Is it right time to buy bitcoin today - scandal!

Jordan Tuwiner Last updated February 14, 2022

![]()

Thinking of investing in Bitcoin or digital currency?

This post will outline some things you NEED to know before you buy.

We’re going to explain:

- The basics of investing in bitcoin

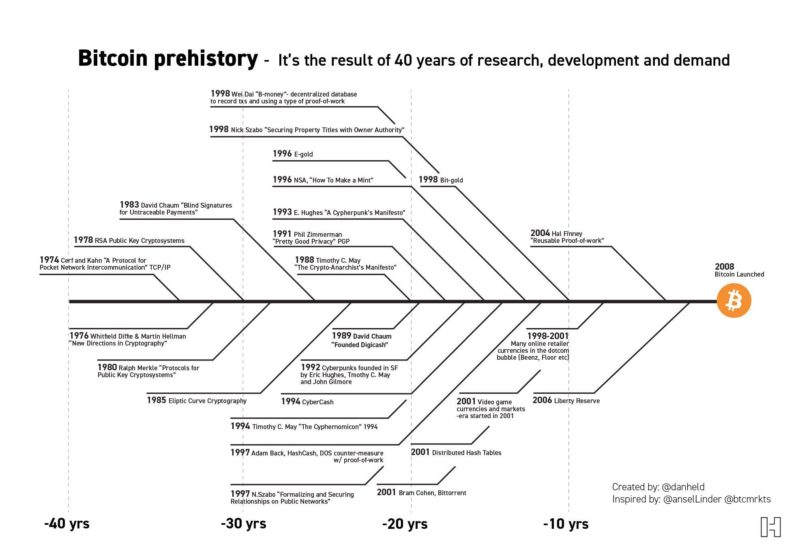

- Why it needs to be taken seriously as an asset class

- How to buy bitcoins (with credit card or bank account)

- How to protect and properly secure your bitcoins in a digital wallet

What is a Bitcoin Investment?

A Bitcoin investment is exactly what it sounds like - using dollars or euros or any other fiat currency and buying Bitcoin with them. It may also mean using retirement funds from a 401k or other funds to invest in a qualified Bitcoin IRA.

How to Invest in Bitcoin

Popular Exchanges

Bits of Gold

BUY NOWat BoG's Secure SitePromotion

Referral Program

- Crypto exchange based in Tel Aviv

- Buy with card, cash or bank transfer

- Supports Bitcoin & Ethereum

- Serves UAE, Saudi Arabi, Kuwait, Oman, Bahrain

- Rain is based in Middle East

- High buying limits

WazirX

BUY NOWat WazirX's Secure SitePromotion

50% Referral Commission

- Crypto exchange based in India

- Deposit INR with IMPS & UPI

- Low fees and many coins

CoinSpot

BUY NOWat CoinSpot's Secure Site- Crypto exchange based in Australia

- Free & instant deposits

- Large selection of cryptos & live chat support

CoinJar

BUY NOWat CoinJar's Secure SitePromotion

500 CoinJar Points

- iOS & Android apps that let you trade

- Free & instant bank transfer with PayID / Osko / NPP

- Australian crypto exchange established in 2013

eToro

BUY NOWat eToro's Secure SiteFees

Varies by crypto/spread

Account Minimum

Starts from $50

- Start trading fast; high limits

- Easy way for newcomers to get bitcoins

- Your capital is at risk.

- Best for Nigeria, South Africa, Indonesia, Malaysia

- East to use interface

- Trusted exchange

Bitpanda

BUY NOWat Bitpanda's Secure Site- Crypto exchange based in Europe

- Buy bitcoin with card, SEPA, SOFORT

- Trusted exchange

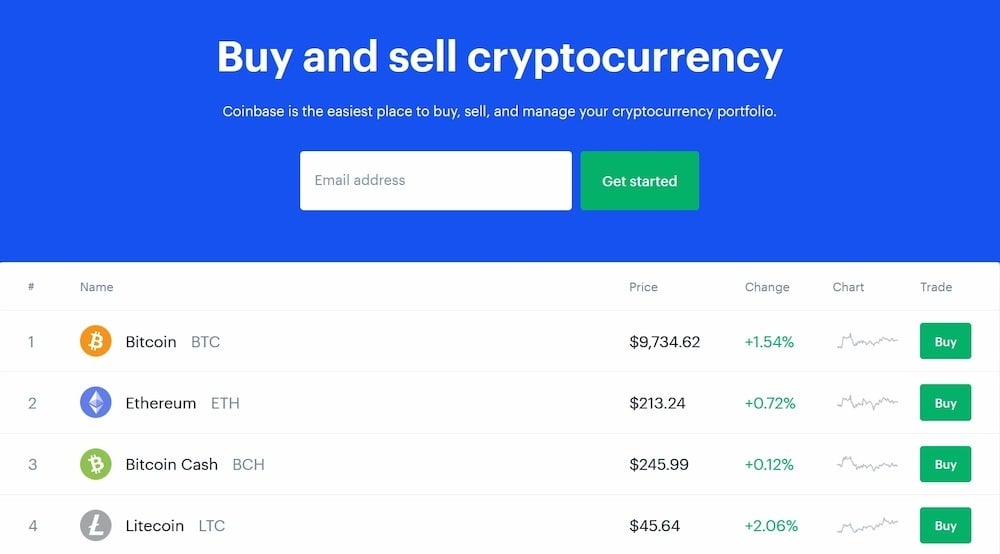

Coinbase

BUY NOWat Coinbase's Secure Site- High liquidity and buying limits

- Easy way for newcomers to get bitcoins

- "Instant Buy" option available with debit card

Bitbuy

BUY NOWat Bitbuy's Secure Site- Exchange based in Canada

- Very high buy and sell limits

- Supports Interac & wire

CoinSmart

BUY NOWat CoinSmart's Secure Site- Crypto exchange based in Canada

- Very high buy and sell limits

- Supports bank account, Interac, credit/debit

Netcoins

BUY NOWat Netcoins' Secure Site- Crypto exchange based in Canada

- Many payment methods available

- Get $10 CAD upon making $100+ in trades

- Easy sign up

- $100 million in insurance

- Trade 24/7

CoinJar

BUY NOWat CoinJar's Secure SitePromotion

500 CoinJar Points

- iOS & Android apps that let you trade

- Free & fast bank transfers

- Crypto exchange established in 2013

eToro

BUY NOWat eToro's Secure SiteFees

Varies by crypto/spread

- Supports Bitcoin, Ethereum & 15 other coins

- Start trading fast; high limits

- Your capital is at risk.

Cryptoasset investing is unregulated in some EU countries and the UK. No consumer protection. Your capital is at risk.

Coinmama

BUY NOWat Coinmama's Secure SitePromotion

30% Referral Commission

- Works in almost all countries

- Highest limits for buying bitcoins with a credit card

- Reliable and trusted broker

Gemini

BUY NOWat Gemini's Secure Site- Clean platform for advanced traders

- Supports all US states

- Trusted exchange

How to invest in Bitcoin will depend on what country you live in. Developed countries have more options and more liquidity.

Coinbase is the world’s largest bitcoin broker and available in the United States, UK, Canada, Singapore, and most of Europe.

Coinbase's home page

But, you can use our crypto exchange finder to find a place to purchase bitcoin in your country.

Find a Bitcoin Exchange

Is Bitcoin Safe?

In some ways, buying Bitcoin is much like buying any other currency. You always need to be mindful that its price rises and falls compared to other currencies.

One way Bitcoin is different than traditional investments is that you either need to hold the coins yourself or trust a third party to do it.

