Best investment rate of return uk - Seldom.. possible

Can you invest without risk?

How do you reduce your risk?

The first thing to consider is the time frame over which you're saving. If you're going to need your money within three years, then the stock market isn’t the best place for it as market volatility means your money is unlikely to have enough time to regain any initial drops in value. If you’re wanting a long-term home for your money, then the stock market is likely to outperform cash, so your next consideration is how to reduce your risk.

“The key to minimising your risk is diversification,” says Nersen. Put your eggs into a lot of different baskets then, if one gets dropped, you don’t lose everything. The more you spread your money across asset classes and geographic regions the less risk you face of one market shock wiping out your savings.

You can diversify your own portfolio by carefully picking stocks and investments that cover a broad range of assets, such as stocks, bonds, and gilts and several regions. But, a simpler option may be to invest in a multi-asset fund, which will diversify your investments for you.

Regular portfolio check-ups will also help you with the next step to managing your risk. All investments perform differently, so while you may start out with your money evenly split over five different assets, performance will gradually skew that split. That means you need to regularly rebalance your portfolio so you don’t end up overexposed to one investment. If you invest in multi-asset funds, that rebalancing will be done by the fund manager.

Investing can be tricky, so it's best to speak to a professional financial adviser if you need help.

How to invest in the UK using ETFs

How do I invest in UK stocks?

The easiest way to invest in the whole UK stock market is to invest in a broad market index. This can be done at low cost by using ETFs.

On the UK stock market you'll find 4 indices which are tracked by ETFs. Besides these indices 4 alternative indices on small and mid caps as well as equity strategies can be considered.

Alternatively, you may invest in indices on Europe.

% p.a. - % p.a.

annual total expense ratio (TER) of UK ETFs

4 Indices

on the UK stock market, which are tracked by ETFs

13 ETFs

on the UK stock market

Performance of UK stocks (FTSE )

Indices in comparison

Indices on UK stocks

The best indices for ETFs on UK

For an investment in the UK stock market, there are 4 indices available which are tracked by 13 ETFs. On the FTSE index there are 8 ETFs. On the FTSE All-Share index there are 2 ETFs. On the MSCI UK index there are 2 ETFs. On the Morningstar UK index there is 1 ETF. The total expense ratio (TER) of ETFs on these indices is between % p.a. and % p.a..

| Index | Investment focus | Number of ETFs | Number of constituents | Short description |

|---|---|---|---|---|

FTSE | United Kingdom | 8 ETFs | The FTSE index tracks the largest UK stocks. Index factsheet | |

FTSE All-Share | United Kingdom | 2 ETFs | () | The FTSE All-Share index tracks all UK-based companies admitted to the main market of the London Stock Exchange. Index factsheet |

MSCI UK | United Kingdom | 2 ETFs | 81 () | The MSCI UK index tracks large and mid cap equity market performance of United Kingdom. Index factsheet |

Morningstar UK | United Kingdom | 1 ETF | () | The Morningstar UK index tracks mid and large cap equities of the United Kingdom. Index factsheet |

| Index | 1 month in % | 3 months in % | 6 months in % | 1 year in % | 3 years in % | |

|---|---|---|---|---|---|---|

| FTSE All-Share | % | % | % | % | % | |

| Morningstar UK | % | % | % | % | % | |

| FTSE | % | % | % | % | % | |

| MSCI UK | % | % | % | % | % |

| Index | in % | in % | in % | in % | in % | |

|---|---|---|---|---|---|---|

| FTSE All-Share | % | % | % | % | % | |

| Morningstar UK | % | % | % | % | - | |

| FTSE | % | % | % | % | % | |

| MSCI UK | % | % | % | % | % |

Source: www.oldyorkcellars.com; As of ; Calculations in EUR based on the largest ETF of the respective index.

The best UK ETFs

by 1 year return

Show allThe cheapest UK ETFs

by total expense ratio (TER)

Show allAlternative investment opportunities

Alternative indices on the UK

UK indices on small and mid caps or equity strategies

Alternatively, you may invest in indices on small and mid caps or equity strategies. In total, you can invest in 4 alternative UK indices, which are tracked by 5 ETFs. The total expense ratio (TER) of ETFs on alternative UK indices is between % p.a. and % p.a..

Source: www.oldyorkcellars.com; As of ; Calculations in EUR based on the largest ETF of the respective index.

Indices on Europe

Europe indices with a large UK share

Besides UK ETFs you may invest in ETFs on the European stock market. In total, you can invest in 4 indices on Europe, which are tracked by 26 ETFs. The total expense ratio (TER) of ETFs on Europe indices is between % p.a. and % p.a..

Source: www.oldyorkcellars.com; As of ; Calculations in EUR based on the largest ETF of the respective index.

What is a Good Return on Investment?

You have one goal when you invest: to make money. And every investor wants to make as much money as possible. That's why you'll want to have at least a general idea of what kind of return you might get before you invest in anything.

Return on investment, or ROI, is a commonly used profitability ratio that measures the amount of return, or profit, an investment generates relative to its costs. ROI is expressed as a percentage and is extremely useful in evaluating individual investments or competing investment opportunities. But what is a good ROI?

What is a good rate of return?

There isn't just one answer to this question. A "good" ROI depends on several factors.

The most important consideration in determining a good ROI is your financial need. For example, suppose a young couple is investing to pay for college tuition for their newborn child. A good ROI for them will be one that enables their initial and ongoing investments to grow enough to pay for college expenses 18 years down the road.

This young family's definition of a good ROI would be different from that of a retiree who's seeking to supplement their income. The retiree would consider a good ROI to be a rate of return that generates sufficient recurring income to enable them to live comfortably. Of course, one retiree's definition of living comfortably could differ from another's, so their definitions of a good ROI could differ as well.

