What is cryptocurrency copy trading and is it worth the risk for beginners?

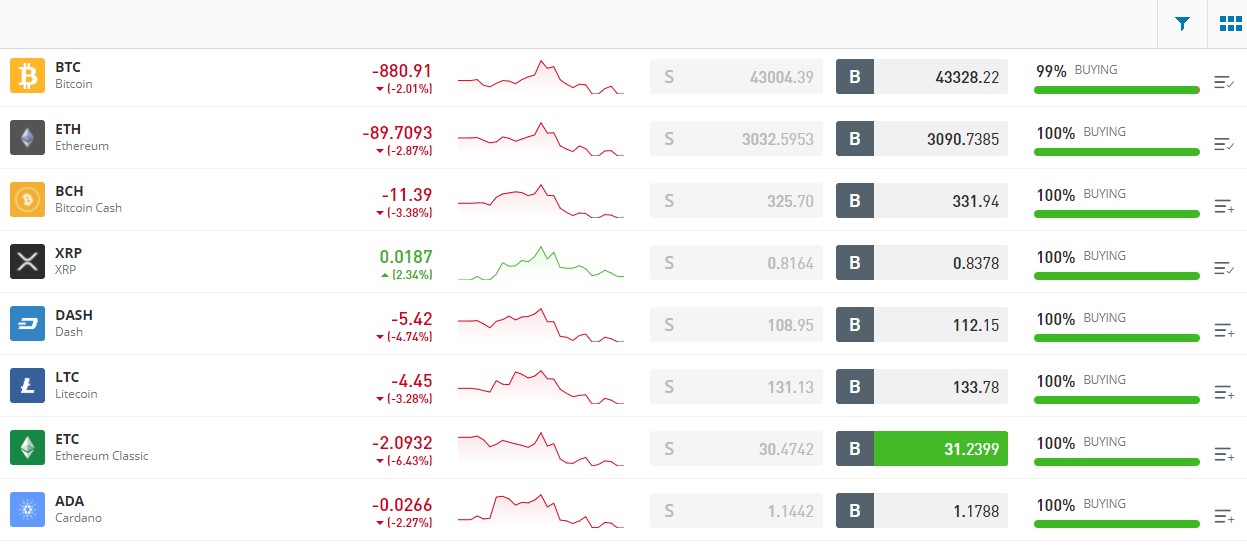

What is cryptocurrency copy trading and is it worth the risk for beginners?This shows that cryptocurrencies are extremely volatile. The cryptocurrency market thrives on speculation. Investors place speculative bets that cause a sudden influx of money or a sudden outgo, leading to high volatility.

Additionally, the crypto market is seen as a way to earn quick profits. Part-timers come with a hope of making quick gains but sometimes when that does not happen, they lose patience and withdraw from it, what to look for when investing in cryptocurrency. This recurring involvement and withdrawal contribute to the volatility of digital what to look for when investing in cryptocurrency it a legal tender in India?

At the moment, there is no legislature that covers cryptocurrencies in India. But this doesn’t mean what to look for when investing in cryptocurrency owning cryptocurrencies is illegal.

Meanwhile, India is yet to table the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021, which will lay down the regulatory framework for the launch of an “official digital currency”, it was to be introduced in Parliament’s Budget session, but was held up as the government continues discussions with stakeholders. So far, only a few countries have accepted cryptocurrencies as legal tender and the list is expected to remain small.

