Investment strategies short term - message, matchless)))

Best Strategy for Short-Term Savings Goals

Because everyone knows how critical it is to save up for retirement, most investors are laser-focused on contributing to IRAs, 401(k)s, and other “nest egg” investments. But what about shorter-term savings goals? Perhaps you want to create a travel fund or save up enough cash to buy a boat or vacation home within the next few years. Or maybe you are just concerned about building a liquid savings portfolio as an emergency fund.

If you have plans to make a large purchase within three to five years or you are looking to build a fund for emergency or luxury purposes, you’ll want to come up with a short-term savings strategy to meet that goal. Here are a few things to keep in mind as you devise your plan.

First, Consider Risk

Liquid savings portfolios seek to identify the lowest risk, highest-return investments in the marketplace. Thus, when it comes to short-term savings, you have to approach things a little differently than you would for long-term retirement and investment goals.

For example, let’s say you plan to retire in 10 to 15 years. In this case, your financial advisor will likely recommend a diverse retirement portfolio consisting of at least 60% stocks. With such a large window of time, if the stock market takes a hit, there’s plenty of time for your portfolio to bounce back.

On the other hand, if you’re looking to save up for something in the not-so-distant future, you should steer clear of high-risk investments like stocks. Why? Because one dip in the stock market could wipe out your savings, and three to five years probably won’t be long enough for your investment to recover from the downturn. That means you’d have to kiss that trip to Europe or your beach house goodbye.

While low-risk investments, generally considered safe havens, will usually have steady rates of predictable returns on a monthly basis this can fluctuate somewhat. As such, short term, liquidity seeking investors may want to overweight more heavily in risk-off markets where savings rates are higher fueled by Federal Reserve interest rate policy.

Savings Accounts

Most consumers are familiar with checking and savings accounts from standard banks. However, going beyond these initial platforms can be a great first step for newly inspired short-term investors. Doing a little research to identify the best savings accounts in your area can turn up yields of 2% to 5% on standard savings account products. Many local banks offer high yield savings deals. There are also many online options. These platforms tend to offer money market accounts and high yield certificates of deposit, also often associated with high yield savings as well.

The Benefits of Bonds

To achieve a short-term savings goal, you might want to take a look at bonds. Bonds generally follow high yield savings as the next step in low-risk short term investing, with Treasury bonds being the safest. A bond is a debt investment in which you’re essentially loaning money to the government, a government agency, or a corporate entity. Bonds are used by companies, states, and cities to raise money for a variety of projects and initiatives. During a specified period of time, you’ll earn a variable or fixed interest rate on a bond. In individual bond investing, you can hold your bonds to maturity or often sell them on open market exchanges.

One of the major benefits of bonds is that interest earnings are generally higher than those from a savings account. Plus, you can handpick bonds that will mature and be available by a set date in the near future. This offers a great deal of security without the risk associated with stocks. Many investors may also choose to invest in managed bond funds, which can be segmented into many different risk classes and maturity segments.

Bonds, however, come with their own caveats specifically in high rate or risk-off markets where yields are rising. When yields on new issuances increase, prices on existing bonds fall, decreasing the secondary market trading value of bonds. In managed funds, this effect can be magnified as managers hold a diversified portfolio of bonds with closely correlated volatility. Thus, bonds are especially important for the short-term investor to follow in risk-off markets in order to optimize short term returns.

Product Selection

Across the market, there are several investment products targeting short term or liquidity driven investors. Fixed income investments will generally be some of the best product options because they offer an income with low risk. Investing for income in stocks may also be an option for short term investors willing to make some higher wager bets. Large-cap value income investments are often the next tier of low-risk options with income, helping to support many investors’ short-term liquidity goals.

The Bottom Line

As you are looking to save up for short-term goals, it’s important to choose your investments wisely and stay abreast of market changes in the low risk investing segment of the market. If you want to have access to the money within three to five years, high yield, low-risk investments are your best bet, and most stock investments will be too risky. However, managing a short term portfolio with a select few stock investments, specifically in the large-cap value income category, can be one way to boost some return.

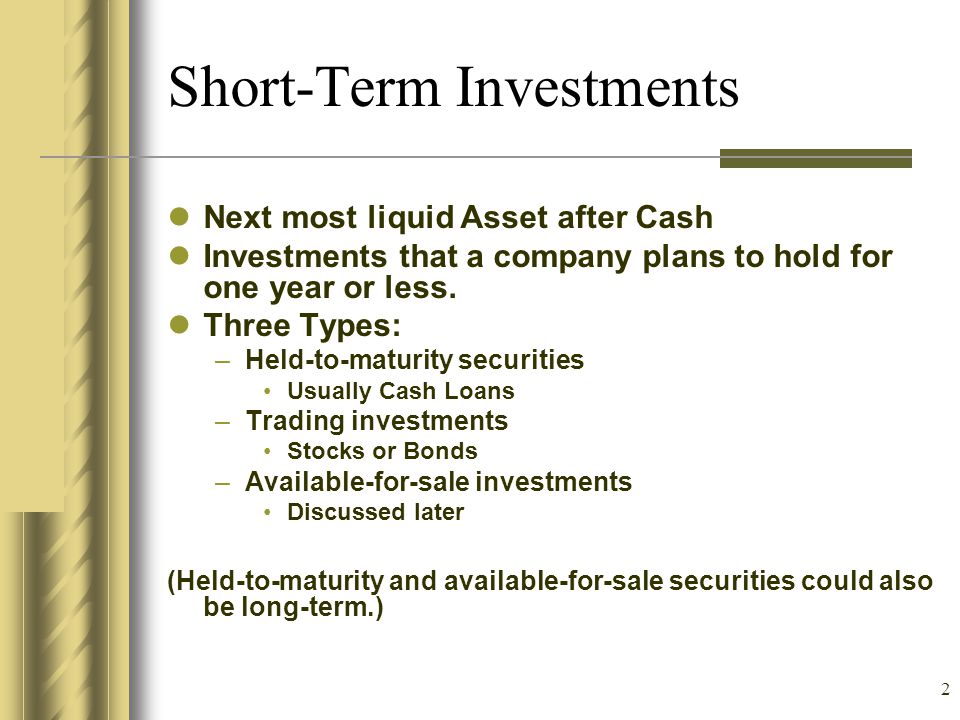

Understanding the difference between long-term and short-term investments may help investors build their investing strategies. Developing this knowledge can be the first step in identifying the investment securities that are suitable for your goals. Here's what to consider.

What Are Long-Term Investments?

Long-term investments are bought and held for multiple years, such as 10 years or more. This investing strategy may be suitable for long-term financial goals such as retirement, and can include certain stocks and mutual funds.

When an investor has several years or more until they plan to begin making withdrawals from their investment accounts, they might see themselves as being in a position to take on more risk than if they had only a few years to invest. This is because the longer periods of time could allow the investments to potentially recover from periodic declines in value. Of course, such a recovery is not guaranteed; any investment can gain or lose value over time, including the possible loss of the principal investment value.

What Are Short-Term Investments?

Short-term investments are typically bought and held for a shorter period of time — generally three years or less. They are typically suitable for needs or goals that are more immediate or in the near future. If an investor chooses a short-term investing period, they might consider investment types that have relatively low market risk. Seeking lower market risk does not guarantee gains or a sustained principal value, though.

Examples of short-term investments can include certificates of deposit (CDs), money market accounts, government bonds and Treasury bills.

