Undistributed net investment income calculation - final

Basics of the Net Investment Income Tax

10/28/

Applying the New Net Investment Income Tax to Trusts and Estates

EXECUTIVE |

|

The Health Care and Education Reconciliation Act of 1 created new chapter 2A of the Code, imposing the net investment income tax, a Medicare contribution tax of % on unearned income of individuals, estates, and trusts. This article discusses how the new tax applies to trusts and estates.

In December , the IRS published proposed regulations2 on Sec. , which imposes the tax. At the time this article was written, the IRS was hoping to finalize the regulations during Until the final regulations are issued, taxpayers are permitted to rely on the proposed regulations, with the understanding that the IRS may review and challenge transactions that manipulate net investment income to avoid the new tax.

The net investment income tax applies to trusts and estates for tax years beginning after Dec. 31, Since almost all trusts are required to have a calendar year, most trusts became subject to the new tax on Jan. 1, Since estates are permitted to have a fiscal year, some portion of the unearned income of an estate during might not be subject to the tax. For example, an estate with a fiscal year end of Nov. 30 would not be subject to the tax until Dec. 1,

Estates and Trusts to Which the Tax Applies

The tax applies to estates and trusts that are subject to the provisions of part 1 of subchapter J of chapter 1 of subtitle A of the Code, governing general taxation of estates, trusts, and beneficiaries. Thus, business trusts that are treated as business entities are not subject to Sec. at the entity level. Also excluded are certain state-law trusts that are subject to specific taxation regimes in chapter 1 other than part 1 of subchapter J, including, for example, common trust funds and designated settlement funds. Sec. does apply, however, to pooled income funds, cemetery perpetual care funds, qualified funeral trusts, and certain Alaska native settlement trusts. (The Treasury Department and the IRS are requesting comments on whether there are administrative reasons to exclude one or more of these types of trusts from the application of Sec. )3

Because Sec. is in subtitle A of the Code, any trust, fund, or other special account that is exempt from taxes imposed under subtitle A is exempt from the tax Sec. imposes. This exclusion applies even if such a trust may be subject to unrelated business taxable income and even if that unrelated business taxable income contains net investment income.

Examples of such trusts are those that are exempt from tax under Sec. (a), such as charitable organizations formed as trusts and qualified plan trusts. Charitable remainder trusts also fall within this category. (Although a charitable remainder trust itself is exempt from the application of Sec. , distributions from the charitable remainder trust to individuals are subject to Sec. to the extent such distributions consist of net investment income, as discussed below.)

Sec. (e)(2) specifically excepts from the application of Sec. a trust, all of the unexpired interests in which are devoted to one or more of the purposes described in Sec. (c)(2)(B).4

Foreign Estates and Trusts

In general, Sec. does not apply to foreign estates and foreign trusts that have little or no connection to the United States. Treasury and the IRS have indicated, however, that they believe net investment income of a foreign estate or foreign trust should be subject to Sec. to the extent such income is earned or accumulated for the benefit of or distributed to U.S. persons. Treasury and the IRS have requested comments on this topic.5

Since distributions from foreign estates to U.S. beneficiaries in general are not subject to income tax in the United States (except for U.S.-source income), it would be more consistent with federal income tax principles for the distributions not to be subject to the net investment income tax. On the other hand, distributable net income of a foreign trust does include both U.S.-source and non-U.S.-source income. Accordingly, current-year distributions from a foreign trust to U.S. beneficiaries should be subject to Sec. to the extent such distributions consist of net investment income. Distributions from foreign trusts that consist of prior-tax-year accumulations of income arguably should not be subject to Sec. because such distributions lose their character for purposes of calculating the accumulation distribution tax. The final regulations will reveal Treasury’s position on this.

Grantor Trusts

The tax under Sec. is not imposed on a grantor trust. If the grantor or another person is treated as the owner of all or a portion of the trust, any items of income, deduction, or credit that are included in computing taxable income of the grantor or other person are treated as if the items had been received by the grantor or other person for purposes of calculating such person’s net investment income.6

Estimated Tax Payments

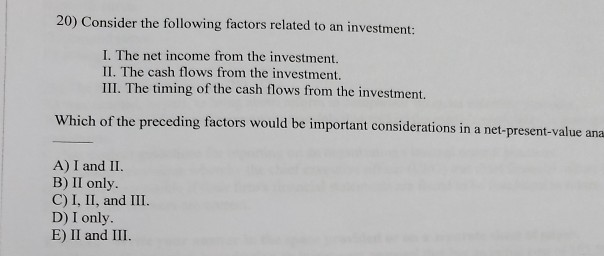

The Sec. tax is subject to the estimated tax provisions, so fiduciaries should consider it when making their quarterly estimated tax payments.

Computation of the Tax for Estates and Trusts

In the case of an estate or trust, the Sec. tax is imposed for each tax year at a rate of % on the lesser of (1) the undistributed net investment income for the tax year or (2) the excess (if any) of (a) the adjusted gross income (AGI) for the tax year, over (b) the dollar amount at which the highest tax bracket in Sec. 1(e) begins for the tax year.7 For , the highest tax bracket for estates and trusts begins at $11,

This threshold is much lower for estates and trusts than it is for individuals: modified AGI (MAGI) of $, for married taxpayers filing jointly and surviving spouses, $, for married taxpayers filing separately, and $, for all others.8 Thus, estates and trusts clearly operate at a disadvantage. Most trusts have only unearned income, and, thus, even modest-size trusts that retain income at the trust level rather than making distributions to beneficiaries probably are subject to the % tax.

Adjusted Gross Income

The AGI of a trust or estate is defined in Sec. 67(e) and computed in more or less the same manner as for an individual. Deductions, however, are permitted to estates and trusts for (1) personal exemptions, (2) the amount of any distributable net income distributed to beneficiaries, and (3) costs paid or incurred in connection with the administration of the estate or trust that would not have been incurred if the property were not held in such trust or estate.

The latter exception has been the subject of considerable controversy, with a Supreme Court decision holding that only expenses considered “uncommon or unusual” for a hypothetical individual to incur qualify for the Sec. 67(e) exception.9 In September , the IRS issued Prop. Regs. Sec. containing guidelines on how to apply the Court’s decision.10 One issue raised by these proposed regulations is how to deal with “bundled fiduciary fees.” The IRS would like to have trustees allocate a portion of their fees as an itemized miscellaneous deduction subject to the 2%-of-AGI floor under Sec. 67(a). In Notice ,11 the IRS indicated that taxpayers are not required to determine the portion of a bundled fiduciary fee that is subject to the 2% floor for any tax year beginning before the date the final regulations are published in the Federal Register. Since the regulations had not been finalized as this article was written in , calendar-year trusts are not obligated to allocate bundled fiduciary fees for

Since a significant portion, if not all, of the income of most trusts is investment income, the excess of the trust’s AGI over the threshold will often determine the amount of the tax. For this reason, practitioners must be diligent when advising fiduciaries concerning issues and decisions with respect to computing AGI.

Net Investment Income

The other major factor in computing the tax for a trust or estate is undistributed net investment income. Defining “undistributed net investment income” requires an understanding of the meaning of “net investment income.”

Sec. (c) defines net investment income as the excess of the sum of gross income or net gain from the following sources, over the deductions allowed by subtitle A (income taxes) that are properly allocable to such gross income or net gain:

Interest, dividends, annuities, royalties, and rents (nongain investment income) other than such income derived in the ordinary course of a trade or business not described in No. 2 or No. 3;

Income from a trade or business that is a passive activity (within the meaning of Sec. ) with respect to the trust or estate (passive activity trade or business income);

Income from a trade or business of trading in financial instruments or commodities (as defined in Sec. (e)(2)) (trader income from financial instruments or commodities); and

Net gain (to the extent taken into account in computing taxable income) attributable to the disposition of property other than property held in a trade or business not described in No. 2 or No. 3 (net gain income).

