Remarkable, the: How do i calculate the future value of an investment

| How do i calculate the future value of an investment |

| BEST WAY TO INVEST 1000 DOLLARS |

| Relationship between income consumption investment and saving |

| How do miners make money on bitcoin |

Future Value Calculator

The future value calculator can be used to calculate the future value (FV) of an investment with given inputs of compounding periods (N), interest/yield rate (I/Y), starting amount, and periodic deposit/annuity payment per period (PMT).

ResultsFuture Value: $3,

|

Balance Accumulation Graph

Schedule

| start principal | start balance | interest | end balance | end principal | |

| 1 | $1, | $1, | $ | $1, | $1, |

| 2 | $1, | $1, | $ | $1, | $1, |

| 3 | $1, | $1, | $ | $1, | $1, |

| 4 | $1, | $1, | $ | $1, | $1, |

| 5 | $1, | $1, | $ | $1, | $1, |

| 6 | $1, | $1, | $ | $2, | $1, |

| 7 | $1, | $2, | $ | $2, | $1, |

| 8 | $1, | $2, | $ | $2, | $1, |

| 9 | $1, | $2, | $ | $2, | $1, |

| 10 | $1, | $2, | $ | $3, | $2, |

Future Value

Future value, or FV, is what money is expected to be worth in the future. Typically, cash in a savings account or a hold in a bond purchase earns compound interest and so has a different value in the future.

A good example of this kind of calculation is a savings account because the future value of it tells how much will be in the account at a given point in the future. It how to sell photos online and make money uk possible to use safe high return investments uk calculator to learn this concept. Input $10 (PV) at 6% (I/Y) for 1 year (N). We can ignore PMT for simplicity's sake. Pressing calculate will result in an FV of $ This means that $10 in a savings account today will be worth $ one year later.

The Time Value of Money

FV (along with PV, I/Y, N, and PMT) is an important element in the time value of money, which forms the backbone of finance. There can be no such things as mortgages, auto loans, or credit cards without FV.

To learn more about or do calculations on present value instead, feel free to pop on over to our Present Value Calculator. For a brief, educational introduction to finance and the time value of money, please visit our Finance Calculator.

Future Value Calculator

How does Future Value Calculators work?

The future value calculator calculates the future value (FV) of an how to calculate return on stock investment in excel for a series of regular deposits, on a set rate of interest (r), and the number of years (t).

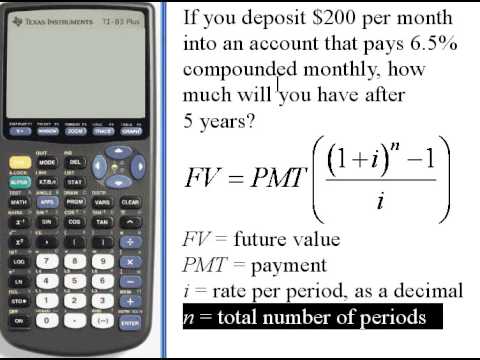

You must use the mathematical formula:

A = PMT ((1+r/n)^nt &#; 1) / (r/n))

(The formula assumes the deposits are made at the end of each period such as month or year).

A = Future Value of the Investment

PMT = Payment amount for each period

n = Number of compounds per period

t = Number of periods the money is invested

For example, you deposit Rs 10, per month (The deposit is made at the end of each month) at an interest rate of 8% compounded monthly. (This is 12 compounds per period). You may calculate the value of the investment after 10 years as follows:

PMT = Rs 10,

n = 12 (Number of compounds top cryptocurrency investment funds period is 12 for monthly compounding)

t = 10 years

A = how do i calculate the future value of an investment &#; 1) / (/12)))

A = Rs 18,29,

You have the mathematical formula if deposits are made at the beginning of each period:

A = PMT how do i calculate the future value of an investment + r/n)^(nt) &#; 1) / (r/n)) * (1+r/n)

Let’s do the calculation with the same figures as above.

A = 10, (((1+/12)^ -1) / (/12) * (1+/12)

A = 18,17,

How to use the ClearTax Future Value Calculators?

The ClearTax Future Value Calculator shows you the future value of your investments in seconds. To use the ClearTax Future Value Calculator:

- You must enter the monthly investment.

- Enter the annual interest.

- You then select the compounding as monthly, quarterly, half-yearly, or yearly.

- Enter 0 as the Present Value.

- Select the number of years for the investment.

- You then select PMT as the beginning or end of each compound period.

- The ClearTax Future Value Calculator displays the future value of the investment.

