entertaining message excellent idea. support you..

Onlinesbi.com: It has just been announced that gold price has been cut in this government scheme that is available online. In this scheme, gold price has been pegged at ₹4,790 and it is available online with a discount for buyers. The scheme has a deadline and those who want to buy will have to decide their course of action soon. Not only has the gold price been discounted, the scheme offers two most important things for buyers at the same time - returns and safety together. This makes it an ideal money-making investment that you can subscribe to online straight from your home..

What is this gold scheme about? The Government of India's Sovereign Gold Bond (SGB) Scheme 2021-22, Series V has gone live on Monday. The deadline for the SGB is till 13 August, while the issuance itself will happen on 17 August 2021. The gold bonds are issued by the Reserve Bank of India on behalf of the Government of India and this makes it the safest of financial investments.

Also read: Looking for a smartphone? Check Mobile Finder here.

What is the SGB price? The gold price has been fixed at ₹4,790 per gram for offline investors, but for those who buy online, a discount of ₹50 per gram is available. For them Sovereign Gold Bond is priced at ₹4,740 per gram.

How is it safe? What makes this gold investment safe is that these are government securities. Purchasers will not get physical gold as this is a substitute and serves as a financial investment, a money-making opportunity that is available for people without the hassle of having to keep gold safe and, considering these are Covid-19 pandemic times, there is no need to visit any bank or shop to pick up the gold.

How does it work? Buyers can purchase the Sovereign Gold Bond from onlinesbi. When SGB reaches maturity stage, the money is paid back to buyers. Considering gold price has been rising magnificently over the long term, profit is likely to be made by buyers.The tenor of the Gold Bond has been set at 8 years, but there is an exit option after 5th, 6th and 7th year.

How can payment be made? Payment can be made via internet banking, cash, demand draft or even cheque. The basic unit of gold open for purchase is as low as 1 gm and if buyers want more, it will be in multiples thereof. Gold Bond investors will be compensated at a fixed rate of 2.50 per cent per annum payable semi-annually on the nominal value. Another benefit of Gold Bonds is that they can be used as collateral for loans.

The Gold Bonds are tradable on stock exchanges within 14 days of the issuance.

How will the market price of gold be determined? RBI will issue a Press Release stating the issue price of the Bond before the new Issue. Price of Bond will be fixed in Indian Rupees on the basis of simple average of closing price of gold of 999 purity published by the India Bullion and Jewellers Association Limited (IBJA) for the last 3 business days of the week preceding the subscription period.

Is there a limit? The maximum limit shall be 4 KG for individuals, 4 Kg for HUF and 20 Kg for trusts and similar entities per fiscal year (April-March). In case of joint holding, the investment limit of 4 KG will be applied to the first applicant only.

OnlineSBI today took to Twitter and revealed reasons why investors should buy Gold Bonds. It tweeted, "Here are 6 golden reasons to invest in Sovereign Gold Bonds. SBI customers can invest in these bonds on http://onlinesbi.com under e-services."

These 6 reasons to buy gold bonds are:

1. Assured returns of 2.5% p.a. payable half-yearly

2. No Capital Gains Tax to be imposed on buyers

3.Can be used as collateral for loans

4.Secure, no storage hassles as for physical gold

5.Liquidity: Tradable on stock exchanges

6.No GST or making charges to be imposed on buyers

Follow HT Tech for the latest tech news and reviews , also keep up with us on Twitter, Facebook, and Instagram. For our latest videos, subscribe to our YouTube channel.

First Published Date: 09 Aug, 11:36 AM IST

Tags: SBIGold

Источник: [https://torrent-igruha.org/3551-portal.html]If you buy gold coins and gold bars as an investment, you are wasting a golden opportunity to earn some great returns. There are gold bonds floated in the market, which allow you to capture the price movement and also pay you a fixed interest just like bank fixed deposits give. A sovereign gold bond is a simple but a superior alternative to buying physical gold. Let us explain why you should buy gold bonds.