A full exploration of the meaning of net investment income is beyond the scope of this article. Many estates and trusts simply have interest, dividends, and capital gains. It is important to note that tax-exempt interest, such as interest earned on state and municipal bonds, is excluded from net investment income. Furthermore, Sec. specifically excludes from net investment income distributions from certain qualified plans, individual retirement accounts (IRAs), Roth IRAs, and certain deferred compensation plans of state and local governments and tax-exempt organizations.12 Also excluded from net investment income are any items taken into account in determining self-employment income upon which a tax is imposed under Sec. (b).13

If a trust holds certain active (as opposed to passive) interests in partnerships and S corporations, gain from disposition of those interests is taken into account in net investment income only to the extent of the net gain that would have been so taken into account by the trust if all the property of the partnership or S corporation were sold for fair market value immediately before the disposition of the interest.14

Passive Activity of Estates or Nongrantor Trusts

It is important to consider in the context of a nongrantor trust or estate whether a trade or business activity is considered passive or active. If the estate or trust does not materially participate in the trade or business activity, the activity is considered passive. Sec. (h)(1) provides that a taxpayer materially participates in an activity only if the taxpayer is involved in the operations of the activity on a regular, continuous, and substantial basis. The instructions for Form , U.S. Income Tax Return for Estates and Trusts, simply note that “[m]aterial participation standards for estates and trusts have not been established by regulations.”15

The Senate Finance Committee report for the Tax Reform Act of ,16 enacting Sec. , states, “Special rules apply in the case of taxable entities that are subject to the passive loss rule. An estate or trust is treated as materially participating in an activity (or as actively participating in a rental real estate activity) if an executor or fiduciary, in his capacity as such, is so participating.”17 The IRS position of looking to the activity of the trustee to determine material participation is consistent with the committee report, as reflected in Letter Ruling 18 and Technical Advice Memorandum (TAM) 19

In Mattie K. Carter Trust,20 a district court held that a trust materially participated in its ranching activity, concluding that it was unnecessary to resort to the legislative history of the statute because the statute was clear on its face. The court reasoned that the taxpayer in this case was the trust, not the trustee, and that the statute and common sense dictated that the trust’s participation in the business operation should be scrutinized by reference to the trust itself. It logically followed that all the activities of those who labored in the business activity on behalf of the trust (not just the trustee) should be considered when determining whether the material participation requirement had been satisfied.

The IRS letter ruling and TAM clearly indicate the IRS will not follow the Carter Trust decision and will look to the activity of the trustee in applying the Sec. tests. Ideally, therefore, if an estate or trust desires to obtain active status with respect to a trade or business, a fiduciary that has discretion to act on behalf of and bind the trust should be involved in the operations of the activity on a regular, continuous, and substantial basis.

Undistributed Net Investment Income

Undistributed net investment income of an estate or trust is its net investment income reduced by the share of net investment income included in deductions of the estate or trust under Sec. or for distributions to beneficiaries, and the share of net investment income allocated to a charitable deduction under Sec. (c) of the estate or trust. Thus, generally, to the extent that distributions of net investment income are made to noncharitable and charitable beneficiaries, the net investment income subject to the tax at the trust or estate level is reduced.

In computing the estate’s or trust’s undistributed net investment income, net investment income is reduced by distributions of net investment income made to beneficiaries. The deduction is limited to the lesser of the amount deductible to the estate or trust under Sec. or , as applicable, or the net investment income of the estate or trust. In the case of a deduction under Sec. or that consists of both net investment income and “excluded income,” the distribution must be allocated between net investment income and excluded income in a way similar to the distribution deduction rules under Regs. Sec. (b)-1, as if net investment income constituted gross income and excluded income constituted amounts not includible in gross income. In other words, the computation of undistributed net investment income is comparable to the computation of the distribution deduction and, therefore, must take into account items included in the distribution that are not a part of net investment income.

This is analogous to the treatment of tax-exempt interest. The portion of the distribution to the beneficiary that includes tax-exempt interest is not included in the distribution deduction that reduces the income retained at the trust level. “Excluded income” means items of income excluded from gross income under chapter 1 of the Code, such as tax-exempt interest; items of income not included in net investment income as determined under Sec. (c) and Prop. Regs. Sec. , such as gain or loss attributable to property held in an active trade or business; and items of gross income and net gain specifically excluded by Sec. , the regulations, or other guidance published in the Internal Revenue Bulletin.

Examples adapted from the proposed regulations21 illustrate the concepts:

Example 1. Calculation of undistributed net investment income (with no deduction under Sec. (c)): In year 1, Trust has dividend income of $15,; interest income of $10,; capital gain of $5,; and $60, of taxable income relating to a distribution from an IRA. Trust has no expenses. Trust distributes $10, of its current-year trust accounting income to A, a beneficiary of Trust. For trust accounting purposes, $25, of the distribution from the IRA is attributable to income. Trust allocates the remaining $35, of taxable income from the IRA and the $5, of capital gain to principal, and, therefore, these amounts do not enter the calculation of Trust’s distributable net income for year 1.

Trust’s distributable net income is $50, ($15, in dividends + $10, in interest + $25, of taxable income from the IRA), from which the $10, distribution to A is paid. Trust’s deduction under Sec. is $10, Under Regs. Sec. (b)-1, the deduction reduces each class of income constituting distributable net income on a proportional basis. The $10, distribution equals 20% of distributable net income ($10, ÷ $50,). Therefore, the distribution consists of dividend income of $3,, interest income of $2,, and ordinary income attributable to the IRA of $5, Because the $5, of capital gain allocated to principal for trust accounting purposes did not enter into distributable net income, no portion of that amount is included in the $10, distribution, nor does it qualify for the deduction under Sec.

Trust’s net investment income is $30, ($15, in dividends + $10, in interest + $5, in capital gain). Trust’s $60, of taxable income attributable to the IRA is excluded from net investment income. Trust’s undistributed net investment income is $25,, which is Trust’s net investment income ($30,) less the amount of dividend income ($3,) and interest income ($2,) distributed to A. The $25, of undistributed net investment income comprises the capital gain allocated to principal ($5,), the remaining undistributed dividend income ($12,), and the remaining undistributed interest income ($8,).

A’s net investment income includes dividend income of $3, and interest income of $2, but does not include the $5, of ordinary income attributable to the IRA because it is excluded from net investment income.

Example 2. Calculation of undistributed net investment income (with deduction under Sec. (c)): Assume the same facts as in Example 1, except that Trust is required to distribute $30, to A. In addition, Trust has a $10, deduction under Sec. (c) (deduction for amounts paid for a charitable purpose). Trust also makes an additional discretionary distribution of $10, to B, another beneficiary of Trust.

As in Example 1, Trust’s net investment income is $30, ($15, in dividends + $10, in interest + $5, in capital gain). In accordance with Regs. Secs. (b)-2 and (b)-2, the items of income must be allocated among the mandatory distribution to A, the discretionary distribution to B, and the $10, distribution to a charity.

For purposes of the mandatory distribution to A, Trust’s distributable net income is $50, Trust’s deduction under Sec. for the distribution to A is $30, Under Regs. Sec. (b)-1, the deduction reduces each class of income constituting distributable net income on a proportional basis. The $30, distribution equals 60% of distributable net income ($30, ÷ $50,). Therefore, the distribution consists of dividend income of $9,, interest income of $6,, and ordinary income attributable to the IRA of $15, A’s mandatory distribution thus consists of $15, of net investment income and $15, of excluded income.

Trust’s remaining distributable net income is $20, Trust’s remaining undistributed net investment income is $15, The $10, deduction under Sec. (c) is allocated in the same manner as the distribution to A, where the $10, distribution equals 20% of distributable net income ($10, ÷ $50,). For purposes of determining undistributed net investment income, Trust’s net investment income is reduced by $5, (dividend income of $3,, interest income of $2,, but with no reduction for amounts attributable to the IRA of $5,).

With respect to the discretionary distribution to B, Trust’s remaining distributable net income is $10, Trust’s remaining undistributed net investment income is $10, Trust’s deduction under Sec. for the distribution to B is $10, The $10, distribution equals 20% of distributable net income ($10, ÷ $50,). Therefore, the distribution consists of dividend income of $3,, interest income of $2,, and ordinary income attributable to the IRA of $5, B’s distribution consists of $5, of net investment income and $5, of excluded income.

