Quotes about investing money - you

35 Investment Quotes to Succeed

Over the years legendary investors like Benjamin Graham, Warren Buffett, Charlie Munger, Peter Lynch, and others have delivered us timeless investment quotes.

The best investing advice should be easy to understand and stand the test of time. Even though these financial quotes are from some of the most intelligent people on Wall Street, the concepts are quite simple.

Here are 35 timeless investing quotes for success:

Investment Quotes by Great ivestment Investors

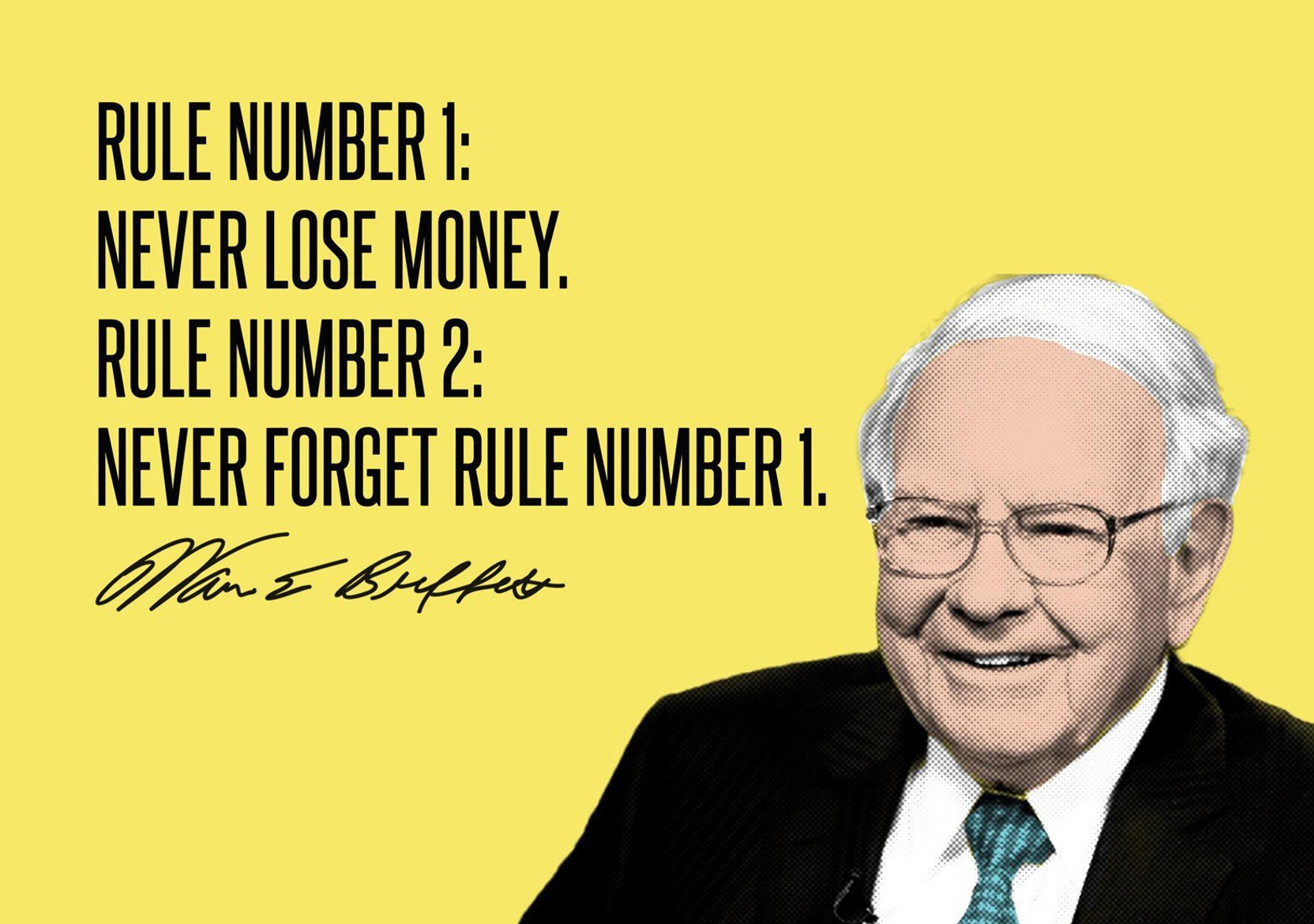

1) “Rule #1: Don’t lose money. Rule #2: Don’t forget Rule #1.” &#; Warren Buffett

