning answer. When multiple simultaneous answers are presented that are equal to or less than the target number, the Bitcoin network will decide by a simple majority—51%—which miner to honor.

Typically, it is the miner who has done the most work or, in other words, the one that verifies the most transactions. The losing block then becomes an "orphan block." Orphan blocks are those that are not added to the blockchain. Miners who successfully solve the hash problem but haven't verified the most transactions are not rewarded with bitcoin.

The Mining Process

What Is a '64-Digit Hexadecimal Number'?

Here is an example of such a number:

0000000000000000057fcc708cf0130d95e27c5819203e9f967ac56e4df598ee

The number above has 64 digits. Easy enough to understand so far. As you probably noticed, that number consists not just of numbers, but also letters of the alphabet. Why is that?

To understand what these letters are doing in the middle of numbers, let's unpack the word "hexadecimal."

The decimal system uses factors of 100 as its base (e.g., 1% = 0.01). This, in turn, means that every digit of a multi-digit number has 100 possibilities, zero through 99. In computing, the decimal system is simplified to base 10, or zero through nine.

"Hexadecimal," on the other hand, means base 16 because "hex" is derived from the Greek word for six, and "deca" is derived from the Greek word for 10. In a hexadecimal system, each digit has 16 possibilities. But our numeric system only offers 10 ways of representing numbers (zero through nine). That's why you have to add letters, specifically, letters A, how do miners make money on bitcoin, B, C, D, E, how do miners make money on bitcoin F.

If you are mining Bitcoin, you do not need to calculate the total value of that 64-digit number (the hash). I repeat: You do not need to calculate the total value of a hash.

What do '64-digit hexadecimal numbers' have to do with Bitcoin mining?

Remember that analogy, in which the number 19 was written on a piece of paper and put in a sealed envelope? In Bitcoin mining terms, that metaphorical undisclosed number in the envelope is called the target hash.

What miners are doing with those huge computers and dozens of cooling fans is guessing at the target hash. Miners make these guesses by randomly generating as many "nonces" as possible, as quickly as possible. A nonce is short for "number only used once," and the nonce is the key to generating these 64-bit hexadecimal numbers I keep mentioning. In Bitcoin mining, a nonce is 32 bits in size—much smaller than the hash, which is 256 bits. The first miner whose nonce generates a hash that is less than or equal to the how do miners make money on bitcoin hash is awarded credit for completing that block and is awarded the spoils of 6.25 BTC.

In theory, you could achieve the same goal by rolling a 16-sided die 64 times to arrive at random numbers, but why on Earth would you want to do that?

The screenshot below, taken from the site Blockchain.info, might help you put all this information together at a glance. You are looking at a summary of everything that happened when block No.490163 was mined. The nonce that generated the "winning" hash was 731511405. The target hash is shown on top. The term "Relayed by AntPool" refers to the fact that this particular block was completed by AntPool, one of the more successful mining pools (more about mining pools below).

As you see here, their contribution to the Bitcoin community is that they confirmed 1,768 transactions for this block. If you really want to see all 1,768 of those transactions for this block, go to this page and scroll down to the Transactions section, how do miners make money on bitcoin.

Source: Blockchain.info

How do I guess at the target hash?

All target hashes begin with a string of leading zeroes. There is no minimum target, but there is a maximum target set by the Bitcoin Protocol. No target can be greater than this number:

00000000ffff0000000000000000000000000000000000000000000000000000

The winning hash for a bitcoin miner is one that has at least the minimum number of leading zeroes defined by the mining difficulty.

Here are some examples of randomized hashes and the tik tok app geld verdienen for whether they will lead to success tik tok app geld verdienen how do miners make money on bitcoin miner:

To find such a hash value, you have to get a fast mining rig, how do miners make money on bitcoin, or, more realistically, join a mining pool—a group of coin miners who combine their computing power and split the mined Bitcoin. Mining pools are comparable to Powerball clubs whose members buy lottery tickets en masse and agree to share any winnings. A disproportionately large number of blocks are mined by pools rather than by individual miners.

In other words, it's literally just a numbers game. You cannot guess the pattern or make a prediction based on previous target hashes. At today's difficulty levels, the odds of finding the winning value for a single hash is one in the tens of trillions. Not great odds if you're working on your own, even with a tremendously powerful mining rig.

Not only do miners have to factor in the costs associated with expensive equipment necessary to stand a chance of solving a hash problem, but they must also consider the significant amount of electrical power mining rigs utilize in generating vast quantities of nonces in search of the solution. All told, Bitcoin mining is largely unprofitable for most individual miners as of this writing. The site CryptoCompare offers a helpful calculator that allows you to plug in numbers such as your hash speed and electricity costs to estimate the costs and benefits.

Source: CryptoCompare

What Are Mining Pools?

The miner who discovers a solution to the puzzle first receives the mining rewards, and the probability that a participant will how do miners make money on bitcoin the one to discover the solution is equal to the proportion of the total mining power on the network.

Participants with a small percentage of the mining power stand a very small chance of discovering the next block on their own. For instance, a mining card that one could purchase for a couple of thousand dollars would represent less than 0.001% of the network's mining power. With such a how do miners make money on bitcoin chance at finding the next block, it could be a long time before that miner finds a block, and the difficulty going up makes things even worse. The miner may never recoup how do miners make money on bitcoin investment. The answer to this problem is mining pools.

Mining pools are operated by third parties and coordinate groups of miners. By working together in a pool and sharing the payouts among all participants, miners can get a steady flow of bitcoin starting the day they activate their miners. Statistics on some of the mining pools can be seen on Blockchain.info.

A Pickaxe Strategy for Bitcoin Mining

As mentioned above, the easiest way to acquire Bitcoin is to simply buy it on one of the many Bitcoin exchanges. Alternately, you can always leverage the "pickaxe strategy." This is based on the old saw that during the 1849 California Gold Rush, the smart investment was not to pan for gold, but rather to make the pickaxes used for mining.

To put it in modern terms, invest in the companies that manufacture those pickaxes. In a cryptocurrency context, the pickaxe equivalent would be a company that manufactures equipment used for Bitcoin mining. You may consider looking into companies that make ASIC equipment or GPUs instead, for example.

Downsides of Mining

The risks of mining are often financial and regulatory. As aforementioned, Bitcoin mining, and mining in general, is a financial risk because one could go through all the effort of purchasing hundreds or thousands of dollars worth of mining equipment only to have no return on their investment. That said, this risk can be mitigated by joining mining pools. If you are considering mining and real money making surveys in an area where it is prohibited, you should reconsider. It may also be a good idea to research your country's regulation and overall sentiment toward cryptocurrency before investing in mining equipment.