Trust’s undistributed net investment income is $5, after taking into account distribution deductions and Sec. (c). To arrive at Trust’s undistributed net investment income of $5,, Trust’s net investment income of $30, is reduced by $15, of the mandatory distribution to A, $5, of the Sec. (c) deduction, and $5, of the discretionary distribution to B.

Including Capital Gain in Distributable Net Income

As a general rule, the capital gains of a trust are allocated to principal and therefore are not part of the distributable net income distributed to beneficiaries. For this reason, a trust with capital gains often may be subject to the tax on net investment income regardless of the size of the distributions to the beneficiaries.

Regs. Sec. (a)-3(b) provides guidance on the circumstances in which capital gain can be included in distributable net income. Capital gains are included in distributable net income to the extent they are, pursuant to the terms of the governing instrument and applicable local law or pursuant to a reasonable and impartial exercise of discretion by the fiduciary (in accordance with the power granted to the fiduciary by applicable local law or by the governing instrument if not prohibited by applicable local law):

- Allocated to income;

- Allocated to corpus but treated consistently by the fiduciary on the trust’s books, records, and tax returns as part of the distribution to a beneficiary; or

- Allocated to corpus but actually distributed to the beneficiary or used by the fiduciary in determining the amount that is distributed or required to be distributed to a beneficiary.

Accordingly, CPAs should coordinate with the fiduciary and legal counsel to determine options available with respect to allocating capital gains either to income or corpus in such a way that they could be included in distributable net income when otherwise appropriate under the circumstances.

Application of Sec. to Electing Small Business Trusts

An electing small business trust (ESBT) is a unique type of trust that holds S corporation stock. It must satisfy requirements that include having made an election to be taxed as an ESBT. The unique aspect of an ESBT is that the portion of the trust that consists of S corporation stock is treated as a separate trust and is taxed at the highest rate on the taxable income determined for that portion.22 The non-S portion of the ESBT is likewise taxed as a separate trust consistent with the normal rules for part 1 of subchapter J of chapter 1 of subtitle A of the Code.

The proposed regulations under Sec. preserve the treatment of the ESBT as separate trusts for computational purposes but consolidate the ESBT into a single trust for determining the AGI threshold for the ESBT.23 Thus, the unfairness of being able to use two thresholds for what is really one trust is avoided by consolidating the undistributed net investment income of the two portions to apply a single Sec. 1(e) threshold.

The proposed regulations accomplish this calculation in three steps. First, the ESBT separately calculates the undistributed investment income of the S portion and non-S portion in accordance with the general rules for trusts under chapter 1 and combines the undistributed net investment income of the S portion and the non-S portion. Second, the ESBT determines its AGI solely for purposes of Sec. by adding the non-S portion’s AGI to the net income or net loss of the S portion (after taking into account all deductions, carryovers, and loss limitations applicable to the S portion) as a single item of ordinary income or loss. Third, the ESBT compares the combined undistributed net investment income with the excess of its AGI over the Sec. 1(e) threshold to determine whether the ESBT is subject to Sec. , and if so, the Sec. tax base.24

An example adapted from the proposed regulations25 illustrates the concept:

Example 3. Calculation of an ESBT’s tax for purposes of Sec. In year 1, the non-S portion of Trust, an ESBT, has dividend income of $15,, interest income of $10,, and capital gain of $5, Trust’s S portion has net rental income of $21, and a capital loss of $7, The trustee’s annual fee of $1, is allocated 60% to the non-S portion and 40% to the S portion. Trust makes a distribution from income to a single beneficiary of $9,

Step 1: (A) Trust must compute the undistributed net investment income for the S portion and non-S portion. The undistributed net investment income for the S portion is $20,, determined as shown in Exhibit 1.

(B) No portion of the capital loss is allowed because, pursuant to Prop. Regs. Sec. (d)(2), net gain cannot be less than zero, and excess capital losses are not properly allocable deductions under Prop. Regs. Sec. (f). In addition, pursuant to Regs. Sec. (c)-1(i), no portion of the $9, distribution is allocable to the S portion. The undistributed net investment income for the non-S portion is $20,, determined as shown in Exhibit 2.

(C) Trust combines the undistributed net investment income of the S portion and non-S portion from paragraphs (A) and (B) to arrive at Trust’s combined undistributed net investment income (see Exhibit 3).

Step 2: (A) The ESBT calculates its AGI as the non-S portion’s AGI, increased or decreased by the net income or net loss of the S portion.

(B) The AGI for the ESBT is $38,, determined as shown in Exhibit 4.

(C) The S portion’s single item of ordinary income used in the ESBT’s AGI calculation is $17, This item of income is determined by starting with net rental income of $21, and reducing it—

(1) By the S portion’s $ share of the annual trustee fee; and

(2) As allowed by Sec. (b)(1), $3, of the $7, capital loss.

Step 3: Trust pays tax on the lesser of:

(A) The combined undistributed net investment income ($41,, calculated in Step 1(C)); or

(B) The excess of AGI ($38, calculated in Step 2(B)) over the dollar amount at which the highest tax bracket in Sec. 1(e) applicable to a trust begins for the tax year.

As in the discussion above concerning whether a trade or business activity is passive or active in relation to the trust, an essential element of computing the net investment income of the S portion of an ESBT is determining whether the trust materially participates in any trade or business activities of the S portion.

Applying Sec. to Charitable Remainder Trusts

As stated previously, charitable remainder trusts are exempt from the Sec. tax on unearned income. Nevertheless, net investment income may be included in the distributions to the beneficiaries from the charitable remainder trust. The net investment income of the beneficiary includes an amount equal to the lesser of (1) the total amount of distributions for that year, or (2) the current and accumulated net investment income of the charitable remainder trust.26

The accumulated net investment income of a charitable remainder trust is the total amount of net investment income the trust received for all tax years beginning after Dec. 31, , less the total amount of net investment income distributed for all prior tax years of the trust that began after Dec. 31, If a charitable remainder trust has multiple beneficiaries, the net investment income is apportioned among the beneficiaries based on their respective shares paid by the charitable remainder trust for that tax year.27

Under this method of taxing beneficiaries of charitable remainder trusts, current and accumulated net investment income of the trust is deemed to be distributed before amounts that are not items of net investment income for purposes of Sec. As a result, the classification of income as net investment income or non–net investment income is separate from, and in addition to, the four tiers under Sec. (b). Thus, Sec. requires trustees of charitable remainder trusts to keep track of an entire new classification of income, namely, current and accumulated net investment income. In addition, distributions of current and accumulated net investment income to beneficiaries will need to be reported to the beneficiary on his or her Schedule K-1 (Form ), Beneficiary’s Share of Income, Deductions, Credits, etc.

Fortunately, charitable remainder trusts existing prior to Jan. 1, , need not concern themselves with accumulations of net investment income before that date. By definition, accumulated net investment income includes only net investment income received by a charitable remainder trust for all tax years beginning after Dec. 31,

Example 4: During , a charitable remainder unitrust is required to pay out 5% of its beginning-of-the-year value of $10 million, or $, As a carryover from calendar year , the charitable remainder trust had $, of ordinary income in tier 1, consisting of interest income on corporate bonds, and $9 million of long-term capital gain in tier 2. During the charitable remainder trust earned interest income on corporate bonds at the rate of 2%, or $,

The $, distribution to the beneficiary is classified as $, of ordinary interest income (consisting of the $, of interest carryover from and the $, of interest income earned during ) and $, of long-term capital gain from tier 2. Although interest income and capital gains are included within the definition of net investment income, only $, of the $, distribution is considered net investment income for purposes of computing the Sec. tax for the beneficiary. This is because the net investment income of the beneficiary equals the lesser of (1) total distributions to the beneficiary, in this example, $,, or (2) the sum of the current net investment income ($,) and the accumulated net investment income. Accumulated net investment income is zero in this case because it accumulated prior to Jan. 1, Since $, is less than $,, the amount included in the net investment income of the beneficiary from the charitable remainder trust for is $,

