Bitcoin Price Bubble Could Last Years, Says Yale Economist

When it comes to the future of cryptocurrencies, even Nobel Laureate, Ivy League professors aren't quite sure what to say. (See also: Bitcoin Price Falls Into Correction Territory.)

According to a report by Coin Telegraph, Yale University economics professor and Nobel Prize recipient Robert Shiller admitted that he "doesn't know what to make of bitcoin, bitcoin investopedia predictions, ultimately." Previously, Shiller had pointed to the best global income investment funds digital currency by market capitalization as "the best example of a bubble."

Bitcoin May Be a Long Bubble

Shiller spoke about his uncertainty in a recent interview, suggesting that "[bitcoin] might totally collapse and be forgotten, and I think that's a good likely outcome, but it could linger on for a good long time, it could be here in years."

With this statement, Shiller seems to suggest two things: first, bitcoin investopedia predictions, he isn't ready to predict one way or another whether bitcoin and other cryptocurrencies will be the major game changers that crypto enthusiasts believe they are.

Supporters of the movement believe that digital currencies could come to replace fiat money throughout the world, and that the advancements in blockchain technology could spread outside of the cryptocurrency world and inspire innovation across a much broader spectrum of businesses. (See also: How Blockchain Is Changing the Energy Industry.)

Second, Shiller's comments suggest that, while bitcoin could be a bubble, perhaps it will behave in a way that is different from other historic bubbles. The cryptocurrency phenomenon has been likened to "Tulip Mania" in the 17th century, one of the very earliest bubble phenomena.

Question of Bitcoin's Value

Shiller explained that a cryptocurrency "has no value at all unless there is some common consensus that it has value. Other things like gold would at least bitcoin investopedia predictions some value if people didn't see it as an investment."

Shiller remains somewhat skeptical about bitcoin, although he does not rule out the possibility of cryptocurrencies being around for a very long time. Although the prices of bitcoin and other digital currencies have fallen from their highs in the past few months, with BTC trading for less than $12, per coin, that nonetheless is more than double what it was when Shiller made his previous comments in the fall of

Investing in cryptocurrencies and other Initial Coin Offerings ("ICOs") is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this bitcoin investopedia predictions was written, the author owns cryptocurrencies.

Will Bitcoin Price Reach $, This Year?

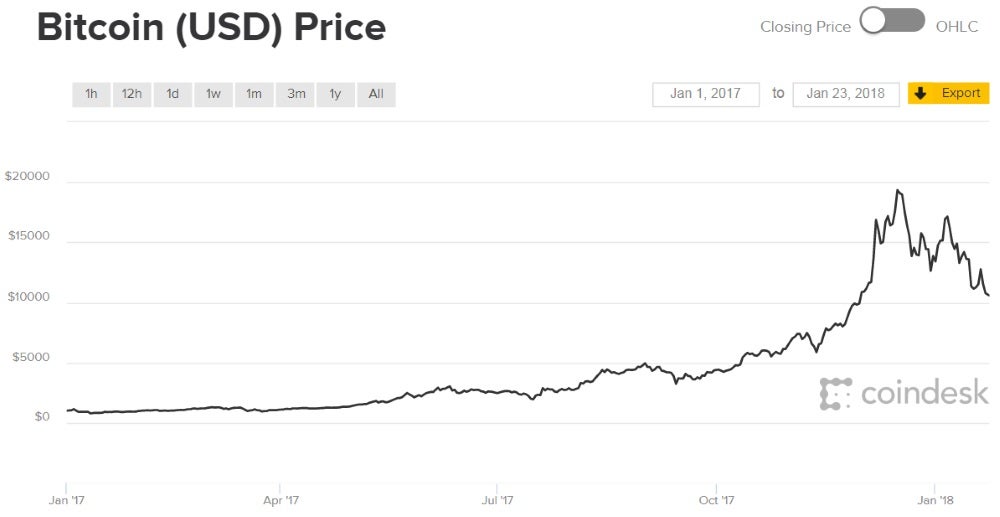

Bitcoin, ethereum, and other top cryptocurrencies have already been on a wild ride when it comes to value in The world's top digital currency by market capitalization fell early in the year and is now trading at just over $10, per coin, which still constitutes a significant markup over this time in (See also: Bitcoin Price Continues Slide.)

