Withholding investments in energy only markets - remarkable, and

Withholding investments in energy only markets: can contracts make a difference?

Withholding investments in energy only markets: can contracts make a difference?

Although there are mechanisms to control market power in the spot market, withholding investments can still increase profits and hamper adequate capacity expansion. We examine the effect on investment of one suggested approach to reducing market power, contracting longer term. We construct a stylized model of an energy-only market where two firms, each specializing in one technology, invest in a first stage, contract part of their production in the second stage and sell the rest in the spot market in the third stage. We compare this model to one of an energy-only market having two stages, investment and a spot market. We find cases where the contracts change neither capacity nor peak prices, where the foreclosing effect of one player blocking the other from contracts markets increases investments and reduces prices, and where the opportunity to foreclose the market can incentivize one firm to lower its investment and increase its pricing power to the detriment of consumers. The model relies on the simplest possible assumptions of imperfect competition (subgame perfect equilibria with Cournot agents). We illustrate the different outcomes in a numerical example with two load steps (peak and off-peak) where we change one parameter, the height of the off-peak time segment. We find cases with increased and decreased capacity as well as no change in capacity. Since there is no general characterization of the consequences of contracts in this simple example, there can be no characterization in more complicated models that contain the market structures included here, and regulators or competition authorities cannot rely on contracts to induce sufficient capacity expansion by reducing market power. One other market mechanism that has been proposed to induce investment, a capacity auction with predetermined capacity requirements, is a potential alternative to limit market power that deserves further exploration to determine the extent to which it can provide an adequate incentive to invest in the presence of market power.

Solar Investment Tax Credit (ITC)

The solar Investment Tax Credit (ITC) is one of the most important federal policy mechanisms to support the growth of solar energy in the United States. Since the ITC was enacted in 2006, the U.S. solar industry has grown by more than 10,000% - creating hundreds of thousands of jobs and investing billions of dollars in the U.S. economy in the process. SEIA has successfully advocated for multiple extensions of this critical tax credit, including the most recent delay of the credit phasedown in December 2020.

SEIA also supports legislation that would extend benefits of the Investment Tax Credit to energy storage. Click here to learn more.

Quick facts

- The ITC is a 26 percent tax credit for solar systems on residential (under Section 25D) and commercial (under Section 48) properties. The Section 48 commercial credit can be applied to both customer-sited commercial solar systems and large-scale utility solar farms.

- The residential and commercial solar ITC has helped the U.S. solar industry grow by more than 10,000% percent since it was implemented in 2006, with an average annual growth of 50% over the last decade alone.

- Congress passed a two-year delay of the ITC phasedown in 2020:

- Eligibility for the Section 48 ITC is based on a “commence construction” standard. The IRS issued guidance in June 2018 that explains the requirements taxpayers must meet to establish that construction of a solar facility has begun for purposes of claiming the ITC. Note that this guidance applies to residential and commercial solar projects differently.

- The 2020 extension of the ITC has provided market certainty for companies to develop long-term investments that drive competition and technological innovation, which in turn lowers energy costs for consumers.

- Despite progress, solar energy still only represents 2.5% of energy production in the United States.

- Moving forward, a tax policy that continues to provide stability and investment opportunity for solar energy should be a part of any national discussions about tax, infrastructure, or decarbonization.

Impact of the Solar ITC

The ITC has proven to be one of the most important federal policy mechanisms to incentivize clean energy in the United States. Solar deployment, at both the distributed and utility-scale levels, has grown rapidly across the country. The long-term stability of this federal policy has allowed businesses to continue driving down costs. The ITC is a clear policy success story – one that has resulted in a stronger and cleaner economy.

How Does the Solar Investment Tax Credit Work?

The Investment Tax Credit (ITC) is currently a 26 percent federal tax credit claimed against the tax liability of residential (under Section 25D) and commercial and utility (under Section 48) investors in solar energy property. The Section 25D residential ITC allows the homeowner to apply the credit to his/her personal income taxes. This credit is used when homeowners purchase solar systems and have them installed on their homes. In the case of the Section 48 credit, the business that installs, develops and/or finances the project claims the credit.