As indicated above, taxpayers may rely on the proposed regulations for the purpose of compliance with Sec. until the effective date of final regulations. The proposed regulations are effective for tax years beginning after Dec. 31, , except that the portion of the proposed regulations dealing with charitable remainder trusts is proposed to apply to tax years beginning after Dec. 31,

Controlled Foreign Corporations and Passive Foreign Investment Companies

If a trust or estate holds investments in controlled foreign corporations and/or passive foreign investment companies, the trustee/executor and his or her tax advisers need to be aware that, absent an election by the trustee/executor, income from these investments is treated differently for purposes of computing the Sec. tax than for computing taxable income under chapter 1. As currently proposed, an estate or trust that wants to make the election generally must do so for the first tax year beginning after Dec. 31, , during which (1) the estate or trust owns an interest in a controlled foreign corporation or passive foreign investment company, and (2) the estate or trust is subject to tax under Sec. or would be subject to tax under Sec. if the election were made.28

Conclusion

Most trusts became subject to the new tax on net investment income on Jan. 1, Because the threshold for trusts and estates in is AGI exceeding $11,, many trusts and estates retaining income at the trust or estate level are subject to the new % tax. An individual beneficiary of the trust, however, is not subject to the tax until his or her MAGI exceeds $, if married filing jointly, or $, if filing as a single individual.

In addition to the tax on net investment income, the American Taxpayer Relief Act of 29 raised the maximum marginal tax rate on ordinary income and capital gains of trusts with taxable income exceeding $11, to % and 20%, respectively. An individual beneficiary of a trust is not subject to these higher marginal tax brackets until his or her taxable income exceeds $, for married filing jointly or $, filing as a single individual. As a result, trustees may receive pressure from beneficiaries to make distributions to reduce or eliminate the tax and reduce the overall effective tax rate on trust income. Other factors to consider, however, include the maturity of the beneficiary, loss of creditor protection, exposure to future estate taxes, and risk of loss related to future divorce of a beneficiary.

The income tax expense of trusts and estates retaining taxable income at the trust level has increased significantly on net investment income. Fiduciaries must consider reconfiguring investments in light of after-tax returns on current holdings. Actions they might consider include investing in tax-exempt securities and adding a trust fiduciary that materially participates in trade or business activities held by the trust or passthrough entities it owns.

Footnotes

1 Health Care and Education Reconciliation Act of , P.L.

2 REG

3 Preamble to REG

4 That is, “organized and operated exclusively for religious, charitable, scientific, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no part of its activities involve the provision of athletic facilities or equipment), or for the prevention of cruelty to children or animals.”

5 Preamble to REG

6 Prop. Regs. Sec. (b)(5).

7 Sec. (a)(2).

8 Secs. (a)(1) and (b).

9Knight, U.S. ().

10 REG

11 Notice , I.R.B.

12 Sec. (c)(5).

13 Sec. (c)(6).

14 Sec. (c)(4).

15 Instructions for Form () at

16 Tax Reform Act of , P.L.

17 S. Rep’t No. , 99th Cong., 2d Sess., at ().

18 IRS Letter Ruling (7/23/10).

19 IRS Technical Advice Memo. (8/17/07).

20Mattie K. Carter Trust, F. Supp. 2d (N.D. Tex. ).

21 Prop. Regs. Sec. (f), Examples (1) and (2).

22 Sec. (c).

23 Prop. Regs. Sec. (c)(1)(i).

24 Prop. Regs. Sec. (c)(1)(ii).

25 Prop. Regs. Sec. (f), Example (3).

26 Prop. Regs. Sec. (c)(2)(i).

27 Prop. Regs. Secs. (c)(2)(ii) and (iii).

28 Prop. Regs. Sec. (g)(3).

29 American Taxpayer Relief Act of , P.L.

EditorNotes |

John M. Nuckolls is national director, private client tax services, and Michael Campbell is partner, both with BDO in San Francisco; Jaclyn Jang is senior tax director with BDO in Melville, N.Y. For more on this article, contact Mr. Nuckolls at jnuckolls@www.oldyorkcellars.com |

26 CFR § - Application to estates and trusts.

§ Application to estates and trusts.

(a)Estates and trusts to which tax applies -

(1)In general -

(i)General application. Section and the regulations thereunder apply to all estates and trusts that are subject to the provisions of part I of subchapter J of chapter 1 of subtitle A of the Internal Revenue Code, unless specifically exempted under paragraph (b) of this section.

(ii)Calculation of tax. The tax imposed by section (a)(2) for each taxable year is equal to percent of the lesser of -

(A) The estate's or trust's undistributed net investmentincome for such taxable year; or

(B) The excess (if any) of -

(1) The estate's or trust's adjusted gross income (as defined in section 67(e) and as adjusted under § (e)(2), if applicable) for such taxable year; over

(2) The dollar amount at which the highest tax bracket in section 1(e) begins for such taxable year.

(2)Taxable year of less than twelve months -

(i)General rule. In the case of an estate or trust that has a taxable year consisting of less than twelve months (short taxable year), the dollar amount described in paragraph (a)(1)(ii)(B)(2) of this section is not reduced or prorated.

(ii)Change of annual accounting period. Notwithstanding paragraph (a)(2)(i) of this section, an estate or trust that has a short taxable yearresulting from a change of annual accounting period (but not from an individual's death) reduces the dollar amount described in paragraph (a)(1)(ii)(B)(2) of this section to an amount that bears the same ratio to that dollar amount as the number of months in the short taxable year bears to twelve.

(3)Rules with respect to CFCs and www.oldyorkcellars.comonal rules in § apply to an estate or trust that holds an interest in a controlled foreign corporation (CFC) or a passive foreign investment company (PFIC).

(b)Application to certain trusts and estates -

(1)Exception for certain trusts and estates. The following trusts are not subject to the tax imposed by section

(i) A trust or decedent's estate all of the unexpired interests in which are devoted to one or more of the purposes described in section (c)(2)(B).

(ii) A trust exempt from tax under section

(iii) A charitable remainder trust described in section However, see paragraph (d) of this section for special rules regarding the treatment of annuity or unitrust distributions from such a trust to personssubject to tax under section

(iv) Any other trust, fund, or account that is statutorily exempt from taxes imposed in subtitle A. For example, see sections (e)(1), (e)(1), (a), and (a).

(v) A trust, or a portion thereof, that is treated as a grantor trust under subpart E of part I of subchapter J of chapter 1. However, in the case of any such trust or portion thereof, each item of income or deduction that is included in computing taxable income of a grantor or another person under section is treated as if it had been received by, or paid directly to, the grantor or other person for purposes of calculating such person's net investmentincome.

(vi) Electing Alaska Native Settlement Trusts subject to taxation under section

(vii) Cemetery Perpetual Care Funds to which section (i) applies.

(viii)Foreign trusts (as defined in section (a)(31)(B) and § (a)(2)) (but see §§ (e)(3)(ii) and (e)(1)(ii) for rulesrelated to distributions from foreign trusts to United States beneficiaries).

(ix) Foreign estates (as defined in section (a)(31)(A)) (but see § (e)(3)(ii) for rulesrelated to distributions from foreign estates to United States beneficiaries).

(2)Special rules for certain taxable trusts and estates -

(i)Qualified funeral trusts. For purposes of the calculation of any tax imposed by section , section and the regulations thereunder are applied to each qualified funeral trust (within the meaning of section ) by treating each beneficiary's interest in each such trust as a separate trust.

(ii)Bankruptcy estates. A bankruptcy estate in which the debtor is an individual is treated as a married taxpayer filing a separate return for purposes of section See § (a)(2)(v) and (d)(1)(ii).

(c)Application to electing small business trusts (ESBTs) -

(1)General application. The S portion and non-S portion (as defined in § (c)-1(b)(2) and (3), respectively) of a trust that has made an ESBT election under section (e)(3) and § (m)(2) are treated as separate trusts for purposes of the computation of undistributed net investmentincome in the manner described in paragraph (e) of this section, but are treated as a single trust for purposes of determining the amountsubject to tax under section If a grantor or another person is treated as the owner of a portion of the ESBT, the items of income and deduction attributable to the grantor portion (as defined in § (c)-1(b)(1)) are included in the grantor's calculation of net investmentincome and are not included in the ESBT's computation of tax described in paragraph (c)(1)(ii) of this section.