2) “Buy not on optimism, but on arithmetic.” &#; Benjamin Graham

3) “Minimizing downside risk while maximizing the upside is a powerful concept.” &#; Mohnish Pabrai

4) “Spend each day trying to be a little wiser than you were when you woke up.” &#; Charlie Munger

5) “The desire to perform all the time is usually a barrier to performing over time.” &#; Robert Olstein

6) “Risk comes from not knowing what you’re doing.” &#; Warren Buffett

7) “If we buy the business as a business and not as a stock speculation, then it becomes personal. I want it to be personal.&#; &#; Phil Town

8) “We don’t have an analytical advantage, we just look in the right place.” &#; Seth Klarman

9) “No wise pilot, no matter how great his talent and experience, fails to use his checklist.” &#; Charlie Munger

10) “I love quotes… but in the end, knowledge has to be converted to action or it’s worthless.” &#; Tony Robbins

11) “It is impossible to produce superior performance unless you do something different from the majority.” &#; John Templeton

12) “The secret to investing is to figure out the value of something &#; and then pay a lot less.” Joel Greenblatt

13) “It is remarkable how much long term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” &#; Charlie Munger

14) “Behind every stock is a company. Find out what it’s doing.” &#; Peter Lynch

15) “Wide diversification is only required when investors do not understand what they are doing.” &#; Warren Buffett

16) “Based on my own personal experience &#; both as an investor in recent years and an expert witness in years past &#; rarely do more than three or four variables really count. Everything else is noise.” &#; Martin Whitman

17) “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.” &#; Albert Einstein

18) “I will tell you how to become rich. Close the doors, be fearful when others are greedy. Be greedy when others are fearful.” &#; Warren Buffett

19) The individual should act consistently as an investor and not as a speculator.” Benjamin Graham

20) “The entrance strategy is actually more important than the exit strategy.” &#; Edward Lampert

21) “In many ways, the stock market is like the weather in that if you don’t like the current conditions all you have to do is wait a while.” &#; Low Simpson

22) “The ability to focus attention on important things is a defining characteristic of intelligence.” &#; Robert J. Shiller

23) “Invest for the long-term.” &#; Lou Simpson

24) “Rapidly changing industries are the enemy of the investor.” &#; Mohnish Pabrai

25) “The easiest way to manage your money is to take it one step at a time and not worry about being perfect.” &#; Ramit Sethi

26) “The stock market is filled with individuals who know the price of everything, but the value of nothing.” &#; Phillip Fisher

27) “Although it’s easy to forget sometimes, a share is not a lottery ticket&#; it’s part ownership of a business.” &#; Peter Lynch

28) “All intelligent investing is value investing. Acquiring more that you are paying for. You must value the business in order to value the stock.” &#; Charlie Munger

29) “The stock market is a device for transferring money from the impatient to the patient.” &#; Warren Buffett

30) “When it comes to investing, we want our money to grow with the highest rates of return, and the lowest risk possible. While there are no shortcuts to getting rich, there are smart ways to go about it.” &#; Phil Town

31) “How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.” &#; Robert G. Allen

32) “You get recessions, you have stock market declines. If you don&#;t understand that&#;s going to happen, then you&#;re not ready, you won&#;t do well in the markets.” &#; Peter Lynch

33) “The four most dangerous words in investing are: ‘this time it&#;s different.&#;” &#; Sir John Templeton

34) “Investing puts money to work. The only reason to save money is to invest it.” &#; Grant Cardone

35) “Wise spending is part of wise investing. And it&#;s never too late to start.” &#; Rhonda Katz

These investors and &#;Fathers of Rule #1 Investing&#; provide us with timeless knowledge in the form of these investment quotes and a great foundation for great investing. Did I miss any of your favorites?