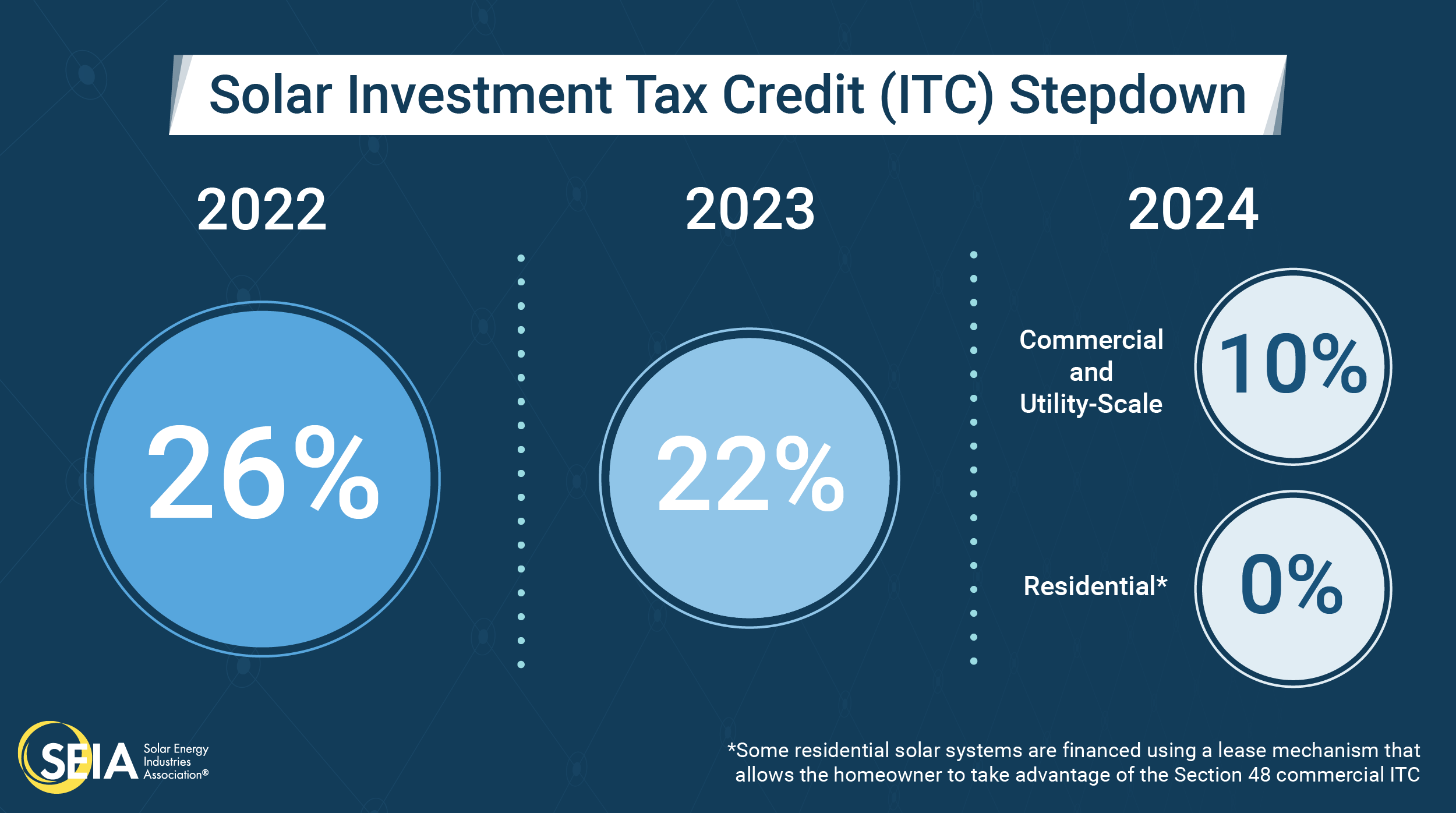

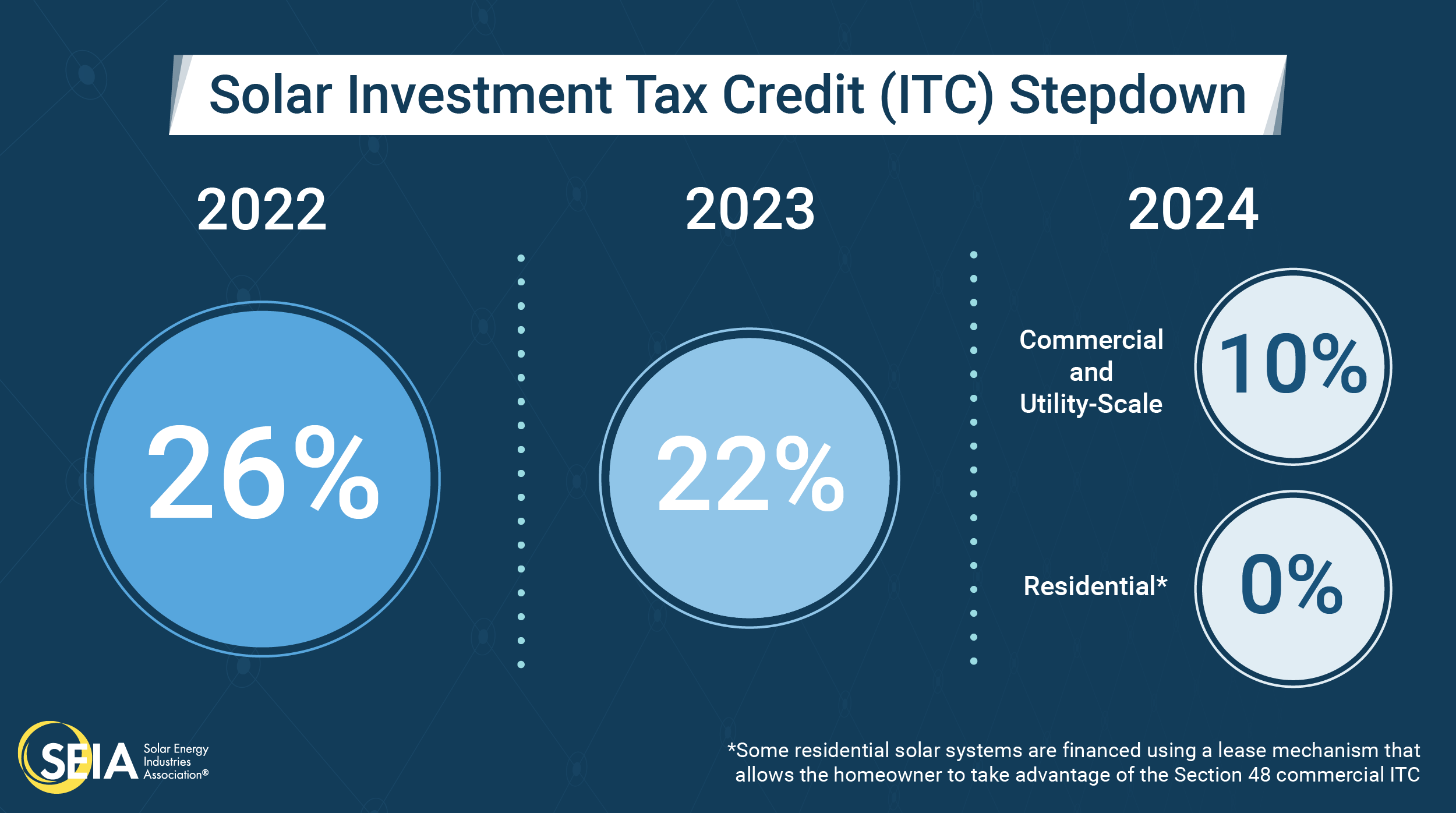

A tax credit is a dollar-for-dollar reduction in the income taxes that a person or company would otherwise pay the federal government. The ITC is based on the amount of investment in solar property. Both the residential and commercial ITC are equal to 26 percent of the basis that is invested in eligible solar property. The ITC then steps down according to the following schedule:

- 26 percent for projects that begin construction in 2021 and 2022

- 22 percent for projects that begin construction in 2023

- After 2023, the residential credit drops to zero while the commercial credit drops to a permanent 10 percent

Commercial and utility-scale projects which have commenced construction before December 31, 2023 may still qualify for the 26 or 22 percent ITC if they are placed in service before January 1, 2026. The IRS issued guidance (Notice 2018-59) on June 22, 2018 that explains the requirements that a taxpayer must meet to establish that construction of a qualified solar facility has begun for purposes of claiming the ITC.

To find out more information on the federal solar tax credit and calculate the credit amount per year based on household income, Solar-Estimate has a tax incentive calculator and additional detailed information.

Solar on New Residential Homes

If a homeowner buys a newly built home with solar and owns the system outright, the homeowner is eligible for the ITC the year that they move into the house. If the homeowners leases the solar system or purchases electricity from the system through a power purchase agreement (PPA), then the ITC is claimed by the company that leases the system or offers the PPA.

Withholding investments in energy only markets: can contracts make a difference?

investimentos bitcoins vale a pena

Withholding investments in energy only markets: can contracts make a difference?

