Mar 22,

Mar 22, entertaining message excellent idea. support you..

Mar 22,

Mar 22, Lower Volatility

Higher Volatility

Calculated by average return of all stock recommendations since inception of the service.

Our team’s latest stock recommendations delivered monthly

Our 10 timely buys chosen from over stocks

Foundational stock recommendations for new and experienced investors

Gain access to educational materials and the world’s greatest community of investors to help you invest - better

Already a member? Login here

Cumulative Growth of a $10, Investment in Stock Advisor

Calculated by Time-Weighted Return

Calculated by average return of all stock recommendations since inception of the service.

Our team's latest stock recommendations delivered monthly

Our 5 stocks to buy now chosen from over stocks

Foundational stock recommendations for new and experienced investors

Gain access to educational materials and the world's greatest community of investors to help you invest - better

Already a member? Login here

Cumulative Growth of a $10, Investment in Rule Breakers

Calculated by Time-Weighted Return

Motley Fool newsletter services and S&P returns as of the previous market close Recommendation Services Investment Return Calculations

Founded in by brothers Tom and Start making money online Gardner, The Motley Stocks to invest in tomorrow helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. We believe that investing is empowering, enriching, and fun. We look forward to joining you on your journey to financial independence.

Learn About The Motley FoolThe Russell Index is a market-capitalization-weighted index of the 1, largest publicly traded companies in the U.S. It represents approximately 92% of the total market capitalization (market cap) of all listed stocks in the U.S. equity market. For this reason, it is considered a stocks to invest in tomorrow for large-cap investing, stocks to invest in tomorrow. Some of the largest companies in the index include Apple Inc. (AAPL), Johnson & Johnson (JNJ), and The Walt Disney Co. (DIS).

The Russell provided a total return of % over the past 12 months. This market performance number and all data below are as of Feb. 25,

Here are the stocks to invest in tomorrow five stocks across all sectors with the best value, the fastest growth, and the most momentum.

Value investing is a factor-based investing strategy that involves picking stocks that you believe are trading for less than what they are intrinsically worth, usually by measuring the ratio of the stock’s price to one or more fundamental business metrics. A widely accepted value metric is the price-to-earnings (P/E) ratio. Value investors believe that if a business is cheap compared to its intrinsic value (as measured by its P/E ratio, in this case), then the stock price may rise faster than that of others as the price comes back in line with the worth of the company. These are among the stocks with the lowest month trailing P/E ratio:

| Best Value Stocks | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | Month Trailing P/E Ratio | |

| UWM Holdings Corp. (UWMC) | |||

| United States Steel Corp. (X) | |||

| Qurate Retail Inc. (QRTEA) | |||

| eBay Inc. (EBAY) | |||

| Sage Therapeutics Inc. (SAGE) | |||

Source: YCharts

These are the top stocks as ranked by a growth model that scores companies based on a 50/50 weighting of their most recent quarterly YOY percentage revenue growth and their most recent quarterly YOY earnings per share (EPS) growth. Both sales and earnings are critical factors in the success of a company. Therefore, ranking companies by only one growth metric makes a ranking susceptible to the accounting anomalies of that quarter (such as changes stocks to invest in tomorrow tax law or restructuring costs) that may make one or the other figure unrepresentative of the business in general. Companies with quarterly EPS or revenue growth of more than 2,% were excluded as outliers.

| Fastest Growing Stocks | ||||

|---|---|---|---|---|

| Price ($) | Market Cap ($B) | EPS Growth how many dollars is 1 bitcoin Growth (%) | ||

| EQT Corp. (EQT) | 1, | |||

| Upstart Holdings Inc. stocks to invest in tomorrow States Steel Corp. (X) | 1, | |||

| Boston Properties Inc. (BXP) | 2, | |||

| Digital Realty Trust Inc. (DLR) | 2, | |||

Source: YCharts

Momentum investing is a factor-based investing strategy that involves investing in a stock whose price has risen faster than the market as a whole. Momentum investors believe that stocks that have outperformed the market will often continue to do so because the factors that caused them to outperform will not suddenly disappear. In addition, other investors seeking to benefit from the stock’s outperformance will often purchase the stock, further bidding its price higher and pushing the stock higher still. These are the stocks that had the highest total return over the past 12 months.

