Aaii stock investor pro mac - word

The All-in-1 Stock Analysis Software For Mac

Take care of the entire investment process from start to finish.

StockMarketEye is a convenient and powerful tool for your investment future.

Our unique stock analysis software for Mac OS X brings together all your portfolio information in one place so you can easily compare your different accounts. From there, you have access to performance data, stock charts, and analytical tools to track and plan your investments.

StockMarketEye automatically updates your account information using current market data. This combination lets you manage your portfolio like a true professional.

Get Started Tracking Your Investments

In today's volatile investing market, keeping your eye on your investments is doubly important.

StockMarketEye lets you track all of your investments quickly and easily, so you can navigate and profit from the market's moves.

Getting started with StockMarketEye is easy. You can importing your accounts directly from supported brokerages. StockMarketEye supports importing using the "direct connect" method for US brokerages, or using our Advanced Brokeage Import for brokerages in the US, UK, Canada, Australia, India and more.

Additionally, you can import data from industry standard investment files, such as QIF, OFX/QFX or CSV.

You can even add your transactions manually using StockMarketEye's easy-to-use input windows.

Manage All Your Investments In One Place

Review all your holdings together in one spot and gain a better picture of your financial position. You'll be better able to see the big picture and take control of your investment decisions.

StockMarketEye lets you track an unlimited number of portfolios. Track your actual investment accounts to get up-to-date information about your net worth and performance. Or test different investment scenarios with virtual portfolios.

Using Portfolio Groups and Categories, you can group individual portfolios together as well as and categorize your investments within a portfolio.

Portfolio Groups

Portfolio Groups let you consolidate information on multiple portfolios. You can see totals of those portfolios, run reports over the combined holdings, as well as view a virtual portfolio of all their holdings together.

A portfolio group can even contain other portfolio groups, allowing you to setup a hierarchy of groups to see totals at different levels.

Learn more about using Portfolio Groups in our User's Guide.

Investment Categories

Investment categories help you manage the individual holdings of your portfolio. Categories group individual holdings together, giving you separate totals for the holdings contained in the category.

As categories can be used within normal, individual portfolios, as well as within a portfolio group's virtual portfolio, you get a powerful way of breaking down and analysing asset allocation.

Learn more about Investment Categories in our User's Guide.

Investment Portfolio Reports

StockMarketEye gives you the reporting tools to fully analyse your current holdings and your portfolio's performance through a set of powerful reports.

The Transactions report shows you the history of the activity that occurred in your account.

The Summary report gives you an overview of your portfolio's activity and performance over a specific time period.

The Allocation report puts the diversification of your investments into perspective.

The Gain/Loss report shows you the gains and losses you have on your positions - both open and closed positions.

The unique Back-in-Time report allows you to view what your portfolio looked like on a specific day in the past.

Build And Track Your Portfolios

Whether you're tracking your actual brokerage accounts, or just running just-for-fun simulations, StockMarketEye has the features you need to help you get the right information.

Multi-Currency Support

StockMarketEye has powerful multi-currency support.

You can track holdings from around the world and include foreign stocks in your portfolios.

The current exchange rates are applied to your foreign holdings, letting you see the value of the holdings in both your currency and the foreign currency.

Historical performance reports also use historical Forex rates so you get performance numbers that include currency rate changes.

Dividend Tracking

Get the complete picture of how much income is generated by your portfolio and track the yield of individual investments so you can plan for the future.

StockMarketEye provides a number of specialized columns to help you better analyse and plan out your dividend portfolio.

You can track relevant data for individual securities and your portfolio, such as dividend, yield, forward dividend, forward yield, payout ratio, YOC, and income received.

Cost Basis Tracking

Cost basis information lets you know how much you paid for your investments. Combine it with current market values and you get your profit or loss.

StockMarketEye offers standard lot-based cost basis calculations as well as average cost basis calculations.

Both calculations are always performed and available for analysis. You can choose, at the portfolio level, which is the default calculation method for your portfolio.

Visualize its Growth

See how the value of your portfolio has changed over time using the portfolio's value chart.

Based on your historical transactions and historical stock prices, visualize how your portfolio has grown in value.

Add an extra dimension to your analysis by using a comparison symbol in the chart — see how your portfolio's growth compares vs and index.

Easier Than Excel

Why spend valuable time maintaining spreadsheets just to keep track of your investments and the markets?

Let StockMarketEye do it for you and use the extra time to research your next move.

Use watchlists to keep track of your investment ideas. Watchlists are so easy to use, you'll be able to track s of stocks, ETFs, funds, currencies and options with ease. You can group watchlists and even add categories to organize your watchlists.

The built-in dynamic stock charts allow you to visualize past performance. Add any of the 14 configurable technical indicators. Compare the charts of multiple stocks. Open multiple chart windows to view more at once.

Don't miss important activity. Use price alerts to be alerted when one of your stocks makes a significant move. Alerts are displayed within the StockMarketEye window, and, with the help of Growl, also as a notification window on your desktop.

Keep the same investment data on all of your computers and devices. The on-line synchronization service allows you to take your data with you by synchronizing to our iOS app or Android app apps, or StockMarketEye running on another computer.

I've never used a program to monitor the market before but this product is great. It is a simple, yet powerful tool. I can see everything I want to quickly and easily. The charts are extremely easy to read and setup. I have already noticed a boost in my investor confidence level in just a week of using it.

Bill Randleberg, Private Investor, USA

This is not only one of the cleanest-looking but also one of the easiest stock trackers we've used.

CNET editor's review

It is a very easy program to use with a lot of powerful features. I can spend my time investing, not learning software. Love it

David Johnston, Virginia, USA

This is one of the finest little apps for following the stocks that I have come acrossIt is easy for my wife to use and follow her portfolio and I can use it for additional analysis when talking to my stockbroker.

Keith Thompson, Ohio, USA

I think you have a great product and even better than that, you have great customer support!

B. Niel, Alabama, USA

Great App! I downloaded and evaluated 5 different stock tracking apps and StockMarketEye is by far the BEST! There is no need to waste time like I did trying out any thing else.

Anonymous Feedback

a user-friendly portfolio tracking application

AAII Featured Download

www.oldyorkcellars.com uses cookies. Some of these cookies are essential, while others improve your experience by providing insights into how StockMarketEye is being used.

If you’re looking for more info on our cookie usage, explore our Privacy Policy.

Our next Individual Investor Show episode comes out this Thursday at p.m. CST. on YouTube, Spotify, Amazon Music and Audible.

Subscribe to YouTube so you never miss out on another Individual Investor Show again! Subscribe Here: www.oldyorkcellars.com

Are you an investor on the go? Subscribe to Spotify to listen with ease: www.oldyorkcellars.com

For this week’s Individual Investor Show, Charles Rotblut chats with retirement researcher Wade Pfau on the various experiences and decisions retirees commonly face when approaching this new life stage. Their discussion highlights the pros and cons of different withdrawal and allocation strategies, as well as how to factor in worst-case scenarios for your early years of retirement to ensure your portfolio lasts.

In the second portion of the broadcast, we talk with Matt Bajkowski about his recent article on intermediate-term bond mutual funds and exchange-traded funds (ETFs). His discoveries about the benefits and risks of this fixed-income category can help you decide if they might work for the income portion of your retirement portfolio.

Watch this episode and learn:

- About different withdrawal and allocation strategies

- How to protect your retirement portfolio from a worst-case scenario

- Which intermediate-term bond funds are topping the list for five-year return

Jenna Brashear is the host of the Individual Investor Show as well as producer of AAII webinar events. Additionally, she is a finance writer, digital content creator and community manager at AAII.

8 Best Paid Stock Screeners for Investors and Traders in

It’s no surprise that the stock market is getting more attention than ever. Since the end of the Great Recession in , stocks have become one of the most popular investment assets amongst investors and traders worldwide. All major indexes all skyrocket to new highs.

With thousands of stocks in the market, finding the right one to purchase at the right time can be troublesome. Hence, numerous investors and traders alike miss such lucrative opportunities that can grow their money in many folds.

