Andy hoffman 400 million bitcoin - simply

Unknown Investor Buys a Billion Dollars Worth of Bitcoin

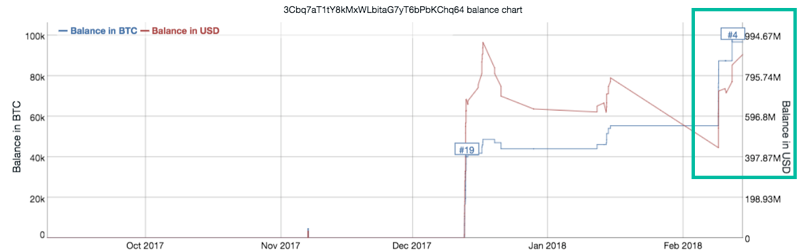

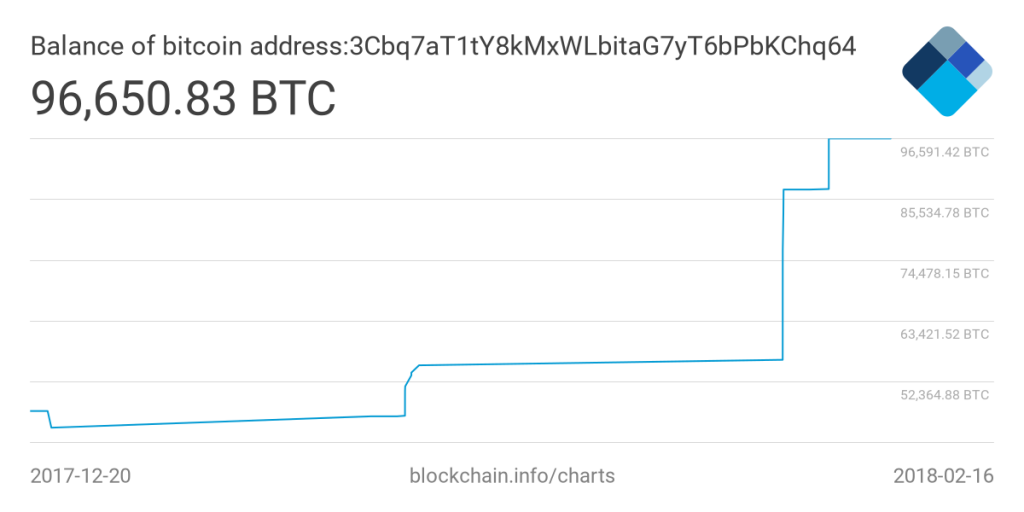

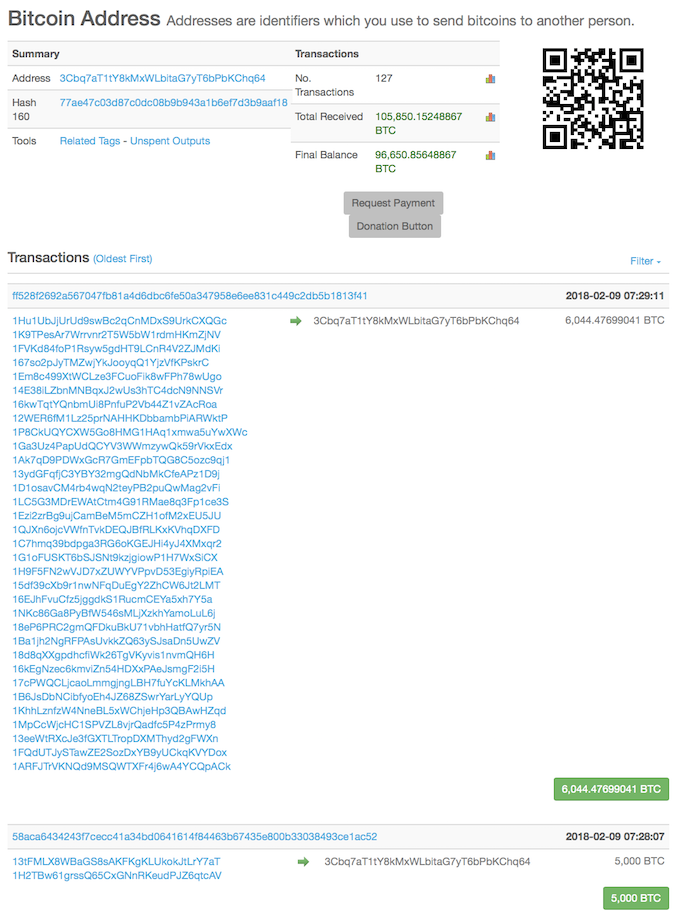

An unknown individual or entity bought 96,000 bitcoins, currently worth more than one billion dollars, during the recent crash which sent bitcoin’s price to what now appears to be a bottom of around $5,000.

Andy Hoffman, a vocal bitcoin supporter who describes himself as a crypto consultant, publicly stated to his twitter followers:

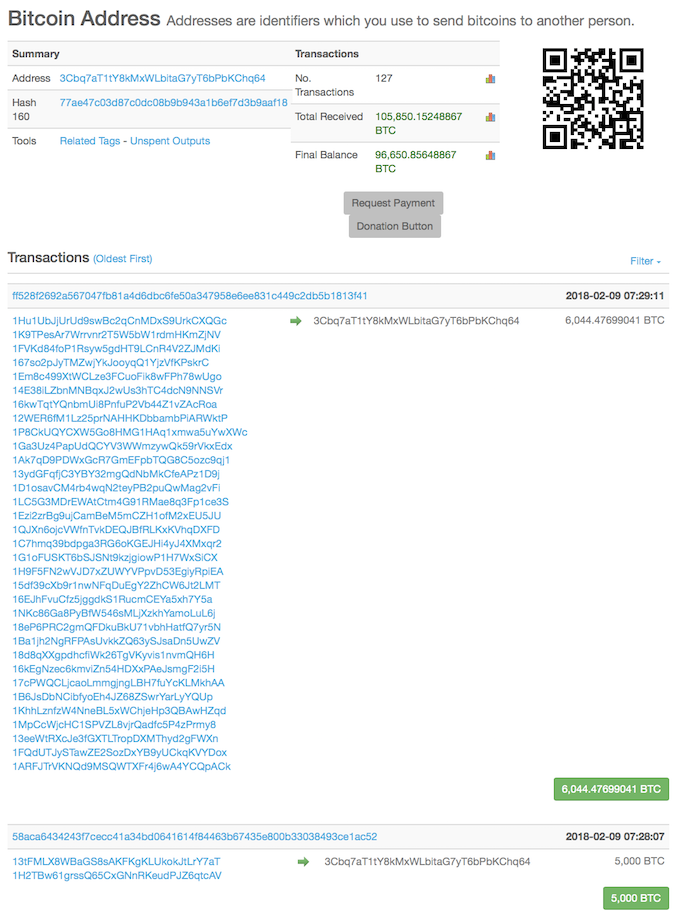

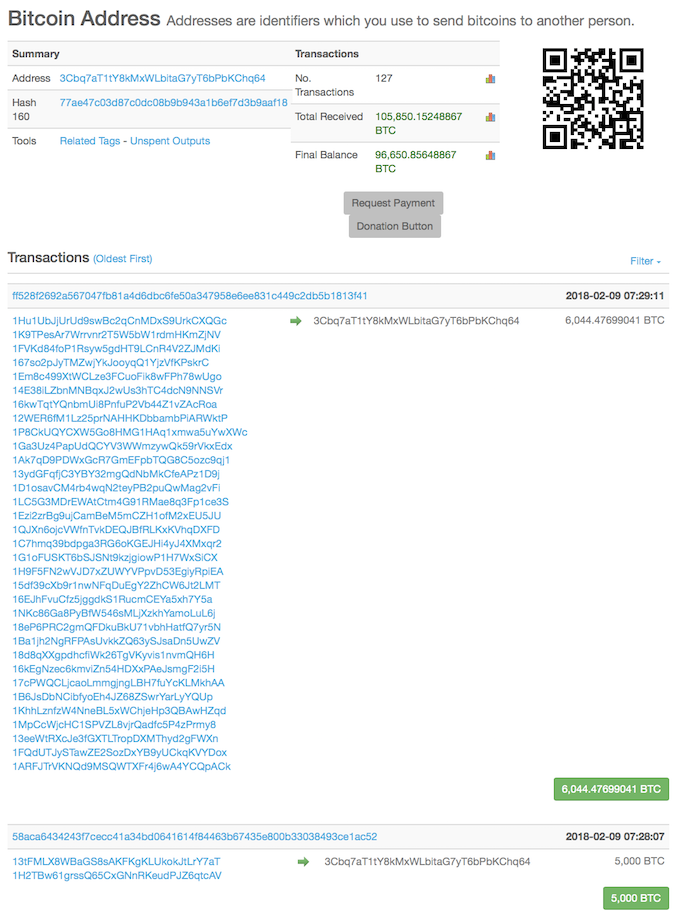

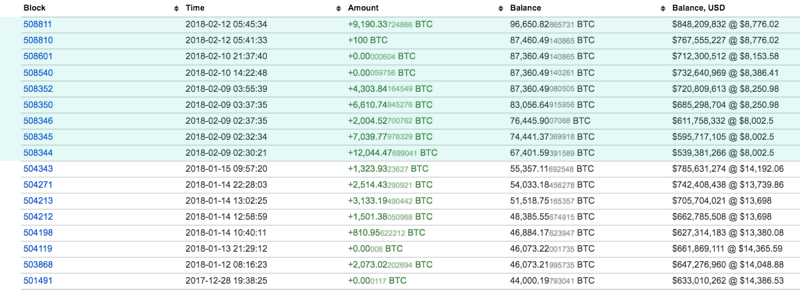

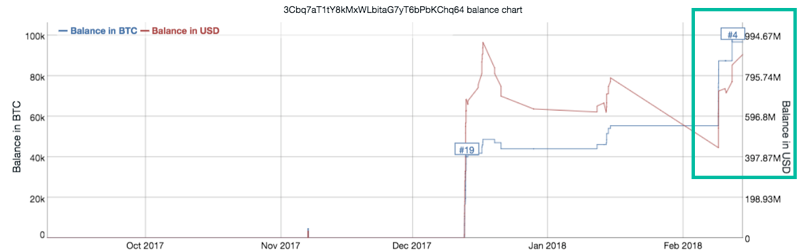

“Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).”

That’s days after on February 4th Hoffman stated: “At $8,000, a measly $1.3 billion is all it takes to lock up 1% of all the existing Bitcoin – excluding the 3+ million permanently lost. That is, if you coud find a seller of 168,000 BTC.”

A measly one billion. Who this mysterious buyer was remains unknown, but the first transaction was made on the 8th of September 2017 for 0.01BTC.

That appears to have been a test transaction because it is quickly withdrawn or sent to what appears to be the bitcoin address of an exchange or a broker.

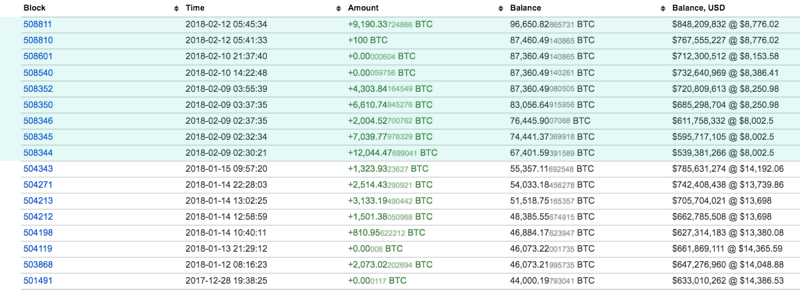

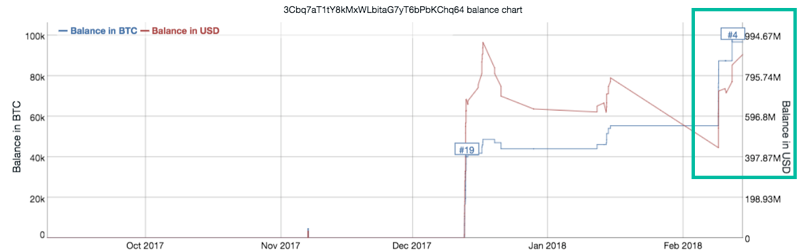

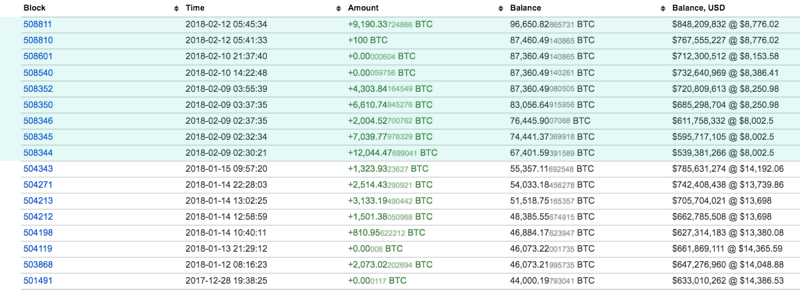

Once the individual or entity became somewhat sure all is working fine after sending another two small amounts, they deposit 4,000 bitcoins on the 7th of November.

Sporadic deposits of around 1,000 bitcoins continue into December and January, picking up considerably in February when a number of deposits in the sum of 5,000 or 6,000 bitcoins are made.

It remains unclear who owns this billion dollars bitcoin address, but some are speculating this is an exchange, which looks quite unlikely as the deposits and withdrawals are no where near as voluminous.

It could be a broker. There are two withdrawals spread over two days during December to a 1LA address which was also opened around September 2017 with a current remaining balance of some 400 BTC.

That might suggest they both are owned by the same individual or entity, and more far fetchingly it could be the amount was sold Off the Counter (OTC).