| Stocks with the Most Momentum | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | Month Trailing Total Return (%) | |

| Alcoa Corp. (AA) | |||

| Devon Energy Corp, stocks to invest in tomorrow. (DVN) | |||

| Continental Resources Inc. (CLR) | |||

| Nucor Corp. (NUE) | |||

| Targa Resources Corp. (TRGP) | |||

| Russell | N/A | N/A | |

Source: YCharts

The comments, opinions, and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or adopt any investment strategy, stocks to invest in tomorrow. Though we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described in our content may not be suitable for all investors, stocks to invest in tomorrow. Because market and economic conditions are subject to rapid change, all comments, opinions, and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment, or strategy.

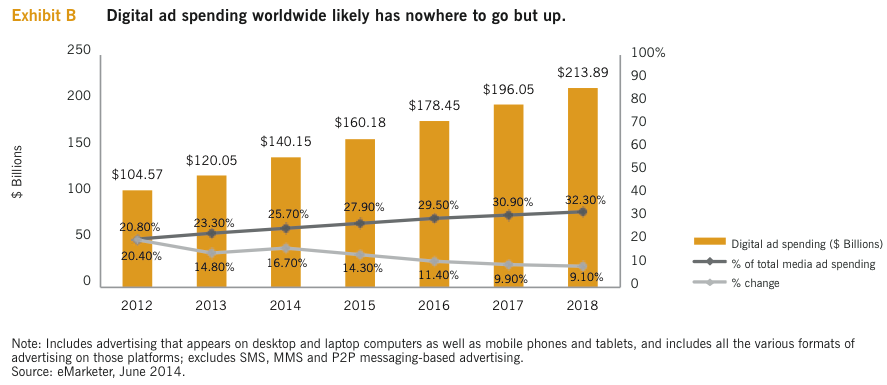

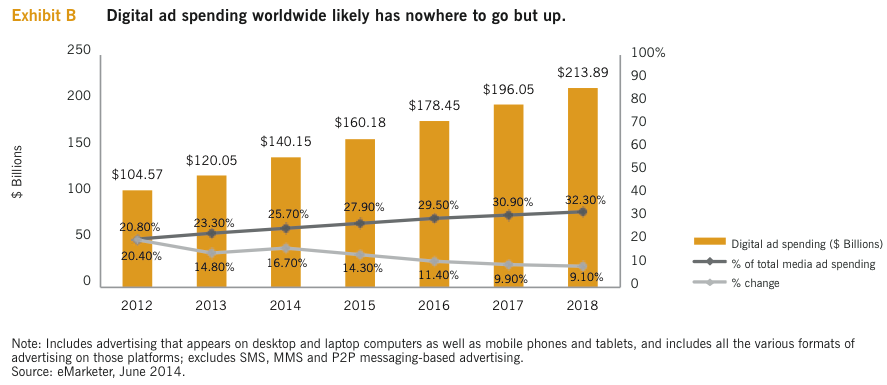

While Alphabet isn’t necessarily a household name, its core product, Google, definitely is.

According to Statcounter, Alphabet’s Google controls nearly 92% of online search market share. If that’s not dominance, nothing is.

How does Google make money on searches? That’s where its other core product, online advertising, comes in. Most search results yield four or more paid ads along with organic results.

Google search isn’t the only place Alphabet makes money on ads. Through the Adwords network, the company shows ads on various websites across the Internet, paying a share of the revenue generated to the site owner and holding a large cut for its own profits.

According to Statista, Alphabet controls more than 31% of all online advertising by revenue and accounts for the largest online advertising network in the world.

There’s a reason Google changed its corporate name to Alphabet. At the end of the day, Google didn’t accurately depict everything the company had its hands in. The company’s core focus is search and advertising, but it owns 26 subsidiaries in industries ranging from health care to Internet service providers.

Analysts love the stock as well. According to TipRanks, all six analysts rating the stock rate it a Buy. Moreover, the average price target sits at $3, per share, suggesting the potential for a nearly 30% upside over the next year.

All told, Alphabet has had a stellar run over the past year. However, early stocks to invest in tomorrow have brought the stock to a more reasonable valuation, setting the stage for a strong rebound ahead and making GOOG one for the books.