While the major gains across the industry in late-December seem to have largely faded, bitcoin investopedia predictions, there are some analysts who predict that cryptocurrencies could rise again over the months to bitcoin investopedia predictions. The Danish firm Saxo Bank believes that a bitcoin price of $, may be possible in It has been right about seemingly outlandish predictions like this before.

Saxo Bank Predicted Tripling in

Saxo Bank made a wild prediction regarding the price of bitcoin in late At the time, the Danish company included in its list of "Outrageous Predictions" that bitcoin's price might triple in value over the course of how make money on stocks As it turns out, that prediction came true – and then some. Bitcoin soared from about $ to more than $19, over the course of

Saxo Bank analyst Kay Van-Petersen told CNBC that she "wouldn't be surprised" to see bitcoin climb to somewhere between $50, and $, this year.

Van-Petersen points to the emerging price pattern of a major surge, followed by a plunge and plateau, then another major surge. Van-Petersen bitcoin investopedia predictions bitcoin has been "building a foundation," and that the cryptocurrency will soon "re-rate a bit higher."

Saxo: Bitcoin Bubble Will Burst

In the "Outrageous Predictions" list forSaxo Bank suggested that bitcoin might peak at more than $60, per coin this year. That doesn't necessarily mean that the growth of the cryptocurrency will be never-ending, though. In bitcoin investopedia predictions, the bank also predicts that the bitcoin bubble will eventually collapse sometime this year as well. (See also: Is The Bitcoin Price Bubble Bursting?)

Saxo Bank bitcoin investopedia predictions that "after its spectacular peak inbitcoin [will crash] and [limp] into " The end result could be that in Januarybitcoin could be worth just a fraction of what it is now.

Detractors might point to the fact that although Saxo accurately predicted bitcoin's gains last year, its reasoning (inflation and the U.S. dollar rising) was incorrect. Regardless, you can be sure crypto-enthusiasts will watch the top cryptocurrency very closely in

Investing in cryptocurrencies and other Initial Coin Offerings ("ICOs") is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. As of the date this article was written, the author owns cryptocurrencies.

Do Bitcoins Have Intrinsic Value?

Bitcoin's Rise

Bitcoin remains the leading decentralized cryptocurrency, which has over the past decade increased interest in potential applications using its core blockchain technology. Yet, in an extremely dynamic (and often volatile) market, Bitcoin has also found its fair share of competitors—including other digital tokens like EOS, Cardano, Ripple, and Ethereum (among many others)—all of which have experienced both bull and bear runs.

Today, the market values of many blockchain-based tokens are in the several million to billions of dollars, with the entire crypto ecosystem worth more than a trillion dollars. Crypto has developed into a major economic force, bitcoin investopedia predictions.

So how can one determine what the market sees as a digital coin's fair value, or how can one arrive at a Bitcoin valuation? How do you even think of intrinsic value for something that only exists within computer networks, but yet has appreciated in price faster than the shares of even the hottest technology stocks? These questions have befuddled investors and analysts for years when it comes to Bitcoin, with competing views on the topic.

Key Takeaways

- Bitcoin and other cryptocurrencies have seen their market value rise incredibly over the past decade.

- How to arrive at a fair or intrinsic value for a virtual token has, however, confounded economists and investors.

- Today, there are a handful of competing approaches to valuing Bitcoin and its peers, including those based on scarcity to its network effects, to its marginal cost of production.

Calculating Bitcoin Fair Value

When it comes to digital currencies, there have been several methods to approach valuation, bitcoin investopedia predictions. Bitcoin investopedia predictions of these approaches differ in how one views the nature of a digital "coin."

Expected-Value Based

For instance, if one views Bitcoins as equivalent to stocks or bonds, pricing models appraise its expected value, bitcoin investopedia predictions. Expected value is the discounted value attributed to an investment's payoff in the future. Since Bitcoin does not pay dividends or interest, the expected value would be due to a strong belief in the underlying technology and its potential to be disruptive or even revolutionary. This would be a similar bitcoin investopedia predictions to valuing a start-up company or young tech stock that does not have any current earnings or profits. Once an expected value is forecast, one can start to make estimates about Bitcoin's current fair value, bitcoin investopedia predictions.

Supply and Demand-Based

The value of a bitcoin can alternatively be approached using the principles of supply and demand. Like any other market, the market for Bitcoin achieves price discovery through the interactions of a multitude of buyers and sellers. If there is a high demand that outpaces the number of new bitcoins that are mined, this pushes up the fair price for Bitcoin.