Holding them yourself means there is the risk that if you don’t store them properly you could lose them forever.

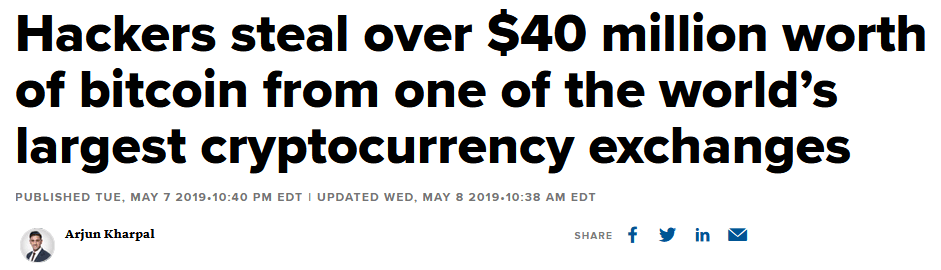

If you let a third party hold them for you, they may get hacked. And unlike storing dollars or stocks, once the coins are hacked, they cannot be easily replaced.

For instance, if someone robs a bank, the US government will make that bank whole through something called the Federal Deposit Insurance Corporation (or FDIC). There is no risk to you, as the bank customer, of having your funds stolen.

But Bitcoin is different. Bitcoin are inherently limited in supply (only 21 million will ever exist). So it isn’t so easy to replace them. Once they are gone, they are usually gone for good.

If the institution holding your Bitcoins gets hacked, they may cover the loss because they can afford to and its good for business, as Binance did in 2019.

Keep in mind, though, there is no legal obligation for them to do so.

There is an advantage to accepting these risks though.

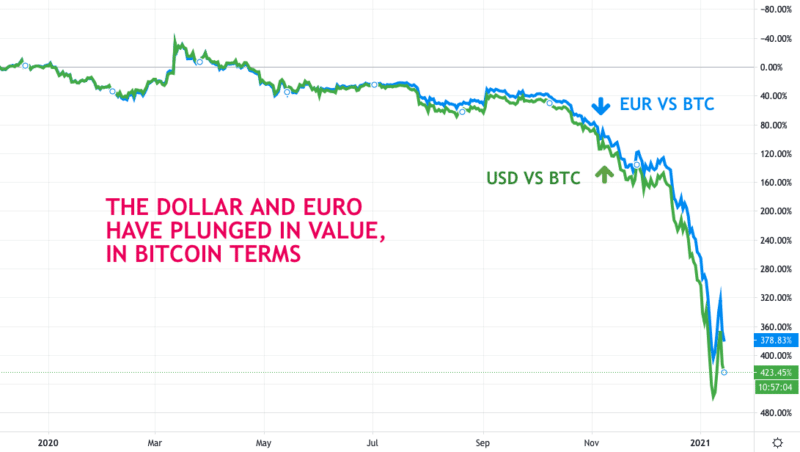

For one, Bitcoin cannot be artificially inflated like US dollars.

Why is this important?

When your government prints more money, it makes the dollars you have worth less over time.

For instance, you used to buy a soda for $0.10. Now, it costs $1.50.

An old cola machine selling bottles for $0.10

That is because of inflation.

Bitcoin is deflationary, which means the coins become MORE valuable over time, not less. You can buy more with a Bitcoin today than you could a year ago.

So while holding Bitcoin has its own risks, so does holding dollars.

Its up to you to decide which one you trust more.

How to Invest $100 in Bitcoin Today

The best way to invest $100 in Bitcoin today is using a Bitcoin exchange.

These services allow you to make recurring Bitcoin buys on a regular schedule (every week, every month, every day, etc), or one-time purchases.

These services do usually require you to verify your identity, which can take up to a few days.

Just be aware that there are higher fees on credit card purchases!

How Much BTC Does $100 Get You?

In November 2020, the price of bitcoin was around $15,000, so $100 would have purchased .0067 BTC. In January 2022, with the price around $47,000, the same $100 would purchase about .0021 BTC. The price of bitcoin relative to the USD will always affect the amount of BTC you can purchase at any given time.

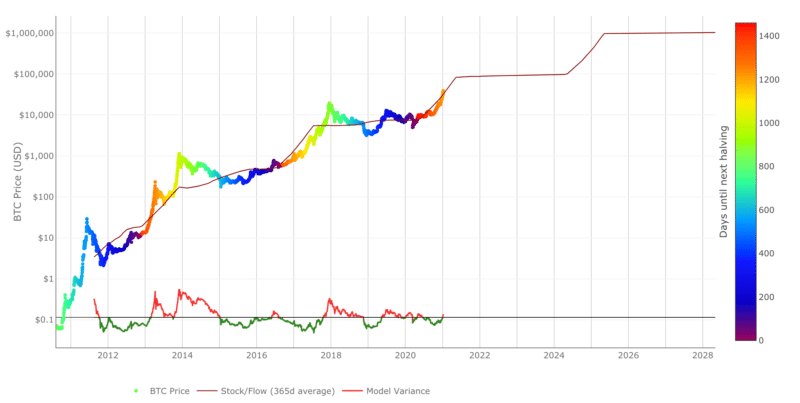

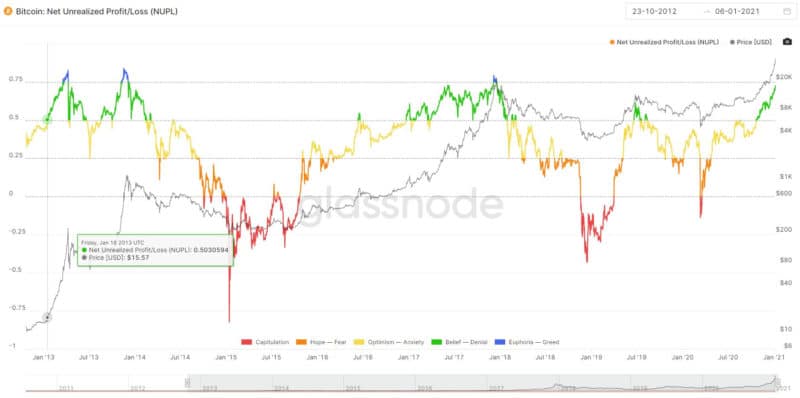

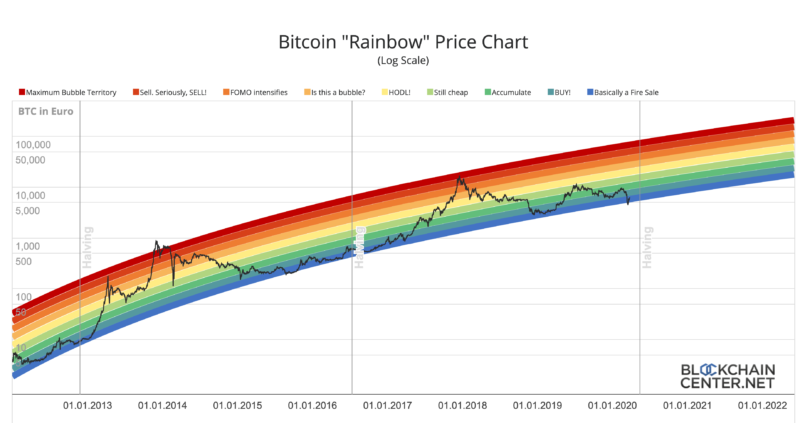

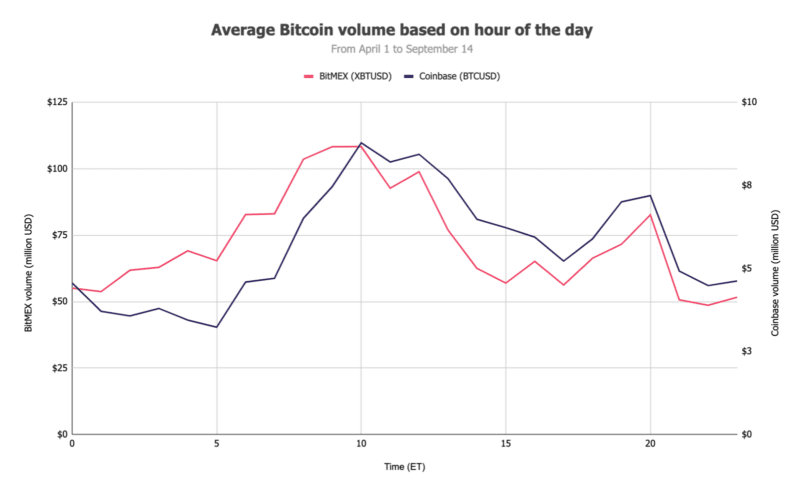

When is the Best Time to Buy Bitcoin?