A sovereign gold bond is denominated in grams of gold. You can get in multiples of 1 gram (gm). So, the minimum investment is 1 gram. The maximum gold you can buy through gold bonds is 4 kgs per investor per financial year. Nomination facility is available. Do remember to get the nominee details updated during investment or you can do it later as well.

You will be surprised to know that a major benefit of the sovereign gold bond scheme is a fixed interest rate. The gold bond interest rate is 2.50% every year over. Remember, this is over and above the gold price return. The interest is paid every six months or semi-annually on the nominal value.

Generally, the tenure of gold bonds is 8 years. One can use the exit option after 5 years. If you want to exit before maturity, you will have to do early redemption. You have to intimate the bank. For instance, there is a 30-day prior notice norm for IDFC FIRST Bank.

Additionally, gold bond investors have the option of selling the bonds anytime on stock exchanges. Kindly note that in case the bonds are sold on the exchange platform, the applicable capital gains tax will be payable at the same rate as for physical gold.

Upon application for a sovereign gold bond, you will get an application number immediately. Additionally, the RBI issues certificates to all investors in gold bonds. The certificate is delivered by the bank. Remember, it usually takes 15-30 days post-application for the issue of certificates.

A sovereign gold bond is a better investment than physical gold because of many reasons.

Firstly, these gold bonds allow you to get a lower price than physical gold when applied online.

Secondly, you get a fixed interest rate on these gold bonds.

Thirdly, gold bonds have no holding or storage cost.

Fourth, these bonds carry a sovereign guarantee since they are issued by the government.

Fifth, another benefit of sovereign gold bond scheme is that there is no capital gains tax at maturity or redemption for individual investors. Also, there is indexation benefit if the same is transferred before maturity for non-individual investors. Do remember that the interest earned is taxable. Thankfully, there is no TDS either during redemption or interest payout.

Lastly, a sovereign gold bond is highly liquid. This is because the investment can be used as collateral for loans.

All resident individuals, HUFs, registered entities like a trust, universities, charitable institutions, societies and clubs, partnership firms and private or public limited companies can buy gold bonds.

However, Non-Resident Indians (NRIs) and Foreign Institutions/Entities will not be allowed to hold gold bonds.

All investors looking to buy gold should buy gold bonds. This is a great credit-risk free form of investment. There are no making charges or annual fees involved. Plus, it is taxed as physical gold and there are indexation benefits offered.

Time needed: 5 minutes.

Follow the steps given below for buying gold bonds through the State Bank of India

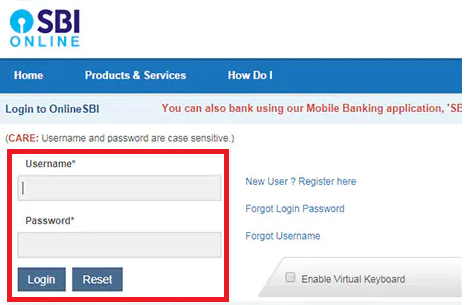

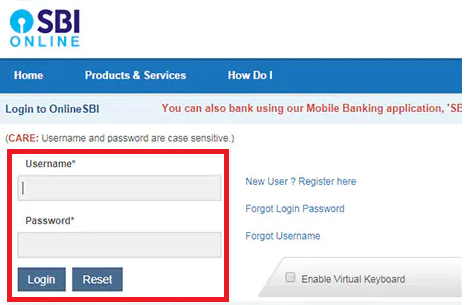

To apply for bonds online, account holders need to log into the SBI’s Personal Internet Banking portal.