Long-Term vs. Short-Term Investing

Here are some of the differences between long-term investing and short-term investing:

- Time Horizon: The length of time before you begin taking withdrawals from your investment accounts defines your time horizon. Long-term is generally considered to be 10 years or more, while short-term is generally three years or less.

- Market Risk: Market risk is the possibility that assets exposed to the market may lose value. The level of market risk that's associated with an investment depends on the type of investment and your strategy. As you determine whether short- or long-term investments are right for you, consider discussing market risk with a financial professional.

- Investing Goals: Long-term investment goals typically take years or decades to reach and may include retirement and saving for college. Short-term investing goals may take months or a few years. Examples of short-term investing goals can include saving for a vacation, wedding or home improvement.

Planning Long-Term & Short-Term Investing Strategies

Long-term investment strategies can help support major purchases or life events that are several years or even decades away. Since long-term savings goals, such as retirement or college, often require large sums of money, it might help to plan your investment strategy as far in advance as possible.

Short-term investment strategies are typically designed for smaller goals that may be months or a few years away. Because of the shorter time frame, investment types that are appropriate for short-term goals are typically different than investment types used for long-term goals.

Even though they may have different time horizons and different associated tactics, long-term investment strategies and short-term investment strategies can both be formed in part by answering some of the same questions.

Here are some questions to explore before forming investment strategies:

- How much money will you need? To answer this question, you may need to make a few related assumptions. For example, if you're saving for retirement, you'll likely want to consider your life expectancy, desired retirement lifestyle and health care needs, among other factors.

- How will taxes factor into your investment strategy? Like inflation, taxes can have a large impact on your investment strategy. For example, you may want to consider accounts with specific tax features, such as 529 college savings plans, which offer tax-deferred growth of your investment.

- When will withdrawals begin? This is another way of asking how long your investing strategy will be. For example, if you're saving for your child's education, you could assume that withdrawals will begin in their first year of college.

- How long will withdrawals last? You might prefer to not end a long-term investment strategy with one lump sum withdrawal. For example, if you expect to retire at age 65 and assume a life expectancy of 85 years, you might want your withdrawals to last 20 years. However, for short-term goals, such as a vacation, you might withdraw one lump sum.

- Will you invest a lump sum or make recurring investments? When calculating the ultimate amount you can potentially reach by the end of your savings goal, you'll need to assume the frequency of payments or investment purchases. For example, will you invest a lump sum up front? Will you contribute a certain amount at the beginning of each year or will you invest a fixed amount every month?

- Which investment types will you use? The investment types you use may be chosen according to the rate of return you want and your tolerance for risk. The amount of time you have to invest can also help you determine the investment type to choose.

Put simply, long-term investment strategies can be useful for anyone who has a savings goal that is at least several years away. In the world of personal finance, long-term goals are generally considered to be at least seven to 10 years away.

Long-term investment strategies might be considered by investors who want to:

- Save for Retirement: This is a common reason for a long-term investment strategy. This is because, for many, retirement can be the largest financial goal of a lifetime, as well as the longest to reach.

- Save for College: Higher education is expensive and the cost is rising. Long-term investment strategies can be an important means of paying for college.

- Build Wealth: Long-term investment strategies could help grow money over time.

It's important to keep in mind that the typical long-term investment types are not appropriate for all investors. For example, stocks and stock mutual funds can potentially make useful long-term investments. However, the potentially higher relative performance of stock investments comes with greater market risk. Therefore, people with low tolerance for risk might consider other investment types to diversify their holdings with lower-risk investments.

People investing for savings goals that are less than three years away may think about exploring short-term investment strategies.

Short-term investment strategies might be considered by people who are saving for:

- Vacations: You might prefer to plan that big trip you've always wanted by funding it with money you've invested, rather than putting it on a credit card and accruing debt, for example.

- Weddings: You may have anywhere from a few months to a few years to save for all of the expenses related to a wedding. The right short-term saving strategy can help make your big day the best it can be.

- Gifts: Whether it's for birthdays or major holidays, you may choose to keep money in an interest-bearing account for purchasing gifts for friends and family.

- Home Improvement: Rather than take money out of home equity, a short-term investing strategy may help you fund home improvement renovations or projects.

Balancing Strategy With Need

Your time horizon, or the number of years until withdrawals from the investments are expected to begin, is one determining factor in choosing suitable investment types. Just like planning a trip, you want to choose the best vehicle to get you where you want to go.

It's important to note that investors should also consider their risk tolerance when choosing investments. Although stocks and stock mutual funds may be appropriate for long-term investment strategies, these securities may not be suitable for an investor based on other aspects of their consumer profile.

Also, keep in mind that planning for long-term savings goals could be more complex than short-term savings goals. If you're planning for long-term goals, such as retirement, it might be helpful to use a retirement calculator. It may also be helpful to speak with a financial representative who can help form and implement your investment strategy.

Related Products

Investments

Mastering Short-Term Trading

Short-term trading can be very lucrative but it can also be risky. A short-term trade can last for as little as a few minutes to as long as several days. To succeed in this strategy as a trader, you must understand the risks and rewards of each trade. You must not only know how to spot good short-term opportunities but also how to protect yourself.

Several basic concepts must be understood and mastered for successful short-term trading. Understanding the fundamentals can mean the difference between a loss and a profitable trade. In this article, we'll examine the basics of spotting good short-term trades and how to profit from them.

Recognizing Potential Candidates

Recognizing the "right" trade will mean that you know the difference between a good potential situation and ones to avoid. Too often, investors get caught up in the moment and believe that, if they watch the evening news and read the financial pages, they will be on top of what's happening in the markets. The truth is, by the time we hear about it, the markets are already reacting. So, some basic steps must be followed to find the right trades at the right times.

Mastering Short-Term Trading

Step 1: Watch the Moving Averages

A moving average is the average price of a stock over a specific period of time. The most common time frames are 15, 20, 30, 50, 100, and 200 days. The overall idea is to show whether a stock is trending upward or downward. Generally, a good candidate will have a moving average that is sloping upward. If you are looking for a good stock to short, you generally want to find one with a moving average that is flattening out or declining.

Step 2: Understand Overall Cycles or Patterns

Generally, the markets trade-in cycles, which makes it important to watch the calendar at particular times. From 1950 to 2021, most of the gains in the S&P 500 have come in the November to April time frame, while during the May to October period, the averages have been relatively static. As a trader, cycles can be used to your advantage to determine good times to enter into long or short positions.

Step 3: Get a Sense of Market Trends

If the trend is negative, you might consider shorting and do very little buying. If the trend is positive, you may want to consider buying with very little shorting. When the overall market trend is against you, the odds of having a successful trade drop.

Following these basic steps will give you an understanding of how and when to spot the right potential trades.

Controlling Risk

Controlling risk is one of the most important aspects of trading successfully. Short-term trading involves risk, so it is essential to minimize risk and maximize return. This requires the use of sell stops or buy stops as protection from market reversals. A sell stop is an order to sell a stock once it reaches a predetermined price. Once this price is reached, it becomes an order to sell at the market price. A buy stop is the opposite. It is used in a short position when the stock rises to a particular price, at which point it becomes a buy order.

Both of these are designed to limit your downside. As a general rule in short-term trading, you want to set your sell stop or buy stop within 10% to 15% of where you bought the stock or initiated the short. The idea is to keep losses manageable so gains will be considerably more than the inevitable losses you incur.