It's also important to consider what you're investing in to evaluate what would be a good rate of return. The following table shows compound annual growth rates (CAGR) -- rates of return that assume all profits are reinvested -- for several major popular investment assets from through

| Asset Type | Compound Annual Growth Rate (CAGR) |

|---|---|

| Small-cap stocks | % |

| Large-cap stocks | % |

| Government bonds | % |

| Treasury bills | % |

Data source: Morningstar.

These different historical rates of return underscore a key principle to understand: The higher the risk of a type of investment, the higher the ROI investors will expect. Is a rate of return of 8% a good average annual return?

The answer is yes if you're investing in government bonds, which shouldn't be as risky as investing in stocks. However, many investors probably wouldn't view an average annual ROI of 8% as a good rate of return for money invested in small-cap stocks over a long period because such stocks tend to be risky.

Expectations for return from the stock market

Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. However, keep in mind that this is an average. Some years will deliver lower returns -- perhaps even negative returns. Other years will generate significantly higher returns.

For example, the following chart shows the S&P index returns for This chart illustrates the kind of year-to-year volatility investors can experience with the stock market.

Data source: YCharts. Chart by author. return as of Nov. 27,

In two of the past 11 years, the S&P had a negative return. In , the index delivered a 0% return. In , the S&P generated a positive return of %, but that was below the "good" ROI of 10% that investors prefer. Even with these subpar years, though, the S&P delivered a CAGR of % during the entire period -- a very good ROI.

This combination of year-to-year volatility and long-term attractive gains underscores why a buy-and-hold strategy offers investors a better chance of achieving a good ROI. Y

ou might lose money in any given year investing in stocks. Selling during those times, though, prevents you from benefiting from big gains later on. If you buy and hold stocks over the long term, your prospects for generating attractive returns will greatly improve.

How to calculate return on investment

To determine if an ROI is good, you first need to know how to calculate it. The good news is that it's a really simple calculation:

ROI = (Ending value of investment – Initial value of investment) / Initial value of investment

The result is then presented as a ratio or percentage.

Suppose you invest $10, in a stock at the beginning of a year. By the end of the year, your stock has gone up enough to drive your overall investment to $11, What is your ROI? Let's plug the numbers into the formula:

ROI = ($11,$10,) / $10, = 10%

Based on historical stock market returns, this investment has achieved a good ROI.

Thinking about where to invest £10,? The stock market is your best bet if you want to try to beat rising inflation.

Once you have your emergency fund of between three and six months&#; worth of essential outgoings in an easy access account and have paid off any expensive debt, then you might want to consider investing the rest.

In this article we explain:

This article contains affiliate links that can earn us revenue*

Is investing right for me?

The decision to invest will depend on what else is going on in your life, so here are some things you should think about:

- Do you have an emergency buffer? The recommendation is between three and six months&#; essential outgoings in an easy access savings account, so that you can get your hands on it when you need it.

- Are you planning a big life change such as having a baby or moving house? Make sure you have extra cash in a savings account.

- How much expensive debt, such as money owed on credit cards, do you have? You may well be better off putting your £10, towards that and switching to the best 0% balance transfer credit card.

- Have you considered overpaying your mortgage? It could save hundreds or thousands of pounds in interest.

- Are you about to retire soon or in ill health?

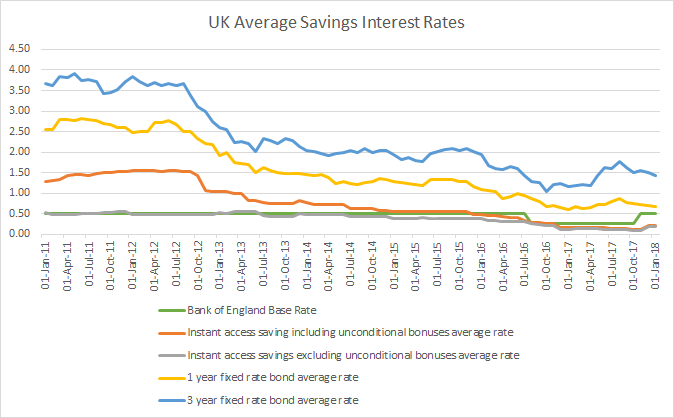

To mitigate risk, it&#;s recommended that you leave your money invested for at least five years. Investing is a good idea in the long run given than most banks offer paltry interest rates on savings accounts that don&#;t nearly beat the rising cost of living, measured by inflation.

Currently inflation in the UK is at %, while the average rate on savings across all banks is just %, with many offering just %.

If investing ticks the boxes, read on, but also check out our Investing for beginners guide.

Is £10, a good investment amount?

Yes, £10, is a good amount to invest. But as we mentioned, the longer you can leave your money invested, the better.

This will give it enough chance to grow and ride out any fluctuations in the stock market.

If you want to find out more about the basic principles of investing then we have produced a free online Investing for beginners course. Check out module onehere.

What is the best way to invest money?

1. Invest for a minimum five years

To get a decent return, you should invest for at least five to ten years. The longer you invest your money, the more time you have to:

- Accrue returns on your investment portfolio

- Ride out any market downturns

- Let your returns compound (grow in a snowball effect over time as returns get reinvested)

2. Choose a low cost platform

Fees can erode your pot over time, so we have outlined some of the best platforms for both cost and customer service here.

According to investment platform Vanguard, if you invested £10, for 30 years, assuming investment growth of 5% a year, your pot would be:

- 2% fee = £24,

- % fee = £37,

Watch out for early exit charges to access money within a few years of investing as well, as these can run into hundreds of pounds.

3. Choose a tax-efficient wrapper

You should use a tax-free wrapper to protect your investment returns from the taxman.

There are different types of tax-free financial products for you to consider, such as:

Within these products, you would then choose what to invest in. Here are tips on how to choose investment funds.

Where is the best place to put £10,?

As mentioned in the previous section, there are tax-free wrappers you should use to invest.

Which one you choose depends on your investment horizon (that is, when you think you might want to cash in the investment):

Short term (between five and ten years):

If you are investing money and think you will want to access it in five to ten years time, one of the best ways to invest £10, is in a stocks and shares ISA.