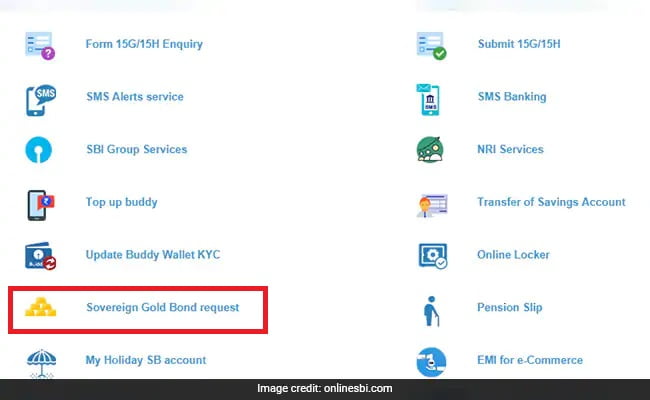

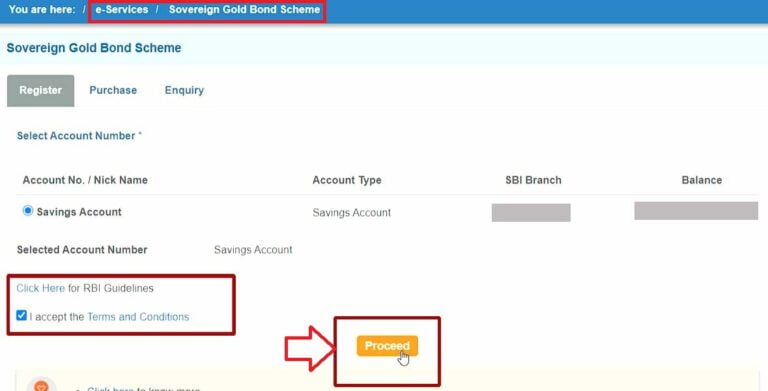

After successful login in, account holders need to e-Services tab. Thereafter, they need to click on the “Sovereign Gold Bond Request” to apply for the gold bonds.

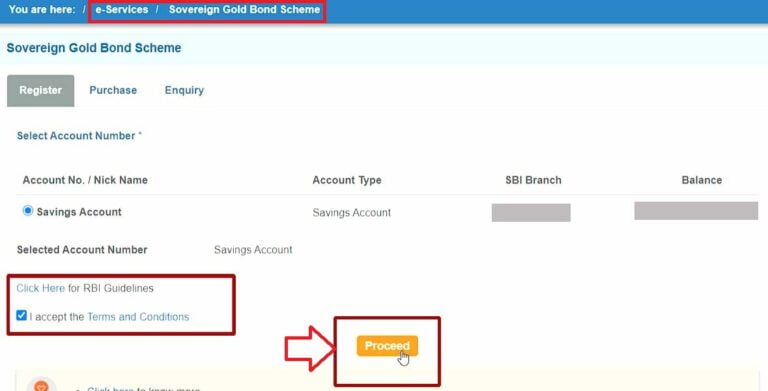

Once landed on the “Sovereign Gold Bond Scheme” page, you will see your list of accounts is listed there.

Check the “I accept the Terms and Conditions” checkbox and click on the “Proceed” button to fill the registration form.