If you&#;re looking for more tips that will teach you how to invest with certainty get this free eBook that contains all of the advice from the world&#;s greatest investors.

Featured Photo Credit: Stuart Isett/Fortune Most Powerful Women/Flickr, used under a Creative Commons license.

Ready to learn more about investing?

You may also enjoy these related articles:

Market Capitalization: Why Price Doesn’t Always Equal Value

The Rule of How to Double Your Money Every 7 Years With Compound Interest

The Best Way to Invest Money: Investment Ideas for $, $1,, $5, & $10,

Phil Town is an investment advisor, hedge fund manager, 3x NY Times Best-Selling Author, ex-Grand Canyon river guide, and former Lieutenant in the US Army Special Forces. He and his wife, Melissa, share a passion for horses, polo, and eventing. Phil&#;s goal is to help you learn how to invest and achieve financial independence.

The Top 25 Investing Quotes of All Time

When it comes to the world of investing, most people don't know where to start. Fortunately, great investors of the past and present can provide us with guidance. These investment quotes date back to Benjamin Franklin, and some are from modern experts like Dave Ramsey and Warren Buffett. The 25 quotes here were selected for their enduring value. Although markets may change, this investing advice is timeless.

Key Takeaways

- Timeless financial quotes give investors a better perspective on the future by conveying wisdom from the past.

- The best stock market quotes teach investors how success in the market depends on playing the odds instead of following natural instincts.

- Investment and wealth quotes show how to build a fortune in the long-run and spend it wisely.

- The top investing quotes from contrarians tell investors how they can profit by going against popular opinion.

Timeless Financial Quotes

1. "An investment in knowledge pays the best interest." — Benjamin Franklin

When it comes to investing, nothing will pay off more than educating yourself. Do the necessary research and analysis before making any investment decisions.

2. "Bottoms in the investment world don't end with four-year lows; they end with or year lows." — Jim Rogers

While to year lows are not common, they do happen. During these times, don't be shy about going against the trend and investing; you could make a fortune by making a bold move or lose your shirt. Remember the first quote in this article and invest in an industry you've researched thoroughly. Then, be prepared to see your investment sink lower before it turns around and starts to pay off.

3. "I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful." — Warren Buffett

Be prepared to invest in a down market and to "get out" in a soaring market, as per the philosophy of Warren Buffett.

4. "With a good perspective on history, we can have a better understanding of the past and present, and thus a clear vision of the future." — Carlos Slim Helu

It's far too easy for investors to lose perspective. Whenever something big goes wrong, a lot of people panic and sell their investments. Looking at history, the markets recovered from the financial crisis, the dotcom crash, and even the Great Depression, so they'll probably get through whatever comes next as well.

Best Stock Market Quotes

5. "It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong." — George Soros

Too many investors become obsessed with being right, even when the gains are small. Winning big and cutting your losses when you're wrong are more important than being right.

6. "Given a 10% chance of a times payoff, you should take that bet every time." — Jeff Bezos

Most people dismiss many of the best and most profitable investment ideas simply because they probably won't work. These investors never stop to consider how much they could make if unlikely outcomes actually occur. Jeff Bezos took those bets and became the richest person in the world.

7. "Don't look for the needle in the haystack. Just buy the haystack!" — John Bogle

If it seems too hard to find the next Amazon, John Bogle came up with the only sure way to get in on the action. By buying an index fund, investors can put a little bit of money into every stock. That way, they never miss out on the stock market's biggest winners.

8. "I don't look to jump over seven-foot bars; I look around for one-foot bars that I can step over." — Warren Buffett

Investors often make things too hard for themselves. The value stocks that Buffett prefers frequently outperform the market, making success easier. Supposedly sophisticated strategies, such as short selling, lose money in the long-run, so profiting is much more difficult.

9. "The stock market is filled with individuals who know the price of everything, but the value of nothing." — Phillip Fisher

That is another testament to the fact that investing without an education and research will ultimately lead to regrettable investment decisions. Research is much more than just listening to popular opinion.