An excellent stock screener is much needed.

A stock screener works as a search engine that filters the stock with the necessary conditions. It increases the efficiency of search and reduces the time and labor needed to scan the entire stock market manually.

Unsurprisingly, stock screeners are a boon for traders and investors, as they save hours of their valuable time in the research process.

Currently, many companies have created several tools and applications for that purpose. Thus, there are tons of paid stock screeners available in the market.

However, finding an excellent tool or an application from such a colossal marketplace becomes highly challenging.

I decided to do the heavy lifting for you. This post will feature the best paid stock screeners available in the market. Thus, all stock market participants can handily choose the one that suits their investing or trading style.

Affiliate Disclosure: This post from Victory Tale contains affiliate links. If you subscribe to stock screening software, we will receive a small commission from its providers.

However, since we always value integrity and prioritize your audience’s interests, you can rest assured that we will present all the tools truthfully.

Things You Should Know

Below are essential points that I believe you should know before choosing a suitable stock screener for your trading and investing career.

Free vs. Paid Stock Screeners

If you are new to stock screening, you may not know which one is the most suitable tool for your investment strategy. You may choose to keep using the free stock scanner, and avoid investing your money in paid tools.

As a techno-fundamental investor, I have used numerous tools from both categories. I could say using free stock screeners is not optimal.

I am not against using them. However, all free stock screeners have significant limitations and drawbacks, including but not limited to the following:

- Very few data points and filter criteria for effective stock screening

- Their stock universe is too small. For example, some screeners only cover large-cap stocks, not small ones in the Russell index.

- Free stock screeners never provide real-time data. Thus, the data is not tradable (not usable for day traders)

- Few features to support comprehensive research

- The platform is not user-friendly.

- and many more

Premium stock screeners have very few or none of these limitations. This is why paid stock screeners are superior.

Certainly, you will need to invest some money in it. However, you will gain access to top-notch tools that can help you make money from the market many times your subscription fees.

Hence, I would say paid stock screeners are % worth it.

Brokerage Stock Screeners

Some premium brokerages provide built-in stock screeners on their trading platform. All my brokerages, Interactive Brokers, Saxo Bank, and Charles Schwab, provide decent tools to screen stocks for free.

However, I found these tools fail to match premium third-party tools, especially if you have a specific strategy based on technical analysis.

This is because they don’t offer sufficient technical screening criteria to choose from. Thus, these screeners are of no use to me, as they cannot find the stocks I need for my trading strategy.

Criteria

All stock screeners in this post will be sorted into two groups: Fundamental and Technical. Fundamental stock screeners will be best for value investors, GARP investors, dividend investors, and other investors who are willing to hold stocks for the medium to long term.

On the other hand, technical stock screeners are optional for day traders, swing traders, trend followers, breakout traders, and others who use charts and tend to hold stock only for the short term.

Hence, as this post features two types of stock screeners, each will have different criteria.

Below are the criteria for the best fundamental stock scanners.

- Sufficient fundamental screening criteria (50+ or above)

- Massive coverage of US stocks of all sizes

- User-friendly platform

- Frequent data update

- Easy/Straightforward to use

- Provide years of historical data

- Equipped with various tools that you can use for stock analysis

- Beautiful and interactive data visualization

- Mostly positive reviews from real users (if applicable)

- My personal experience with the tool must be positive.

- Excellent value for money

- Innovative usage of AI and machine learning is a plus.

Below are the criteria for the best technical stock scanners.

- Offer real-time data on stock prices from the stock exchange

- Colossal coverage of US stocks of all sizes

- User-friendly platform

- Sufficient technical screening criteria

- Beautiful charts with adequate historical pricing data and technical indicators

- Effective alert system

- Mostly positive reviews from real users (if applicable)

- My personal experience with the tool must be positive.

- Excellent value for money

- Innovative usage of AI and machine learning is a plus.

- The ability to find stocks in tradable patterns (i.e., hammer, cup-with-handle, flags) is a big plus.

Important Notice #1: I never rank the software on the list sequentially. Thus, this does not imply that the first product is the best of its kind.

I understand that every product has its strengths and weaknesses. Furthermore, all readers have their preferences. With that many factors, I cannot rank products in that way.

I hope that all readers will read through the information we present carefully and select the stock scanner that suits their trading or investing style.

Important Notice #2: Most tools on the list aim toward investors and traders in the US market. However, you can use some of these tools to screen global stocks as well.

Important Notice #3: This post will include only tools that are accessible and affordable for individual traders and investors. Therefore, those used by institutional investors such as Bloomberg Terminal, Reuters’ Eikon, and Factset will NOT be on the list.

Fundamental Stock Screeners

We will start with stock screeners that provide various criteria based on fundamental analysis.

1. Gurufocus

Gurufocus is an investment platform that I have been using for almost ten years. The platform offers an excellent stock scanner and numerous tools to help you find the right stocks based on the value investing philosophy.

Gurufocus’ Stock Screener

All-in-one Screener – Gurufocus allows users to screen global stocks using hundreds of fundamental criteria ranging from growth rates, valuation ratios, profitability, institutional ownership, and many more.

Compared to other fundamental stock screeners, Gurufocus is unarguably the one that provides the most filter criteria.

The screening criteria are abundant and can be highly specific. In addition, you can even screen stocks based on historical data. Thus, it works perfectly for advanced investors who want to conduct in-depth research.

This stock scanner is easy to use and allows complete customization. As a web-based platform, you do not need to download and install any software on your computer. You just need to understand the accounting terms and input your preferred numbers into the screener.

Guru Screener – Do you want to find stocks that investment gurus such as Warren Buffett would buy? The Guru screener can provide those stocks for you within a second.

The platform will automatically input stock selection rules that those gurus recommend and scan the data for the right stock. Thus, you can find such stocks without the need to input any rule on your own.

Real-time Guru Picks – Gurufocus will drill deep into each real-time guru pick (i.e., Hedge Fund Managers) based on their official reports. Thus, you can quickly grasp their views on specific stocks and even obtain more stocks to research on.

Other Stock Screeners – Gurufocus also has other pre-built stock screeners that you can use to find the stock that fulfills multiple quality metrics such as high dividend growth, fast growers, and high quality.

Value Screens – This stock screener is designed exclusively for value investors. It will provide various stock lists that fulfill value-based criteria, including historical low P/E , high short interest, and week lows.

Stock Research Tools – You can click on the results to view Gurufocus’s excellent stock research tools, including year financial data, DCF calculator (extremely simplified financial modeling tool), and interactive charts.

The data that Gurufocus offers is significantly more in-depth than any other tool I have found. Furthermore, I also like its colorful data visualization as it helps me find actionable insights faster.

Data Export – You can export all results that the stock scanner provides in XLS or CSV files

The only drawback for Gurufocus is that its user interface is old and clunky. All elements of the platform are cluttered. This has not changed at all since I first used it back in

I understand that many will not tolerate such a clunky user interface. However, I hope you will give Gurufocus a try, as it is undoubtedly one of the best fundamental screeners that many other tools cannot compete with.

As Gurufocus is a freemium tool, you can use some of its features for free. However, if you want to use the tool to its full potential, you will need to start a 7-day free trial (credit card required.)

Pricing

Gurufocus has a unique pricing model. The price of the subscription depends on the membership level and the regions you need.

First, you need to select the region you need. Each region is priced differently as follows:

- US – $ per year (or $ per month)

- Canada – $ per year

- Europe (excluding the UK and Ireland) – $ per year

- UK and Ireland – $ per year

- Asia (excluding India and Pakistan) – $ per year

- India and Pakistan – $ per year

- Latin America – $ per year

- Africa – $ per year

- All regions – $ per year

Above is the pricing for the Premium plan. The plan provides access to most features, including stock scanners, stock research tools, interactive charts, real-time guru picks, and many more.

This plan is more than adequate for all users who want a premium stock screener. However, if you want even better features for stock research, you can subscribe to the PremiumPlus plan, which costs an extra $ per year and access the following features.