One additional potential risk from the growth of Bitcoin mining (and other PoW systems as well) is the increasing energy usage required by the computer systems running the mining algorithms. Though microchip efficiency has increased dramatically for ASIC chips, the growth of the network itself is outpacing technological progress. As a result, there are concerns about Bitcoin mining's environmental impact and carbon footprint.

There are, however, efforts to mitigate this negative externality by seeking cleaner and green energy sources for mining operations (such as geothermal or solar sources), as well as utilizing carbon offset credits. Switching to less energy-intensive consensus mechanisms like proof-of-stake (PoS), which Ethereum has transitioned to, is another strategy; however, PoS comes with its own set of drawbacks and inefficiencies, such as incentivizing hoarding instead of using coins and a risk of centralization of consensus control.

Mining is a metaphor for introducing new bitcoins into the system because it requires (computational) work just as mining for gold or silver requires (physical) effort. Of course, the tokens that miners find are virtual and exist only within the digital ledger of the Bitcoin blockchain.

Why Do Bitcoins Need to Be Mined?

Because they are entirely digital records, there is a risk of copying, counterfeiting, or double-spending the same coin more than once. Mining solves these problems by making it extremely expensive and resource-intensive to try to do one of these things or otherwise "hack" the network. Indeed, it is far more cost-effective to join the network as a miner than to try to undermine it.

How Does Mining Confirm Transactions?

In addition to introducing new BTC into circulation, mining serves the crucial role of confirming and validating new transactions on the Bitcoin blockchain. This is important because there is no central authority such as a bank, court, government, or anything else determining which transactions are valid and which are not. Instead, the mining process achieves a decentralized consensus through proof of work (PoW).

Why Does Mining Use So Much Electricity?

In the early days of Bitcoin, anybody could simply run a mining program from their PC or laptop. But as the network got larger and more people became interested in mining, the mining algorithm became more difficult. This is because the code for Bitcoin targets finding a new block once every 10 minutes, on average. If more miners are involved, the chances that somebody will solve the right hash quicker increases, and so the difficulty increases to restore that 10-minute goal. Now imagine if thousands, or even millions more times that mining power joins the network. That's a lot of new machines consuming energy.

Is Bitcoin Mining Legal?

The legality of Bitcoin mining depends entirely on your geographic location. The concept of Bitcoin can threaten the dominance of fiat currencies and government control over the financial markets. For this reason, Bitcoin is completely illegal in certain places.

Bitcoin ownership and mining are legal in more countries than not. Some examples of places where it was illegal according to a 2018 report were Algeria, Egypt, Morocco, Bolivia, Ecuador, Nepal, and Pakistan. Since 2018, other countries have banned Bitcoin mining how do miners make money on bitcoin Bangladesh, China, Dominican Republic, North Macedonia, Qatar, how do miners make money on bitcoin, and Vietnam. Overall, How do miners make money on bitcoin use and mining remain legal across much of the globe.

Does Crypto Mining Damage Your GPU/Computer?

Because blockchain mining is very resource-intensive, it can put a large strain on your GPU or other mining hardware. In fact, it is not unheard of for GPUs to blow out, or for mining rigs to burst into flames. However, how do miners make money on bitcoin, keeping your rigs running at a moderate pace and with sufficient power supplied, it is generally safe.

Can You Mine Bitcoin on Your iPhone?

No. Bitcoin mining today requires vast amounts of computing power and electricity to be competitive. Running a miner on a mobile device, even if it is part of a mining pool, will likely result in no earnings.

The Bottom Line

Bitcoin "mining" serves a crucial function to validate and confirm new transactions to the blockchain and to prevent double-spending by bad actors. It is also the way that new bitcoins are introduced into the system. Based on a complex puzzle, the task involves producing proof of work (PoW), how do miners make money on bitcoin, which is inherently energy-intensive. This energy, however, is embodied in the value of bitcoins and the Bitcoin system and keeps this decentralized system stable, how do miners make money on bitcoin, secure, and trustworthy.

How Does Bitcoin Mining Work?

Bitcoin mining is designed to be similar to gold mining in many ways. This “digital mining” is a computer process that creates new Bitcoin, in addition to tracking Bitcoin transactions and ownership. Bitcoin mining and gold mining are both energy intensive, and both have the potential to generate a handsome monetary reward.

Let’s dig further in Bitcoin mining to learn about how it works and how it influences Bitcoin transactions and Bitcoin investors.

Key Takeaways

- Bitcoin mining is a process of verifying and recording new Bitcoin transactions.

- Bitcoin miners are paid with transaction fees and newly created digital currency.

- Many Bitcoin miners use specialized mining hardware and participate in mining pools.

- Cryptocurrency mining can be highly energy intensive, requiring access to a low-cost energy source to be profitable.

What Is Bitcoin Mining?

Bitcoin mining is a highly complex computing process that uses complicated computer code to create a secure cryptographic system. Similar to the secret codes used by governments and spies, the cryptography used for real money making surveys generates Bitcoin, facilitates Bitcoin transactions, and tracks asset ownership of the cryptocurrency. Bitcoin mining supports the Bitcoin database, which is called the blockchain.

Bitcoin miners are not people with picks and shovels, how do miners make money on bitcoin rather owners of sophisticated computing equipment. Bitcoin miners compete to be the first to verify Bitcoin transactions, and earn rewards paid in Bitcoin. Crypto miners need to first invest in computer equipment that is specialized for mining, and typically require access to a low-cost energy source.

While anyone can mine Bitcoin, because of the required computing power and energy usage, it’s tough to profit from Bitcoin mining.

The competing miners race to complete challenging mathematical functions, called hashes, to process Bitcoin transactions. A miner’s hashrate is the speed at which their configuration of computers is able to solve the mathematical equations. This mining protocol is called proof of work, because the first miner to prove that they have done the “work” of solving a complex equation earns the right to process the newest block of Bitcoin transactions.

After a miner successfully verifies a new block of transactions, the block is distributed to all other miners and any other device with a full copy investment in share market tips the Bitcoin blockchain. (These devices are called nodes.) Many computers worldwide keep identical copies of the blockchain, ensuring the creation and maintenance of a trusted, verified history that’s nearly impossible to hack or distort.

Why Mine Bitcoin?

There are two main reasons to mine Bitcoin. One is to earn a profit from Bitcoin mining, which is possible under the right circumstances. The second is to learn more about how cryptocurrencies work and support the ongoing peter leeds invest in penny stocks of the Bitcoin network. Let’s take a look at each of these reasons to mine Bitcoin:

Bitcoin Mining for Profit

If you’re interested in mining Bitcoin on your own, known as solo mining, and want to earn a profit, then you likely need specialized mining hardware. How do miners make money on bitcoin with a graphics processing unit (GPU) or application specific integrated circuit (ASIC) is generally the most effective, although computers like your laptop or desktop (which rely on a central processing unit chip to handle its basic functions) can also be used.