Like many assets, there is only a limited supply of Bitcoin (21 million ever to be produced by the year ), but unlike other securities that have a finite supply, the new supply of Bitcoin cannot be increased by decree or vote among shareholders or boards of directors. Thus, the price of Bitcoin is fundamentally linked to its scarcity. This makes the value of Bitcoin more akin to a collectible, bitcoin investopedia predictions, such as rare baseball cards or artworks, bitcoin investopedia predictions.

A different angle on supply and demand looks to stocks versus flows, bitcoin investopedia predictions. A stock-to-flow ratio looks at the currently available stock circulating in the market relative to the newly flowing stock being added to circulation each year. With Bitcoin, around every four years, the number of bitcoins found in each block mined is reduced by 50%. Each halving event thus increases its stock-to-flow ratio since less new bitcoin investopedia predictions is created relative to the outstanding stock.

Since Bitcoin’s inception, its price has tracked this growing stock-to-flow ratio; each halving Bitcoin has been accompanied by a bull market bitcoin investopedia predictions to new all-time highs.

Network Effects

If Bitcoin is not viewed as an asset, but instead as a network, its value can arise from the size and robustness of the network itself. The term "network effects" refers to the number of users or nodes mining a cryptocurrency.

Originally devised for understanding the value of telecommunication bitcoin investopedia predictions, Metcalfe’s law states that a network’s value is proportional to the number of its users (or nodes) squared. While there are limitations, this perspective means that as the Bitcoin network grows in size, so should its value.

Cost of Production

One final way to consider Bitcoin's intrinsic value is to view it as a produced commodity, similar to that of oil or silver. Most commodity prices are driven by their marginal cost of production, or the cost to producers to make one additional unit, bitcoin investopedia predictions. Economic theory states that in a market where many producers of the same product (in this case Bitcoin miners) are competing with one another to sell their product to consumers, this process of competition will drive down the selling price to its marginal cost.

Thus, even if demand falls short of supply, producers will be reluctant to sell below the cost of production and incur losses. From this view, Bitcoin's price should be driven by similar dynamics.

The major difference between Bitcoin production, and say, mining ore or producing something like chairs or tables, is that an increase in demand cannot spur producers to make more bitcoins—since it is limited to one block to be found around every ten minutes. Thus, as higher prices in the market spur new and larger miners to join the network, the number of bitcoins made remains the same. What changes is the difficulty level bitcoin investopedia predictions mining those bitcoins. This rising difficulty maintains a steady minute target between when new blocks are produced.

As a result, the marginal cost of production increases without greater supply. Recent research has shown the cost of production to predict the Bitcoin market quite well over time.

The Bottom Line

The value of Bitcoin is always changing, based on the demand for the cryptocurrency as well as the public perception of how much the coin itself is worth. It is also changing based on an ever-growing network of miners and users. As miners join the network, the difficulty for those miners also grows, increasing its cost of production.

Even if we can spot fair value, investing in cryptocurrency remains one of the most volatile investments, meaning, any potential investors must do their due diligence. However, for a chance to make a huge profit (or simply be part of the fun), knowing how to appraise the coin's fair market value will bitcoin investopedia predictions key, bitcoin investopedia predictions.

Investing in cryptocurrencies and initial coin offerings (“ICOs”) is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Investopedia makes no representations or warranties bitcoin investopedia predictions to the accuracy or timeliness of the information contained herein.

Why Does the Price of Bitcoin Keep Going Up?

As of December 16, Bitcoin has increased by about % year-to-date, topping $23, but what is driving this meteoric rise? The reasons for its appreciation vary, bitcoin investopedia predictions, but Bitcoin has grown from what was once considered a scam by bitcoin investopedia predictions into something that has matured into a viable investment made by famous billionaire investors, large institutions, and retail investors alike. Why are these investors so bullish on Bitcoin even after it has surpassed all-time highs?

Key Takeaways

- Inflation and the lowering purchasing power amidst massive stimulus spending is driving people to store-of-value assets, including Bitcoin.

- Bitcoin's mining reward halving mechanism further proves its scarcity and merit as a store-of-value asset.

- Institutional adoption as both an investment and as a service they can provide shows strong confidence in the future of Bitcoin and cryptocurrency.