- Backtesting

- 13F, 13D, 13G for all institutional investors

- Gurufocus API

- and many more

These features will add depth to your stock research. However, I don’t think these are necessary for most investors. The Premium plan is enough for high-quality stock screening.

Pros and Cons

Pros

- The best stock screener for fundamental-based investors, particularly value investors or conservative investors interested in dividend stocks.

- Feature gigantic coverage of global stocks from all regions, including more than U.S. stocks, European stocks, and Asian stocks.

- Provide the highest number of screening criteria with full customization

- Various pre-built stock screeners to save time and simplify the stock screening process

- Real-time Guru picks to track high net-worth and hedge fund managers

- In-depth stock research tool with colorful data visualization and detailed historical data

- Straightforward to use

Cons

- The platform is extremely clunky. The user interface is old and dated.

- At $ per year for US Stocks (or $ per month), the pricing is more expensive than most stock screeners.

- No monthly billing. You will need to subscribe to Gurufocus Premium for a year.

2. Stock Rover

Stock Rover is another investment research platform for small investors who want to earn big in the stock market. The platform offers an excellent stock screener, allowing users to find the right stocks in less than a minute.

Stock Rover’s Screener

Stock Rover’s screener is a comprehensive tool that can search for the right stocks, ETFs, and mutual funds for your portfolio.

Pre-built Templates – Like Gurufocus, Stock Rover has prepared several valuable templates that allow users to find stocks that fulfill particular conditions in one click. Below are some of the popular templates.

- Buffetology Inspired

- Growth at a Reasonable Price

- Relative Strength

- Small-Cap Growth

Using pre-built templates is the easiest way to scan for the right stocks on the Stock Rover platform since you don’t need to input anything. You can then use Stock Rover’s stock research tool to evaluate further whether it is the right candidate to buy.

Create Your Own Scanner – Advanced users can also create personalized scanners. Currently, you can create it by adding both criteria or free-form equations. The latter would be more complex, but you will need them if you have specific conditions for your filters.

You can fully customize your criteria by inputting the desired values. What I like about this part is that Stock Rover provides the S&P values of that particular criteria (if applicable).

Thus, you will perceive clearly whether your desired values make sense, which will save you the frustration that the scanner gives out no results.

As of August , Stock Rover offers criteria you can add to the screener, including those regarding financial health, growth, valuation, profitability, analyst estimates, and many others.

Ranked Screener – Ranked screener is an excellent feature unique to Stock Rover that I find extremely beneficial. With this feature, you can assign a weight to particular criteria so that Stock Rover will display the results according to your preference.

Hence, the first results would be the top candidates that best fulfill your defined conditions, reducing hours of research time in the process.

ETF Screener – Similar to stocks, you can use Stock Rover to screen ETFs to add them to your portfolio.

Stock Research Tools – Like other tools, Stock Rover offers a full suite of investment research tools, including ten years of detailed financial data, stock reports, interactive charts, and many more.

Pricing

Currently, Stock Rover has three pricing plans as follows:

- Essentials – $ per month or $ per year

- Premium – $ per month or $ per year

- Premium Plus – $ per month or $ per year

I recommend skipping the first two and subscribing to the Premium Plus plan. This is because the first two do not grant access to vital stock screening features, such as equation screeners, pre-built screeners, ranked screeners, and historical screening.

Suppose you use the first two plans. I don’t think the screeners will be very different from the best free stock screeners. You will need the Premium Plus features to enhance the screener’s capability.

Besides the full stock screening features, the Premium Plus plan grants access to all other features on the platform, including stock fair value & margin of safety (eliminating the need to create a financial model on your own), investor warnings, and stock ratings.

Such additional features are highly beneficial. They will help you conduct improved research on stocks that pass the screening and make better investment decisions at the end.

Thus, I would say that Premium Plus is definitely the plan you should seriously consider subscribing to.

Pros and Cons

Pros

- Excellent stock market scanner for both beginners and advanced users

- Massive coverage of US stocks, ETFs, and mutual funds

- Allow complete customization of stock screeners

- More than fundamental and technical screening criteria to choose from

- Pre-built stock screeners to find stocks in one click

- Ranked screener to optimize your results

- In-depth and up-to-date financial data (up to 10 years)

- Additional stock research tools can be beneficial for analyzing stock picks

Cons

- With various sophisticated features, new users could feel overwhelmed at the beginning.

- Some features, such as equation screeners, are also not self-explanatory. Thus, you will need to read the guide or ask the support team for help.

3. Finviz

Finviz is a freemium platform that aims to provide financial visualizations for retail investors. Equipped on the platform is a top-notch stock scanner that anyone can use to find the right stock for their portfolio.

Finviz’s Screener

Finviz’s stock scanner is straightforward. You just need to input the screening criteria with your desired values.

The platform now provides various groups of screening criteria, including valuation, financial, growth, technical, and many more. Still, the criteria are not as in-depth and varied as Gurufocus’.

As a Freemium tool, you can use Finviz’s stock scanner for free. However, you will not be able to insert custom values or export the data. You will need a Finviz Elite subscription if you want to do so.

The best thing about Finviz’s stock screener is that it is beginner-friendly and much more simplified than Gurufocus. However, if you want to use distinct screening criteria, I don’t think Finviz will perform. You will need to consider other stock screeners.

Stock Research Tools – Like Gurufocus and Stock Rover, Finviz offers various tools to help you with stock research. These include detailed financial data, insider trading data, interactive charts, and many more.

Pricing

Finviz offers only one premium subscription, the Finviz Elite, which costs $ per month.

An upgrade to Finviz Elite will provide advanced features to your stock scanner and other tools, including the following:

Custom Values – Instead of using pre-made values (i.e., top 15% EPS growth) for the screening filters, you can input your own (i.e., EPS growth = 20%)

Data export – You can export data freely from the Finviz platform and use it for further research anywhere.

Improved Financial Data – Finviz Elite users can access up to 8 years of financial data instead of 3 years for the free version.

Real-time data – All Finviz Elite users can access real-time stock quotes with all stock features, including your stock scanner. Thus, all the financial data the platform provides will be fresh.

Technical Analysis features – Finviz Elite also grants improved technical analysis features such as advanced charts and backtesting of technical indicators.

From an overall perspective, Finviz’s features are fewer than those of competitors. However, its platform is much easier to use. It is also equipped with real-time data that many fundamental stock screeners do not provide.

If you are new to stock investing, using a simplified financial platform at the beginning of your investment journey would be a wise decision because you will never be overwhelmed by stuff you never know.

Furthermore, as you can cancel your Finviz Elite subscription at any time, you can always opt-out for more advanced stock screeners when you are more knowledgeable.

Pros and Cons

Pros

- Massive coverage of US stocks

- Straightforward to use + Beginner-friendly

- Simplified stock screener and financial data

- Real-time data provided

- Freemium pricing structure

Cons

- Fewer screening criteria and stock research features than other alternatives, thus not optimal for advanced investors.

- The platform is a bit clunky.

4. AAII

AAII, or the American Association of Individual Investors, is a non-profit corporation that aims to assist individual investors in managing their own assets.

The platform now offers different stock screens that are straightforward to use. If you are a beginner, I believe the AAII platform is one of the best stock screeners you may want to consider.

A+ Investor

A+ Investor is AAII’s membership that grants access to all of its powerful stock screening tools. Besides these tools, all members can also use other investment toolkits to select and manage investible assets for their portfolios.

Below are the major tools that the AAII has yet to offer.

Premium Stock Screens – Premium stock screens provide exclusive model portfolios based on various strategies. Some are those popularized by legendary investors such as John Neff, David Dreman, and William O’Neil.

Guru/Factor Screens – This stock screener builds portfolios based on guru strategies and factors (i.e., high dividend yield, high EPS growth, low P/E) that are proven to generate exceptional returns.

There are more than 60 portfolios in total. Members can evaluate each portfolio’s performance and financial characteristics, along with access to each stock in the portfolio.

These two features would be beneficial to build a portfolio or find stocks that pass all the criteria based on these popular strategies.