"In investing, what is comfortable is rarely profitable." — Robert Arnott

At times, you will have to step out of your comfort zone to realize significant gains. Know the boundaries of your comfort zone and practice stepping out of it in small doses. As much as you need to know the market, you need to know yourself too. Can you handle staying in when everyone else is jumping ship? Or getting out during the biggest rally of the century? There's no room for pride in this kind of self-analysis. The best investment strategy can turn into the worst if you don't have the stomach to see it through.

"How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case." — Robert G. Allen

Though investing in a savings account is a sure bet, your gains will be minimal due to the extremely low interest rates. But don't forgo one completely. A savings account is a reliable place for an emergency fund, whereas a market investment is not.

"If there is one common theme to the vast range of the world’s financial crises, it is that excessive debt accumulation, whether by the government, banks, corporations, or consumers, often poses greater systemic risks than it seems during a boom." — Carmen Reinhart

Beware of debts that seem sensible during periods of prosperity. When a crisis comes, individuals, companies, and even governments that ran up debts during the boom usually suffer the most.

"We don't prognosticate macroeconomic factors, we're looking at our companies from a bottom-up perspective on their long-run prospects of returning." — Mellody Hobson

It's very difficult to predict when the next recession or stock market crash will come, so many of the best investors don't even try. Instead, look for good companies with the strength to make it through the occasional challenging economic environment.

"Courage taught me no matter how bad a crisis gets any sound investment will eventually pay off." — Carlos Slim Helu

Don't despair amid the inevitable setbacks that all investors face, especially during a crisis in the market. If the reasoning behind the investment was sound, stick with it, and it should eventually turn around.

"The individual investor should act consistently as an investor and not as a speculator." — Ben Graham

You are an investor, not someone who can predict the future. Base your decisions on real facts and analysis rather than risky, speculative forecasts.

Investment and Wealth Quotes

"The biggest risk of all is not taking one." — Mellody Hobson

There is a direct tradeoff between risk and returns. If investors stick to low-risk assets like the money market and bonds, then they run a high risk of low long-term returns.

"Returns matter a lot. It's our capital." — Abigail Johnson

The long-run rate of return on investments ultimately determines how much wealth people accumulate over time. Always look at returns when considering mutual funds or exchange-traded funds (ETFs).

"It's not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for." — Robert Kiyosaki

If you're a millionaire by the time you're 30 but blow it all by age 40, you've gained nothing. Grow and protect your investment portfolio by carefully diversifying it, and you may find yourself funding many generations to come.

"Know what you own, and know why you own it." — Peter Lynch

Do your homework before making a decision. Once you've made a decision, make sure to re-evaluate your portfolio on a timely basis. A wise holding today may not be a wise holding in the future.

"Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this." — Dave Ramsey

By being modest in your spending, you can ensure you will have enough for retirement and can give back to the community as well.

"Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $ and go to Las Vegas." — Paul Samuelson

If you think investing is gambling, you're doing it wrong. The work involved requires planning and patience. However, the gains you see over time are indeed exciting.

Many of the best quotes about investing urge thoughtfulness over impulsiveness, boldness instead of caution, and smart research over flavor-of-the-month decision making.

Top Investing Quotes from Contrarians

"The four most dangerous words in investing are, it’s different this time." — Sir John Templeton

Follow market trends and history. Don't speculate that this particular time will be any different. For example, a major key to investing in a specific stock or bond fund is its performance over five years.

"Wide diversification is only required when investors do not understand what they are doing." — Warren Buffett

In the beginning, diversification is relevant. However, there are dangers of over-diversifying your portfolio. Once you've gotten your feet wet and have confidence in your investments, you can adjust your portfolio accordingly and make bigger bets.

"You get recessions, you have stock market declines. If you don't understand that's going to happen, then you're not ready, you won't do well in the markets." — Peter Lynch

When hit with recessions or declines, you must stay the course. Economies are cyclical, and the markets have shown that they will recover. Make sure you are a part of those recoveries.

"The most contrarian thing of all is not to oppose the crowd but to think for yourself." — Peter Thiel

The Bottom Line

The world of investing can be cold and hard. Refer back to these quotes when you're feeling shaky or confused about investing. How are they relevant to your experience? Do you have any favorite quotes to add? Is there something you're overlooking that you could be doing differently? Whenever everything seems too tough, remember the words of Colin Powell, "A dream doesn't become reality through magic; it takes sweat, determination, and hard work."