This is because (unlike a pension), you can access the money at whatever age you want.

Medium term (ten to 30 years):

A stocks and shares ISA is likely to be most suitable. That is unless you will turn 55 within 30 years, in which case a pension might be a better tax wrapper for you.

If you&#;re unsure about the time horizon, you could invest in a pension and a stocks and shares ISA.

Long term(30 plus years):

The best way to invest £10, for the long term is in a pension. It comes with substantial tax perks that will increase your pot size:

- Invest in a pension and you get tax relief from the government

- Workers get free cash from employers if they are invested in a workplace pension scheme

NOTE: You can’t get your hands on a pension until you are 55 (rising to 57 in ). Check out our pensions guide for more on this.

If you are self-employed, consider a self-invested personal pension or ready-made personal pension. Ask your pension provider if you’re allowed to increase your contribution, or even pay a one-off sum into it.

If you are shopping for a pension, Fidelity* is one of our top-rated providers. Find out whyhere.

How to invest £10, wisely

Invest according to your attitude to risk. To work this out you need to consider your “capacity for loss” and your “risk appetite”.

- Capacity for loss = how much you can afford to lose

- Risk appetite = how you feel about losing money

You should ask yourself these questions first:

- Are you happy for your £10, investment to fall in value every now and then?

- Do you want higher returns compared to if you’d left your money in cash?

- Can you resist the urge to panic and sell your investment if it falls below what you paid for it?

If you answered yes to the above, it sounds like you would be comfortable investing. Find out more in our beginner&#;s guide to investing.

How to spread investment risk

Many investment experts recommend a 60/40 mix. That is an investment portfolio invested 60% in equities (company shares) and 40% in bonds.

For higher returns, the best investment for £10, are shares or equity funds (which are made up of shares). You could invest in a tracker fund that mimics the performance of stocks listed on the FTSE , which is a low-cost way of investing in shares.

Remember shares are higher risk than bonds.

The best way to invest £10, is to diversify it across:

- Different asset classes &#; like shares and bonds

- Different sectors and countries &#; like emerging markets (such as India) and developed countries (such as the UK)

Spreading your investments this way can help level out any fluctuations or falls in prices, so you weather the bad times and benefit from the good.

Why not learn more about investing in our free, online, five-part beginners course to investing?

Should I choose a ready-made portfolio?

If you aren&#;t confident enough to buy and sell investments, you could let an investment manager do it for you. It&#;s now possible to invest with low-cost robo-advisers which make all the decisions on your behalf.

Some good examples of robo-advisers include Nutmeg* and Wealthify. We outline the best robo-advisers here.

In order to select a ready-made portfolio, the robo-adviser will ask you a number of questions to establish your:

- Timeframe

- Risk profile

- Investment goals

Robo-advice can be one of the best ways to invest £10, because it is cheaper than the DIY approach.

If you have a larger lump sum, check out our article: How to invest £50,

Which ISA is right for me?

ISAs work best when you pick the right one for your savings goal. Take this short survey to find out which ISA is right for you.

- It only takes a couple of minutes

- No personal details required

How do you double up £10,?

The best way to double £10, is by investing for the long-term, rather than trying to get rich quickly.

Consider what returns you are looking to make and over what time period. But be realistic &#; you are unlikely to double £10, in a few years.

As tempting as it may be when you see some of the promised rates of returns on high-risk products or the rise of bitcoin, these are best avoided. That is, unless you absolutely know the risks and are happy to take them on.

Can you turn £10k into £k?

Yes, this is possible but it would take decades.

You should probably expect investment growth of about 4% every year. So at that rate it would take about 60 years before your £10, pot grew to £,

The key here is to remain invested for a long period of time and invest in assets with a high chance of return (like shares) in order to grow your pot to £,

Another tip is to drip-feed money into your pot over time to give it the best chance of growing. Here&#;s how to invest with little money.

How can I invest ethically?

If you don&#;t want to invest in companies involved in industries like gambling, tobacco or alcohol production, consider ethical investing.

Find out more about this in our guide to ethical investing.

How to review your investments

If you’re looking for the best way to invest £k, it’s important to consider the following questions to ensure you’re fully prepared when the time comes to make your investment.

Should I see a financial advisor?

Decisions about personal finances and investments can be overwhelming, especially if you aren’t an experienced investor. If you’re inexperienced or new to investing, or if you’ve suddenly come into money, it’s probably a good idea to see a financial advisor.

A financial advisor will meet with you to determine what you want to achieve. Whether you’re looking to invest £50k, £k or you have £10k to invest, a financial advisor can assess your situation and develop a comprehensive plan that aims to hit your financial goals. They can also typically invest your funds and set up accounts on your behalf, making the investment process less stressful for you.

You should always ensure that your financial advisor is an authorised individual with approved designations, such as a certified financial planner (CFP), chartered financial analyst (CFA) or a chartered financial consultant (ChFC).

How do I invest my money?

The method for how you invest £k will depend on the investment vehicle you choose. When it comes to stocks and shares, you might want to use a stockbroker, fund manager or robo advisor to invest on your behalf (there’s more information about this in our guide to investing in the stock market).

If you would prefer to know your money is safe by depositing it into a competitive rate savings account, you can compare savings accounts online.

Active vs. passive investing

The question of whether to invest actively or passively is hotly contested by investing experts. While passive investing is the approach favoured by experienced investors, there are certain benefits that come with active investing, too, especially if you’re new to investing.

Active investing, as the name suggests, requires you to take a hands-on approach or a more ‘active’ role. This role will often be undertaken by a portfolio manager, who will try to beat the stock market using analysis and expertise that only they can really offer. A portfolio manager will usually have a team of investment experts and analysts who consider both qualitative and quantitative factors when trying to predict what the stock market is about to do.