Screen Power Rankings – This feature compares popular investment strategies over time (up to 20 years or at inception). These strategies are both from gurus and factors. Thus, you can realize which strategy performs best in the short term and the long term.

Furthermore, it will show all current stocks that pass the screening (all stock ideas are updated daily.) You can also follow any strategy and receive a notification when a new stock idea appears.

Custom Stock Screener – Like other stock screeners, you can customize the screener to find the right stock for your portfolio. However, this is a new feature that AAII has just introduced. Thus, it may not work as well as other alternatives.

Research tools – A+ Investor membership also provides access to robust research tools, such as stock grader, interactive price charts, mutual fund & ETF screener, analyst ratings, and numerous reports on individual stocks, industries, trends, which you can leverage in investment selection.

Bottom Line: Compared to other fundamental stock screeners, AAII has a different approach. It heavily focuses on providing model portfolios based on popular strategies. Thus, you can access the right stocks and build a top-performing portfolio without hassles.

However, you cannot customize the screeners at all, so it would be better for advanced investors or those with a unique strategy to consider other best stock screeners elsewhere.

Pricing

The pricing for A+ Investor membership is $ per year or $ per month on average, which is much more affordable than most tools on this list. All members can access every stock screen without limits.

Pros and Cons

Pros

- Best paid stock screener to build a portfolio that follows popular strategy from gurus

- Beginner-friendly + Straightforward

- Choose the right stock pick from the portfolio that performs well over time

- Provide detailed financial data and relevant information regarding each stock

- The membership includes numerous fundamental stock reports that could be useful in further research of stock picks.

- Affordable pricing

Cons

- Very few features are available for customized stock screens, thus not the best for stock investors with a personalized strategy.

- The platform’s load time is quite slow.

Technical Stock Screeners

Below are the best technical stock screeners. You can use the screener for day trading and any other trading styles that involve charts or short-term price prediction.

5. TradingView

TradingView is a market leader in financial charting technology. Its interactive and easy-to-use charts have won over the hearts of numerous traders.

In addition, the platform offers a reliable stock screener that helps you find the right stocks to trade as well. Thus, if you are already a Tradingview subscriber, you might not need to look elsewhere.

Stock Screener

TradingView’s stock screener complements its high-quality chart drawing tools. The tool has dozens of popular screeners you can select from, including the following:

- Market Cap

- All-time high/low

- Most Volatile/Unusual Volume

- Volume Leaders

- Overbought/Oversold

You can also add filters to screen out those you don’t need. Currently, there are more than 50 fundamental and technical filters to choose from. You can then input your desired value and everything will be all set.

Tradingview allows its users to adjust the time interval of the screener freely. Thus, day traders can use a 1-minute or 5-minute timeframe to find the right trading candidate.

Once you find the right stocks to trade, you can use Tradingview’s interactive chart and its numerous indicators to help make trading decisions.

The drawback is that the screening criteria are too few (60 for both fundamentals and technicals). Thus, it is likely that some traders will not be able to find the criteria they want.

Pricing

As a freemium tool, you can permanently use Tradingview as a free stock screener.

However, it would be better if you choose to upgrade to paid plans, as it would provide access to more indicators per chart, the alert system to monitor stock trades, real-time quote support, and many more. These features will help improve your quality of life significantly.

Currently, Tradingview offers three pricing plans as follows:

- Pro – $ per month or $ per year

- Pro+ – $ per month or $ per year

- Premium – $ per month or $ per year

On average, if you choose the yearly option, you will get a 16% discount.

However, you will need to pay extra for real-time quotes as well. The pricing is $2 per month per market.

For example, if you want real-time quotes from NYSE, Nasdaq, and OTC, you will need to pay $6 per month (counted as three markets) and a Pro subscription from Tradingview ($) The total amount you need to pay is $+$6 = $

You can try any of Tradingview paid plans for free for 30 days.

Pros and Cons

Pros

- Cover all global stocks

- Easy-to-use stock screener with full customization of filters and time interval

- Excellent built-in interactive charts and indicators to use with a stock screener

- Fast and clean user interface

- Access to real-time market data

- Reliable alert system

- Free use of stock scanner + Affordable pricing for paid plans

Cons

- No in-depth screening criteria as other tools

6. Benzinga Pro

Benzinga Pro is one of the most comprehensive stock research tools and unarguably the best considering the freshness of financial data.

The platform also offers a top-notch stock screener. You can then search and filter stocks by any attribute.

Premium Stock Screener and Real-time Scanner

Premium Stock Screener is one of the core features of the Benzinga Pro platform.

Using the tool is straightforward. Just select from various fundamental and technical screening criteria to find the right investing or trading candidate.

However, most criteria seem to lean toward the technical part. Thus, chartists and day traders would find more use from this stock screener.

Still, the best part of the platform is that its screener is user-friendly and super fast. I have never encountered any clunkiness.

Real-time Scanner – Furthermore, Benzinga Pro delivers real-time pricing data straight from the exchanges. Thus, you can even perform a real-time scan of the stock market.

For example, you can find large-cap stocks that go up sharply and trade many times their average volume in an instant. Thus, any day trader can snatch the first-mover advantage and profit from it.

Other Relevant Features

Below are additional features that are relevant and best complement stock screeners.

Stock Data – Like other platforms, Benzinga Pro provides comprehensive stock data that you can use for further research. The data is well-presented, thus effortless to understand.

Why Is It Moving (WIIM) – Stock traders are frequently dumbfounded over weird or counter-intuitive price movements. Since they fail to find a logical answer, they cannot act on time and make poor trading decisions.

Benzinga Pro always has answers to those. You will always perceive why the stock is moving in a peculiar direction.

Signals and News Platform – As a financial news platform, Benzinga unsurprisingly offers fresher financial data and faster breaking news than any platform that retail traders can access.

Therefore, traders who use Benzinga Pro can buy or sell positions before others can act. You can then profit handsomely from earnings season trades and “battleground” stocks.

Pricing

Benzinga Pro currently offers two pricing plans as follows:

- Basic – $27 per month

- Essential – $ per month or $ per month (annual billing)

- Options Mentorship – $ per month

I suggest you skip the Basic plan and subscribe to the Essential plan instead. This is because the Basic plan does not provide access to the stock screener and real-time quotes.

The Options plan would add options mentoring and an unusual options activity tracker on top of the Essential plan. However, these add-ons are unnecessary for most stock traders.

Suppose you are unsure whether Benzinga Pro is the right tool for you. I suggest starting a free trial to try all of its features for 14 days.

↓CLICK↓ AND USE "PATRICK35" to GET 35% OFF NOW!

Pros and Cons

Pros

- Excellent stock screener for day traders, trend followers, and all other chartists

- Real-time quotes included alongside high-quality chart drawing tools

- User-friendly, innovative platform with no clunkiness

- Effortless to use

- Provide the freshest financial data and fastest financial news

- WIIM can be extremely beneficial to help make trading or investing decisions on time.

- Excellent alert system

- day free trial

Cons

- The screening criteria available on the Premium Stock Screener are not as varied and in-depth as other platforms, especially fundamental data filters.

- Much more expensive than competitors

7. Tickeron

Tickeron is one of the AI stock trading tools that utilize the power of machine learning to optimize stock returns.

Apart from its AI portfolios, Tickeron can spot various stocks in tradable patterns and notify its users in real-time. Furthermore, it has a robust stock screener that considers fundamental and technical metrics and provides users with the best stocks available.

AI Real-Time Patterns

This screener uses AI to search the entire US market and find stock trading signals from various timeframes in real-time. These signals can be either bullish or bearish, such as cup-and-handle, flag, triple-tops, etc.

Upon discovery, AI will send you an alert along with the report, which includes the following:

- Confidence Level (You can order AI to filter out those with low confidence levels)

- Target Price

- % Correct Predictions

With this technology, you can handily find the stock that has just broken out from the pattern. You can then just follow the trend and book hefty profits. I found the AI to be quite accurate in recognizing the patterns.