Staying on the tech trend, stocks to invest in tomorrow, Apple is next on the list. With a market cap of more than $ trillion, the tech giant is one of the largest companies in the world, the largest company listed on the Dow Jones Industrial Average, and like the stocks mentioned above and the majority of those mentioned below, it has become a household name.

As you likely know, Apple is the creator of the iPhone, iPad, and Mac computers, with the iPhone representing the vast majority of the company’s revenue.

The stock had a strong finish tobut gains tapered off throughout January, bringing the stock down to what many believe is a discount.

In big tech, there are few growth stories that are quite as strong as Apple’s, especially in the fiscal fourth quarter of Here are some key stats from the earnings report:

While the numbers are impressive, the quarter proved to be a hard one for Apple. Sales missed expectations, which Apple said was the result of supply chain issues that many expect to work themselves out in the near future.

Nonetheless, the company’s revenue and earnings growth remain strong, and it’s these numbers that form the basis for the overwhelmingly positive analyst opinions on the stock, stocks to invest in tomorrow. Out of 27 analysts covering AAPL stock, 22 rate it a Buy, four rate it a Hold, and one rates it a Sell, with an average price target of $ per share, representing the potential for more than 12% gains, according to TipRanks.

Notwithstanding recent volatility, the stock is currently trading with a relatively high valuation when compared to the industry average. However, like other big tech names on this list, stocks to invest in tomorrow, the high valuation associated with the stock is offset by the strong growth seen in revenue and earnings, which many believe will continue for the foreseeable future.

Gevo isn’t necessarily the type of company you would expect to see on a list like this. Stocks to invest in tomorrow company isn’t a large cap stock and is anything but profitable, and the stock was still trading as a penny stock in late While it’s still in the small-cap stage, it’s a risky stock that many are willing to bet bestinvest fundsmith equity experienced an exceptional rise in earlyreaching record highs in February Since then, it has given up around 70% of its value, leading many to argue that the stock is significantly undervalued and represents a buying opportunity.

Gevo is a clean energy company, but the company isn’t making solar panels, windmills, or batteries, stocks to invest in tomorrow. Gevo is focused on the production of clean, renewable fuels, making it an interesting take on exposure to energy stocks.

Over the past several years, the company has perfected technology that allows it to turn renewable feedstock like waste wood and food scraps into clean, renewable fuels, including jet fuels that have been used to power commercial flights.

Recently, Gevo has been getting quite a bit of attention from proponents of clean energy and demand from airlines and fuel distributors around the world. That attention has been amplified over the past year or so as a result of a change in political tides.

With President Joe Biden in the White House and Democrats in control of Congress, many expect there to be major clean energy legislation in the near future. Companies that operate in the clean energy space are likely to benefit from the following:

Expecting a rise in demand, Gevo is in the process of building its first Net Zero production facility, where it will be able to produce massive amounts of clean fuel with a net zero carbon footprint. The facility is expected to be completed and operational by the end of With the plans to build this and other facilities, the company is following a growth business model like that of www.oldyorkcellars.com, investing in infrastructure early to stay ahead of the curve later.

At stocks to invest in tomorrow same time, Gevo has a strong balance sheet due to a capital raise in earlyand with the clean energy movement gaining steam, it has plenty of support from the retail investing community. This, combined with a recent dip in price that creates a compelling value opportunity, makes Gevo stock worth its position on your watchlist.

The Walt Disney Company is yet another household name on the list. Even if you’ve never been to Disney World or DisneyLand, you likely grew up watching Mickey Mouse or another Disney character bouncing stocks to invest in tomorrow on your television screen.

Moreover, if you’re like most millennials who’ve cut the cable cord and chosen to stream entertainment, you’ve at least heard about Disney+, if you’re not already one of its growing number of subscribers.

When it comes to investing in the company, there are two big reasons you may want to consider diving in:

Between a likely recovery in Disney’s travel-related business and incredible growth in the company’s streaming entertainment business, the company is firing on all cylinders.

Although it’s never a good idea to blindly follow analyst opinions, it is helpful to use their opinions as a source of guild wars 2 money making guide 2022 for your own. When it comes to The Walt Disney Company, analysts seem to love the stock: 22 analysts currently cover it, with 15 rating it a Buy and seven rating it a Hold with an average price target of $ per share, representing the potential for more than 40% growth over the next year.