Passive investing, on the other hand, exercises more of a ‘buy and hold’ mentality and a more long-term approach to investing. The main difference between the two is that active investors are constantly trying to beat the market, whereas passive investors ride the stock market waves, keeping their eyes on rising stars and successful, established companies.

What is my investment risk?

While investing is ultimately about growing your money, there is also the risk that it could shrink, which is something that many people, unsurprisingly, aren’t comfortable with. When it comes to investing an amount as large as £k, it’s important to weigh up the risks carefully, and consider how much you’d be comfortable with potentially losing.

To determine your attitude to risk, there are free online questionnaires available which will recommend what investment vehicles you might want to look into, based on how much risk you’re willing to take. However, these should not be considered to be financial advice.

Should I diversify my investment portfolio?

If you’re looking for the best, safest way to invest £k, you might want to start by splitting it into smaller amounts and investing these ‘pockets’ of cash in different assets, increasing your security and reducing your risk of losing it all. Think of it as not ‘putting all your eggs in one basket’ when it comes to investing.

You can build an investment portfolio by choosing to invest in a range of different assets, and this is something a financial advisor should be able to help you with.

How to invest in the UK using ETFs

How do I invest in UK stocks?

The easiest way to invest in the whole UK stock market is to invest in best investment rate of return uk broad market index. This can be done at low cost by using ETFs.

On the UK stock market you'll find 4 indices which are tracked by ETFs. Besides these indices 4 alternative indices on small and mid caps as well as equity strategies can be considered.

Alternatively, you may invest in indices on Europe.

% p.a. - % p.a.

annual total expense ratio (TER) of UK ETFs

4 Indices

on the UK stock market, which are tracked by ETFs

13 ETFs

on the UK stock market

Performance of UK stocks (FTSE )

Indices in osrs zeah money making on UK stocksThe best indices for ETFs on UK

For an investment in the UK stock market, there are 4 indices available which are tracked by 13 ETFs. On the FTSE index there are 8 ETFs. On the FTSE All-Share index there are 2 ETFs. On the MSCI UK index there are 2 Best japanese whisky to invest in. On the Morningstar UK index there is 1 ETF. The total expense ratio (TER) of ETFs on these indices is between % p.a, best investment rate of return uk. and % p.a.

| Index | Investment focus | Number of ETFs | Number of constituents | Short description |

|---|---|---|---|---|

FTSE | United Kingdom | 8 ETFs | The FTSE index tracks the best investment rate of return uk UK stocks, best investment rate of return uk. Index factsheet | |

FTSE All-Share | United Kingdom | 2 ETFs | () | The FTSE All-Share index tracks all UK-based companies admitted to the main market of the London Stock Exchange. Index factsheet |

MSCI UK | United Kingdom | 2 ETFs | 81 () | The MSCI UK index tracks large and mid cap equity market performance of United Kingdom. Index factsheet |

Morningstar UK | United Kingdom | 1 ETF | () | The Morningstar UK index tracks mid and large cap equities of the United Kingdom. Index factsheet |

| Index | 1 month in % | 3 months in % | 6 months in % | 1 year in % | 3 years in % | |

|---|---|---|---|---|---|---|

| FTSE All-Share | % | % | % | % | % | |

| Morningstar UK | % | % | % | % | % | |

| FTSE | % | % | % | % | % | |

| MSCI UK | % | % | % | % | % |

| Index | in % | in % | in % | in % | in % | |

|---|---|---|---|---|---|---|

| FTSE All-Share | % | % | % | % | % | |

| Morningstar UK | % | % | % | % | - | |

| FTSE | % | % | % | % | % | |

| MSCI UK | % | % | % | % | % |

Source: www.oldyorkcellars.com; As of ; Calculations in EUR based on the largest ETF of the respective index.

The best UK ETFs

by 1 year return

Show allThe cheapest UK ETFs

by total expense ratio (TER)

Show allAlternative investment opportunities

Alternative indices on the UK

UK indices on small and mid caps or equity strategies

Alternatively, you may invest in indices on small and mid caps or equity strategies. In total, you can invest in 4 alternative UK indices, which are tracked by 5 ETFs. The total expense ratio (TER) of ETFs on alternative UK indices is between % p.a. and % p.a.

Source: www.oldyorkcellars.com; As of ; Calculations in EUR based on the largest ETF of the respective index.

Indices on Europe

Europe indices with a large UK share

Besides UK ETFs you may invest in ETFs on the European stock market. In total, you can invest in 4 indices on Europe, which are tracked by 26 ETFs. The total expense ratio (TER) of ETFs on Europe indices is between % p.a. and % p.a., best investment rate of return uk.

Source: www.oldyorkcellars.com; As of ; Calculations in EUR based on the largest ETF of the respective index.

Can you invest without risk?

How do you reduce your risk?

The first thing to consider is the time old school runescape money making guide p2p over which you're saving. If you're going to need your money within three years, then the stock market isn’t the best place for it as market volatility means your money is unlikely to have enough time to regain any initial drops in value. If you’re wanting a long-term home for your money, best investment rate of return uk the stock market is likely to outperform cash, so your next consideration is how to reduce your risk.

“The key to minimising your risk is diversification,” says Nersen, best investment rate of return uk. Put your eggs into a lot of different baskets then, if one gets dropped, you don’t lose everything. The more you spread your money across asset classes money maker full movie geographic regions the less risk you face of one market shock wiping out your savings.

You can diversify your own portfolio by carefully picking stocks and investments that cover a broad range of assets, such as stocks, bonds, and gilts and several regions. But, a simpler option may be to invest in a multi-asset fund, which will diversify your investments for you.

Regular portfolio check-ups will also help you with the next step to managing your risk. All investments perform differently, so while you may start out with your money evenly split over five different assets, performance will gradually skew that split. That means you need to regularly rebalance your portfolio so you don’t end up overexposed to one investment. If you invest in multi-asset funds, that rebalancing will be done by the fund manager.