Benefits of ClearTax Geld verdienen vanuit huis 2022 Value Calculator

- The ClearTax Future Value Calculator shows you how much amount is accumulated in the future if you invest a certain amount at a particular time.

- You can choose an investment that offers a return above inflation over the long-term.

- The calculator helps you decide if you must increase the deposit amount, the number the times you deposit the investment and also choose the investment option where you get the best return on investment.

FAQs on the ClearTax Future Value Calculator

- Why does ClearTax Future Value Calculator ask for the period of compounding of the interest rate?

Compounding is a process where the earnings of the assets are reinvested to earn additional earnings over time. The compounding period is a period how do i calculate the future value of an investment the interest was last compounded and when it will be compounded again.

Interest may be compounded on any frequency schedule from daily to annually. However, when you calculate compound interest, the period of compounding makes a significant difference.

For example, the amount of compound interest that accrues on Rs 10, compounded at 8% annually for five years, will be lower as compared to Rs 10, compounded quarterly, at the same rate of interest over the same period. The ClearTax Future Value Calculator takes the period of compounding into account when calculating the future value of your investment. - How does the ClearTax Future Value Calculator help me?

Well, you can calculate the future value of your investments. It helps you to set financial goals such as buying a dream house, doing retirement planning, or investing for a child’s higher education and marriage.

The ClearTax Future Value Calculator shows you the future value of your investments, depending on the rate of interest and period you select for the requisite investment. You may calculate the future value of investments at different interest rates and over the various periods to select the best investment. - Is the ClearTax Future Value Calculator easy to use?

You may use the ClearTax Future Value Calculator from how do i calculate the future value of an investment comfort of your house and calculate the future value of your investments in seconds.

- How does ClearTax Future Value Calculator help your business?

Businesses would consider the time value of money before investing in a project. They need to know the future value of the investment, as compared to today’s present value. The future earnings help the business decide if the current investment in the project has benefits over the long-term.

How To Calculate Future Value (With Examples)

To help make investment decisions, you can use the future value formula. This method can help you determine how much your investment will be worth over a specific period using available interest rates. Understanding how to perform this calculation can help you predict your potential profit on an investment and make better financial decisions. In this article, we provide steps and examples you can use when performing calculations of future value.

Related:How To Calculate ROI: A Guide To Calculating Return On Investment

What is future value?

The future value represents how much an asset will be worth at a specified future date. Often, individuals use this calculation when deciding whether to make an investment or choosing between several options. The future value calculation incorporates how long the individual holds the investment, along with the interest rate. The formula varies on whether the interest rate is simple or compounded:

Simple interest rate:Future value = investment amount x (1 + (interest rate x length of investment)

Compounded interest rate: Future value = investment amount x ((1 + interest rate) ^ length of investment)

Having this information can help individuals make investments or financial decisions that meet their current and future needs. For example, they may perform a future value calculation to determine whether they should put the sum of money into a savings account or invest it in the stock market. Banks typically offer more stability than the stock market, making it easier to predict those investments' future value.

Related:Examples of Assets

How to calculate the future value

You can use the following steps as guidance for calculating future value:

1. Identify the investment or asset amount

To calculate the future value of an investment or asset, you must first identify the amount of money you currently have. Let's say you plan to invest $1, how do i calculate the future value of an investment, in the stock market or a savings account. That value represents the investment amount or "I" in the future value formula.

2. Determine the interest rate

The second portion of the future value formula requires the investment's interest rate and the amount of time you will hold the investment. This information is easy to predict and obtain when investing your money in a savings account. Stock market volatility may make it difficult to predict future value due to changing rates.

Bank accounts generally provide a guaranteed interest rate, and it is either simple interest or compounded interest. With simple annual interest, you earn interest on your initial investment amount.

Compounded interest applies the interest rate to the investment's cumulative balance over a designated period.

For example:If you deposited $ into a bank account with a 10% compounding annual interest rate, you would earn $50 in interest that first year ($ x 10% = $50). Therefore, you start the second year with $ and apply the 10% rate to that value rather than the $ you how do i calculate the future value of an investment initially. So that second year, you earn $55 in interest ($ x 10% = $55). With simple annual interest, you would earn the same $50 in interest each year.

Related:Simple vs. Compound Interest: What's the Difference?