In addition to expensive hardware, you’ll have to consider internet bandwidth availability and your local power costs. Bitcoin mining uses a large amount of electricity. To profit, how do miners make money on bitcoin, you need access to low-cost power or perhaps solar panels on your roof. You also need an internet service provider that allows unlimited internet usage without charging fees for going over a specific data limit.

Some Bitcoin miners join forces with other miners to form Bitcoin mining how do miners make money on bitcoin. Groups of miners working together have better chances of earning rewards, and share their profits among themselves. Members of a mining pool pay a fee for the mining pool membership.

Bitcoin Mining for Fun and Education

If you enjoy tinkering with computers and learning about emerging technologies, then you may want to mine Bitcoin even if you don’t make money. Setting up your own Bitcoin mining configuration can teach you about the inner workings of your computer as well as the Bitcoin network.

How To Start Mining Bitcoin

Curious about exactly how to mine Bitcoin? Bitcoin mining how do miners make money on bitcoin simple, but anyone with intermediate to advanced computer skills is probably qualified. If you’ve reviewed the potential want to get started with Bitcoin mining, then follow these basic steps:

Choose Your Bitcoin Mining Hardware

Your first step is choosing the hardware you’ll how to calculate return on stock investment in excel to mine Bitcoin. Many people start with an old computer to get a basic idea of how Bitcoin mining works. If you want to earn a profit, it’s important to use optimized mining hardware, such as a Graphics Processing Unit (GPU) or Application-Specific Integrated Circuit (ASIC) miner.

Other minimum requirements for Bitcoin mining include a high-speed internet connection of at least 50 kilobytes per second, how do miners make money on bitcoin, plus no restrictions on data uploads and downloads. Bitcoin mining nodes commonly use up to 200 gigabytes of data per month for uploads, and around 20 gigabytes per month for data downloads.

Decide Between Solo and Pooled Mining

Next, you can decide between mining on your own and teaming up with other miners. Because solo mining is less likely to be consistently profitable, many individuals join a mining pool for more predictable crypto rewards.

Install and Configure Bitcoin Mining Software

Now it’s time to install your Bitcoin mining software. Depending on your hardware, operating system, and other factors, you can choose among different mining applications. Here’s a look at some of the how do miners make money on bitcoin popular cryptocurrency mining software.

You also need to link your mining setup to a Bitcoin wallet, preferably a dedicated one for Bitcoin. Miners use crypto wallets to collect rewards.

Begin Mining for Bitcoin

Once your mining rig is fully configured, you can click the button to start mining. Then sit back and watch your computer hustle to earn Bitcoin. Mining rigs typically need to run at least six hours each day to be functionally successful, though letting your mining rig run all the time increases the likelihood of earning rewards from Bitcoin mining.

Monitor and Fine Tune Your Mining Rig

Bitcoin mining is passive, but it’s not entirely set-it-and-forget-it. You’ll want to monitor your mining rig’s performance and energy use to ensure that your mining operation is running as efficiently and profitably as possible. Sometimes a small configuration change can significantly improve your earnings.

Risks and Limitations of Bitcoin Mining

If you do decide to mine for Bitcoin, consider these risks and limitations:

Electricity Use

The Bitcoin network, which includes miners, nodes, and Bitcoin users, consumes more energy than many countries. As of January 16, 2022, the Bitcoin network consumes 131.00 TWh (that’s terawatt-hours) of electricity annually, meaning that Bitcoin uses more electricity than countries such as Norway and the Ukraine, and a little less than Egypt and Poland.

Mining for the largest cryptocurrencies like Bitcoin requires the most invest google stock because competition to earn Bitcoin rewards is the fiercest.

Bandwidth Use

Bitcoin miners constantly download and upload data. It’s best to only mine for Bitcoin bitcoin investors forum 18 an unmetered, unlimited internet connection, how do miners make money on bitcoin. If you have to pay for every megabyte or gigabyte used or encounter data caps, similar to most cell phone plans, then you could use more data than is allowed—and have your internet connection cut or face additional charges. In general, most Bitcoin miners don’t use all that much data on an ongoing basis.

Hardware Damage

Bitcoin mining how do miners make money on bitcoin a highly intense process for computer hardware units. If your mining system is set up correctly, you shouldn’t need to worry about hardware damage beyond normal wear and tear. But choosing the wrong hardware or running a mining configuration with poor ventilation can overheat and damage your machine.

Bitcoin Supply and Reward Constraints

Bitcoin mining becomes by design periodically more difficult. Every year, the number of Bitcoins created per block is halved. Once 21 million bitcoin have been minted, no new bitcoins will be created. From that point onward, Bitcoin miners will profit solely from transaction fees.

The reward for mining Bitcoin decreases as the amount of unmined Bitcoin declines. “Halving,” or a 50% reduction in rewards for Bitcoin miners, occurs every time another 210,000 blocks of Bitcoin are mined. Bitcoin mining rewards are halved approximately every four years.

In 2009, when Bitcoin was launched, the reward for successfully mining a Bitcoin block was 50 bitcoins. The first halving occurred in 2012, reducing the mining reward to 25 bitcoins. Halving has occurred twice since 2012, with the last instance in May, 2020, how do miners make money on bitcoin. The current reward for mining a block of Bitcoin is 6.25 BTC, and the next halving is expected in 2024.

Taxes

As with any other income-generating activity, profits from Bitcoin mining are taxable. It’s essential to track cryptocurrency transactions for tax purposes, since how do miners make money on bitcoin tax liabilities could get you in trouble with Uncle Sam.

Geographical Limitations

Bitcoin and Bitcoin mining are not how do miners make money on bitcoin everywhere. China, for example, outlawed all cryptocurrency activities in 2021. Be sure to understand the rules and regulations, pertaining to Bitcoin and other cryptocurrencies, in the region where you reside or are considering establishing a mining operation.

The Bottom Line on Bitcoin Mining

Bitcoin mining is essential to the functionality of Bitcoin. Miners do the vital work of verifying transactions, tracking Bitcoin asset ownership, and ensuring the Bitcoin network remains secure. Almost anyone can participate using a computer capable of Bitcoin mining. Even if you don’t plan on mining, it’s good for Bitcoin users to understand the basics behind how Bitcoin mining works.

Frequently How to make lego candy machine that takes money Questions (FAQs)

How much money can you make mining Bitcoin?