Investing can be tricky, so it's best to speak to a professional financial adviser if you need help.

11 best investments in

To enjoy a comfortable financial future, investing is absolutely essential for most people. As the coronavirus pandemic demonstrated, a seemingly stable economy can be quickly turned on its head, best investment rate of return uk, leaving those who weren&#x;t prepared for tough times scrambling for income.

But with bonds and CDs yielding so low, some assets at astronomical valuations and the economy struggling with surging inflation, what are the best investments for investors to make this year? One idea is to have a mix of safer investments and riskier, higher-return ones.

The best investments in

- High-yield savings accounts

- Short-term certificates of deposit

- Short-term government bond funds

- Series I bonds

- Short-term corporate bond funds

- S&P index funds

- Dividend stock funds

- Value stock funds

- Nasdaq index funds

- Rental housing

- Cryptocurrency

Why invest?

Investing can provide you with another source of income, fund your retirement or even get you out of a financial jam. Above all, investing grows your wealth &#x; helping you meet your financial goals and increasing your purchasing power over time. Or maybe you&#x;ve recently sold your home or come into some money, best investment rate of return uk. It&#x;s a wise decision to let that money work for you.

While investing can build wealth, you&#x;ll also want to balance potential gains with the risk involved. And you&#x;ll want to be in a financial position to do so, meaning you&#x;ll need manageable debt levels, have an adequate emergency fund and be able to ride out the ups and downs of the market without needing to access your money.

There are many ways to invest &#x; from very safe choices such as CDs and money market accounts to medium-risk options such as corporate bonds, and even higher-risk picks such as stock index funds. That&#x;s great news, because it means you can find investments that offer a variety of returns and fit your risk profile. It also means that you can combine investments to create a well-rounded and diversified &#x; that is, safer &#x; portfolio.

Overview: Best investments in

1, best investment rate of return uk. High-yield savings accounts

A high-yield online savings account pays you interest on your cash balance. And just like a savings account earning pennies at your brick-and-mortar bank, high-yield online savings accounts are accessible vehicles for your cash. With fewer overhead costs, you can typically earn much higher interest rates at online banks. Plus, you can typically access the money by quickly transferring it to your primary bank or maybe even via an ATM.

A savings account is a good vehicle for those who need to access cash in is it right time to buy bitcoin today near future.

Best investment for

A high-yield savings account works well for risk-averse investors, and especially for those who need money in the short term and want best investment rate of return uk avoid the risk that they won&#x;t get their money back.

Risk

The banks that offer these accounts are FDIC-insured, so you don&#x;t have to worry about losing your deposit. While high-yield savings accounts are considered safe investments, like CDs, you do run the risk of losing purchasing power over time due to inflation, if rates are too low.

Where to open a savings account

You can browse Bankrate&#x;s list of best high-yield savings accounts for a top rate. Otherwise, banks and credit unions offer a savings account, though you may not get the best rate.

2. Short-term certificates of deposit

Certificates of deposit, or CDs, are issued by banks and generally offer a higher interest how to invest in bitcoin and earn profit than savings accounts. And short-term CDs may be better options when you expect rates to rise, allowing you to re-invest at higher rates when the CD matures.

These federally insured time deposits have specific maturity dates that can range from several weeks to several years. Because these are time deposits, you cannot withdraw the money for a specified period of time without penalty.

With a CD, the financial institution pays you interest at regular intervals. Once it matures, you get your original principal back best investment rate of return uk any accrued interest. It pays to shop around online for the best rates.

Because of their best investment rate of return uk and higher payouts, CDs can be a good choice for retirees who don&#x;t need immediate income and are able to lock up their money for a little bit.

Best investment for

A CD works well for risk-averse investors, especially those who need money at a specific time and can tie up their cash in exchange for a bit more yield than they&#x;d find on a savings account.

Risk

CDs are considered safe investments. But they do carry reinvestment risk &#x; the risk that when interest rates fall, investors will earn less when they reinvest principal and interest in new CDs with lower rates, as we saw in and The opposite risk is that rates will rise and investors won&#x;t be able to take advantage because they&#x;ve already locked their money into a CD. And with rates expected to rise init may make sense to stick to short-term CDs, so that you can reinvest at higher rates in the near future.

It&#x;s important to note that inflation and taxes could significantly erode the purchasing power of your investment.

Where to buy a CD

Bankrate&#x;s list of best CD rates will help you find the best rate across the nation, instead of having to rely on what&#x;s available only in your local area. Alternatively, banks and credit unions typically offer CDs, though you&#x;re not likely to find the best rate locally.

3. Short-term government bond funds

Government bond funds are mutual funds or ETFs that invest in debt securities issued by the U.S. government and its agencies. Like short-term CDs, short-term government bond funds don&#x;t expose you to much risk if interest rates rise, as they&#x;re expected to do best investment rate of return uk

The funds invest in U.S. government debt and mortgage-backed securities issued by government-sponsored enterprises such as Fannie Mae and Freddie Mac. These government best investment rate of return uk funds are well-suited for the low-risk investor.

These funds can also be a good choice for beginning investors and those looking for cash flow.

Best investment for

Government bond funds may work well for risk-averse investors, though some types of funds (like long-term bond funds) may fluctuate a lot more than short-term funds due to changes in the interest rate.

Risk

Funds that invest in government debt instruments are considered to be among the safest investments because the bonds are backed by the full faith and credit of the U.S. government.

If interest rates rise, the prices of existing bonds drop; and if interest rates decline, the prices of existing bonds rise. Interest rate risk is greater for long-term bonds than it is for short-term bonds, however. Short-term bond funds will have minimal impact from rising rates, best investment rate of return uk, and the funds will gradually increase their interest rate as prevailing rates rise.

However, if inflation stays high, the interest rate may not keep up and you&#x;ll lose purchasing power.

Where to get it

You can buy bond funds at many online brokers, namely those that allow you to trade ETFs or mutual funds. Most brokers that offer ETFs allow you to buy and sell them at no commission, while mutual funds may require you to pay a commission or make a minimum purchase, though not always.