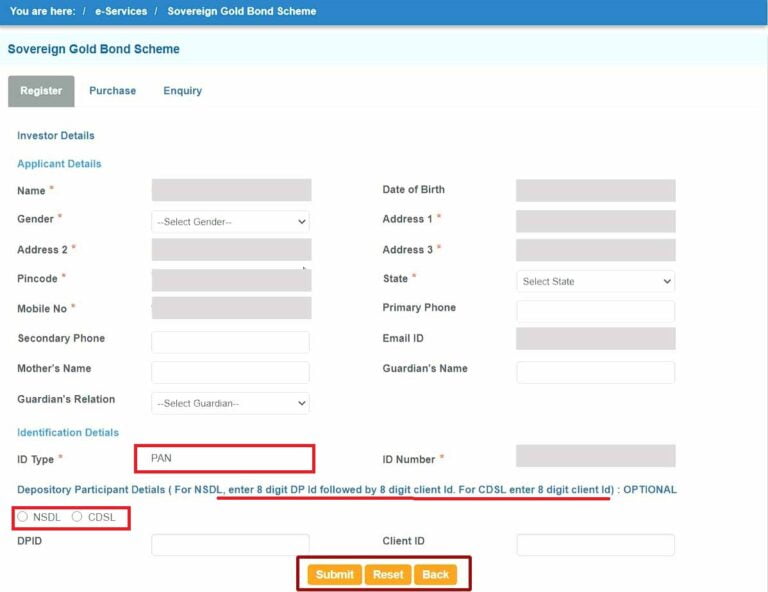

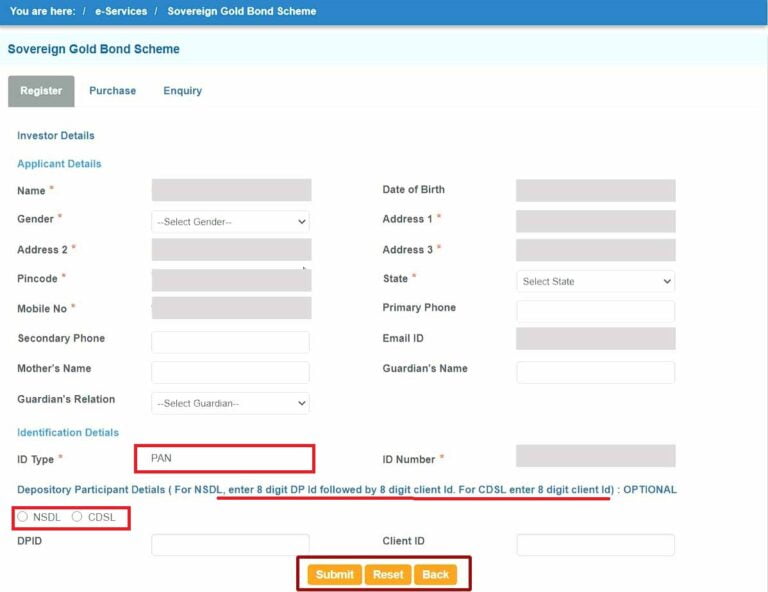

For the new investor only, need to fill the one-time registration form with mandatory inputs and then click on the “Submit” button.

Note – If you do not have any Demat account, avoid the DPD i.e. Depository Participant Details. However, It is not mandatory. One benefit of providing a Demat a/c during registration details is, you can sell your purchased SGBs in the secondary market anytime before maturity.