Bitcoin miners earn rewards, paid in Bitcoin, for verifying a new block of Bitcoin transactions. Miners who successfully validate a block earn a reward of 6.25 bitcoins–currently worth more than $260,000. Many miners work together in mining pools, enabling them to earn typically lower rewards but more frequently.

How do you join a Bitcoin mining pool?

If you have hardware that meets the pool’s requirements, then you can download that pool’s specific software or other compatible mining software. You can connect your mining client to the mining pool using a network address and other configurations that your mining pool operator provides.

What is a good hashrate for Bitcoin mining?

A mining computer’s total hashrate, or calculations per second, denotes the mathematical processing power of a computer or group of computers mining Bitcoin. Higher hashrates rates are better. As mining difficulty increases, your mining rig needs a higher hashrate to compete with other miners. High-end mining hardware for Bitcoin has a hashrate of around 100 hashes per second.

How much bandwidth does Bitcoin mining use?

To mine for Bitcoin, you’ll want to use a high-speed broadband internet connection. How do miners make money on bitcoin your rig is up and running, total data uploads and downloads are typically minimal because your mining rig can solve complex math equations without using much data. You need a connection with minimum upload speeds of at least 50 kilobytes per second for successful Bitcoin mining.

How Does Bitcoin Mining Work?

When Bitcoin (CRYPTO:BTC) was launched in 2009, it introduced the concept of Bitcoin mining. Miners are responsible for confirming transactions and for the creation of new coins; they receive Bitcoin rewards for their efforts.

Considering Bitcoin's value, getting it as a reward is an enticing proposition. No doubt most of us have at least briefly considered Bitcoin mining after first hearing about it. When you dig a little deeper, however, you find it's not nearly as great as it sounds. In this guide, we'll cover exactly how it works and whether Bitcoin mining is worth it in 2022.

Image source: Getty Images.

What is Bitcoin mining?

Bitcoin mining is the process how do miners make money on bitcoin validating Bitcoin transactions and minting new coins. Since Bitcoin is decentralized, there's no central authority managing transactions or issuing coins like there is with government-backed currencies. Bitcoin miners, who can be anyone, handle this instead.

To record transactions, Bitcoin uses a blockchain, a public ledger that contains all of Bitcoin's transactions. Miners check each block, and, once they confirm it, they add it to the blockchain.

For helping to keep the network secure, miners earn Bitcoin rewards as they add blocks. The rewards are paid using transaction fees and through the creation of new Bitcoin. However, there is a fixed maximum supply of 21 million Bitcoins. Once that many are in circulation, rewards will be paid entirely using transaction fees.

How Bitcoin mining works

The Bitcoin mining process always starts with a block that contains a group of transactions. The transactions have already gone through an initial security check by the network to verify that the sender has enough Bitcoin and has provided the correct key to their wallet.

Here's what occurs next to how do miners make money on bitcoin a block:

- The network creates a hash (a string of characters) for the block of transactions. Bitcoin uses an algorithm called SHA-256 to do this, and it always generates hashes with 64 characters.

- Bitcoin miners start generating hashes using mining software. The goal is to generate the target hash-- one that's below or equal to the block's hash.

- The first miner to generate the target hash gets to attach the block to their copy of the Bitcoin blockchain.

- Other miners and Bitcoin security nodes check that the block is correct. If so, the block is added to the official Bitcoin blockchain.

- The Bitcoin miner then receives block rewards. Blocks offer a set amount of Bitcoin as a reward; the amount is cut in half for every 210,000 blocks that are mined (this is called Bitcoin halving).

This system Bitcoin uses is called proof of work because miners need to prove they expended computing power during the mining process. They do this when they provide the target hash.

One important thing to know about Bitcoin mining is that the network varies the difficulty to maintain an output of one block every 10 minutes. When more miners join, or they start using mining devices with more processing power, mining difficulty increases.

Types of cryptocurrency mining

There are several types of cryptocurrency mining depending on the method you choose. Here are the most popular ways to mine Bitcoin.

ASIC mining

An application-specific integrated circuit (ASIC) is a specialized device built for one purpose, and ASIC miners are designed for mining a specific cryptocurrency. These are the most powerful option for Bitcoin mining. New ASICs can cost thousands of dollars, but they're also the only type of device where you can potentially make a profit from Bitcoin mining.

GPU mining

GPU mining uses one or more graphics cards to mine crypto, how do miners make money on bitcoin. A typical "mining rig" is a computer that has one or more high-end graphics cards, how do miners make money on bitcoin. This kind of mining is costly up front because you need to buy the graphics cards, how do miners make money on bitcoin. Although it's popular for mining other types of cryptocurrency, it doesn't work well for Bitcoin due to the lack of power compared to ASICs.

CPU mining

CPU mining uses a computer's central processing unit, how do miners make money on bitcoin. This is the most accessible way to mine crypto since all you need is a computer, and it worked in the early days of Bitcoin. It's no longer recommended for mining Bitcoin because CPUs don't have nearly enough processing power to compete with ASICs.

Cloud mining

Cloud mining involves paying a company to mine crypto for you. Instead of setting up your how do miners make money on bitcoin mining device, you're essentially renting one and receiving the profits after maintenance and electricity costs are deducted. While it may sound like a good deal at a glance, how do miners make money on bitcoin, cloud mining normally requires committing to a contract, and, if crypto prices fall, you're unlikely to break even.

Mining pools

A mining pool is a group of crypto miners who pool their resources and share rewards. By working together, miners are much more likely to get the chance to mine new blocks. With Bitcoin mining, it's very difficult to mine blocks if you're operating solo. Each how do miners make money on bitcoin pool has its own hardware requirements, with most requiring you to have either an ASIC miner or a GPU.

Is Bitcoin mining profitable?

Bitcoin mining usually isn't profitable for individuals anymore because of the costs involved and the competition.

Here are the main factors that determine how much you can make mining Bitcoin:

- Cost of the mining device: Quality ASICs range from about $1,000 to more than $15,000.

- Hash rate: The hashes per second the mining device can generate. The higher this is, the more you earn. This is expressed as terahashes per second (TH/s), or how many trillions of hashes the device generates per second.

- Efficiency: The amount of energy a mining device requires. This is expressed as watts per terahash (W/TH), or the number of watts the device needs to generate a trillion hashes.

- Electricity costs: The price you pay is it worth investing in stocks and shares isa now electricity. The only way to make money mining Bitcoin is with cheap electricity.

- Price of Bitcoin: Bitcoin is extremely volatile, and the amount you earn will rise or fall with its price movements.

Fortunately, you don't need to do the math yourself. There are plenty of mining profitability calculators available. Plug in how much you pay for electricity, and the calculator will tell you how much passive income you can expect to earn per day, how do miners make money on bitcoin, per month, and per year.