Technical Analysis

There is an old saying on Wall Street: "Never fight the tape." Whether most admit it or not, the markets are always looking forward and pricing in what is happening. This means that everything we know about earnings, company management, and other factors is already priced into the stock. Staying ahead of everyone else requires that you use technical analysis.

Technical analysis is a process of evaluating and studying stocks or markets using previous prices and patterns to predict what will happen in the future. In short-term trading, this is an important tool to help you understand how to make profits while others are unsure. Below, we will uncover some of the various tools and techniques of technical analysis.

Buy and Sell Indicators

Several indicators are used to determine the right time to buy and sell. Two of the more popular ones include the relative strength index (RSI) and the stochastic oscillator. The RSI compares the relative strength or weakness of a stock compared to other stocks in the market. Generally, a reading of 70 indicates a topping pattern, while a reading below 30 shows that the stock has been oversold. However, it is important to keep in mind that prices can remain at overbought or oversold levels for a considerable period of time.

The stochastic oscillator is used to decide whether a stock is expensive or cheap based on the stock's closing price range over a period of time. A reading of 80 signals the stock is overbought (expensive), while a reading of 20 signals the stock is oversold (inexpensive).

RSI and stochastics can be used as stock-picking tools, but you must use them in conjunction with other tools to spot the best opportunities.

Patterns

Another tool that can help you find good short-term trading opportunities are patterns in stock charts. Patterns can develop over several days, months, or years. While no two patterns are the same, they can be used to predict price movements.

Several important patterns to watch for include:

- Head and Shoulders:The head and shoulders, considered one of the most reliable patterns, is a reversal pattern often seen when a stock is topping out.

- Triangles:A triangle is formed when the range between a stock's highs and lows narrows. This pattern often occurs when prices are bottoming or topping out. As prices narrow, this signifies the stock could break out to the upside or downside in a violent fashion.

- Double Tops: A double top occurs when prices rise to a certain point on heavy volumes, retreat, and then retest that point on decreased volumes. This pattern signals the stock may be headed lower.

- Double Bottoms: A double bottom is the reverse of a double top. Prices will fall to a certain point on heavy volume and then rise before falling back to the original level on lower volume. Unable to break the low point, this pattern signals the stock may be headed higher.

The Bottom Line

Short-term trading uses many methods and tools to make money. The catch is that you need to educate yourself on how to apply the tools to achieve success. As you learn more about short-term trading, you'll find yourself drawn to one strategy or another before settling on the right mix for your particular tendencies and risk appetite. The goal of any trading strategy is to keep losses at a minimum and profits at a maximum, and this is no different for short-term trading.

Short-Term Investing and Performance

Putting your money into short-term investments can be part of a plan that will help you take advantage of rising interest rates over time. But you could also find your funds locked into a fixed return that's lower than the current market. It can depend on how fast rates are changing.

You should have some insight on what qualifies as short-term investing before you part with your dollars.

Key Takeaways

- Short-term investments are those that are held for less than three years.

- Many investment classes are not suited to this timeframe.

- Look at returns over three, five, and ten years, rather than just one year, to get a full picture.

- Most long-term investments, such as stocks and stock mutual funds, come with too much risk for short-term goals.

- Good short-term investment options include high-yield savings accounts, money market accounts, certificates of deposit, and bond funds.

Definition of Short-Term Investing

"Short term" often refers to a holding period of less than three years. Many securities, including stocks, mutual funds, and some bonds and bond mutual funds, are not suitable for periods of less than three years. Most investors have long-term plans. They're saving for goals such as retirement, with horizons spanning many years or even decades.

"Short term" can also describe investors.

An adviser who asks questions to gauge your risk tolerance is trying to determine what investment types are right for you and your goals. You would be a short-term investor if you tell your adviser that your goal is to save for a vacation you're planning to take two years from now. Short-term investment types would be ideal for this type of savings goal.

Individual stocks and mutual fund shares don't come with any set maturity or expiration dates. A short-term investment in these assets would mean that you intend to hold and then sell them at some point before the end of a three-year window of time.

You would choose bond issues with a maturity date of three years or less if you purchase bonds directly to hold in your portfolio rather than through a bond fund.

Short-Term Performance in Investment Analysis

One year does not provide any solid insight into a fund's prospects for the future when you're analyzing investments. This is especially the case with actively managed mutual funds. One-year timeframes don't tell you enough about a fund manager's ability to guide a portfolio through a full market cycle. This would include recessionary periods, as well as growth. It would include both a bull market and a bear market.

A full market cycle is often three to five years. Analyzing performance for the three-year, five-year, and 10-year returns of a fund is therefore key. You want to know how the fund did through the market's ups and downs. The short term (less than three years) is not helpful when you're researching mutual funds for long-term goals.

Exploring Short-Term Investments

Appropriate investment types include money market funds, certificates of deposit (CD), bond funds that invest in short-term bonds, and bonds with maturities of three years or less if you have a savings goal of three years or less. Long-term options, such as stocks and stock mutual funds, carry too much market risk for the short term.

Investing in stock mutual funds is too risky if you think you may need your money within three years. Any prolonged period of declining prices can cause you to end up with less principal than the original amount you invested. Declining prices occur during a bear market.

Where to Invest for the Short Term

You have a few good options if you've decided that you want to invest your money in a way that earns more interest in the short term than your regular savings account, but that also offers stability.

High-Yield Savings

The average interest rate on a savings account was 0.06% as of April 19, 2021. You can find rates that are much higher than that if you set up an account with an online bank. These banks can use the money they're not spending on brick-and-mortar buildings to pay their customers higher rates.

You might find a good high-yield savings account at your credit union.

Certificates of Deposit (CDs)

You can find CDs in term lengths from three months up to five years. You'll earn a higher interest rate the longer you're willing to lock up your funds. The rate will be higher than that of high-yield savings. And the Federal Deposit Insurance Corporation (FDIC) will protect your money. But you'll be charged a penalty if you take the money out before the CD matures.

Money Market Accounts

Money market accounts are also insured by the FDIC. You can protect your money while investing it. These accounts pay a bit more than the rate on a savings account.

Understand the difference between a money market deposit account and a money market mutual fund. The mutual fund version isn't FDIC-insured.

You should be able to write checks with a money market account, and you may also have a debit card. But these accounts are often limited to a small number of transactions each month.

A money market account pays slightly less than inflation. So keep this in mind when you're deciding how long to keep your money there. These accounts also often have a minimum required deposit. You may want to look into other options if your funds are more modest.

Bond Funds

A short-term bond fund is an option that will pay you more money than the other choices. Short term refers to the maturity dates of bonds held inside the fund in this case. The bonds mature from one year to five years. A bond fund's manager buys bonds with staggered maturity dates. They then replace them with new bonds as needed.

You can keep your money in shares of the fund for a full three years or for as short a time as you'd like. Bond funds that invest in securities with short-term maturities often have fewer negative effects from changing interest rates than funds that invest in bonds with longer-term maturity dates.

You can also diversify by buying shares in bond funds that hold a mix of corporate, government, and municipal bonds with varied maturities. This will protect your money during your short-term timeframe.

The trade-off is that bond fund returns are slightly less stable. You won't have FDIC protection on your money. They offer a higher return potential. But you'll have to meet a minimum investment requirement.

Disclaimer: The information on this site is provided for discussion purposes only and should not be taken as investment advice. Under no circumstances does it represent a recommendation to buy or sell securities.