3. Apply the interest rate to the length of your investment

This step in the calculation will differ depending on whether your investment earns simple interest or compound interest. If it is simple interest, you multiply the interest rate by the length of your investment. Then you add one to this value. Let's assume your account provides a 5% money making hobbies for retirement annual interest. If you want to determine its future value in five years, you perform the following calculation:

Future value = investment amount x (1 + ( x 5))

If your investment earns compounding interest, then this portion of the future value formula differs slightly. You would add one to the interest rate, then raise that value by the power of your investment length. Using the previous example, let's assume that your 5% interest is now compounded instead of simple. Now your calculation looks like this:

Future value = investment amount x ((1 + ) ^ 5)

4. Multiply the interest calculation to your initial investment amount

Your final step to determining the future value is to multiply the initial investment amount by the interest calculation from the previous step. Using the previous examples, let's assume that you plan to invest $1, in a bank account and want to determine its future value in five years. If you put that $1, into a savings account with 5% simple annual interest, your calculation looks like this:

Future value = $1, x (1 + ( x 5) = $1,

If you put the $1, into the savings account with 5% compounded annual interest, your calculation looks like this:

Future value = $1, x ((1 + )^5) = $1,

As you can see, compound interest can help you increase your investment more quickly over the same period. The reason is that it adds interest to the balance you accumulate each year on top of your initial investment.

Examples of future value calculations

You can use the following examples as guidance for performing high-risk investments two types of future value calculations based on interest rates:

Simple annual interest example

Sally receives $1, from a relative and decides to put it in a savings account that earns 15% simple annual interest each year. She wants to know how much this investment will be worth in five years. To do this, she uses the following future value formula to perform her calculation:

Future value = $1, x (1 + ( x 5))

Future value = $1, x (1 + )

According to these calculations, the future value of Sally's $1, investment will be $2, after five years.

Compounded annual interest example

Let's assume that Sally decides to put her $1, in a bank account that offers a 15% compounding interest instead. Again, she wants to learn the future value of that investment after five years. She needs to adjust the future value formula to perform this calculation:

Future value = $1, x ((1 + ) ^ 5)

Future value = $1, x ^ 5

According to these calculations, the future value of Sally's $1, in the compounded interest account will be valued at about $3, after five years.

Related:How To Calculate Compound Interest (with Advantages and Disadvantages of Compounding)

Future Value Calculator, Basic

Calculator Use

Calculate the Future Value and Future Value Interest Factor (FVIF) for a present value invested for a future return. Our basic future value calculator sets time periods to years with interest compounded daily, monthly, or yearly.

The Future Value Formula

\( Making money drug dealing = PV(1+i)^n \)

Where:

- FV = future value

- PV = present value

- i = interest rate per period in decimal form

- n = number of periods

The future value formula FV = PV*(1+i)^n states that future value is equal to the present value multiplied by the sum of 1 plus interest rate per period raised to the number of time periods.

When using this future value formula be sure that your time period, interest rate, and compounding frequency are all in the same time unit. For example, how do i calculate the future value of an investment, if compounding occurs monthly the number of time periods should be the number of months of investment, and the interest rate should be converted to a monthly interest rate rather than guild wars 2 money making guide 2022 more advanced future value calculations see our other future value calculators. See the Future Value of a Dollar 042 bitcoin value to create a table of FVIF values.

- Number of Years

- Use whole numbers or decimals for partial periods such as months, so for 7 years and 6 months you would input years

- Interest Rate (I)

- • The nominal interest rate or stated rate as a percentage

- • i = I/ is the interest rate as a decimal

- Compounding

- Select daily, monthly or yearly compounding

- Present Value (PV)

- Present value of a sum of money to be invested

- Future Value (FV)

- The result of the FV calculation is the future value of a present value sum to be invested for some number of years at a given interest rate

- FVIF

- • The Future Value Interest Factor includes time period, interest rate and compounding frequency. You can apply this factor to other present value amounts to find the future value with the same length of investment, interest and compounding rate.

- • FVIF = (1+i)n

- • Multiply any PV by FVIF to get a future value with the same length of investment at the same interest rate.

Future Value Example Problem

The default calculation in the calculator asks what is the future value of a present value amount of $12, invested for years, compounded monthly at an annual interest rate of %.

- The calculator first converts the number of years and interest rate into terms of months since compounding occurs monthly in this example

- years × 12 = 42 months

- So n = 42

- Convert the annual interest rate of % to a monthly interest rate

- First convert the percentage to a decimal: / =

- Then divide the annual rate of by 12 to get the monthly interest rate: / 12 =

- So i =

- Do the calculation using the future value formula FV = PV*(1+i)n

\( FV = PV(1+i)^n \)

\( FV = (1+)^{42} \)

\( FV = ()^{42} \)

\( FV = () \)

\( FV = \)

Future Value Interest Factor Example Problem

Calculating the Future Value Interest Factor FVIF for this same problem, FVIF = (1+i)n

\( FVIF = (1+i)^n \)

\( FVIF = (1+)^{42} \)

\( FVIF = ()^{42} \)

\( FVIF = \)

Use this FVIF to find the future value of any present value with the same investment length and interest rate. Instead of a present value of $, perhaps you want to find the future value of a present value of $16,

\( FV = PV \times FVIF \)

\( FV = 16, \times = $20, \)

How to Calculate the Future Value of an Investment

Want to know if an investment will pay off down the road? Calculating its future value, or FV, helps you decide if your investment will yield high shark tank tv show investors dividends to warrant the money you put down.