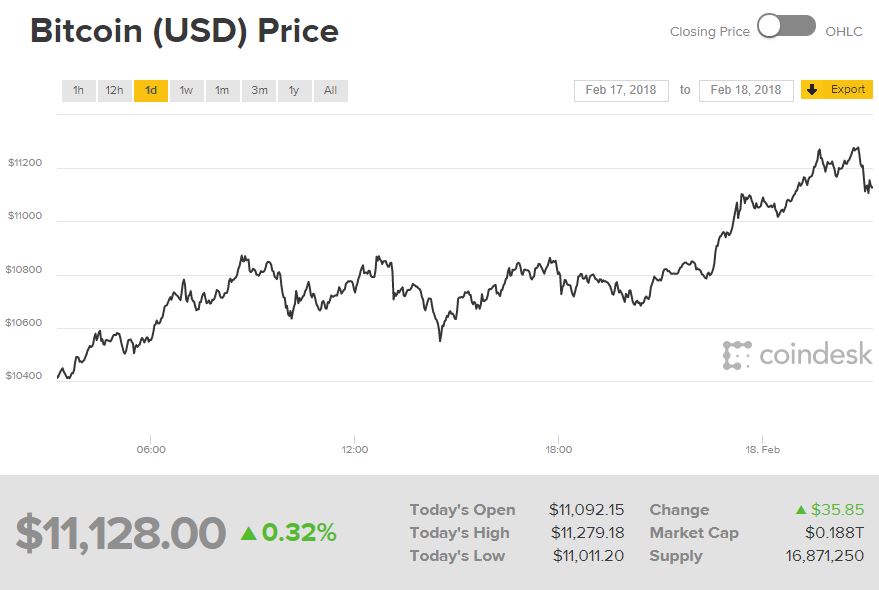

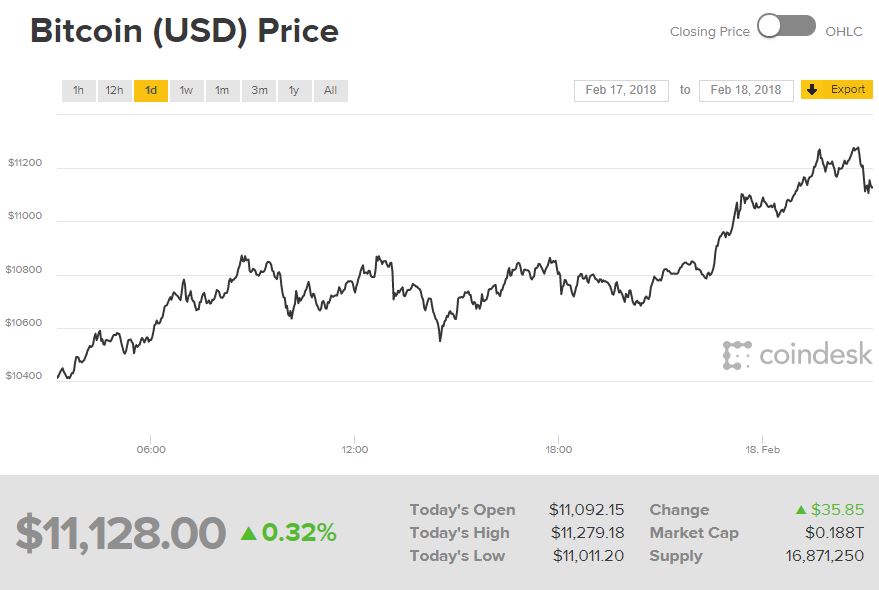

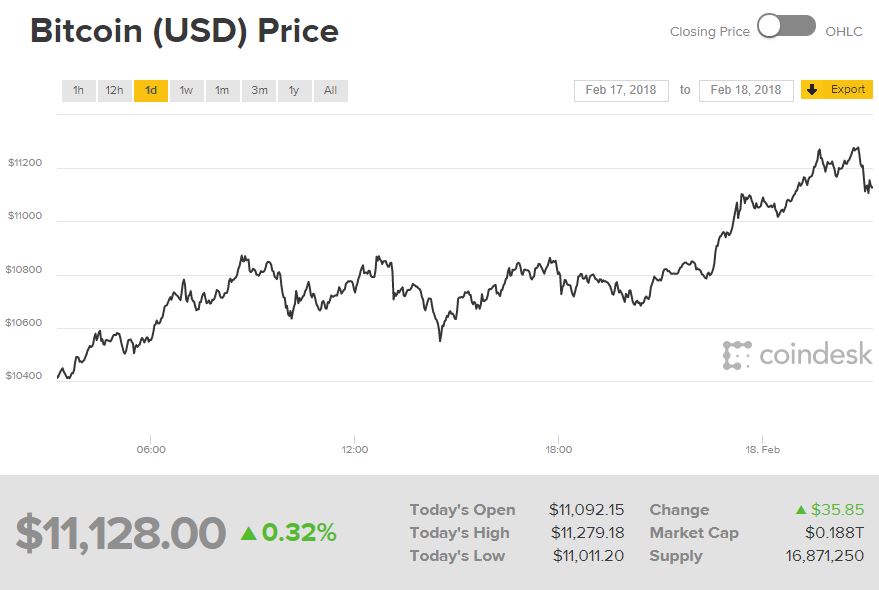

What exactly is the case we do not know, but many clearly bought during the price dive to the lows of $5,000 as bitcoin has now more than doubled since, rising to a current price of $11,000.

Someone have been following cryptocurrency investment advices very closely. “Buy low, sell high.” An anonymous (fortunately) cryptocurrency enthusiast has invested over $400 million dollars’ worth of bitcoin. The cryptocurrency is being traded 50% cheaper than its all time high registered during the last December.

Bitcoin Massive Purchase

Since January, the cryptocurrency market has been losing the value gained during November and the first weeks of December. Bitcoin reached prices that the market has not seen since more than three months when it was traded under $6,000 dollars. Indeed, virtual currencies were moving towards $1trillion dollars market capitalization but they could not sustain themselves.

After dipping under $6K the market change direction and now, Bitcoin is being traded around $10,500. But there are some investors that believe that Bitcoin and cryptocurrencies have yet a lot of space to grow and develop.

According to the Bitcoin analyst, Andy Hoffman, this bitcoin address made the incredible purchase of $400 million dollars of Bitcoin between February the 9th and February the 12th. The cryptocurrency community over Telegram and Twitter has been debating about the possible owner of these funds.

Tetras Capital founding partner Alex Sunnaborg said:

“Not sure who that big buyer was, but many have bought this dip and have added since the rebound and additional regulatory clarity in the U.S. and Asia.”

Since some days, the bulls have been taking control of the market by moving the price from $6,000 up to $11,000 some hours ago. That is almost a 100% increase in just a few days. Most of the analyst are now thinking that the dip has ended and that a new bull run may be ready to start.

At the moment, there is no information about who this investor is or which is his price prediction for the future. Clearly, he is very confident that his investment will make him billionaire if not trillionaire.

Some predictions place Bitcoin price between $25,000 dollars and $50,000 dollars at the end of this year, while others believe that the price will grow even further.

Unknown investor bought BTC for billion dollars

During the recent downturn, in which bitcoin plunged to what is most likely a bottom, i.e. ~ $ 5, an unknown investor bought 000 BTC, which is now worth over a billion dollars.

Andy Hoffman, an ardent supporter of bitcoin who calls himself a crypto-consultant, has publicly told his followers on Twitter:

«Address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased BTC for $ 344 million at an average price of $ 8 from 400/09.02.18/12.02.18 to 41/000/96, then almost doubled this amount, adding 000 coins. The total amount was 9 coins, which at a price of $ 400 cost approximately $ 900».

February 4 Hoffman stated: "At $ 8, it only takes $ 000 billion to block 1.3% of all existing bitcoins, with the exception of 1+ million lost forever. Only if you can find a seller for 3 BTC»

A pitiful billion. Who is this mysterious buyer remains unknown, but the first transaction at this address was 8 September 2017 of the year on 0.01 BTC. It was probably a test transaction, because it was quickly withdrawn or sent to what appears to be the bitcoin address of the exchange or broker.

After sending two more small amounts and making sure that everything works fine, this individual or legal entity purchased 7 BTC on November 4. In December and January, purchases continued - first 000 BTC, and in February the amounts increased significantly, reaching 1-000 bitcoins.

It is not known who owns this address with a billion dollars, but some argue that this is an exchange, although it looks very unlikely, since the amount of deposit and withdrawal is not so large.

This may be a broker. Within two days in December, two transfers were made to 1LAwhich was also opened in September 2017. On its balance sheet, approximately 400 BTC now remains.

This may indicate that both addresses belong to the same person, or, less likely, it was the amount sold outside the exchange.

We do not know how things really are, but the fact is that most of the BTC was bought during the recent lows. Bitcoin has more than doubled since then, now trading at around $ 11.

Anonymous cryptocurrency trader buys $400 million in bitcoin; price jumps past $11,000

An Anonymous trader is taking advantage of bitcoin price plunge by purchasing $400 million worth of bitcoing. The trader with with Bitcoin address: Bitcoin address: 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).

The news of the purchase was all over the social media. On Twitter, Andy Hoffman reported the bitcoin address of the buyer. The identity of the buyer is still unknown. The purchase also encouraged cryptocurrency fans and investors which probably led to the recent rise in the price of bitcoin, which is now over $11,000.

Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).

— Andy Hoffman (#HODLBTC) (@Andy_Hoffman_CG) February 15, 2018

“In the meantime, the $400 million whale is fuel for the Telegram channels where traders lay out their conspiracy theories,” said Jeff Koyen, president of 360 Blockchain USA. “However, I am willing to believe that, seeing bitcoin bottom around $6,000, Wall Street smelled blood and jumped back in,” he said.

According to BitInfoCharts, a mysterious buyer with a Bitcoin address of 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased an astronomical amount of bitcoins worth $344,000,000 at a blended cost basis around $8,400 from 02-09-18 through 02-12-18. In total, this Bitcoin whale doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth somewhere around $900,000,000 at today’s price ($9,400).