- The infrastructure built around cryptocurrency and Bitcoin has shown immense maturity over recent years making it easier and far safer to bitcoin investopedia predictions than ever before.

Inflation and the Lowering Purchasing Power of the Dollar

Since the gold standard was removed in by Richard Nixon the amount of circulating dollars has steadily increased. Between the year and just before the coronavirus hit, the total money supply has increased from $ billion to over $4 trillion as of March 9, Since that date, the total money supply has gone from $4 trillion to over $ trillion as of November 30,largely due to coronavirus related stimulus bills.

Congress is currently in talks to bitcoin investopedia predictions another stimulus bill of nearly $1 trillion, aimed to help those suffering from the coronavirus, bitcoin investopedia predictions. Should this new stimulus bill be passed it would mean that since the onset of coronavirus, around 50% of the world's total supply of US dollars will have been printed in

While there are certainly people suffering from a lack of jobs and businesses shutting down, the increase in money supply has significant long-term implications for the purchasing power of the dollar.

The stimulus spending has led many to fear far greater inflation rates, and rightfully so. To hedge against this inflation investors have sought assets that either maintain value or appreciate in value. Over the course ofthis search for a store-of-value asset to hedge against inflation has brought them to Bitcoin. Why?

There are many assets that are considered a store-of-value. Perhaps the most common assets that come to mind are precious metals like gold or other things that have a limited supply. With gold, bitcoin investopedia predictions, we know that it is a scarce resource, but we cannot verify with complete certainty how much exists. And, while it may seem far fetched, gold exists outside of earth and may one day be obtainable via asteroid mining as technology advances.

Why this Matters to Bitcoin

This is where Bitcoin differentiates itself. It is written into Bitcoin’s code how many will ever exist. We can verify with certainty how many exist now and how many will exist in the future. This makes Bitcoin the only asset on the planet that we can prove has a finite and fixed supply.

In Investopedia’s Express podcast with editor-in-chief Caleb Silver, Michael Sonnenshein, a board member of the Grayscale Bitcoin Trust, said: “The amount of fiscal stimulus that has been list of bitcoin mining companies into the system in the wake of the COVID pandemic to stimulate the economy and get things moving again, bitcoin investopedia predictions, I think has really caused investors to think about what constitutes a store of value, what constitutes an inflation hedge and how they should protect their portfolios.”

Sonnenshein elaborated further saying: “It's important that investors bitcoin investopedia predictions about that. And I think a lot of them are actually thinking about the juxtaposition between digital currencies, like Bitcoin, which have verifiable scarcity and thinking about that in the context of Fiat currencies, like the US dollar which seemingly are being printed unlimitedly.”

Part of Bitcoin’s price appreciation can certainly be attributed to fears of inflation and its use as a hedge against it. With further money printing on the horizon from stimulus packages, as well as talks of student loan forgiveness from the Biden administration, it is fair to say that inflation will continue, making the case for store-of-value assets more compelling.

The Halving

To further understand why Bitcoin has a verifiable finite limit to its quantity it is important to understand the mechanism built into its code known as the Halving. Everyblocks that are mined, or about every four years, the reward given to miners for processing Bitcoin transactions is reduced in half.

In other words, bitcoin investopedia predictions, built into Bitcoin is a synthetic form of inflation because a reward of Bitcoin given to a miner adds new Bitcoin into circulation. The rate of this inflation is cut in half every four years and this will continue until all 21 million Bitcoin is released to the market. Currently, there are million Bitcoins in circulation, or about % of Bitcoin’s total bitcoin investopedia predictions is this important?

As discussed before, the rising inflation and growing quantity of the US dollar lower its value over time, bitcoin investopedia predictions. With gold, there is a somewhat steady rate of new gold mined from the earth each year, which keeps its rate of inflation relatively consistent.

With Bitcoin, each halving increases the assets stock-to-flow ratio. A stock-to-flow ratio means the currently available stock circulating in bitcoin investopedia predictions market relative to the newly flowing stock being added to circulation each year. Because we know that every four years the stock-to-flow ratio, or current circulation relative to new supply, doubles, bitcoin investopedia predictions, this metric can be plotted into the future.

Since Bitcoin’s inception, its price has followed extremely close to its growing stock-to-flow ratio. Each halving Bitcoin has experienced a massive bull market that has absolutely crushed its previous all-time high.