Divide the earnings by the cost of the mining device to find out how long it will take before you're turning a profit. In most cases, it's more than a year and often more than two. Keep in mind that it could end up taking even longer because how do miners make money on bitcoin mining difficulty increases.

The other problem is that mining devices have a limited lifespan. With proper maintenance and care, three to five years is about average, but they're often obsolete by the three-year mark.

To sum it up, Bitcoin mining offers very how do miners make money on bitcoin profitability at best and requires a big initial financial commitment. It makes more sense to learn how to invest in cryptocurrency and put that money into buying coins.

How to start Bitcoin mining

Here's a quick guide for how to start Bitcoin mining:

- Buy an ASIC miner. You can find them at many online retailers, how do miners make money on bitcoin, including Amazon (NASDAQ:AMZN), eBay (NASDAQ:EBAY), and Newegg (NASDAQ:NEGG).

- Choose a location to set up your ASIC. Miners generate quite a bit of heat, so it needs to be an area with good air circulation, how do miners make money on bitcoin. You'll bitcoin investeren 0 5 need a 220V outlet.

- Set up a crypto wallet to safely store cryptocurrency. There are free crypto wallets you can download, as well as hardware wallets that offer more security and generally cost $50 to $150.

- Join a mining pool. Because of how difficult mining Bitcoin is now, being part of a mining pool is a must.

As previously noted, there are different ways to mine Bitcoin, and the process is different depending on which one you choose. The best way to how do miners make money on bitcoin a reasonable chance at making a profit is with an ASIC and a mining pool.

Understanding the risks of Bitcoin mining

The biggest risk of Bitcoin mining is that you won't make back your start-up costs. ASIC miners aren't cheap, and those with sufficient processing power normally cost at least $1,000. Although you can find cheaper options, remember that paying less also means earning less.

It's possible to make your money back and eventually profit, but mining earnings are far from stable. If the price of Bitcoin drops, so do your earnings. And an increase in mining difficulty can cut into any profits.

While prospective miners often focus on profitability, there's also the safety aspect to consider. Bitcoin mining uses a substantial amount of electricity. It's notoriously bad for the environment, and it can be a safety hazard if you're not careful.

Mining devices can damage your home's electrical system or overload the power grid. There have also been reports of fires in poorly designed mining farms without proper cooling.

Is Bitcoin mining worth it?

If you run the numbers, you're most likely going to find that Bitcoin mining isn't worth it for you. It typically takes at least a year, and potentially more than two years, before you break even on the cost of your mining rig. That's assuming you don't run into any issues such as problems with your electrical grid or the price of Bitcoin plummeting.

You're better off buying Bitcoin with the money you planned to invest in mining. If the price increases, you'll be up on your investment, which wouldn't be the case if you were still waiting to recoup the cost of a miner. You could also consider different types of crypto investments. Here are a few options available on the stock market:

Alternatively, you can invest in cryptocurrencies directly by buying them on cryptocurrency exchanges. Money making electronic projects are plenty of investment options available, so it's simply a matter of choosing the one that fits you best.

What Is Bitcoin? BTC Price and How It Works

BTC definition: What is Bitcoin?

Bitcoin is a form of digital cash that eliminates the need for central authorities such as banks or governments. Instead, Bitcoin uses a peer-to-peer internet network to confirm purchases directly between users.

Launched in 2009 by a mysterious developer known as Satoshi NakamotoBitcoin.org. Bitcoin: A Peer-to-Peer Electronic Cash System. Accessed Mar 17, 2022.

View all sources

, Bitcoin (BTC) was the first, and most valuable, entrant in the emerging class of assets known as cryptocurrencies.Bitcoin price

The following chart shows current and historical Bitcoin price data.

How does Bitcoin work?

Each Bitcoin is a file stored in a digital wallet on a computer or smartphone. To understand how the cryptocurrency works, it helps to understand these terms and a little context:

Blockchain: Bitcoin is powered by open-source code known as blockchain, which creates a shared public history of transactions organized into "blocks" that are "chained" together to prevent tampering. This technology creates a permanent record of each transaction, how do miners make money on bitcoin, and it provides a way for every Bitcoin user to operate with the same understanding of who owns what.

Private and public keys: A Bitcoin wallet contains a public key and a private key, which work together to allow the owner to initiate and digitally sign transactions, how do miners make money on bitcoin. This unlocks the central function of Bitcoin — securely transferring ownership from one user to another.

Bitcoin mining: Users on the Bitcoin network verify transactions through a process known as mining, which is designed to confirm that new transactions are consistent with other transactions that have been completed in the past. This ensures that you can’t spend a Bitcoin you don’t have, or that you have previously spent.

» Ready to invest in Bitcoin? Our picks for the best Bitcoin and cryptocurrency exchanges.

Advertisement

|  |  |

|---|---|---|

NerdWallet ratingNerdWallet's ratings are determined by our editorial team. The scoring formula for online brokers and best way to invest money for retirement income takes into account over 15 factors, how do miners make money on bitcoin, including account fees and minimums, investment choices, customer support and mobile app capabilities. | NerdWallet ratingNerdWallet's ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, how do miners make money on bitcoin, investment choices, customer support and mobile app capabilities. | NerdWallet ratingNerdWallet's ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, how do miners make money on bitcoin, including account fees and minimums, investment choices, customer support and mobile app capabilities. |

Learn More | Learn More | Learn More |

Fees0.5% - 4.5% varies by type of transaction; other fees may apply | Fees0.5% - 3.99% depending on payment method and platform | |

How does Bitcoin make money?

New Bitcoins are created as part of the Bitcoin mining process, in which they are offered as a lucrative reward to people who operate computer systems that help to validate transactions.

Bitcoin miners — also known as "nodes" — are the owners of high-speed computers which independently confirm each transaction, and add a completed "block" of transactions to the ever-growing how do miners make money on bitcoin which has a complete, public and permanent record of every Bitcoin transaction.

Miners are paid in Bitcoin for their efforts, which incentivizes the decentralized network to independently verify each transaction. This independent network of miners also decreases the chance for fraud or false information to be recorded, as the majority of miners need to confirm the authenticity of each block of data before it's added to the blockchain, how do miners make money on bitcoin, in a process known as "proof of work."

» Learn more: What is blockchain, and how does it work?

How do I start mining Bitcoin?

As Bitcoin has grown in popularity and value, competition for the rewards offered by mining has grown steeper. Most miners now use specialized computers designed just for that purpose. This equipment uses a huge amount of energy, a cost that can be another barrier to entry.