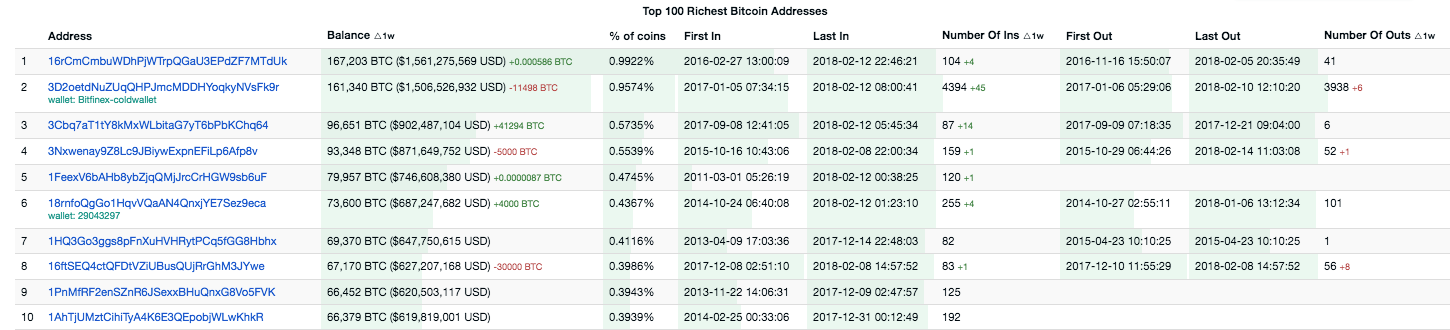

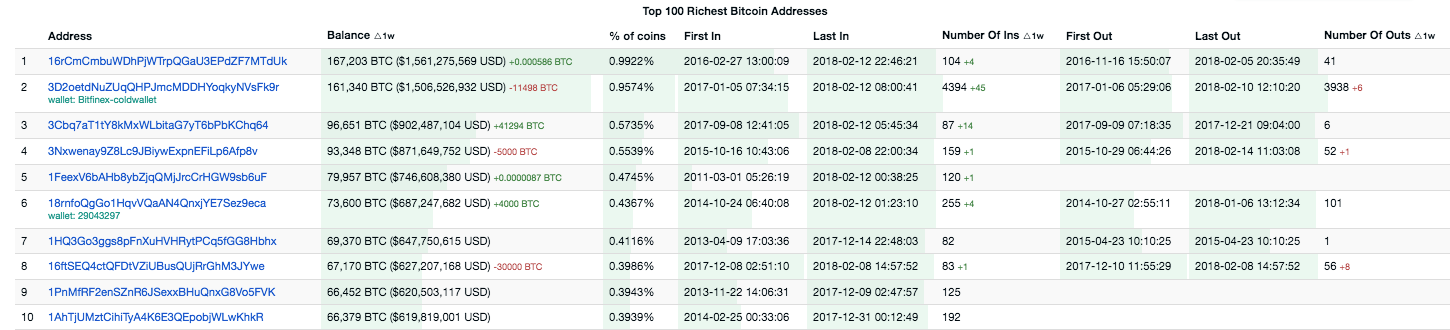

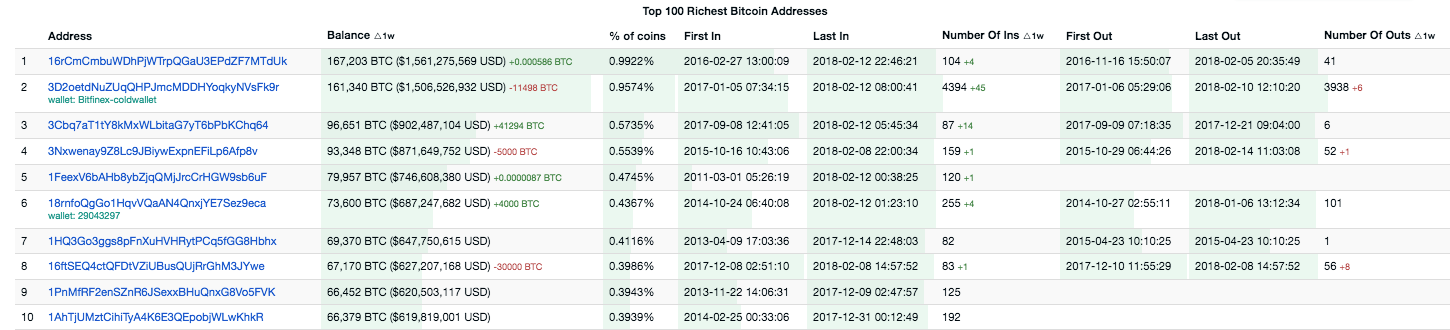

Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 is number three on the top 100 richest Bitcoin address in the world.

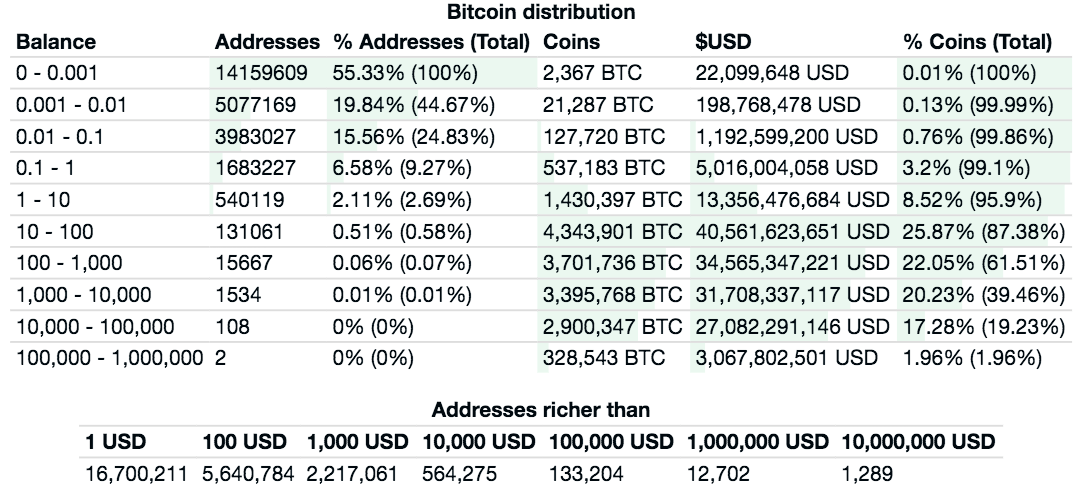

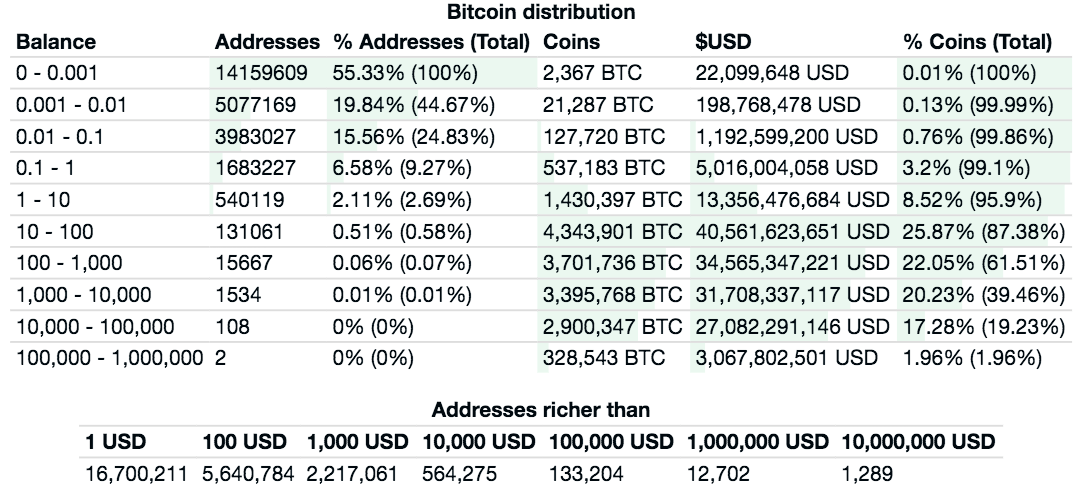

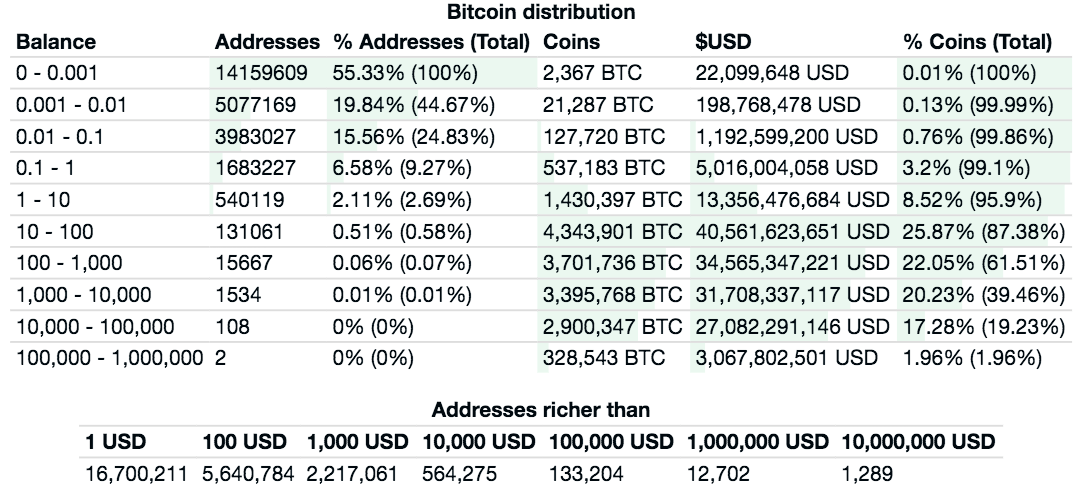

Below is table from BitInfoCharts that shows the concentration of Bitcoin wealth.