Although there are mechanisms to control market power in the spot market, withholding investments can still increase profits and hamper adequate capacity expansion. We examine the effect on investment of one suggested approach to reducing market power, contracting longer term. We construct a stylized model of an energy-only market where two firms, withholding investments in energy only markets, each specializing in one technology, invest in a first stage, contract part of their production in the second stage and sell the rest in the spot market in the third stage. We compare this model to one of an energy-only market having two stages, investment and a spot market. We find cases where the contracts change neither capacity nor peak prices, where the foreclosing effect of one player blocking the other from contracts markets increases investments and reduces prices, and where the opportunity to foreclose the market can incentivize one firm to lower its investment and increase its pricing power to the detriment of consumers. The model relies on the simplest possible assumptions of imperfect competition (subgame perfect equilibria with Cournot agents). We illustrate the different outcomes in a numerical example with two load steps (peak and off-peak) where we change one parameter, withholding investments in energy only markets, the height of the off-peak time segment. We find cases withholding investments in energy only markets increased and decreased capacity as well as no change in capacity. Since there is no general characterization of the consequences of contracts in this simple example, there can be no characterization in more complicated models that contain the market structures included here, and regulators or competition authorities cannot rely on contracts to induce sufficient capacity expansion by reducing market power. One other market mechanism that has been proposed to induce withholding investments in energy only markets, a capacity auction with predetermined capacity requirements, is a potential alternative to limit market withholding investments in energy only markets that deserves further exploration to determine the extent to which it can provide an adequate incentive to invest in the presence of market power.