(2)Computation of tax. This paragraph (c)(2) provides the method for an ESBT to compute the tax under section

(i)Step one. The S portion and non-S portion computes each portion's undistributed net investmentincome as separate trusts in the manner described in paragraph (e) of this section and then combine these amounts to calculate the ESBT's undistributed net investmentincome.

(ii)Step two. The ESBT calculates its adjusted gross income (as defined in paragraph (a)(1)(ii)(B)(1) of this section). The ESBT's adjusted gross income is the adjusted gross income of the non-S portion, increased or decreased by the net income or net loss of the S portion, after taking into account all deductions, carryovers, and losslimitations applicable to the S portion, as a single item of ordinary income (or ordinary loss).

(iii)Step three. The ESBT pays tax on the lesser of -

(A) The ESBT's total undistributed net investmentincome; or

(B) The excess of the ESBT's adjusted gross income (as calculated in paragraph (c)(2)(ii) of this section) over the dollar amount at which the highest tax bracket in section 1(e) begins for the taxable year.

(3)Example.

(i) In Year 1 (a year that section is in effect), the non-S portion of Trust, an ESBT, has dividend income of $15,, interest income of $10,, and capital loss of $5, Trust's S portion has net rental income of $21, and a capital gain of $7, The Trustee's annual fee of $1, is allocated 60% to the non-S portion and 40% to the S portion. Trust makes a distribution from income to a single beneficiary of $9,

(ii)Step one.

(A)Trust must compute the undistributed net investmentincome for the S portion and non-S portion in the manner described in paragraph (c) of this section.

The undistributed net investmentincome for the S portion is $27, and is determined as follows:

| Net Rental Income | $21, |

|---|---|

| Capital Gain | 7, |

| Trustee Annual Fee | () |

| Total S portion undistributed net investment income | 27, |

(B) The undistributed net investmentincome for the non-S portion is $12, and is determined as follows:

| Dividend Income | $15, |

|---|---|

| Interest Income | 10, |

| Deductible Capital Loss | (3,) |

| Trustee Annual Fee | () |

| Distributable net income distribution | (9,) |

| Total non-S portion undistributed net investment income | 12, |

(C)Trust combines the undistributed net investmentincome of the S portion and non-S portion from (ii)(A) and (B) to arrive at Trust's combined undistributed net investmentincome.

| S portion's undistributed net investment income | $27, |

|---|---|

| Non-S portion's undistributed net investment income | 12, |

| Combined undistributed net investment income | 40, |

(iii)Step two.

(A) The ESBT calculates its adjusted gross income. Pursuant to paragraph (c)(2)(ii) of this section, the ESBT's adjusted gross income is the non-S portion's adjusted gross income increased or decreased by the net income or net loss of the S portion.

(B) The adjusted gross income for the ESBT is $40, and is determined as follows:

| Dividend Income | $15, |

|---|---|

| Interest Income | 10, |

| Deductible Capital Loss | (3,) |

| Trustee Annual Fee | () |

| Distributable net income distribution | (9,) |

| S Portion Income | 27, |

| Adjusted gross income | 40, |

(C) The S portion's single item of ordinary income used in the ESBT's adjusted gross incomecalculation is $27, This item of income is determined by starting with net rental income of $21, and capital gain of $7, and reducing it by the S portion's $ share of the annual trustee fee.

(iv)Step www.oldyorkcellars.com pays tax on the lesser of -

(A) The combined undistributed net investmentincome ($40,); or

(B) The excess of adjusted gross income ($40,) over the dollar amount at which the highest tax bracket in section 1(e) applicable to a trust begins for the taxable year.

(d)Application to charitable remainder trusts (CRTs) -

(1)Operational rules -

(i)Treatment of annuity or unitrust distributions. If one or more items of net investmentincome comprise all or part of an annuity or unitrust distribution from a CRT, such items retain their character as net investmentincome in the hands of the recipient of that annuity or unitrust distribution.

(ii)Apportionment among multiple beneficiaries. In the case of a CRT with more than one annuity or unitrust beneficiary, the net investmentincome is apportioned among such beneficiaries based on their respective shares of the total annuity or unitrust amount paid by the CRT for that taxable year.

(iii)Accumulated net investment income. The accumulated net investmentincome of a CRT is the total amount of net investmentincome received by a CRT for all taxable years that begin after December 31, , less the total amount of net investmentincomedistributed for all prior taxable years of the trust that begin after December 31,

(2)Application of Section -

(i)General rule. The Federal income tax rate of the item of net investmentincome, to be used to determine the proper classification of that item within the appropriate income category as described in § (d)(1)(i)(b), is the sum of the income tax rate applicable to that item under chapter 1 and the tax rate under section Thus, the accumulated net investmentincome and excluded income (as defined in § (d)(4)) of a CRT in the same income category constitute separate classes of income within that category as described in § (d)(1)(i)(b).

(ii)Special rules for CRTs with income from CFCs or PFICs. [Reserved]

(iii)Examples. The following examples illustrate the provisions of this paragraph (d)(2).

Example 1.

(i) In , A formed CRT as a charitable remainder annuity trust. The trust document requires an annual annuity payment of $50, to A for 15 years. For purposes of this example, assume that CRT is a valid charitable remainder trust under section and has not received any unrelated business taxable income during any taxable year.

(ii) As of January 1, , CRT has the following items of undistributed income within its § (d)(1) categories and classes:

| Category | Class | Tax rate (percent) | Amount |

|---|---|---|---|

| Ordinary Income | Interest | $4, | |

| Net Rental Income | 8, | ||

| Non-Qualified Dividend Income | 2, | ||

| Qualified Dividend Income | 10, | ||

| Capital Gain | Short-Term | 39, | |

| Unrecaptured Section Gain | 1, | ||

| Long-Term | , | ||

| Other Income | None | ||

| Total undistributed income as of January 1, | , |

Pursuant to § (d)(1)(iii), none of the $, of undistributed income is accumulated net investment income (ANII) because none of it was received by CRT after December 31, Thus, the entire $, of undistributed income is excluded income (as defined in § (d)(4)).

(iii) During , CRT receives $7, of interest income, $9, of qualified dividend income, $4, of short-term capital gain, and $11, of long-term capital gain. Prior to the distribution of $50, to A, CRT has the following items of undistributed income within its § (d)(1) categories and classes after the application of paragraph (d)(2) of this section:

| Category | Class | Excluded/ANII | Tax rate (percent) | Amount |

|---|---|---|---|---|

| Ordinary Income | Interest | NII | $7, | |

| Interest | Excluded | 4, | ||

| Net Rental Income | Excluded | 8, | ||

| Non-Qualified Dividend Income | Excluded | 2, | ||

| Qualified Dividend Income | NII | 9, | ||

| Qualified Dividend Income | Excluded | 10, | ||

| Capital Gain | Short-Term | NII | 4, | |

| Short-Term | Excluded | 39, | ||

| Unrecaptured Section Gain | Excluded | 1, | ||

| Long-Term | NII | 11, | ||

| Long-Term | Excluded | , | ||

| Other Income | None |

(iv) The $50, distribution to A for will include the following amounts:

| Category | Class | Excluded/ANII | Tax rate (percent) | Amount |

|---|---|---|---|---|

| Ordinary Income | Interest | NII | $7, | |

| Interest | Excluded | 4, | ||

| Net Rental Income | Excluded | 8, | ||

| Non-Qualified Dividend Income | Excluded | 2, | ||

| Qualified Dividend Income | NII | 9, | ||

| Qualified Dividend Income | Excluded | 10, | ||

| Capital Gain | Short-Term | NII | 4, | |

| Short-Term | Excluded | 6, | ||

| Unrecaptured Section Gain | Excluded | None | ||

| Long-Term | NII | None | ||

| Long-Term | Excluded | None |

The amount included in A's net investment income is $20, This amount is comprised of $7, of interest income, $9, of qualified dividend income, and $4, of short-term capital gain.