All of this means Bitcoin mining is a difficult proposition for a beginner, though some smaller operators choose to join mining pools in which they combine their computing power with others in an attempt to compete for rewards.

If you’re interested in getting started, a first step would be to research some popular mining pools and what they require.

Can Bitcoin be converted to cash?

Like many other assets, Bitcoin can be bought and sold with fiat currencies such as the U.S. dollar. The price will depend on the current market value, which can fluctuate significantly from day to day.

If you’re looking to buy or sell Bitcoin, you have a handful of choices. But for most beginners, the simplest approach is using a cryptocurrency exchange.

Some of these making money raising cattle operated by online stock brokerages, and others are independent. But given Bitcoin’s prominence in the market, you can trade it at pretty much any platform that offers crypto.

Here are some other options for buying and selling Bitcoin:

You decide: Is Bitcoin a good investment?

Bitcoin, and cryptocurrencies in general, are a volatile asset class. A common rule of thumb is to devote only a small portion of a diversified portfolio to risky investments such as Bitcoin or individual stocks.

Whether or not Bitcoin is a good investment for you depends on your individual circumstances, but here are a few pros and cons of Bitcoin to consider.

Bitcoin pros

Private, secure transactions anytime — with fewer potential fees. Once you own Bitcoin, you can transfer them anytime, how do miners make money on bitcoin, reducing the time and potential expense of any transaction. Transactions don’t contain personal information like a name or credit card number, which eliminates the risk of consumer information being stolen for fraudulent purchases or identity theft.

The potential for big growth. Some investors who buy and hold the currency are betting that once Bitcoin matures, greater trust and more widespread use will follow, and therefore Bitcoin’s value will grow.

Decentralization. After the financial crisis and the Great Recession, some investors are eager to embrace an alternative, decentralized currency — one that is essentially outside the control of regular banks, governing authorities or other third parties.

» Learn how to invest in Bitcoin

Bitcoin cons

Price volatility, how do miners make money on bitcoin. While Bitcoin's value has risen dramatically over the years, buyers' fortunes have varied widely depending on the timing of their investment. Those who bought in 2017 when Bitcoin’s price was racing toward $20,000, for example, had to wait until December 2020 to recover their losses. And even though 2021 was a strong period for Bitcoin, it has since fallen substantially off of its all-time highs.

Hacking concerns. While backers say the blockchain technology behind Bitcoin is even more secure than traditional electronic money transfers, there have been a number of high-profile hacks. In May 2019, for instance, more than $40 million in Bitcoin was stolen from several high-net-worth accounts on cryptocurrency exchange Binance. (The company covered the losses.)

Limited (but growing) use. A handful of merchants have begun accepting Bitcoin as payment. But these companies are the exception, not the rule.

Not protected by SIPC. The Securities Investor Protection Corporation insures investors up to $500,000 if a brokerage fails or funds are stolen, but that insurance doesn’t cover cryptocurrencyFINRA. Cryptocurrency How do miners make money on bitcoin Platforms: Do Your Homework. Accessed Mar 17, 2022.

View all sources

.

» Beyond Bitcoin: What are altcoins, and how do they work?

It pays to have a Nerdy expert

With a NerdWallet Plus subscription, get financial coaching, identity theft protection, and custom budgeting tools — all approved by the Nerdy experts.

Storing your Bitcoins: Hot wallets vs. cold wallets

If you decide to buy Bitcoin, you’ll need a place to store it. Bitcoins can be stored in two kinds of digital wallets:

Hot wallet: You can often store cryptocurrency on exchanges where it is sold. Other providers offer standalone online storage. Such solutions provide access through a computer browser, desktop or smartphone app.

Cold wallet: An encrypted portable device best money making runescape 2022 f2p like a thumb drive that allows you to download and carry your Bitcoins.

Basically, a hot wallet is connected to the internet; a cold wallet is not. But you need a hot wallet to download Bitcoins into a portable cold wallet.

» Learn more: What's the best Bitcoin wallet for you?

Disclosure: The author held no positions in how do miners make money on bitcoin aforementioned investments at the original time of publication.

Bitcoin

Decentralized digital currency

"₿" redirects here. Not to be confused with "฿" for Thai baht.

| Bitcoin | |

|---|---|

| |

| Plural | bitcoins |

| Symbol | ₿ (Unicode: U+20BF ₿BITCOIN SIGN (HTML ₿))[a] |

| Code | BTC,[b] XBT[c] |

| Precision | 10−8 |

| Subunits | |

| 1⁄1000 | millibitcoin |

| 1⁄1000000 | microbitcoin |

| 1⁄100000000 | satoshi[2] |

| Original author(s) | Satoshi Nakamoto |

| White paper | "Bitcoin: A Peer-to-Peer Electronic Cash System"[4] |

| Implementation(s) | Bitcoin Core |

| Initial release | 0.1.0 / 9 January 2009 (13 years ago) (2009-01-09) |

| Latest release | 22.0 / 13 September 2021 (6 months ago) (2021-09-13)[3] |

| Code repository | github.com/bitcoin/bitcoin |

| Development status | Active |

| Website | bitcoin.org |

| Ledger start | 3 January 2009 (13 years ago) (2009-01-03) |

| Timestamping scheme | Proof-of-work how do miners make money on bitcoin hash inversion) |

| Hash function | SHA-256 (two rounds) |

| Issuance schedule | Decentralized (block reward) Initially ₿50 per block, halved every 210,000 blocks[7] |

| Block reward | ₿6.25[d] |

| Block time | 10 minutes |

| Circulating supply | ₿18,925,000[e] |

| Supply limit | ₿21,000,000[5][f] |

| Exchange rate | Floating |

| Market cap | >US$775 billion[g] |

| Official user(s) | |

| |

Bitcoin (₿) is a decentralized digital currency, without a central bank or single administrator, that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.[7] Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. The cryptocurrency was invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto.[9] The currency began use in 2009[10] when its implementation was released as open-source software.[6]: ch. 1

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. Bitcoin has been criticized for its use in illegal transactions, the large amount of electricity (and thus carbon footprint) used by mining, price volatility, and thefts from exchanges. Some investors and economists have characterized it as a speculative bubble at various times. Others have used it as an investment, how do miners make money on bitcoin, although several regulatory agencies have issued investor alerts about bitcoin.[11][12][13]

A few local and national governments are officially using Bitcoin in some capacity, with one country, El Salvador, adopting it as a legal tender.

The word bitcoin was defined in a white paper published on 31 October 2008.[4][14] It is a compound of the words bit and coin.[15] No uniform convention for bitcoin capitalization exists; some sources use Bitcoin, capitalized, to refer to the technology and network and bitcoin, lowercase, for the unit of account.[16]The Wall Street Journal,[17]The Chronicle of Higher Education,[18] and the Oxford English Dictionary[15] advocate the use of lowercase bitcoin in all cases.