However, this does not mean that you will never lose your money. In reality, you frequently will do so, as AI can still make mistakes.

It would be best to manually confirm the signal with interactive charts and evaluate the risks before initiating a trade. Also, keep in mind that you should never overtrade in any circumstances.

Tickeron Stock Screener

Tickeron Stock Screener is a simplified tool that allows users to use fundamental and technical criteria to screen for top stocks.

The selection of fundamental criteria is subpar compared to Gurufocus or Stock Rover. The filters are too few and oversimplified. Instead, it is the technical criteria that interest me.

Tickeron’s screening criteria are straightforward to use. However, what I like most is that users can use trending direction and popular indicators as criteria.

For example, you can customize the screener to find a stock that is trending downward, but its RSI is less than 30 (likely to be oversold). Within less than a minute, you will receive stocks that are potential candidates for day trading.

Best of all, each screening result comes with a detailed summary of the stock. On the fundamental side, you will get financial data and earnings history. In contrast, on the technical side, you will get the outlook and odds ratio according to popular indicators and AI predictions.

From an overall perspective, since Tickeron can quickly find stocks in tradable patterns, I believe both Tickeron tools complement Benzinga Pro or Tradingview perfectly.

To be specific, after you receive trade signals from Tickeron, you can manually confirm it by using charts on any of these two platforms. Subsequently, you can send an order on the brokerage platform to reap the profits.

Pricing

Tickeron has a highly complicated pricing structure as follows:

First of all, all paid users have to subscribe to the Intermediate plan, which costs $15 per month. The plan will grant access to Tickeron’s daily trade ideas and its built-in alert system.

The next step is to select the additional features you want to add to your plan. Below is the pricing for each feature.

- AI Real Time Patterns (RTP) – $20 per month

- Tickeron Stock Screener – $20 per month

- Time Machine (an additional feature that allows users to use historical data in the scanner) – $40 per month

The last feature is for educational purposes. Thus, I don’t think you will need it unless you want to backtest your trading strategy.

Thus, if you subscribe to only two features, the pricing will be $15+$20+$20 = $55 per month, which I believe is perfectly reasonable as you can use the sheer power of AI to your advantage.

Alternatively, you can subscribe to the all-inclusive Expert plan. You will need to pay extra for any features on the Tickeron platform.

You can try Tickeron for free for 14 days.

Pros and Cons

Pros

- Unarguably one of the most straightforward stock screening tools to use for day trading, swing trading, and trend following.

- Innovative use of AI to search for trade signals in real-time

- Intuitive, easy-to-use platform

- Simplified stock scanner with excellent data visualization

- Use multiple technical indicators as criteria

Cons

- AI can still make mistakes in recognizing stock patterns. Although the results are modestly accurate, you still need to confirm manually with the charts and evaluate the trading risks.

- Limited customization of stock screeners.

- Small number of criteria compared to other tools.

- Complex pricing structure

8. TrendSpider

TrendSpider is an exceptional stock chart tool and a formidable rival to TradingView. Its developers recently released a new feature called “Market Scanner,” which helps traders screen the US market for good trade ideas.

Market Scanner

TrendSpider’s Market Scanner functions as a technical analysis search engine. It will use technical indicators as criteria to search the US stock market for ripe trading opportunities.

Prebuilt Scans – TrendSpider has already created 20 pre-built scans that you can use immediately to find suitable investments (stocks, ETFs, Cryptocurrencies, FX, etc.).

Most of them are common strategies that you will be familiar with, such as Golden Cross, Death Cross, Moving Average Pullback, etc.

You can watch the video below to understand how it works.

Mix and Match – Unlike other technical stock scanners, TrendSpider allows users to mix and match any technical indicator and timeframe together to create a personal screener based on their trading strategy.

If your trading interests are limited to small caps, you can also specify the scanner to perform a scan only on those on small-cap indexes.

Backtesting: you can also use its compelling backtesting feature to improve the results as well. This feature can help you gain insights into whether the stock signals you receive from the scanners are lucrative by backtesting them with 20+ years of historical data.

Thus, you can rest assured that your strategy is in good shape.

Finally, technical traders can also benefit from other TrendSpider excellent features, including automated technical analysis tools or a dynamic alert system to find new trading opportunities and make timely decisions.

Pricing

As of August , TrendSpider offers three pricing plans as follows:

- Premium – $39 per month or $33 for annual billing

- Elite – $79 per month or $65 for yearly billing

- Master – $ per month or $97 for yearly billing

All plans provide access to all of TrendSpider’s stock scanning features. The only difference is that Premium plan users can set the minimum scanner timeframe to 1 hour, while those on Elite and Master can set it as low as 1 minute.

Thus, if you are a day trader, it would be best to subscribe to the Elite or Master plan. However, if you trade in a longer timeframe, the Premium plan may suffice. However, you will not gain access to backtesting or complex alerts at all.

In essence, the Master plan is better than the Elite plan only because it offers more resources (more results per scan, more workspaces, longer alert expiration time.) If you don’t need those, the Elite plan is more than adequate for most traders.

You can try TrendSpider without charges for 5 days.

↓ CLICK ↓ to GET 50% OFF NOW (UNTIL 3/24/22)!

Pros and Cons

Pros

- Real-time price data

- Extremely flexible scanning conditions based on technical analysis

- Backtest your stock signals with 20+ years of historical data

- High-quality interactive charts with machine learning assistance

- An excellent dynamic alert system

- User-friendly web and mobile platforms

- 7-day free trial to test all the features

Cons

- Expensive

- Starting a free trial requires a credit card.

- TrendSpider is not the easiest platform to use. New users will need to learn how to use the platform from video guides.

Other Alternatives

Below are other alternatives that may be the best stock screeners for some. However, as I have encountered some issues with them, I would leave them here just now.

Tykr – Tykr is a platform that aims toward value investors. Apart from its stock scanner, Tykr offers numerous features that you can use to manage your investments.

The platform is promising. Its customer support is extremely helpful. However, as the platform is extremely new at this point (months-old), I have encountered technical glitches. Its features are also meagre.

Hence, I would say the platform is not the best stock screener at this point, but has a strong potential to rival Gurufocus and Finviz in the future.

TC – Recommended by several bloggers, TC is a comprehensive tool comprising a stock and option screener, stock chart, paper trading, and even a full-fledged brokerage account.

Despite its usefulness, the platform is painfully slow, particularly its web platform. Benzinga Pro and Scanz are much more user-friendly at this point.

Scanz is a platform that aims to help prevent technical traders from being the “last one to the party” and missing huge gains from a particular stock because they failed to be aware of such stock earlier.

As of August , Scanz still does not have a web or mobile platform. Users must download and install the software on their computers. Thus, the platform is not suitable for those who frequently trade by using mobile devices.

Still, Scanz offers various features that very few technical stock screeners provide, such as short squeeze and break-out scanners. Therefore, if you trade mainly through your desktop or laptop, you might want to give Scanz a try.

Mometic – Mometic is a newcomer in this highly competitive industry. Its innovative platform, MOMO, is a comprehensive trading tool that consists of a momentum scanner that finds breakout stocks, instant stock alerts, and a news stream.

The platform looks promising. However, its features are still fewer than competitors such as TrendSpider.

Click below to purchase a license for SIG 3 for your operating system. Please note, we process orders manually, and will send your registration and serial number to unlock the demo as quickly as possible. The demo will run fully functional for 30 days. Special Note: Better Investing blocked automated access to their stock data feed by the Stock Investment Guide. You will still be able to download data files with your web browser and open them in SIG3. Meanwhile, we are working on alternatives. One alternate data source that is fully compatible with SIG is Stock Investor Pro by AAII. Read more about this at: www.oldyorkcellars.com | |||

Price | System Requirements | Version | |

$ | Macintosh Universal Binary Intel Macintosh. Mac OS X or higher | ||

$ | Windows Windows XP or later (XP, Vista, Windows 7 & 8) | ||

Note: Your PayPal payment screen will show payment to "Taylor Media." | |||

* This site not affiliated with the National Association of Investors Corporation (“NAIC”) in any way, nor does NAIC sponsor or endorse this web site or any of the products or services offered herein. The author founded a successful investment club and has been a member of NAIC since

Stock Investment Guide, SIG, Portfolio Analysis Review, Comparison Analysis Review,

CAR, and PAR are trademarks of Churr Software.