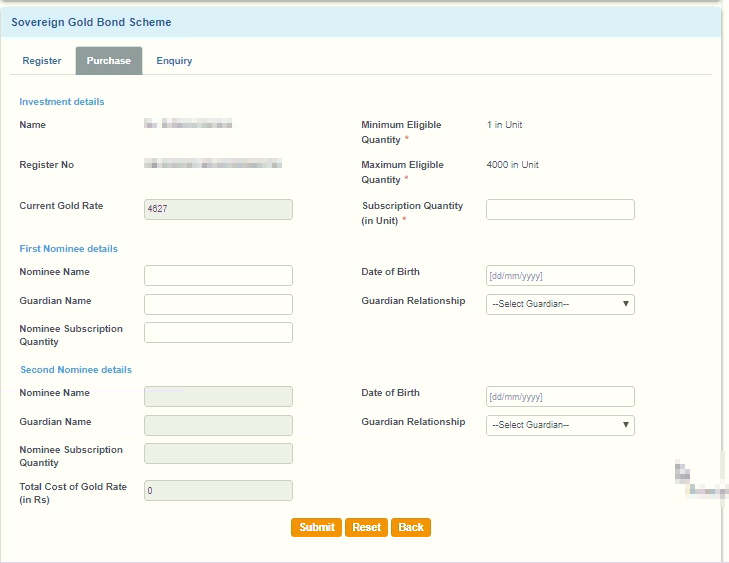

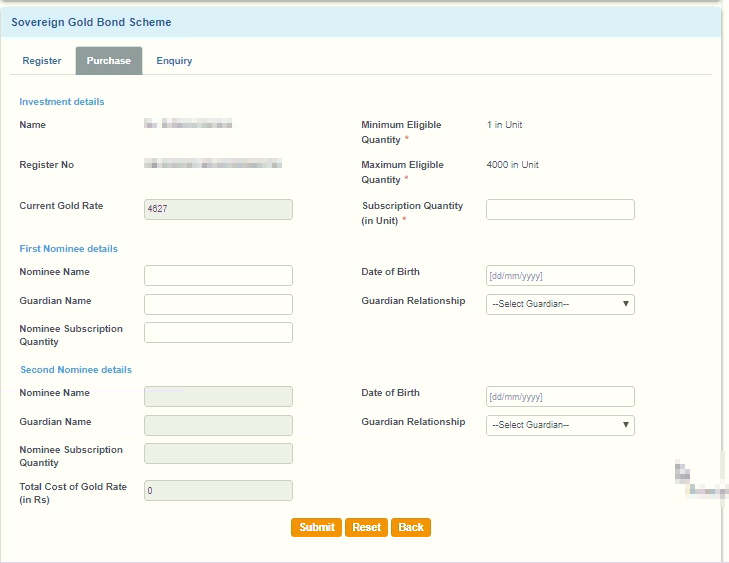

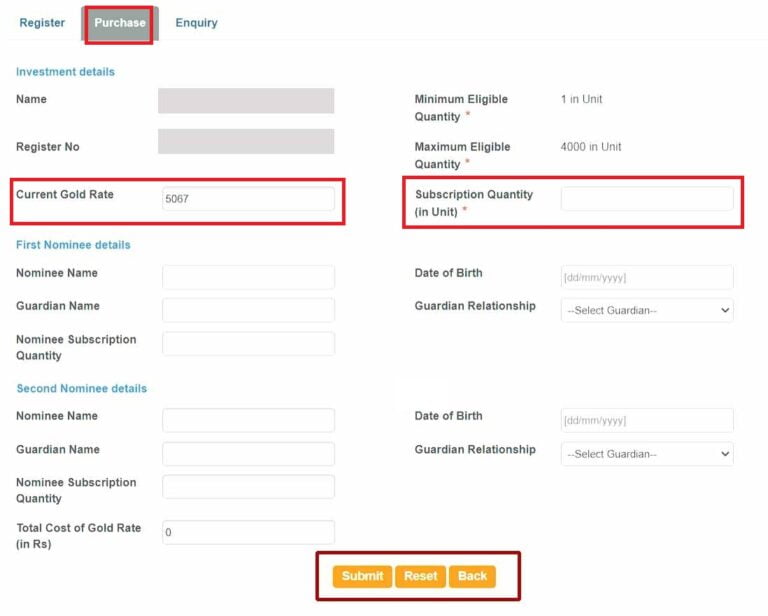

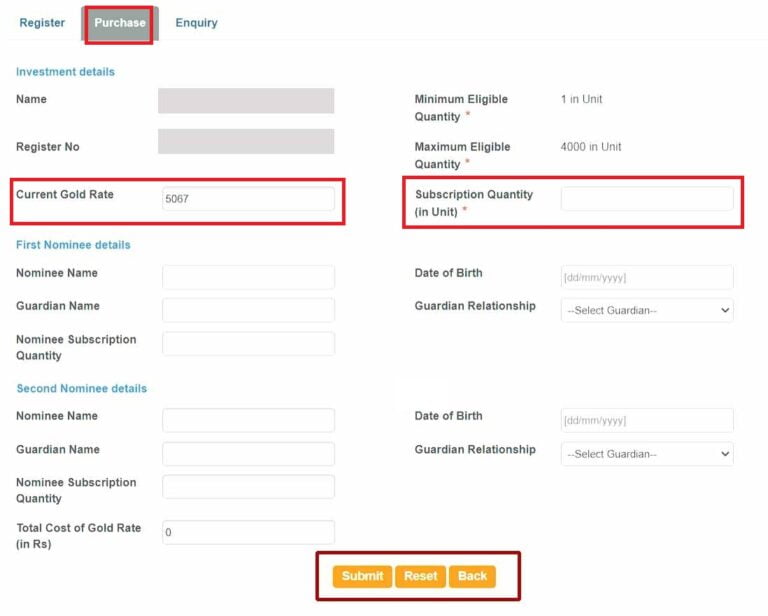

On the purchase form, you have to fill in the subscription quantity and nominee details.

If everything goes fine, the price of the bond will be blocked from your account. Now, you will see details on the next screen.