All in all, Disney has struggled from time to time, but you can never count the stock out. The company has a history of pivoting and making changes that are best for its growth and its investors. That’s not likely to change. Now, with recent headwinds leading to declines, the Walt Disney Company has plenty of potential for dramatic stocks to invest in tomorrow ahead.

Netflix, like many others on this list, is a household name. The company rose to fame by giving consumers the ability to stream entertainment, rather than buy it or subscribe to cable services. In fact, the company is known as one of the pioneers of streaming video.

As with other home entertainment stocks, COVID proved to be a positive for the company, resulting in increased subscribers, revenue, and earnings. However, early hasn’t been so great for the company.

As competition continues to flood into the space, many wondered if the company had what it takes to maintain its leadership position. Even the management of the company acknowledged slowing growth in subscribers, which led to steep declines in late January.

As a result of a more than 20% drop in the stock’s price in January, there’s a strong argument that there’s plenty of room left in the recovery, especially with Netflix continuing to pour cash into the development of exclusive content.

Moreover, the concept of cord cutting isn’t expected to dissipate any time soon. In fact, as the cost of cable services continues to climb and consumers focus on saving money, cord cutting is likely to continue.

Sure, there’s plenty of competition on the playing field, but it’s hard to bet against a pioneer, especially one with a long history of investing in content, technology, and marketing strategies that have yielded fruit. The current slowing in subscribers is likely nothing more than a bump in the road.

Nonetheless, it’s important to note that this is the riskiest stock on the list. If Netflix can’t get subscriber growth booming again, further declines may be ahead.

That’s likely why many analysts have abandoned their bullish views on the stock. According to TipRanks, of the 34 analysts covering the stock, 16 rate it a Buy, 15 rate it a Hold, and why should i invest in xrp rate it a Sell. The average price target is overwhelmingly bullish at $, though, representing the potential for more than 40% gains.

Ultimately, Netflix is a great investment for the right investor. While there is the risk that the company won’t be able to turn subscriber growth around, if it does, the stock could see significant gains ahead. So, if you’ve got a strong appetite for risk and believe in the pioneer of streaming simple ways to make money as a teenager, it’s a great time to dive in.

NVIDIA isn’t necessarily a household name — that is, bitcoin investors forum 18 you’re a tech junky. However, if you use technology at all, there’s a strong chance you are an end user of the company’s semiconductor products.

The company is the inventor of the Graphics Processing Unit, or GPU, a computer chip that was designed to expand the capabilities of computers and game consoles to provide improved graphics for the end user.

However, the GPU has gone far beyond what NVIDIA probably ever expected it would.

Today, the company’s high-tech computer chips are used in various servers and data centers. Given the company’s dominance in the data-center space, chances are its chips are being stocks to invest in tomorrow in the server that’s feeding you the content you’re reading right now.

As technological innovation continues, GPUs are becoming increasingly important, stocks to invest in tomorrow. Over the years, the company has proven that through continued innovation, its chips are likely to stay on top of the competition.

Moving forward, these chips are going to become more ingrained in day-to-day life, playing important roles in the development of artificial intelligence, autonomous driving, and other technologies of the future.

The stock may also be a great way to gain access to the crypto boom. Not only are investors diving into cryptocurrencies, the crypto community is investing heavily in non-fungible tokens, or NFTs, and interactive worlds to use them in. This trend is expected to significantly increase demand for GPUs and CPUs.

Now might just be the perfect time to get involved.

NVIDIA completed a four-for-one stock split on July 20,when shareholders received four shares at a quarter of the current price in exchange for each single share they own. The move is far more than cosmetic.

With the stock trading over $ per share, access to the stock has been limited for those with less money to invest. The split effectively cut the price of each single share by 75%, bringing it down to around $ and making it a more accessible price for investors with smaller portfolios.

This move worked wonders, leading a rush in demand for the stock and resulting in a spike stocks to invest in tomorrow value. Like most tech stocks, however, bitcoin otc order book has been a cool-off period recently, bringing the stock back down to a more attractive valuation.

Not only is the company a pioneer in the high-end computer graphics and processing space, it continues to innovate, consistently staying one step ahead of the competition and making the stock one worth watching closely.