As with any market, nothing is for sure.

Anyone’s guess is just about as good as anyone else’s when it comes to predicting near term Bitcoin prices.

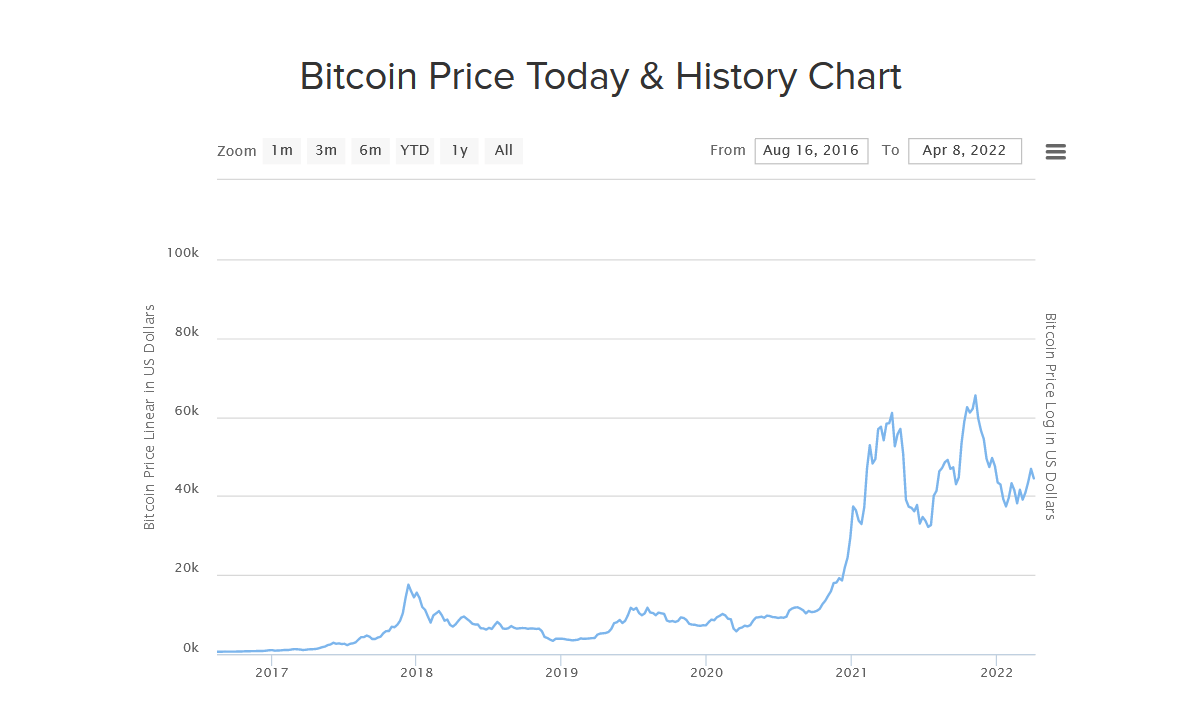

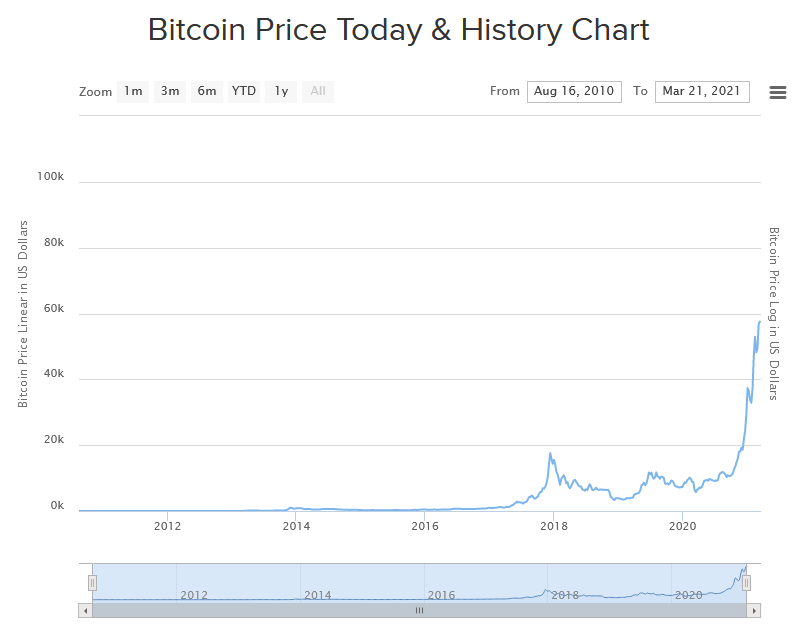

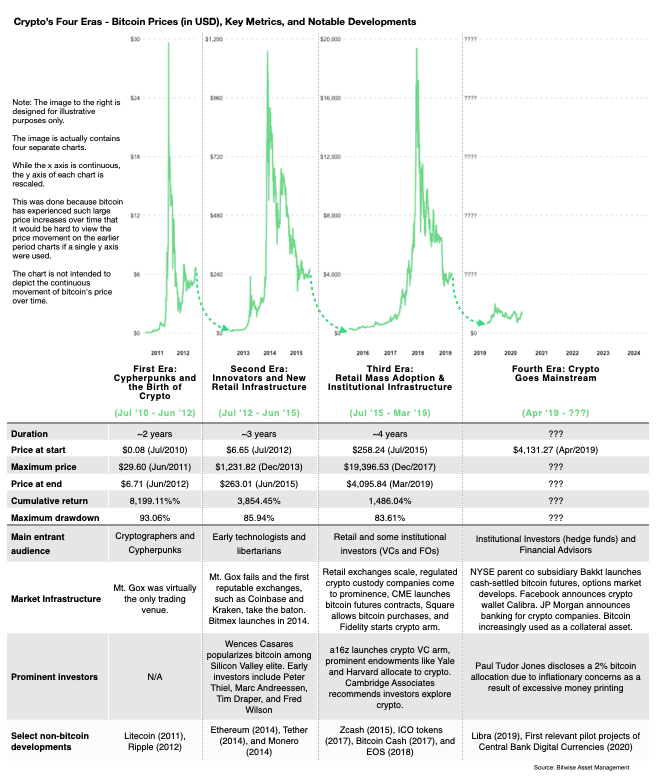

Throughout its history, Bitcoin has generally increased in value at a very fast pace, followed by a slow, steady downfall until it stabilizes.

Use tools like our Bitcoin price chart to analyze charts and understand Bitcoin’s price history.