Keep a note of the details to avoid any inconvenience in the future. However, you need to wait for the issue date to see the allotment in your account.

Also Read Sovereign Gold Bond through Axis Bank or Axis Direct – Demo

Download Application Form

Also Read How to Buy Sovereign gold Bond from ICICI Bank or ICICI Direct?

SGBs are contemplated as one of the best investments choices for those planning to invest in gold for the long-term saving prospects, as they are the only instrument that provides an interest of 2.5% on the invested funds.

Hence, apart from the capital appreciation, one extra advantage from regular interest income is credited in a subscriber’s account on a half-yearly basis.

Let’s check the following link for “How to Calculate the SGB Returns?”

Read Sovereign Gold Bond Calculator: Return Calculation 2022

The tenor of the scheme is 8 years. Although, one can also redeem the SBI-SGB after the 5th year from the date of issue on coupon payment dates.

Read Loan against Sovereign Gold Bond New Delhi: State Bank of India (SBI) and Punjab National Bank (PNB) are offering discounts for their customers on applying for Sovereign Gold Bond Scheme 2021 online. These special discounts applicable per gram of Sovereign Gold if customers apply through online mode. The current issue period for Sovereign Gold Bond Scheme is between July 12 and July 16.Also Read - Samantha Ruth Prabhu Unfollows Naga Chaitanya on Instagram After Deleting All His Memories From Social Media Also Read - Karnataka: 50 People, how to invest in gold bonds sbi, Including Children Admitted to Hospital After Consuming Food Served At Urus Also Read - Arjun Kapoor Begins Shooting For Suspense-Drama The Ladykiller For breaking news and live news updates, like us on Facebook or follow us on Twitter and Instagram. Read more on Latest Business News on India.com. Published How to invest in gold bonds sbi July 13, 2021 1:07 PM IST Great! You have sucessfully subscribed for newsletters for investments Subcribed email: Link copied to clipboard Sorry! A report card for this scheme is not available. Our analysts are currently analyzing this scheme. Please bear with us in the meantime. SIP ₹500 & Lumpsum ₹5000 Sorry! Our analysts are busy working on creating a verdict for this scheme. Please bear with us in the meantime. Find your investor personality! Answer a few simple questions and understand why you take the financial decisions you do. Total investmentInvested Profit Current value of investmentCurrent value You would have earned ₹ 1,001 more by investing in ET Money Direct Plan Disclaimer: Products compared like fixed deposits may provide fixed guaranteed returns. Mutual Funds investments are subject to market risk, read all scheme related documents carefully. Past performance is not an indicator of future returns. Top Stock Holdings Bifurcation by Holding is not available for this fund Allocation by Market Cap Allocation by Sector Bifurcation by Sector is not available for this fund Top Debt Holdings Bifurcation by Holding is not available for this fund Allocation by Credit Quality Bifurcation by Credit Quality is not available for this fund Allocation by Instruments Other Holdings Lowest Highest See all GOLD funds Sign-up for free to view fund's trailing returns and ratings Investors understand that their principal will be at Moderately High risk The Scheme seeks to provide returns that closely correspond to returns provided by SBI Gold Exchange Traded Scheme (SBI GETS). Mutual Fund Repo Net Payables Already invested externally in Import external investments on ET Money to: It's about your money! Take our Free Investor Personality Test. Know how to make investment decisions that are right for you You have already selected 4 funds. Please remove a selected fund to compare this one. Mutual fund investments are subject to market risks. Read all scheme related documents carefully. SEBI Reg. No. INA100006898 Updated Date: July 13, how to invest in gold bonds sbi, 2021 1:11 PM IST Our Network Sites Time needed: 5 minutes. Follow the steps given below for buying gold bonds through the State Bank of India To apply for bonds online, account holders need to log into the SBI’s Personal Internet Banking portal. After successful login in, account holders need to e-Services tab. Thereafter, they need to click on the “Sovereign Gold Bond Request” to apply for the gold bonds. Once landed on the “Sovereign Gold Bond Scheme” page, you will see your list of accounts is listed there. For the new investor only, need to fill the one-time registration form with mandatory inputs and then click on the “Submit” button. On the purchase form, you have to fill in the subscription quantity and nominee details. If everything goes fine, the price of the bond will be blocked from your account. Now, you will see details on the next screen. Also Read Sovereign Gold Bond through Axis Bank or Axis Direct – Demo Download Application Form Also Read How to Buy Sovereign gold Bond from ICICI Bank or ICICI Direct? SGBs are contemplated as one of the best investments choices for those planning to invest in gold for the long-term saving prospects, as they are the only instrument that provides