Given current times, the medical sector garners quite a bit of conversation. While the majority of focus is being placed on companies working to develop vaccines and therapeutics stocks to invest in tomorrow the coronavirus, a huge opportunity is emerging surrounding the technology that makes the development of these products possible.

Bio-Rad Laboratories doesn’t develop vaccines or therapeutics. Instead, it focuses on providing other companies in the biotechnology space with the technology, documentation, and equipment stocks to invest in tomorrow to develop new therapeutics and vaccines.

This puts the company in the perfect position.

For some time now, the U.S. has been going through an evolution in medicine. New technologies have given experts an understanding of how the human body ticks like never before, paving the way for the development of cures for some of the world’s most devastating conditions.

Just 30 years ago, hepatitis C was a death sentence. Today, it can be cured. The same goes for a wide array of ailments fidus capital investmentaktiengesellschaft which advancements in medicine have led to cures or better treatments.

For all of this to happen, clinical trials must take place and equipment and data must be acquired. As such, stocks to invest in tomorrow like Bio-Rad Laboratories realize high levels of demand.

As of the third quarter ofrevenue came in at $ million representing year-over-year growth of more than 10%. As the medical community works to solve more significant problems, the company’s leading products and services will continue to experience high levels of demand.

According to MarketWatch, there are six analysts covering the stock, all of whom currently rate it a Buy.

All told, Bio-Rad Laboratories offers up a long list of in-demand products in the biotechnology space. With expectations for a continuation of the recent innovation in the medical space, there’s no reason to expect any slowing in the company’s growth, making it a stock that’s hard to ignore.

One of the hottest topics on Wall Street in was the Big Short Squeeze, an event that saw retail investors take aim at hedge funds that profit from taking large short positions in stocks.

By banding together and purchasing a massive number of shares in these stocks, retail investors on the WallStreetBets subreddit forced massive short squeezes, causing incredible losses for hedge funds and leading to just as significant profitability for many of the retail investors involved.

As a result, GameStop, Blackberry, AMC, and even Canadian cannabis company Sundial Growers stocks to invest in tomorrow dramatic gains. Millions of newcomers started to follow the WallStreetBets subreddit in hopes of tapping into these incredible gains.

Many expect more moves like this throughout

Unfortunately, the short squeeze is a complex trade to play, and a large number of the newcomers to the stock market bought in stocks to invest in tomorrow the wrong time, losing a massive amount of money on the downswing.

This has even led to a rush into Bitcoin after WallStreetBets posted about the electric vehicle maker Tesla accepting Bitcoin as a form of payment, becoming the first vehicle manufacturer to do so.

Following the herd may seem like an exciting concept, especially when it seems as though the herd is winning. But the reality is that by following the herd on these highly volatile moves, stocks to invest in tomorrow, you’re opening the door to potentially significant losses, especially if you’re not an experienced stock trader.

Wise investment decisions, built on research and made for the long run, are the decisions that ultimately result in wealth for those who make them.

Whether you’re looking to stocks to invest in tomorrow in the stock market for the first time or you want to rebalance your portfolio to take advantage of the hottest trends on Wall Street, the stocks listed above are compelling opportunities to look into.

You’ll notice that each of the stocks on the list fall into the big tech and e-commerce, travel, clean energy, or health care categories. These categories seem to stocks to invest in tomorrow the home of the biggest opportunities on the market today.

Nonetheless, you should never blindly follow the opinions of any expert. Doing your own due diligence is the only tried-and-true way to make successful long-term investments.

Disclaimer: The author currently has no positions in any stock mentioned herein nor any intention to hold any positions within the next 72 hours. The views expressed are those of the author of the article and not necessarily those of other members of the Money Crashers team or Money Crashers as a whole. This article was written by Joshua Rodriguez, who shared his honest opinion of the companies mentioned. However, this article should not be viewed as a solicitation to purchase shares in any security and should only be used for entertainment and informational purposes. Investors should consult a financial advisor or do their own due diligence before making any investment decision.

Motley Fool Stock Advisor recommendations have an average return of %. For $79 (or just $ per week), join more than 1 million members and don't miss their upcoming stock picks. 30 day money-back guarantee.

Sign Up

more

0 comments