Our Bitcoin Price Chart

Bitcoin is global, and therefore less affected by any single country’s financial situation or stability, good or bad.

For example, speculation about the Chinese Yuan devaluing has, in the past, caused more demand from China, which also pulled up the exchange rate on U.S. and Europe based cryptocurrency exchanges.

We’ve also seen bull markets in Bitcoin in the United States result in large arbitrage events in markets with much less liquidity due to capital controls, such as Korea. In the case of Korea, these were known as the ‘Kimchi Premium’

As Igor Makarov and Antoinette Shoar note in Trading and Arbitrage in Cryptocurrency Markets,

The daily average price ratio between the US and Korea between December 2017 to February 2018 reached 40% for several days...We estimate that during this period a minimum of $2 billion of potential total arbitrage profits were left on the table. In contrast, the price deviations between exchanges in the same country typically do not exceed 1%, on average.

Makarov & Schoar, Economists, Harvard and MIT

Makarov & Schoar, Economists, Harvard and MITGetting Bitcoin into Korea to take advantage of the large premium was incredibly easy. The issue was getting your fiat out of the country after you sold.

Ironically, such controls only fed the Bitcoin price even further, as individuals realized Bitcoin could do what fiat could not: make cross border payments in any amount without permission from any regulatory authority.

All of these examples illustrate how global chaos is generally seen as beneficial to Bitcoin’s price since Bitcoin is apolitical and sits outside the control or influence of any particulate government.

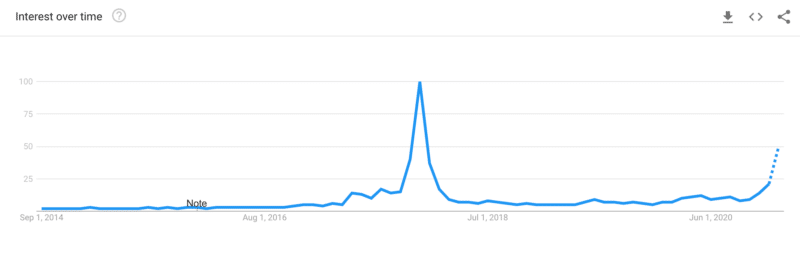

COVID19 was one such example of global Chaos boosting Bitcoin, as the Federal Reserve proclaimed an 'ample reserves regime'.

When thinking about how economics and politics will affect Bitcoin’s price, it’s important to think on a global scale and not just about what’s happening in a single country.

Is Bitcoin Legit?

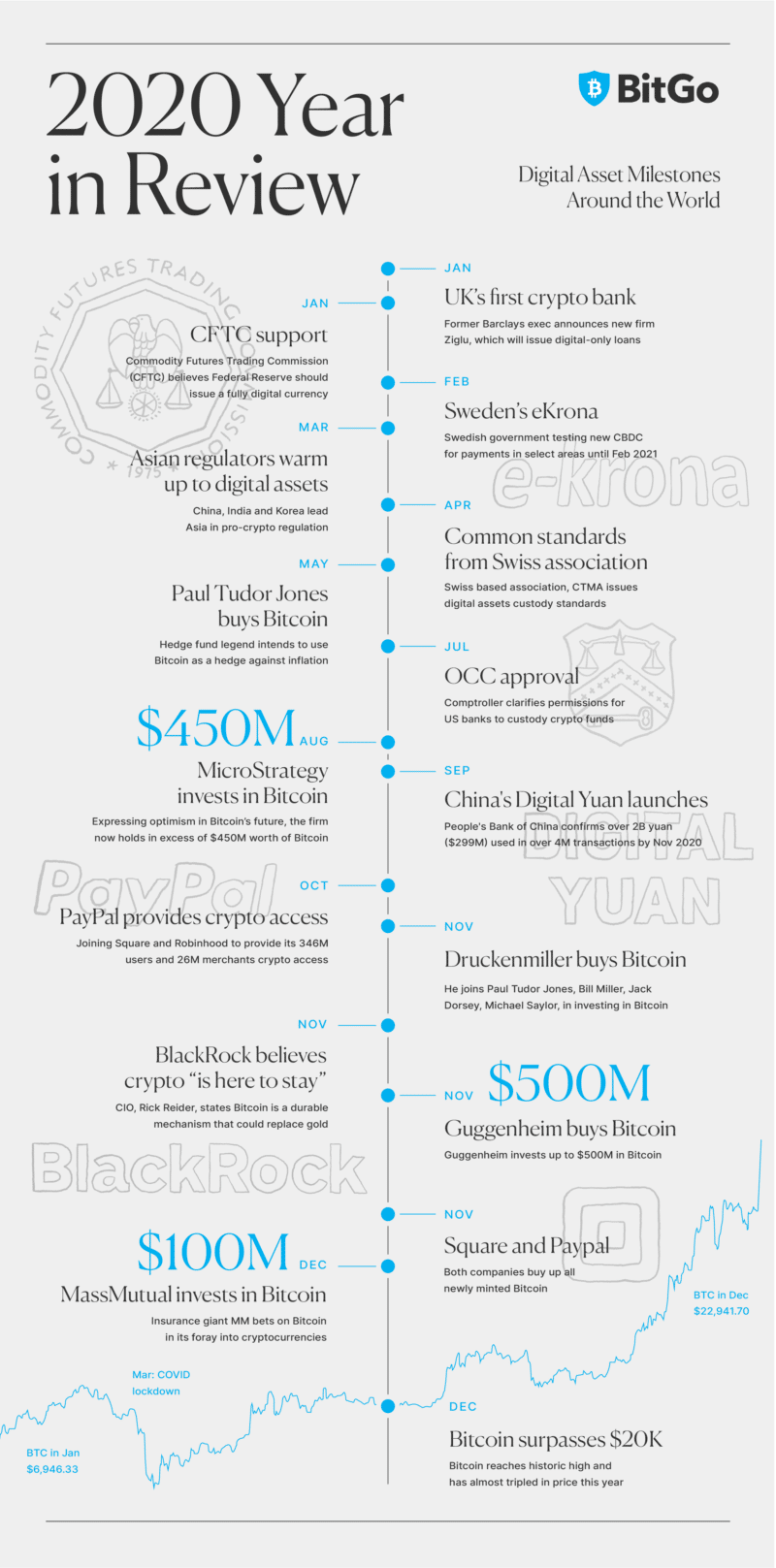

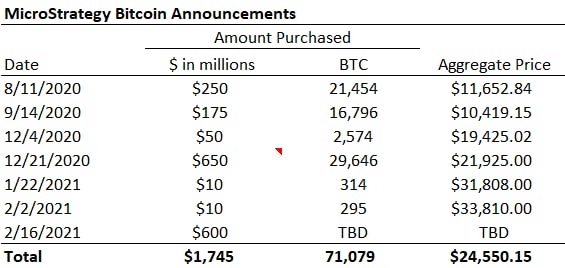

Yes, Bitcoin is absolutely a legitimate asset. So much so that publicly traded companies such as Microstrategy and Tesla have invested billions of dollars into Bitcoin.

But Tesla isn’t the only big firm catching onto Bitcoin.

In fact, the oldest and largest bank on planet Earth - BNY Mellon - has said they are going to provide custody and exchange integration services into their banking offerings.

We firmly believe digital assets are here to stay, so that's the future.

Michael Demissie Head of Advanced Solutions, BNY Mellon

Michael Demissie Head of Advanced Solutions, BNY MellonAnd it gets even better.