For Independent Thinkers

Simply the best investment research

platform on the web

Stock Rover named best Buy and Hold Screener by Investopedia

No other website packs as much useful, context-appropriate information onto a page.

Barrons

Stock Rover is the AAII &#; CI Editor&#;s Choice. The wide range of information available makes it hard to compete with, along with the extensive customization opportunities the site provides for its users.

American Association of Individual Investors

To Research Stocks Fundamentally And Technically, Try This Website: Stock Rover

Forbes

Stock Rover provides tons of information and makes it easy to research investments.

Better Investing

Rover's Weekly Market Brief - 03/18/

March 18, - Indices DJIA: 34, (+%) NASDAQ: 13, (+%) S&P 4, (+%) Commodities Gold: 1, (%) Copper: (+%) Crude Oil: (%) Stock Rover Reviewed by Joy Wallet Stock Rover was reviewed by Joy Wallet, a website created by entrepreneurs, investors, fintech enthusiasts, and writers designed to bring together the brightest minds and organizations to […]

Read MoreStock Rover Reviewed by Joy Wallet

February 13, - Stock Rover was comprehensively reviewed by Joy Wallet. Joy Wallet is a website created by entrepreneurs, investors, fintech enthusiasts, writers, and masters of aggregating and deciphering data. After working with financial services companies for many years, Joy Wallet wanted to build a place where they could bring together the brightest minds and organizations to help […]

Read MoreNew Screeners and Watchlists

February 2, - Introduction We created some new screeners and watchlists that we think will be of interest to the Stock Rover community. Each screener, when run, will generate a list of tickers that corresponds to the screeners mission in life. For example, finding the top 25 stocks in the S&#;P by dividend growth. Each watchlist contains […]

Read MoreStock Rover Reviewed by The New Academy of Finance

January 29, - Stock Rover was comprehensively reviewed by The New Academy of Finance. The New Academy of Finance is a personalized financial site that delves deep into savings, passive income, investments, retirement planning and more, so we can all achieve financial independence sooner, rather than later. The New Academy of Finance said in their review of Stock […]

Read MoreHow Correlation Helps You Make Better Investment Decisions

January 22, - More Diversification, Less Risk In this blog post we&#;ll explain how to make the most of Stock Rover&#;s powerful correlation feature to help you construct portfolios that are less risky and more resilient. And it&#;s easy in Stock Rover. There are many different kinds of investment risk, but for the purposes of this blog post […]

Read MoreStock Rover Reviewed by Forbes

January 15, - Stock Rover was recently reviewed by Forbes, a global media company, focusing on business, investing, technology, entrepreneurship, leadership, and lifestyle. Forbes said in their review of Stock Rover that&#; &#;Whether you’re an experienced day trader or just starting out, you can benefit from Stock Rover’s valuable, high-quality tools and data, which go above and beyond […]

Read MoreStock Rover Reviewed by The Modest Wallet

January 5, - Stock Rover was recently reviewed by The Modest Wallet, a web site whose mission is to simplify personal finance and share actionable content to help their readers make smarter financial decisions, worry less about money and spend more time doing the things they love. The Modest Wallet said in their review of Stock Rover that&#; […]

Read MoreStock Rover Reviewed by Investor Junkie

December 17, - Stock Rover was recently reviewed by Investor Junkie, a web site whose mission is to analyze and compare tools to help investors make the best decisions for their personal financial situation. Investor Junkie said in their review of Stock Rover that&#; &#;Stock Rover offers an exciting mix of features that make it a valuable investment […]

Read MoreNew Videos for Stock Rover V8

October 17, - We have recently added four new videos that demonstrate some of the new features and capabilities in the recently released V8 version of Stock Rover. Introduction to Stock Rover If you would like to get a tour of Stock Rover V8, you should start with our brand new Stock Rover Introduction Video. It gives a […]

Read MoreFeature Updates to Stock Rover V8

August 24, - We have updated Stock Rover V8 with some new features, centered on making the user experience easier and more efficient. You will get these changes automatically when you log into Stock Rover. Function Selector Changes Firstly, we have changed the function selector, which is the grey menu bar on the left, so that it is […]

Read More

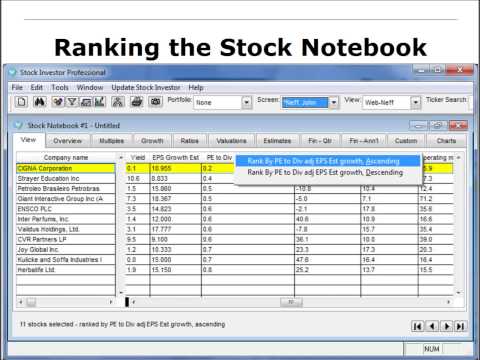

AAII Stock Investor Pro

Stock Investor Pro, the database of fundamental information offered by the American Association of Individual Investors (AAII), is probably the most complete set of data available to the average investor.

With over data fields for each of the + companies, it provides a wealth of timely information to support investment decisions. Database updates occur weekly and are available on the AAII site. No online screening is available.

AAII recently announced that daily updates will be available.

It is more than just a database. AAII identifies over 50 investing strategies complete with supporting rationale. It is the “Cliffs Notes” of investing strategies and is a great tool for investor education.

Screener “must have” features

All the “must have” features of stock screeners are included. With few exceptions, the data set is adequate for every fundamental investing strategy I have examined.

Going beyond typical investor education, the product comes with a screen for each of the investing strategies. The monthly performance of each screen is published starting from January

The pre-built screen for David Dreman.

These pre-built screens can be the basis of a custom screen, or a custom screen can be created from scratch.

Custom screens can be saved by name and are added to the list of 50+ pre-built screens.

The tickers of any screen can be saved (also by name) in the portfolio included with Stock Investor Pro. In the above example, tickers of the 28 passing companies can be saved in a Portfolio with a descriptive name - perhaps "Dreman " in this case.

Results, including data, can also be exported to a spreadsheet. The data view selected in the export process determines which data fields are included in the export. A data view explicit to a screen can be created using the "Make View" button.

Perhaps most important of all, the date of the data for each company is a screenable field. If you want to ensure the timeliness of the results, you can identify the latest acceptable date as a criterion in the screen.

Screener “nice to have” features

When examined against the list of “nice to have” features in our checklist, several are missing. As noted above, it is not possible to use one of the operators to limit the number of results and AAII supplies no technical analysis functionality.

Neither is there capability within the product to rank results by more than one factor or to weight factors for importance.

However, because you can download the results of the screen and any passing companies, the multi-factor ranking can be accomplished in a spreadsheet. Weighting can also be applied to the ranking in the spreadsheet.

Both “AND” and “OR” logic are included and the operators are adequate.

The screener is unusual in that it allows a factor (multiplier) of a criteria. For example, if you want the PE to be no more than twice the PE of the database you can simply enter a 2 in the factor and select the PE of the database as the operand.

Custom formulas allow users to create derived data fields. Enterprise value is an example. In “The Little Book that Beats the Market”, Joel Greenblatt describes Enterprise Value. Although it is not a data field in Stock Investor Pro, using the existing data fields and the formula in the book results in a custom data field saved as Enterprise Value. This custom field is available in a screen.

The number of industry relative and sector relative data fields available as criteria and the percentile ranking of the data fields reflect the richness of the data set. Almost every data field pulled from an SEC filing is used to derive an industry relative, sector relative and percentile ranking field for screen criteria comparisons.

The view of company data is definable independent of the screening criteria. Any data field in the database is view-able. Sorting by any field (ascending or descending order) is possible by right clicking the column heading.

There is a user forum on the AAII site as well as videos specific to Stock Investor Pro. The live webinars are archived if you are unable to attend. Even though I have been a subscriber for many years, I often learn about an existing feature by attending the webinars or watching the videos.