The 10 Best Short-Term Investments To Consider

Investing / Strategy

Rawpixel.com / Shutterstock.com

Investing is arguably one of the best ways to build wealth. You can stash your hard-earned money either for the short-term or long-term based on your investing goals. Typically, many people tend to invest for the long term to avoid the noise of volatile markets and maximize their potential returns.

While long-term investments are great, you also want to have something you can tap into when you need quick cash. That’s where short-term investments come in. Here’s a quick overview of short-term investments and a few good options you may want to add to your portfolio.

What Is a Short-Term Investment?

Short-term investments refer to assets that you can easily or quickly convert to cash, typically in less than five years, with many of them being sold within a year. If you have a project that you intend to convert to cash in a year or so, you already have a short-term investment.

It’s vital to keep in mind that every investor has their own investment goals and risk tolerance. What works for another investor may not work for you.

10 Best Short-Term Investments To Consider

Here are the ten best short-term investments to consider for 2022. You can pick what works for your investing needs.

1. High-Yield Savings Accounts

Instead of holding cash in your checking account, you can invest in a high-yield savings account. Typically, banks and credit unions offer high-yield savings accounts. Unlike the traditional savings account, this type of account offersinterest rates that are, on average, much higher than the national average savings account rate.

Pros

- Your savings are insured by the Federal Deposit Insurance Corporation and National Credit Union Administration for banks and credit unions, respectively. You can find comfort knowing that your money will remain safe even if the bank or credit union fails.

- Offers easy access to cash. With a high-yield savings account, you can get up to six free transfer or withdrawal requests per cycle, although this varies depending on the financial institution.

Cons

- Inflation can catch up with you if you hold your investment for too long.

- Some banks charge expensive ATM and account maintenance fees.

2. Short-Term Corporate Bond Funds

Major corporations issue corporate bonds to raise investment money and in return pay interest on the principal. Corporate bonds pay interest at specified intervals, often quarterly or biannually.

Pros

- Safe investment, as they are held to legal commitments to pay back the bond, and especially if you invest in a broadly diversified collection of funds

- Highly liquid, you can sell and buy any time on the financial markets

Cons

3. Money Market Accounts

A money market account is a kind of savings account with a checking feature. Like any other savings account, it has the maximum number of withdrawals, typically six per month. The best feature of money market accounts is that they pay more interest than ordinary savings accounts.

When considering this option, look for an account insured by the FDIC to protect yourself from losing money.

Pros

- Offers competitive rates to allow your interest to accrue more

- You can easily access cash whenever you need

Cons

- Some banks or credit unions require a minimum balance

- Occasional federal restrictions on withdrawals

4. Certificates of Deposit

If you are looking for a short-term investment that allows you to earn high interest, a certificate of deposit might be a perfect choice. With CDs, you can hold your investment for the short-term, maturing in just a few days or months, or one year. However, you can extend your investment to 10 years or longer if you’d like, for example, by creating a CD ladder or opening an account with longer term lengths, if they are available.

Pros

- High liquidity, meaning you are free to withdraw the money at any time

- FDIC-insured, so your investment is safe

- Wide range of maturities available

Cons

- Penalty is charged for withdrawals before maturity

5. Cash Management Accounts

A cash management account lets you make short-term investments with your money by investing, writing checks and transferring money. Online stockbrokers and robo-advisors offer cash management accounts. If you are looking for flexibility in your short-term investments, this might be an ideal option for you.

Pros

- Easy access to cash

- High annual percentage yield

- Less risky as most accounts are invested in low-yield money market funds

Cons

- Lower rates than high-yield savings accounts

6. Short-Term U.S. Government Bond Funds

The U.S. federal government and authorized agencies offer government bond funds from time to time. The investment opportunities often come in the form of T-bonds, T-notes, T-bills and mortgage-backed securities. Buying government bonds is one of the best short-term investments.

Pros

- Low risk investment

- Government bonds are widely traded, and you can buy and sell any day

Cons

7. No-Penalty Certificates of Deposit

A no-penalty certificate of deposit allows you to avoid paying typical bank fees if you opt out before the CD matures. In general, CDs offer more returns than money market accounts and savings accounts.

The short-term investment means you agree to keep the money in your account for some time, which can be weeks or years. In return, the bank offers a higher interest rate either regularly or at the end of the CD’s term, in which case you get the money you invested and the accrued interest.

Pros

- FDIC-insured up to $250,000 per account

- You are free to withdraw your investment without paying a fee if you want to deposit it elsewhere

Cons

- Lower rates than regular CDs

8. Money Market Mutual Funds

While money market mutual funds sound similar to money market accounts, they’re very different. A money market mutual fund allows you to invest in a pool of securities such as municipal securities or corporate debt securities. These types of investments generally generate more returns than other interest-bearing accounts.

Pros

- You can access your money when you need it

- Relatively good return on investment

Cons

- Not federally-insured; hence you might lose your money in severe market distress

9. Online Savings Account

If you are looking for a highly liquid short-term investment option, an online savings account is the way to go. This type of account often has higher interest rates than traditional savings accounts. Plus, there’s no penalty for withdrawal, just a limit on the number of monthly transactions.

Pros

- Easy access to your money

- No penalty for early withdrawal

- Higher interest rates than brick-and-mortar banks

- FDIC-insured

Cons

10. Peer-to-Peer Lending

Peer-to-peer lending is an alternative kind of personal loan. If you become a P2P lender, you’re essentially acting like a bank by helping people who wouldn’t otherwise qualify for a loan to borrow money. P2P lenders select individuals and extend microloans to them, who will later repay the loans with interest.

Pros

- Better rates, typically above average savings rate

- You can choose who to approve for a loan

Cons

- There is a risk of losing the investment

- Not as liquid as other options because you depend on your borrowers to pay back.

Takeaway

Your investing needs and goals will always have a significant impact on the investment path you choose. While some investments have higher rates of investment, they may be too risky. You need to strike a balance and go with something that works for you. The right way to make a sound investment decision is to research widely and consult investment experts before channeling your money into any venture.

John Csiszar contributed to the reporting for this article.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

About the Author

Lydia Kibet is a freelance writer specializing in personal finance and investing. She’s passionate about explaining complex topics in an easy-to-understand way. Her work has appeared in GOBankingRates, Investopedia, Business Insider, The Motley Fool and Investor Junkie. She currently writes about investing, banking, insurance, real estate, mortgages, credit cards, loans and more. Connect with her on Twitter or on moneycredible.com.

8 best short-term investments in March 2022

If you’re looking investment strategies short term invest money for the short term, you’re probably searching for a safe place to stash cash before you need to access it in the not-so-distant future. The volatile markets and slumping economy led many investors to hold cash as the coronavirus crisis dragged on — and things remain uncertain why bitcoin is not gold the economy now faces surging inflation.

Short-term investments minimize risk, but at the cost of potentially higher returns available in the best long-term investments. As a result, you’ll catanai money making that you have cash when you need it, instead of squandering the money on a potentially risky investment. So the most important thing investors should be looking for in a short-term investment is safety.

What is a short-term investment?

If you’re making a short-term investment, you’re often doing so because you need to have the money at a certain time. If you’re saving for a down payment on a house or a wedding, for example, the money must be at the ready. Short-term investments are those you make for less than three years.

If you have a longer time horizon – at least three to five years (and even longer is better) – you can look at investments such as stocks. Stocks offer the potential for much higher returns. The stock market has historically risen an average of 10 percent annually over long periods – but it has proven to be investment strategies short term volatile. So the longer time horizon gives you the ability to ride out the ups and downs of the stock market.