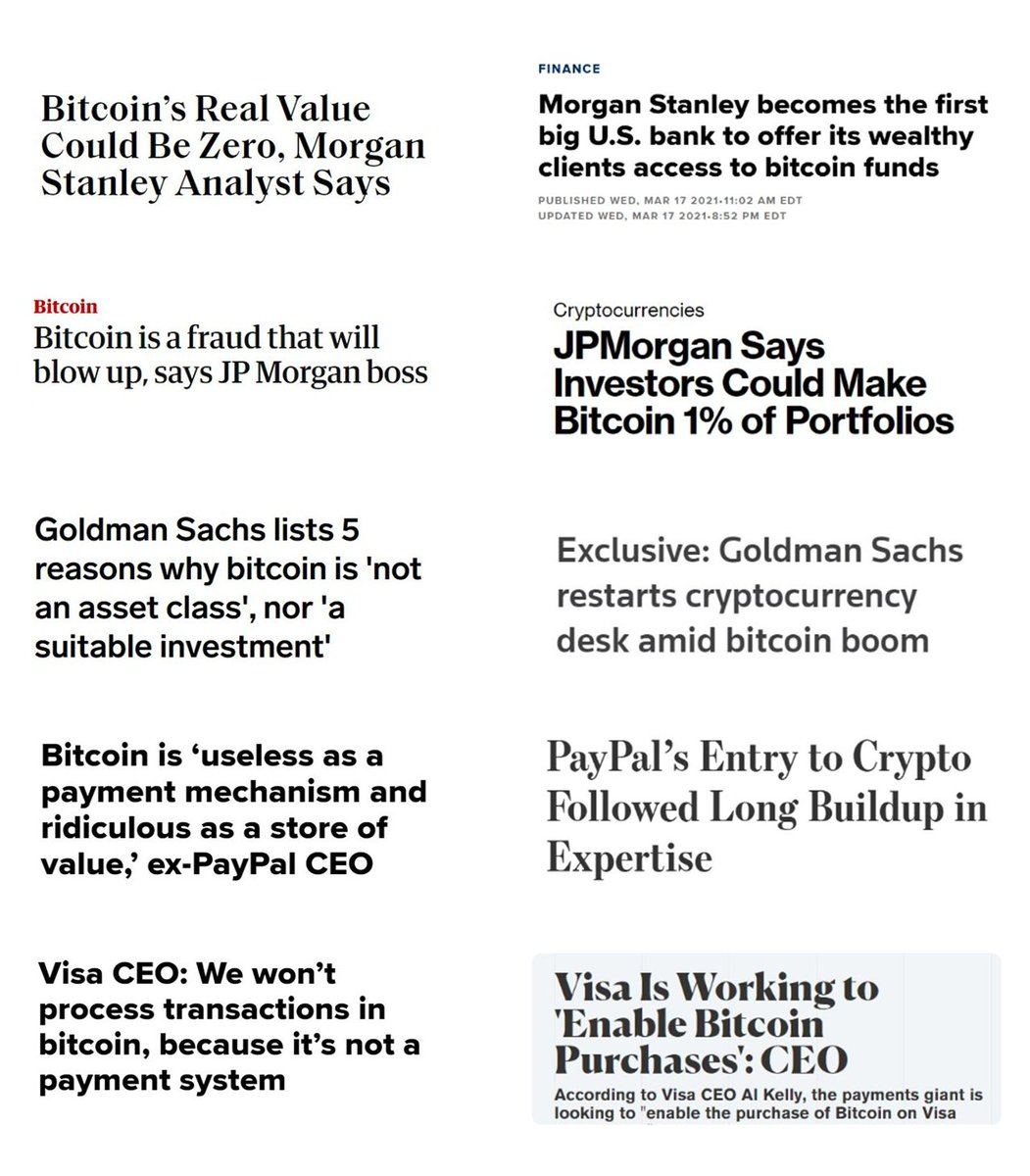

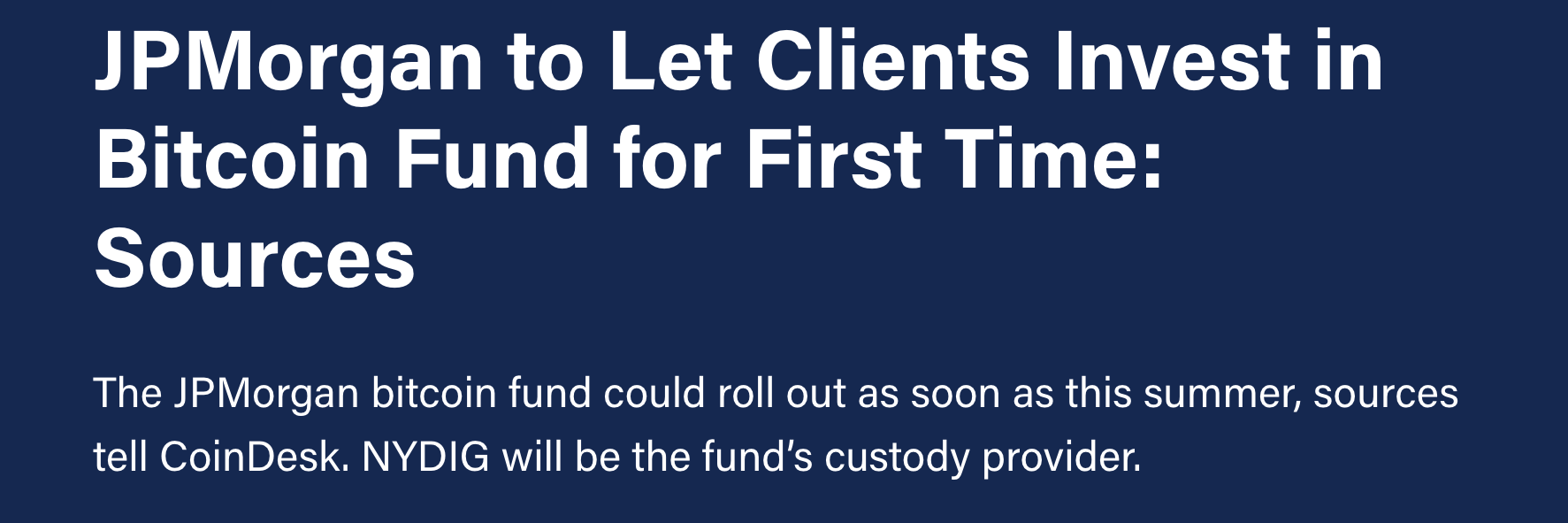

Nearly every large bank that has ever had anything bad to say about Bitcoin is now stumbling over themselves to offer services to customers who want in.

Here are some of the biggest changes in position from major financial firms over the years:

There are almost no institutions of consequence left who haven’t reversed their opinions on Bitcoin - and they all agree: Bitcoin is legitimate and here to stay.