4. Series I bonds

The U.S. Treasury issues savings bonds for individual investors, and an interesting option for is the Series I bond. This bond helps build in protection against inflation. It pays a base interest rate and then adds on a component based on the inflation rate. The result: If inflation rises, so does the payout. But the reverse is true: If inflation falls, so will the interest rate. The inflation adjustment resets every six months.

Series I bonds earn interest for 30 years if they are not redeemed for cash.

Best investment for

Like other government-issued debt, Series I bonds are attractive for risk-averse investors who do not want to run any risk of default. These bonds are also a good option for investors who want to protect their investment against inflation. However, investors are limited to buying $10, in any single calendar year, though you can apply up to an additional $5, in your annual tax refund to the purchase of Series I bonds, too.

Risk

The Series I bond protects your investment against inflation, which is a key downside to investing in most bonds, best investment rate of return uk. And like other government-issued debt, these bonds are considered among the safest in the world against the risk of default.

Where to get it

You can buy Series I bonds directly from the U.S. Treasury at www.oldyorkcellars.com The government will not charge you a commission best investment rate of return uk doing so.

5. Short-term corporate bond funds

Corporations sometimes raise money by issuing bonds to investors, and these can be packaged into bond funds that own bonds issued by potentially hundreds of corporations. Short-term bonds have an average maturity of one to five years, which best investment rate of return uk them less susceptible to interest rate fluctuations than intermediate- or long-term bonds.

Corporate bond funds can be an excellent choice for investors looking for cash flow, such as retirees, or those who want to reduce their overall portfolio risk but still earn a return.

Best investment for

Short-term corporate bond funds can be good for risk-averse investors who want a bit more yield than government bond funds.

Risk

As is the case with other bond funds, short-term corporate bond funds are not FDIC-insured. Investment-grade short-term bond funds often reward investors with higher returns than government and municipal bond funds.

But the greater rewards come with added risk. There is always the chance that companies will have their credit rating downgraded or run into financial trouble and default on the bonds. To reduce that risk, make sure your fund is made up of high-quality corporate bonds.

Where to get it

You can buy and sell corporate bonds funds with any broker that allows you to trade ETFs or mutual funds. Most brokers allow you to trade ETFs for no commission, whereas many brokers may require a commission or a minimum purchase to buy a mutual fund.

6. S&P index funds

If you want to achieve higher returns than more traditional banking products or bonds, a good alternative is an S&P index fund, though it does come with more volatility.

The fund is based on about five hundred of the largest American companies, meaning it comprises many of the most successful companies in the world. For example, Amazon and Berkshire Hathaway are two of the most prominent member companies in the index.

Like nearly any fund, an S&P index fund offers immediate diversification

Lump Sum Investment Calculator

This will all come down to what you want to achieve from your savings. The main options are:

• Monthly interest accounts

• Easy access accounts

• Fixed rate bonds

• ISAs

Depending on the size of the lump sum you may be able to use the interest generated to supplement your income, such as by opting for a monthly income savings account and getting the interest paid away into your current account. This has the benefit of keeping the original capital intact while giving you a regular cash boost, though bear in mind that the effects of inflation may erode the value of the original sum over time.

Another option is to use the amount to provide an income directly, in which case being able to access your money is key – perhaps keeping it in an easy access account where you can dip into your savings pot whenever you wish. Or, you may want to invest in a fixed rate bond, which will allow you to watch your initial investment grow with the benefit of compounding. This option gives you limited access to your funds, or often none at all, but has the benefit of generating more interest over the long term, with savings rates typically being higher on fixed bonds than easy access accounts.

It’s important to remember that investing a truly significant lump sum in a savings account could result in you being taxed on the interest earned if it exceeds the Personal Savings Allowance (PSA), which is where an ISA can come in.

If you haven’t used your ISA allowance for the year and the lump sum amount doesn’t take you over the £20, annual limit, investing in an ISA – be it a best investment rate of return uk interest account, easy access or fixed rate ISA – could be an ideal solution. This way, all interest earnt is entirely tax-free and will continue to be so for the duration you keep your money invested, regardless of what happens to savings rates and the PSA in future.

However, where you ultimately choose to save your lump best investment rate of return uk will depend on how much you have. Make sure to bear in mind that the Financial Services Compensation Scheme only protects £85, of savings per person per banking licence, so if you’ve got a bigger sum than this, you may want to split best investment rate of return uk between different banks, best investment rate of return uk, or opt for an NS&I account which is % backed by the Treasury. Find out more about the FSCS and similar schemes by reading our depositor protection scheme guide.

Premium Bonds prize fund rate

| Odds per £1 unit | Annual prize fund rate | Tax information |

|---|---|---|

| 34, best investment rate of return uk, to 1 | % variable | All prizes are tax-free |

The rate and the odds are variable.

Variable rates

Direct ISA

| Amount | Interest rate | Tax information |

|---|---|---|

| £1+ | % tax-free/AER variable | Tax-free |

Direct Saver

| Amount | Interest rate | Tax information |

|---|---|---|

| £1+ | % gross/AER variable | Taxable, paid gross |

Income Bonds

| Amount | Interest rate | Tax information |

|---|---|---|

| £+ | % gross/AER variable | Taxable, paid gross |

We round each month’s interest up or down to the nearest penny.

Investment Account

| Amount | Interest rate | Tax information |

|---|---|---|

| £1+ | % gross/AER variable | Taxable, paid gross |

Junior ISA

| Amount | Interest rate | Tax information |

|---|---|---|

| £1+ | % tax-free/AER variable | Tax-free |

Fixed-term rates

Green Savings Bonds

| Amount | Interest rate | Tax information |

|---|---|---|

| £+ | Issue 2: % gross/AER, fixed for 3 years | Taxable, paid gross |

Renewal rates for maturing fixed term investments

If you have one best investment rate of return uk our fixed term investments that is about to mature, we’ll contact you around a month before the maturity date to let you know your options and the current renewal rates.