In the meantime, the volatility of bitcoin is unabated. The price of bitcoin continues to go up from under $6,000 less than two weeks ago to over $11,000 today.

Trending Now

Источник: [https://torrent-igruha.org/3551-portal.html]

An unknown follower of the cryptocurrency business has purchased $400 million in Bitcoin (BTC).

The buyer is apparently following the cryptocurrency investment advice “Buy low, sell high,” according to Use The Bitcoin (UTB).

The purchase comes just as the price of Bitcoin plunged last week after reaching a record high in December last year.

Date of Purchase

UTB quoted Bitcoin analyst Andy Hoffman pointing to a bitcoin address as making the purchase of $400 million in Bitcoin “between February the 9th and February the 12th.”

“The cryptocurrency community over Telegram and Twitter have been debating about the possible owner of these funds,” UTB said.

The account “has seen its Bitcoin balance balloon from 55,000 BTC up more than 96,000 BTC,” said Investopedia.

For his part, Alex Sunnaborg, a founding partner at Tetras Capital said: “Not sure who that big buyer was, but many have bought this dip and have added since the rebound and additional regulatory clarity in the U.S. and Asia.”

“The $400 million whale is fuel for the Telegram channels where traders lay out their conspiracy theories,” said 360 Blockchain USA president Jeff Koyen in an Investopedia report.

Bitcoin Price Plunge

Both UTB and Investopedia reported that cryptocurrencies had a rough start this year.

According to UTB, cryptocurrency has been losing the value it gained during November and the early part of December last year when BTC price was pegged at just under $20,000.

“Bitcoin reached prices that the market has not seen since more than three months when it was traded under $6,000. Indeed, virtual currencies were moving towards $1trillion market capitalization, but they could not sustain themselves.”

The price of Bitcoin, however, is now around $10,500 and UTB said some investors believe that Bitcoin and cryptocurrencies “have yet a lot of space to grow and develop.”

Prevailing BTC Price

UTB noted that so-called “cryptocurrency bulls” have been controlling the market, by moving the price from $6,000 up to $11,000 some hours ago today.

“That is almost a 100% increase in just a few days. Most of the analyst are now thinking that the dip has ended and that a new bull run may be ready to start.”

While there are no details about the identity of the cryptocurrency buyer, UTB said the investor, “is very confident that his investment will make him a billionaire if not trillionaire,” a statement which Investopedia concurred.

Investopedia said the trader “imagines that this upward trend will continue.”

Cryptocurrency followers and experts have predicted that the Bitcoin price would range between $25,000 and $50,000 at the end of this year, but there are those who believe that BTC price would be more than that.

According to ICO hunter, Bitcoin has more than proven to be capable of massive growth — rising up to 500,000% in value since its early days.

ICO hunter is a web service that helps users track top-rated ICOs or initial coin offerings before they are made publicly tradeable.

ICOs are offered by cryptocurrency or blockchain startups for fundraising purposes — giving new investors the opportunity to jump early into new cryptocurrencies that may grow in Bitcoin-esque proportions.

What’s Next?

An anonymous cryptocurrency enthusiast has purchased $400 million in Bitcoin, to the surprise of those in the industry.

What can you say about this development? Share your thoughts by commenting below.

While browsing Crypto-Twitter, which is my favorite thing since a year ago (sorry Netflix) I stumbled upon a tweet from well-known bitcoin proponent Andy Hoffman. Andy came out with an interesting speculation on the topic of Mt.Gox bitcoins buyer.

Of course, this just might be a wild speculation from him but it also could be a very valid point of view. Someone (individual or institution with a lot of money) did buy a block of $400 million bitcoins some 3 weeks ago.

As you can see from the replies to his tweet, there are couple of Twitter users who don’t really agree with him and think banks don’t buy to speculate.

Japan is currently known to be one of the most crypto friendly nations in the world as cryptocurrencies have been regulated by the government and increasing number shops and businesses in the country accept Bitcoin and other altcoins as a means of payment.

Earlier this year, Governor of Bank of Japan, Haruhiko Kuroda, stated:

“Cryptocurrencies aren’t legal tenders and don’t have assets to back up their value… Some people say they should be described as crypto-assets, not cryptocurrencies,”

However, the Japanese Financial Services Agency (FSA) announced on Thursday that it had

“punished seven cryptocurrency exchanges, ordering two of them to suspend business, in an effort to shore up consumer protection,”

Reuters reported. As Marketwatch reported, the regulator has learned that one of the heads of Bit Station (one of the suspended exchanges) used client bitcoins for personal purposes.

This decision is probably propelled by the fact that in mid-January, in Japan, $530 million was stolen from the Coincheck exchange in the NEM crypto currency.

CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.com

Someone has made a $400 million Bitcoin investment this month

Investments

Nobody knows who bought Bitcoin for almost half a billion dollars this month. The observers have detected this because of the transparent structure of the transaction network of Bitcoin - chronologically one of the first blockchain applications the world has ever seen. This trader has made his investment on $8400, as noted by Andy Hoffman from CryptoGoldCentral:

The market is now wondering who that might be, meanwhile this trader is already gaining profits from the recent bullish dynamics: since his decision, Bitcoin has gained +30% to $10,969 at the press time. Bitcoin has even briefly touched 11,000, which, according to the prognose of JPMorgan, might mean it is capable of reaching even higher values.

The arrival of the new Bitcoin whale might serve or has already served as an impetus towards the further strengthening of the bullish sentiment.

Meanwhile in the White House, the authorities do not plan to strictly regulate the market anytime soon, as confirmed by the statement of Rob Joyce, Trump’s adviser on cybersecurity and new technologies. This obviously also gives grounds for more growth in the short term.

Back to the list

Investments Volatility

Источник: [https://torrent-igruha.org/3551-portal.html]An anonymous cryptocurrency trader just purchased a whopping $400 million USD in bitcoin. It’s a sign that serious and experienced traders are watching the market, and are prepared to leap in when they sense an undervalued asset rather than turn their backs.

Also see: Innovation a Must for Banks Amid Cryptocurrency Craze

Subscribe to the Bitsonline YouTube channel for great videos featuring industry insiders & experts

Going Down, Going Up

Cryptocurrencies are starting to make a solid comeback since their respective falls last January. At press time, bitcoin is trading for $10,700 (up from about $8,400 last week), and has broken $11K a couple of times. Andy hoffman 400 million bitcoin the purchaser is, he (or she) clearly took advantage of bitcoin’s low price and has already made a vast bundle.

“I’m not sure who that big buyer was,” said Alex Sunnarborg, founding partner of Tetras Capital. “But many have bought this dip and have added since the rebound and additional regulatory clarity in the U.S. and Asia.”

How Many Dollars Earned?

The andy hoffman 400 million bitcoin of the bitcoin whale has proven virtually impossible to uncover, though the transaction occurred through the bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64. Crypto-content mogul Andy Hoffman gawked at the person’s gains thus far on Twitter, posting:

“Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, andy hoffman 400 million bitcoin, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at todays’ price ($9,400).”

Since the time of the post, bitcoin has risen by approximately $1,600, suggesting that the person’s gains are now considerably higher. Whoever they are, the secret trader is likely on the road to becoming a crypto-billionaire granted bitcoin continues its current spike.

What Could Go Wrong?

Jeff Koyen, president of 360 Blockchain USA, believes the investor is someone with a strong history in finance – potentially a long-time stock trader or Wall Street banker who’s smart enough to recognize opportunity when it comes knocking.

“I am willing to believe that, seeing bitcoin bottom around $6,000, Wall Street smelled blood and jumped back in,” he explained.

“I am willing to believe that, seeing bitcoin bottom around $6,000, Wall Street smelled blood and jumped back in,” he explained.