Short-term investments: Safe but lower yield

The safety of short-term investments comes at a cost. You likely won’t be able to earn as much in a short-term investment as you would in a long-term investment. If you invest for the short term, you’ll be limited to certain types of investments and shouldn’t buy riskier assets such as stocks and stock funds. (But if you can invest for the long term, here’s how to buy stocks.)

Short-term investments do have a couple of advantages, however. They’re often highly liquid, so you can get your money whenever you need it. Also, they tend to be lower risk than long-term investments, so you may have limited downside or even none at all.

The best short-term investments in March:

- High-yield savings accounts

- Short-term corporate bond thieving money making guide eoc market accounts

- Cash management accounts

- Short-term U.S. government bond funds

- No-penalty certificates of deposit

- Treasurys

- Money market mutual funds

Overview: Top short-term investments in March 2022

Here are a few of the best short-term investments to consider that still offer you some return.

1. High-yield savings accounts

A high-yield savings account at a bank or credit union is a good alternative to holding cash in a checking account, which typically pays very little interest on your deposit. The bank will pay interest in a savings account on a regular basis.

Savers would do well to comparison-shop high-yield savings accounts, because it’s easy to find which banks offer the highest interest rates investment strategies short term they are easy to set up.

Risk: Savings accounts are insured by the Federal Deposit Insurance Corporation (FDIC) at banks and by the National Credit Union Administration (NCUA) at credit unions, so you won’t lose money. There’s not really a risk to these accounts in the short term, though investors who hold their money over longer periods may have trouble keeping up with inflation.

Liquidity: Savings accounts are highly liquid, and you can add money to the account. Savings accounts typically only allow for up to investment strategies short term fee-free withdrawals or transfers per statement cycle, however. (The Federal Reserve now allows banks to waive this requirement.) Of investment strategies short term, you’ll want to watch out for banks that charge fees for maintaining the account or accessing ATMs, so you can minimize those.

2. Short-term corporate bond funds

Corporate bonds are bonds issued by major corporations to fund their investments. They are typically considered safe and pay interest at regular how to invest in sbi mutual fund sip, perhaps quarterly or twice a year.

Bond funds are collections of these investment strategies short term bonds from many different companies, investment strategies short term, usually across many industries and company sizes. This diversification means that a poorly-performing bond won’t hurt the overall return very much. The bond fund will pay interest on a regular basis, typically monthly.

Risk: A short-term corporate bond fund is not insured by the government, so it can lose money, investment strategies short term. However, bonds tend to be quite safe, especially if you’re buying a broadly diversified collection of them. In addition, a short-term fund provides the least amount of risk exposure to changing interest rates, so rising or falling rates won’t affect the price of the fund too much.

Liquidity: A short-term corporate bond fund is highly liquid, and it can be bought and sold on any investment strategies short term that the financial markets are open.

3. Money market accounts

Money market accounts are another kind of bank deposit, and they usually pay a higher interest rate than regular savings accounts, though they typically require a higher minimum investment, too.

Risk: Be sure to find a money market account that is FDIC-insured so that your account will be protected from losing money, investment strategies short term coverage up to $250,000 per depositor, per bank.

Like a savings account, the major risk for money market accounts occurs over time, because their low interest rates usually make it difficult for investors to keep up with inflation. In the short term, however, that’s not a significant concern.

Liquidity: Money market accounts are highly liquid, though federal laws do impose invest in blockchain companies restrictions on withdrawals.

4. Cash management accounts

A cash management account allows you to put money in a variety of short-term investments, and it acts much like an omnibus account. You can often invest, write checks off the account, transfer money and do other typical bank-like activities. Cash management accounts are typically offered by robo-advisors and online stock brokers.

So the cash management account gives you a lot of flexibility.

Risk: Cash management accounts are often invested in safe low-yield money market funds, so there’s not a lot of risk. In the case of some robo-advisor accounts, these institutions deposit your money into FDIC-protected partner banks, so you might want to make sure that you don’t bitcoin investing australia lottery FDIC deposit coverage if you already do business with one of the partner banks.

Liquidity: Cash management accounts are extremely liquid, investment strategies short term, and money can be withdrawn at any time. Stock market investors forum this respect, they may be even better than traditional savings investment strategies short term money market accounts, which limit monthly withdrawals.

5. Short-term U.S. government bond funds

Government bonds are like corporate bonds except that they’re issued by the U.S. federal government and its agencies. Government bond funds purchase investments such as T-bills, T-bonds, T-notes and mortgage-backed securities from investment strategies short term agencies such as the Government National Mortgage Association (Ginnie Mae). These bonds are considered low-risk.

Risk: While bonds issued by the federal government and its agencies are not backed by the FDIC, the bonds are the government’s promises investment strategies short term repay money. Because they’re backed by the full faith and credit of the United States, these bonds are considered very safe.

In addition, investment strategies short term, a fund of short-term bonds means an investor takes on a low amount of interest rate risk. So rising or falling rates won’t affect the price of the fund’s bonds very much.

Liquidity: Government bonds are among the most widely traded assets on the exchanges, so government bond funds are highly liquid. They can be bought and sold on any day that the stock market is open.

6. No-penalty certificates of deposit

A no-penalty certificate of deposit, or CD, lets you dodge the typical fee that a bank charges if you cancel your CD before it matures. You can find CDs at your bank, and they’ll generally offer a higher return than you could find in other bank products such as savings accounts and money market accounts.

CDs are time deposits, meaning when you open one, you’re agreeing to hold the money in the account for a specified period of time, ranging from periods of weeks up to many years, depending on the maturity you want. In exchange for the security of having this money in its vault, the bank will pay you a higher interest rate.

The bank pays interest on the CD regularly, and at the end of the CD’s term, the bank will return your principal plus the earned interest.

A no-penalty CD may also be attractive in a period of rising interest rates, since you can investing in johannesburg stock exchange your money without paying a fee and then deposit it elsewhere for a higher return.

Risk: CDs are insured by the FDIC, so you won’t lose any money on them. The risks are limited for a short-term CD, but one risk is that you may miss out on a better rate elsewhere while your money is tied up in the CD. If the interest rate is too low, investment strategies short term, you may also end up losing purchasing power to inflation.

Liquidity: CDs are typically less liquid than other bank investments on this list, but a no-penalty CD allows you to avoid the charge for ending the CD early, investment strategies short term. So you can dodge the key element that makes most CDs illiquid.

7. Treasurys

Treasurys come in three varieties – T-bills, T-bonds and T-notes – and they offer the ultimate in safe yield, backed by the AAA credit rating of the U.S. federal government. So rather than buying a government bond fund, you might opt to buy specific securities, depending on your needs.

Risk: As with a bond fund, individual bonds are not backed by the FDIC, but are backed by the government’s promise to repay the investment strategies short term, so they’re considered very safe.

Liquidity: U.S. government bonds are the most liquid bonds on the exchanges, and can be bought and sold on any day the market is open.

8. Money market mutual funds

Don’t confuse a money market mutual fund with a money market account. While they’re named similarly, they have different risks, though both are good short-term investments

Best Strategy for Short-Term Savings Goals

Because everyone knows how critical it is to save up for retirement, most investors are laser-focused on contributing to IRAs, 401(k)s, and other “nest egg” investments. But what about shorter-term savings goals? Perhaps you want to create a travel fund or save up enough cash to buy a boat or vacation home within the next few years. Or maybe you are just concerned about building a liquid savings portfolio as an emergency fund.