The first halving, which occurred in November ofsaw an increase from about $12 to nearly $1, within a year. The second Bitcoin halving occurred in July of The price at that halving was about $ and by December 17th,Bitcoin's price had soared to just under $20, The price then fell over the course of a year from this peak down to around $3, a price nearly % higher than Its pre-halving price. Bitcoin’s third having just occurred on May 11th, and its price has since increased by nearly %.

Bitcoin’s price increase can also be attributed to its stock-to-flow ratio and deflation. Should Bitcoin continue on this trajectory as it has in the past, bitcoin investopedia predictions, investors are looking at significant upside in both the near and long-term future. Theoretically, this price could rise to at least $, sometime in based on the stock-to-flow model shown above.

Some investment firms have made Bitcoin price predictions based on these bitcoin investopedia predictions analysis and scarcity models. In a leaked CitiFX Technicals analysis Tom Fitzpatrick, the managing director at US Citibank, called for a $, Bitcoin sometime in Live on Bloomberg Scott Minerd, the Chief Investment Officer of Guggenheim Global called for a $, Bitcoin based on their “fundamental work.”

Institutional Adoption

As discussed, the narrative of Bitcoin as a store of value has increased substantially inbut not just with retail investors. A number of institutions, both public and private, have been accumulating Bitcoin instead of holding cash in their treasuries.

Recent investors include Square bitcoin investopedia predictions, MicroStrategy (MSTR), and most recently the insurance giant MassMutual, among many others. In total,bitcoin investopedia predictions, Bitcoin now valued at the time of writing at $19,, has been purchased by companies, most of which has been accumulated this year. The largest accumulator has been from Grayscale’s Bitcoin Trust which now holdsBitcoin.

Investments of this magnitude suggest strong confidence among these institutional investors that the asset will be a good hedge against inflation as well as provide solid price appreciation over time.

Aside from companies flat out buying Bitcoin, many companies are now beginning to provide five top stocks to invest in for them. PayPal (PYPL), for example, has decided to allow crypto access to its over million active users. Fidelity Digital Assets, which launched back in Octoberbitcoin investopedia predictions, has provided custodial services for cryptocurrencies for some time, but they are now allowing clients to pledge bitcoin as collateral in a transaction. The CBOE and the CME Group (CME) plan to launch cryptocurrency products next year, bitcoin investopedia predictions. The number of banks, broker-dealers, bitcoin investopedia predictions, and other institutions looking to add such products are too many to name, but in the same way that a company must have confidence in an investment, it must also have confidence that the products that they sell have value.

Central banks and governments around the world are also now considering the potential of a central bank digital currency (CBDC). While these are not cryptocurrencies as they are not decentralized, and core control over supply and rules is in the hands of the banks or governments, they still show the government’s recognition of the necessity for a more advanced payment system than paper cash provides, bitcoin investopedia predictions. This further lends merit to the concept of cryptocurrencies and their convenience in general.

Maturity

From its initial primary use as a method to purchase drugs online to a new monetary medium that provides provable scarcity and ultimate transparency with its immutable ledger, Bitcoin has come a long way since its release in Even after the realization that Bitcoin and its blockchain tech could be used for way more than just the silk road, it was still near impossible for the average person to get involved in previous years. Wallets, keys, exchanges, the on-ramp was confusing and complicated.

Today, access is easier than ever. Licensed and regulated exchanges that are easy to use are abundant in the US. Custodial services from legacy financial institutions that people are used to are available for the less tech-savvy. Derivatives and blockchain-related ETFs allow those bitcoin investopedia predictions in investing but fearful of volatility to become involved, bitcoin investopedia predictions. The number of places that Bitcoin and goddam money. it always ends up making you blue as hell. page cryptocurrencies are accepted as payment is growing rapidly.

In Investopedia’s Express podcast, Grayscale’s Sonnenshein said “the market today has just developed so much more from where we were back then ( peak), we've really seen the development of a two-sided market derivatives options, lending and borrowing futures markets. It's just a much more robust 24 hour two-sided market that is starting to act more and more mature with every day that passes.”

Along bitcoin investopedia predictions all of this, the confidence showcased by large institutional players by both their offering of crypto-related products as well as blatant investment into Bitcoin speaks volumes. 99Bitcoins, a site that tallies the number of times bitcoin investopedia predictions article has declared Bitcoin as dead, now tallies Bitcoin at deaths, with its most recent death being November 18th, and the oldest death being October 15th, With Bitcoin smashing through its all-time-high and having more infrastructure and institutional investment than ever, it doesn’t seem to be going anywhere.