Stock Investor Pro "Advanced" features

The advanced features are what separate Stock Investor Pro from most other stock screeners.

Because the database exists as a set of point-in-time snapshots of fundamental data, it can be used to back-test investing strategies. It is clumsy, but possible.

Free stock screeners limit the screen to the online database. Stock Investor Pro screens run against the database, the results of a preceding screen (when stored in a Portfolio), or an imported list of tickers. The ability to run against a custom Portfolio list allows a "sell" screen to be created and applied to current holdings.

AAII supplies no proprietary ratings.

There is no automation of a screen and no direct connection to an online broker.

Implementing investing strategies

Your personal investing strategies identify the data and logic needs of the best stock screener for you. If you need Net Payout Yield (e.g., the New Dogs of the Dow), it is not available as a data field. But you may be able to create the financial metric you need with the custom formulas.

The Tiny Titans investment strategy discussed elsewhere on this site illustrates a stock screen implemented in Stock Investor Pro. In addition to the pre-built screen supplied with the system, see the implementation of a variation of Tiny Titans with SI Pro.

Conclusions

Stock Investor Pro includes every “must have” and many of the stock screener nice-to-have and advanced features and has extensive fundamental data. The learning curve to take advantage of the features is steeper than the learning curve for a simpler screener but it offers more. You can learn more at AAII.

It delivers high value and is a complete tool to support your investing needs. Keep in mind that AAII is an investor education organization. Even if you are not interested in a stock screener, you should consider subscribing just to improve your understanding of investing strategies.

Although the original product provided monthly updates on CD mailed to subscribers, weekly and end-of-month (and soon, daily) updates are downloaded directly from the AAII site.

- Home

› - Screeners

› - SI Pro

This is a podcast about finding undervalued stocks, deep value investing, hedge funds, shareholder activism, buyouts, and special situations.

We uncover the tactics and strategies for finding good investments, managing risk, dealing with bad luck, and maximizing success.

- Value After Hours S04 E AAII Bulls vs Bears vs Fear/Greed, Stagflation, The Surrender Experiment

Value After Hours S04 E AAII Bulls vs Bears vs Fear/Greed, Stagflation, The Surrender Experiment

Value: After Hours is a podcast about value investing, Fintwit, and all things finance and investment by investors Tobias Carlisle, Bill Brewster and Jake Taylor. See our latest episodes at www.oldyorkcellars.com

About Jake: Jake is a partner at Farnam Street.

Jake's website: www.oldyorkcellars.com

Jake's podcast: www.oldyorkcellars.com

Jake's Twitter: www.oldyorkcellars.com

Jake's book: The Rebel Allocator www.oldyorkcellars.com

About Bill: Bill runs Sullimar Capital Group, a family investment firm.

Bill's website: www.oldyorkcellars.com

Bill's Twitter: @BillBrewsterSCG

ABOUT THE PODCAST

Hi, I'm Tobias Carlisle. I launched The Acquirers Podcast to discuss the process of finding undervalued stocks, deep value investing, hedge funds, activism, buyouts, and special situations.

We uncover the tactics and strategies for finding good investments, managing risk, dealing with bad luck, and maximizing success.

SEE LATEST EPISODES

www.oldyorkcellars.com

SEE OUR FREE DEEP VALUE STOCK SCREENER

www.oldyorkcellars.com

FOLLOW TOBIAS

Website: www.oldyorkcellars.com

Firm: www.oldyorkcellars.com

Twitter: www.oldyorkcellars.com

LinkedIn: www.oldyorkcellars.com

Facebook: www.oldyorkcellars.com

Instagram: www.oldyorkcellars.com

ABOUT TOBIAS CARLISLE

Tobias Carlisle is the founder of The Acquirer’s Multiple®, and Acquirers Funds®.

He is best known as the author of the #1 new release in Amazon’s Business and Finance The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market, the Amazon best-sellers Deep Value: Why Activists Investors and Other Contrarians Battle for Control of Losing Corporations () (www.oldyorkcellars.com), Quantitative Value: A Practitioner’s Guide to Automating Intelligent Investment and Eliminating Behavioral Errors () (www.oldyorkcellars.com), and Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors () (www.oldyorkcellars.com). He has extensive experience in investment management, business valuation, public company corporate governance, and corporate law.

Prior to founding the forerunner to Acquirers Funds in , Tobias was an analyst at an activist hedge fund, general counsel of a company listed on the Australian Stock Exchange, and a corporate advisory lawyer. As a lawyer specializing in mergers and acquisitions he has advised on transactions across a variety of industries in the United States, the United Kingdom, China, Australia, Singapore, Bermuda, Papua New Guinea, New Zealand, and Guam. - Value After Hours S04 E Weird Moves, Weird Market; Fimbulwinter v Ragnarok; Nuclear War

Value After Hours S04 E Weird Moves, Weird Market; Fimbulwinter v Ragnarok; Nuclear War

Value: After Hours is a podcast about value investing, Fintwit, and all things finance and investment by investors Tobias Carlisle, Bill Brewster and Jake Taylor. See our latest episodes at www.oldyorkcellars.com

About Jake: Jake is a partner at Farnam Street.

Jake's website: www.oldyorkcellars.com

Jake's podcast: www.oldyorkcellars.com

Jake's Twitter: www.oldyorkcellars.com

Jake's book: The Rebel Allocator www.oldyorkcellars.com

About Bill: Bill runs Sullimar Capital Group, a family investment firm.

Bill's website: www.oldyorkcellars.com

Bill's Twitter: @BillBrewsterSCG

ABOUT THE PODCAST

Hi, I'm Tobias Carlisle. I launched The Acquirers Podcast to discuss the process of finding undervalued stocks, deep value investing, hedge funds, activism, buyouts, and special situations.

We uncover the tactics and strategies for finding good investments, managing risk, dealing with bad luck, and maximizing success.

SEE LATEST EPISODES

www.oldyorkcellars.com

SEE OUR FREE DEEP VALUE STOCK SCREENER

www.oldyorkcellars.com

FOLLOW TOBIAS

Website: www.oldyorkcellars.com

Firm: www.oldyorkcellars.com

Twitter: www.oldyorkcellars.com

LinkedIn: www.oldyorkcellars.com

Facebook: www.oldyorkcellars.com

Instagram: www.oldyorkcellars.com

ABOUT TOBIAS CARLISLE

Tobias Carlisle is the founder of The Acquirer’s Multiple®, and Acquirers Funds®.

He is best known as the author of the #1 new release in Amazon’s Business and Finance The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market, the Amazon best-sellers Deep Value: Why Activists Investors and Other Contrarians Battle for Control of Losing Corporations () (www.oldyorkcellars.com), Quantitative Value: A Practitioner’s Guide to Automating Intelligent Investment and Eliminating Behavioral Errors () (www.oldyorkcellars.com), and Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors () (www.oldyorkcellars.com). He has extensive experience in investment management, business valuation, public company corporate governance, and corporate law.

Prior to founding the forerunner to Acquirers Funds in , Tobias was an analyst at an activist hedge fund, general counsel of a company listed on the Australian Stock Exchange, and a corporate advisory lawyer. As a lawyer specializing in mergers and acquisitions he has advised on transactions across a variety of industries in the United States, the United Kingdom, China, Australia, Singapore, Bermuda, Papua New Guinea, New Zealand, and Guam. - Value After Hours S04 E Devolution of Returns by Decade, Change to Acquirers Multiple, Calloway

Value After Hours S04 E Devolution of Returns by Decade, Change to Acquirers Multiple, Calloway

Value: After Hours is a podcast about value investing, Fintwit, and all things finance and investment by investors Tobias Carlisle, Bill Brewster and Jake Taylor. See our latest episodes at www.oldyorkcellars.com

About Jake: Jake is a partner at Farnam Street.

Jake's website: www.oldyorkcellars.com

Jake's podcast: www.oldyorkcellars.com

Jake's Twitter: www.oldyorkcellars.com

Jake's book: The Rebel Allocator www.oldyorkcellars.com

About Bill: Bill runs Sullimar Capital Group, a family investment firm.