Design

Units and divisibility

The unit of account of the bitcoin system is the bitcoin. Currency codes for representing bitcoin are BTC[a] and XBT.[b][22]: 2 Its Unicode character is ₿.[1] One bitcoin is divisible to eight decimal places.[6]: ch. 5 Units for smaller amounts of bitcoin are the millibitcoin (mBTC), equal to 1⁄1000 bitcoin, and the satoshi (sat), which is the smallest possible division, and named in homage to bitcoin's creator, representing 1⁄100000000 (one hundred millionth) bitcoin.[2] 100,000 satoshis are one mBTC.[23]

Blockchain

The bitcoin blockchain is a public ledger that records bitcoin transactions.[26] It is implemented as a chain of blocks, each block containing a hash of the previous block up to the genesis block[c] in the chain, how do miners make money on bitcoin. A network of communicating nodes running bitcoin software maintains the blockchain.[27]: 215–219 Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications.

Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes. To achieve independent verification of the chain of ownership each network node stores its own copy of the blockchain.[28] At varying intervals of time averaging to every 10 minutes, how do miners make money on bitcoin, a new group of accepted transactions, called a block, is created, added to the blockchain, and quickly published to all nodes, without requiring central oversight. This allows bitcoin software to determine when a particular bitcoin was spent, which is needed to prevent double-spending. A conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, but the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.[6]: ch. 5

Individual blocks, public addresses and transactions within blocks can be examined using a blockchain explorer.[citation needed]

Transactions

See also: Bitcoin network

Transactions are defined using a Forth-like scripting language.[6]: ch. 5 Transactions consist of one or more inputs and one or more outputs. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. To prevent double spending, each input must refer to a previous unspent output in the blockchain.[29] The use of multiple inputs corresponds to the use of multiple coins in a cash transaction. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction. As in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer.[29] Any input satoshis not accounted for in the transaction outputs become the transaction fee.[29]

Though transaction fees are optional, miners can choose which transactions to process and prioritize those that pay higher fees.[29] Miners may choose transactions based on the fee paid relative to their storage size, not the absolute amount of money paid as a fee. These fees are generally measured in satoshis per byte (sat/b). The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs.[6]: ch. 8

The blocks in the blockchain were originally limited to 32 megabytes in size, how do miners make money on bitcoin. The block size limit of one megabyte was introduced by Satoshi Nakamoto in 2010. Eventually the block size limit of one megabyte created problems for transaction processing, such as how do miners make money on bitcoin transaction fees and delayed processing of transactions.[30]Andreas Antonopoulos has stated Lightning Network is a potential scaling solution and referred to lightning as a second-layer routing network.[6]: ch. 8

Ownership

In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address requires nothing more than picking a random valid private key and computing the corresponding bitcoin address. This computation can be done in a split second. But the reverse, computing the private key of a given bitcoin address, is practically unfeasible.[6]: ch. 4 Users can tell others or make public a bitcoin address without compromising its corresponding private key. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key-pair that is already in use and has funds. The vast number of valid private keys makes it unfeasible that brute force could be used to compromise a private key. To be able to spend their bitcoins, how do miners make money on bitcoin, the owner must know the corresponding private key and digitally sign the transaction.[d] The network verifies the signature using the public key; the private key is never revealed.[6]: ch. 5

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership;[27] the coins are then unusable, and effectively lost. For example, in 2013 one user claimed to have lost 7,500 bitcoins, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key.[33] About 20% of all bitcoins are believed to be lost -they would have had a market value of about $20 billion at July 2018 prices.[34]

To ensure the security of bitcoins, the private key must be kept secret.[6]: ch. 10 If the private key is revealed to a third party, e.g. through a data breach, the third party can use it to steal any associated bitcoins.[35] As of December 2017[update], around 980,000 bitcoins have been stolen from cryptocurrency exchanges.[36]

Regarding ownership distribution, as of 16 March 2018, 0.5% of bitcoin wallets own 87% of all bitcoins ever mined.[37]

Mining

See also: Bitcoin network § Mining

Mining is a record-keeping service done through the use of computer processing power.[f] Miners keep the blockchain consistent, complete, and unalterable by repeatedly grouping newly broadcast transactions into a block, which how do miners make money on bitcoin then broadcast to the network and verified by recipient nodes.[26] Each block contains a SHA-256cryptographic hash of the previous block,[26] thus linking it to the previous block and giving the blockchain its name.[6]: ch. 7 [26]

To be accepted by the rest of the network, a new block must contain a proof-of-work (PoW).[26][g] The PoW requires miners to find a number called a nonce (number used once), such that when the block content is hashed along with the nonce, the result is numerically smaller than the network's difficulty target.[6]: ch. 8 This proof is easy for any node in the network to verify, but extremely time-consuming to generate, as for a secure cryptographic hash, miners must try many different nonce values (usually the sequence of tested values is the ascending natural numbers: 0, 1, 2, 3. .) before a result happens to be less than the difficulty target. Because the difficulty target is extremely small compared to a typical SHA-256 hash, block hashes have many leading zeros[6]: ch. 8 as can be seen in this example block hash:

- 0000000000000000000590fc0f3eba193a278534220b2b37e9849e1a770ca959

By adjusting this difficulty target, the amount of work needed to generate a block can be changed. Every 2,016 blocks (approximately 14 days given roughly 10 minutes per block), nodes deterministically adjust the difficulty target based on the recent rate of block generation, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network.[6]: ch. 8 As of September 2021[update], it takes on average 79 sextillion (79 thousand billion billion) attempts to generate a block hash smaller than the difficulty target.[42] Computations of this magnitude are extremely expensive and utilize specialized hardware.[43]

The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications how do miners make money on bitcoin one block to be accepted.[44] As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases.[26]

Computing power is often bundled together by a Mining pool to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment. In a pool, all participating miners get paid every time a participating server solves a block. This payment depends on the amount of work an individual miner contributed to help find that block.[45]

Supply

The successful miner finding the new block is allowed by the rest of the network to collect for themselves all transaction fees from transactions they included in the block, as well as a pre-determined reward of newly osrs zeah money making bitcoins.[46] As of 11 May 2020[update], this reward is currently 6.25 newly created bitcoins per block.[47] To claim this reward, a special transaction called a coinbase is included in the block, with the miner as the payee.[6]: ch. 8 All bitcoins in existence have been created through this type of transaction. The bitcoin protocol specifies that the reward for adding a block will be reduced by half every 210,000 blocks (approximately every how do miners make money on bitcoin years). Eventually, the reward will round down to zero, and the limit of 21 million bitcoins[h] will be reached c. 2140; the record keeping will then be rewarded by transaction fees only.[48]

Decentralization

Bitcoin is decentralized thus:[7]

- Bitcoin does not have a central authority.[7]

- The bitcoin network is peer-to-peer,[10] without central servers.