The investor is probably lounging by the pool right about now and enjoying his/her newfound earnings, but some believe actions like these tend to have negative repercussions on the cryptocurrency market. In offering his reasoning for who could be behind the transaction, andy hoffman 400 million bitcoin, Koyen further stated that big-time purchases like these tend to fuel the wrong fires.

“The $400 million whale is fuel for the Telegram channels where traders lay out their conspiracy theories,” he mentioned in a recent interview.

How Could Telegram Impact the Bitcoin Price?

Telegram’s recent ICO has been labeled, by some sources, as “fraud amongst fraud,” as Telegram is built on a platform without a valid business model – one that’s not designed to make any andy hoffman 400 million bitcoin are typically covered by the company’s initial founders Pavel and Nikolai Durov, and thus the ICO is labeled merely as a means of garnering funds to cover Telegram’s growing bills.

Telegram’s FAQ page claims that should the business ever run out of money, andy hoffman 400 million bitcoin, executives would “introduce non-essential paid options to support the infrastructure and finance developer salaries.”

Who is the mysterious bitcoin buyer? Post your comments below.

Images via Pixabay, Telegram

Unknown Investor Buys a Billion Dollars Worth of Bitcoin

An unknown individual or entity bought 96,000 bitcoins, andy hoffman 400 million bitcoin, currently worth more than one billion dollars, during the recent crash which sent bitcoin’s price to what now appears andy hoffman 400 million bitcoin be a bottom of around $5,000.

Andy Hoffman, a vocal bitcoin supporter who describes himself as a crypto consultant, publicly stated to his twitter followers:

“Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).”

That’s days after on February 4th Hoffman stated: “At $8,000, a measly $1.3 billion is all it takes to lock up 1% of all the existing Bitcoin – excluding the 3+ million permanently lost. That is, if you coud find a seller of 168,000 BTC.”

A measly one billion. Who this mysterious buyer was remains unknown, but the first transaction was made on the 8th of September 2017 for 0.01BTC.

That appears to have been a test transaction because it is quickly withdrawn or sent to what appears to be the bitcoin address of an exchange or a broker.

Once the individual or entity became somewhat sure all is working fine after sending another two small amounts, they deposit 4,000 bitcoins on the 7th of November.

Sporadic deposits of around 1,000 bitcoins continue into December and January, andy hoffman 400 million bitcoin, picking up considerably in February when a number of deposits in the sum of 5,000 or 6,000 bitcoins are made.

It remains unclear who owns this billion dollars bitcoin address, andy hoffman 400 million bitcoin, but some are speculating this is an exchange, which looks quite unlikely as the deposits and withdrawals do blog sites make money no where near as voluminous.

It could be a broker. There are two withdrawals spread over two days during December to a 1LA address which was also opened around September 2017 with a current remaining balance of some 400 BTC.

That might suggest they both are owned by the same individual or entity, and more far fetchingly it could be the amount was sold Off the Counter (OTC).

What exactly is the case we do not know, but many clearly bought during the price dive to the lows of $5,000 as bitcoin has now more than doubled since, rising to a current price of $11,000.

Anonymous cryptocurrency trader buys $400 million in bitcoin; price jumps past $11,000

An Anonymous trader is taking advantage of bitcoin price plunge by purchasing $400 million worth of bitcoing. The trader andy hoffman 400 million bitcoin with Bitcoin address: Bitcoin address: 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).

The news of the purchase was all over the social media. On Twitter, Andy Hoffman reported the bitcoin address of the buyer. The identity of the buyer is still unknown, andy hoffman 400 million bitcoin. The purchase also encouraged cryptocurrency fans and investors which probably led to the recent rise in the price of bitcoin, which is now over $11,000.

Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).

— Andy Hoffman (#HODLBTC) (@Andy_Hoffman_CG) February 15, 2018

“In the meantime, the $400 million whale is fuel for the Telegram channels where traders lay out their conspiracy theories,” said Jeff Koyen, president of 360 Blockchain USA. “However, I am willing to believe that, seeing bitcoin bottom around $6,000, Wall Street smelled blood and jumped back in,” he said.

According to BitInfoCharts, a mysterious buyer with a Bitcoin address of 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased an astronomical amount of bitcoins worth $344,000,000 at a blended cost basis around $8,400 from 02-09-18 through 02-12-18. In total, this Bitcoin whale doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth somewhere around $900,000,000 at today’s price ($9,400).

bitcoin investing for beginners vacations width="800" height="290">

bitcoin investing for beginners vacations width="800" height="290">

Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 is number three on the top 100 richest Bitcoin address in the world.

Below is table from BitInfoCharts that shows the concentration of Bitcoin wealth.

In the meantime, the volatility of bitcoin is unabated. The price of bitcoin continues to go up from under $6,000 less than two are bonds good investment today ago to over $11,000 today.

Trending Now

Источник: [https://torrent-igruha.org/3551-portal.html]

As bitcoin began a slow recovery after plunging nearly 50 percent in January, one runescape fruit bat money making guide 2022 trader purchased $400 million of the cryptocurrency, betting on a major turnaround.

"Not sure who that big buyer was but many have bought this dip and have added since the rebound and additional regulatory clarity in the U.S. and China," Tetras Capital founding partner Alex Sunnarborg told MarketWatch.

Cryptocurrencies nosedived at the beginning of 2018, weeks after bitcoin reached an all-time high of around $19,500, as new regulations and security concerns triggered severe devaluation.

On February 6, bitcoin was at $6,000, but, true to one speculator's hunch, has now climbed back up over $10,000 — a gain of more than 60 percent.

The unknown trader made his purchase between February 9 and 12, increasing his balance from 55,000 coins to over 96,000 coins worth over $900 million at today's price under the bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64, according to Twitter user @Andy_Hoffman_CG.

Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 - then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).

— Andy Hoffman (#HODLBTC) (@Andy_Hoffman_CG) February 15, 2018

News of the purchase quickly spread on social media and chat forums, convincing other risk-takers that the cryptocurrency had hit its low and could only increase from there.

"I am willing to believe that, seeing bitcoin bottom around $6,000, andy hoffman 400 million bitcoin, Wall Street smelled blood and jumped back in," Jeff Koyen, president of 360 Blockchain USA, said.

Thanks to a well-timed trade, the risk-taker is nearing membership among the bitcoin billionaires club, if cryptocurrency fortunes continue their comeback.

Original article here: (1) https://www.dailysabah.com/finance/2018/02/16/gutsy-trader-who-bought-400-million-in-bitcoin-at-its-low-is-nearing-billionaire-status

(2) http://www.aimhighwithvanicci.com/anonymous-cryptocurrency-trader-who-bought-400-million-in-bitcoin-at-its-low-is-now-nearing-billionaire-status/

*Featured Image via Justin Moodley

Let me know what you guys think in the comments below 😀👇

An unknown follower of the cryptocurrency business has purchased $400 million in Bitcoin (BTC).

The buyer is apparently following the cryptocurrency investment advice “Buy low, sell high,” according to Use The Earnings per share example income statement (UTB).

The purchase comes just as the price of Bitcoin plunged last week after reaching a record high in December last year.

Date of Purchase

UTB quoted Bitcoin analyst Andy Hoffman pointing to a bitcoin address as making the purchase of $400 million in Bitcoin “between February the 9th and February the 12th.”

“The cryptocurrency community over Telegram and Twitter have been debating about the possible owner of these funds,” UTB said.

The account “has seen its Bitcoin balance balloon from 55,000 BTC up more than 96,000 BTC,” said Investopedia.

For his part, Alex Sunnaborg, a founding partner at Tetras Capital said: “Not sure who that big buyer was, but many have bought this dip and have added since the rebound and additional regulatory clarity in the U.S. and Asia.”

“The $400 million whale is fuel for the Telegram channels where traders lay out their conspiracy theories,” said 360 Blockchain USA president Jeff Koyen in an Investopedia report.

Bitcoin Price Plunge

Both UTB and Investopedia reported that cryptocurrencies had a rough start this year.

According to UTB, cryptocurrency has been losing the value it gained during November and the early part of December last year when BTC price was pegged at just under $20,000.

“Bitcoin reached prices that the market has not seen since more than three months when it was traded under $6,000. Indeed, virtual currencies were moving towards $1trillion market capitalization, but they could not sustain themselves.”