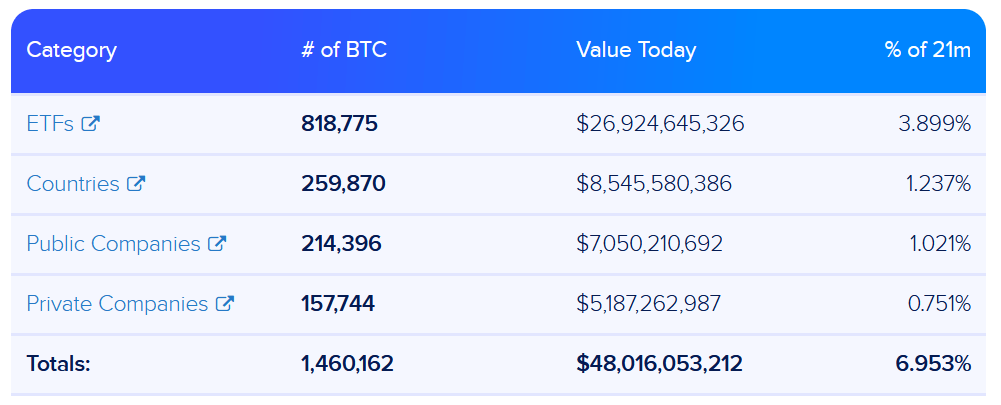

Here is a global view of how much Bitcoin is owned and held by big public and private institutions as well as governments all over the world:

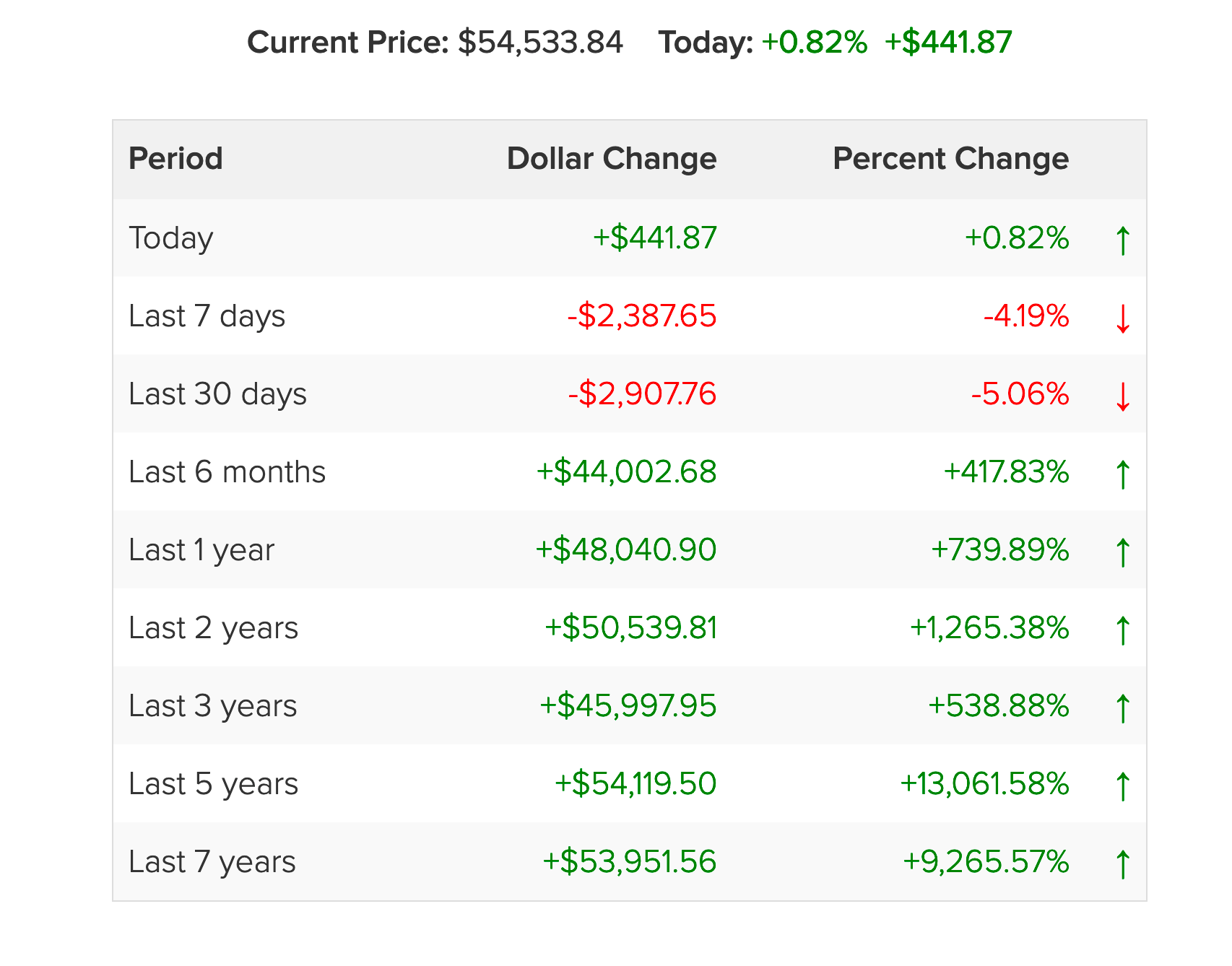

How to Check the Bitcoin Price – How Much Does a Bitcoin Cost?

The best way to check the price of Bitcoin is by using our Bitcoin price page!

On that page, you can see our historical chart.

As well as more specific information related to the price for that day.

How Much to Buy in Bitcoin

If you want to invest in Bitcoin, the best strategy for investing and how much to invest will again depend on your needs and lifestyle. Your financial advisor will be the best person to talk to.

That said, some people like to use a strategy called ‘dollar cost averaging’. With this strategy, you buy a little at a time every day, week, or month, etc.

It’s up to you to decide how frequently and in what quantity to buy. The important thing is to keep the dollar amount the same each purchase. This helps to avoid going “all in” at a high price. Ask your financial advisor about this strategy if you are curious. There a tons of services that cater to this strategy, including Swan, and Coinbase

What’s The Difference Investing in Altcoins vs Bitcoins?

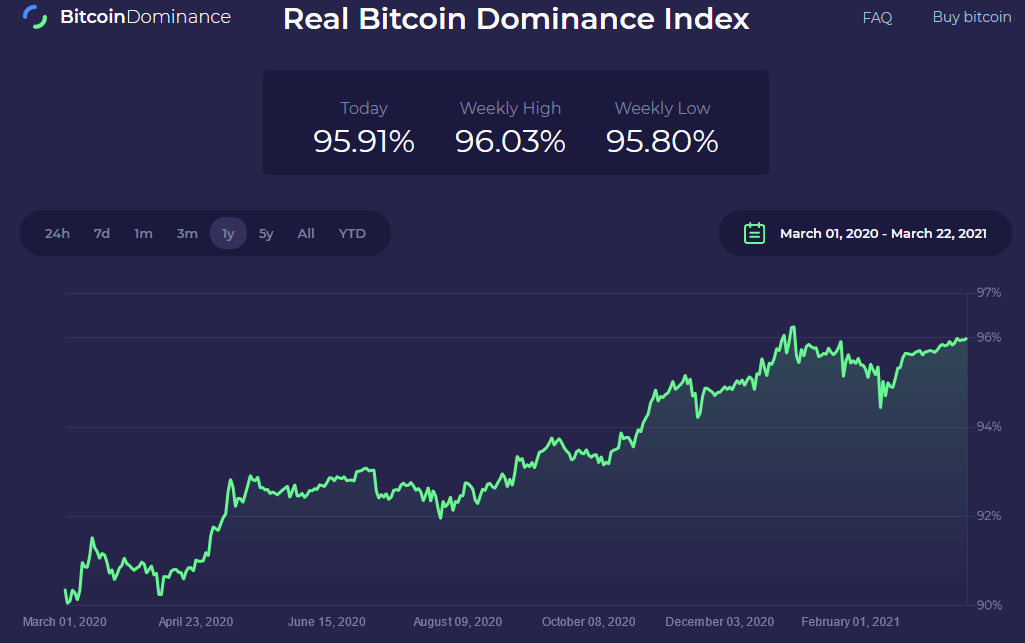

The difference between Bitcoin and all other coins is enormous.

Bitcoin has a market cap worth over $1 Trillion. No altcoin–even Litecoin or Ethereum–comes even close to that.

There is also no other crypto asset or altcoin that is as old or established as Bitcoin is.