Five investing quotes to print and frame in your study

However, most people have no idea where to begin when it comes to investing. Fortunately, we can learn from great investors from the past and present.

Famous investors such as Benjamin Graham, Warren Buffett, Charlie Munger, Peter Lynch, and others have provided us with timeless investment quotes over the years.

Sure, these investing quotes will be meaningless if you do not take action and put what you've learned into practice. But they can sometimes provide the motivation you need to make better financial decisions.

Here's a selection of timeless investing quotes that can guide you through your investment journey.

#1 The Value of Knowledge

‘An investment in knowledge pays the best interest’ - Benjamin Franklin

Legendary leader Benjamin Franklin, being a man of wisdom, precisely explained the value of knowledge.

Knowledge plays a part in everything we do. It can help you get wealthy, make better decisions, be better at sports, take better care of your health and much more.

When it comes to investing, nothing will pay off more than educating yourself.

The investment you make in yourself will always pay off. The wiser you are, the better decisions you'll make. The smarter you are, the more things you will be successful at.

#2 Be Fearful When Others are Greedy

‘I will tell you the secret to getting rich on Wall Street. You try to be greedy when others are fearful. And you try to be fearful when others are greedy’ - Warren Buffett

Warren Buffett says he always tries to remain fearful when others are greedy. From fearful, he means to say be cautious about stock markets and not remain too invested when others are greedy.

But why?

When investors get too optimistic about something, prices rise unnecessarily.

They usually do not book profits, will purchase more and more, and will ignore what the asset's correct price is.

However, if there is any unfavourable news about it on any given day, this price would be difficult to maintain and might result in a very abrupt decline.

Thus, when others are too greedy, we should be fearful of our investments and reduce our portfolio.

In doing so, we may take benefit of the higher price (due to others' greed) and protect ourselves against a major downturn. When the cost of anything is very high, the risk of failure is likewise increased.

#3 Financial Security

‘Financial peace isn't the acquisition of stuff. It's learning to live on less than you make, so you can give money back and have money to invest. You can't win until you do this’ - Dave Ramsey

When it comes to financial stability, you can be your own worst enemy. According to Dave Ramsey, a financial expert and radio presenter, a lot of it is in your brain.

After years of working with people in debt, Ramsey believes it's apparent that it's not only a lack of money that prevents individuals from attaining ‘financial serenity’. Instead, it's their attitude towards money.

Denial, keeping up with the Joneses, and ignorance are three typical mindsets that Ramsey has identified as impediments to financial serenity.

Keeping up with the Joneses is an idiom which basically means when an individual is doing something in order to show that they have as much money as other people, rather than because they really want to do it.

If you want to win in life and have financial peace, you should learn to control your spendings and save more money to invest.

Working towards your financial goals will provide far more security than buying unnecessary or expensive things.

4. Time is Precious

‘Time is more valuable than money. You can get more money, but you cannot get more time’ - Jim Rohn

Time is one of the most important things a human being has, we cannot afford to waste it since it is what we require to accomplish our goals.

We encounter many things during our life, and each one provides us with a learning opportunity.

However, there are instances when this opportunity is not favourable, and we feel as if we have wasted our time. Because time is irreversible, this would be the worst-case scenario.

When we strike a balance between money and time, time takes all the weight, because even in order to make money, we need this indispensable tool as time is.

So, we must not allow that the pursuit of money blind us and don’t let us take advantage of all the time life gives us, not just to attain our objectives, but also to enjoy life and make it all worthwhile.

It should always be our top goal to make sure that every experience in which we devote our time is valuable and fruitful.

5. Short Term vs Long Term

‘All self-help boils down to choose long-term over short-term’ - Naval Ravikant

According to Ravikant, long-term thinking gets you long-term results.

He has implied this saying in a thousand different ways like in business you want to play long-term game with long-term people.

Short-term thinkers focus on the now, with little regard for the future. They make decisions and take action accordingly.

On the other hand, long-term visionaries are always visualizing what’s next. Could be tomorrow, next month, or many years down the road.