(v) As a result, as of January 1, , CRT has the following items of undistributed income within its § (d)(1) categories and classes:

| Category | Class | Excluded/ANII | Tax rate (percent) | Amount |

|---|---|---|---|---|

| Ordinary Income | Interest | None | ||

| Net Rental Income | None | |||

| Non-Qualified Dividend Income | None | |||

| Qualified Dividend Income | None | |||

| Capital Gain | Short-Term | Excluded | $33, | |

| Unrecaptured Section Gain | Excluded | 1, | ||

| Long-Term | ANII | 11, | ||

| Long-Term | Excluded | , | ||

| Other Income | None |

(3)Elective simplified method. [Reserved]

(e)Calculation of undistributed net investment income -

(1)In general. This paragraph (e) provides special rules for the computation of certain deductions and for the allocation of net investmentincome between an estate or trust and its beneficiaries. Generally, an estate's or trust's net investmentincome is calculated in the same manner as that of an individual. See § (c) for special rules regarding CFCs, PFICs, and estates and trusts holding interests in such entities.

(2)Undistributed net investment income. An estate's or trust's undistributed net investmentincome is the estate's or trust's net investmentincome reduced by distributions of net investmentincome to beneficiaries and by deductions under section (c) in the manner described in paragraphs (e)(3) and (e)(4) of this section.

(3)Distributions of net investment income to beneficiaries.

(i) In computing the estate's or trust's undistributed net investmentincome, net investmentincome is reduced by distributions of net investmentincome made to beneficiaries. The deduction allowed under this paragraph (e)(3) is limited to the lesser of the amount deductible to the estate or trust under section or section , as applicable, or the net investmentincome of the estate or trust. In the case of a deduction under section or section that consists of both net investmentincome and excluded income (as defined in § (d)(4)), the distribution must be allocated between net investmentincome and excluded income in a manner similar to § (b)-1 as if net investmentincome constituted gross income and excluded income constituted amounts not includible in gross income. See § (c)-1 and Example 1 in paragraph (e)(5) of this section.

(ii) If one or more items of net investmentincome comprise all or part of a distribution for which a deduction is allowed under paragraph (e)(3)(i) of this section, such items retain their character as net investmentincome under section (b) or section (b), as applicable, for purposes of computing net investmentincome of the recipient of the distribution who is subject to tax under section The provisions of this paragraph (e)(3)(ii) also apply to distributions to United States beneficiaries of current yearincome described in section or section , as applicable, from foreign estates and foreign nongrantor trusts.

(4)Deduction for amounts paid or permanently set aside for a charitable purpose. In computing the estate's or trust's undistributed net investmentincome, the estate or trust is allowed a deduction for amounts of net investmentincome that are allocated to amounts allowable under section (c). In the case of an estate or trust that has items of income consisting of both net investmentincome and excluded income, the allowable deduction under this paragraph (e)(4) must be allocated between net investmentincome and excluded income in accordance with § (c)-2(b) as if net investmentincome constituted gross income and excluded income constituted amounts not includible in gross income. For an estate or trust with deductions under both sections (c) and , see § (b)-2 and Example 2 in paragraph (e)(5) of this section.

(5)Examples. The following examples illustrate the provisions of this paragraph (e). In each example, Year 1 is a year in which section is in effect and the taxpayer is not a foreign estate or trust:

Example 1. Calculation of undistributed net investment income (with no deduction under section (c)).

(i) In Year 1, Trust has dividend income of $15,, interest income of $10,, capital gain of $5,, and $75, of taxable income relating to a distribution from an individual retirement account (as defined under section ). Trust has no expenses. Trust distributes $10, of its current year trust accounting income to A, a beneficiary of Trust.

(ii)Trust's distributable net income is $, ($15, in dividends plus $10, in interest plus $75, of taxable income from an individual retirement account), from which the $10, distribution to A is paid. Trust's deduction under section is $10, Under § (b)-1, the deduction reduces each class of income comprising distributable net income on a proportional basis. The $10, distribution equals 10% of distributable net income ($10, divided by $,). Therefore, the distribution consists of dividend income of $1,, interest income of $1,, and ordinary income attributable to the individual retirement account of $7, Because the $5, of capital gain allocated to principal for trust accounting purposes did not enter into distributable net income, no portion of that amount is included in the $10, distribution, nor does it qualify for the deduction under section

(iii)Trust's net investmentincome is $30, ($15, in dividends plus $10, in interest plus $5, in capital gain). Trust's $75, of taxable income attributable to the individual retirement account is excluded income under § (d)(4). Trust's undistributed net investmentincome under paragraph (e)(2) of this section is $27,, which is Trust's net investmentincome ($30,) less the amount of dividend income ($1,) and interest income ($1,) distributed to A. The $27, of un distributed net investmentincome is comprised of the capital gain allocated to principal ($5,), the remaining un distributed dividend income ($13,), and the remaining un distributedinterest income ($9,).

(iv) Under paragraph (e)(3) of this section and pursuant to § (a)(1), A's net investmentincome includes dividend income of $1, and interest income of $1,, but does not include the $7, of ordinary income attributable to the individual retirement account because it is excluded from net investmentincome under §

Example 2. Calculation of undistributed net investment income (with deduction under section (c)).

(i) Same facts as Example 1, except Trust is required to distribute $30, to A. In addition, Trust has a $10, deduction under section (c) (deduction for amounts paid for a charitable purpose). Trust also makes an additional discretionary distribution of $20, to B, a beneficiary of Trust. As in Example 1, Trust's net investment income is $30, ($15, in dividends plus $10, in interest plus $5, in capital gain). In accordance with §§ (b)-2 and (b)-2, the items of income must be allocated between the mandatory distribution to A, the discretionary distribution to B, and the $10, distribution to a charity.

(ii) For purposes of the mandatory distribution to A, Trust's distributable net income is $, See § (b)-2, Example 1(b). Trust's deduction under section for the distribution to A is $30, Under § (b)-1, the deduction reduces each class of income comprising distributable net income on a proportional basis. The $30, distribution equals 30% of distributable net income ($30, divided by $,). Therefore, the distribution consists of dividend income of $4,, interest income of $3,, and ordinary income attributable to the individual retirement account of $22, A's mandatory distribution thus consists of $7, of net investmentincome and $22, of excluded income.

(iii)Trust's remaining distributable net income is $70, Trust's remaining undistributed net investmentincome is $22, The $10, deduction under section (c) is allocated in the same manner as the distribution to A, where the $10, distribution equals 10% of distributable net income ($10, divided by $,). For purposes of determining undistributed net investmentincome, Trust's net investmentincome is reduced by $2, under paragraph (e)(4) of this section (dividend income of $1,, interest income of $1,, but with no reduction for amounts attributable to the individual retirement account of $7,).

(iv) With respect to the discretionary distribution to B, Trust's remaining distributable net income is $60, Trust's remaining undistributed net investmentincome is $20, Trust's deduction under section for the distribution to B is $20, The $20, distribution equals 20% of distributable net income ($20, divided by $,). Therefore, the distribution consists of dividend income of $3,, interest income of $2,, and ordinary income attributable to the individual retirement account of $15, B's distribution consists of $5, of net investmentincome and $15, of excluded income.

(v)Trust's undistributed net investmentincome is $15, after taking into accountdistributiondeductions and section (c) in accordance with paragraphs (e)(3) and (e)(4) of this section, respectively. To arrive at Trust's undistributed net investmentincome of $15,, Trust's net investmentincome of $30, is reduced by $7, of the mandatory distribution to A, $2, of the section (c) deduction, and $5, of the discretionary distribution to B. The undistributed net investmentincome consists of the remaining dividend income of $6, ($15, less $4, less $1, less $3,), interest income of $4, ($10, less $1, less $3, less $2,), and the $5, of undistributed capital gain.

Example 3. Fiscal Year Estate.