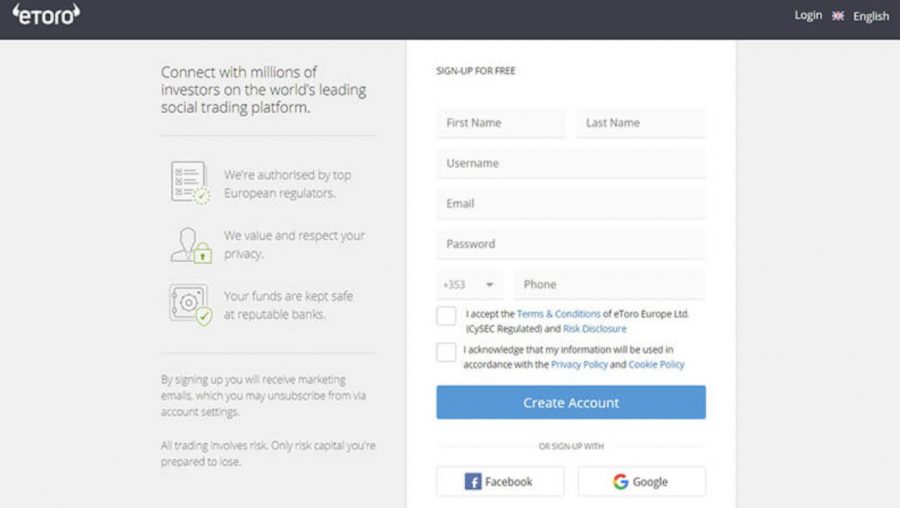

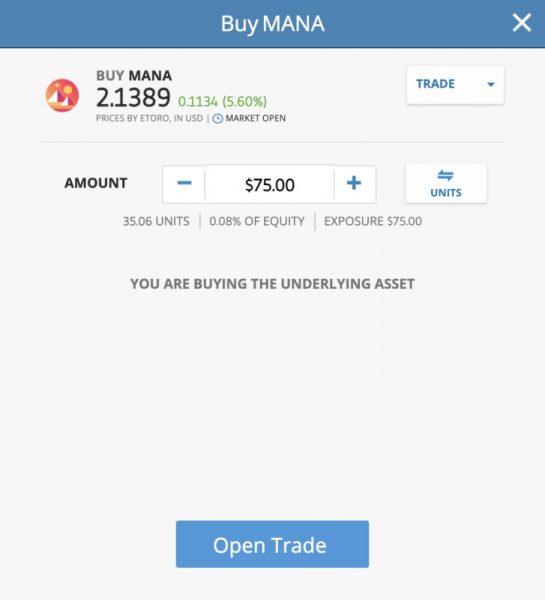

what to look for when investing in cryptocurrency won’t find a better online broker to buy cryptocurrency than eToro – which offers a safe, low-cost, and budget-friendly way to invest. First, this innovative social trading platform is regulated by several tier-one licensing bodies – which include the SEC in addition to the FCA, ASIC, and CySEC. Moreover, what to look for when investing in cryptocurrency, eToro is a member of FINRA.

what to look for when investing in cryptocurrency won’t find a better online broker to buy cryptocurrency than eToro – which offers a safe, low-cost, and budget-friendly way to invest. First, this innovative social trading platform is regulated by several tier-one licensing bodies – which include the SEC in addition to the FCA, ASIC, and CySEC. Moreover, what to look for when investing in cryptocurrency, eToro is a member of FINRA.

Out of more than 17,000 digital currencies listed on CoinMarketCap – more than 40% of all cryptocurrency investments are held in Bitcoin. This clearly highlights that across the board – Bitcoin is the most popular cryptocurrency.