Regardless of the timeframe, the key is that when they make decisions they are taking into consideration the consequences, benefits, etc. of the current actions but at a later date.

The same theory applies for investors as well. Short term trading without proper understanding can make you or break you, while long-term investment can help you become financially stable.

Final Thoughts

Timeless financial quotes give investors a better perspective on the future by conveying wisdom from the past.

If you are nervous or scared of investing in stock markets, then look at these quotes for reassurance and everything will work out well in the long run.

Also, if you are just starting out investing, use the wisdom passed on by these legends to help you be a smarter investor.

At the end of the day, the more knowledge you have about a topic and the more you can control your emotions, the better off you will be.

Happy Investing!

(This article is syndicated from www.oldyorkcellars.com)

Never miss a story! Stay connected and informed with Mint. Download our App Now!!

While we at Wall Street Survivor think we give some pretty stellar investing advice, we'd be lying if we said it all came from us.

We've spent plenty of time studying the investing greats, and we think you should too!

These are some of the top investing quotes that we believe every investor should know.

# It's Okay to Be Wrong

“It's not whether you're right or wrong, but how much money you make when you're right and how much you lose when you're wrong.”

George Soros

George Soros is known as one of the most influential activist investors in history.

He made a lot of money in the world of investing and has gone on to use that money to support causes that he cares about.

Here, Soros teaches us an important lesson about taking your losses and accepting that not every investment is going to be a winner.

Sometimes you’re going to make money and sometimes you’re going to lose money, but it’s important to have rules in place that dictate how much money you’re willing to lose.

For example, you might hold yourself to a rule that states that you’ll pull your investment if you lose more than 5%.

Whatever your own personal rule may be, it’s important to have limits set in advance.

#9: Be a Lifelong Learner

“Those who keep learning will keep rising in life.”

Charlie Munger

Charlie Munger is Warren Buffett’s right-hand man.

He is vice chairman of Berkshire Hathaway as well as a real estate investor and guru.

Munger’s message here is a simple but important one: never stop learning.

Whether we're talking about investing, fishing, sewing, or anything else in life, you have to commit to being a lifelong learner if you want to see yourself improve.

There are plenty of resources out there that you can use to enhance your investing knowledge. Zacks is our favorite investment research platform, and they also provide a stock list (#1 Strong Buy) that has beaten the market bigtime over the past few decades. You can access a free report from Zacks when you sign up with your email address.

#8: Understand Compound Interest

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.”

Albert Einstein

The speaker of this quote needs no introduction.

The famed German physicist may have made a name for himself as the developer of scientific theories, but he was clearly also smart enough to realize the importance of compound interest.

If you’re smart about your money, then you find ways to make it earn compound interest for you, such as investing in stocks. (And continually reinvesting your gains and dividends!)

If you don’t understand money, then you become a prisoner to compound interest actually working against you.

For example, you might get into some steep credit card debt that becomes very difficult to pay off as the interest constantly stacks up to increase the amount of money you owe.

Nobody wants to get caught in a cycle like that; so make sure you understand compound interest and make it work for you!

#7: Be Wealthy, Not Rich

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

Robert Kiyosaki

Robert Kiyosaki is a businessman and author who wrote the influential book Rich Dad Poor Dad.

He educates others on investing and personal finance and is famous for using debt to his advantage.

This quote from Kiyosaki outlines the difference between being rich and being wealthy.

Rich people make a lot of money. They spend it on unnecessary things and live lives of flashy indulgence.

But wealthy people save their money. They spend money on investments that will earn them compound interest and passive income, and they pass that wealth down through their families.

It’s important to understand that money doesn’t make you rich; many people have made a lot of money and gone on to lose it. Money is simply a tool that you can use to build wealth.

#6: Commit to Long-Term Investing

“The individual investor should act consistently as an investor and not as a speculator.”

Benjamin Graham

Benjamin Graham was one of the most influential investors and writers of the 20th century.

He is known as “the father of value investing” and is the author of the legendary book The Intelligent Investor.

Here, Graham is telling us that the market is at least somewhat efficient, and fundamental analysis will get you much further than technical analysis. (Read more about financial analysis in our article about Stock Market Terminology.)