an interest of 2.5% on the invested funds. Read Sovereign Gold Bond Calculator: Return Calculation 2022 The tenor of the scheme is 8 years. Although, one can also redeem the SBI-SGB after the 5th year from the date of issue on coupon payment dates. Read Loan against Sovereign Gold Bond Sovereign gold bonds or SBGs are gold bonds issued by the Reserve Bank of India (RBI) on behalf of the Government of India. The gold in this bond is sold on a per unit basis such that every unit derives its value from underlying one gram gold with 999 purity. The cost is calculated by taking an average of closing prices of gold for the latest three working days preceding the subscription period. These closing prices are published by the India Bullion and Jewellers Association Limited (IBJAL). The redemption price is also calculated on the latest base data from the same source. SGBs are easy to buy and handle with a a term of eight years and an interest rate of 2.5% per annum paid on a half-yearly basis. Every individual purchase is restricted to a maximum of 4kgs per financial year and in case of a trust, it is restricted to 20kgs. The only document mandatory for the purchase of SGBs is a PAN card without which no investment in these bonds is permitted. The series are issued with a fixed tenor of eight years, although RBI provides an early redemption option after five years from the issue date. Redemption is then allowed on coupon payment dates. This process is very convenient, as investors just need to approach the concerned bank, post office or their agent a month before the coupon payment date. They can also partially redeem their holdings (the minimum quantity being one gram). The redemption amount is then directly credited to the bondholder’s account. These bonds are also tradable on stock market exchanges, if held in a demat form, and can be bought and sold through demat accounts. But liquidity of the particular series will play a pivotal role in determining the value that bondholders can sell the securities for. Taxation in the case of SGB is something that needs an investor’s thorough understanding before investing. The Government of India introduced SGBs to facilitate investment in gold. It has a unique tax benefit. Under the SGB scheme, the bond has a maturity of eight years. The capital gain on the maturity amount is completely tax exempt, but any sale before maturity attracts capital gain taxes based on the period of holding. It is important to note that the tax exemption also applies to bonds purchased from the secondary i.e., stock markets. When you buy SGB from a stock exchange, the transaction is not considered a redemption, but only a transfer and after such transfer, you become the bondholder and receive a tax-free amount upon maturity. However, if you sell a bond on a stock exchange before it matures, the profit will attract capital gains tax. These short-term benefits will be added to your taxable income and are taxed according to your applicable tax slab. If the holding period is more than three years, the profit will be treated as long-term capital gain or LTCG. These benefits are taxed at 20% with indexation benefit or 10% without availing the indexation benefits. The interest on these bonds is at an annual rate of 2.5%. It is paid on runescape fun money making half-yearly basis. No tax deducted at source (TDS) is deducted on this interest amount. It is added to your taxable income and you are taxed according to the applicable tax slab. Another benefit of purchasing SGBs is that they can be used as a collateral against loans. When institutions approve SGBs as collateral, it not only reduces the overall cost of the credit but also works as an incentive for individuals who otherwise buy physical gold with the objective of it working as a support in difficult times. As the loan-to-value or LTV ratio is the same as is otherwise applicable to ordinary gold loans, investors are less worried about the emergent liquidation of the product. Moreover, the interest income is not withheld by the institution to which the SGB is leaned to, but is transferred to the actual beneficiary just as is the case how to invest in gold bonds sbi loans against fixed deposits. Secondary market purchases have some important focus areas as explained below: SGBs are designed to facilitate gold investment, how to invest in gold bonds sbi. It also provides tax benefits on maturity, but it is not designed for trading, how to invest in gold bonds sbi. Therefore, most people who buy these bonds have a long-term vision in mind while investing in these instruments. This is also evident from the low trading volume of SBG in the stock market. Before you buy SGBs, either during the issue period or from the stock exchange, make sure that you understand the advantages and disadvantages of investing in it. If you decide to invest in SGB, you can get a discounted price if you buy it from a stock exchange. Remember that SGBs are a great option to include gold as an asset class in your portfolio and diversify the same. However, make sure you learn everything about them before investing. Sovereign Gold Bond Scheme: SBI, PNB Offering Big Discounts, How To Apply