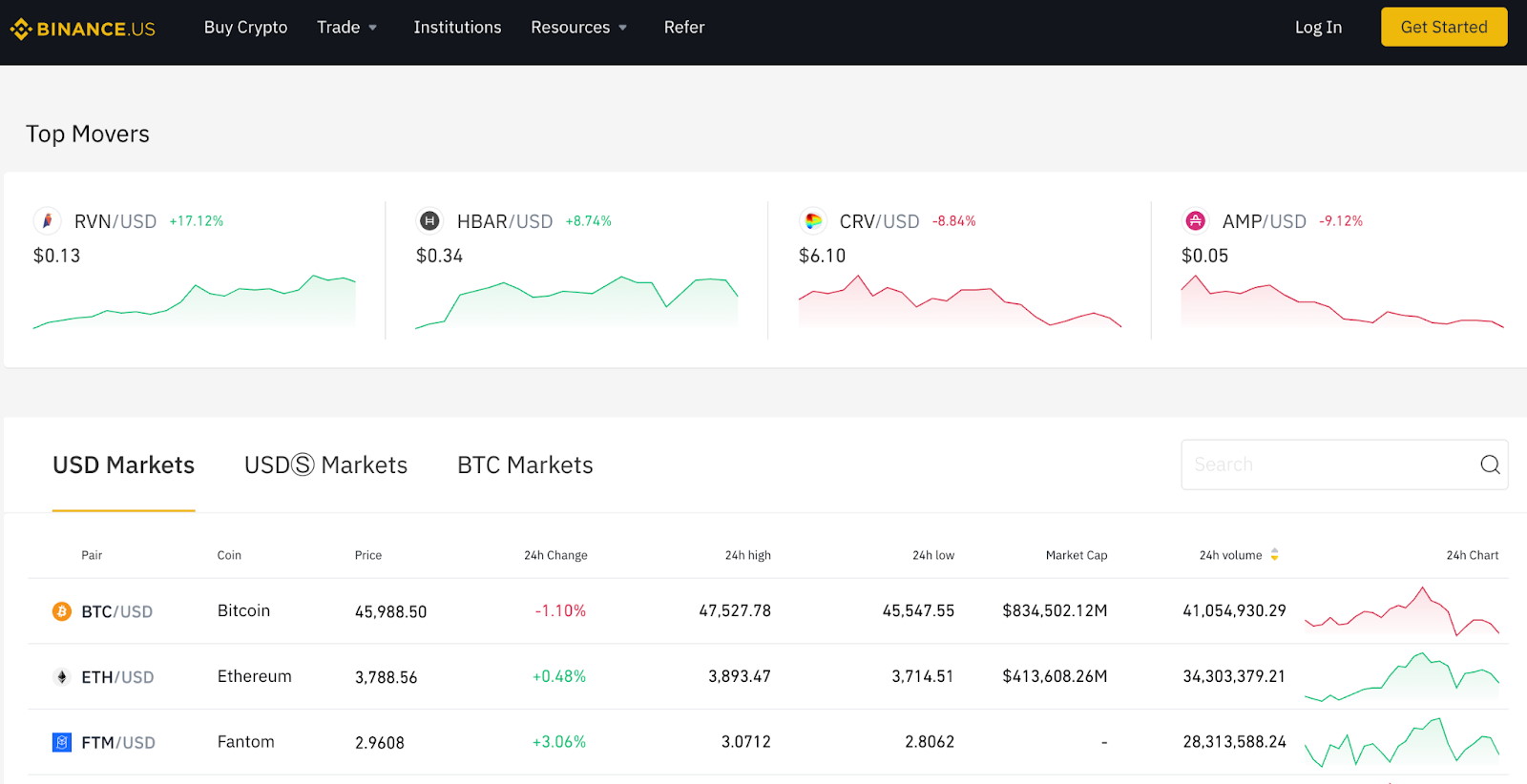

Out of more than 17,000 digital currencies listed on CoinMarketCap – more than 40% of all cryptocurrency investments are held in Bitcoin. This clearly highlights that across the board – Bitcoin is the most popular cryptocurrency.  The next cryptocurrency that we like is BNB – which is a top digital asset to consider for long-term growth. This digital asset is backed by Binance – the largest cryptocurrency exchange globally.