You have to be prepared to look at the fundamentals of a company, such as its balance sheet and management, in order to make a profit.

If you try to “get rich quick” by acting on short-term patterns in price and trading volume, you will get burned more often than not.

#5: Know That the Market Is Irrational

“Every once in a while, the market does something so stupid it takes your breath away.”

Jim Cramer

Jim Cramer has made a name for himself as an eccentric but intelligent television personality as the host of Mad Money on CNBC. He is also a co-founder of www.oldyorkcellars.com

Jim knows that the market can be wildly irrational and unpredictable at times, so much that it can stop you in your tracks.

But the important thing about investing is to know that just because the market is acting crazily, doesn’t mean that the values of your investments has changed.

You have to stop yourself from letting the irrational market make you invest irrationally, and only switch up your investments when there has been a change in their fundamental values.

#4: Take Control Through Budgeting

“A budget is telling your money where to go instead of wondering where it went.”

Dave Ramsey

Dave Ramsey is known for helping people take control of their financial lives and pay down their debt using his Baby Steps plan.

He hosts the radio show The Ramsey Show where he gives advice on personal finance and takes calls from audience members that are struggling with debt and budgeting.

The above quote is textbook Dave Ramsey; you have to be in control of your money or it will control you.

If you don’t take the initiative necessary to make a budget so that you can reign in your spending habits, you will be left wondering why you don’t have any money and struggling to finance your own lifestyle.

If you want a platform to help you budget without all the extra work, check out Personal Capital. Personal Capital offers many free personal finance tools as well as a wealth management program, but the Budgeting tool is one of our favorite.

#3: Understand Risk vs. Reward

“Big companies have small moves, small companies have big moves.”

Peter Lynch

Peter Lynch is one of the most successful hedge fund managers of all time.

He managed Fidelity’s Magellan Fund for 13 years and more than doubled the S&P on average.

This quote is a good example of the concept of risk vs. reward; bigger companies tend to be lower risk and their stock prices tend to make smaller moves, while smaller companies tend to be higher risk and their stock prices tend to make bigger moves.

#2: Diversify

“Don’t look for the needle in the haystack. Just buy the haystack!”

John Bogle

You know how we at Wall Street Survivor like to talk about index funds all the time?

You can thank John Bogle for that.

Bogle was the founder of Vanguard and the creator of the first-ever index fund, which is now known as the Vanguard (VFINX).

Here, Bogle gives us an important lesson in diversification: you don’t have to stake your life on finding that one-of-a-kind investment investment opportunity that will make you a millionaire.

Instead, you can diversify your portfolio (or, in other words, buy the haystack) and increase your chances of having one or several investments that exceed expectations in a big way.

Not coincidentally, one of the best ways to diversify your portfolio is by investing in an index fund! We personally recommend Robinhood for getting started with index funds, as their commission-free investing platform has paved the way for investors with any amount of money to get started.

If you live outside of the United States, we recommend International Brokers. International Brokers is our #1 recommended broker for non-U.S. citizens due to the fact that they give their investors access to financial markets in 33 different countries.

#1: Understand Price vs. Value

“It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Warren Buffett

Naturally, we had to save Warren Buffett for last.

The man, the myth, the legend himself.

Warren Buffett is a year old investing legend as well as the chairman and CEO of Berkshire Hathaway Inc.

He is famous for his strict, textbook approach to fundamental investing through extensive research and understanding your investments.

While Buffett’s advice usually comes in the form of telling investors to buy great companies at a discounted price, this particular quote focuses more on the importance of passing up on poor investments, even if you think their stock price might shoot up.

It’s not worth it to invest in a company with poor fundamentals in the hope of a price jump.

Rather, you should find good investments at a discounted price, and like Buffett says, it’s better to buy a good company at a fair price than a poor company at a discounted price.

Remember, price is not equivalent to value, and a lower price does not mean you’re buying a valuable company.

Final Thoughts

No matter what type of saver, investor, or spender you are, you can thank the investing legends that came before us for paving the way and setting the groundwork for our paths to financial success.