Altcoins also lack the security and decentralization of Bitcoin, and are therefore much more open to an attack that takes down the entire network.

Our advice is to stay away from altcoins and just focus on Bitcoin.

On a long enough timeline, Bitcoin almost always beats the performance of any altcoin anyway.

Just look at Bitcoin’s dominance index - a measure of how much of the crypto market share is held by Bitcoin:

Is Bitcoin Still a Good Investment, Even Above $50,000?

No one knows, and frankly, no one will ever know at any price point. Anyone who tells you know if now is a good price to buy in at is likely scamming you.

Bitcoin is still considered by most to be a risky investment and you should never invest more than you can afford to lose. That being said, high volatility assets do tend to have greater potential for return (matched by its potential for incredible loss). You should always consult a licensed financial planner.

What About Investing in Bitcoin Mining?

The Bitcoin mining industry has grown at a rapid pace.

Mining, which could once be done on the average home computer is now only done profitably using specialized data centers and hardware (known as ‘ASIC’s’).

The latest round of Bitcoin hardware—dedicated ASICs—has co-evolved with datacenter design, and now most computation is performed in specialized ASIC datacenters....

These datacenters are warehouses, filled with computers built for the sole purpose of mining Bitcoin. Today, it costs millions of dollars to even start a profitable mining operation.

A view from inside a very organized mining farm

Bitcoin miners are no longer a profitable investment for new Bitcoin users, even despite rising transaction fees.

If you want a small miner to play around with mining, go for it. But don’t treat your home mining operation as an investment or expect to get a return.

There may be one exception to this rule: investing money into a co-location style mining facility that allows you to buy the hardware and they handle the maintenance of that hardware. They also negotiate with energy companies to get a good price on electricity.

A good example of such a company would be Compass Mining or Blockstream mining.

Bitcoin Interest Schemes

If someone asks you to invest in Bitcoin interest schemes, be careful.

As of now, Blockfi (based in New York) and Gemini trading platform are some of the only legit ways for retail investors to earn interest on bitcoin and crypto.

What About Using PayPal and Robinhood?

As of now, these two companies do not allow you to withdrawal your bitcoins. This means they control your coins, and not you.

Bitcoin ETFs

Currently, the closest thing to a Bitcoin ETF is the Grayscale Bitcoin Trust (GBTC). This is the only way to buy bitcoin in your standard stock market brokerage account, though that may change soon:

Conclusion

Investing in Bitcoin comes with outsized risk compared with traditional assets.

But with that risk comes the opportunity for outsized reward.

Like all major financial decisions, you should consult with your financial planner before investing in Bitcoin. If and when you are ready to make your first purchase, this guide and the rest of BuyBitcoinWorldwide should put you on the right path.

Digital currencies are continuing to make headlines. Berkshire Hathaway, the company of star investor Warren Buffett, has bought $1 billion worth of stock in a digital bank focusing on cryptocurrencies.

However, regulators and central banks remain concerned. The price of bitcoin plunged to $34,000 in February from $69,000 in November. It is now around $39,000. So should you join the hype or run a mile?

In this article we explain:

Related content: Is cryptocurrency a good investment?

This article contains affiliate links that can earn us revenue.*

What is bitcoin and how does it work?

The concept of digital money that you use online is not that complicated in itself. After all, most of us will be familiar with transferring money from one online bank account to another.

Cryptocurrencies like bitcoin are digital assets that operate like normal currency, but with notable differences. They use peer to peer payment methods, without the banks taking a cut with every transaction. There are no physical versions of the coins either.

Each bitcoin is created (or mined) using an encrypted code, which is a string of numbers and letters. The same equation used to create the code is can “unlock” it (like a virtual key).

Other important points about bitcoin:

- Cryptocurrencies, like bitcoin, ethereum and cardano, are a form of payment that uses blockchain technology to send data in cyberspace

- Each bitcoin must be mined

- It is finite: only 21 million bitcoins that can be mined in total

- Cryptocurrencies are “decentralised” meaning they are not regulated by a financial authority, like a government or central banks

- Most platforms will allow bitcoin purchases using credit cards (bear in mind that your credit card provider will probably charge you a fee to do this)

Why has bitcoin dropped?

The price of bitcoin and several other leading cryptocurrencies suffered huge falls in December 2021 and prices have been on a downward trajectory so far in 2022.

The Fed’s January meeting to decide whether to raise interest rates saw crypto fall along with other stocks and shares.

The bitcoin price is around $35,000, as of 24 February, according to data from Coinbase*. That’s a long way from the all-time high of $69,000 seen in November.

The recent turmoil has been caused by:

- Uncertainty around rising interest rates in the US and UK, causing a sell-off in risky assets

- China making cryptocurrency transactions illegal

- Suggestions that Russia could ban cryptocurrency trading and mining, causing prices to plummet

There have also been threats of further regulation for cryptocurrency investments in the future.

Should I invest in bitcoin?

Bitcoin is extremely volatile. If you are willing to take the risk, first make sure you understand what you are investing in and have a crypto investment strategy.

Also make sure you aren’t investing simply because you have a fear of missing out. There are a number of questions you should ask yourself before getting involved:

- Do I understand what I am investing in and how bitcoin and the crypto market work?

- Am I happy with the level of risk?

- How much more expensive is it now compared to a few months ago? If so, why am I wanting to buy a thing because its price is higher? Where else in my life do I do that?

- Is there any evidence to suggest prices could rise even higher?

- If I buy it now with a view to sell it for even more later, who do I think will buy it from me for that higher price and why?

- If an asset is so great, why was I not interested when it was much cheaper?

- Have I convinced myself that I am in some way “in the know?”

If you don’t have answers to these questions, it’s probably not a good idea to invest. If you do buy bitcoin, make sure you aren’t putting money you need on the line. Read more about cryptocurrency tips (and mistakes to avoid).

If you are new to investing and want to know more about the general principles and how to get started, check out our guide here.

Like any investment, cryptocurrency comes with risks and potential rewards. Compared to traditional types of investments, cryptocurrency is particularly risky.

Here are some things to think about before you invest:

- We definitely don’t recommend investing all your life savings on cryptocurrency markets

- It’s best to see it a bit like gambling so only invest small amount of your disposable income and be prepared to lose the lot

- Never invest more than you can afford to lose

- If you haven’t got much money left at the end of each month, it’s best to steer clear of crypto and focus on saving your money instead

- Like traditional assets, it’s best to treat cryptocurrency as a long-term investment to give you the best chance of making money

- Cryptocurrencies are extremely volatile, subject to bull runs and market crashes

The ups and downs of bitcoin

It is hailed by fans as a market-disrupting liberation and demonised by many personal finance experts as a dangerous creation. One things for sure is that bitcoin is volatile.

Since December 2020, bitcoin has enjoyed a theatre of dramatic ups and downs. We outline some of these here: is a bitcoin crash coming?

The problem is that the price of cryptocurrencies is not underpinned by any intrinsic value. It is determined by one thing: confidence, says Mark Northway, investment manager at Sparrows Capital.

So if you decide to invest, be prepared for a bumpy ride.

Can you lose all your money in bitcoin?

Yes you certainly can. Crypto is very risky and not like conventional investing in the stock market.

Bitcoin’s value is based purely on speculation. This is different to company stocks where the share price will move depending on how the business is performing.

Important: cryptocurrencies are unregulated by the UK watchdog, the Financial Conduct Authority. Crypto platforms are only regulated for anti-money laundering purposes.

There are three main ways to lose all you money with bitcoin:

- The value plummetsand you sell: crypto is volatile with its price determined by sentiment. Though technically you only lose money if you sell an investment for less than you bought it for. This is known as “crystallising your losses”.