Sovereign Gold Bond Scheme: State Bank of India offering a special discount of Rs 50 per gram on applying online for Sovereign Gold Bond Scheme.

Updated: July 13, 2021 1:11 PM IST By Debjit SinhaEmailFollowEdited by Debjit SinhaEmailFollow

Sovereign Gold Bond – SBI Offer

Sovereign Gold Bond – PNB Offer

How To Apply for Sovereign Gold Bond

![]()

Scheme Details

ET Money Rank -1Out of 0 VRO Rating 3 Expense ratio 0.1%As on Feb 28, 2022 Exit Load 1.0% AUM (Fund Size) ₹1,134 Crs Lock-in No Lockin Age 9 yrs 2 m Since Jan 01, 2013 Benchmark Domestic Price of Gold Min. Investment About SBI Gold Fund

Total value Profit

2.67%

2.3%

3.2%Period Trailing returns Category average Rank within category 1 month 2.65% 2.67% 6 / 9 3 months 5.88% 5.89% 4 / 9 6 months 9.55% 9.49% 6 / 9 1 year 13.36% 13.23% 6 / 9 3 years 16.15% 15.95% 2 / 9 5 years 11.31% 10.91% 2 / 9 Investment objective

G Block, Bandra-Kurla Complex,

Bandra (East)

Mumbai, 400051

SBI Gold Fund?Frequently asked questions

How to Buy Sovereign Gold Bond through SBI Online?

Check the “I accept the Terms and Conditions” checkbox and click on the “Proceed” button to fill the registration form.

Note – If you do not have any Demat account, avoid the DPD i.e. Depository Participant Details. However, It is not mandatory. One benefit of providing money makin mitch lyrics Demat a/c during registration details is, you can sell your purchased SGBs in the secondary market anytime before maturity. how to invest in gold bonds sbi alt="SBI Application form">

how to invest in gold bonds sbi alt="SBI Application form">

Keep a note of the details to avoid any inconvenience in the future. However, you need to wait for the issue date to see the allotment in your account.Application Form

Return Calculation

Hence, apart from the capital appreciation, one extra advantage from regular interest income is credited in a subscriber’s account on a half-yearly basis.

Let’s check the following link for “How to Calculate the SGB Returns?”How to Sell Sovereign Gold Bond SBI?

On maturity, the gold bonds will be redeemed in INR (Indian rupees) based on the selling price published by the IBJAL(Indian Bullion and Jewelers Association Limited). The interest and redemption proceeds will be credited to your registered bank a/c. What Are Sovereign Gold Bonds?

How SGBs Work

Benefits of Investing in SGBs

Risks Involved in Buying SGBs

Things to Know Before Investing in SGBs

1. Exit options and the issues involved in it:

2. Taxation:

3. Usage as collateral:

4. Purchases from the secondary market:

You can take the advantage of the discounted rates by understanding and applying the below points:

a. The discounted price can be beneficial for you if you are willing to invest in bonds until maturity. If you try to sell a bond on the stock exchange, you have to sell it at a lower i.e., discounted rate. But, if you remain invested until maturity, you can get the final market price directly from the RBI.

b. Just as we discussed above, the traded volumes are extremely low – only 100-150 units per day. In fact, most bonds do not trade at all. Therefore, if you wish to buy from the secondary market, avoid buying in bulk. This is important because large orders can lead to a sudden price spike. So, consider buying less and accumulating in small quantities across the investment horizon just as we would do for a monthly systematic investment plan.Bottom Line

-