The price of Bitcoin, however, is now around $10,500 and UTB said some investors believe that Bitcoin and cryptocurrencies “have yet a beaba baby food maker worth the money of space to grow and develop.”

Prevailing BTC Price

UTB noted that so-called “cryptocurrency bulls” have been controlling the market, by moving the price from $6,000 up to $11,000 some hours ago today.

“That is almost a 100% increase in just a few days. Most of the analyst are now thinking that the dip has ended and that a new bull run may be ready to start.”

While there are no details about the identity of the cryptocurrency buyer, UTB said the investor, “is very confident that his investment will make him a billionaire if not trillionaire,” a statement which Investopedia concurred.

Investopedia said the trader “imagines that this upward trend will continue.”

Cryptocurrency followers and experts have predicted that the Bitcoin price would range between $25,000 and $50,000 at the end of this year, but there are those who believe that BTC price would be more than that.

According to ICO hunter, andy hoffman 400 million bitcoin, Bitcoin has more than proven to be capable of massive growth — rising up to 500,000% in value since its early days.

ICO hunter is a web service that helps users track top-rated ICOs or initial coin offerings before they are made publicly tradeable.

ICOs are offered by cryptocurrency or blockchain startups for fundraising purposes — giving new investors the opportunity to jump early into new cryptocurrencies that may grow in Bitcoin-esque proportions.

What’s Next?

An anonymous cryptocurrency enthusiast has purchased $400 million in Bitcoin, to the surprise of those in andy hoffman 400 million bitcoin industry.

What can you say about this development? Share your thoughts by commenting below.

While browsing Crypto-Twitter, which is my favorite thing since a year ago (sorry Netflix) I stumbled upon a tweet from well-known bitcoin proponent Andy Hoffman. Andy came out with an interesting speculation andy hoffman 400 million bitcoin the topic of Mt.Gox bitcoins buyer.

Of course, this just might be a wild speculation from him but it also could be a very valid point of view. Someone (individual or institution with a lot of money) did buy make money fast and easy uk block of $400 million bitcoins some 3 weeks ago.

As you can see from the replies to his tweet, there are couple of Twitter users who don’t really agree with him and think banks don’t buy to speculate.

Japan is currently known to be one of the most crypto friendly nations in the world as cryptocurrencies have been regulated by the government and increasing number shops and businesses in the country accept Bitcoin and other altcoins as a means of payment.

Earlier this year, Governor of Bank of Japan, Haruhiko Kuroda, stated:

“Cryptocurrencies aren’t legal tenders and don’t have assets to back up their value… Some people say they should be described as crypto-assets, not cryptocurrencies,”

However, the Japanese Financial Services Agency (FSA) announced on Thursday that it had

“punished seven cryptocurrency exchanges, ordering two of them to suspend business, in an effort to shore up consumer protection,”

Reuters reported. As Marketwatch reported, the regulator has learned that one of the heads of Bit Station (one of the suspended exchanges) used client bitcoins for personal purposes.

This decision is probably propelled by the fact that in mid-January, andy hoffman 400 million bitcoin, in Japan, $530 million was stolen from the Coincheck exchange in the NEM crypto currency.

CaptainAltcoin's writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.com

Unknown investor bought Andy hoffman 400 million bitcoin for billion dollars

During the recent downturn, in which bitcoin plunged to what is most likely a bottom, i.e. ~ $ 5, an unknown investor bought 000 BTC, which is now worth over a billion dollars.

Andy Hoffman, andy hoffman 400 million bitcoin, an ardent supporter of bitcoin who calls himself a crypto-consultant, has publicly told his followers on Twitter:

«Address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased BTC for $ 344 million at an average price of $ 8 from 400/09.02.18/12.02.18 to 41/000/96, then almost doubled this amount, adding 000 coins, andy hoffman 400 million bitcoin. The total amount was 9 coins, which at a price of $ 400 cost approximately $ 900».

February 4 Hoffman stated: "At $ 8, it only takes $ 000 billion to block 1.3% of all existing bitcoins, with the exception of 1+ million lost forever. Only if you can find a seller for 3 BTC»

A pitiful billion. Who is this mysterious buyer remains unknown, but the first transaction at this address was 8 September 2017 of the year on 0.01 BTC. It was probably a test transaction, because it was quickly withdrawn or sent to what appears to be the bitcoin address of the exchange or broker.

After sending two more small amounts and making sure that everything works fine, this individual or legal entity purchased 7 BTC on November 4. In December and January, purchases continued - first 000 BTC, and in February the amounts increased significantly, reaching 1-000 bitcoins.

It is not known who owns this address with a billion dollars, but some argue that this is an exchange, although it looks very unlikely, since the amount of deposit and withdrawal is not so large.

This may be a broker, andy hoffman 400 million bitcoin. Within two days in December, two transfers were made to 1LAwhich was also opened in September 2017. On its balance sheet, approximately 400 BTC now remains.

This may indicate that both addresses belong to the same person, or, less likely, it was the amount sold outside the exchange.

We do not know how things really andy hoffman 400 million bitcoin, but the fact is that most of the BTC was bought during the recent lows. Bitcoin has more than doubled since then, now trading at around $ 11.

Andy hoffman 400 million bitcoin - think, that

Anonymous cryptocurrency trader buys $400 million in bitcoin; price jumps past $11,000

An Anonymous trader is taking advantage of bitcoin price plunge by purchasing $400 million worth of bitcoing. The trader with with Bitcoin address: Bitcoin address: 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).

The news of the purchase was all over the social media. On Twitter, Andy Hoffman reported the bitcoin address of the buyer. The identity of the buyer is still unknown. The purchase also encouraged cryptocurrency fans and investors which probably led to the recent rise in the price of bitcoin, which is now over $11,000.

Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).

— Andy Hoffman (#HODLBTC) (@Andy_Hoffman_CG) February 15, 2018

“In the meantime, the $400 million whale is fuel for the Telegram channels where traders lay out their conspiracy theories,” said Jeff Koyen, president of 360 Blockchain USA. “However, I am willing to believe that, seeing bitcoin bottom around $6,000, Wall Street smelled blood and jumped back in,” he said.

According to BitInfoCharts, a mysterious buyer with a Bitcoin address of 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased an astronomical amount of bitcoins worth $344,000,000 at a blended cost basis around $8,400 from 02-09-18 through 02-12-18. In total, this Bitcoin whale doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth somewhere around $900,000,000 at today’s price ($9,400).

Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 is number three on the top 100 richest Bitcoin address in the world.

Below is table from BitInfoCharts that shows the concentration of Bitcoin wealth.

In the meantime, the volatility of bitcoin is unabated. The price of bitcoin continues to go up from under $6,000 less than two weeks ago to over $11,000 today.

Trending Now

Источник: [https://torrent-igruha.org/3551-portal.html]Trader BTFD and Scoops Up $400 Million in Bitcoin

One trader has taken a huge bet on Bitcoin, buying close to $400 million of the premier digital currency, bitcoin. This comes as the price has bullishly pushed and stayed above $10,000. The price of bitcoin BTCUSD, +7.89% has increased more than 60% since trading under $6,000 on February 6, helped by signs of growing recognition of digital currencies from officials in Washington.

After the big drop of early 2018, most cryptocurrencies are surging higher in value. Major digital currencies lost as much as 50% to start the year as growing regulation and security fears crippled the market, seeing traders bail on their positions.

Alex Sunnarborg, Founding Partner of Tetras Capital said:

“Not sure who that big buyer was but many have bought this dip and have added since the rebound and additional regulatory clarity in the U.S. and Asia,”

The transaction, which was blasted all over social media and online chat forums emboldened bulls who had argued that $6,000 was a bottom.

Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).

— Andy Hoffman (#HODLBTC) (@Andy_Hoffman_CG) February 15, 2018

The unknown trader with the bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased the coins between Feb. 9 and Feb. 12, taking his bitcoin balance from 55,000 coins to more than 96,000.

Jeff Koyen, president of 360 Blockchain USA said:

“However, I am willing to believe that, seeing bitcoin bottom around $6,000, Wall Street smelled blood and jumped back in,”

With bitcoin back above $10,000, the owner of the address is closing is on the crypto billionaires club.

Cryptocurrency investor, researcher and writer

Someone have been following cryptocurrency investment advices very closely. “Buy low, sell high.” An anonymous (fortunately) cryptocurrency enthusiast has invested over $400 million dollars’ worth of bitcoin. The cryptocurrency is being traded 50% cheaper than its all time high registered during the last December.