- Your memory: experts estimate 20 per cent of all cryptocurrency has either been forgotten about or lost with a current value of around $140billion, according to Crypto data firm Chainalysis

- Cyber crime: hackers and scammers are thought to steal around $10million worth of cryptocurrency every day, according to Atlas VPN

Some people choose to take their holdings offline and store it in a physical device called a cold wallet, otherwise known as a hardware wallet or cold storage that is similar to a USB stick. While this protects from online attacks you risk losing your holdings.

As with any investment, do your due diligence and don’t pin all your hopes on one company or one cryptocurrency.

Spread your money around so you spread the risk and only invest what you can afford to lose.

How to make money by investing in bitcoin

Like any investment, making money depends on what price you buy and sell an asset for. If you sell when its price is higher than you bought it for, you will make money.

If you sell for a lower price than you bought it for, you will lose money.

For example, if you had invested in bitcoin at the start of:

- 2020 and sold on 31 December 2020, you would have made a 300% profit

- 2018 and sold on 31 December 2018, you would have made a 73% loss

Bitcoin is extremely volatile so the trick is not to panic and crystallise your losses by selling when its value inevitably falls. This is the same with all investments.

Ways to invest in bitcoin

Buying the coins (or unit of a coin) on a cryptocurrency exchange is the most common way of investing in bitcoin.

But there are other options:

Buy shares in bitcoin-related companies

You could invest in cryptocurrency exchanges or even buy shares in companies that are accepting bitcoin as payment.

Bitcoin ETFs

You could invest in a bitcoin exchange traded fund ETF. This copies the price of the digital currency, allowing you to buy into the fund without actually trading bitcoin itself.

Invest in blockchain technology companies

You could invest in the blockchain network (the system for recording information about crypto). For example, tech platform Solana claims to be the fastest blockchain in the world.

Bitcoin funds

Several investment companies are launching bitcoin funds.

It will still be volatile, but it could be easier to sell your investment and get your money back than investing directly.

There are also funds that have some exposure to bitcoin as well as traditional assets like shares and bonds.

Bitcoin options

These are a form of financial derivative that gives you the right to buy or sell bitcoin at a set price (known as a strike price) before a certain date of expiry.

Unlike buying bitcoin cryptocurrency outright, bitcoin options enable you to take a speculative position (up or down) on the future direction of a market price.

You would buy a call option if you believe the market price would increase:

- If your prediction was correct and the market price increased above the bitcoin option’s strike price, you’d be able to buy bitcoin at the pre-specified price. How far the bitcoin price rose past the strike price determines how much profit you’d make.

- If your prediction was wrong and the price of bitcoin fell, you could let the options contract expire and only lose the premium you paid to open the trade.

Read aboutLewis, who taught himself about cryptocurrency and made £8,500 in less than a year after setting up an account with trading platform eToro.

Is bitcoin bad for the environment?

The digital currency uses as much power as the Netherlands every year, with just 30 countries using more energy, according to researchers from the University of Cambridge.

Computers that mine bitcoin use up to 1% of the world’s electricity supply.

While some of bitcoin’s consumption is renewable (an estimated 39%), fossil fuels are still being used to power the mining and servicing of the digital currency.

This is why electric car manufacturer Tesla has stopped accepting crypto payments, causing bitcoin to fall. Find out more in our Guide to eco-friendly cryptocurrencies.

What are the fees when buying bitcoin?

If you want to buy and sell bitcoin, there are usually fees to pay, such as:

- Transaction fees

- Deposit fees

- Withdrawal fees

- Trading fees

- Escrow fees

These usually cost a few percent of the total transaction value.

Do financial institutions support bitcoin?

Governments, regulators and companies are looking closely at bitcoin and other cryptocurrencies.

Companies adopting bitcoin include:

Investment companies that are showing an interest include:

- The world’s largest asset manager, BlackRock, opened two of its funds to the possibility of investing in bitcoin futures

- UK based Ruffer Investment Management added bitcoin to its multi-asset portfolios before pulling out five months later with a $1.1B profit

- In 2020, one of the world’s biggest index providers, S&P Dow Jones Indices announced it would launch indexing services in 2021 for over 550 of the top traded cryptocurrencies.

The Bank of England has been exploring the possibility of its own central bank-backed digital currencies. This has been dubbed as “britcoin”. Other central banks like the Federal Reserve have been doing the same.

As more institutional investors get on board with crypto assets for capital gains, this could help to calm dramatic price moves.

Crypto friendly banks UK

Most of the UK’s major banks now let you move money between a regulated crypto exchange and your bank account.

However, some banks are more cautious than others. For example, Starling Bank had imposed a temporary suspension on outbound faster payments to cryptocurrency exchanges in order to protect customers.

The banks are continually weighing up the risks. Some make it easier for customers to move money to and from crypto exchanges.

What is Binance and can I still use it in the UK?

The UK financial watchdog has blacklisted cryptocurrency exchange Binance and banned it from carrying out any regulated activity over concerns about its money laundering controls.

The regulator has also ordered the company to stop any form of advertising in the UK.

Binance isn’t based in the UK, so the British regulator doesn’t have the power to stop investors from buying and selling cryptocurrency using the exchange. However exchanges do have to register with the FCA to operate in the UK and are monitored for money-laundering.

This is a clear warning that investors should be very cautious.

Why are regulators concerned?

The FCA has also warned investors to be wary about companies that promise high returns from cryptocurrency. The nature of investment means that there is never a guarantee of making money.

In January 2021 the FCA banned the sale of complex derivatives that speculate on cryptocurrency movements.

This means that financial services can’t offer retail customers contracts for difference, spreadbet options, futures and exchange traded notes that focus on digital currencies.

China’s crypto ban

Trading cryptocurrency in China has been illegal since 2019, in what Beijing says is an attempt to stop money-laundering. People could still trade online however on foreign exchanges.

At the end of September 2021, China’s central bank went a step further by banning bitcoin transactions and basically making cryptocurrency illegal. The central bank warned that cryptocurrency “seriously endangers the safety of people’s assets”, which knocked thousands of dollars off the price of bitcoin.

Banks and payment firms are banned from providing cryptocurrency transaction services. In May 2021, three state-backed organisations announced there would be no protection for consumers if they lost any money from crypto trading.

The following month, banks and payment platforms were told to stop facilitating transactions while bans were issued on crypto “mining”.

Amazon to accept bitcoin as payment?

If the rumours are true, the technology company could accept bitcoin payments sooner rather than later which could drive the price of the cryptocurrency upwards.

This comes after Amazon posted a job advert looking to hire someone to develop its digital currency strategy.

Amazon isn’t the only tech giant to be branching into cryptocurrency; there are rumours circulating that Apple will use some of its large cash reserves to invest in bitcoin.

“Given the huge volatility and that the use case of crypto currencies is far from proven, traders should only dabble with money they can afford to lose.’’

Susannah Streeter

Senior Investment and Markets Analyst, Hargreaves Lansdown

Is there a less risky way of investing in crypto?

“Stablecoins” could be a less risky way of investing in cryptocurrency, according to Gavin Brown, associate professor in financial technology at the University of Liverpool.

Brown points to tether, the largest stablecoin, backed by one dollar per coin. It topped the $50bn mark on 26 April 2021 but he warns that potential investors shouldn’t necessarily see tether as the next big thing.

“In theory it won’t ever be worth more than a dollar. But it’s potentially an interesting option for any varied portfolio and it could be a slice of stability if [other] things start to suffer.”

The stablecoin has not been without controversy either – being fined by the New York Attorney General and banned from the state the year.

0 comments