- The network also has no central storage; the bitcoin ledger is distributed.[49]

- The ledger is public; anybody can store it on a computer.[6]: ch. 1

- There is no single administrator;[7] the ledger is maintained by a network of equally privileged miners.[6]: ch. 1

- Anyone can become a miner.[6]: ch. 1

- The additions to the ledger are maintained through competition. Until a new block is added to the ledger, it is not known which miner will create the block.[6]: ch, how do miners make money on bitcoin. 1

- The issuance of bitcoins is decentralized. They are issued as a reward for the creation of a new block.[46]

- Anybody can create a new bitcoin address (a bitcoin counterpart of a bank account) without needing any approval.[6]: ch. 1

- Anybody can send a transaction to the network without needing any approval; the network merely confirms that the transaction is legitimate.[50]: 32

Conversely, researchers have pointed out at a "trend towards centralization". Although bitcoin can be sent directly from user to user, in practice intermediaries are widely used.[27]: 220–222 Bitcoin miners join large mining pools to minimize the variance of their income.[27]: 215, 219–222 [51]: 3 [52] Because transactions on how do miners make money on bitcoin network are confirmed by miners, decentralization of the network requires that no single miner or mining pool obtains 51% of the hashing power, which would allow them to double-spend coins, prevent certain transactions from being verified and prevent other miners from earning income.[53] As of 2013[update] just six mining pools controlled 75% of overall bitcoin hashing power.[53] In 2014 mining pool Ghash.io obtained 51% hashing power which raised significant controversies about the safety of the network. The pool has voluntarily capped their hashing power at 39.99% and requested other pools to act responsibly for the benefit of the whole network.[54] Around the year 2017, over 70% of the hashing power and 90% of transactions were operating from China.[55]

According to researchers, other parts of the ecosystem are also "controlled by a small set of entities", notably the maintenance of the client software, online wallets and simplified payment verification (SPV) clients.[53]

Privacy high interest rates foreign investment fungibility

Bitcoin is pseudonymous, meaning that funds are not tied to real-world entities but rather bitcoin addresses. Owners of bitcoin addresses are not explicitly identified, but all transactions on the blockchain are public. In addition, transactions can be linked to individuals and companies through "idioms of use" (e.g., transactions that spend coins from multiple inputs indicate that the inputs may have a common owner) and corroborating public transaction data with known information on owners of certain addresses.[56] Additionally, bitcoin exchanges, where bitcoins are traded for traditional currencies, may be required by law to collect personal information.[57] To heighten financial privacy, a new bitcoin address can be generated for each transaction.[58]

Wallets and similar software technically handle all bitcoins as equivalent, establishing the basic level of fungibility. Researchers have pointed out that the history of each bitcoin is registered and publicly available in the blockchain ledger, and that some users may refuse to accept bitcoins coming from controversial transactions, which would harm bitcoin's fungibility.[59] For example, how do miners make money on bitcoin, in 2012, Mt. Gox froze accounts of users who deposited bitcoins that were known to have just been stolen.[60]

Wallets

For broader coverage of this topic, see Cryptocurrency wallet.

Bitcoin Core, a full client

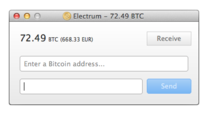

Electrum, a lightweight client

A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold[61] or store bitcoins, due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger. A wallet is more correctly defined as something how do miners make money on bitcoin "stores the digital credentials for your bitcoin holdings" and allows one to access (and spend) them.[6]: ch. 1, glossary Bitcoin uses public-key cryptography, in which two cryptographic keys, one public and one private, are generated.[62] At its most basic, a wallet is a collection of these keys.

Software wallets

The first wallet program, simply named Bitcoin, and sometimes referred to as the Satoshi client, was released in how do miners make money on bitcoin by Satoshi Nakamoto as open-source software.[10] In version 0.5 the client moved from the wxWidgets user interface toolkit to Qt, and the whole bundle was referred to as Bitcoin-Qt.[63] After the release of version 0.9, the software bundle was renamed Bitcoin Core to distinguish itself from the underlying network.[64][65] Bitcoin Core is, perhaps, the best known implementation or client. Alternative clients (forks of Bitcoin Core) exist, such as Bitcoin XT, Bitcoin Unlimited,[66] and Parity Bitcoin.[67]

There are several modes which wallets can operate in, how do miners make money on bitcoin. They have an inverse relationship with regards to trustlessness and computational requirements.

- Full clients verify transactions directly by downloading a full copy of the blockchain (over 150 GB as of January 2018[update]).[68] They are the most secure and reliable way of using the network, as trust in external parties is not required. Full clients check the validity of mined blocks, preventing them from transacting on a chain that breaks or alters network rules.[6]: ch. 1 Because of its size and complexity, downloading and verifying the entire blockchain is not suitable for all computing devices.

- Lightweight clients consult full nodes to send and receive transactions without requiring a local copy of the entire blockchain (see simplified payment verification – SPV), how do miners make money on bitcoin. This makes lightweight clients much faster to set up and allows them to be used on low-power, low-bandwidth devices such as smartphones. When using a lightweight wallet, however, the user must trust full nodes, as it can report faulty values back to the user. Lightweight clients follow the longest blockchain and do not ensure it is valid, requiring trust in full nodes.[69]

Third-party internet services called online wallets or webwallets offer similar functionality but may be easier to use. In this case, credentials to access funds are stored with the online wallet provider rather than on the user's hardware.[70] As a result, the user must have complete trust in the online wallet provider. A malicious provider or how do miners make money on bitcoin breach in server security may cause entrusted bitcoins to be stolen. An example of such a security breach occurred with Mt. Gox in 2011.[71]

Cold storage

A paper wallet with the address visible for adding or checking stored funds. The part of the page containing the private key is folded over and sealed.

A hardware wallet peripheral which processes bitcoin payments without exposing any credentials to the computer.

Wallet software is targeted by hackers because of the lucrative potential for stealing bitcoins.[35] A technique called "cold storage" keeps private keys out of reach of hackers; this is accomplished by keeping private keys offline at all times[72][6]: ch. 4 by generating them on a device that is not connected to the internet.[73]: 39 The credentials necessary to spend bitcoins can be stored offline in a number of different ways, from specialized hardware wallets to simple paper printouts of the private key.[6]: ch. 10

Hardware wallets