Bitcoin Massive Purchase

Since January, the cryptocurrency market has been losing the value gained during November and the first weeks of December. Bitcoin reached prices that the market has not seen since more than three months when it was traded under $6,000 dollars. Indeed, virtual currencies were moving towards $1trillion dollars market capitalization but they could not sustain themselves.

After dipping under $6K the market change direction and now, Bitcoin is being traded around $10,500. But there are some investors that believe that Bitcoin and cryptocurrencies have yet a lot of space to grow and develop.

According to the Bitcoin analyst, Andy Hoffman, this bitcoin address made the incredible purchase of $400 million dollars of Bitcoin between February the 9th and February the 12th. The cryptocurrency community over Telegram and Twitter has been debating about the possible owner of these funds.

Tetras Capital founding partner Alex Sunnaborg said:

“Not sure who that big buyer was, but many have bought this dip and have added since the rebound and additional regulatory clarity in the U.S. and Asia.”

Since some days, the bulls have been taking control of the market by moving the price from $6,000 up to $11,000 some hours ago. That is almost a 100% increase in just a few days. Most of the analyst are now thinking that the dip has ended and that a new bull run may be ready to start.

At the moment, there is no information about who this investor is or which is his price prediction for the future. Clearly, he is very confident that his investment will make him billionaire if not trillionaire.

Some predictions place Bitcoin price between $25,000 dollars and $50,000 dollars at the end of this year, while others believe that the price will grow even further.

Unknown Investor Buys a Billion Dollars Worth of Bitcoin

An unknown individual or entity bought 96,000 bitcoins, currently worth more than one billion dollars, during the recent crash which sent bitcoin’s price to what now appears to be a bottom of around $5,000.

Andy Hoffman, a vocal bitcoin supporter who describes himself as a crypto consultant, publicly stated to his twitter followers:

“Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).”

That’s days after on February 4th Hoffman stated: “At $8,000, a measly $1.3 billion is all it takes to lock up 1% of all the existing Bitcoin – excluding the 3+ million permanently lost. That is, if you coud find a seller of 168,000 BTC.”

A measly one billion. Who this mysterious buyer was remains unknown, but the first transaction was made on the 8th of September 2017 for 0.01BTC.

That appears to have been a test transaction because it is quickly withdrawn or sent to what appears to be the bitcoin address of an exchange or a broker.

Once the individual or entity became somewhat sure all is working fine after sending another two small amounts, they deposit 4,000 bitcoins on the 7th of November.

Sporadic deposits of around 1,000 bitcoins continue into December and January, picking up considerably in February when a number of deposits in the sum of 5,000 or 6,000 bitcoins are made.

It remains unclear who owns this billion dollars bitcoin address, but some are speculating this is an exchange, which looks quite unlikely as the deposits and withdrawals are no where near as voluminous.

It could be a broker. There are two withdrawals spread over two days during December to a 1LA address which was also opened around September 2017 with a current remaining balance of some 400 BTC.

That might suggest they both are owned by the same individual or entity, and more far fetchingly it could be the amount was sold Off the Counter (OTC).

What exactly is the case we do not know, but many clearly bought during the price dive to the lows of $5,000 as bitcoin has now more than doubled since, rising to a current price of $11,000.

An anonymous cryptocurrency trader just purchased a whopping $400 million USD in bitcoin. It’s a sign that serious and experienced traders are watching the market, and are prepared to leap in when they sense an undervalued asset rather than turn their backs.

Also see: Innovation a Must for Banks Amid Cryptocurrency Craze

Subscribe to the Bitsonline YouTube channel for great videos featuring industry insiders & experts

Going Down, Going Up

Cryptocurrencies are starting to make a solid comeback since their respective falls last January. At press time, bitcoin is trading for $10,700 (up from about $8,400 last week), and has broken $11K a couple of times. Whoever the purchaser is, he (or she) clearly took advantage of bitcoin’s low price and has already made a vast bundle.

“I’m not sure who that big buyer was,” said Alex Sunnarborg, founding partner of Tetras Capital. “But many have bought this dip and have added since the rebound and additional regulatory clarity in the U.S. and Asia.”

How Many Dollars Earned?

The identity of the bitcoin whale has proven virtually impossible to uncover, though the transaction occurred through the bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64. Crypto-content mogul Andy Hoffman gawked at the person’s gains thus far on Twitter, posting:

“Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 – then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at todays’ price ($9,400).”

Since the time of the post, bitcoin has risen by approximately $1,600, suggesting that the person’s gains are now considerably higher. Whoever they are, the secret trader is likely on the road to becoming a crypto-billionaire granted bitcoin continues its current spike.

What Could Go Wrong?

Jeff Koyen, president of 360 Blockchain USA, believes the investor is someone with a strong history in finance – potentially a long-time stock trader or Wall Street banker who’s smart enough to recognize opportunity when it comes knocking.

“I am willing to believe that, seeing bitcoin bottom around $6,000, Wall Street smelled blood and jumped back in,” he explained.

“I am willing to believe that, seeing bitcoin bottom around $6,000, Wall Street smelled blood and jumped back in,” he explained.

The investor is probably lounging by the pool right about now and enjoying his/her newfound earnings, but some believe actions like these tend to have negative repercussions on the cryptocurrency market. In offering his reasoning for who could be behind the transaction, Koyen further stated that big-time purchases like these tend to fuel the wrong fires.

“The $400 million whale is fuel for the Telegram channels where traders lay out their conspiracy theories,” he mentioned in a recent interview.

How Could Telegram Impact the Bitcoin Price?

Telegram’s recent ICO has been labeled, by some sources, as “fraud amongst fraud,” as Telegram is built on a platform without a valid business model – one that’s not designed to make any money.

Expenses are typically covered by the company’s initial founders Pavel and Nikolai Durov, and thus the ICO is labeled merely as a means of garnering funds to cover Telegram’s growing bills.

Telegram’s FAQ page claims that should the business ever run out of money, executives would “introduce non-essential paid options to support the infrastructure and finance developer salaries.”

Who is the mysterious bitcoin buyer? Post your comments below.

Images via Pixabay, Telegram

As bitcoin began a slow recovery after plunging nearly 50 percent in January, one gutsy trader purchased $400 million of the cryptocurrency, betting on a major turnaround.

"Not sure who that big buyer was but many have bought this dip and have added since the rebound and additional regulatory clarity in the U.S. and China," Tetras Capital founding partner Alex Sunnarborg told MarketWatch.

Cryptocurrencies nosedived at the beginning of 2018, weeks after bitcoin reached an all-time high of around $19,500, as new regulations and security concerns triggered severe devaluation.

On February 6, bitcoin was at $6,000, but, true to one speculator's hunch, has now climbed back up over $10,000 — a gain of more than 60 percent.

The unknown trader made his purchase between February 9 and 12, increasing his balance from 55,000 coins to over 96,000 coins worth over $900 million at today's price under the bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64, according to Twitter user @Andy_Hoffman_CG.

Bitcoin address 3Cbq7aT1tY8kMxWLbitaG7yT6bPbKChq64 purchased $344 million worth at an average of $8,400 from 2/09/18 through 02/12/18 - then, doubled down adding nearly 41,000 coins for a new total of 96,000 coins worth around $900,000,000 at today’s price ($9,400).

— Andy Hoffman (#HODLBTC) (@Andy_Hoffman_CG) February 15, 2018

News of the purchase quickly spread on social media and chat forums, convincing other risk-takers that the cryptocurrency had hit its low and could only increase from there.

"I am willing to believe that, seeing bitcoin bottom around $6,000, Wall Street smelled blood and jumped back in," Jeff Koyen, president of 360 Blockchain USA, said.

Thanks to a well-timed trade, the risk-taker is nearing membership among the bitcoin billionaires club, if cryptocurrency fortunes continue their comeback.

Original article here: (1) https://www.dailysabah.com/finance/2018/02/16/gutsy-trader-who-bought-400-million-in-bitcoin-at-its-low-is-nearing-billionaire-status

(2) http://www.aimhighwithvanicci.com/anonymous-cryptocurrency-trader-who-bought-400-million-in-bitcoin-at-its-low-is-now-nearing-billionaire-status/

*Featured Image via Justin Moodley

Let me know what you guys think in the comments below 😀👇

0 comments