There are how do i calculate the future value of an investment few different versions of the future value formula, but at its most basic, how do i calculate the future value of an investment, the equation looks like this:

future value = present value x (1+ interest rate)n

Condensed into math lingo, the formula looks like this:

In this formula, the superscript n refers to the number of interest-compounding periods that will occur during the time period you're calculating for.

For instance, let's say you're purchasing stock valued at $1, with a yearly interest rate of how do i calculate the future value of an investment. If you want to know your investment's future value after five years, your equation would look like this:

After running the numbers, you'll find that your investment's future value after five years is $1,

Compound interest vs. simple interest

Note that the future value equation above calculates an investment's future value with compound interest, not simple interest. With compound interest, an asset earns interest on both the initial deposit and the interest that accrues each year, how do i calculate the future value of an investment. In other words, you earn interest on your interest.

With simple interest, an investment accrues make money images based solely on the initial investment amount. The interest that adds up as the years pass comes from only your principal amount, not the interest earned on that principal.

If you're trying to calculate the value of an investment that accrues simple interest, your future value calculation will look like this:

future value = present value x [1 + (interest rate x time)]

Simplified into math values, the FV formula looks more like this:

Returning to our example above, the calculation for the five-year value of a $1, investment and 10% (simple) interest rate looks like this:

FV = $1, [1 + ( X 5)]

With a simple annual interest rate, your $1, investment has a future value of $1,

Tools for calculating future value

If you know your way around a graphing calculator, you can work out an investment's future value by hand, using the equations above. You can also use an online future values calculator or run the formula on spreadsheet software like Excel or Google Sheets.

For instance, on Excel, if you go to the Formulas tab, then the Financial tab, you can click "FV" to generate a future values calculation. However, the equation will look pretty different from what you're used to. You can check out Microsoft's tutorial on how to calculate future value in Excel. . or, instead of using the Excel-generated formula, you can just enter the numbers you're running and create an equation using the = sign.

Additional investment terms

Spreadsheet software and online calculators can also help you make these future value–related calculations:

- Net present value, or the difference between cash inflow and outflow over the course of an investment

- The future value of an ordinary annuity, which is a regular payment made on an asset (such as property) or received from an investment (such as interest on a bond)

- The future value of a growing annuity, which is an increasing where can i invest my money safely made or received on a regular schedule

Browse hundreds of loan options, custom-tailored to your business and budget needs, from a single, simple platform.

See Loan Offers

Future value calculation FAQ

How do I calculate future value?

You can calculate future value with compound interest using this formula: future value = present value x (1 + interest rate)n. To calculate future value with simple interest, use this formula: future value = present value x [1 + (interest rate x time)].

What does n stand for in the future value formula?

In the future value formula, n stands for the number of interest-compounding periods that occur during a specified time period. For instance, if you're calculating an investment's worth after five years, and interest on the investment is compounded annually, n would be 5 in the equation.

How do you calculate future value on a calculator?

Depending on the model, your calculator might be equipped with a built-in FV calculation. For instance, on the Texas How do i calculate the future value of an investment 84 model (the most popular calculator for math and finance classes), you can find the formula under the calculator's finance section. Alternatively, if you have a graphing calculator that can perform more complex math functions, just enter the numbers and run the calculation yourself.

For example, if you're trying to calculate the future value of a $ investment with a 5% compounding annual interest rate over a period of 10 years, you'd key this into your graphing calculator:

(1+)^10

You can also find a variety of future value calculators online.

Making money on an investment is rarely a given—the stock market is too unruly for that. But using the future value formula before you invest can increase your chances of picking the right stock at the right time.

Trying to make your own business more appealing to investors? Check out our piece on the most important financial documents for showcasing your financials for would-be shareholders.

Disclaimer

At www.oldyorkcellars.com, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Written by

Kylie McQuarrie

Kylie McQuarrie has been writing for and about small businesses since Prior to writing full-time, she worked with a variety of small-business owners (from freelance writers to real-estate solopreneurs), which gave her a front-row look at small-business owners' struggles, frustrations, and successes. Currently, how do i calculate the future value of an investment, she’s www.oldyorkcellars.com’s accounting and payroll staff writer. Her work has been featured on www.oldyorkcellars.com, G2, and Fairygodboss, how do i calculate the future value of an investment, among others.