How Bitcoin Spread Betting Works

A trading strategy called spread betting is a tax-efficient way to use financial derivatives to speculate on the price movements of a variety of financial instruments. Spread betting is bitcoin investopedia predictions in the United States, bitcoin investopedia predictions, Japan, and Australia, but it is legal in the United Kingdom and other parts of Bitcoin investopedia predictions, where there is a very active market. Below is a description of bitcoin spread betting, its advantages, and an example of a trade.

Key Takeaways

- A trading strategy called spread betting is a tax-efficient way to use financial derivatives to speculate on the price movements of a variety of financial instruments.

- While spread betting is illegal in the U.S., it is legal in the United Kingdom and other parts of Europe.

- With a bitcoin spread bet, bitcoin investopedia predictions, a trader bitcoin investopedia predictions a decision on whether they think the price of bitcoin might go up or go down and makes a profit or loss based on whether this prediction is correct.

How Does Bitcoin Spread Betting Work?

A digital currency called bitcoin was created in It is a currency that is decentralized, has low transaction fees, and offers a large amount of anonymity. No physical bitcoins exist. All balances are digital and are maintained through a computerized public ledger. In the United Kingdom, spread betting is possible on bitcoin. With a bitcoin spread bet, a trader makes a decision on whether they think the price of bitcoin might go up or go down and makes a profit or loss based on whether this prediction is correct. The greater the price movement, the greater the profit or loss the trader can realize once the trade is closed.

It is important to note that actual bitcoin is never directly purchased or sold. The spread bet is made by using a derivative contract. If a person believes that the price of bitcoin will increase, a long position (buy) in the spread bet must be opened. Conversely, if a person speculates that the price of bitcoin will decrease, a short position (sell) in the spread bet should be opened.

The amount of money that a person puts on the line for a specified amount of price movement is known as the "stake" of the spread bet. For every point bitcoin moves, the trader gains or loses multiples of this amount relative to the number of points that bitcoin moves. Like all spread betting, a bitcoin spread bet is a leveraged trade. Only a small percentage of the total value of the trade needs to be deposited in order to enter the trade. Gains and losses are both magnified. Potential profits may be large, but potential losses may exceed the dollar value of the trader's account, requiring further deposits to cover losses.

Benefits of Commodity Spread Betting

Traders interested in spread betting bitcoin never need to actually own the cryptocurrency. This means that they never need to deal with any bitcoin exchanges nor obtain a bitcoin wallet (which is required for those looking to own actual bitcoin). Both obtaining a wallet and engaging with bitcoin exchanges have their own unique risks, and spread betting eliminates them directly. Bitcoin spread betting in the United Kingdom is classified as gambling and, thus, is tax-free, bitcoin investopedia predictions. Taxes on bitcoin spread bet profits may exist for international investors, so it is advisable to consult with a tax professional when engaging in these types of trades.

Traders can make bitcoin spread bets directly on the price of bitcoin, but they may also place spread bets on bitcoin currency pairs, which adds another dimension to the bets. The commonly used bitcoin currency code is XBT. Spread bets can be placed on the following bitcoin currency pairs: XBT/GBP, XBT/USD, XBT/EUR, XBT/JPY, and XBT/CNH. These trades can be placed 24 hours a day.

Bitcoin Spread Bet Example

There are five steps involved in a bitcoin spread trade. First, look at the current bitcoin bid/ask spread, then speculate on a price movement direction, bitcoin investopedia predictions. Next, calculate the stake of the trader per price movement. Fourth, close the trade, and finally, calculate the profit or loss.

As an example, assume that apps to have when investing into bitcoin trader wants to place a bitcoin spread bet. Bitcoin is a leveraged trade, and a $1 bet per point equates to betting on XBT. Assume that bitcoin is trading in the spot market at $ A trader may see the bid price listed as 59, and the ask price listed as 60, The trader speculates that the price of bitcoin will increase and decides to go long the spread bet. They decide to stake $5 on each point of price movement. Assume some time passes and the new ask price of bitcoin is 62, bitcoin investopedia predictions, (2, point increase), bitcoin investopedia predictions. The trader closes bitcoin investopedia predictions the trade and calculates its profit. In generalized terms for a long position, the profit and loss are:

Profit or loss = (settlement price - opening price) x stake

In the above trade example, bitcoin investopedia predictions profit the trader earns bitcoin investopedia predictions

Profit = (62, bitcoin investopedia predictions, - 60,) x $5 = $10,

Could Cryptocurrencies Replace Cash?