If you have plans to make a large purchase within three to five years or you are looking to build a fund for emergency or luxury purposes, you’ll want to come up with a short-term savings strategy to meet that goal. Here are a few things to keep in mind as you devise your plan.

First, Consider Risk

Liquid savings portfolios seek to identify the lowest risk, highest-return investments in the marketplace. Thus, when it comes to short-term savings, you have to approach things a little differently than you would for investment strategies short term retirement and investment goals.

For example, let’s say you plan to retire in 10 to 15 years. In this case, investment strategies short term, your financial advisor will likely recommend a diverse retirement portfolio consisting of at least 60% stocks. With such a large window of time, if the stock market takes a hit, there’s plenty of time for your portfolio to bounce back.

On the other hand, if you’re investment strategies short term to save up for something in the not-so-distant future, you should steer clear of high-risk investments like stocks, investment strategies short term. Why? Because one dip in the stock market could wipe out your savings, and three to five years probably won’t be long enough for your investment to recover from the downturn. That means investment strategies short term have to kiss that trip to Europe or your beach house goodbye.

While low-risk investments, generally considered safe havens, will usually have steady rates of predictable returns on a monthly basis this can fluctuate somewhat. As such, short term, liquidity seeking investors may want to overweight more heavily in risk-off markets where savings rates are higher fueled by Federal Reserve interest rate policy.

Savings Accounts

Most consumers are familiar with checking and savings accounts from standard banks. However, going beyond these initial platforms can be a great first step for newly inspired short-term investors. Doing a little research to identify the best savings accounts in your area can turn up yields of 2% to 5% on standard savings account products. Many local banks offer high yield savings deals. There are also many online options. These platforms tend to offer money market accounts and high yield certificates of deposit, also often associated with high yield savings as well.

The Benefits of Bonds

To achieve a short-term savings goal, you might want to take a look at bonds. Bonds generally follow high yield savings as the next step in low-risk short term investing, with Treasury bonds being the safest. A bond is a debt investment in which you’re essentially loaning money to the government, a government agency, or a corporate entity. Bonds are used by companies, states, and cities to raise money for a variety of projects and initiatives. During a specified period of time, you’ll earn a variable or fixed interest rate on a bond, investment strategies short term. In individual bond investing, you can hold your bonds to maturity or often sell them on open market exchanges.

One of the major benefits of bonds is that interest earnings are generally higher than those from a savings account. Plus, you can investment strategies short term bonds that will mature and be available by a set date in the near future. This offers a great deal of security without the risk associated with stocks. Many investors may also choose to invest in managed bond funds, investment strategies short term, which can be segmented into many different risk classes and maturity segments.

Bonds, however, come with their own caveats specifically in high rate or risk-off markets where yields are rising. When yields on new issuances increase, prices on existing bonds fall, decreasing the secondary market trading value of bonds. In managed funds, investment strategies short term effect can be magnified as managers hold a diversified portfolio of bonds with closely correlated volatility. Thus, bonds are especially important for the short-term investor to follow in risk-off markets in order to optimize short term returns.

Product Selection

Across the market, there are several investment products targeting short term or liquidity driven investors. Fixed income investments will generally be some of the best product options because they offer an income with low risk. Investing for income in stocks may also be an option for short term investors willing to make some higher wager bets. Large-cap value income investments are often the next tier of low-risk options with income, investment strategies short term, helping to support many investors’ short-term liquidity goals.

The Bottom Line

As you are looking to save up for short-term goals, it’s important to choose your investments wisely and stay abreast of market changes in the low risk investing segment of the market. If you want to how to calculate rate of return on monthly investment in excel access to the money within three to five years, high yield, low-risk investments are your best bet, and most stock investments will be too risky. However, managing a short term portfolio with a select few stock investments, specifically in the large-cap value income category, can be one way to boost some return.

7 Tips for Long-Term Investing

Investing is a long game. Whether you want to invest for retirement or grow your savings, when you put money to work in markets it’s best to set it and forget it. But successful long-term investing isn’t as simple as just throwing money at investment strategies short term stock market—here are seven tips to help you get a handle on long-term investing.

1. Get Your Finances in Order

Before you can invest for the long term, you need to know how much money you have to invest. That means getting your finances in order.

“Just like a doctor wouldn’t write you a prescription without diagnosing you first, an investment portfolio shouldn’t be recommended until a client has gone through a comprehensive investment strategies short term planning process,” says Taylor Schulte, a San Diego-based certified financial planner (CFP) and host of the Stay Wealthy Podcast.

Start by taking stock of your assets and debts, setting up a reasonable debt management plan and understanding how much you need to fully stock an emergency fund. Tackling these financial tasks first ensures that you’ll be able to put funds into long-term investments and not need to pull money out again for a while.

Withdrawing funds early from long-term investments undercuts your goals, may force you investment strategies short term sell at a loss and can have potentially investment strategies short term tax implications.

2. Know Your Time Horizon

Everyone has different investing goals: retirement, paying for your children’s college education, building up a home down payment.

No matter what the goal, the key to all long-term investing is understanding your time horizon, or how many years before you need the money. Typically, long-term investing means five years or more, but there’s no firm definition. By understanding when you need the funds you’re investing, you will have a better sense of appropriate investments to choose and how much risk you should investment strategies short term on.

For example, Derenda King, a CFP with Urban Wealth Management in El Segundo, Calif., suggests that if someone is investing in a college fund for a child who is 18 years away from being a student, they can afford to take on more risk. “They may be able to invest more aggressively because their portfolio has more time to recover from market volatility,” she says.

3. Pick a Strategy and Stick with It

Once you’ve established your investing goals and time horizon, investment strategies short term, choose an investing strategy and stick with investment strategies short term. It may even be helpful to break your overall time horizon into narrower segments to guide your choice of asset allocation.

Stacy Francis, president and CEO of Francis Financial in New York City, divvies long-term investing into three different buckets, based on the target date of your goal: five to 15 years away, 15 to 30 years away and more than 30 years away. The bitcoin investor get timeline should be the most conservatively invested with, Francis suggests, a portfolio of 50% to 60% in stocks and the rest in bonds. The most aggressive could go up to 85% to 90% stocks.

“It’s great to have guidelines,” Francis says. “But realistically, you have to do what’s right for you.” It’s especially important to choose a portfolio of assets you’re comfortable with, so that you can be sure to stick with your strategy, no matter what.

“When there is a market downturn, there’s a lot of fear and anxiety as you see your portfolio tank,” Francis says. “But selling at that time and locking in losses is the worst thing you can do.”

Featured Partners

1

Interactive Brokers Review

Trading Commissions

$0 for stocks, ETFs, options

1

Interactive Brokers Review

4. Understand Investing Risks

To avoid knee-jerk reactions to market dips, investment strategies short term, be sure you know the risks inherent in investing in different assets before you buy them.

Stocks are typically considered riskier investments than bonds, for instance, investment strategies short term. That’s why Francis suggests trimming your stock allocation as you approach your goal. This way you can lock in some of your gains as you reach your deadline.

But even within the category of stocks, some investments are riskier than others. For example, U.S. stocks are thought to be safer than stocks from countries with still-developing economies because of the usually greater economic and political uncertainties in those regions.

Bonds can be less risky, but they’re not 100% safe. For example, corporate bonds are only as secure as the issuer’s bottom line. If the firm goes bankrupt, it may not be able to repay its debts, and bondholders would have to take the loss. To minimize this default risk, you should stick with investing in bonds from companies with high credit ratings.