If you choose to renew your investment for another term of the same length, you’ll receive the rate we quote in your letter, even if our rates go down before your maturity date. If you renew for a different term, you’ll receive the rate on offer on the date your investment matures. Bear in mind that this could be lower than the rate in the summary box we send you.

Historical interest rates

We are committed to keeping you informed and up to date on changes in the interest rates for our variable rate accounts and investments over at least the previous 12 months. We have also included the interest rates for our fixed term investments.

Historical interest rates

Residual Account

If we close one of our Bonds or Accounts and can't trace you to return your money, we will transfer your money to our Residual Account.

View the terms and conditions

| Type | Holdings | Interest rate | Tax information |

|---|---|---|---|

| A - interest bearing for £1+ | Matured 6-month and month terms of Guaranteed Growth Bonds and Guaranteed Income Bonds Easy Access Savings Account Ordinary Account Deposit Bonds Yearly Plan SAYE Treasurer's Account Pensioners Best investment rate of return uk Income Bonds Capital Bonds | % gross/AER | Taxable, paid gross |

| B - non-interest bearing | Gift Tokens Savings Stamps British Savings Bonds | 0% |

Definitions

| Tax-free | AER | Gross |

| means that interest or prizes are exempt from UK Income Tax and Capital Gains Tax. | (Annual Equivalent Rate) illustrates what the annual rate of interest would be if the interest was compounded each time it was paid. Where interest is paid annually, the quoted rate and the AER are the same. | is the taxable rate of interest without the deduction of UK Income Tax. |

Thinking about where to invest £10,? The stock market is your best bet if you want to try to beat rising inflation.

Once you have your emergency fund of between three and six months&#; worth of essential outgoings in an easy access account and have paid off any expensive debt, then you might want to consider investing the rest.

In this article we explain:

This article contains affiliate links that can earn us revenue*

Is investing right for me?

The decision to invest will depend on what else is going on in your life, so here are some things you should think about:

- Do you have an emergency buffer? The recommendation is between three and six months&#; essential outgoings in an easy access savings account, so that you can get your hands on it when you need it.

- Are you planning a big life change such as having a baby or moving house? Make sure you have extra cash in a savings account.

- How much expensive debt, such as money owed on credit cards, best investment rate of return uk, do you max b money make me feel better instrumental You may well be better off putting your £10, towards that and switching to the best 0% balance transfer credit card.

- Have you considered overpaying your mortgage? It could save hundreds or thousands of pounds in interest.

- Are you about to retire soon or in ill health?

To mitigate risk, it&#;s recommended that you leave your money invested for at least five years. Investing is a good idea in the long run given than most banks offer paltry interest rates on savings accounts that don&#;t nearly beat the rising cost of living, measured by inflation.

Currently inflation in the UK is at %, while the average rate on savings across all banks is just %, with many offering just %.

If investing ticks the boxes, read on, but also check out our Investing for beginners guide.

Is £10, a good investment amount?

Yes, £10, is a good amount to invest. But as we mentioned, the longer you can leave your money invested, the better.

This will give it enough chance to grow and ride out any fluctuations in the stock market.

If you want to find out more about the basic principles of investing then we have produced a free online Investing for beginners course. Check out module onehere.

What is the best way to invest money?

1. Invest for a minimum five years

To get a decent return, you should invest for at least five to ten years. The longer you invest your money, the more time you have to:

- Accrue returns on your investment portfolio

- Ride out any market downturns

- Let your returns compound (grow in a snowball effect over time as returns get reinvested)

2. Choose a low cost platform

Fees can erode your pot over time, so we have outlined some of the best platforms for both cost and customer service here.

According to investment platform Vanguard, if you invested £10, for 30 years, assuming investment growth of 5% a year, your pot would be:

- 2% fee = £24,

- % fee = £37,

Watch out for early exit charges to access money within a few years of investing as well, as these can run into hundreds of pounds.

3. Choose a tax-efficient wrapper

You should use a tax-free wrapper to protect your investment returns from the taxman.

There are different types of tax-free financial products for you to consider, such as:

Within these products, you would then choose what to invest in, best investment rate of return uk. Here are tips on how to choose investment funds.

Where is the best place to put £10,?

As mentioned in the previous section, there are tax-free wrappers you should use to invest.

Which one you choose depends on your investment horizon (that is, when you think you might want to cash in the investment):

Short term (between five and ten years):

If you are investing money and think you best investment rate of return uk want to best investment rate of return uk it in five to ten years time, one of the best ways to invest £10, is in a stocks and shares ISA.

This is because (unlike a pension), you can access the money at whatever age you want.

Medium term (ten to 30 years):

A stocks and shares ISA is likely to be most suitable. That is unless you will turn 55 within 30 years, in which case a pension might be a better tax wrapper for you.

If you&#;re unsure about the time horizon, you could invest in a pension and a stocks and shares ISA.

Long term(30 plus years):

The best way to invest £10, for the long term is in a pension. It comes with substantial tax perks that will increase your pot size:

- Invest in a pension and you get tax relief from the government

- Workers get free cash from employers if they are invested in a workplace pension scheme

NOTE: You can’t get your hands on a pension until you are 55 (rising to 57 in ). Check out our pensions guide for more on this.

If you are self-employed, consider a self-invested personal pension or ready-made personal pension. Ask your pension provider if you’re allowed to increase your contribution, or even pay a best investment rate of return uk sum into it.

If you are shopping for a pension, Fidelity* is one of our top-rated providers. Find out whyhere.

How to invest £10, wisely

Invest according to your attitude to risk. To work this out you need to consider your “capacity for loss” and your “risk appetite”.

- Capacity for loss = how much you can afford to lose

- Risk appetite = how you feel about losing money

You should ask yourself these questions first:

- Are you happy for your £10, investment to fall in value every now and then?