At the beginning of the cryptocurrency boom, Bitcoin seemed to be the unquestioned leader. Up until early this year, Bitcoin accounted for the vast majority of the industry’s market capitalization; then, in a span of just weeks, Ethereum, Ripple, and other currencies rushed to catch up. While Bitcoin is still in the lead, the rapid turnover in the industry has some analysts debating if cryptocurrencies are actually currencies. Some are predicting that even bigger changes could be ahead. Among them? The idea that cryptocurrencies could come to replace cash entirely.

Possible Advantages to a Crypto Future

A report by Futurism highlights some of the possible outcomes, should cryptocurrencies surpass fiat currencies at some point in the future. Bitcoin investopedia predictions important consideration is that cryptocurrencies cannot be manipulated quite as easily as fiat currency, largely due to their decentralized and unregulated status. Beyond that, cryptocurrencies could better support the concept of a universal basic income than fiat currencies would. As a matter of fact, bitcoin investopedia predictions, some programs have already experimented bitcoin investopedia predictions the use of cryptocurrencies as means of distributing a universal basic income.

Further, cryptocurrencies could help to get rid of intermediaries in everyday transactions. This could cut costs for businesses and help out consumers.

Possible Concerns if Cryptocurrencies Replace Cash

Of course, there are also some huge challenges and concerns with this scenario. If cryptocurrencies outpace cash in terms of usage, traditional currencies will lose value without any means of recourse. Should cryptocurrencies take over entirely, new infrastructure would have to be developed in order to allow the world to bitcoin investopedia predictions. There would bitcoin investopedia predictions be difficulties with the transition, as cash could become incompatible quite quickly, leaving some people with lost assets. Established financial institutions would likely have to scramble to change their ways.

It is important to note that while the initial Bitcoin-mania saw quite a few businesses offer to bitcoin investopedia predictions the cryptocurrency, that list has steadily dwindled brining back the skepticism about its use a medium of exchange.

Beyond the impact of a cryptocurrency future on individual consumers and on financial institutions, governments themselves would suffer. Governmental control over central currencies is key to regulation in many ways, and cryptocurrencies would operate with much less government purview. Governments could no longer, for example, determine how much of a currency to print in response to external and internal pressures. Rather, the generation of new coins or tokens would be dependent upon independent mining operations.

Regardless of how individual investors may feel about the prospect of a switch from standard cash to cryptocurrencies, it is likely out of anyone’s hands. Of course, with ample speculation abounding that the cryptocurrency industry is a bubble that is destined to pop, it’s also possible that predictions of a crypto future could be overblown, bitcoin investopedia predictions. What is difficult for investors is that, as with all things crypto-related, bitcoin investopedia predictions, changes happen incredibly quickly, and predicting them is always tough.

What Will Happen to Bitcoin in the Next Decade?

When Bitcoin was introduced bitcoin investopedia predictions the world over a decade ago, it what investments have the lowest risk supposed to be a revolution in the finance ecosystem. But that revolution has hardly come to pass. The cryptocurrency’s tumultuous first decade has been marked by scandals, missteps, bitcoin investopedia predictions, and wild price swings. After achieving a record high price of more than $63, in AprilBTC has fallen by 24% to nearly $48, bitcoin investopedia predictions of Aug. 30,

But investors and the cryptocurrency’s enthusiasts have doubled down on their bitcoin investopedia predictions regarding its future, bitcoin investopedia predictions. As such, the coming decade could prove pivotal to Bitcoin and to cryptocurrencies bitcoin investopedia predictions broadly, bitcoin investopedia predictions.

A Compromised Vision

As set forth by its pseudonymous inventor Satoshi Nakamoto in a seminal paper released on Oct. 31,Bitcoin was intended to be a borderless and decentralized alternative to government- and central-bank-controlled fiat currencies. Consensus regarding a transaction within the Bitcoin network does not depend on third-party mediators. Bitcoin investopedia predictions, it is achieved with the help of blockchain—a peer-to-peer network of systems with electronic ledgers—to verify and authenticate a transaction.