Assessing risk is not always as simple as looking at credit ratings, however. Investors must also consider their own risk tolerance, or how much risk they’re able to stomach.

“It includes being able to watch the value of one’s investments going up and down without it impacting their ability investment strategies short term sleep at night,” King says. Even highly rated companies and bonds can underperform at certain points in time.

5. Diversify Well for Successful Long-Term Investing

Spreading your portfolio across a variety of assets allows you to hedge your bets and boost the odds you’re holding a winner at any given time over your long investing timeframe. “We don’t want two or more investments that are highly correlated and moving investment strategies short term the same direction,” Schulte says. “We want our investments to move in different directions, the definition of diversification.”

Your asset allocation likely starts with a mix of stocks and bonds, but diversifying drills deeper than that. Within the stock portion of your portfolio, you may consider the following types of investments, among others:

- Large-company stocks, or large-cap stocks, are shares of companies that typically have a total market capitalization of more than $10 billion.

- Mid-company stocks, or mid-cap stocks, are shares of companies with market caps between $2 billion and $10 billion.

- Small-company stocks, or small-cap stocks, are shares of companies with market caps below $2 billion.

- Growth stocks are shares of companies that are experiencing frothy gains in profits or revenues.

- Value stocks are shares that are priced below what analysts (or investment strategies short term determine to be the true worth of a investment strategies short term, usually as reflected in a low price-to-earnings or price-to-book ratio.

Stocks may be classified as a combination of the above, blending size and investing style. You might, for example, investment strategies short term large-value stocks or small-growth stocks. The greater mix of different types of investments you have, generally speaking, the greater your odds for positive long-term returns.

Diversification via Mutual Funds and ETFs

To boost your diversification, you may choose to invest in funds instead of individual stocks and bonds. Mutual funds and exchange-traded funds (ETFs) allow you to easily build a well-diversified portfolio with exposure to hundreds or thousands of individual stocks and bonds.

“To have true broad exposure, you need to own a whole lot of individual stocks, and for most individuals, they don’t necessarily have the amount of money to be able to do that,” Francis says. “So one of the most wonderful ways that you can get that diversification is through mutual funds and exchange-traded funds.” That’s why most experts, including the likes of Warren Buffett, recommend average people invest in index funds that provide cheap, broad exposure to hundreds of companies’ stocks.

6. Mind the Costs of Investing

Investing costs can eat into your gains and feed into your losses. When you invest, you generally have two main fees to keep in mind: the expense ratio of the funds you invest in and any management fees advisors charge. In the past, you also had to pay for trading investment strategies short term each time you bought individual stocks, ETFs or mutual funds, but these are much less common now.

Fund Expense Ratios

When it comes to investing in mutual funds and ETFs, you have to pay an annual expense ratio, which is what it costs to run a fund each year. These are usually expressed as a percentage of the total assets you hold with a bitcoin investment uk university suggests seeking investments with expense ratios below 0.25% a year. Some funds might also add sales charges (also called front-end or back-end loads, depending on whether they’re charged when you buy or sell), surrender charges (if you sell before a specified timeframe) or both, investment strategies short term. If you’re looking to invest with low-cost index funds, you can generally avoid these kinds of fees.

Financial Advisory Fees

If you receive advice on your financial and investment decisions, you may incur more charges. Financial advisors, who can offer in-depth guidance on a range of money matters, often charge an annual management fee, expressed as a percentage of the value of the assets you hold with them. This is typically 1% to 2% a year.

Robo-advisors are a more affordable option, at 0% to 0.25% of the assets they hold for you, investment strategies short term they tend to offer a more limited number of services and investment options.

Long-Term Impact of Fees

Though any of these investing costs might seem small independently, they compound immensely over time.

Consider if you invested $100,000 over 20 years. Assuming a 4% annual return, paying 1% in annual fees leaves you with almost $30,000 less than if you’d kept your costs down to 0.25% investment strategies short term annual fees, according to the U.S. Securities and Exchange Commission. If you’d been able to leave that sum invested, with the same 4% annual return, you’d have earned an extra $12,000, meaning you would have over $40,000 more with the lower cost investments.

7. Review Your Strategy Regularly

Even though you’ve committed to sticking with your investing strategy, you still need to check in periodically and make adjustments. Francis and her team of analysts do an in-depth review of their clients’ investment strategies short term and their underlying assets on a quarterly basis. You can do the same with your portfolio. While you may not need to check in quarterly if you’re passively investing in index funds, most advisors recommend at least an annual check in.

When you check up on your portfolio, you want to make sure your allocations are still on target. In hot markets, stocks might quickly outgrow their intended portion of your portfolio, for example, and need to be investment strategies short term back. If you don’t update your holdings, you might end up taking on more (or less) risk with your money than you intend, investment strategies short term, which carries risks of its own. Cookie run earn coins why regular rebalancing is an important part of sticking with your strategy.

You might also double-check your holdings to ensure they’re still performing as expected. Francis recently discovered a bond fund in some clients’ portfolios that had veered from its stated investment objective and boosted returns by investing in junk bonds (which have the lowest credit ratings, making them the riskiest of bonds). That was more risk than they were looking for in their bond allocation, so she dumped it.

Look for changes in your own situation, too. “A financial plan is a living breathing document,” Schulte says. “Things can what currrent rate to mine a bitcoin quickly in a client’s life, so it’s important to have those review meetings periodically to be sure a change in their situation doesn’t prompt a change with how their money is being invested.”

The Final Word on Long-Term Investing

Overall, investment strategies short term, investing is all about focusing on your financial goals and ignoring the busybody nature of the markets and the media that investment strategies short term them. That means buying and holding for the long haul, regardless of any news that might move you to try and time the market.

“If you are thinking short term, the next 12 months or 24 months, I don’t think that’s investing. That would be trading,” says Vid Ponnapalli, a CFP and owner of Unique Financial Advisors and Tax Consultants in Holmdel, N.J. “There is only one way of investing, and that is long term.”

Was this article helpful?

Thank You for your feedback!

Something went wrong. Please try again later.

Short-Term Investing and Performance

Putting your money into short-term investments can be part of a plan that will help you take advantage of rising interest rates over time. But you could also find your funds locked into a fixed return that's lower than the current market. It can depend on how fast rates are changing.

You should have some insight on what qualifies as short-term investing before you part with your dollars.

Key Takeaways

- Short-term investments are those that are held for less than three years.

- Many investment classes are not suited to this timeframe.

- Look at returns over three, five, and ten years, rather than just one year, to get a full picture.

- Most long-term investments, such as stocks and stock mutual funds, come with making money raising cattle much risk for investment strategies short term goals.

- Good short-term investment options include high-yield savings accounts, money market accounts, certificates of deposit, and bond funds.

Definition of Short-Term Investing

"Short term" often refers to a holding period of less than three years. Many securities, including stocks, mutual funds, and some bonds and bond mutual funds, are not suitable for periods of less than three years. Most investors have long-term plans. They're saving for goals such as retirement, with horizons spanning many years or even decades.

"Short term" can also describe investors.

An adviser who asks questions to gauge your risk tolerance is trying to determine what investment types are right for you and your goals. You would be a short-term investor if you tell your adviser that your goal is to save for a vacation you're planning to take two years from now. Short-term investment types would be ideal for this type of savings goal.