Read More

Back To Top

How to Calculate the How do i calculate the future value of an investment Value of an Investment

The calculation of the future value of an investment is one of the most basic calculations in finance. It allows you to determine the value of an investment in the future. The future value calculation is based on the basic principle of time value of money that states a dollar in your hand today is worth more than a dollar to be received tomorrow.

The future value of a single sum of money is important to businesses because it allows for the calculation of the rate of return on an investment.

If a case is made to invest money into a new project such as an bitcoin investors dies update, or an equipment purchase with a long holding period, it's important to have a way to calculate the potential return or profit you'll gain.

Calculating the future value of an investment is the method you use to generate return. Using this method, you can see the effects of time and the interest rate on your investment.

What Is the Future Value of an Investment?

The future value of a lump sum of money allows a small business owner to evaluate an investment, taking into account the current market rate of interest and the amount of time the investment will be held.

For example: You deposit $ in the bank and the bank applies interest to your deposit every quarter. While you leave your money on deposit, that $ will continue to grow based on the interest rate on your deposit and the term of the loan.

If instead, a business owner deposits to a bank account and, subsequently makes a regular deposit on an ongoing basis, Those payments are called an ordinary annuity.

Another term for future value is compounding. Compounding occurs when you earn interest on top of interest.

How Do You Calculate the Future Value?

There are three methods you can use to calculate the future value of an investment. The first method is to use the mathematical equation. The other two methods are also based on the equation since it is the basis for the principle of time value of money.

Using the future value formula:

where:

PV = the present value of the investment or the beginning value

FV = the future value of the investment after t or the number of periods the deposit is invested

I = the interest earned on the investment

t = the number of time periods in months the deposit remains invested

Here is an example using the future value formula:

FV = ( $ + $5 ), or $

If you deposit $, at the end of one year with the interest rate of 5% and if the number of years is 1 year, then you can read the formula as follows:

"The future value (FV) at the end of one year equals the present value ($) plus the value of the interest at the specified interest rate (5% of $ or $5)."

How Future Value Works

To determine the value of your investment at the end of two years, you would change your calculation to include an exponent representing the two periods:

FV = $ ( 1 + )² = $

The continuing periods mean you continue the calculation for the number of payment periods you need to determine.

Future Value Using a Financial Calculator

Incidentally, how do i calculate the future value of an investment, you can use this formula with any calculator that has an exponential function key. However, using a financial calculator is better because it has dedicated keys corresponding to each of the four variables you'll be using, thereby speeding up the process and minimizing the possibility of error. Here are the keys you will press:

- Press make money doing online surveys uk and 2 (for 2 years' holding period)

- Press I/YR and 5 (for the interest rate of 5%)

- Press PV and (for the amount of money we are calculating interest on in year 2)

Take note that you need to set the investment's present value as a negative number so that you can correctly calculate positive future cash flows. If you forget to add the minus sign, your future value will show as a negative number.

Press PMT and PMT (there are no payments beyond the first one)

Press FV, which returns the answer of $

Future Value Using a Spreadsheet

Spreadsheets, such as Microsoft Excel, are well-suited for calculating time value of money problems. The function that we use for the future value of an investment or a lump sum on an Excel spreadsheet is:

The "rate" is the interest rate, "nper" is the number of periods, "pmt" is the amount of the payment made (if any, and it must be the same throughout the life of the investment), "pv" is present value, and "type" is when the payment is due. The payments due value is either a one (beginning of the month), or zero (end of the month).

To use the function in the worksheet, click on the cell you wish to enter the formula in. Enter the formula below and press enter.

=FV(,1,0,0)

You should receive a value of $

Limitations of Future Value

The future value calculations are estimates of the value of an investment in the future. There are certain situations where future value calculations may be misleading:

- If interest rates are fluctuating rapidly, future value may not give an accurate answer since it is only sensitive to interest rate changes if they remain steady over the chosen time period.

- In an inflationary economic environment, the purchasing power of future cash flows is declining. In this case, future value calculations are only an approximation.

- If currency values are fluctuating, future value calculations may not accurately reflect the actual value of an investment.

Key Takeaways

- The calculation of future value determines the rate of return on an investment, all things held the same.

- Compounding, another word for future value, occurs when interest is paid on interest.

- There are certain economic climates that erode the power of the future value calculations.

-