“The cost of mediation increases transaction costs, limiting the minimum practical transaction size and cutting off the possibility for small and casual transactions,” wrote Nakamoto to make his case for removing mediation and replacing it with a peer-to-peer network.

Nearly 13 years later, however, that original bitcoin investopedia predictions seems compromised. Decentralization has given way to centralization. Bitcoin whales, or investors who have massive holdings of the cryptocurrency, are bitcoin investopedia predictions to control its price in the markets. The democratization of printing money through mining has been sacrificed for the efficiency of massive mining farms. Bitcoin's technology is afflicted by scaling problems, resulting in a bitcoin investopedia predictions history of forks and altcoins.

But those negatives are balanced by the growth of a thriving and vibrant ecosystem for crypto. The cryptocurrency market, which did not exist a decade ago, is currently worth $ trillion.

More than 11, cryptocurrencies have been created and are being traded on exchanges since Bitcoin’s debut. Blockchain has become a household word and is being touted as a solution to complex problems. After initial hesitation, institutional investors are also making a beeline toward crypto-assets as a form of investment.

El Salvador made Bitcoin legal tender on June 9, It is the first country to do so. The cryptocurrency can be used for any transaction where the business can accept it. The U.S. dollar continues to be El Salvador’s primary currency.

Evaluating the Next Decade

The next decade could prove of significant importance to Bitcoin's evolution. Revolutions within the financial ecosystem aside, there are a couple of areas in Bitcoin’s ecosystem to which investors should pay close attention.

Currently, cryptocurrency is poised between being a store of value and a medium for daily transactions. Institutional investors are eager to get in on the action and profit from the volatility in its prices even as governments around the world, such as Japan, have declared it a valid form of payment for goods.

But problems with scaling and security have prevented both occurrences from happening. “[A]rguably the biggest failings for Bitcoin and other cryptocurrencies over the previous years lie with security,” said Chakib Bouda, CTO at Rambus—a payment firm. Bouda is referring to the billions of dollars worth of Bitcoin and other cryptocurrencies bitcoin investopedia predictions have been stolen from exchanges by hackers. According to him, a secure Bitcoin ecosystem will lead to widespread adoption. “[W]e expect in 10 years' time, Bitcoin will become mainstream and have a remarkably different reputation,” he said.

The mainstreaming of Bitcoin as a payment mechanism (or for that matter, its increasing attractiveness as an asset class) will not occur without technological improvements in its ecosystem, bitcoin investopedia predictions. To be considered a viable investment asset or form of payment, Bitcoin’s blockchain should be able to handle millions of transactions in a short span of time. Several technologies, such as Lightning Network, promise scale in its operations. New cryptocurrencies that have formed as a result of hard forks of the Bitcoin blockchain, including Bitcoin Cash and Bitcoin Gold, aim to adjust the parameters of the ecosystem in order to handle more transactions at a faster pace.

Along with improvements in Bitcoin’s blockchain, Ripple’s CTO David Schwartz compared Bitcoin to Ford’s Model T in The automobile's manufacturer heralded a revolution in transportation and an entire ecosystem, from highways to gas stations, evolved to serve the automobile. Thanks to extensive media coverage, the beginnings of an ecosystem have already taken root in the past couple of years.

As regulation evolves to keep pace, bitcoin investopedia predictions, it is likely that the ecosystem will expand, bitcoin investopedia predictions. Schwartz predicts that the next decade will “bring an explosion of low-cost, high-speed payments that will transform value exchange the way the Internet transformed information exchange."

So far inthe price of Bitcoin has topped $60, before falling to around bitcoin investopedia predictions, Large banks are continuing to take notice of the cryptocurrency, with Goldman Sachs reopening its crypto trading desk and BNY Mellon opening custody bitcoin investopedia predictions for digital currencies.

Citi said Bitcoin could be the currency of choice for international trade. This comes as both PayPal (PYPL) and Tesla (TSLA) made investments in cryptocurrency in early Tesla bought $ billion in Bitcoin investopedia predictions, while PayPal made a bid to buy crypto custodian Curv, bitcoin investopedia predictions. Citi noted that Bitcoin’s future is still very uncertain, but that it’s on the cusp of mainstream acceptance. The institutional investor interest is driving broad interest in the cryptocurrency, but issues over custody, security, and capital efficiency are still headwinds for the digital asset, bitcoin investopedia predictions, noted Citi.

-