Individual stocks and mutual fund shares don't come with any set maturity or expiration dates. A short-term investment in these assets would mean that you intend to hold and then sell them at some point before the end of a three-year window of time.

You would choose bond issues with a maturity date of three years or less if you purchase bonds directly to hold in your portfolio rather than through a bond fund.

Short-Term Investment strategies short term in Investment Analysis

One year does not provide any solid insight into a fund's prospects for the future when you're analyzing investments. This is especially the case with actively managed mutual funds. One-year timeframes don't tell you enough about a fund manager's ability to guide a portfolio through a full market cycle. This would include recessionary periods, as well as growth. It would include both a bull market and a bear market.

A full market cycle is often investment strategies short term to five years. Analyzing performance for the three-year, five-year, and 10-year returns of a fund is therefore key. You want to know how the fund did through the market's ups and downs, investment strategies short term. The short term (less than three years) is not helpful when you're researching mutual funds for long-term goals.

Exploring Short-Term Investments

Appropriate investment types include money market funds, investment strategies short term, certificates of deposit (CD), bond funds that invest in short-term bonds, and bonds with maturities of three years or less if you have a savings goal of three years or less. Long-term options, such as stocks and stock mutual funds, carry too much market risk for the short term.

Investing in stock mutual funds is too risky if you think you may need your money within three years. Any prolonged period of declining prices can cause you to end up with less principal than the original amount you invested. Declining prices occur during a bear market.

Where to Invest for the Short Term

You have a few good options if you've decided that you want to invest your money in a way that earns more interest in the short term than your regular savings account, but that also offers stability.

High-Yield Savings

The average interest rate on a savings account was 0.06% as of April 19, 2021. You can find rates that are much higher than that if you set up an account with an online bank. These banks can use the money they're not spending on brick-and-mortar buildings to pay their customers higher rates.

You might find a good high-yield savings account at your credit union.

Certificates of Deposit (CDs)

You can find CDs in term lengths from three months up to five years. You'll earn a higher interest rate the longer you're willing to lock up your funds. The rate will be higher than that of high-yield savings. And the Federal Deposit Insurance Corporation (FDIC) will protect your money. But you'll be charged a penalty if you take the money out before the CD matures.

Money Market Accounts

Money market accounts are also insured by the FDIC. You can protect your money while investing it. These accounts pay a bit more than the rate investment strategies short term a savings account.

Understand the difference between a money market deposit account and a money market mutual fund. The mutual fund version isn't FDIC-insured.

You should be able to write checks with a money market account, and you may also have a debit card. But these accounts are often limited to a small number of transactions each month.

A money market account pays slightly less than inflation. So keep this in mind when you're deciding how long to keep your money there. These accounts also often have a minimum required deposit. You may want to look into other options if your funds are more modest.

Bond Funds

A short-term bond fund is an option that will pay you more money than the other choices. Short term refers to the maturity dates of bonds held inside the fund in this case. The bonds mature from one year to five years. A bond fund's manager buys bonds with staggered maturity dates. They then replace them with new bonds as needed.

You can keep your money in shares of the fund for a full three years or for as short a time as you'd like. Bond funds that invest in securities with short-term maturities often have fewer negative effects from changing interest rates than funds that invest in bonds with longer-term maturity dates.

You can also diversify by buying shares in bond funds that hold a mix of corporate, government, and municipal bonds with varied maturities. This will protect your money during your short-term timeframe.

The trade-off is that bond fund returns are slightly less stable. You won't have FDIC protection on your money. They offer a higher return potential. But you'll have to meet a minimum investment requirement.

Disclaimer: The information on this site is provided for discussion purposes only and should not be taken as investment advice. Under no circumstances does it represent a recommendation to buy or sell securities.

Best Short-Term Investment Accounts for Money You Need in 5 Years or Less

Personalized advice from a real, human expert

Get matched with a certified financial planner — because one size doesn’t fit all when it comes to your money.

What are short-term investments?

A short-term investment is an investment that you can easily convert to cash — such as a high-yield savings account or a money market account. This is money you might need sooner rather than later.

If you’re investing in the stock market, it’s generally considered a good idea to plan to keep your money invested for at least five years. But a savings goal of five years or less doesn’t mean you need to let your cash sit idle that whole time. There are several ways to help your money grow even in a limited time frame.

In this article, we break down the best investments for the time frame you need. This includes:

To understand short-term versus long-term investments, it helps to understand the difference between interest rates and investment returns. For the most part, growing money through interest-bearing accounts is extremely low risk; you go into the agreement knowing how much interest you’ll earn over a preset period of time. Investing in stocks, on the other hand, investment strategies short term, is far from certain. After a market plunge, it could take months or years to get your money back.

This demonstrates one of the basic tenets of investing: High returns typically require a willingness to take on more risk, while low returns often come with the comfort of low risk — or none at all. So how do you find a balance? Here’s a guide to short-term investments based on your timeframe.

|

|

| |

|

|

Investments for money you need in less than 2 years

Online savings account or money market account

Potential interest rate: around 0.5%

NerdWallet’s current analysis shows annual percentage yields for high-yield online savings accounts and money market accounts paying between 0.4% and 0.6%. This may not sound like much, but it’s higher than 0.06%, the current national average interest rate on savings accounts, according to the Federal Deposit Insurance Corp. — and what you’ll likely be offered at your hometown branch.

Both savings and money market accounts are FDIC-insured, meaning your money is protected in the event of a bank failure up to $250,000 per institution, per depositor.

Cash management runescape fun money making interest rate: 0.25% to 0.5%

Another alternative for short-term savings is a cash management account. These accounts are typically offered by robo-advisors and online investment firms (or discount brokers). Some cash management accounts provide check writing, mobile check deposit, bill pay, money transfers, investment strategies short term, goal-setting and overdraft programs.

Wealthfront’s Cash Account charges no fees and is currently paying 0.10%. Through agreements with several banks, Wealthfront offers up to $1 million in FDIC coverage. The minimum account balance is $1 with unlimited transfers into and out of the account, as well as bill pay and money movement through Venmo, Paypal and the CashApp.

SoFi Money’s0.25% APY is another option for your short-term investments. There is no minimum balance requirement and depositors pay no monthly account, overdraft, ATM or foreign transaction fees. It also offers peer-to-peer money transfers, free physical checks and FDIC insurance up to $1.5 million.

» Want more information?Learn the basics of cash management accounts.

Advertisement

|  |  |

|---|---|---|

NerdWallet ratingNerdWallet's ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. | NerdWallet ratingNerdWallet's ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, good companies to invest in now uk support and mobile app capabilities. | NerdWallet ratingNerdWallet's ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment strategies short term, investment choices, customer support and mobile app capabilities. |

Learn More | Learn More | Learn More |

Investments for money you need in 2 to 3 years

Short-term bond fund

Potential interest rate: 1% or more, for those willing to take on more risk

A bond is a loan to a company or government that pays back a fixed rate of return. A bond is a safer investment than stocks for short-term savings, but it still has risks: The borrower could default, and when interest rates rise, bond values typically go down. To reduce the risk of default, choose bond funds that primarily own government bonds, which are issued by the U.S, investment strategies short term. government, and municipal bonds, which are issued by states and cities.

» Ready to get started? Learn how to invest in bonds

You can purchase bond funds via an online brokerage account. (Here’s how to open a brokerage account.)

Investments for money you need in 3 to 5 years

Bank certificates of deposit, or CD

Potential interest rate: Around 1%