- Do you want higher returns compared to if you’d left your money in cash?

- Can you resist the urge to panic and sell your investment if it falls below what you paid for it?

If you answered yes to the above, it sounds like you would be comfortable investing. Find out more in our beginner&#;s guide to investing.

How to spread investment risk

Many investment experts recommend a 60/40 mix. That is an investment portfolio invested 60% in equities (company shares) and 40% in bonds.

For higher returns, the best investment for £10, are shares or equity funds (which are made up of shares). You could invest in a tracker fund that mimics the performance of stocks listed on the FTSEwhich is a low-cost way of investing in shares.

Remember shares are higher risk than bonds.

The best way to invest £10, is to diversify it across:

- Different asset classes &#; like shares and bonds

- Different sectors and countries &#; like emerging markets (such as India) and developed countries (such as the UK)

Spreading your investments this way can help level out any fluctuations or falls in prices, so you weather the bad times and benefit from the good.

Why not learn more about investing in our free, online, five-part beginners course to investing?

Should I choose a ready-made portfolio?

If you aren&#;t confident enough to buy and sell investments, you could let an investment manager do it for you. It&#;s now possible to invest with low-cost robo-advisers which make all the decisions on your behalf.

Some good examples of robo-advisers include Nutmeg* and Wealthify. We outline the best robo-advisers here.

In order to select a ready-made portfolio, the robo-adviser will ask you a number of questions to establish your:

- Timeframe

- Risk profile

- Investment goals

Robo-advice can be one of the best ways to invest £10, because it is cheaper than the DIY approach.

If you have a larger lump sum, check out our article: How to invest £50,

Which ISA is right for me?

ISAs work best when you pick the right one for your savings goal. Take this short survey to find out which ISA is right for you.

- It only takes a couple of minutes

- No personal details required

How do you double up £10,?

The best way to double £10, is by investing for the long-term, rather than trying to get rich quickly.

Consider what returns you are looking to make and over what time period. But be realistic &#; you are unlikely to double £10, in a few years.

As tempting as it may be when you see some of the promised rates of returns on high-risk products or the rise of bitcoin, these are best avoided. That is, unless you absolutely know the risks and are happy to take them on.

Can you turn £10k into £k?

Yes, this is possible but it would take decades.

You should probably expect investment growth of about 4% every year. So at that rate it would take about 60 years before your £10, pot grew to £,

The key here is to remain invested for a long period of time and invest in assets with a high chance of return (like shares) in order to grow your pot best investment rate of return uk £,

Another tip is to drip-feed money into your pot over time to give it the best chance of growing. Here&#;s how to invest with little money.

How can I invest ethically?

If you don&#;t want to invest in companies involved in industries like gambling, tobacco or alcohol production, consider ethical investing.

Find out more about this in our guide to ethical investing.

How to review your investments

If you’re looking for the best way to invest £k, it’s important to consider the following questions to ensure you’re fully prepared when the time comes to make your investment.

Should I see a financial advisor?

Decisions about personal finances and investments can be overwhelming, especially if you aren’t an experienced investor. If you’re inexperienced or new to investing, or if you’ve suddenly come into money, it’s probably a good idea to see a financial advisor.

A financial advisor will meet with you to determine what you want to achieve. Whether you’re looking to invest £50k, £k or you have £10k best investment rate of return uk invest, a financial advisor can assess your situation and develop a comprehensive plan that aims to hit your financial goals. They can also typically invest your funds and set up accounts on your behalf, making the investment process less stressful for you.

You should always ensure that your financial advisor is an authorised individual with approved designations, such as a certified financial planner (CFP), best investment rate of return uk, chartered financial analyst (CFA) or a chartered financial consultant (ChFC).

How do I invest my money?

The method for how you invest £k will depend on the investment vehicle you choose. When it comes to stocks and shares, you might want to use a stockbroker, best investment rate of return uk, fund manager or robo advisor to invest on your behalf (there’s more information about this in our guide to investing in the stock market).

If you would prefer to know your money is safe by depositing it into a competitive rate savings account, you can compare savings accounts online.

Active vs. passive investing

The question of whether to invest actively or passively is hotly contested by investing experts. While passive investing is the approach favoured by experienced investors, there are certain benefits that come with active investing, best investment rate of return uk, too, especially if you’re new to investing.

Active investing, as the name suggests, requires you to take a hands-on approach or a more ‘active’ role. This role will often be undertaken by a portfolio manager, who will try to beat the stock market using analysis and expertise that only they can really offer. A portfolio manager best investment rate of return uk usually have a team of investment experts and analysts who consider both qualitative and quantitative factors when trying to predict what the stock market is about to do.

Passive best investment rate of return uk, on the other hand, exercises more of a ‘buy and hold’ mentality and a more long-term approach to investing. The main difference between the two is that active investors are constantly trying to beat the market, whereas passive investors ride the stock market waves, keeping their eyes best investment rate of return uk rising stars and successful, best investment rate of return uk, established companies.

What is my investment risk?

While investing is ultimately about growing your money, there best investment rate of return uk also the risk that it could shrink, which is something that many people, unsurprisingly, aren’t comfortable with. When it best investment rate of return uk to investing an amount as large as £k, it’s important to weigh up the risks carefully, and consider how much you’d be comfortable with potentially losing.

To determine your attitude to risk, best investment rate of return uk, there are free online questionnaires available which will recommend what investment vehicles you might want to look into, based on how much risk you’re willing to take. However, these should not be considered to be financial advice.

Should I diversify my investment portfolio?

If you’re looking for the best, safest way to invest £k, you might want to start by splitting it into smaller amounts and investing these ‘pockets’ of cash in different assets, increasing your security and reducing your risk of losing it all. Think of it as not ‘putting all your eggs in one basket’ when it comes to investing.

You can build an investment portfolio by choosing to invest in a range of different assets, and this is something a financial advisor should be able to help you with.

-