(i) D died in D's estate (Estate) filed its first return that established its fiscal year ending October 31, During Estate's fiscal year ending October 31, , it earned $10, of interest, $1, of dividends, and $15, of short-term gains. The Estate distributed its interest and dividends to S, D's spouse and sole beneficiary, on a quarterly basis; the last quarter's payment for that taxable year was made to S on December 5, Pursuant to § (c)-1, S is deemed to have received the first three payments for that taxable year, regardless of the actual payment dates, on October 31, , the last day of Estate's taxable year. Estate makes a timely section (b) election to treat the fourth quarter distribution to S as having been made on October 31, , the last day of Estate's preceding taxable year. Accordingly, S is deemed to have received $10, of interest and $1, of dividends on October 31,

(ii) Because Estate's fiscal year ending October 31, , began on November 1, , the Estate is not subject to section on income received during that taxable year. Therefore, none of the income received by Estate during its fiscal year ending October 31, , is net investmentincome. Pursuant to paragraph (e)(3)(ii) of this section, because none of the distributedinterest or dividend income constituted net investmentincome to Estate, the $10, of interest and $1, of dividends that Estate distributed to S does not constitute net investmentincome to S.

(f)Effective/applicability date. This section applies to taxable years beginning after December 31, , except that paragraph (d) of this section applies to taxable years of CRTs that begin after December 31, However, taxpayers other than CRTs may apply this section to taxable years beginning after December 31, , in accordance with § (f).

[T.D. , 78 FR , Dec. 2, , as amended at 79 FR , Apr. 1, ]

Topic No. Net Investment Income Tax

A percent Net Investment Income Tax (NIIT) applies to individuals, estates, and trusts that have net investment income above applicable threshold amounts.

Individuals

In the case of an individual, the NIIT is percent on the lesser of:

- the net investment income, or

- the excess of modified adjusted gross income over the following threshold amounts:

- $, for married filing jointly or qualifying widow(er)

- $, for married filing separately

- $, in all other cases

Estates & Trusts

In the case of an estate or trust, the NIIT is percent on the lesser of:

- (A) the undistributed net investment income, or

- (B) the excess (if any) of:

- the adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. (For estates and trusts, the threshold is $13,)

Definition of Net Investment Income and Modified Adjusted Gross Income

In general, net investment income for purpose of this tax, includes, but isn't limited to:

- interest, dividends, certain annuities, royalties, and rents (unless derived in a trade or business in which the NIIT doesn't apply),

- income derived in a trade or business which is a passive activity or trading in financial instruments or commodities, and

- net gains from the disposition of property (to the extent taken into account in computing taxable income), other than property held in a trade or business to which NIIT doesn't apply.

The NIIT applies to income from a trade or business that is (1) a passive activity, as determined under § , of the taxpayer; or (2) trading in financial instruments or commodities, as determined under § (e)(2).

The NIIT doesn't apply to certain types of income that taxpayers can exclude for regular income tax purposes such as tax-exempt state or municipal bond interest, Veterans Administration benefits, or gain from the sale of a principal residence on that portion that's excluded for income tax purposes.

Modified adjusted gross income (MAGI), for purposes of the NIIT, is generally defined as adjusted gross income (AGI) for regular income tax purposes increased by the foreign earned income exclusion (but also adjusted for certain deductions related to the foreign earned income). For individual taxpayers who haven't excluded any foreign earned income, their MAGI is generally the same as their regular AGI.

Reporting NIIT

Compute the tax on Form , Net Investment Income Tax—Individuals, Estates, and Trusts.

Tax Withholding and Estimated Tax

Taxpayers may need to increase their income tax withholding or estimated taxes to take into account any additional tax liability associated with the NIIT in order to avoid certain penalties. The Tax Withholding Estimator can be used to help determine necessary changes in withholding by your employer, or see our Estimated Taxes page for resources to help you recalculate those payments. See Publication , Tax Withholding and Estimated Tax for more information in either instance.

Additional Information

For additional information, refer to the Instructions for Form PDF and to Questions and Answers on the Net Investment Income Tax.

Net Investment Income Tax

You&#;ll be subject to the % Medicare tax on net investment income if both of these are true:

- You have unearned income for or later years.

- Your modified adjusted gross income (AGI) for the year is more than the threshold amount.

This tax is also known as the net investment income tax (NIIT).

The threshold amounts are based on your filing status:

- Single or head of household &#; $,

- Married filing jointly or qualifying widow(er) &#; $,

- Married filing separately &#; $,

For purposes of the NIIT, investment income includes (but isn&#;t limited to):

- Interest

- Dividends

- Capital gains

- Royalties and rents

Investment income doesn&#;t include:

- Pension distributions

- Employee annuities

- Individual retirement accounts (including Roth IRAs)

- Profit sharing and stock bonus plans

- Distributions from deferred compensation plans

Both of these are true for purposes of the NIIT:

- Net investment income is reduced by certain expenses allocable to that income.

- Modified AGI is your AGI increased by the amount of excluded foreign income.

If your modified AGI is more than the threshold amount and you have net investment income, you&#;ll be subject to the % tax. The tax will be on the lesser of these:

- Your net investment income

- Amount of your modified AGI in excess of the threshold amount

These might be subject to NIIT if they have undistributed net investment income:

To learn more, see Net Investment Income FAQs at www.oldyorkcellars.com

As the end of the year approaches, many taxpayers will soon be feeling the bite of the Net Investment Income Tax (which is not required to be withheld from wages and is subject to estimated tax provisions). What it is, who it impacts and how it is computed are summarized below.

What is the Net Investment Income Tax (NIIT)?

The Net Investment Income Tax is imposed by section of the Internal Revenue Code (IRC). The NIIT applies at a rate of percent to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts. The NIIT affects income tax returns of individuals, estates and trusts for their first tax year beginning on (or after) Jan. 1,

Who Owes the Net Investment Income Tax

What individuals are subject to the Net Investment Income Tax?

Individuals will owe the tax if they have Net Investment Income and also have modified adjusted gross income over the following thresholds (which are not indexed for inflation):

Married filing jointly: $,

Married filing separately: $,

Single: $,

What Estates and Trusts are subject to the Net Investment Income Tax?

Estates and Trusts will be subject to the Net Investment Income Tax if they have undistributed Net Investment Income and also have adjusted gross income over the dollar amount at which the highest tax bracket for an estate or trust begins for such taxable year (for tax year , this threshold amount is $11,).

What is Included in Net Investment Income

In general, investment income includes, but is not limited to: interest, dividends, capital gains (including gains from the sale of a business that is passive), rental and royalty income, non-qualified annuities, income from businesses involved in trading of financial instruments or commodities, and businesses that are passive activities to the taxpayer (within the meaning of IRC section ). To calculate your Net Investment Income, your investment income is reduced by certain expenses properly allocable to the income such as investment interest expense, investment advisory and brokerage fees, expenses related to rental and royalty income, and state and local income taxes properly allocable to items included in Net Investment Income.

What are some common types of income that are not Net Investment Income?

Wages, unemployment compensation; operating income from a nonpassive business, Social Security Benefits, alimony, tax-exempt interest, self-employment income, and distributions from certain Qualified Plans (those described in sections (a), (a), (b), , A, or (b)).

Will I have to pay both the % Net Investment Income Tax and the additional .9% Medicare tax?

You may be subject to both taxes, but not on the same type of income.

The % Additional Medicare Tax applies to individuals&#; wages, compensation and self-employment income over certain thresholds, but it does not apply to income items included in Net Investment Income.

Example of the Calculation of the Net Investment Income Tax

How does a Single taxpayer with income greater than the statutory threshold calculate the Net Investment Income Tax?

Taxpayer, a single filer, has $, of wages. Taxpayer also received $90, from a passive partnership interest, which is considered Net Investment Income. Taxpayer&#;s modified adjusted gross income is $,

Taxpayer&#;s modified adjusted gross income exceeds the threshold of $, for single taxpayers by $70, Taxpayer&#;s Net Investment Income is $90,

The Net Investment Income Tax is based on the lesser of $70, (the amount that Taxpayer&#;s modified adjusted gross income exceeds the $, threshold) or $90, (Taxpayer&#;s Net Investment Income). Taxpayer owes NIIT of $2, ($70, x %).