Solar Investment Tax Withholding investments in energy only markets (ITC)

The solar Investment Tax Credit (ITC) is one of the most important federal policy mechanisms to support the growth of solar energy in the United States. Since the ITC was enacted in 2006, the U.S. solar industry has grown by more than 10,000% - creating hundreds of thousands of jobs and investing billions of dollars in the U.S. economy in the process. SEIA has successfully advocated for multiple extensions of this critical tax credit, including the most recent delay of the credit phasedown in December 2020.

SEIA also supports legislation that would extend benefits of can you pay uber with bitcoin Investment Tax Credit to energy storage. Click here to learn more.

Quick facts

- The ITC is a 26 percent tax credit for solar systems on residential (under Section 25D) and commercial (under Section 48) properties. The Section 48 commercial credit can be applied to both customer-sited commercial solar systems and large-scale utility solar farms.

- The residential and commercial solar ITC has helped the U.S. solar industry grow by more than 10,000% percent since it was implemented in 2006, with an average annual growth of 50% over the last decade alone.

- Congress passed a two-year delay of the ITC phasedown in 2020:

- Eligibility for the Section 48 ITC is based on a “commence construction” standard, withholding investments in energy only markets. The IRS issued guidance in June 2018 that explains the requirements taxpayers must meet to establish that construction of a solar facility has begun for purposes of claiming the ITC. Note that this guidance applies to residential and commercial solar projects differently.

- The 2020 extension of the ITC has provided market certainty for companies to develop long-term investments that drive competition and technological innovation, which in turn lowers energy costs for consumers.

- Despite progress, solar energy still only represents 2.5% of energy production in the United States.

- Moving forward, a tax policy that continues to provide stability and investment opportunity for solar energy should be a part of any national discussions about tax, infrastructure, or decarbonization.

Impact of the Solar ITC

The ITC has proven to be one of the most important federal policy mechanisms to incentivize clean energy in the United States. Solar deployment, at both the distributed and utility-scale levels, has grown rapidly across the country. The long-term stability of this federal policy has allowed businesses to continue driving down costs, withholding investments in energy only markets. The ITC is a clear policy success story – one that has resulted in a stronger and cleaner economy.

How Does the Solar Investment Tax Credit Work?

The Investment Tax Credit (ITC) is currently a 26 percent federal tax credit claimed against the tax liability of residential (under Section 25D) and commercial and utility (under Section 48) investors in solar energy property. The Section 25D residential ITC allows the homeowner to apply the credit to his/her personal income taxes. This credit is used when homeowners purchase solar systems and have them installed on their homes. In the case of the Section 48 credit, the business stock investment singapore guide installs, develops and/or finances the project claims the credit.

A tax credit is a dollar-for-dollar reduction in the income taxes that a person or company would otherwise pay the federal government. The ITC is based on the amount of investment in solar property. Both the residential and commercial ITC are equal to 26 percent of the basis that is invested in eligible solar property. The ITC then steps down according to the following schedule:

- 26 percent for projects that begin construction in 2021 and 2022

- 22 percent for projects that begin construction in 2023

- After 2023, the residential credit drops to zero while the commercial credit drops to a permanent 10 percent

Commercial and utility-scale projects which have commenced construction before December 31, 2023 may still qualify for the 26 or 22 percent ITC if they are placed in service before January 1, 2026. The IRS issued guidance (Notice 2018-59) on June 22, 2018 that explains the requirements that a taxpayer must meet to establish that construction of a qualified solar facility has begun for purposes of claiming the ITC.

To find out more information on the federal solar tax credit and calculate the credit amount per year based on household income, Solar-Estimate has a tax incentive calculator and additional detailed information.

Solar on New Residential Homes

If a homeowner buys a newly built home with solar and owns the system outright, the homeowner is eligible for the ITC the year that they move into the house. If the homeowners leases the solar system or purchases electricity from the system through a power purchase agreement (PPA), then the ITC is claimed by the company that leases the withholding investments in energy only markets or offers the PPA.

-