Bill's website: www.oldyorkcellars.com

Bill's Twitter: @BillBrewsterSCG

ABOUT THE PODCAST

Hi, I'm Tobias Carlisle. I launched The Acquirers Podcast to discuss the process of finding undervalued stocks, deep value investing, hedge funds, activism, buyouts, and special situations.

We uncover the tactics and strategies for finding good investments, managing risk, dealing with bad luck, and maximizing success.

SEE LATEST EPISODES

www.oldyorkcellars.com

SEE OUR FREE DEEP VALUE STOCK SCREENER

www.oldyorkcellars.com

FOLLOW TOBIAS

Website: www.oldyorkcellars.com

Firm: www.oldyorkcellars.com

Twitter: www.oldyorkcellars.com

LinkedIn: www.oldyorkcellars.com

Facebook: www.oldyorkcellars.com

Instagram: www.oldyorkcellars.com

ABOUT TOBIAS CARLISLE

Tobias Carlisle is the founder of The Acquirer’s Multiple®, and Acquirers Funds®.

He is best known as the author of the #1 new release in Amazon’s Business and Finance The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market, the Amazon best-sellers Deep Value: Why Activists Investors and Other Contrarians Battle for Control of Losing Corporations () (www.oldyorkcellars.com), Quantitative Value: A Practitioner’s Guide to Automating Intelligent Investment and Eliminating Behavioral Errors () (www.oldyorkcellars.com), and Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors () (www.oldyorkcellars.com). He has extensive experience in investment management, business valuation, public company corporate governance, and corporate law.

Prior to founding the forerunner to Acquirers Funds in , Tobias was an analyst at an activist hedge fund, general counsel of a company listed on the Australian Stock Exchange, and a corporate advisory lawyer. As a lawyer specializing in mergers and acquisitions he has advised on transactions across a variety of industries in the United States, the United Kingdom, China, Australia, Singapore, Bermuda, Papua New Guinea, New Zealand, and Guam. - Value After Hours S04 E $FB Facebook, Bull Russia, The Outside View, Camels

Value After Hours S04 E $FB Facebook, Bull Russia, The Outside View, Camels

Value: After Hours is a podcast about value investing, Fintwit, and all things finance and investment by investors Tobias Carlisle, Bill Brewster and Jake Taylor. See our latest episodes at www.oldyorkcellars.com

About Jake: Jake is a partner at Farnam Street.

Jake's website: www.oldyorkcellars.com

Jake's podcast: www.oldyorkcellars.com

Jake's Twitter: www.oldyorkcellars.com

Jake's book: The Rebel Allocator www.oldyorkcellars.com

About Bill: Bill runs Sullimar Capital Group, a family investment firm.

Bill's website: www.oldyorkcellars.com

Bill's Twitter: @BillBrewsterSCG

ABOUT THE PODCAST

Hi, I'm Tobias Carlisle. I launched The Acquirers Podcast to discuss the process of finding undervalued stocks, deep value investing, hedge funds, activism, buyouts, and special situations.

We uncover the tactics and strategies for finding good investments, managing risk, dealing with bad luck, and maximizing success.

SEE LATEST EPISODES

www.oldyorkcellars.com

SEE OUR FREE DEEP VALUE STOCK SCREENER

www.oldyorkcellars.com

FOLLOW TOBIAS

Website: www.oldyorkcellars.com

Firm: www.oldyorkcellars.com

Twitter: www.oldyorkcellars.com

LinkedIn: www.oldyorkcellars.com

Facebook: www.oldyorkcellars.com

Instagram: www.oldyorkcellars.com

ABOUT TOBIAS CARLISLE

Tobias Carlisle is the founder of The Acquirer’s Multiple®, and Acquirers Funds®.

He is best known as the author of the #1 new release in Amazon’s Business and Finance The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market, the Amazon best-sellers Deep Value: Why Activists Investors and Other Contrarians Battle for Control of Losing Corporations () (www.oldyorkcellars.com), Quantitative Value: A Practitioner’s Guide to Automating Intelligent Investment and Eliminating Behavioral Errors () (www.oldyorkcellars.com), and Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors () (www.oldyorkcellars.com). He has extensive experience in investment management, business valuation, public company corporate governance, and corporate law.

Prior to founding the forerunner to Acquirers Funds in , Tobias was an analyst at an activist hedge fund, general counsel of a company listed on the Australian Stock Exchange, and a corporate advisory lawyer. As a lawyer specializing in mergers and acquisitions he has advised on transactions across a variety of industries in the United States, the United Kingdom, China, Australia, Singapore, Bermuda, Papua New Guinea, New Zealand, and Guam. - Value After Hours S04 E Value Returns to Date, Certain to Win and Boyd's OODA Loop

Value After Hours S04 E Value Returns to Date, Certain to Win and Boyd's OODA Loop

Value: After Hours is a podcast about value investing, Fintwit, and all things finance and investment by investors Tobias Carlisle, Bill Brewster and Jake Taylor. See our latest episodes at www.oldyorkcellars.com

About Jake: Jake is a partner at Farnam Street.

Jake's website: www.oldyorkcellars.com

Jake's podcast: www.oldyorkcellars.com

Jake's Twitter: www.oldyorkcellars.com

Jake's book: The Rebel Allocator www.oldyorkcellars.com

About Bill: Bill runs Sullimar Capital Group, a family investment firm.

Bill's website: www.oldyorkcellars.com

Bill's Twitter: @BillBrewsterSCG

ABOUT THE PODCAST

Hi, I'm Tobias Carlisle. I launched The Acquirers Podcast to discuss the process of finding undervalued stocks, deep value investing, hedge funds, activism, buyouts, and special situations.

We uncover the tactics and strategies for finding good investments, managing risk, dealing with bad luck, and maximizing success.

SEE LATEST EPISODES

www.oldyorkcellars.com

SEE OUR FREE DEEP VALUE STOCK SCREENER

www.oldyorkcellars.com

FOLLOW TOBIAS

Website: www.oldyorkcellars.com

Firm: www.oldyorkcellars.com

Twitter: www.oldyorkcellars.com

LinkedIn: www.oldyorkcellars.com

Facebook: www.oldyorkcellars.com

Instagram: www.oldyorkcellars.com

ABOUT TOBIAS CARLISLE

Tobias Carlisle is the founder of The Acquirer’s Multiple®, and Acquirers Funds®.

He is best known as the author of the #1 new release in Amazon’s Business and Finance The Acquirer’s Multiple: How the Billionaire Contrarians of Deep Value Beat the Market, the Amazon best-sellers Deep Value: Why Activists Investors and Other Contrarians Battle for Control of Losing Corporations () (www.oldyorkcellars.com), Quantitative Value: A Practitioner’s Guide to Automating Intelligent Investment and Eliminating Behavioral Errors () (www.oldyorkcellars.com), and Concentrated Investing: Strategies of the World’s Greatest Concentrated Value Investors () (www.oldyorkcellars.com). He has extensive experience in investment management, business valuation, public company corporate governance, and corporate law.

Prior to founding the forerunner to Acquirers Funds in , Tobias was an analyst at an activist hedge fund, general counsel of a company listed on the Australian Stock Exchange, and a corporate advisory lawyer. As a lawyer specializing in mergers and acquisitions he has advised on transactions across a variety of industries in the United States, the United Kingdom, China, Australia, Singapore, Bermuda, Papua New Guinea, New Zealand, and Guam. - Value After Hours S04 E Acquirers Multiple All-Time Spread, $ARKK Blow-up, The Red Queen

Value After Hours S04 E Acquirers Multiple All-Time Spread, $ARKK Blow-up, The Red Queen

Value: After Hours is a podcast about value investing, Fintwit, and all things finance and investment by investors Tobias Carlisle, Bill Brewster and Jake Taylor. See our latest episodes at www.oldyorkcellars.com

About Jake: Jake is a partner at Farnam Street.

Jake's website: www.oldyorkcellars.com