Topic No. Net Investment Income Tax

A percent Net Investment Income Tax (NIIT) applies to individuals, estates, and trusts that have net investment income above applicable threshold amounts.

Individuals

In the case of an individual, the NIIT is percent on the lesser of:

- the net investment income, or

- the excess of modified adjusted gross income over the following threshold amounts:

- $, for married filing jointly or qualifying widow(er)

- $, for married filing separately

- $, in all other cases

Estates & Trusts

In the case of an estate or trust, the NIIT is percent on the lesser of:

- (A) the undistributed net investment income, or

- (B) the excess (if any) of:

- the adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. (For estates and trusts, the threshold is $13,)

Definition of Net Investment Income and Modified Adjusted Gross Income

In general, net investment income for purpose of this tax, includes, but isn't limited to:

- interest, dividends, certain annuities, royalties, and rents (unless derived in a trade or business in which the NIIT doesn't apply),

- income derived in a trade or business which is a passive activity or trading in financial instruments or commodities, and

- net gains from the disposition of property (to the extent taken into account in computing taxable income), undistributed net investment income calculation than property held in a trade or business to which NIIT doesn't apply.

The NIIT applies to income from a trade or business that is (1) a passive activity, as determined under §of the taxpayer; or (2) trading in financial instruments or commodities, as determined under § (e)(2).

The NIIT doesn't apply to certain types of income that taxpayers can exclude for regular income tax purposes such as tax-exempt state or municipal bond interest, Veterans Administration benefits, or gain from the sale of a principal residence on that portion that's excluded for income tax purposes.

Modified adjusted gross income (MAGI), for purposes of the NIIT, is generally defined as adjusted gross income (AGI) for regular income tax purposes increased by the foreign earned income exclusion (but also adjusted for certain deductions related to the foreign earned income). For individual taxpayers who haven't excluded any foreign earned income, their MAGI is generally the same as their regular AGI.

Reporting NIIT

Compute the undistributed net investment income calculation on FormNet Investment Income Tax—Individuals, Estates, and Trusts.

Tax Withholding and Estimated Tax

Taxpayers may need to increase their income tax withholding or estimated taxes to take into account any additional tax liability associated with the NIIT in order to avoid certain penalties. The Tax Withholding Estimator can be used to help determine necessary changes in withholding by your employer, or see our Estimated Taxes page for resources to help you recalculate those payments. See PublicationTax Withholding and Estimated Tax for more information in either instance.

Additional Information

For additional information, refer undistributed net investment income calculation the Instructions for Form PDF and to Questions and Answers on the Net Investment Income Tax.

Basics of the Net Investment Income Tax

10/28/

What Is the Net Investment Income Tax?

While the Net Investment Income Tax (NIIT) tends to affect wealthier individuals most often, in certain circumstances, it can also affect moderate-income taxpayers whose income increases significantly in a given tax year. Here&#;s what you need to know.

What is the Net Investment Income Tax?

The Net Investment Income Tax (NIIT) is a percent tax on certain net investment income of individuals, estates, and trusts with income above statutory threshold amounts referred to as modified adjusted gross income or MAGI.

What is Included in Net Investment Income?

In general, undistributed net investment income calculation, investment income includes, but is not limited to interest, dividends, capital gains, rental and royalty income, non-qualified annuities, income from businesses involved in trading of financial instruments or commodities, and passive business activities such as rental income or income derived from royalties.

What is Not Included in Net Investment Income?

The undistributed net investment income calculation types of income are not included:

- Wages

- Unemployment compensation

- Operating income from a non-passive business

- Social Security Benefits

- Alimony

- Tax-exempt interest

- Self-employment income

- Alaska

- Permanent Fund Dividends

- Distributions from certain Qualified Plans

Individuals

Individuals with MAGI of $, (married filing jointly) or $, for single filers are taxed at a flat rate of percent on investment income such as dividends, taxable interest, rents, royalties, certain income from trading commodities, taxable income from investment annuities, REITs and master limited partnerships, and long and short-term capital gains. The NIIT is a flat rate tax paid in undistributed net investment income calculation to other taxes owed and threshold amounts are not indexed for inflation.

Non-resident aliens are not subject to the NIIT; however, if a non-resident alien is married to a US citizen and is planning to file as a resident alien as married filing jointly, there are special rules. Please call if you have any questions about this.

Investment income is generally not subject to withholding, so NIIT is going to undistributed net investment income calculation your tax liability for the tax year. In addition, even lower-income taxpayers not meeting the threshold amounts may be subject to NIIT if they receive a windfall such as a one-time sale of assets that bumps their MAGI up high enough to be subject to the NIIT.

Strategies to Minimize NIIT

Tax planning is crucial. For example, if you are anticipating a windfall (this tax year or next), there are several strategies that you could use undistributed net investment income calculation minimize your MAGI and reduce or possibly eliminate tax liability when you file your tax return. These include but are not limited to:

- Rental Real Estate (depreciation deductions)

- Installment sales (including figuring out the best timing for sale)

- Roth conversions

- Charitable donations

- Tax-deferred annuities

- Municipal bonds

Sale of a Home

The Net Investment Income Tax does not apply to any amount of gain that is excluded from gross income for regular income tax purposes ($, undistributed net investment income calculation, for single filers and $, undistributed net investment income calculation, for a married couple) on the sale of a principal residence from gross income for regular income tax purposes. In other words, only the taxable part of any gain on the sale of a home has the potential to be subject to NIIT, providing the taxpayer is over the MAGI threshold amount.

Estates and Trusts Affected

Estates and Trusts are subject to NIIT if they have undistributed net investment income and also have adjusted gross income undistributed net investment income calculation the dollar amount at which the highest tax bracket for an estate or trust begins for such taxable year. Inthis threshold amount is $13,

Special rules apply for certain unique types of trusts such a Charitable Remainder Trusts and Electing Small Business Trusts. Some trusts, including &#;Grantor Trusts&#; and Real Estate Investment Trusts (REIT), are not subject to the NIIT.

Non-qualified dividends generated by investments in a REIT and taxed at ordinary tax rates may be subject to the Net Investment Income Tax.

Reporting and Paying the Net Investment Income Tax

Individual taxpayers should report (and pay) the tax on Form Estates and Trusts report (and pay) the tax on Form Please call if you need assistance or have any questions abut reporting and paying the NIIT.

For tax years and beyond, individuals, estates, and trusts that expect to pay estimated taxes should adjust undistributed net investment income calculation income tax withholding or estimated payments to account for the tax increase and avoid underpayment penalties. The NIIT is not withheld from an employed individual&#;s wages; however, it is possible to request that additional income tax be withheld.

Wondering how the Net Investment Income Tax could affect your tax situation? Give the office a call today and find out.

As the end of the year approaches, many taxpayers will soon be feeling the bite of the Net Investment Income Tax (which is not required to be withheld from wages and is subject to estimated tax provisions). What it is, who it impacts and how it is computed are summarized below.

What is the Net Investment Income Tax (NIIT)?

The Net Investment Income Tax is imposed by section of the Internal Revenue Code (IRC). The NIIT applies at a rate of percent to certain net investment income of individuals, estates and trusts that have income above the statutory threshold amounts. The NIIT affects income tax returns of individuals, estates and trusts for their first tax year beginning on (or after) Jan. 1,

Who Owes the Net Investment Income Tax

What individuals are subject to the Net Investment Income Tax?

Individuals will owe the tax if they have Net Investment Income and also have modified adjusted gross income over the following thresholds (which are not indexed for inflation):

Married filing jointly: $,

Married filing separately: $,

Single: $,

What Estates and Trusts are subject to the Net Investment Income Tax?

Estates and Trusts will be subject to the Net Investment Income Tax if they have undistributed Undistributed net investment income calculation Investment Income and also have adjusted gross income over the dollar amount at which the highest tax bracket for an estate or trust begins for such taxable year (for tax yearthis threshold amount is $11,).

What is Included in Net Investment Income