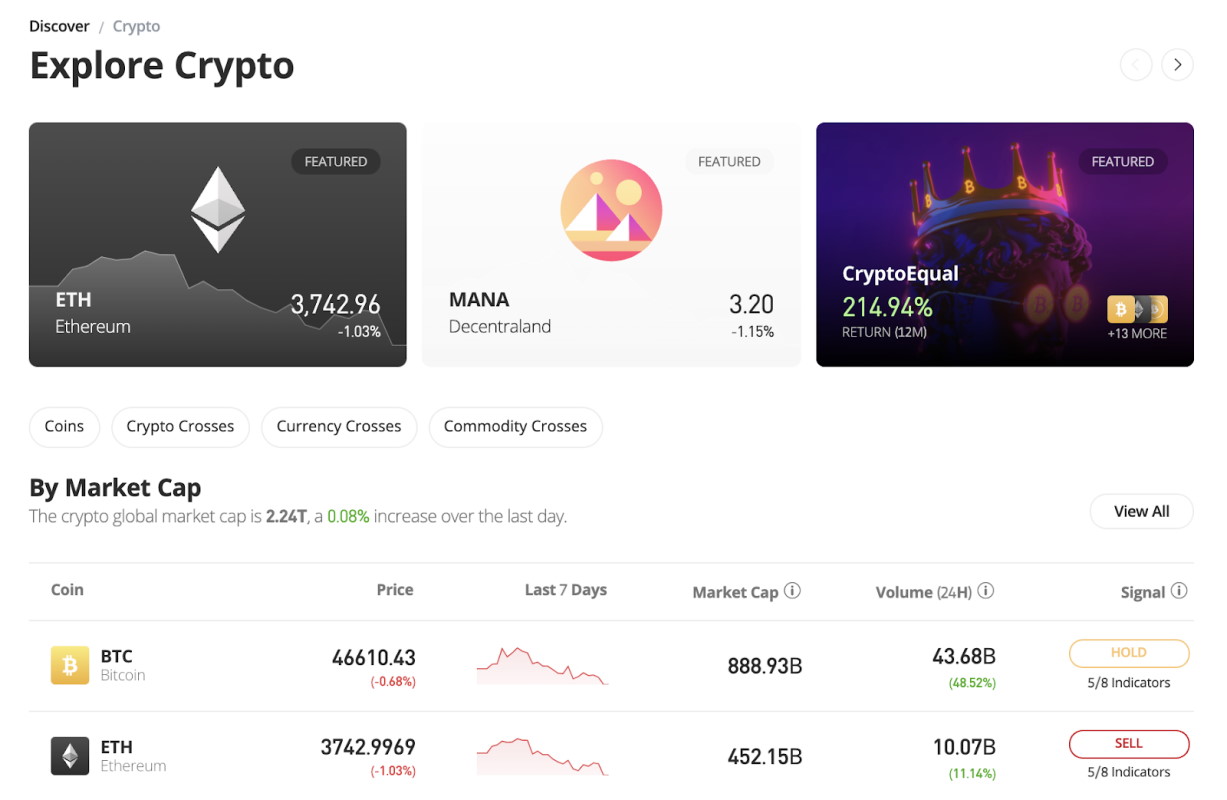

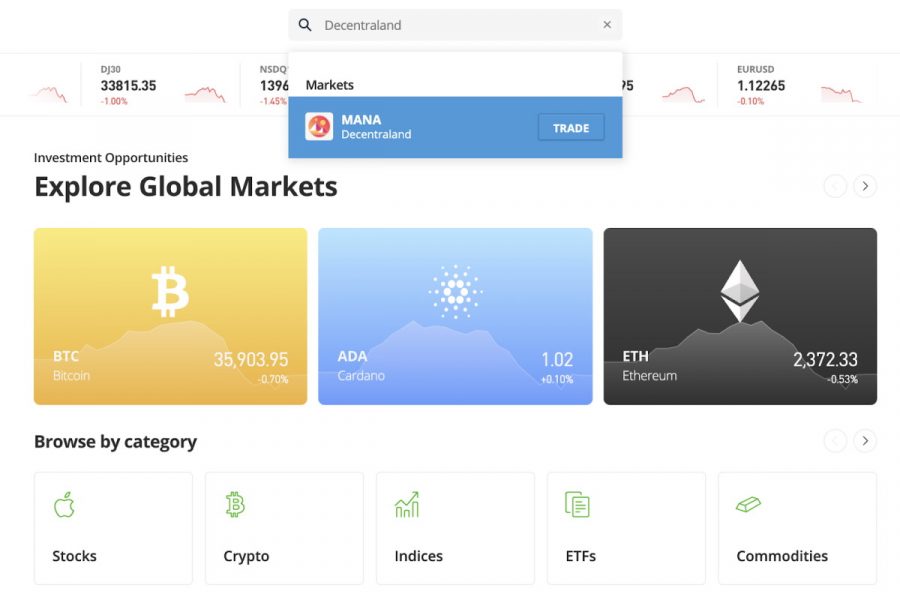

The next cryptocurrency that we like is BNB – which is a top digital asset to consider for long-term growth. This digital asset is backed by Binance – the largest cryptocurrency exchange globally.  Another cryptocurrency to consider buying for your investment portfolio is Decentraland – which is focused on creating a global MetaVerse via its decentralized 3D gaming world. Players within the Decentraland virtual world can build characters, wearables, and even real estate.

Another cryptocurrency to consider buying for your investment portfolio is Decentraland – which is focused on creating a global MetaVerse via its decentralized 3D gaming world. Players within the Decentraland virtual world can build characters, wearables, and even real estate.  Ever wondered if you should buy Ethereum right now? As noted earlier, Ethereum is the second-largest cryptocurrency for market capitalization – behind Bitcoin. This project was launched back in 2015 and it dominates the smart contract niche. These are pre-programmed blockchain contracts that facilitate trustless agreements.

Ever wondered if you should buy Ethereum right now? As noted earlier, Ethereum is the second-largest cryptocurrency for market capitalization – behind Bitcoin. This project was launched back in 2015 and it dominates the smart contract niche. These are pre-programmed blockchain contracts that facilitate trustless agreements.  Another area of the cryptocurrency arena that is growing in prominence is the availability of decentralized financial services. More specifically, there are platforms in existence that allow users to engage with traditional financial products on a peer-to-peer basis.

Another area of the cryptocurrency arena that is growing in prominence is the availability of decentralized financial services. More specifically, there are platforms in existence that allow users to engage with traditional financial products on a peer-to-peer basis.

-