Investing Quotes

Quotes tagged as "investing" Showing of

Like

Like

Like

“It's nice to have a lot of money, but you know, you don't want to keep it around forever. I prefer buying things. Otherwise, it's a little like saving sex for your old age.”

&#; Warren Buffett

Like

“Games are won by players who focus on the playing field –- not by those whose eyes are glued to the scoreboard.”

&#; Warren Buffett

Like

“October: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August and February.”

&#; Mark Twain, Pudd'nhead Wilson

Like

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble”

&#; warren buffett

Like

“Investors should be skeptical of history-based models. Constructed by a nerdy-sounding priesthood using esoteric terms such as beta, gamma, sigma and the like, these models tend to look impressive. Too often, though, investors forget to examine the assumptions behind the models. Beware of geeks bearing formulas. ”

&#; Warren Buffett

Like

“If you aren't thinking about owning a stock for ten years, don't even think about owning it for ten minutes.”

&#; Warren Buffett

Like

“It amazes me how people are often more willing to act based on little or no data than to use data that is a challenge to assemble.”

&#; Robert Shiller

Like

Like

Like

“Acknowledge the complexity of the world and resist the impression that you easily understand it. People are too quick to accept conventional wisdom, because it sounds basically true and it tends to be reinforced by both their peers and opinion leaders, many of whome have never looked at whether the facts support the received wisdom. It's a basic fact of life that many things "everybody knows" turn out to be wrong.”

&#; Jim Rogers

Like

“You can get in way more trouble with a good idea than a bad idea, because you forget that the good idea has limits.”

&#; Ben Graham

Like

“Buffett's methodology was straightforward, and in that sense 'simple.' It was not simple in the sense of being easy to execute. Valuing companies such as Coca-Cola took a wisdom forged by years of experience; even then, there was a highly subjective element. A Berkshire stockholder once complained that there were no more franchises like Coca-Cola left. Munger tartly rebuked him. 'Why should it be easy to do something that, if done well two or three times, will make your family rich for life?”

&#; Roger Lowenstein, Buffett: The Making of an American Capitalist

Like

“The broker said the stock was "poised to move." Silly me, I thought he meant up.”

&#; Randy Thurman

Like

Like

“Investing money is the process of committing resources in a strategic way to accomplish a specific objective.”

&#; Alan Gotthardt, The Eternity Portfolio

Like

“When our money is pooled together, we can do more good in the world. As spiritual people and conscious people, we can leverage our combined monetary power to have a greater influence on the economy and make it better reflect our values. At the same time, it can be profitable for each of us independently. There’s power in pooling capital. And that’s part of what we do at Mayflower-Plymouth.”

&#; Hendrith Smith

Like

“When we look at asset protection from a natural perspective, we realize that in nature, assets are protected not with fences or walls but with internal and external immune systems. So the best way to protect an asset is with systems that self organize and self execute behaviors which function as protective to the asset.”

&#; Hendrith Smith, The Wealth Reference Guide: An American Classic

Like

“A business is like a living being. It’s more of a process than a stagnant thing. The way you manage your business today shouldn’t be the same way you managed it ten years ago or even ten months ago. Because your business should have evolved and changed and adapted in some way during that time - just like living beings evolve and change and adapt to their environments.”

&#; Hendrith Vanlon Smith Jr

Like

“When we invest, It’s about the big picture, and having a holistic approach to investing”

&#; Hendrith Vanlon Smith Jr

Like

“The Decentralization of Finance is really good for humanity and it’s ultimately a win for each and every one of us. Because now that we can circumvent banks, exchanges and brokerage companies by using smart contracts on the blockchain… every person, every family, and every business will experience more more liberty, more freedom, more opportunities, more abundance, more power, and more wealth.”

&#; Hendrith Vanlon Smith Jr

Like

“A mistake is a signal that it is time to learn something new, something you didn't know before.”

&#; Robert Kiyosaki

Like

“Business ideas are sensitive to market conditions, culture, technological development and other things. What maybe was a bad business idea ten years ago may be a great business idea today. Give it a try. Mayflower Plymouth.”

&#; Hendrith Vanlon Smith Jr

Like

Like

Like

-